1. Research Report Highlights

1.1 Investment Logic

From the perspective of business development, the Thorchain project is very promising, with a token economy deeply tied to the native token. The growth of Total Value Locked (TVL) is directly related to the value of RUNE, and it is expected that the increase in BTC and ETH prices will drive the growth of $RUNE, further expanding its business scale. Moreover, compared to projects in the same field, Thorchain's overall development is superior. Therefore, Thorchain is a relatively excellent investment target with a not low probability.

1.2 Valuation Explanation

At the peak of the previous bull market, the market value of RUNE was $4.6 billion, and now there is approximately 4 times the space for growth. Additionally, Thorchain's investment by Multicoin Capital demonstrates that its economic operation has also been recognized by VCs. In the new bull market, with the normal operation of the economic cycle and no hacker attacks, its TVL will experience significant growth, driving the demand for RUNE to grow positively, possibly leading to a 5-10 times growth space.

1.3 Main Risks

Although Thorchain has high potential for upward movement, there are still high risks, mainly in terms of technology and the market:

Technology Risk

Thorchain's essence is a cross-chain liquidity protocol, and cross-chain bridges have always been a key area of hacker attacks. Thorchain not only includes cross-chain swaps but also synthetics, account savings, multi-stage swaps, PoL, and lending, making it more susceptible to risks related to vulnerabilities. Currently, Thorchain's corresponding solution is to have a dedicated security team monitor network anomalies, including node pauses, bounties, transaction throttling, and intervention by the thorsec team.

Market Risk

Lending accounts are quite sensitive to the price of RUNE. When the price of RUNE is better than the price of non-RUNE assets, the protocol performs well. However, once the price of RUNE falls, it is likely to lead to a cascading liquidation. In the design of the lending business, the protocol's pledging of RUNE tokens will perform better than BTC and ETH, further increasing market risk.

2. Project Overview

Thorchain is a decentralized cross-chain Automated Market Maker (AMM) trading protocol created by a group of anonymous cryptocurrency developers at the 2018 Binance Hackathon. Its goal is to decentralize cryptocurrency liquidity through the public ThorNode and ecosystem product network. Any individual, product, or institution can use its native and cross-chain liquidity.

2.1 Business Scope

The Thorchain project mainly targets native cross-chain swaps for users with demand for native cross-chain transactions, who are typically large capital users or institutions.

2.2 Founding Team

The team is anonymous, so no public team information has been obtained. At the same time, an anonymous team can also be seen as a characteristic or risk point of the Thorchain project.

2.3 Investment Background

In terms of financing, the project has received investments from Multicoin and the highly capable engineering team Delphi Digital. However, the specific amount of financing has not been disclosed. Combined with the anonymity of the team, the possibility of deep involvement by the investors cannot be ruled out. In addition, the project has undergone multiple IEOs, with participants receiving considerable profits exceeding a hundredfold.

2.4 Project Development Roadmap

The Thorchain roadmap is relatively simple. Currently available information shows that the project plans to achieve order books and futures trading functionality by 2024.

3. Product and Business Situation

3.1 Code and Product

On August 21, 2023, Thorchain developed cross-chain lending business. Thorchain's lending business has essential differences in logic from projects like Aave, with features such as no liquidation, no interest, and no maturity date.

Thorchain lend is designed in a way similar to UST & LUNA, meaning that when users collateralize assets to borrow, they do not need to repay the debt, pay interest, or have a maturity date. The specific implementation is as follows:

Opening Process

First, users need to deposit BTC as collateral into the BTC Pool, which will directly convert the user's tokens into RUNE.

Then, the user puts the RUNE into the virtual pool to burn it. In the V BTC Pool, synthetic assets THOR.BTC are generated, and RUNE is minted.

Finally, in the USDT Pool, the corresponding RUNE is exchanged for USDT worth the borrowed BTC value, with the swap fee going to LP.

Assuming the user has 2 BTC, and the current collateralization ratio is 200%, if the user wants to borrow 1 BTC worth of USDT, approximately 1.998 THOR.TOR (THOR.TOR is the pricing unit for calculating the USD average) will be generated and placed in the V TOR Pool. Then, approximately 0.996 BTC worth of USDT will be exchanged from the USDT Pool for the user. The burned value of RUNE = collateral value (2 BTC) - debt (0.996 BTC) + wear and tear of fees. From the perspective of borrowing, the system will additionally burn approximately 1/CR value of RUNE. (Assuming the RUNE price remains unchanged).

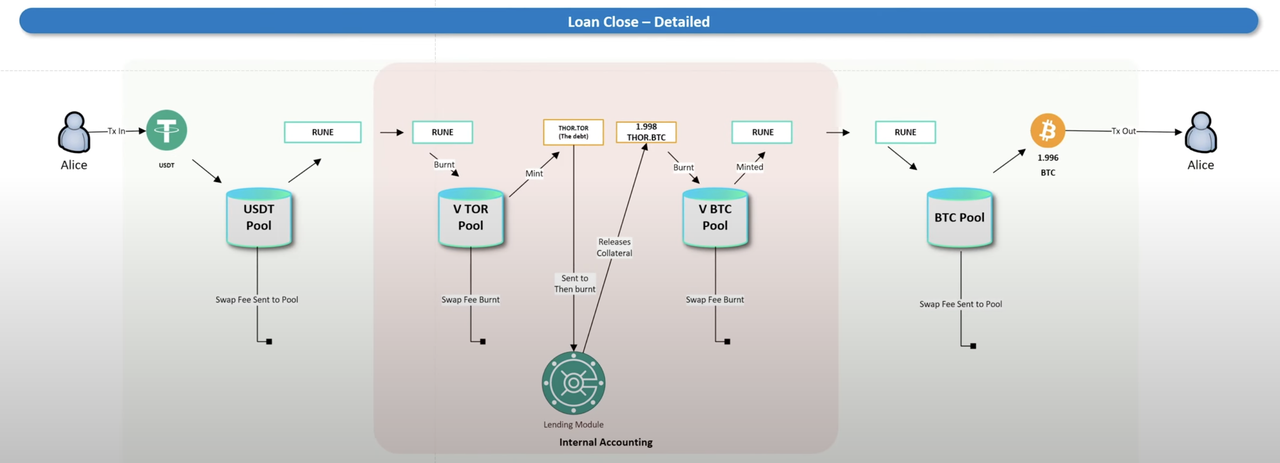

Repayment Process

First, the user exchanges USDT for RUNE in the USDT Pool, then exchanges the obtained THOR.TOR from the virtual pool and transfers it to the lending module for repayment.

Then, the user can withdraw the synthetic asset THOR.BTC and place it in the V BTC Pool, minting RUNE.

Finally, the user exchanges BTC assets with RUNE in the BTC Pool.

The minted value of RUNE = collateral value (1.998 BTC) - debt (0.996 BTC) + wear and tear of fees. From the perspective of repayment, the system will additionally mint approximately 1/CR value of RUNE. (Assuming the RUNE price remains unchanged).

Looking at the borrowing and repayment processes, a total of 8 transactions are involved, each requiring a fee. Both borrowed assets and repaid collateral assets will experience wear and tear. In other words, the more active the trading, the more RUNE will be burned. The lending business is indirectly creating demand for DEX and RUNE, completely linked to DEX. Furthermore, the Borrower is shorting USD and longing collateral assets (conversely, the protocol is longing USD and shorting collateral assets). Our lending pool is not similar to AAVE's collateral assets under normal circumstances; it is synthetic assets that come out of thin air, essentially just a voucher, converted through RUNE, with fees collected. There is naturally no liquidation mechanism, as our BTC has already been sold when it enters the lending business; there are also no interest payments, as interest is collected through transaction fees. The lending module is the counterparty to the user.

The counterpart of the borrowing user is the holder of RUNE, who hopes that users will borrow without repaying, as this reduces the circulation of RUNE. However, when users repay, the circulation of RUNE increases. Generally, when the collateral value is rising, users are more willing to repay, while they have less motivation to repay when the value is falling. Since RUNE is used as a trading medium to exchange borrowed assets in the trading pool, essentially, the LP of the trading pool is the loan provider.

Additional Borrowing Details

Even if the current collateral price rises, users cannot borrow more and can only use new collateral for borrowing again.

Users can repay part of the debt, but can only withdraw collateral after repaying all the debt.

Currently, a 30-day collateral lock-up period is required before repayment, which may change according to the protocol itself.

If the value of RUNE relative to BTC remains unchanged between the start and end of the loan, there will be no net inflation impact on $RUNE (the amount destroyed will be equal to the amount minted minus transaction fees).

If the value of the collateral relative to RUNE increases between the start and end of the loan, the supply of $RUNE will experience net inflation.

3.2 Official Website Data

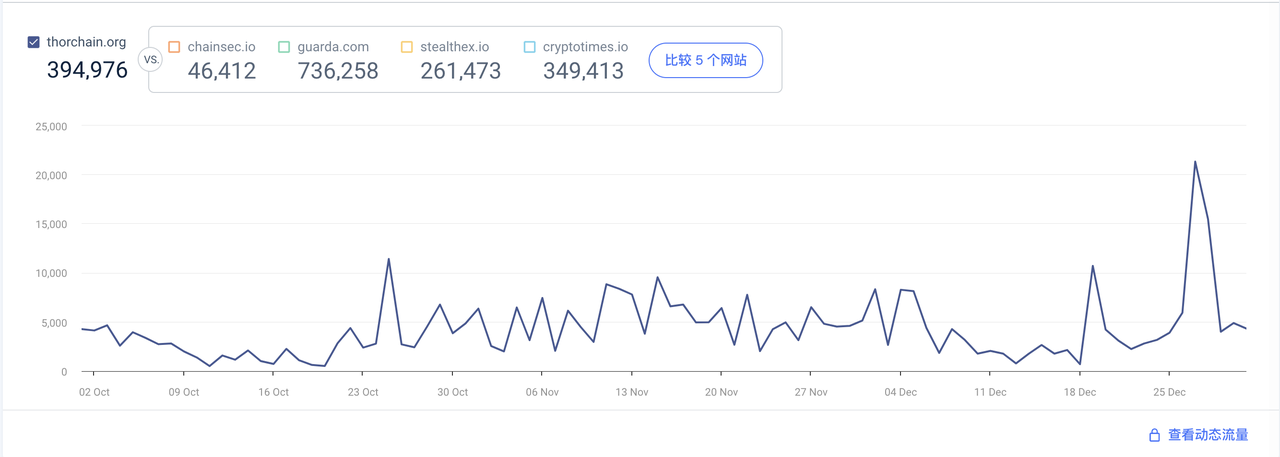

The average daily website traffic is below 5,000, with the main traffic coming from the United States, Malaysia, and Russia. Considering the actual situation, this data is somewhat unreliable and should be used for reference only.

3.3 Social Media Data

The project's social media presence is not comprehensive. Developers occasionally participate in AMAs, but they do so anonymously.

3.4 Community Data

4. Business Analysis

4.1 Track Scale and Potential

In the cross-chain swap track, projects based on Cosmos such as Injective and Kujira have TVL and project token prices close to AHT in the Cosmos ecosystem, posing a risk of overvaluation. However, the market generally has high expectations for the development of cross-chain applications in the Cosmos ecosystem, making these projects appear very promising.

4.2 Project Competitive Landscape

Currently, Thorchain's competitors include Injective, Kujira, and Chainflip, as follows:

Injective's advantage lies in its strong capital support, including from Jump and Binance Labs. Injective generally has a market value ahead of ecosystem development, leading to significant overvaluation in the short term.

Kujira's advantage lies in its product development capabilities and steadily increasing TVL, but it lacks capital support and is relatively weak in competition.

Chainflip is currently in the development stage, supporting only a few token conversions between ETH and DOT. Actual competition will depend on later developments and market trends.

Thorchain's advantage lies in its support from Binance Labs, as well as its strong token economics and focus on the native token RUNE. It also has high market attention and is in direct competition with Injective in the market.

The main difference between these projects lies in their token economics, but all of these projects provide cross-chain liquidity. Comparatively, Thorchain may be a more suitable investment target.

5. Token Circulation and Distribution

5.1 Total and Circulating Supply

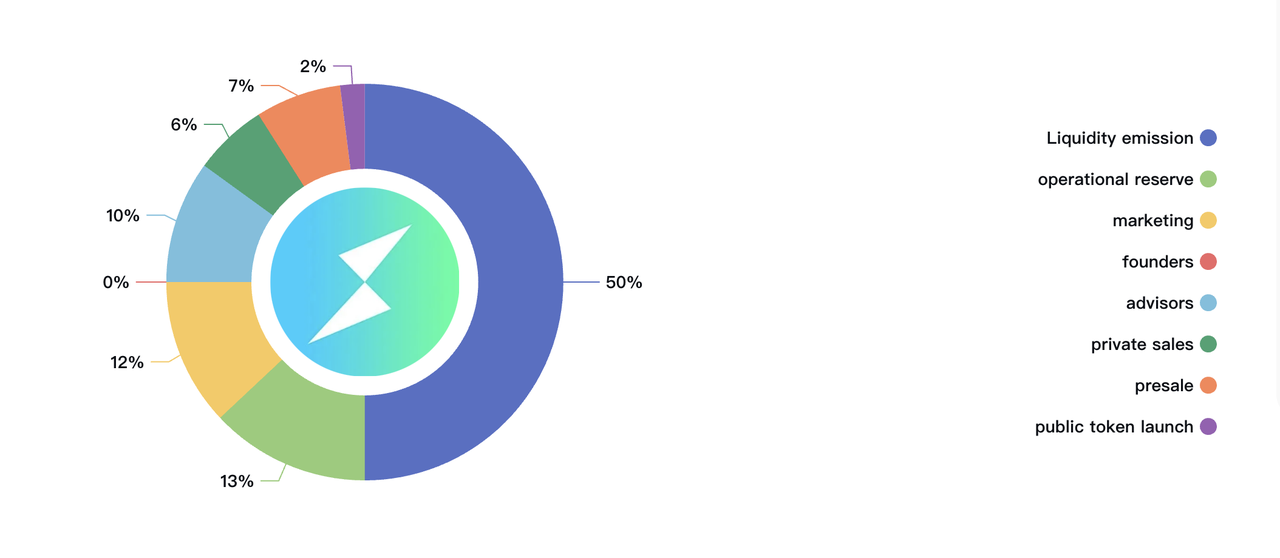

The total supply of tokens is 500 million. Currently, all tokens are in circulation, but there are approximately 200 million tokens staked, resulting in an actual circulating supply of 300 million tokens.

5.2 Distribution, Staking, and Release

In terms of token distribution and liquidity release, the tokens are currently fully in circulation, but nearly one billion tokens are staked, and 200 million tokens are held by the team as a reserve for emergency needs.

5.3 Token Operating Mechanism

Providing Liquidity: In the DEX LP, RUNE exists as an intermediary, representing a 1:1 intermediary product of two target tokens.

Incentive Mechanism: Liquidity providers (LPs) receive transaction fees and system rewards in the form of RUNE, totaling approximately 3.6%.

Security and Assurance: Node operators must stake RUNE to participate in network consensus and governance, helping to ensure network security and decentralization.

Governance: RUNE holders can participate in Thorchain's governance decisions, such as voting on protocol updates, fee structures, and other important matters.

Transaction Fees: Transaction fees on Thorchain are partially paid in RUNE, increasing the demand for RUNE.

Collateral and Debt: In the Thorchain ecosystem, RUNE can also be used as collateral or to pay off network debt.

Cross-Chain Transactions: Thorchain supports cross-chain transactions, with RUNE used as a bridge to connect different blockchain assets.

RUNE tokens directly participate in the operation of the lending business, meaning that the required value of RUNE in the network is locked at three times the value of non-RUNE assets. If $1,000,000 worth of non-RUNE tokens is deposited into Thorchain, the market value of RUNE will be at least $3,000,000. This is only the minimum or deterministic value of RUNE.

5.4 Market Performance Expectations

The current price of the RUNE token is $5.93, with a Coingecko ranking of #56, a market value of $1.78 billion, and a Fully Diluted Valuation (FDV) of $2.958 billion. Due to the 1:3 minimum mechanism, the market value of the RUNE token has a basic support. As the prices of assets such as ETH and BTC rise, the support price of RUNE will also rise in a 1:3 ratio with the prices of ETH and BTC, assuming the coin-based value remains unchanged. Additionally, as the protocol is used, the quantity of RUNE will also decrease to a certain extent.

6. Investment Value Assessment

Currently, the Thorchain project is in a mature stage. Due to its strong token economics and market attention, it is bound to benefit from the overall market trend and is highly likely to perform better in an upward trend.

In the medium to long term, as long as the market values of BTC and ETH rise, its TVL will inevitably increase, driving the price of the RUNE token. With the emergence of more use cases, the potential for RUNE to outperform BTC and ETH is very high, making it worth considering gradual accumulation in a sideways range.

7. Conclusion

Thorchain has a token economics deeply tied to the native token, and the growth of TVL will directly impact the value of the RUNE token. It is expected that the increase in the values of BTC and ETH will drive the corresponding growth of RUNE. Compared to projects in the same track in terms of capital, ecosystem, and market, Thorchain's overall development is better than similar projects. In the future, with the expansion of Thorchain's business scale, improvements in token economics, order books, and futures trading, RUNE is likely to have a more impressive performance and is worth long-term attention as an investment target.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。