Author: Cobo Global

Preface

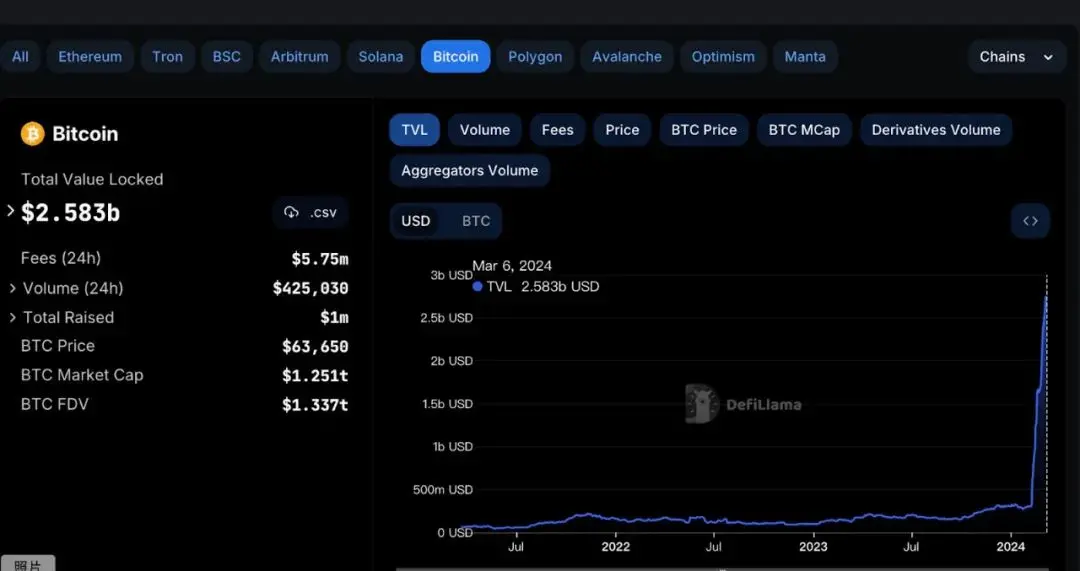

This article analyzes the huge potential of the Bitcoin Layer 2 network as the financial infrastructure of the BTC ecosystem, specifically in the following aspects: First, the total locked value (TVL) of the BTC Layer 2 protocol has exceeded 2.5 billion US dollars, achieving a 734% growth in less than a month, reflecting the strong demand and huge potential for BTC DeFi in the market. Secondly, as the most distinctive asset in the crypto field, Bitcoin not only has a market value and trading volume 2.5 times that of Ethereum, but also has over 200 million global Bitcoin users, far exceeding Ethereum's 14 million users. Lastly, as the most valuable, widely adopted, and secure decentralized cryptocurrency in the world, Bitcoin is the best option to act as a global settlement layer, but relative to its scale, Bitcoin is still one of the least financialized assets in the world.

All of this means that whoever can seize the opportunity of BTC Layer 2 in this bull market will reap substantial returns in the bull market driven by the Bitcoin halving effect.

However, the accompanying high risk of fund storage, especially for BTC Layer 2 projects with TVL reaching hundreds of millions of US dollars, poses a huge challenge on how to securely store and manage the BTC native assets deposited by users to prevent hacker attacks. Cobo has launched an MPC (multi-party computation) co-management solution specifically for BTC Layer 2, which can effectively resist external malicious behavior at the operational level and allow project parties to customize more risk control rules to refine security management measures.

It should be noted that security risks are multidimensional, and different participants face different security threats.

In this case, the BTC Layer 2 project will receive Bitcoin from retail stakers and store it in the BTC Layer 1 network, where the concern is malicious withdrawal by external hackers and internal personnel. Cobo's MPC Layer 2 co-management solution essentially relies on the multi-signature mechanism of MPC technology to ensure that all approved actions are in line with the intentions of the project party, and any malicious operations outside the project party will be invalid.

For retail stakers participating in the staking, the security risk they face comes from another perspective. Bitcoin stakers need to understand that the high potential returns of BTC Layer 2 always come with risks. This means that anonymous projects are best avoided, founders of projects with a bad history should handle with caution, and they should also follow the "Do Your Own Research" principle, understand relevant risk control strategies, such as withdrawal limits or time locks, and other measures.

Finally, Cobo emphasizes that although Cobo provides a technical solution, it does not represent an endorsement of the project party. The ultimate security of user assets depends on how the project party formulates its own risk control strategy.

Bitcoin's Technological Innovation and DeFi Potential

Bitcoin is one of the most unique assets in the crypto ecosystem, with a market value and trading volume approximately 2.5 times that of Ethereum. There are over 200 million Bitcoin holders globally, compared to 14 million Ethereum holders.

Compared to Bitcoin's huge influence in the market, its potential in technological innovation seems to be underexplored. This limitation poses obstacles to Bitcoin's potential in scalability, programming capabilities, and attracting developers. A meme about Bitcoin circulating on the internet pointed out this limitation very sharply, "As an investment target, Bitcoin seems to have no other way besides long-term holding ('hodl')." This meme conveys the fact that although Bitcoin is a powerful store of value, there is still a lot of room for expansion in its functionality and use cases at the application level.

With the unstoppable macro trends and the evolution of Bitcoin's underlying technology, this situation is changing.

Technologically, since the Taproot upgrade, the amount of data and logic that can be stored in Bitcoin transactions has been expanded. As a result, Bitcoin can execute more complex transactions, expanding the use cases on Bitcoin. The introduction of Ordinal Inscriptions supports inscribing richer data (such as images, text, SVG, HTML, etc.) on the smallest unit of Bitcoin, "satoshi," and adding inscriptions to Bitcoin transactions, giving the inscribed "satoshi" uniqueness and scarcity, which means that the Bitcoin ecosystem now has a metadata layer of irreplaceable tokens. Finally, the introduction of BRC-20 further improves Ordinals. This protocol writes token information such as token names and total supply in a standardized JSON format into "satoshi" to achieve token deployment, minting, and transfer functions.

In addition, with the approval of Bitcoin spot ETFs and the upcoming Bitcoin halving in April, investors are starting to seek use cases for Bitcoin beyond digital gold, especially in decentralized finance (DeFi) on Bitcoin.

The latest trend shows that decentralized finance on top of Bitcoin is quietly rising, with its potential similar to or even greater than DeFi on Ethereum. Data shows that the total locked value (TVL) of BTC Layer 2 protocols has exceeded 2.5 billion US dollars, with a growth of 734% in less than a month, reflecting strong demand and huge potential for BTC DeFi. Whoever seizes the opportunity of BTC Layer 2 has the potential to gain substantial returns in the bull market catalyzed by the Bitcoin halving.

As the most valuable, widely adopted, and secure decentralized cryptocurrency in the world, Bitcoin is the best option to act as a global settlement layer, but relative to its scale, Bitcoin is still one of the least financialized assets in the world.

This indicates that Bitcoin has great potential for development in the decentralized finance field. So, how big is the potential of DeFi on Bitcoin?

Data shows that Ethereum, with a market value of approximately 424.6 billion US dollars, carries most of today's DeFi activities. Historical data shows that the proportion of DeFi applications to Ethereum's market value ranges from 8% to 50%, and currently this proportion is about 13%.

If we take Ethereum as a reference, assuming that DeFi in the Bitcoin ecosystem can reach the same proportion as Ethereum, then we can calculate that the total market value of DeFi applications on Bitcoin will reach 161.8 billion US dollars (13% of Bitcoin's market value), with historical scales possibly ranging from 99.6 billion US dollars to 622.2 billion US dollars (8% to 50% of Bitcoin's market value). It is worth noting that all the above assumptions are based on the current market value of Bitcoin remaining unchanged.

Undoubtedly, the macroeconomic trends and technological innovations of Bitcoin have not only ignited investors' enthusiasm for Bitcoin decentralized finance (DeFi), but also heralded a key breakthrough in the field of Bitcoin DeFi. DeFi will benefit greatly from Bitcoin's huge influence, abundant liquidity, and its dominant position in the market. With the comprehensive deployment of Bitcoin Layer 2 (L2) technology and the profound impact of cutting-edge innovative solutions on DeFi, it is highly likely to further strengthen Bitcoin's leadership in the Web3 field.

Bitcoin's Bridging Standard: Security Guarantee Based on MPC

The biggest challenge to unleash the potential of decentralized finance in the Bitcoin ecosystem is how to bridge native Bitcoin assets to these new Layer 2 solutions.

In Ethereum's Layer 2 solution, the bridging to L2 is controlled by L1. Bridging to L2, also known as transfer, actually means locking the assets on L1 and minting a copy of the asset on L2. In Ethereum's case, this is achieved through L2's native bridging smart contract. This smart contract stores all assets bridged to L2, and its security is derived from L1 verification nodes. This makes bridging to L2 secure and minimizes trust.

The original text has been translated into English. Here is the translated text:

Bitcoin was originally designed to be used solely as a payment medium, using the UTXO model at its core. This simple payment ledger does not have smart contracts, which is suitable for payment scenarios. However, when it comes to more complex logic and loops, the limitations of this design become apparent. It is not flexible enough and restricts the potential of Bitcoin, unable to balance the security and efficiency issues of bridges like Ethereum.

To embrace the DeFi moment of Bitcoin, Cobo has launched an MPC co-management solution based on BTC Layer 2, and has already practiced it for the first time on Merlin Chain, which has a TVL of up to 3 billion US dollars (BTC Layer 2+Ordinals). This solution supports the bridging of various native assets from Bitcoin Layer 1 to Layer 2. Cobo hopes to promote its professional BTC bridging technology framework to a wider range of applications, now opening its doors to all BTC Layer 2 projects, providing a secure and flexible BTC Layer 2 chain construction framework.

The Cobo MPC co-management solution provides asset security protection through the following two key measures:

Multi-Signature Mechanism: The Cobo MPC co-management solution adopts a multi-signature mechanism, requiring multiple independent private key shards to participate in order to sign a valid transaction. Cobo, as a co-manager, participates in verification to ensure that every transaction truly reflects the intentions of the project party, rather than external malicious behavior, making any external hacker attacks unsuccessful.

Risk Control Strategies: The Cobo MPC co-management solution allows project parties to implement predefined risk control strategies for asset withdrawals, such as limits and withdrawal frequency restrictions. Any operation that does not comply with the project party's set risk control strategies may be rejected or delayed, providing further security for the project party.

Cobo provides a technical solution for BTC Layer 2, but does not endorse the project party. The security of end-user assets still depends on how the project party defines its own risk control strategies. In an extreme case, the project party may even engage in malicious fund withdrawals, such as setting an anonymous address as a whitelist and withdrawing assets within the withdrawal limit, which may not trigger risk control rules. As a co-signer, Cobo cannot judge whether this operation constitutes malicious behavior.

For staking users, the security of their assets is influenced by the risk control strategies defined by the project party. Even in the case of MPC co-management, if the project party sets inappropriate risk control measures, users' assets may still be at risk.

Cobo reminds users to be aware of the risks when participating in BTC staking and to follow the "Do Your Own Research" (DYOR) principle to ensure asset security. DYOR includes, but is not limited to:

- Assessing the balance between returns and risks;

- Understanding relevant risk control strategies, such as withdrawal limits or time locks;

- Considering the reputation, history, and transparency of the project party and asset custodian, avoiding anonymous project parties;

- Recognizing the trading conditions and restrictions, and their impact on asset liquidity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。