Abstract

After nearly two rounds of bull and bear market fluctuations and policy cycles, the Bitcoin mining industry has all gone global. With the approval of the US Bitcoin ETF, the rise of AI computing power, and a new round of semiconductor process upgrades, mining enterprises are once again at a new starting point, and vertical integration has become a common strategy. Taking the example of Bitcoin mining hosting, self-mining, and cloud computing service provider Bitdeer, on January 5, 2024, it announced the development of its own mining machine on its official website and has placed an order with TSMC to purchase chips specifically designed for mining. This batch of chips is expected to be delivered in the first quarter of 2024 for further design verification and prototype testing.

How to view the self-developed mining machine by miners?

—The income of Bitcoin mining is mainly affected by mining difficulty and electricity costs. The mining difficulty and coin price of the entire Bitcoin network are uncontrollable for all miners. Miners can only increase their income by expanding their own computing power. The mining machine is the main means of production for miners, and the energy efficiency ratio of the mining machine (J/TH, power consumption per unit computing power) can simultaneously affect mining income and costs. For the same computing power, the mining income is the same, but a mining machine with lower energy consumption will incur less electricity costs, theoretically resulting in higher mining income.

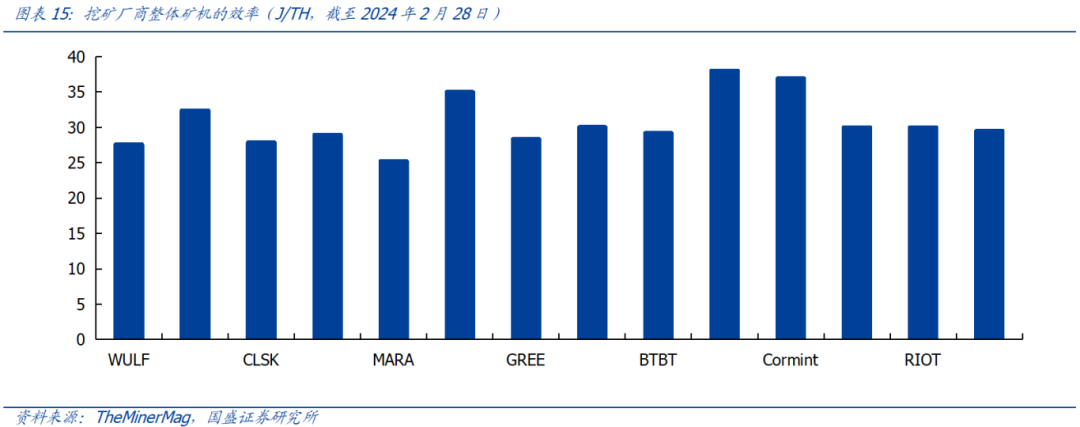

—The halving is imminent, and mining costs are about to double, making high-performance mining machines crucial. Bitcoin halving refers to the halving of the number of bitcoins mined as confirmation rewards for miners. Since the launch of Bitcoin, halving has occurred three times, and the next halving is expected to occur in April 2024. For miners, Bitcoin halving means a halving of income, resulting in a doubling of costs for the same income. The key to controlling costs lies in controlling mining machine electricity costs, with significant room for improvement in the performance of mining machines (reflected in the energy efficiency ratio J/TH). Currently, the overall level of mining machines from mining manufacturers varies, leading to significant differences in computing power costs. Considering the imminent increase in Bitcoin mining costs due to halving, only more efficient and advanced mining equipment can ensure mining profitability and prevent mining machines from being phased out by the market.

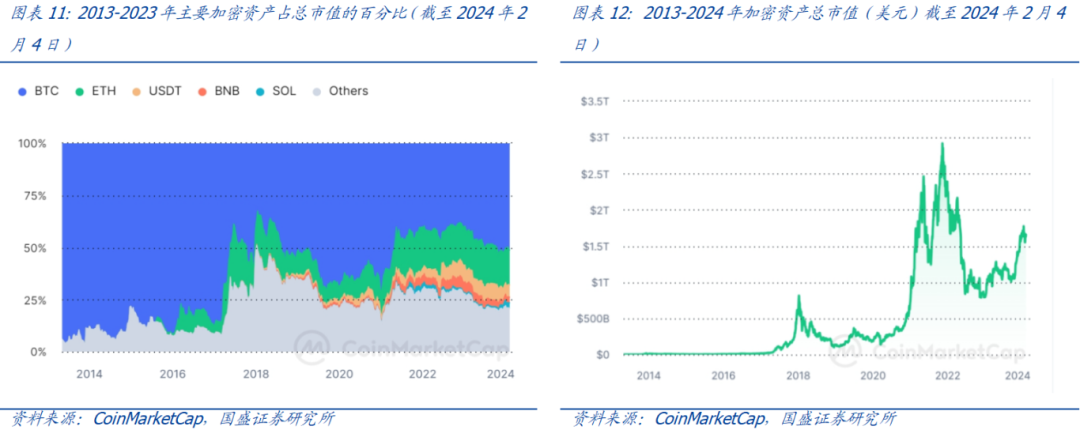

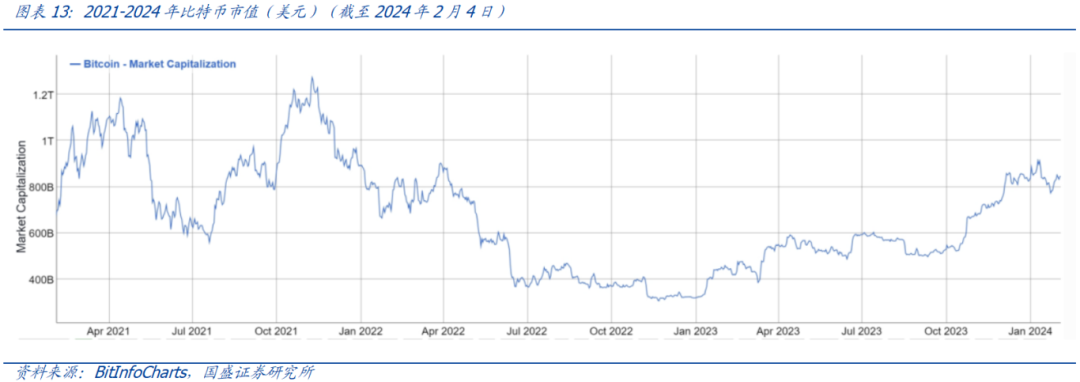

—Coin prices have bottomed out and rebounded, the mining market is beginning to recover, mining machine prices are rising, and the trend of centralized computing power has emerged. Coin price is the "ultimate factor" affecting miner income. In 2023, coin prices rebounded from the bottom, and as of February 4, 2024, the price of Bitcoin had risen from $16,000 on November 11, 2020, to $43,000, an increase of 175%. Overall, coin prices have emerged from the bear market, confidence has increased, and the mining market has subsequently recovered, with mining machine prices also "rising." With the increase in mining difficulty and the decrease in Bitcoin production, traditional retail miners have left the market, and the trend of institutionalized miners is gradually emerging.

The self-developed mining machine is expected to achieve cost reduction and efficiency improvement. It is expected that more mining manufacturers will enter the field of self-developed mining machines in the future. Independent research and development of mining machines is conducive to the further expansion of company business and helps the company cope with the upcoming halving and rising mining machine prices. Since mining machines are related to miner income and costs, and the imminent halving and rising mining machine prices are problems faced by all manufacturers, we expect that more mining manufacturers will start to develop their own mining machines. At the current stage, due to issues such as mining machine procurement batches and product updates, the overall efficiency levels of mining machines from various manufacturers vary. With Bitdeer taking the lead in developing its own mining machine, manufacturers with originally higher energy efficiency may seek to surpass through self-development, while manufacturers with originally lower energy efficiency may also consider self-development to ensure a leading advantage.

Investment advice: It is recommended to pay attention to Bitdeer, MicroStrategy (MSTR), Bitcoin miners (MARA, etc.), Bitcoin mining machine manufacturer Canaan (CAN), cryptocurrency exchanges Coinbase, and BC Technology Group, a cryptocurrency exchange in Hong Kong.

Risk warning: Bitcoin price decline, stricter regulation of Bitcoin by various countries, unexpected electricity supply shortages, and lower-than-expected computing power increases.

1. Bitdeer officially announces the self-developed mining machine, and the Bitcoin mining industry is now vertically integrated

After nearly two rounds of bull and bear market fluctuations and policy cycles, the Bitcoin mining industry has all gone global. With the approval of the US Bitcoin ETF, the rise of AI computing power, and a new round of semiconductor process upgrades, mining enterprises are once again at a new starting point, and vertical integration has become a common strategy. Taking the example of Bitcoin mining hosting, self-mining, and cloud computing service provider Bitdeer, on January 5, 2024, it announced the development of its own mining machine on its official website and has placed an order with TSMC to purchase chips specifically designed for mining. This batch of chips is expected to be delivered in the first quarter of 2024 for further design verification and prototype testing.

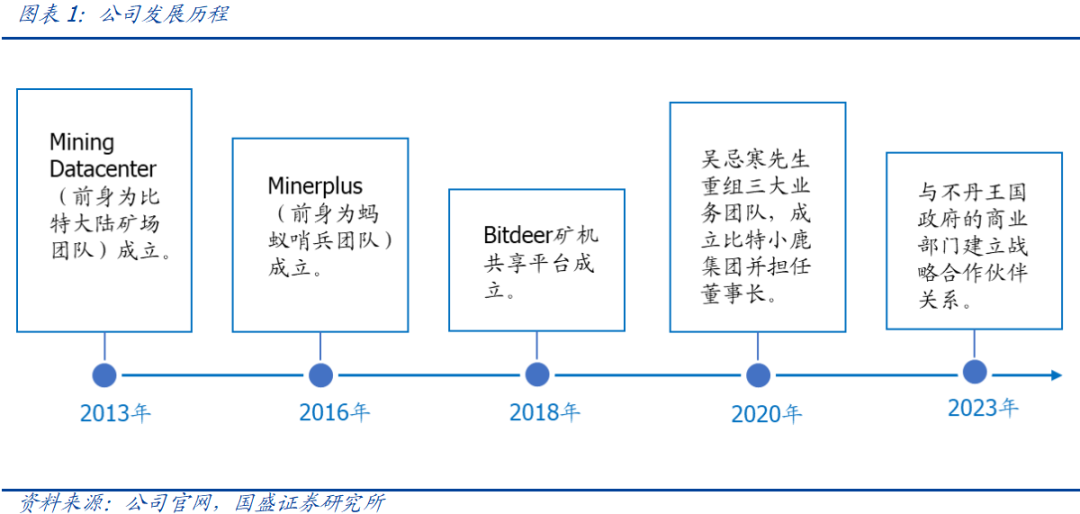

A leading global digital asset mining service provider. Founded by the Bitmain team in 2013, it provides hardware design and various solutions for the blockchain and artificial intelligence applications, becoming a leading brand in the digital currency mining industry. In 2016, the integrated intelligent software platform Minerplus was established. In 2018, the Bitdeer mining machine sharing platform was established. In 2020, the business team was restructured to establish the Bitdeer Group. In 2023, the company established a strategic partnership with the Department of Commerce of the Kingdom of Bhutan.

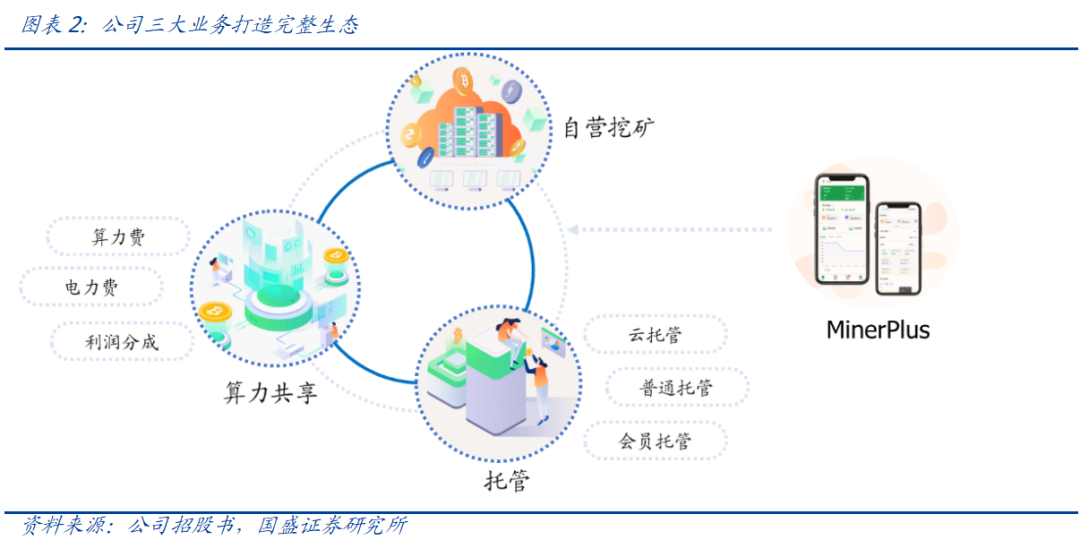

Bitdeer is committed to meeting the personalized mining needs of users worldwide and plays an important role in the entire digital currency mining industry ecosystem, including hardware, software, and various support services. The three vertical business lines of the company, supported by its independently developed Minerplus, include self-mining, shared computing power, and hosting services, forming the company's three main business lines.

Among the three business lines:

- The self-mining business involves the company mining cryptocurrencies for its own accounts.

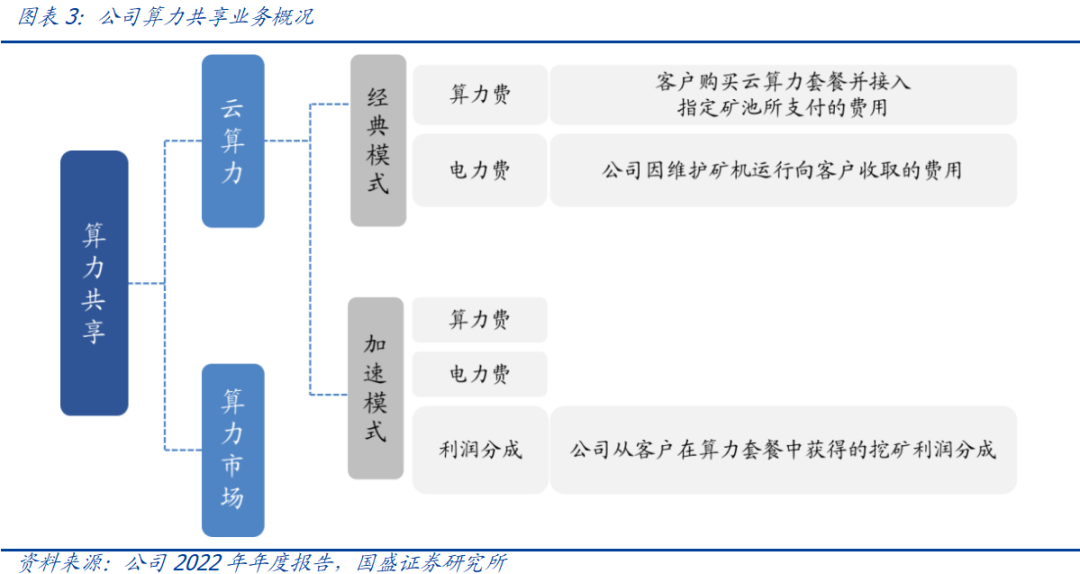

- The shared computing power business provides two solutions: cloud computing power and computing power market, to provide convenient, transparent, and reliable computing power support for cryptocurrency mining activities worldwide. As of December 31, 2022, the revenue from the computing power market solution is relatively unimportant compared to the total revenue. The revenue of the computing power sharing business is mainly from cloud computing power, including:

- In the computing power market solution, the company acts as an intermediary connecting third parties (such as miners or mine owners) and customers with computing power needs, and only charges service fees.

The cloud computing power solution provides customers with the computing power of the company's self-operated mining machines, which can be divided into three packages: 30/45/360 days, and two billing methods: classic mode and accelerated mode.

The cost of the classic mode consists of two parts: 1) computing power fee, which is the fee required for customers to purchase cloud computing power packages and access specified mining pools, and must be paid in full when purchasing the package; 2) electricity fee, which is the cost required to maintain the mining machines providing computing power, and is fixed at the beginning of each electricity subscription and can be paid in installments during the package period.

In the accelerated mode, the computing power fee paid by customers is relatively lower than that in the classic mode, but after the cost paid by the customer is recovered, the company will receive a profit share. In addition to the computing power fee and electricity fee, the company has the right to receive additional profits as a percentage of the mining profits obtained by customers from the cloud computing power package.

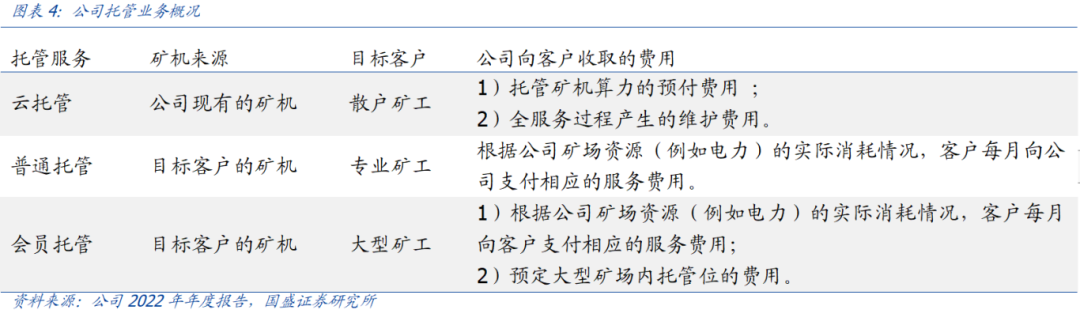

The hosting includes three types of services: cloud hosting, regular hosting, and member hosting, to meet the diverse needs of customers for professional hosting solutions and reduce the upfront investment costs of mine construction, deployment, and operation. Among them:

The cloud hosting mode provides a "group purchase" service for mining machines, allowing retail miners to collectively purchase the company's mining machine computing and maintenance services. The company plans to use the future capacity expansion of the mine for regular and member hosting services, and the existing cloud hosting services will continue to be maintained but will no longer be the mainstream product.

In the regular hosting mode and member hosting mode, the hosted mining machines are all from target customers, with the member hosting mode targeting large-scale mining customers seeking long-term stable hosting services. The company will prioritize meeting the hosting needs of members and provide preferential service fees.

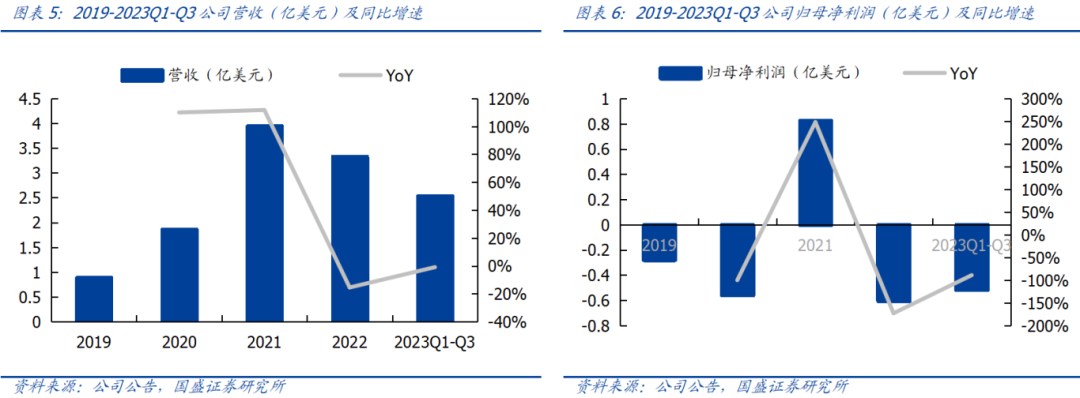

Revenue and net profit fluctuate significantly, heavily influenced by Bitcoin prices. The company's revenue continued to rise from 2019 to 2021, but in 2022, revenue decreased by 15.5% year-on-year due to the impact of coin prices. The company's net profit attributable to the parent company fluctuated greatly, reaching a peak of $83 million in 2021, a year-on-year increase of 248%, but dropping to a loss of $60 million in 2022. In 2023 Q1-Q3, with the rebound of coin prices, the company's revenue and net profit attributable to the parent company were $250 million and a loss of $50 million, respectively, showing an improvement compared to 2022.

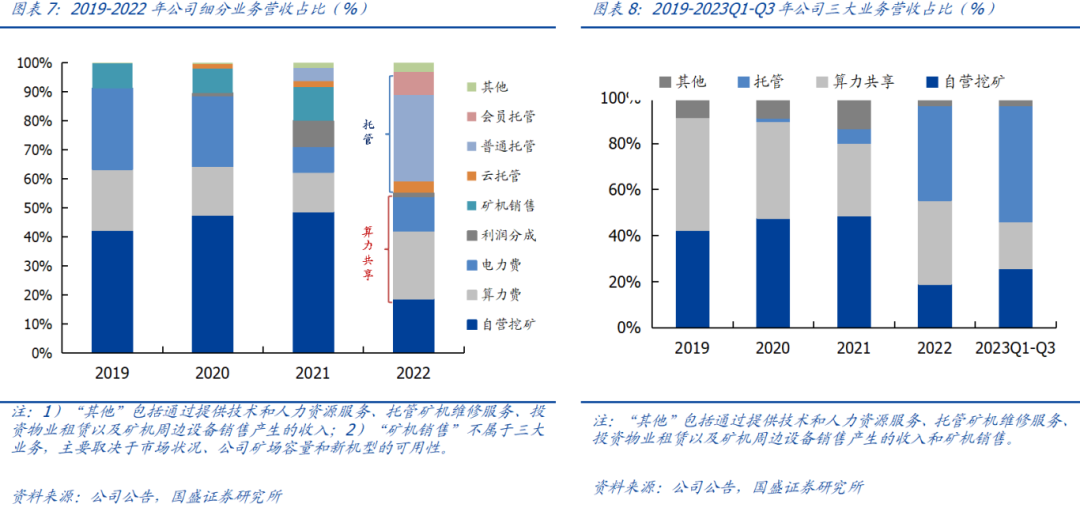

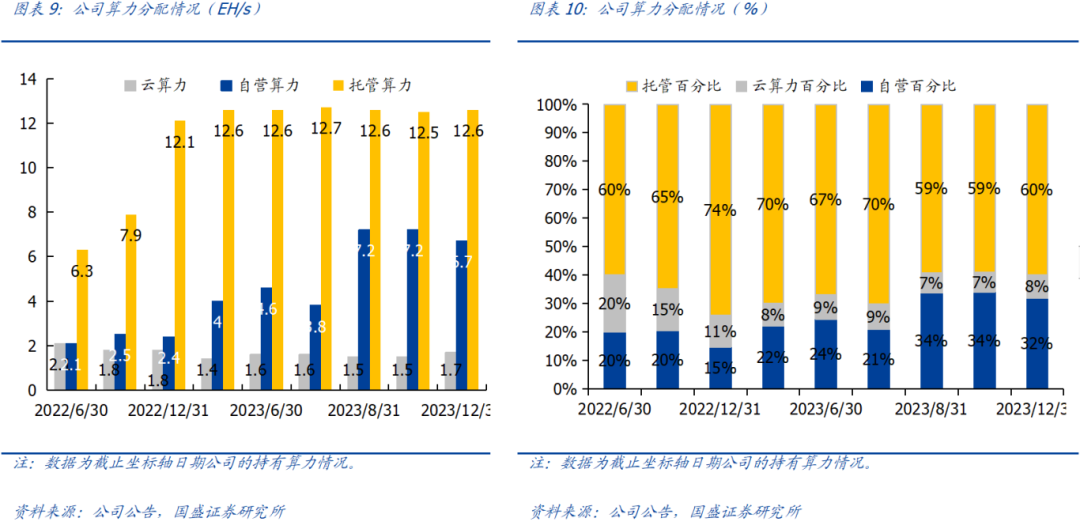

Vertical integration of the three major businesses, with flexible allocation strategies. The company's business relies on its own mining farms and mining machines, and has extensive freedom in pricing strategies and resource allocation, allowing for flexible adjustments to mining farm capacity and self-operated computing power allocation in response to market conditions. In 2022, the revenue share of self-mining business significantly decreased to 18.7%, but increased to 25.6% in 2023 Q1-Q3. Since the launch of hosting services in 2020, its revenue share has continued to rise, with hosting services rapidly becoming the main source of revenue, accounting for 50.7% in 2023 Q1-Q3. According to the company's operational report in December 2023, the company's self-operated computing power scale reached 8.4 EH/s, a year-on-year increase of 105%.

2. Halving is coming, mining machine prices are rising, and self-developed mining machines may become a trend in the mining industry

2.1. Mining machines are the main means of production for miners, affecting mining income and costs simultaneously

Bitcoin is a medium of exchange and a store of value. It uses encryption technology to control the creation of currency units and verify fund transfers. Many consumers use Bitcoin because it provides cheaper and faster peer-to-peer payment options without the need to provide personal information. Bitcoin features decentralization, global circulation, exclusive ownership, low transaction fees, no hidden costs, and the ability to mine across platforms, and its value can be determined without relying on third-party pricing institutions.

Bitcoin has always maintained a dominant position in the cryptocurrency market. According to CoinMarketCap data, as of February 4, 2024, the total market value of global cryptocurrencies (including stablecoins and tokens) reached $1.65 trillion, with major cryptocurrencies including Bitcoin, Ethereum, Tether, and BNB. As the first cryptocurrency to emerge, Bitcoin has consistently maintained a dominant position in the market value of cryptocurrencies, accounting for 51.21% of the total market value of cryptocurrencies as of February 4, 2024.

Blockchain is the underlying technology of Bitcoin. It is a decentralized digital ledger consisting of data layer, network layer, consensus layer, incentive layer, contract layer, and application layer, which can record and secure peer-to-peer transactions without the need for third-party intermediaries, ensuring the ownership of digital assets. When a user requests the blockchain network to process a transaction, a peer-to-peer network of mining machines (specialized computers) uses known algorithms to verify the transaction and compete for the right to record the transaction.

After the transaction is verified, a new data block is generated on the blockchain. The new block is added to the existing blockchain in a permanent and tamper-resistant manner, completing the transaction. Each transaction and the ownership of each digital asset in circulation are recorded on the blockchain. Each time a transaction occurs, the mining machines update the BTC ledger.

Mining machines that successfully verify transactions receive Bitcoin rewards and transaction fees (Bitcoin is publicly issued in this way). As of February 4, 2024, the market value of Bitcoin is close to $840 billion. The following conditions have been determined:

1) Bitcoin was launched in 2009, and mining machines that "mine" new blocks can receive a reward of 50 Bitcoins. Every 4 years, this reward is halved. The current block reward for Bitcoin is 6.25 Bitcoins (note: the block reward has been 50-25-12.5-6.25, and the next halving is expected to occur in April 2024).

2) Regardless of the total network computing power, the Bitcoin network maintains a constant block generation speed, with approximately 1 new block appearing every 10 minutes.

3) The current unit price of Bitcoin is approximately $42,842 (BitInfoCharts, February 4, 2024).

Based on the above, the theoretical daily block reward for Bitcoin can be calculated as follows:

Theoretical daily block reward = Block reward * (24 hours / time to mine 1 block)

= 6.25 * (24 * 60 / 10)

= 6.25 * 144

= 900 (Bitcoins)

Theoretical daily block reward market value = Bitcoin price * Bitcoin daily block reward

= $42,842 * 900

= $38,557,800 (USD)

≈ $38,557.8 (million USD)

As of 5:00 PM on February 4, 2024, the total block rewards and transaction fees in the past 24 hours were 975 BTC and 186.53 BTC, totaling $49.75 million. The minimum unit of Bitcoin is expected to be mined by 2140, at which point miners will only receive transaction fees.

Bitcoin is "issued" in this way, with a total quantity of approximately 21 million. According to BitInfoCharts, as of February 4, 2024, approximately 19.617 million Bitcoins have been mined, and the unit price of Bitcoin is $42,842. The market value of all mined Bitcoins as of February 4, 2024 is approximately $840 billion.

Miners' mining income is directly related to the proportion of their computing power to the total network computing power. During the mining process, miners need to solve a complex mathematical problem to prove their workload, and the difficulty value of this mathematical problem determines approximately how many hash operations a node needs to perform to produce a valid block. To maintain a constant rate of new block generation under the constantly changing total network computing power, the difficulty value must be adjusted according to changes in the total network computing power, with the relationship:

Time to mine 1 block (approximately 10 minutes) = Difficulty value * 2^32 / total network computing power

Converting this relationship yields "Difficulty value = 10 * total network computing power / 2^32," meaning that the higher the total network computing power, the greater the mining difficulty. A miner's daily mining income depends on the amount of Bitcoin mined per day and the coin price, and can be calculated as follows:

Daily mining income = Amount of Bitcoin mined per day * Coin price

= (Miner's computing power / Total network computing power) * Bitcoin daily block reward * Coin price

Since the Bitcoin daily block reward and coin price are the same for all miners, a miner's mining income is only related to the proportion of their mining machine's computing power to the total network computing power. The larger the proportion of computing power, the higher the mining income.

Bitcoin mining income is mainly affected by mining difficulty and electricity costs. Since the mining difficulty of the entire Bitcoin network (which determines the unit mining income) and the coin price are the same for all miners, a miner's mining income is only related to the computing power of their mining machine. Therefore, the main factors affecting mining costs are the power consumption and electricity costs of the mining machine, and the energy efficiency ratio (J/TH) of the mining machine is an important indicator to consider. For the same computing power, a mining machine with lower energy consumption will incur less electricity costs, theoretically resulting in higher mining income.

2.2. Halving is coming, mining costs are about to double, only high-performance mining machines will not be eliminated

Bitcoin halving refers to the event where the amount of Bitcoin received by miners as a reward for processing transactions is halved. Since the launch of Bitcoin, halving has occurred on three different occasions. The first halving occurred on November 28, 2012, the second halving occurred on July 9, 2016, and the most recent halving occurred on May 20, 2020. The Bitcoin rewards have been halved from 50 to 25 to 12.5 to 6.25, and the next halving is expected to occur in April 2024.

For mining manufacturers, Bitcoin halving means a 50% reduction in income, which translates to a doubling of costs for the same revenue. The key to controlling mining costs lies in the power consumption and electricity costs of mining machines, with significant room for improvement in the performance of mining machines (reflected in energy efficiency ratio J/TH).

At present, the overall level of mining machines from mining manufacturers varies, resulting in significant differences in computing power costs. Considering the imminent significant increase in costs due to the upcoming Bitcoin mining halving, only more efficient and advanced mining equipment can ensure mining profitability and prevent mining machines from being eliminated from the market.

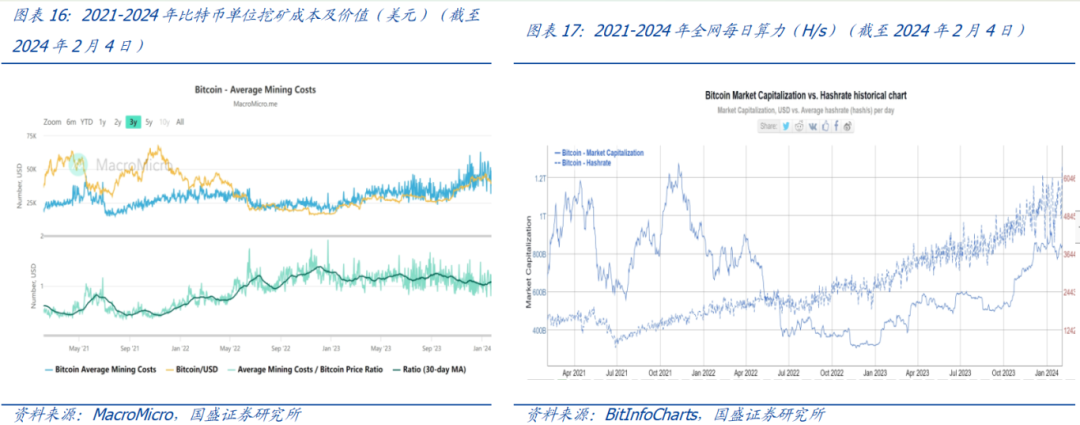

2.3. A year of soaring coin prices has driven up mining machine prices, and self-developed mining machines may help miners reduce costs and increase efficiency

Coin prices have rebounded from their lows, signaling a recovery in the mining market. Coin price is the "ultimate factor" affecting miner income. Ultimately, the mainstream means for miners to generate income is by selling the mined coins, whether in the short or long term. According to MacroMicro, in May 2022, the average mining cost exceeded the value of a single Bitcoin, leading many miners to choose to exit the market or shut down their mining machines, resulting in a decline in total network computing power for the first time since 2021. In 2023, coin prices rebounded from their lows, and as of February 4, 2024, the price of Bitcoin had risen from $16,000 on November 11, 2020 to $43,000, an increase of 175%. Overall, coin prices have emerged from the bear market, confidence has increased, and the mining market has subsequently recovered. According to BitInfoCharts, the total network daily average computing power reached 582.403 EH/s on February 4, 2024.

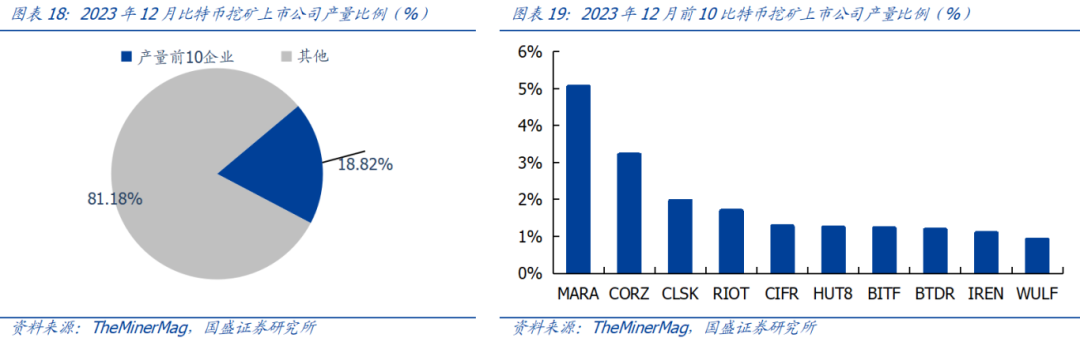

The trend of centralized computing power has already taken shape. With the increase in mining difficulty and the reduction in Bitcoin production, traditional miners focused on short-term investment-oriented returns have exited the market, leaving behind more entities focused on institutional mining farms, computing power product centers, and state-owned capital mining farms. According to TheMinerMag data, in December 2023, the top 10 listed companies in terms of Bitcoin production accounted for 18.82% of the total network Bitcoin production, with Marathon (MARA) accounting for 5.05% of the total network Bitcoin production for that month. With the resurgence of coin prices, the competition for computing power has intensified. According to BitInfoCharts, the total network daily average computing power reached 582.403 EH/s on February 4, 2024, a year-on-year increase of 124.5%.

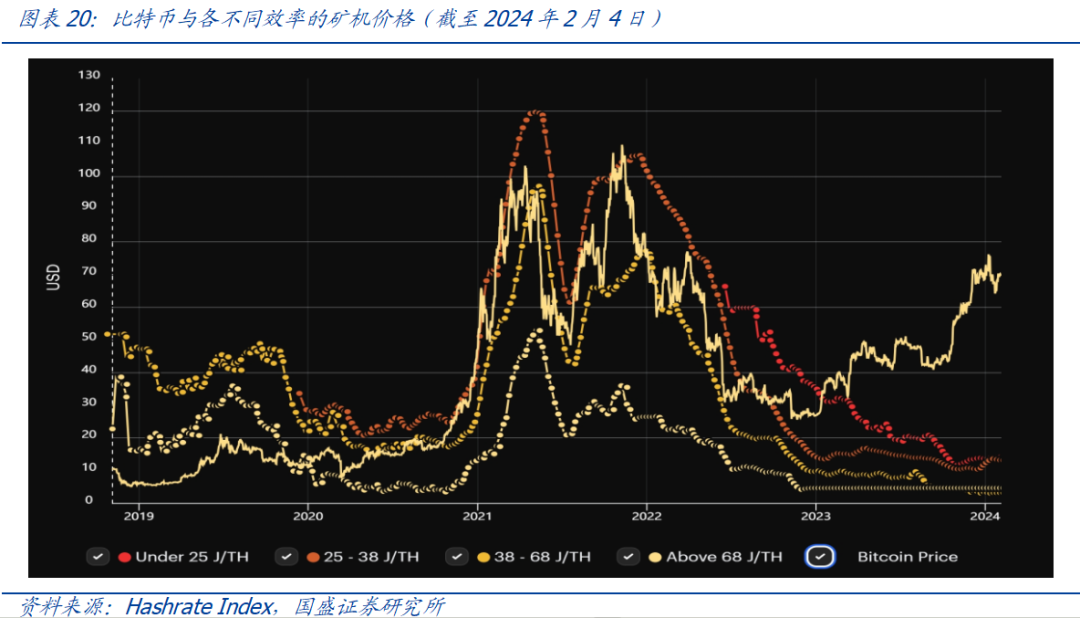

According to Hashrate Index data, mining machine prices have risen. Over the past year, as the price of Bitcoin has continued to rise, mining machine prices have remained relatively low. However, starting from the end of 2023, mining machine prices have begun to rise, showing an upward trend. In addition, with the impending Bitcoin halving, the demand for high-performance mining machines is expected to grow, and mining machine prices are likely to continue to rise in the future.

Self-developed mining machines by Bitdeer are expected to reduce costs and increase efficiency. As a mining manufacturer, the company's three main business operations are closely related to the performance of mining machines. Independent research and development of mining machines will benefit the further expansion of its business and help the company cope with the upcoming halving and rising mining machine prices.

We expect that more mining manufacturers will start to develop their own mining machines. In summary, the efficiency of mining machines is a key factor affecting mining manufacturers' income and costs. The upcoming halving and the rise in mining machine prices are common challenges faced by all manufacturers. Currently, due to issues such as mining machine procurement batches and product upgrades, the overall efficiency levels of mining machines from various manufacturers vary. Following Bitdeer's demonstration of self-developed mining machines, manufacturers with originally higher efficiency may seek to surpass through self-development, while manufacturers with originally lower efficiency may also consider self-development to ensure a leading edge.

Risk Warning

Bitcoin price decline. Bitcoin has a limited history and its fair value fluctuates greatly. The historical performance of Bitcoin prices does not represent its future performance, as its price is influenced by multiple factors and has significant uncertainty.

Strict regulation of Bitcoin by various countries. There is significant uncertainty regarding regulations related to holding, using, or mining Bitcoin in the future. Bitcoin has anonymous properties and may be used for black market transactions, money laundering, illegal activities, or tax evasion, leading governments to regulate, restrict, control, or prohibit the mining, use, and holding of Bitcoin.

Unanticipated power supply issues. Mining requires a large and low-cost supply of electricity. Adverse weather, policies, or local power supply limitations may prevent mining activities from obtaining sufficient power supply, thereby affecting mining income.

Unanticipated increase in computing power. With the increase in coin prices, the supply of new high-performance mining machines may increase. If miners are unable to obtain new high-performance mining machines in a timely manner, they may not be able to maintain a competitive advantage in the intensified computing power competition, resulting in significant negative impacts on their operations.

This article is an excerpt from a report titled "The Path of Integrated Integration of Overseas Bitcoin Mining Industry" published by Guosheng Securities Research Institute on February 29, 2024. For specific details, please refer to the relevant report.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。