On the evening of February 27th, AICoin researchers conducted a live graphic and textual sharing of the "MACD Automatic Trading Indicator (with Membership)" in the AICoin PC End-Group Chat-Live. The following is a summary of the live content.

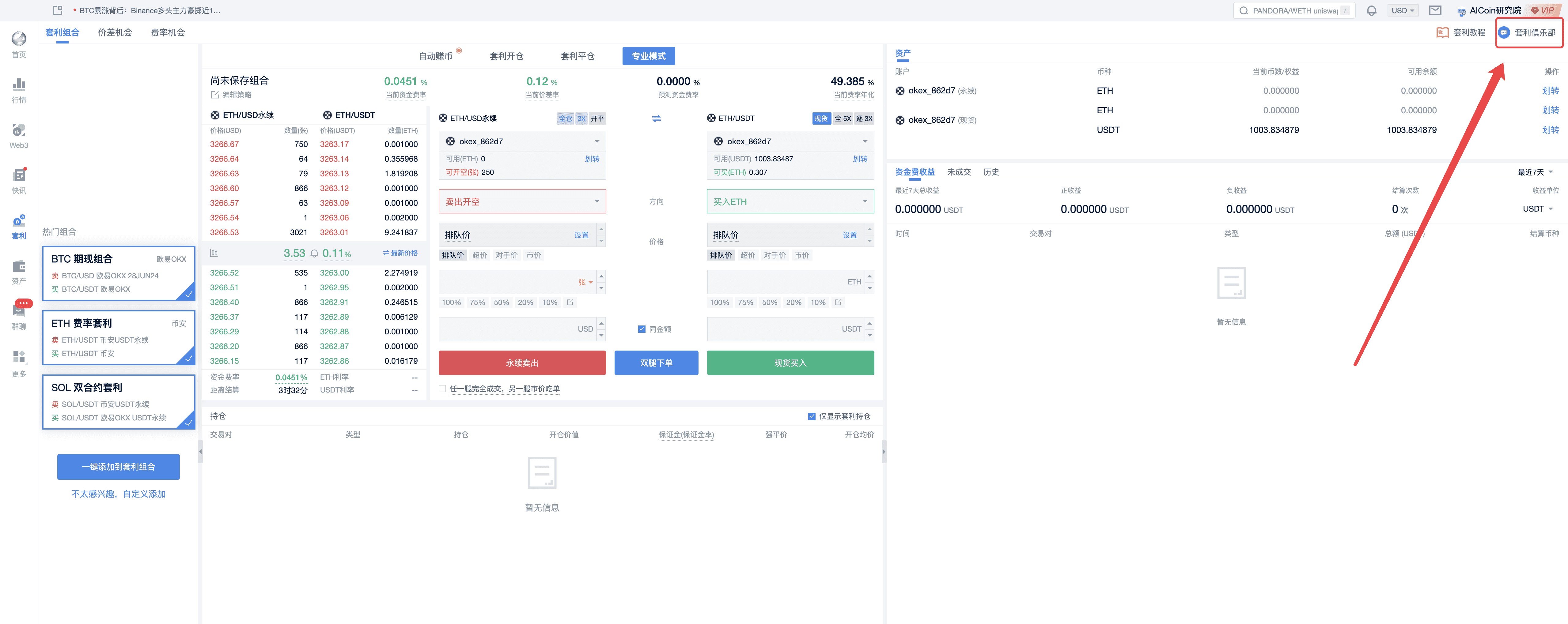

I. Review of the Future—Finding Arbitrage Opportunities

- Pay attention to flash news for arbitrage opportunities.

What are the arbitrage opportunities?

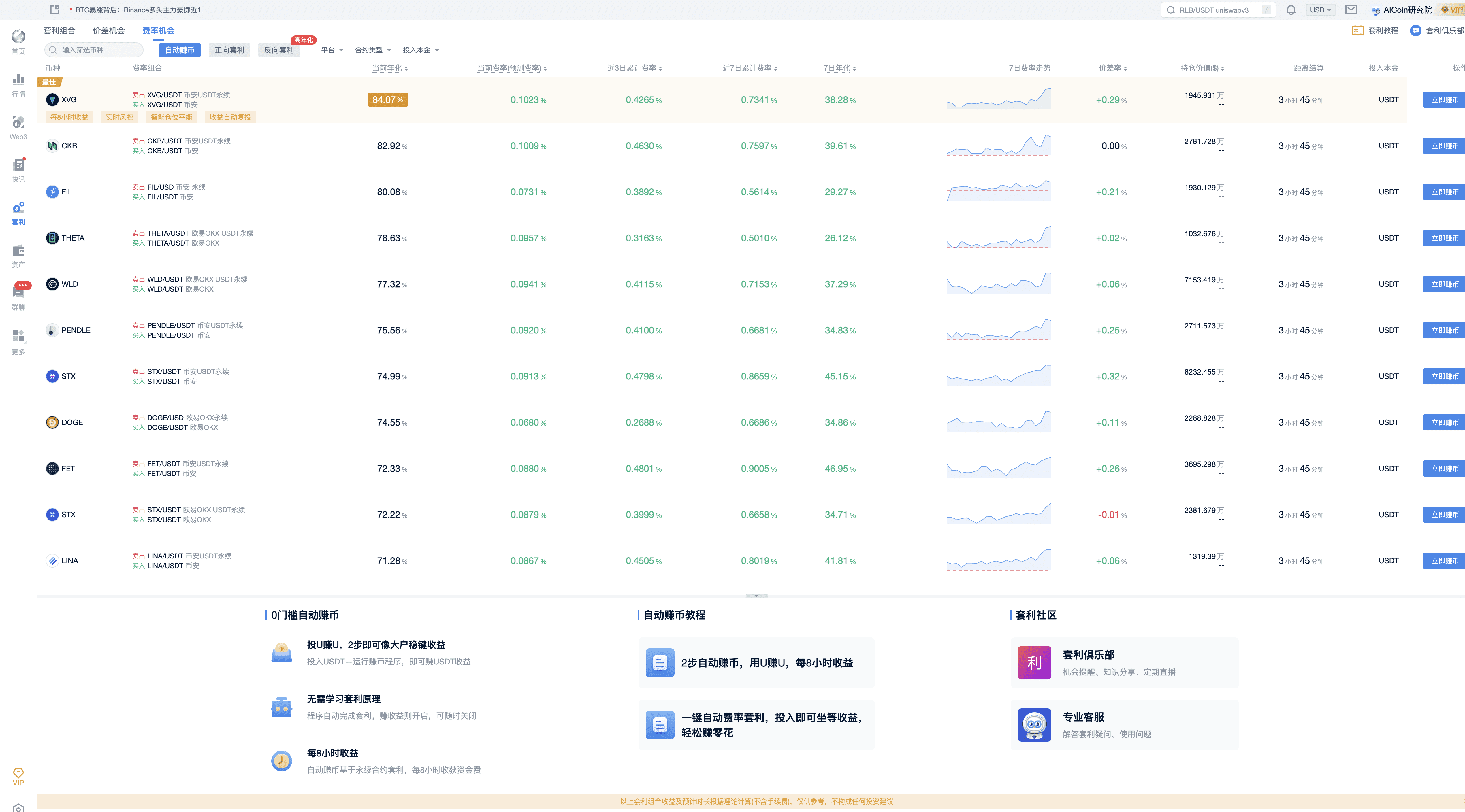

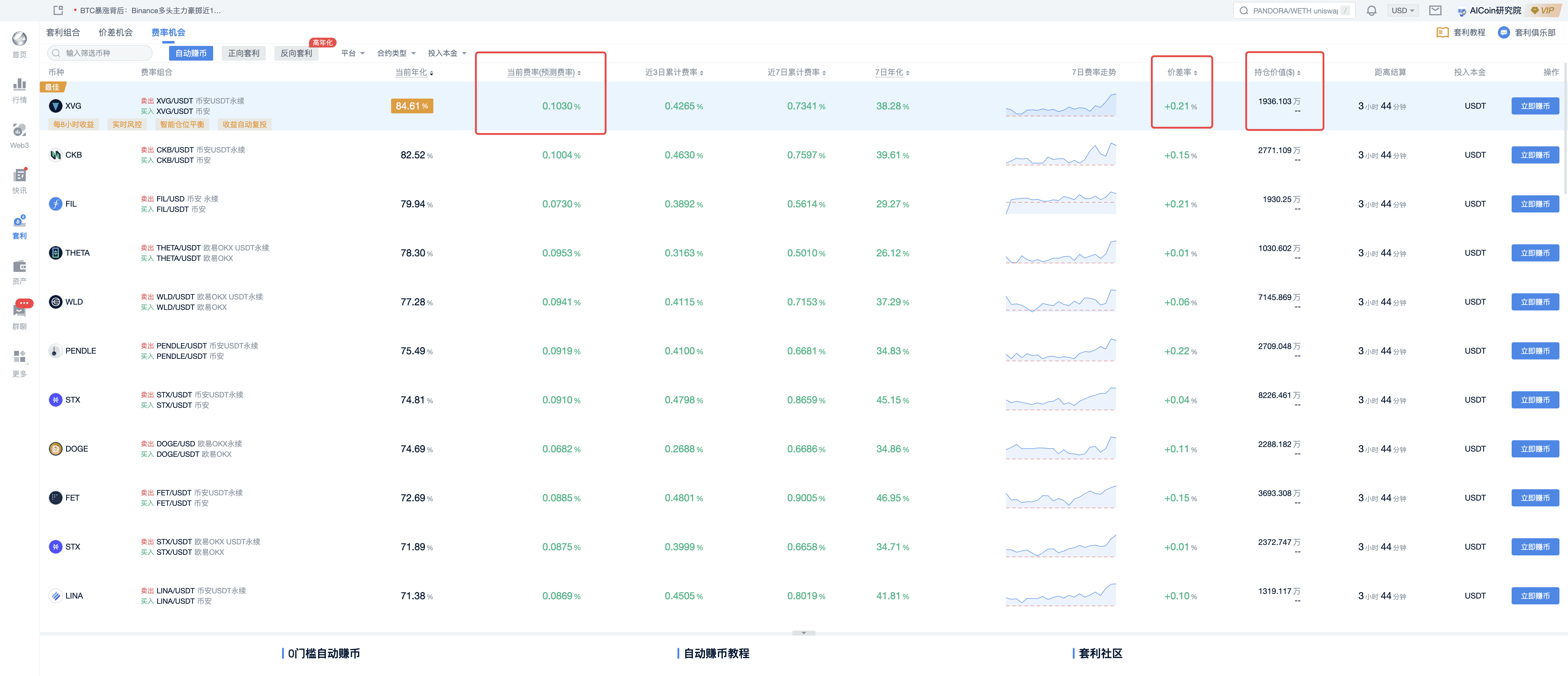

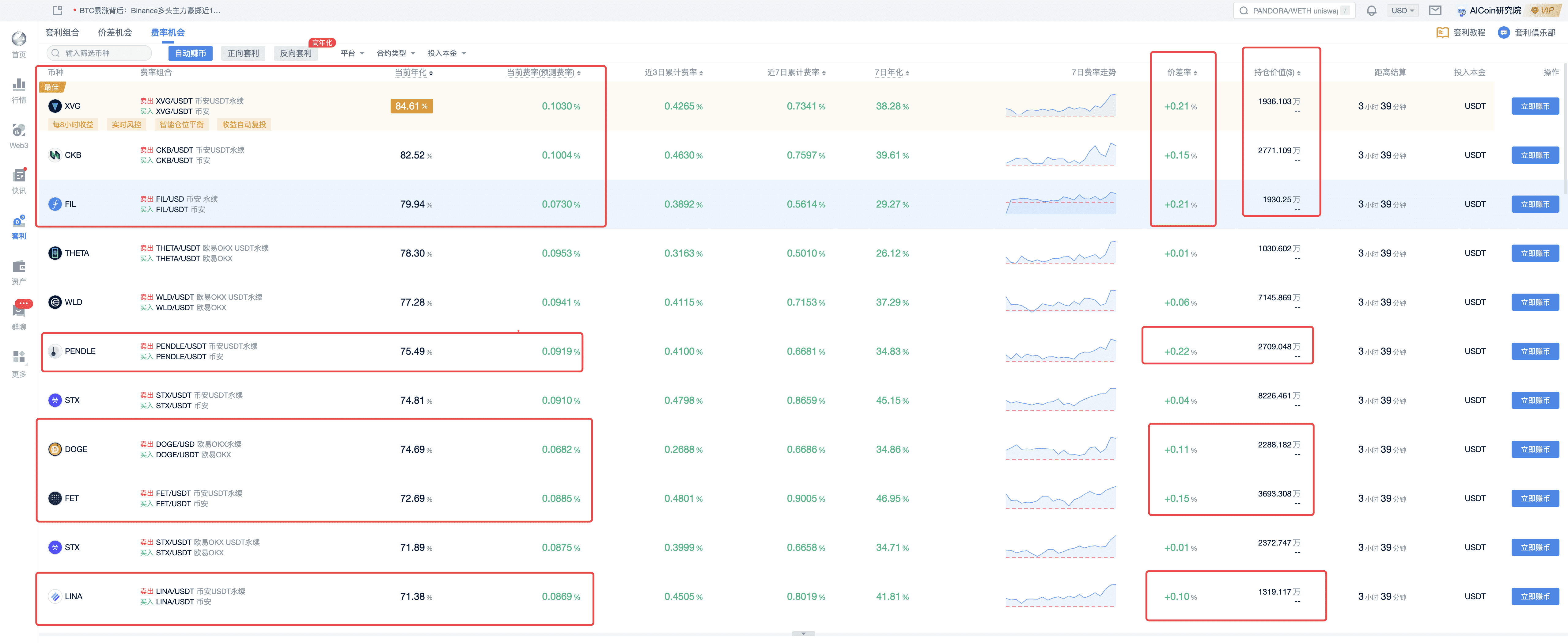

(1) Click on the arbitrage section as shown in the image.

(2) Principles for screening currency pairs.

Conditions to be met:

Check the position value, which should be greater than $10 million.

Current fee rate (predicted fee rate) is above 0.03% (expected to recoup expenses within 2 days), the higher the better.

Price difference rate is above 0.05%, with a higher rate indicating more floating profit from opening positions.

(3) Screen arbitrage opportunities based on the three conditions.

Auxiliary tools related to arbitrage

Use professional arbitrage tools and customize your own tools.

Click to join the arbitrage club and engage in group chat for progress.

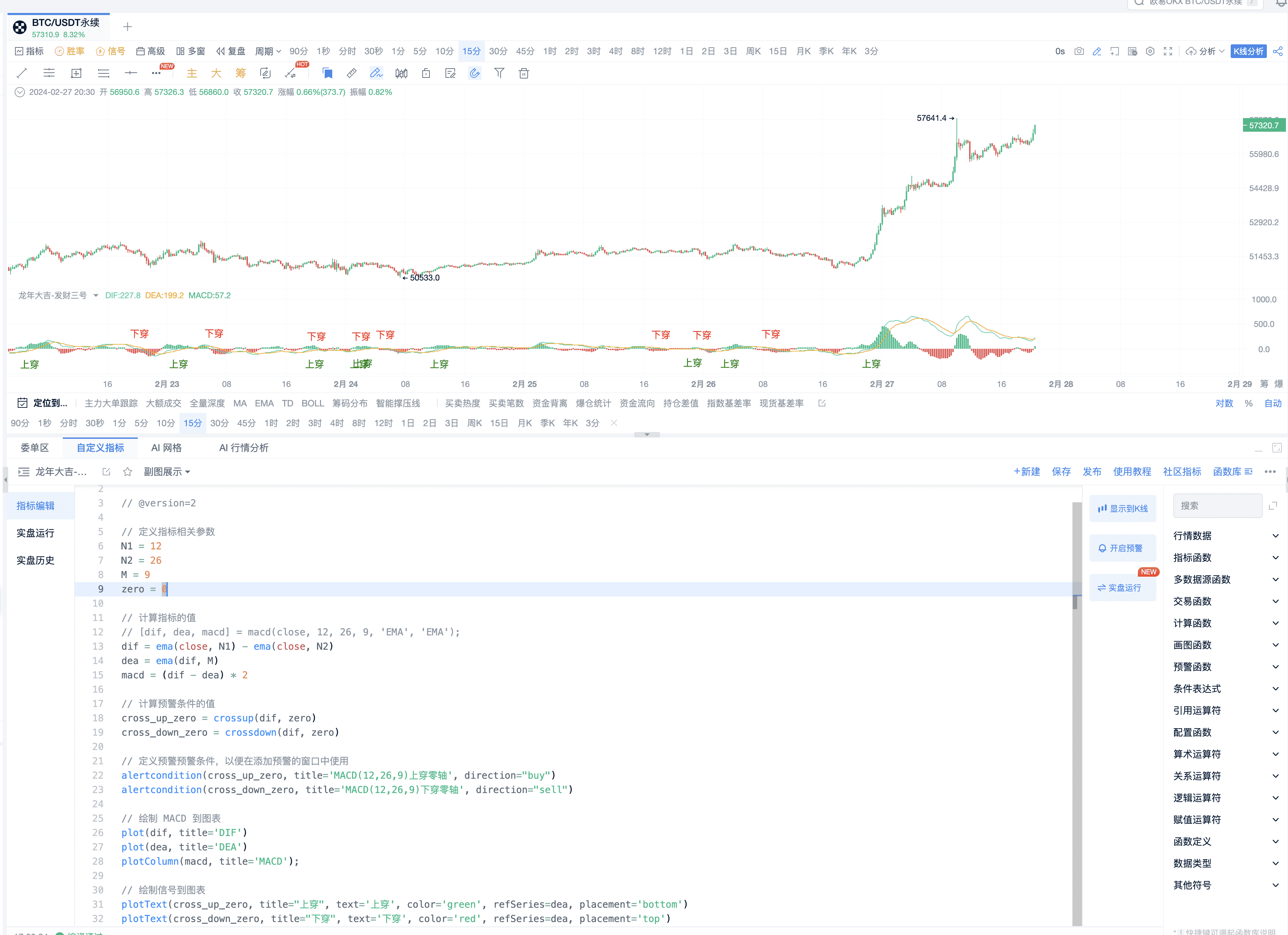

II. MACD Automatic Trading

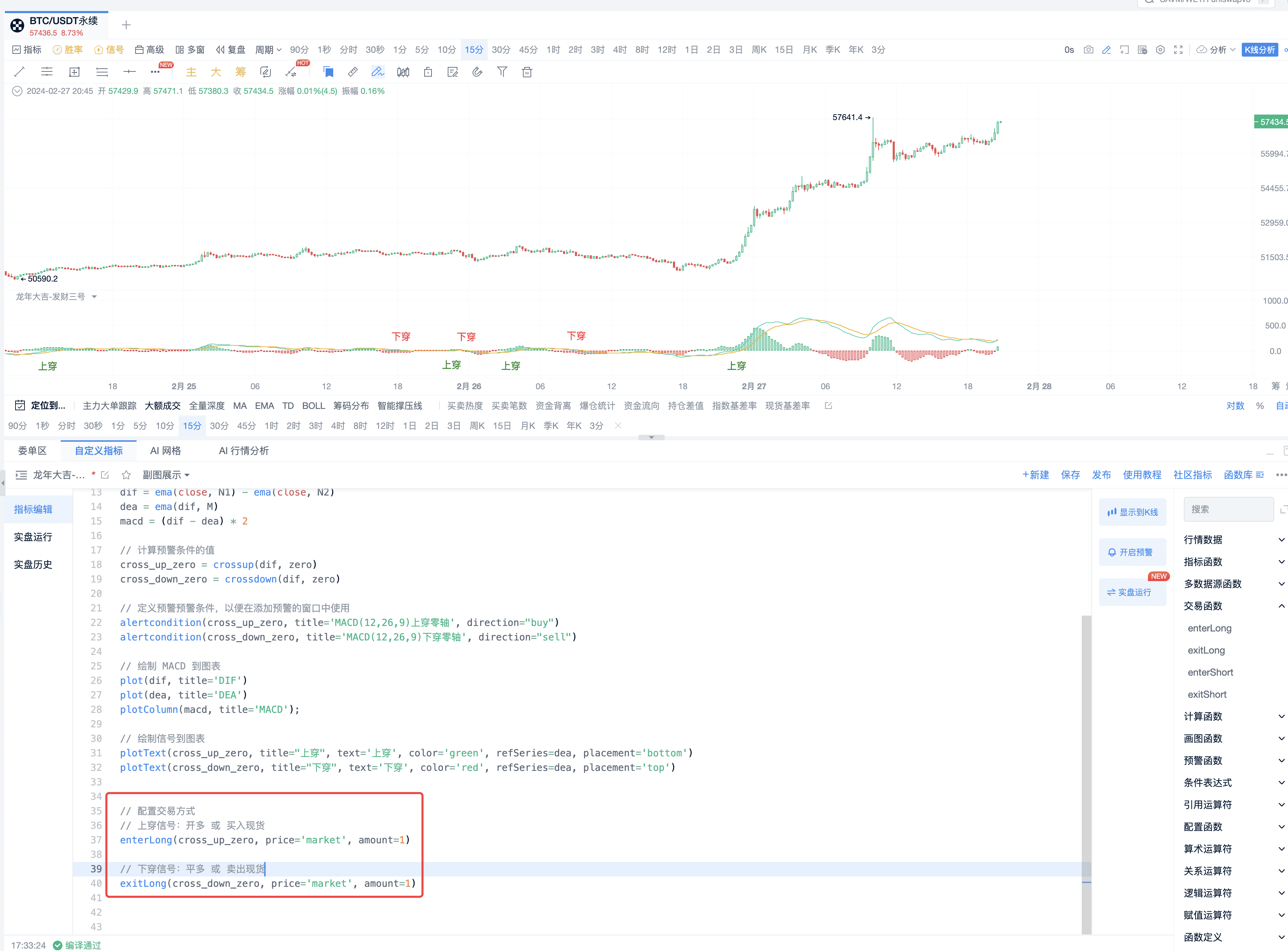

Constructed basic MACD strategy.

Specifically constructed custom indicators that can provide alerts.

// This indicator is created by AICoin Research Institute. In case of any usage issues, you can join the indicator community for consultation.

// @version=2

// Define indicator-related parameters

N1 = 12

N2 = 26

M = 9

zero = 0

// Calculate the value of the indicator

// [dif, dea, macd] = macd(close, 12, 26, 9, 'EMA', 'EMA');

dif = ema(close, N1) - ema(close, N2)

dea = ema(dif, M)

macd = (dif - dea) * 2

// Calculate the value of the alert condition

cross_up_zero = crossup(dif, zero)

cross_down_zero = crossdown(dif, zero)

// Define alert conditions for use in the alert window

alertcondition(cross_up_zero, title='MACD(12,26,9) Crosses Above Zero Line', direction="buy")

alertcondition(cross_down_zero, title='MACD(12,26,9) Crosses Below Zero Line', direction="sell")

// Draw MACD on the chart

plot(dif, title='DIF')

plot(dea, title='DEA')

plotColumn(macd, title='MACD');

// Draw signals on the chart

plotText(cross_up_zero, title="Crosses Above", text='Crosses Above', color='green', refSeries=dea, placement='bottom')

plotText(cross_down_zero, title="Crosses Below", text='Crosses Below', color='red', refSeries=dea, placement='top')

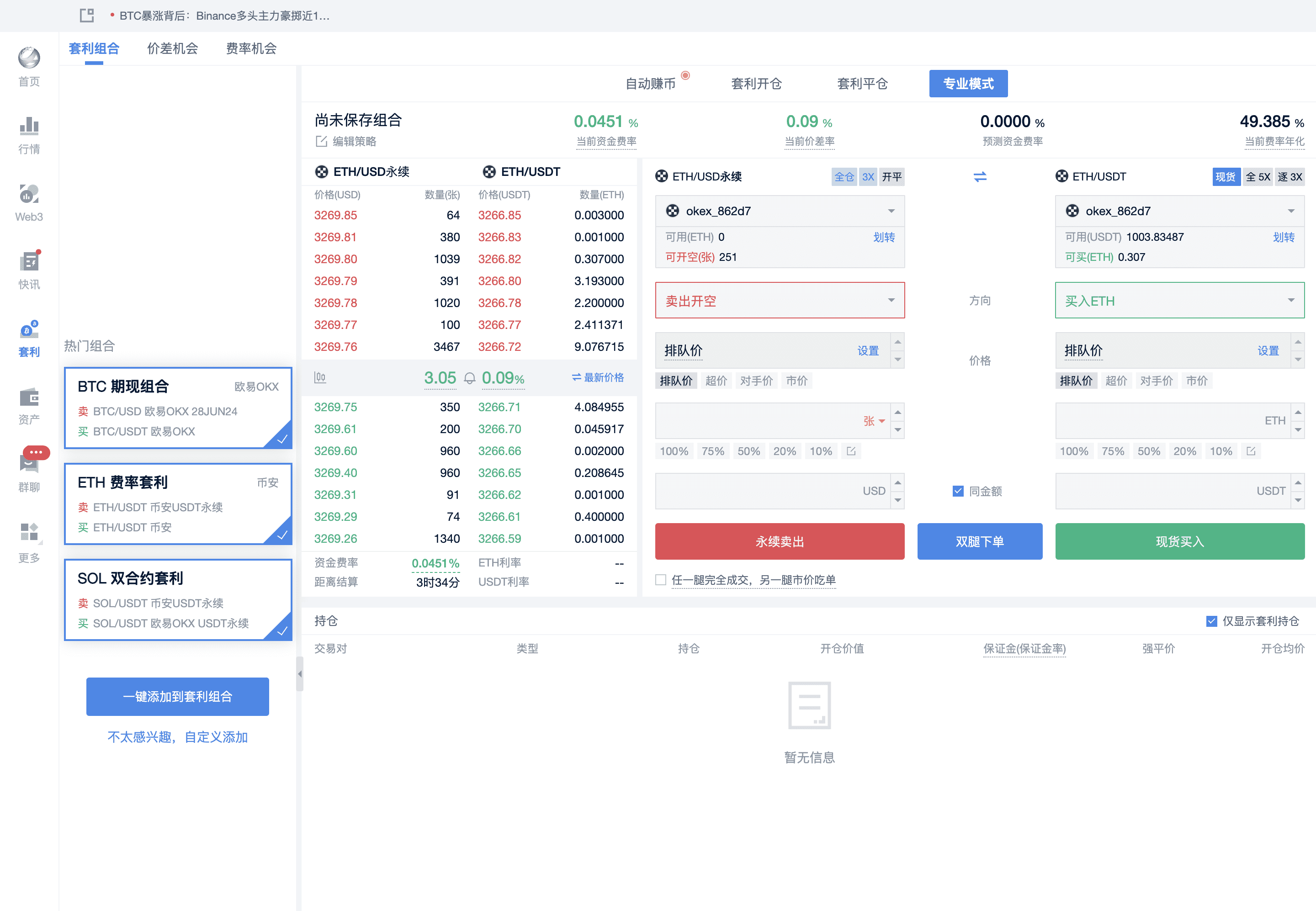

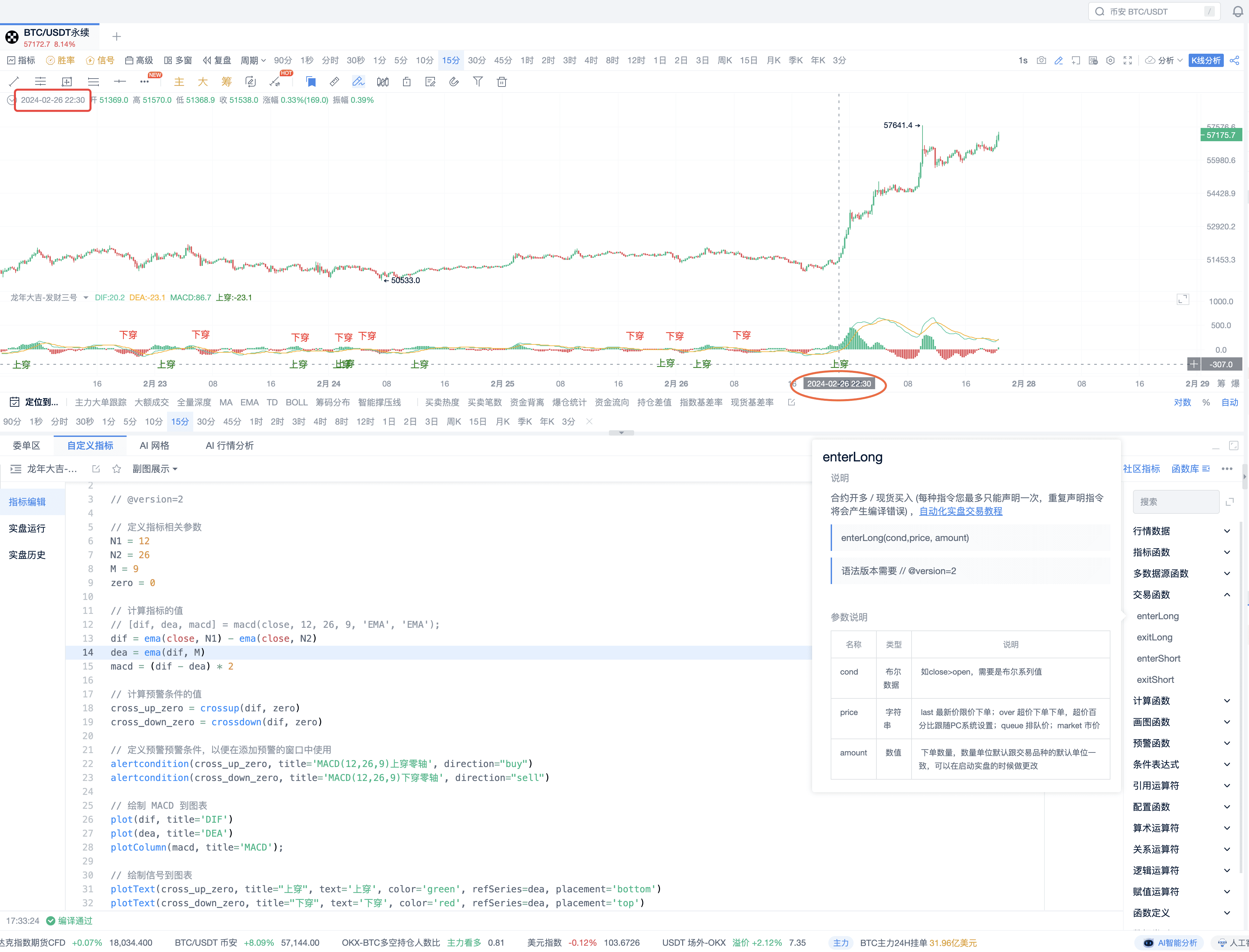

Add trading functions to the MACD strategy to achieve automation.

(1) Relevant functions

When trading, click on the function library to see which functions need to be configured:

Click on the function library to see four functions: open long function/close long function/open short function/close short function

If it is spot trading, they are: buy function/sell function/shorting is invalid

(2) Buy signal alert

When the MACD strategy shows a cross above signal,

When the MACD strategy shows a cross above signal, there is a profit of 10 points.

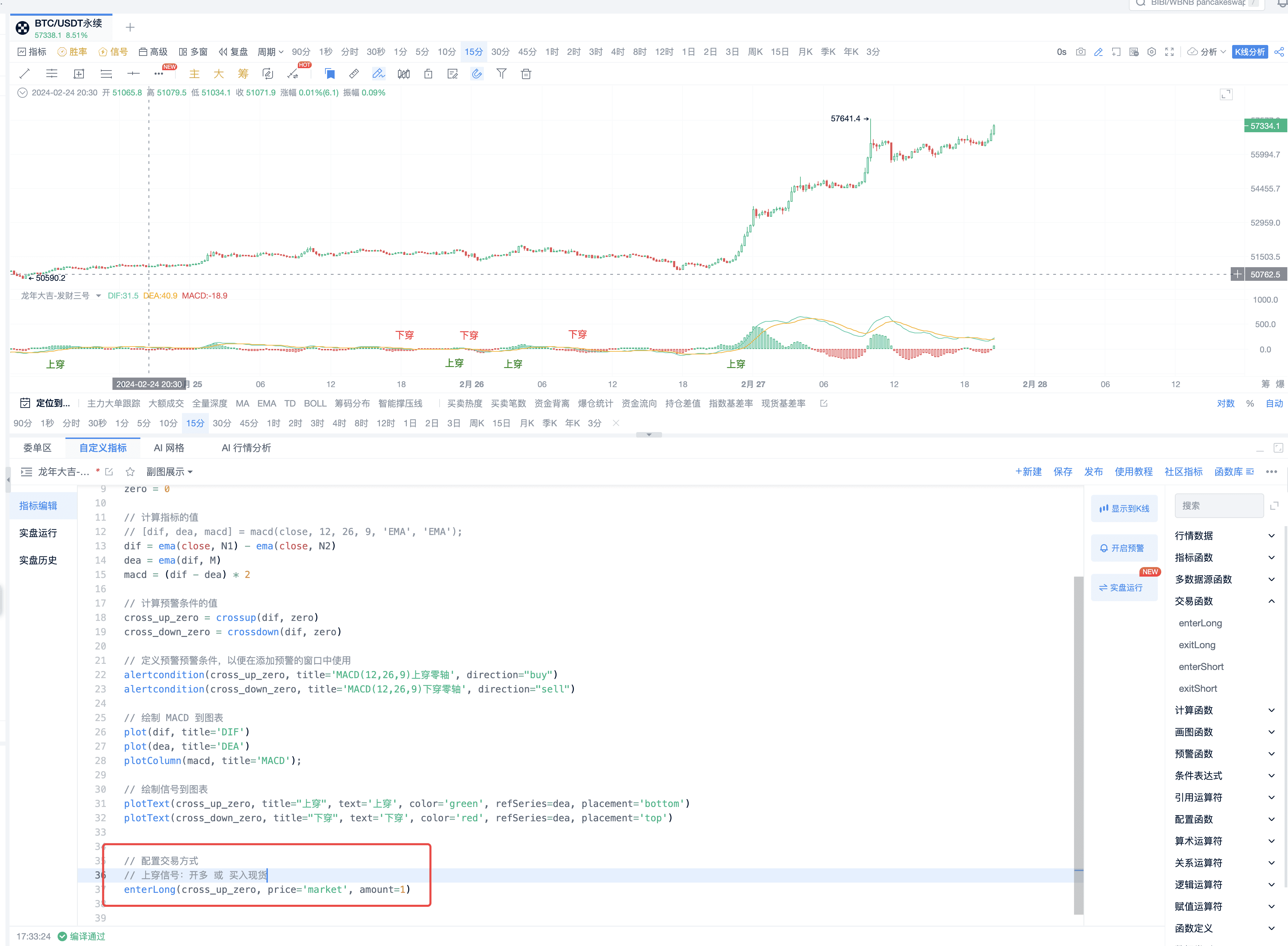

(3) Add trading codes

Add long position/buy spot codes as shown in the image.

Close position/sell spot codes as shown in the image.

(4) This set of codes is suitable for players who are bullish and do not short, and for those who are bullish in the bull market theory.

// Draw MACD on the chart

plot(dif, title='DIF')

plot(dea, title='DEA')

plotColumn(macd, title='MACD');

// Draw signals on the chart

plotText(crossupzero, title="Cross Above", text='Cross Above', color='green', refSeries=dea, placement='bottom')

plotText(crossdownzero, title="Cross Below", text='Cross Below', color='red', refSeries=dea, placement='top')

// Configure trading methods

// Cross above signal: enter long or buy spot

enterLong(crossupzero, price='market', amount=1)

// Cross below signal: exit long or sell spot

exitLong(crossdownzero, price='market', amount=1)

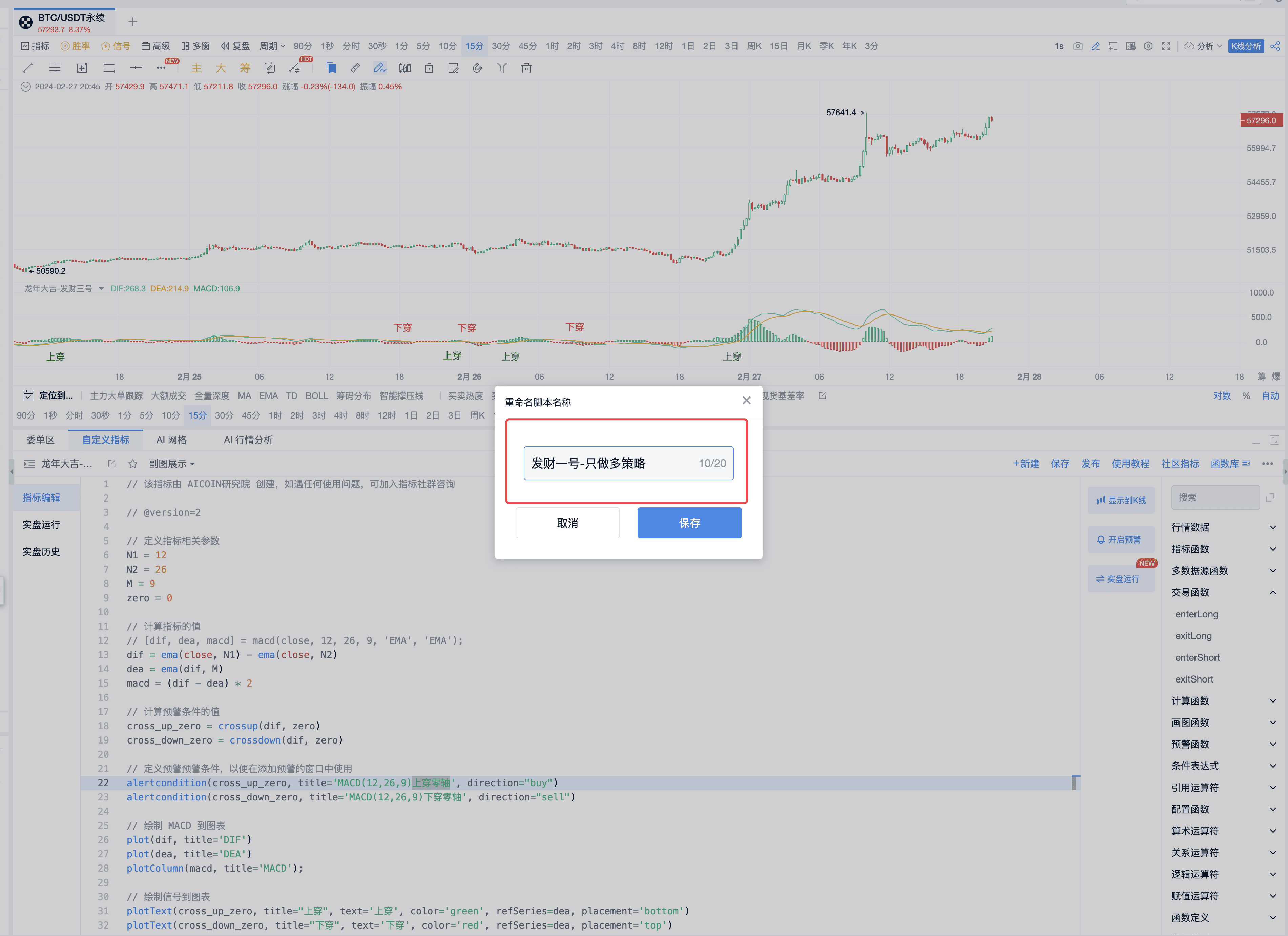

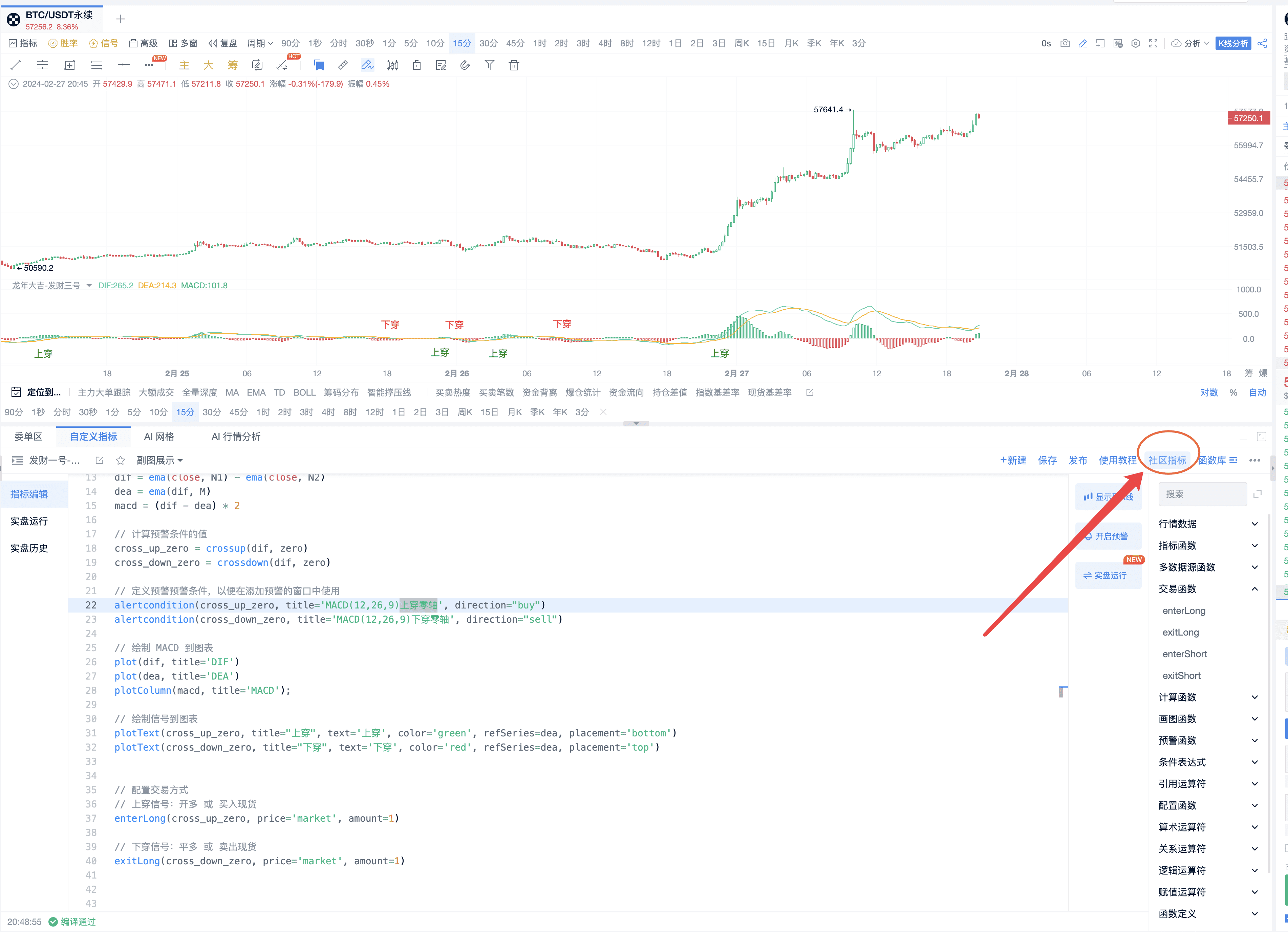

(5)Subscribe to use the MACD strategy directly

Name and save the strategy,

Click here to subscribe and find the published strategy for direct use.

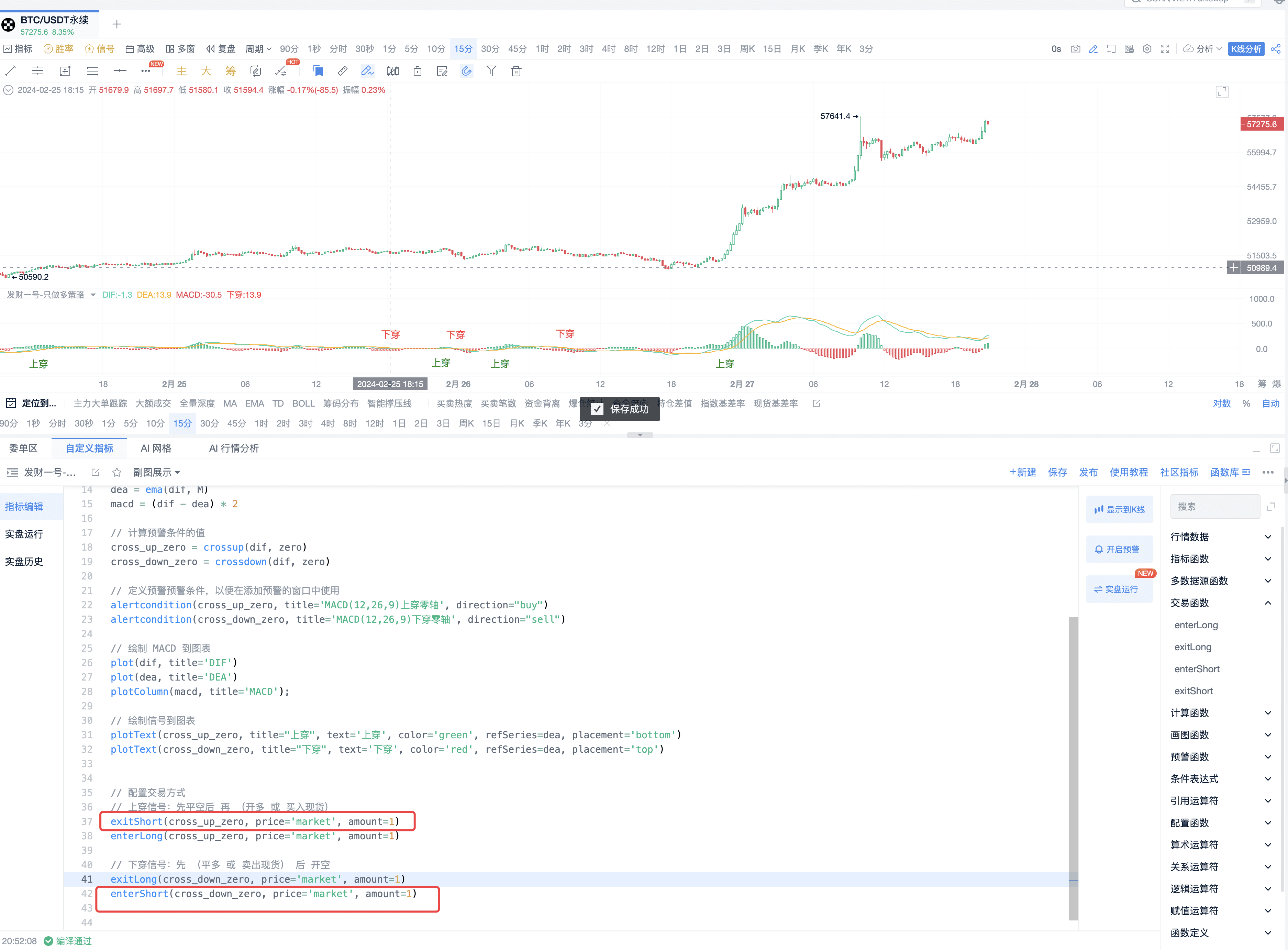

(6)Construct a complete contract trading strategy (can open long and short positions).

Add the trading codes as shown in the boxed area in the image.

III. Custom Indicator Customization Benefits

If you want to build your own trading strategy, have ideas but don't know how to implement them, we can help you realize your creative ideas. With AICoin's custom indicators and research institute, the barriers between you and automated trading no longer exist.

You can click the link below to subscribe to PRO membership and automatically enter the PRO CLUB member group. Our editors in the CLUB will assist you in organizing your thoughts, implementing your trading strategy, and solving programming problems for you, directly helping you write. https://aicoin.app/zh-CN/vip/chartpro

Recommended Reading

The Best Arbitrage Guide: Grasping Risks, Locking in Profits, and Exploring Endless Opportunities

Arbitrage Acceleration, MACD Navigation: A New Chapter in Automated Trading

Capturing Buy and Sell Signals from Volume Changes, Making Your Investments More Confident

For more live content, please follow AICoin's "News/Information-Live Review" section, and feel free to download AICoin PC End

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。