Binance has launched a new project again! This time it is the decentralized derivatives trading platform AEVO, which focuses on options and perpetual trading, with a total financing of 16.6 million US dollars and a final valuation of 2.5 billion US dollars.

$AEVO has an initial circulation of 11%, and the futures price is currently at 2.55U. It looks like another group of people will soon become rich. For information about the project highlights, team background, and more, there are various social media channels available. Those interested can directly search on Twitter or refer to Binance Research: https://www.binance.com/en/research/projects/aevo

This article focuses on the peculiarities before and after AEVO was launched on Binance for reference:

①Whales of BNB are mining new coins and making a fortune

Binance has been launching new projects at a very fast pace recently, and the price of BNB has been rising all the way, making every new coin mining a whale's carnival.

According to on-chain monitoring, the fourth-ranked whale in Blast staked an additional 39,700 BNB to participate in the AEVO new coin mining, with a total investment amount exceeding 37.42 million US dollars, the highest investment amount in the past four mining participations.

There are less than 4 days left for Binance mining. Holders of BNB and FDUSD should continue to rush: https://launchpad.binance.com/en/launchpool/AEVO_BNB

②RBN arbitrageurs have already made huge profits by laying ambush in advance

RBN and AVEO are exchanged at a 1:1 ratio. Many people only found out about it after Binance announced the launch of AEVO, and then went to the secondary market, causing RBN to soar, while sensitive arbitrageurs had already made huge profits.

Since the end of August last year, the economic model, including RBN staking rewards, has been gradually closed in preparation for the subsequent 1:1 exchange with AEVO. In other words, there has been a long six-month arbitrage window from the initiation of the exchange proposal until now. Did you seize the opportunity?

③Crazy brushing by the god of brushing, a wave of airdrops for a pleasant surprise

Even before Binance announced the launch of AEVO, some gods of brushing were already trading in large volumes, with billions or even tens of billions, and this wave of airdrops will undoubtedly create numerous versions of the wealth creation myth again.

I really appreciate this kind of strategy of seizing an opportunity and going all out to brush, although the process may be tedious, it may be more effective than sowing everywhere.

There are mixed projects in the market now, and more and more projects treat users as slaves and come up with various ways of manipulation. The god of brushing indeed needs to be selective and precise, and prioritize laying ambush for projects that are highly likely to be listed on Binance.

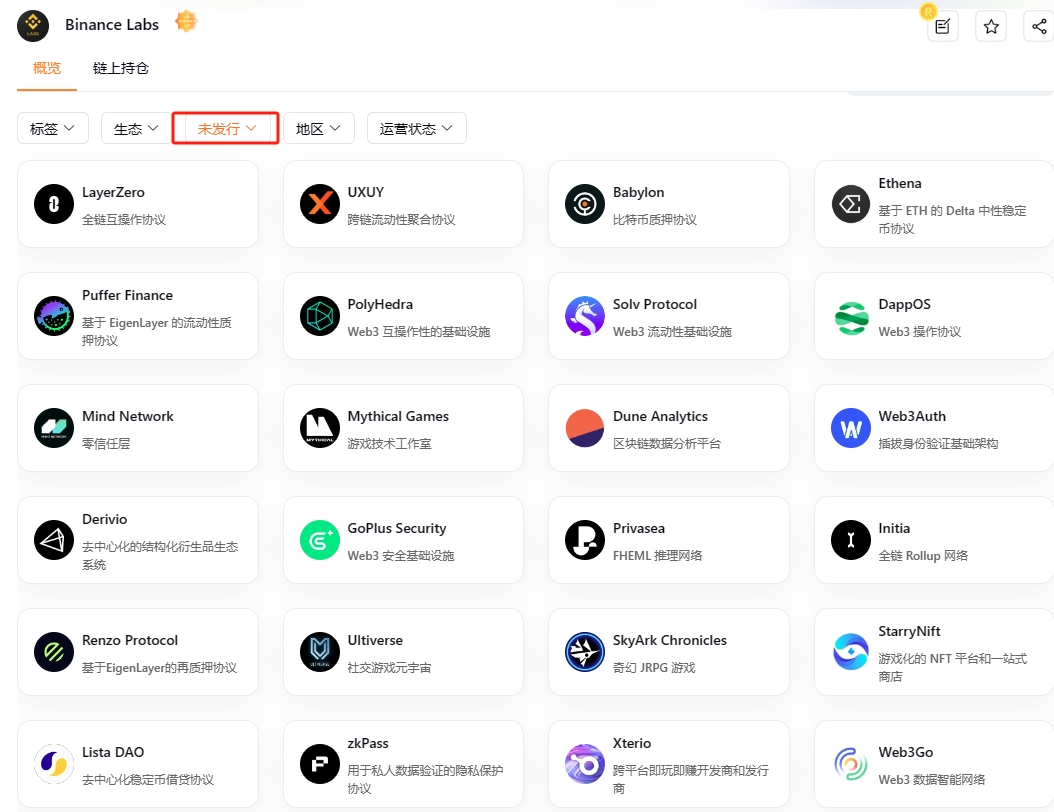

Attached Binance Labs investment collection (can be filtered for unreleased projects): https://www.rootdata.com/en/Investors/detail/Binance%20Labs?k=MjI5

④Technology is the primary productive force, a scientist brushed 20 million with 70U

According to community messages, a scientist wrote a script for AEVO options, brushing 20 million with 70U, and someone else brushed 20 billion with 2000 dollars.

Although the authenticity of these messages cannot be verified, it is undeniable that in the cryptocurrency circle, understanding technology is a force multiplier, often obtaining returns several times that of ordinary people with little effort.

⑤Pre-market trading of Aevo tokens raises questions, and the official prohibits employees from participating

Aevo has initiated pre-market trading for its tokens, raising questions from the public. Julian Koh, co-founder of Aevo, stated that employees have been prohibited from trading their tokens before listing.

He also revealed that no information about the listing price has been shared with investors or internal personnel. Before the airdrop, traders can receive larger airdrop rewards based on trading volume.

In any case, the initial circulation of $AEVO is only 11%, and Binance Launchpool accounts for 4.5%. The exchange between RBN and AEVO requires a lock-up period of 2 months, so there was indeed little selling pressure in the early stage. If you hold BNB or FDUSD, it is advisable to stake them as soon as possible, as the mining returns will not be bad.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。