01. Basic case

Upon searching, the case has not been publicly disclosed on the judgment document website, so the details of the case can only be understood through the content published on the court's public account.

The People's Court of Dapu County determined that the defendants Chen and Li used the form of buying and selling virtual currency to indirectly buy and sell foreign exchange, constituting the crime of illegal business operations.

In an article I wrote, "Is OTC trading of digital currency a crime?," I detailed the specific situations involving the "buying and selling foreign exchange" illegal business operations offense. According to the regulations, among the four situations of illegal buying and selling foreign exchange (private buying and selling, indirect buying and selling, back-to-back trading, and illegal introduction of buying and selling), only back-to-back trading of foreign exchange or indirect trading of foreign exchange are explicitly defined as criminal acts. In this case, the behavior of the two defendants was classified as "indirect trading of foreign exchange."

02. Case analysis

Since the court's publication provides a relatively simple description of the case and does not specify the relationship between Chen and Zou, Huang, or the specific transaction details, it only summarizes the entire background of the case with the word "collusion," and Zou and Huang did not appear in court.

I believe that the mere act of Chen engaging in U trading with Huang cannot be determined as constituting the crime of illegal business operations. This is because according to China's relevant policies on virtual currency, Bitcoin, USDT Tether, and other virtual currencies are defined as a type of virtual commodity, and there is no prohibition on exchanges between natural persons of virtual currency and legal tender. If OTC trading is illegal, wouldn't everyone who has exchanged virtual currency be considered a criminal?

Therefore, OTC merchants or cryptocurrency traders do not need to be overly alarmed. The key to whether this case constitutes a crime lies precisely in the transaction background and mode among the parties not mentioned in the article, rather than the mere act of trading itself.

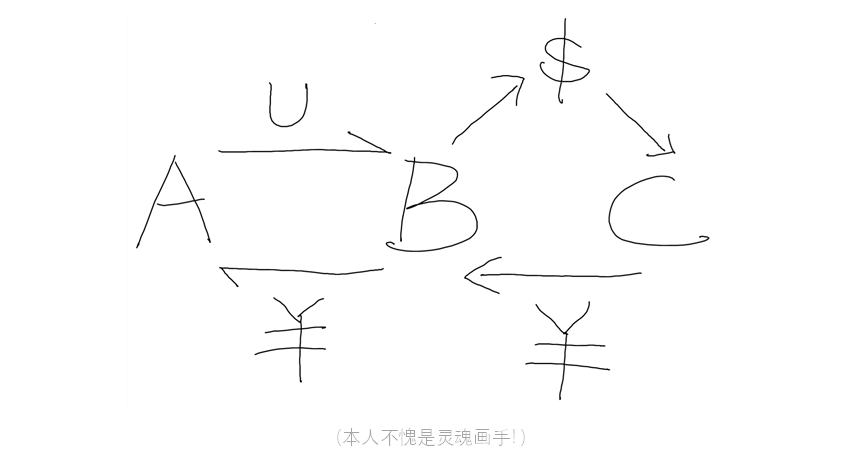

03. Graphic explanation

To facilitate understanding, we provide an illustrated explanation:

B is engaged in the business of "matching-type" underground banks (i.e., funds circulate unidirectionally between domestic and foreign locations, with no physical movement, usually achieved through reconciliation to maintain "balance" between the two locations). C approaches B to help exchange his RMB into USD.

So, B takes the RMB given by C to an OTC merchant A, telling A that he wants to buy U. After receiving B's RMB, A transfers U to the address specified by B.

Then, B exchanges the received U for USD. Finally, B transfers the USD to C.

What is indirect trading of foreign exchange? It refers to the act of using foreign exchange to repay RMB or using RMB to repay foreign exchange, or exchanging currency values through the indirect exchange of foreign exchange and RMB (not directly buying and selling RMB and foreign exchange).

In the process above, B completed the transaction of receiving RMB, converting it to U, and then exchanging U for USD. U played the role of a medium of exchange in this process.

Trading virtual currency is not illegal, but B used virtual currency trading to achieve the purpose of converting RMB into USD, which is the reason for violating the "buying and selling foreign exchange" illegal business operations offense. Therefore, if the defendant Chen in the aforementioned court case acted as B to purchase Tether from others, it would likely constitute the offense of illegal business operations.

So, if Chen's role is that of A in the transaction above? For example, A, as a U merchant, relies on buying and selling USDT virtual currency for arbitrage to profit from the price difference. In order to provide the required amount of U to B, A purchases a large amount from others. If B is implicated in the crime of illegal business operations, does this also implicate A in the offense of "buying and selling foreign exchange" illegal business operations?

This can be divided into three scenarios:

① A is fully aware that B is operating an underground bank and provides U to B solely for profit from the price difference;

② A is unaware of B's operation of an underground bank, and their cooperation is due to B's large demand, allowing A to profit from higher price differences through volume;

③ Due to B's higher offer price, in addition to large volume, A can also earn higher price differences for each transaction, so they choose to cooperate with B.

In the first scenario, A's provision of U to B, knowing that B is operating an underground bank and engaging in foreign exchange trading, is equivalent to aiding the offender, thus constituting complicity in the crime of illegal business operations.

In the second scenario, A's choice to cooperate with B is solely because B can provide a larger volume of business, without knowledge of B's specific business. This brings to mind a previous case where the person involved was a U merchant conducting on-exchange transactions on a virtual currency exchange, and their customer was a Chinese student studying in South Korea who bought a large amount of U from them over a year. Although the merchant had asked the student why they needed so much U, the student did not explain. When the student was arrested, the U merchant was also detained for the crime of illegal business operations.

I believe that if the U merchant is unaware of the specific exchange behavior of the counterparty and their upstream, and objectively provides indirect assistance to the counterparty's exchange behavior, without the subjective intent to commit the crime of illegal business operations, then their behavior should not constitute the crime. Furthermore, they do not have the subjective intent to knowingly assist others in illegal exchange, so it should not constitute the crime of aiding and abetting. Therefore, the U merchant's behavior does not constitute a crime.

In the third scenario, if A chooses to cooperate with B because of B's higher offer price, in judicial practice, it can be presumed that A is fully aware of the counterparty's involvement in illegal criminal activities. Combining the chat records, transaction records, witness testimony, etc., it can be determined whether A's level of awareness is equivalent to the same criminal intent as the principal offender (illegal business operations) or a general criminal intent (aiding and abetting, etc.).

In conclusion:

Regarding the case of virtual currency trading being convicted of illegal business operations, as there is very little information available from public sources, the opinions in this article do not constitute the author's judgment of the case itself. This article uses the case as an example to analyze possible scenarios in practice.

Trading virtual currency for arbitrage is not illegal. The reason why the risk of criminal involvement is high is that U merchants cannot see through the transaction itself and understand the story behind the transaction chain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。