On the evening of February 20th, AICoin researchers conducted a live graphic and text sharing session titled "A Simple and Easy-to-Use MACD Strategy (with Membership Giveaway)" in the AICoin PC-end Group Chat-Live. Below is a summary of the live content.

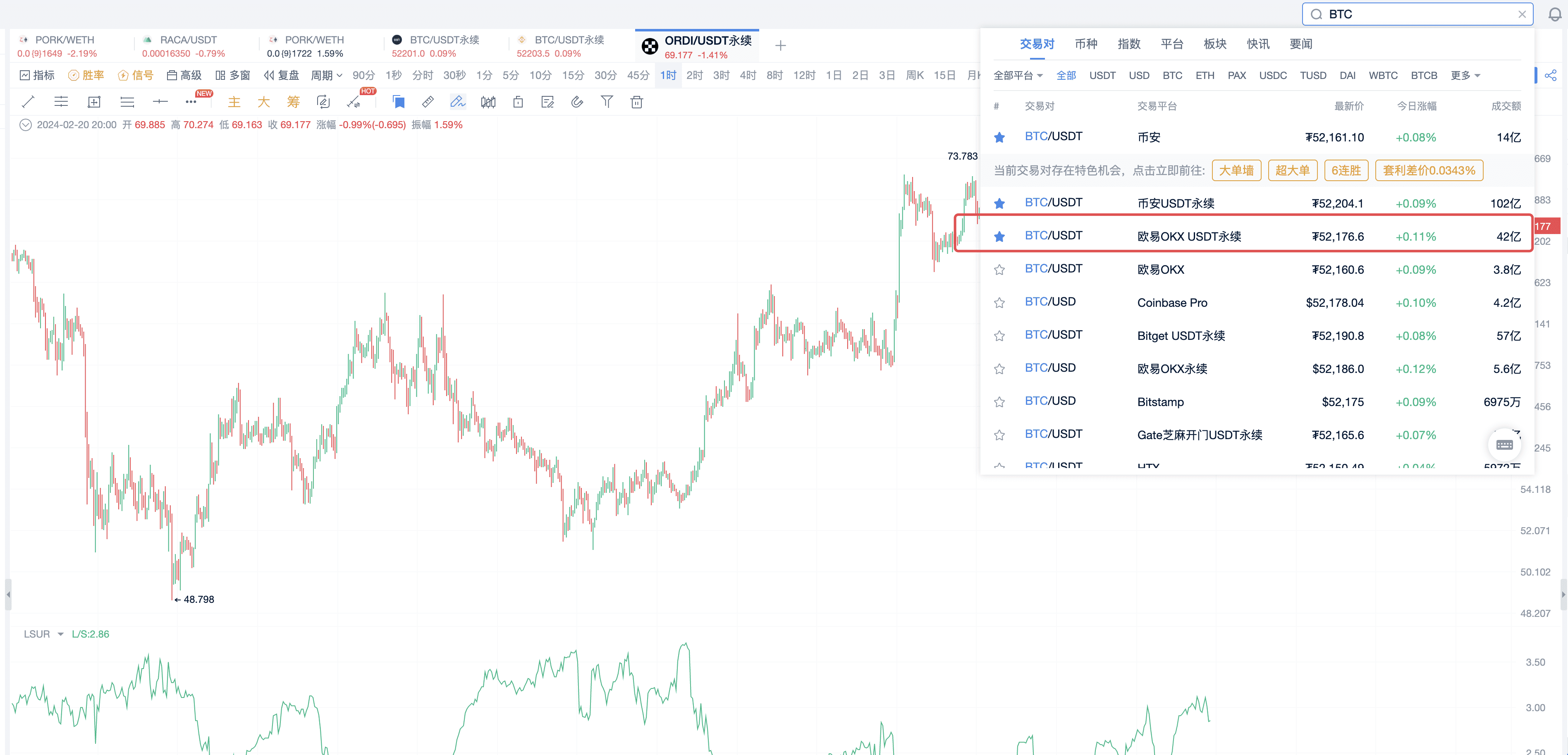

I. Seeking Arbitrage Opportunities

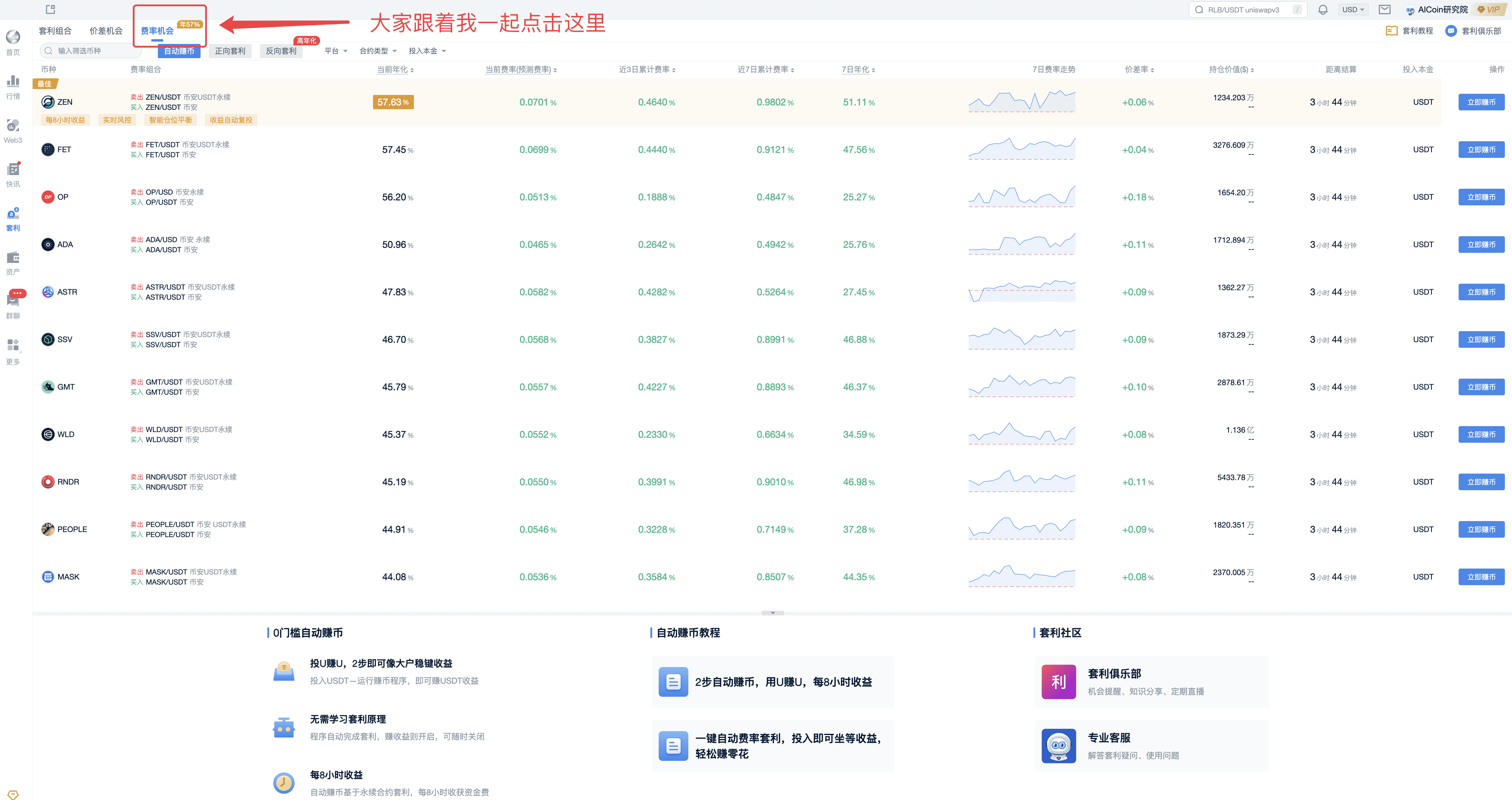

Open the arbitrage page.

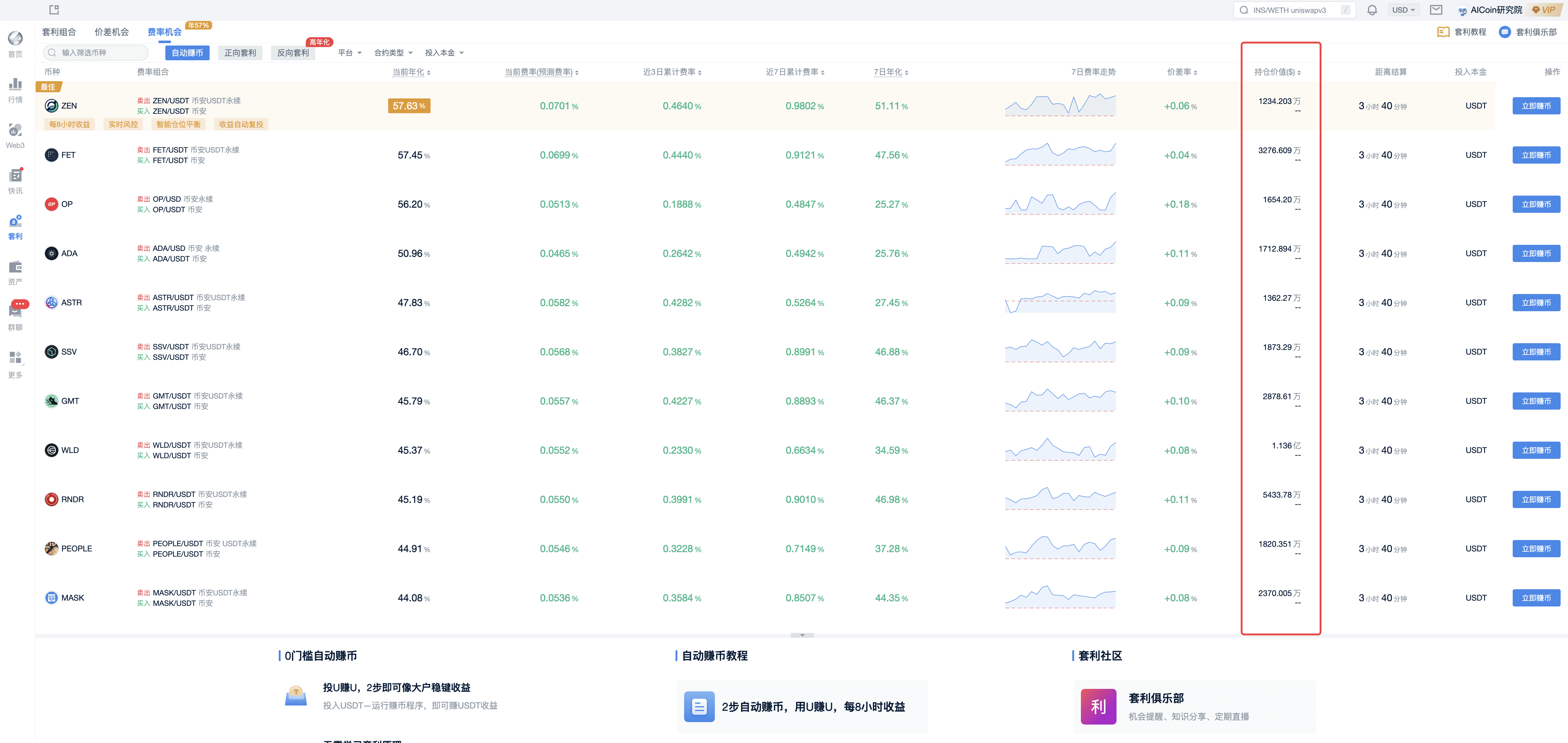

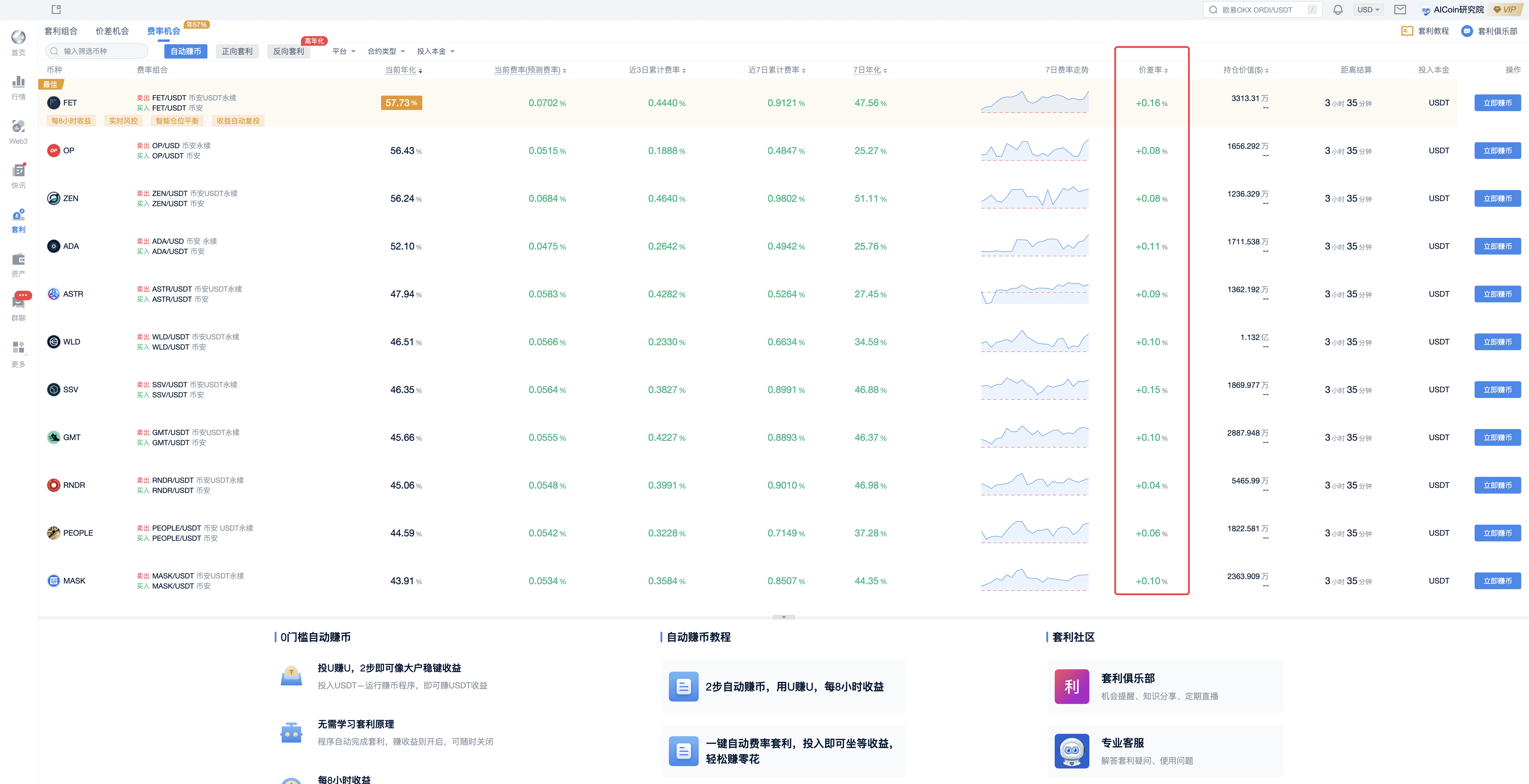

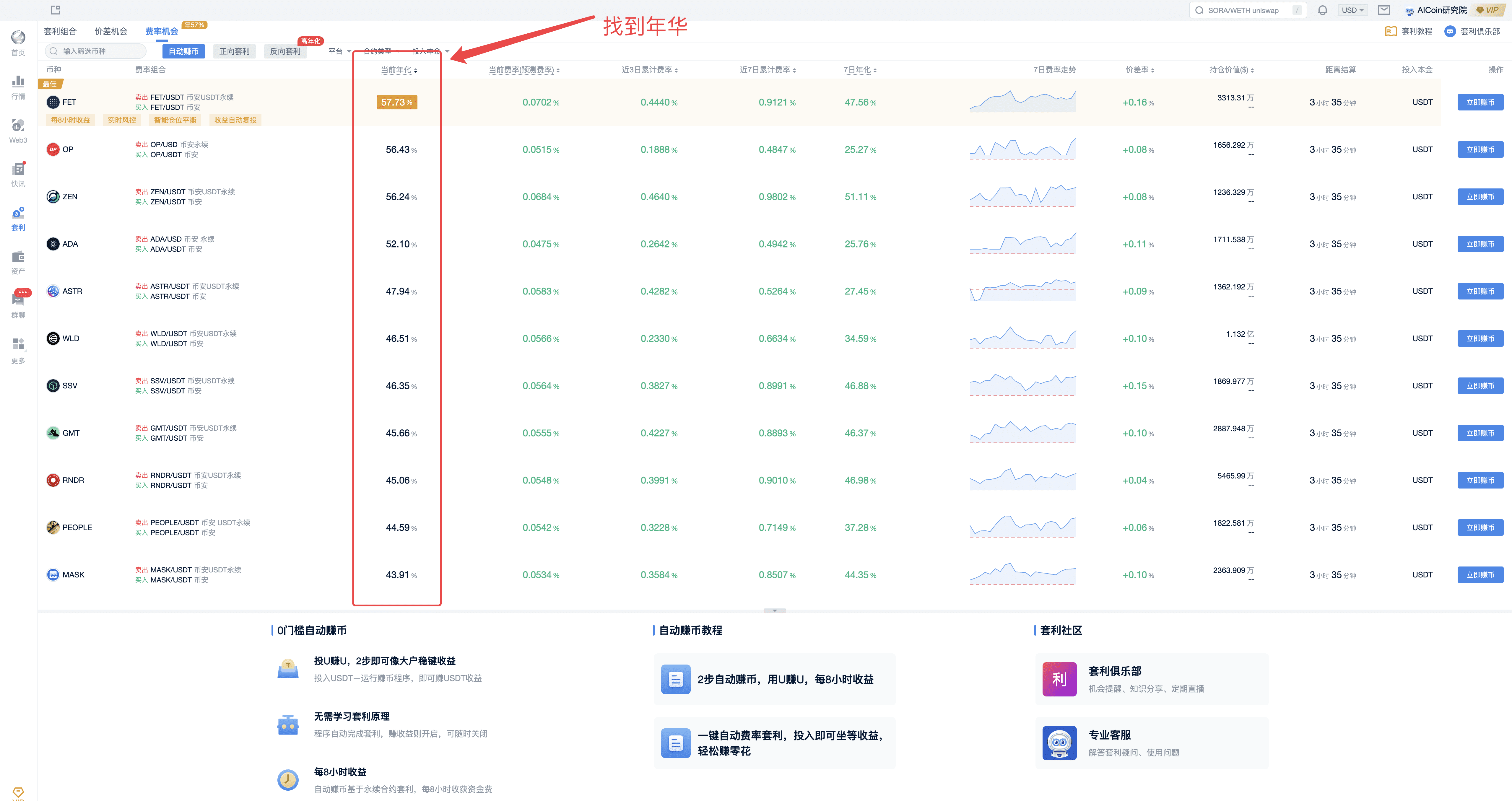

Step 1: Find a combination with a holding value of over 10 million dollars; the larger the holding value, the more stable the arbitrage combination will be due to more funds involved.

Step 2: The current fee rate (predicted fee rate) is above 0.03% (expected to recoup expenses within 2 days), the higher the better.

Step 3: The price difference rate is above 0.05%, with a higher rate indicating more floating profit from opening positions.

Combine the above steps to screen for arbitrage opportunities.

Step 1: Select combinations with a large holding value.

Step 2: Fee rate is above 0.03%.

Step 3: Check the price difference rate, which should be above 0.05%.

Use these three steps as screening criteria, then sort by annualized rate from high to low.

Once the conditions are met, select and admit the best options.

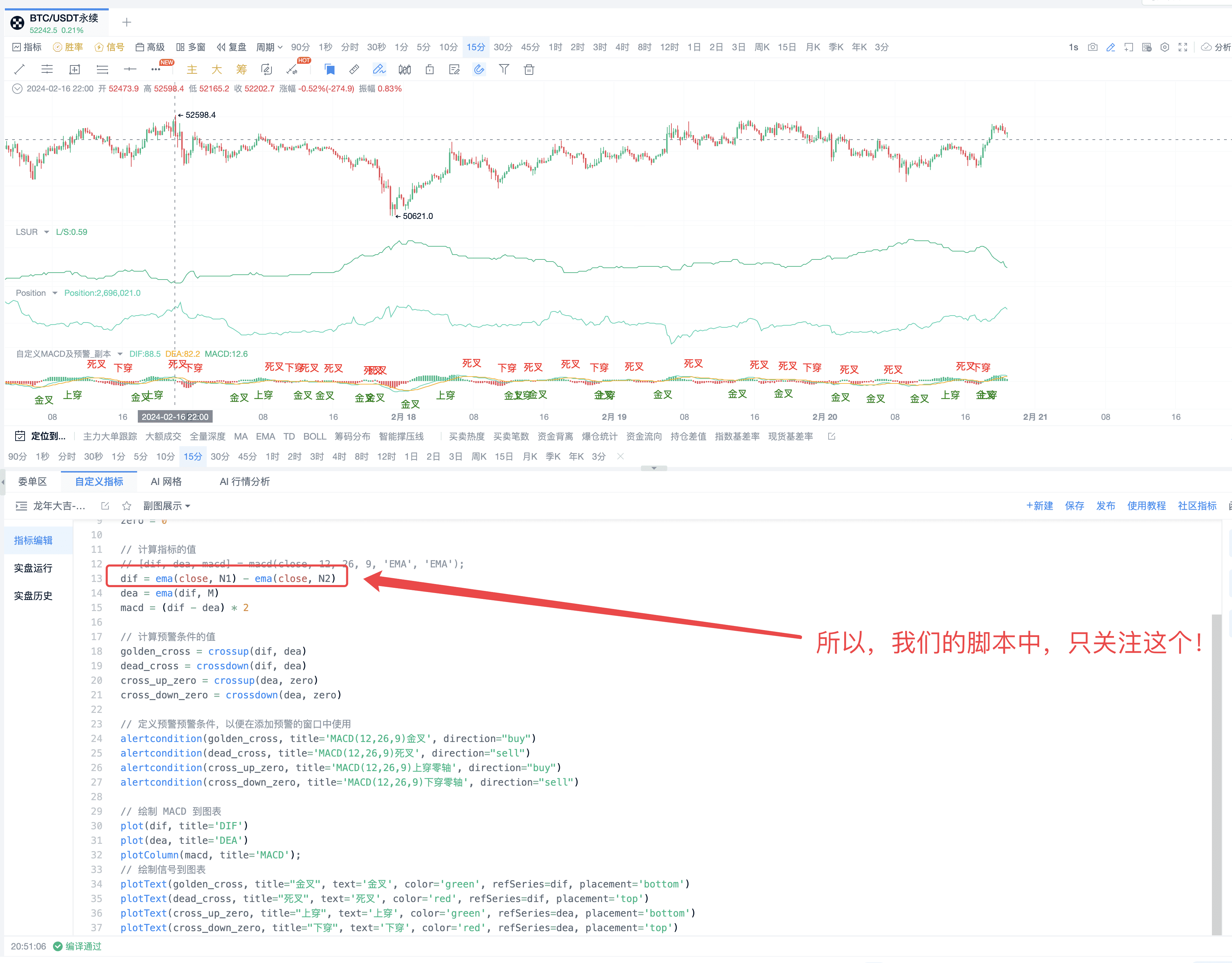

II. MACD Strategy

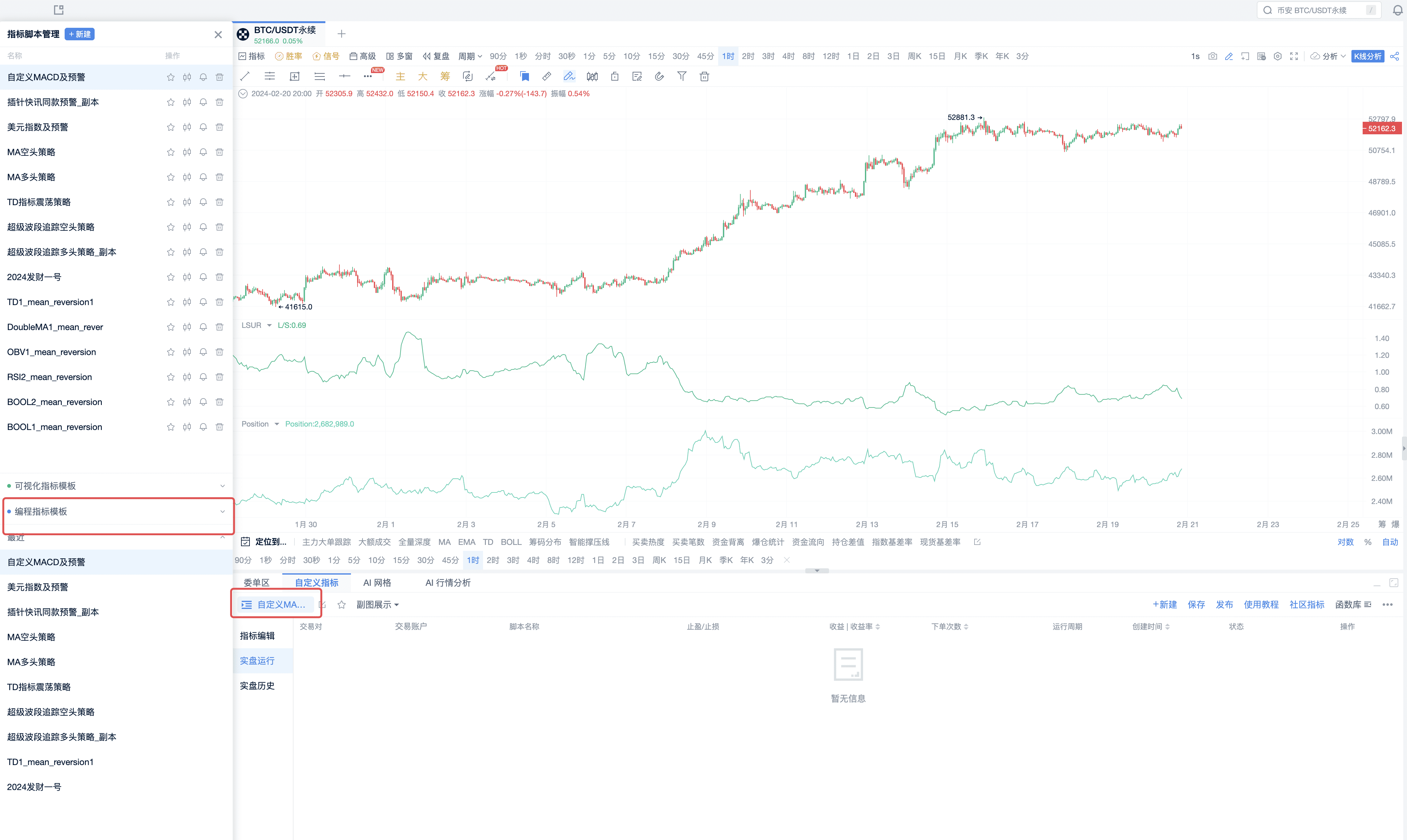

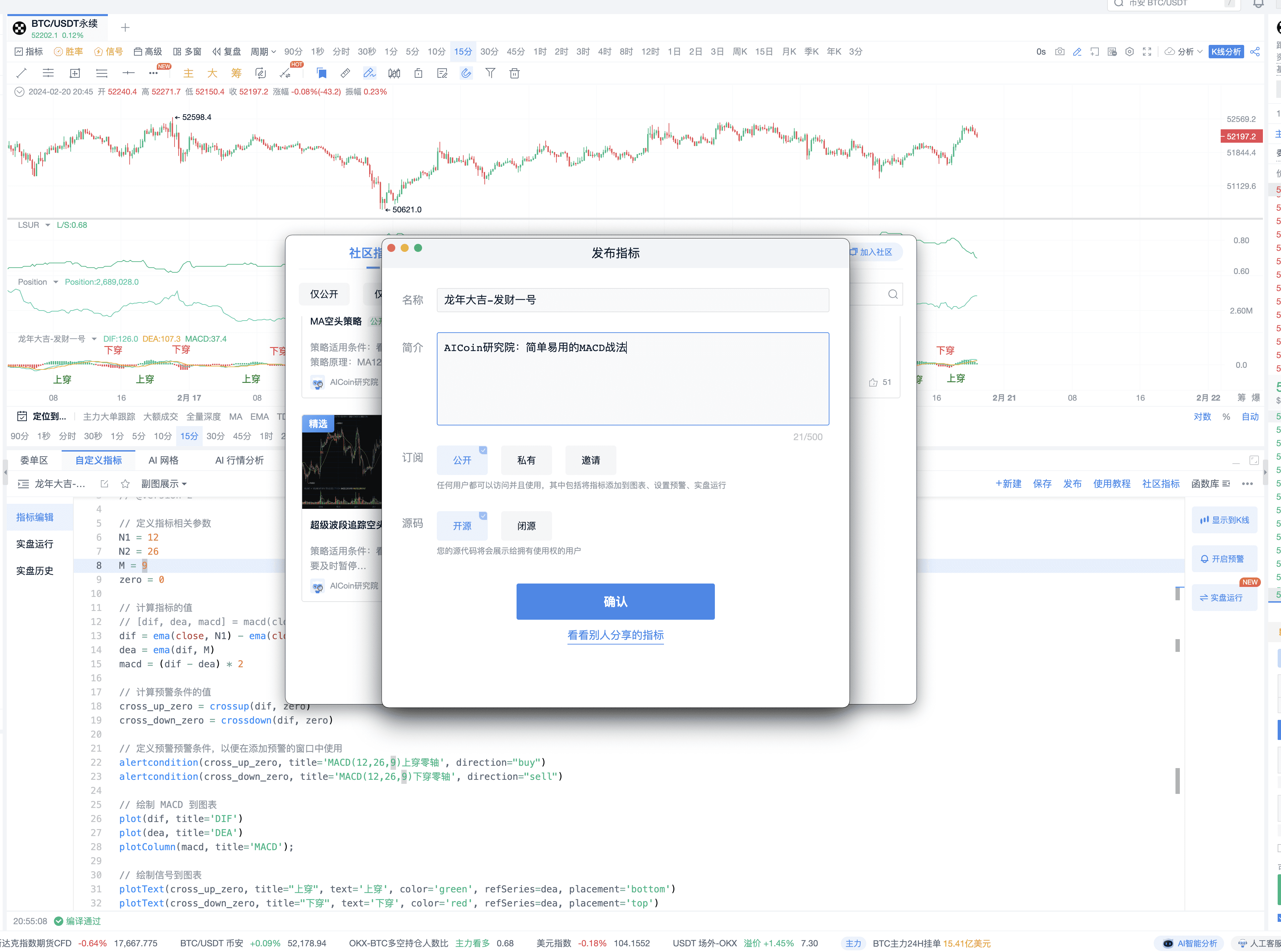

Search for BTC on the OKX platform.

Select custom indicators.

Then click here to find MACD.

Click "Use Now".

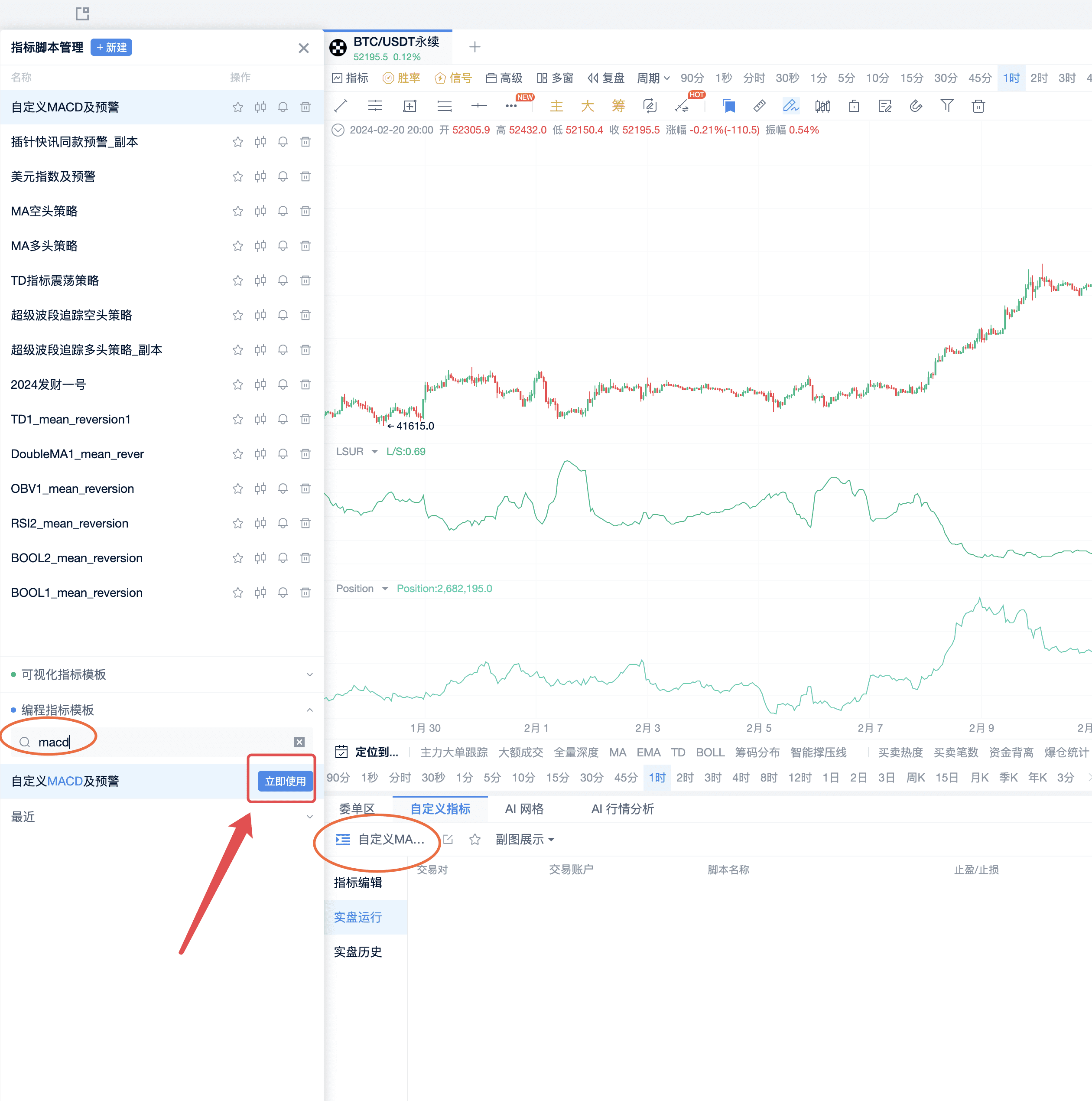

Change the name.

Use a 15-minute period for the MACD strategy.

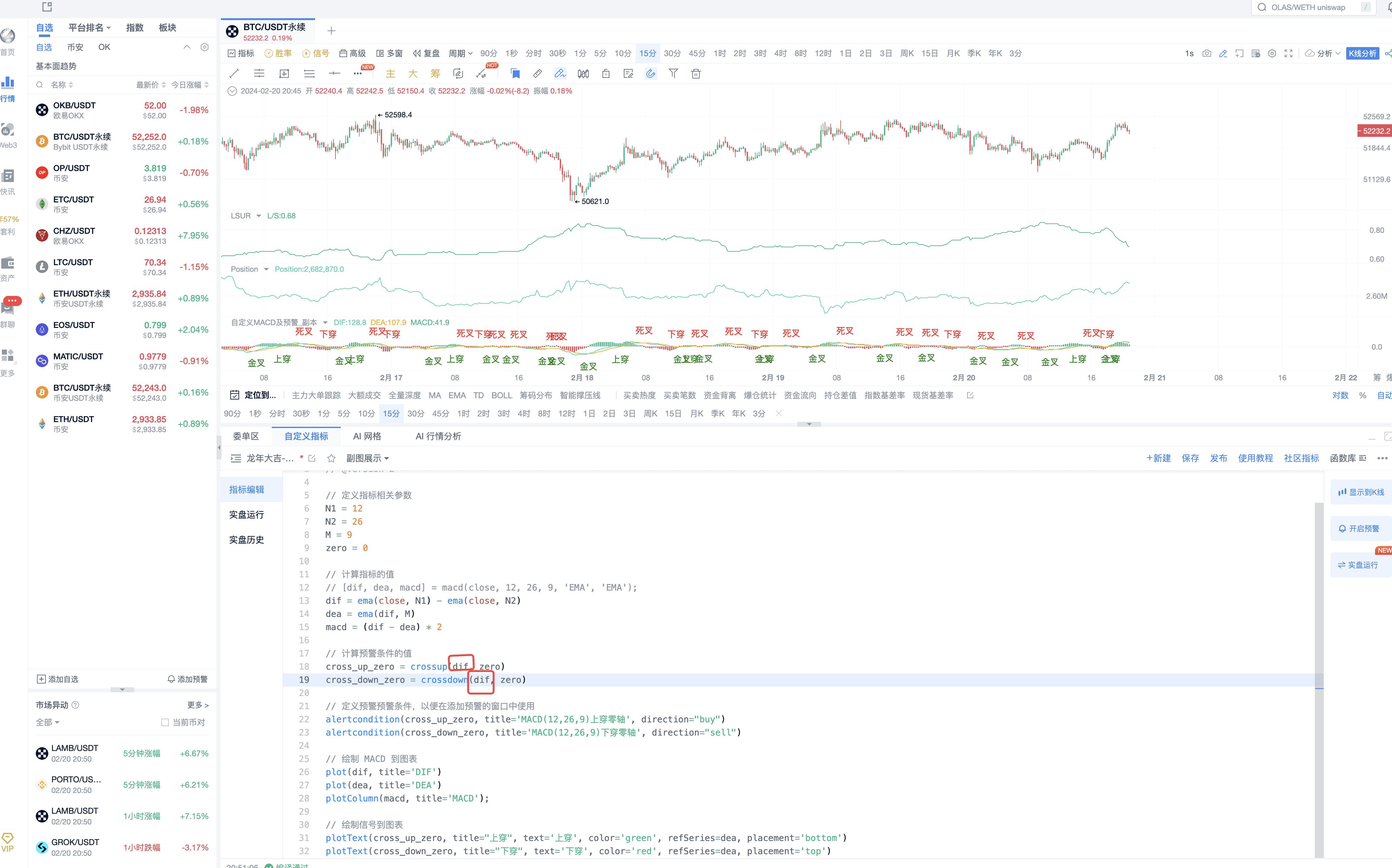

The signal criteria are:

When the DIF line crosses above the zero axis, it's a bullish signal.

When the DIF line crosses below the zero axis, it's a bearish signal.

Remove the golden cross and death cross, and the display effect will be as shown in the image.

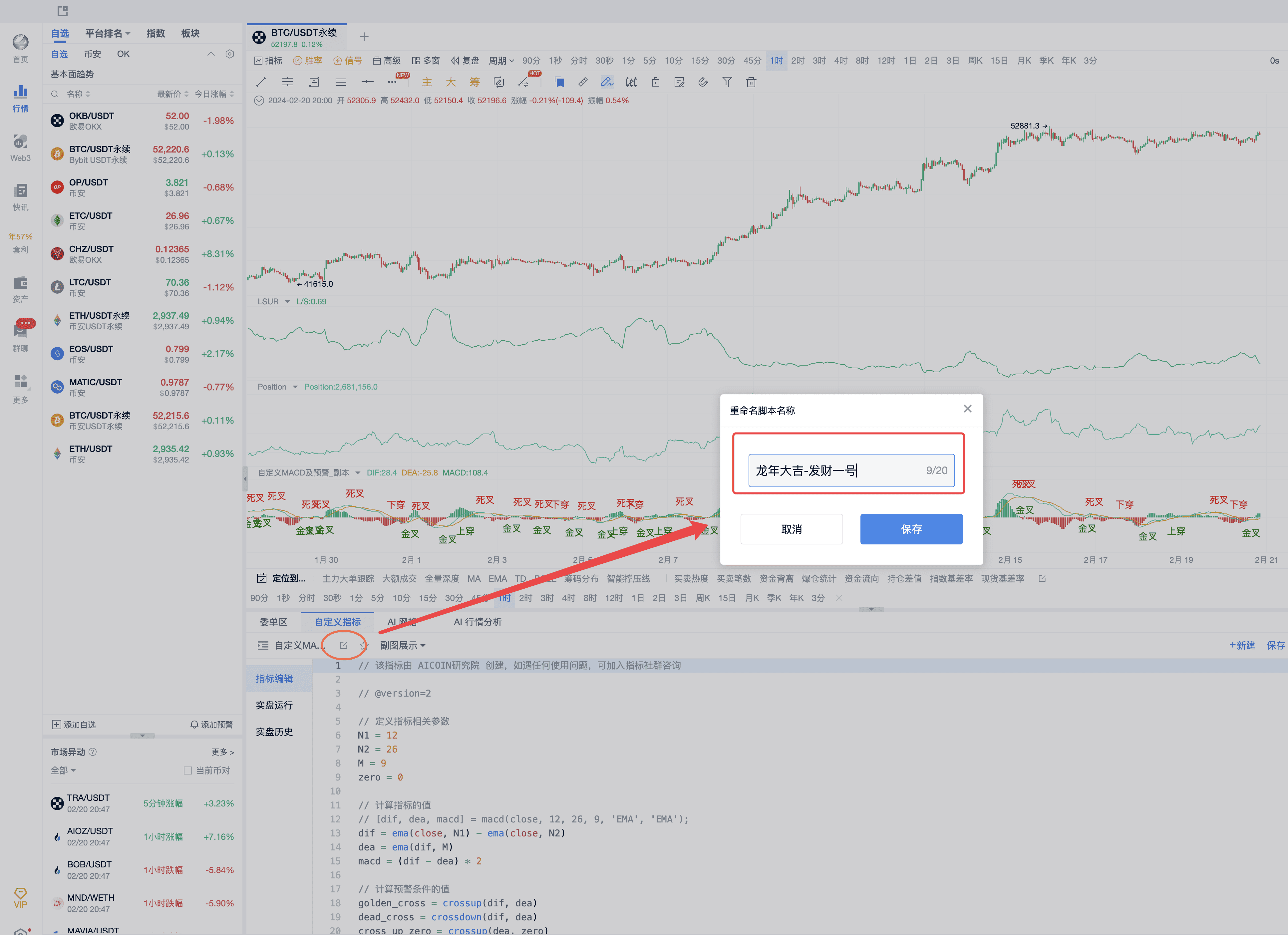

Alternatively, you can directly copy the script below to save the strategy.

// This indicator is created by AICOIN Research Institute. In case of any usage issues, you can join the indicator community for consultation.

// @version=2

// Define indicator-related parameters

N1 = 12

N2 = 26

M = 9

zero = 0

// Calculate the value of the indicator

// [dif, dea, macd] = macd(close, 12, 26, 9, 'EMA', 'EMA');

dif = ema(close, N1) - ema(close, N2)

dea = ema(dif, M)

macd = (dif - dea) * 2

// Calculate the value of the alert condition

crossupzero = crossup(dif, zero)

crossdownzero = crossdown(dif, zero)

// Define the alert condition for use in the alert window

alertcondition(crossupzero, title='MACD(12,26,9) Crosses Above Zero', direction="buy")

alertcondition(crossdownzero, title='MACD(12,26,9) Crosses Below Zero', direction="sell")

// Draw MACD on the chart

plot(dif, title='DIF')

plot(dea, title='DEA')

plotColumn(macd, title='MACD');

// Draw signals on the chart

plotText(crossupzero, title="Crosses Above", text='Crosses Above', color='green', refSeries=dea, placement='bottom')

plotText(crossdownzero, title="Crosses Below", text='Crosses Below', color='red', refSeries=dea, placement='top')

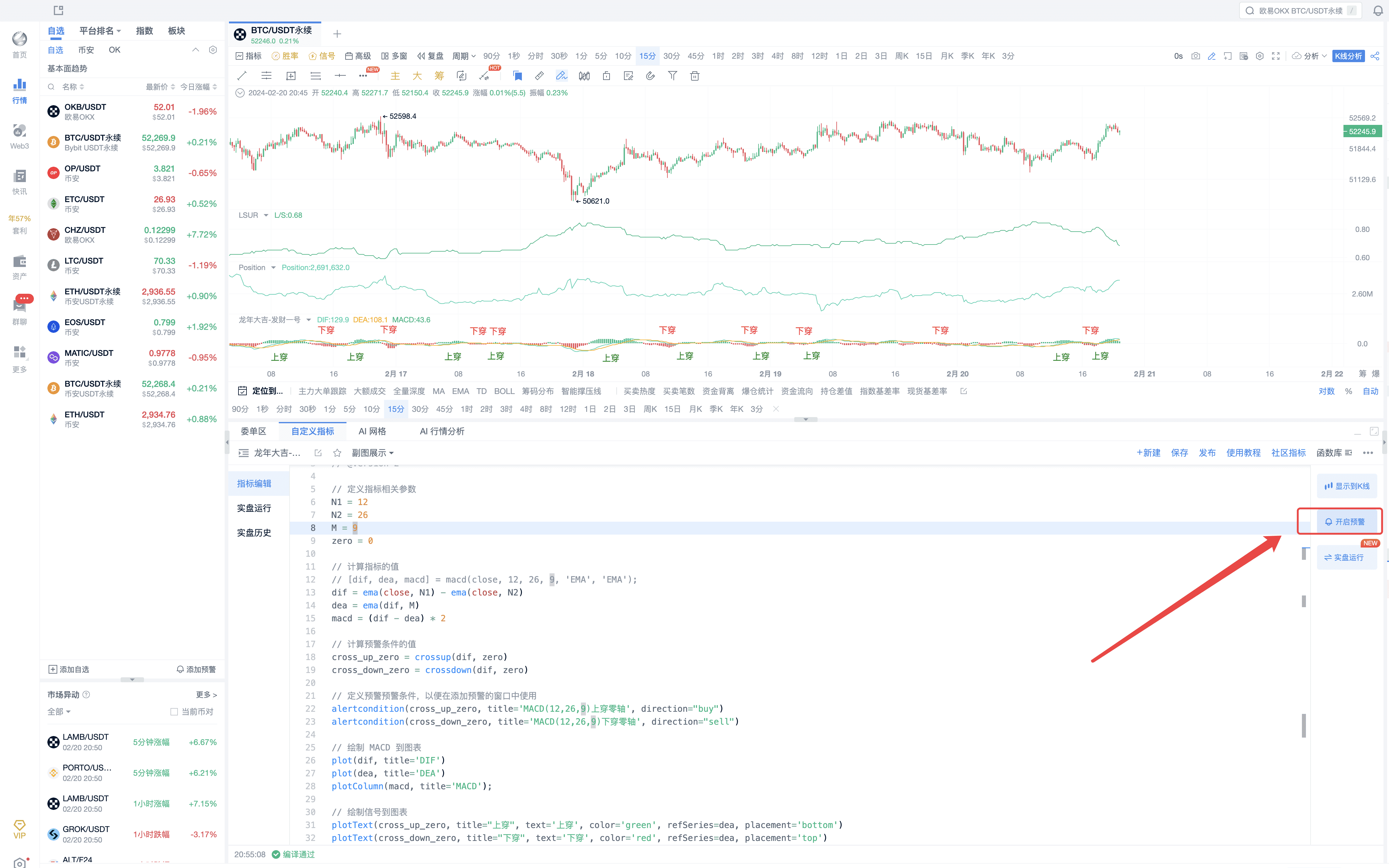

Click to enable alerts as shown in the image, to identify trend openings and profits.

For more custom indicator strategy displays and multiple alert reminders, feel free to subscribe to any of the three memberships: Signal Alert/PRO K-line/Indicator Win Rate. You can experience any of them for free for a limited time. Click the link below to subscribe: https://aicoin.app/vip/indicator

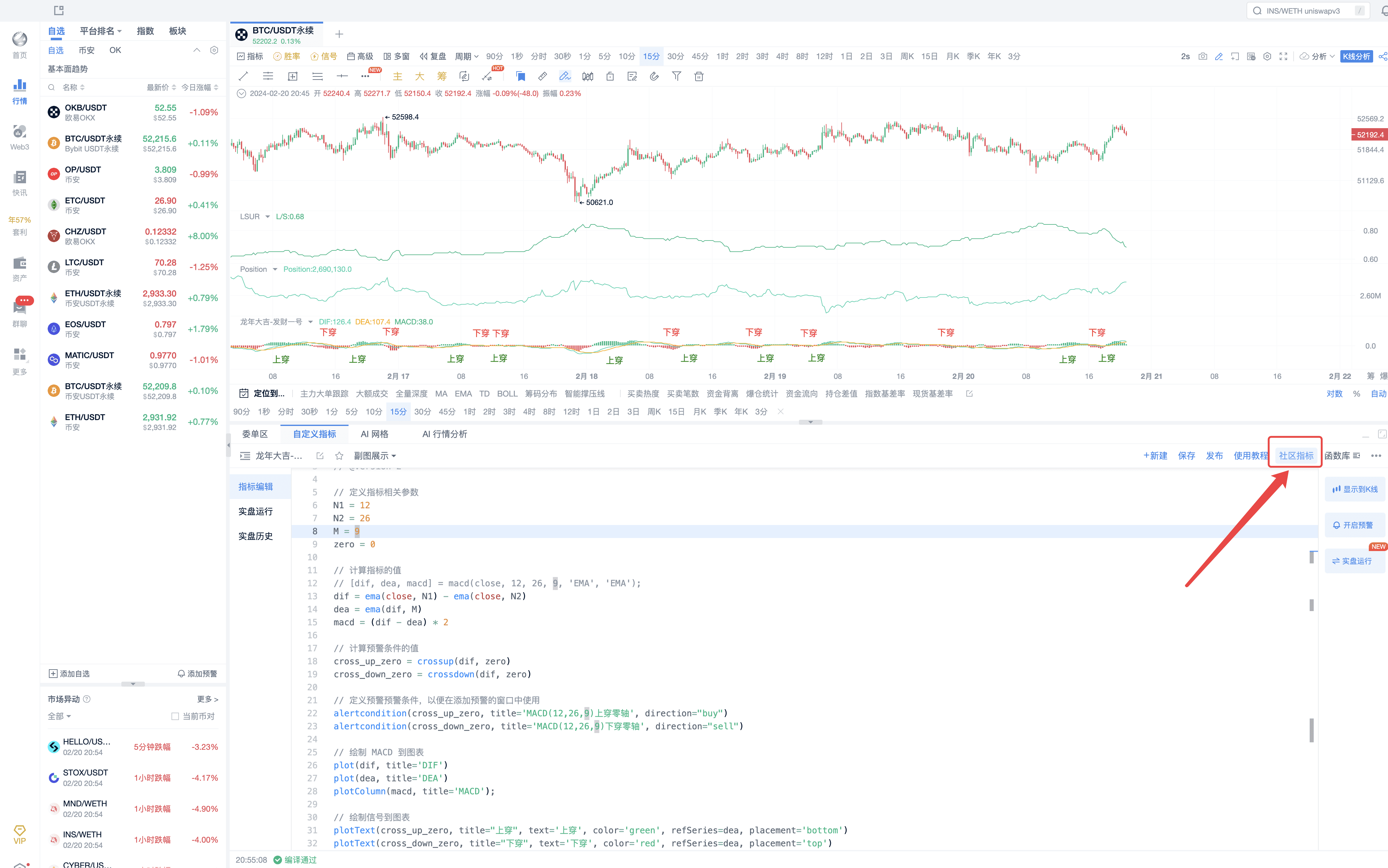

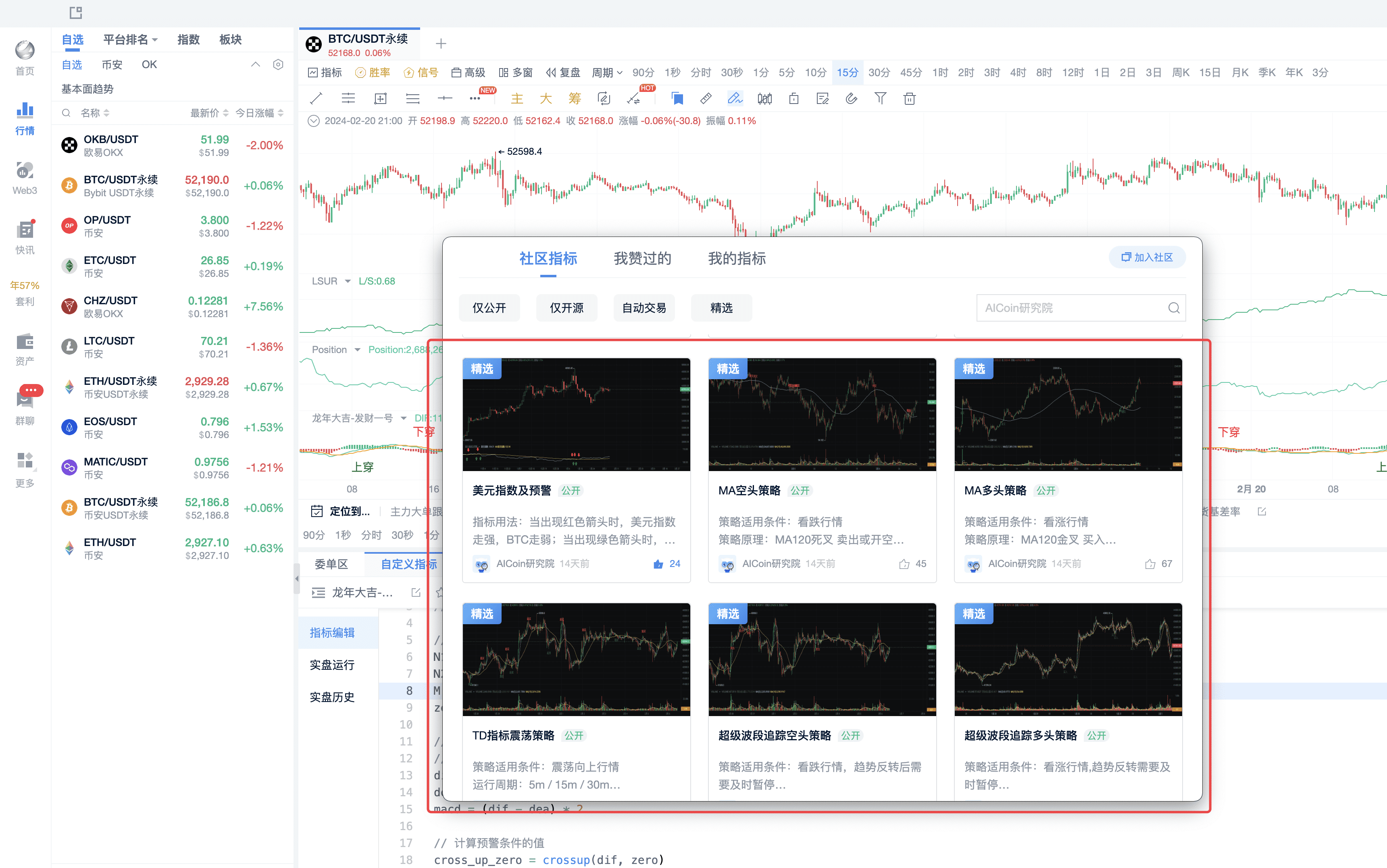

III. Community Subscription

Open the community indicators.

Click "Publish Strategy" as shown in the image.

We have published many strategies, and welcome subscriptions.

To see more custom indicator strategy displays and multiple alert reminders, feel free to subscribe to any of the three memberships: Signal Alert/PRO K-line/Indicator Win Rate. You can experience any of them for free for a limited time. Click the link below to subscribe: https://aicoin.app/vip/indicator

Recommended Reading

EMA Indicator Automated Trading: A Guide to Maximizing Returns

Unveiling MACD: The Versatile Indicator in the Investment Field

For more live content, please follow AICoin's "News/Information-Live Review" section, and feel free to download AICoin PC-end

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。