Hello everyone, this is the AiCoin Research Institute!

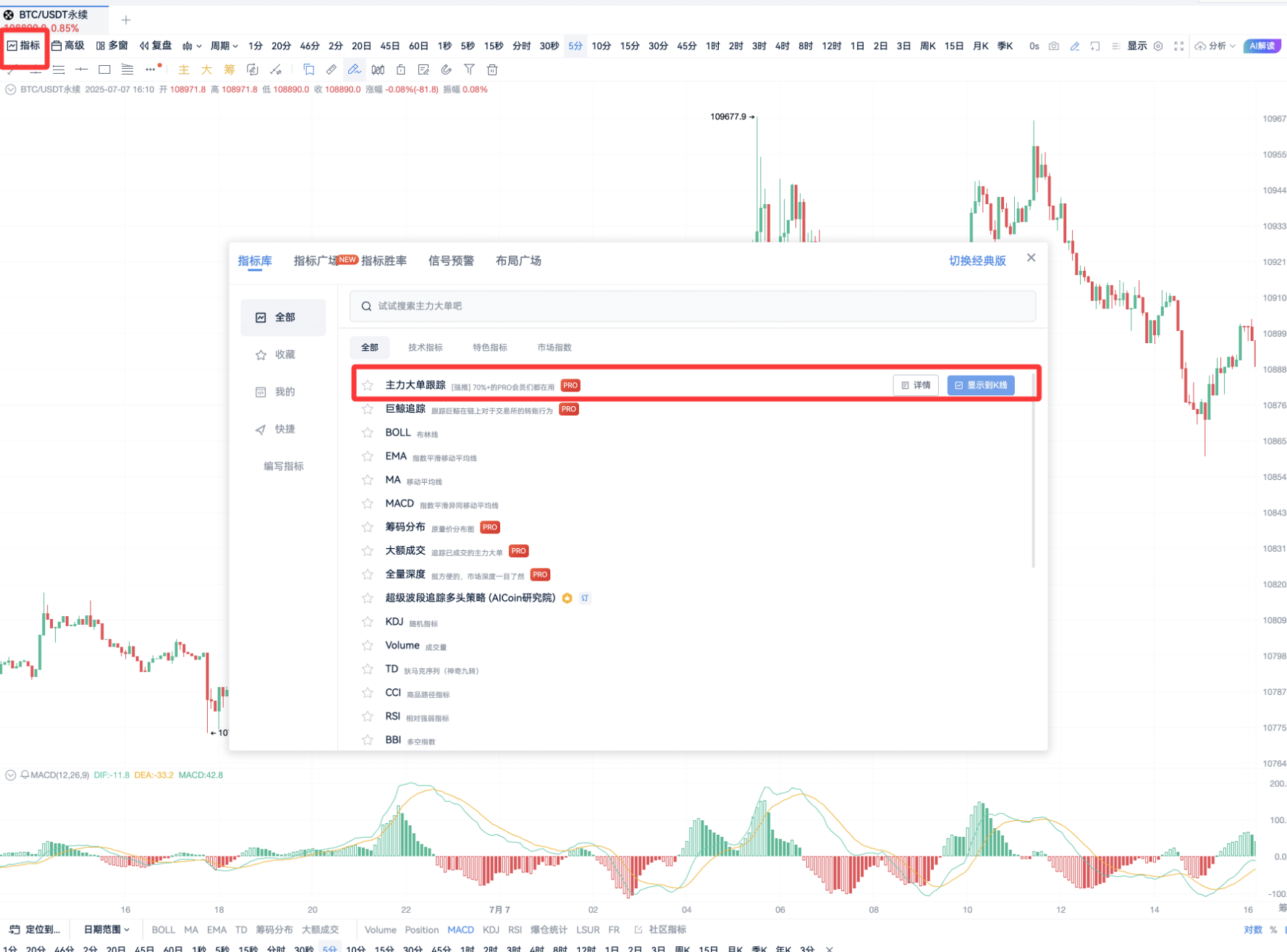

The pulse of the market often hides in the movements of the whales, and today, a silent game is unfolding on the Bitcoin chart. Opening the BTC/USDT contract, let's get straight to the point—Major Order Indicator, which is the most authentic language of the market.

Pulling up the Major Order Data from the indicator library, the most eye-catching aspect is the mountain of unfilled orders. Behind these numbers lies the true intention of the major funds, and understanding them can provide a glimpse into the short-term highs and lows of the market.

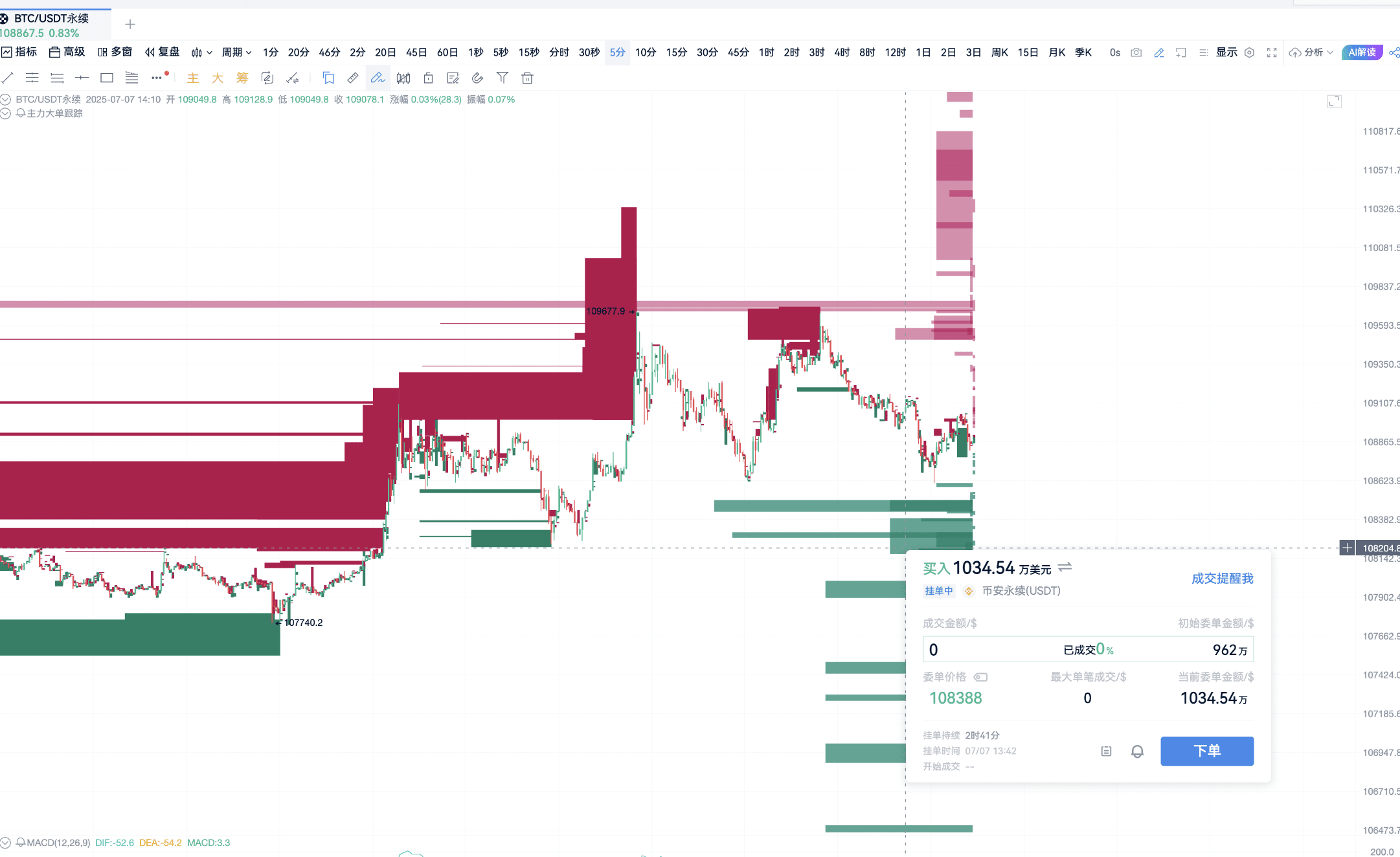

Major Attraction Method, a strategy well-known to our long-time followers—when there are extremely large unfilled sell orders above the current price, the major players are likely "luring buyers," and the price is likely to be pushed up to that level; conversely, if there is a massive accumulation of buy orders below the current price, it indicates that the major players may be "luring sellers," and the price may temporarily drop to that support level.

And now, the chart is telling a clear story.

An hour ago, an $110,000 super large sell order suddenly appeared, large enough to catch the market's attention. According to the logic of the Major Attraction Method, this could very well become a short-term top target. In other words, if Bitcoin continues to rise, $110,000 will be the critical line of life and death for bulls and bears.

And what about below? The market is not without support. There are 6.93 million buy orders at $108,500, barely forming a defensive line, but if the bears hit hard, this volume may not hold up completely.

Looking further down, there are 10.34 million buy orders piled up around $108,388, combined with the 6.93 million above, barely forming a buffer zone. If a pullback occurs here, it might present an opportunity for short-term bottom fishing.

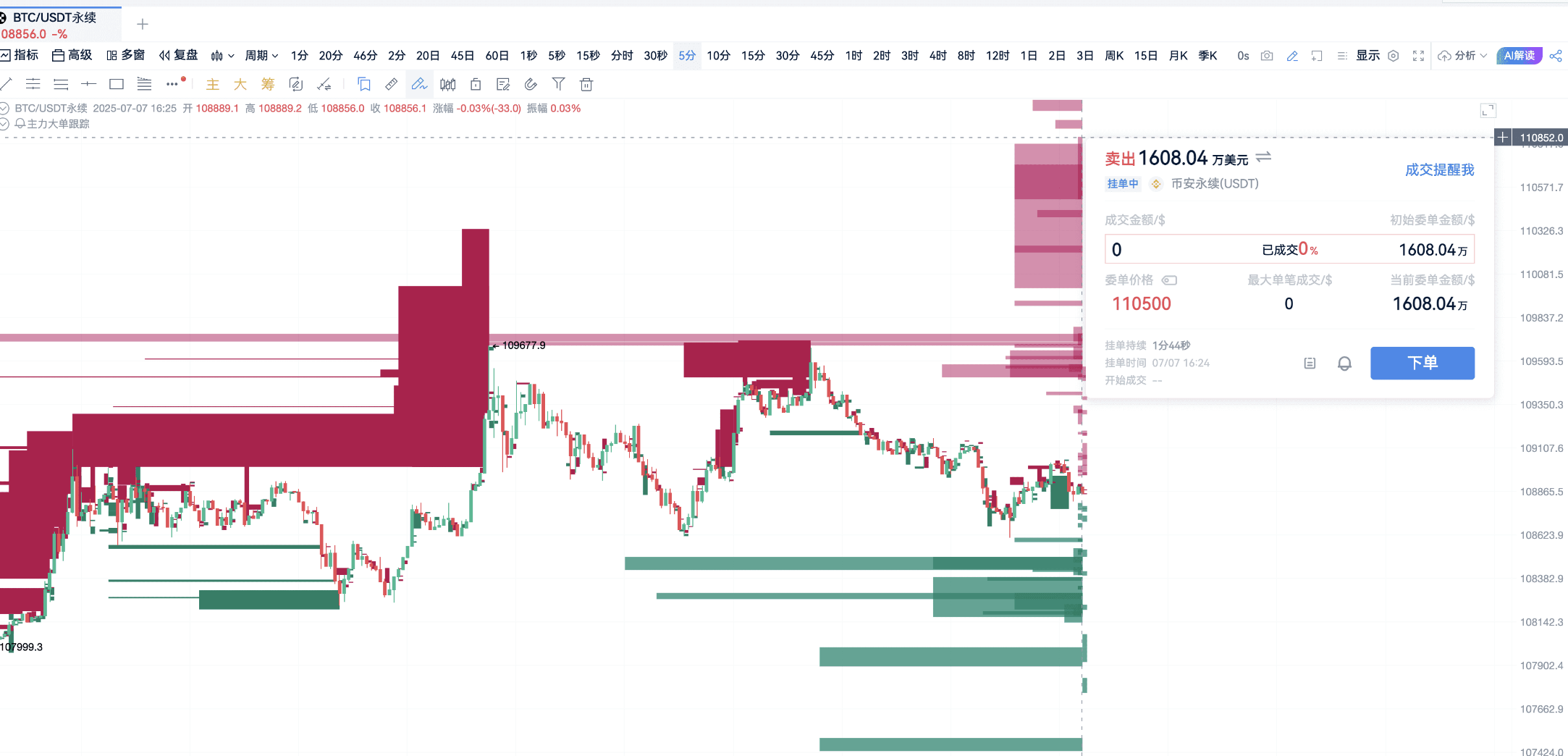

But the real dramatic changes are just beginning—while we were analyzing, another $16.08 million sell order was added above, and at the $110,000 mark, there is a staggering $23 million in unfilled sell orders. What does this mean? The major players are clearly setting a trap at the $110,000 price level, and once the price approaches, it is likely to trigger violent fluctuations.

In summary, the current battlefield is clearly defined:

Upper Pressure: $110,000 (heavily guarded by major sell orders)

Lower Support: $108,388 - $108,500 (buy orders barely holding the line)

If you were a major player, how would you play it? Most likely, you would first push the price up to lure buyers, allowing retail investors to chase the price near $110,000, and then strike hard. As ordinary traders, what we can do is closely monitor these large order movements and position ourselves in advance at key levels, rather than blindly chasing highs and cutting losses.

The market is ever-changing, but the major players' orders do not lie. Now, are you ready to face this battle between bulls and bears?

This article only represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。