Original Title: Stablecoin Evolution: USDe's Impact on Decentralized Finance

Original Source: Greythorn Asset Management

- Project Name: EthenaLabs

- Network: Ethereum L1

- Current TVL (Total Value Locked): $4.1 billion

- Project Type: CDP (Collateralized Debt Position)

- Symbols: $USDe & $ENA

- Cryptocurrency Ranking: #NA

- Market Cap: NA

- Fully Diluted Valuation (FDV): NA

- Circulating Supply: NA

- Total Supply: NA

Introduction

Following the collapse of Terra and its related UST and Anchor protocol in 2022, interest in decentralized stablecoins plummeted. However, with the continuous development of Web3, sectors are constantly rotating and evolving. Currently, the Greythorn team sees projects like Prisma, Liquity, and Lybra at the forefront of innovation in the LSD/CDP space, while Maker and Curve maintain their Total Value Locked (TVL).

Many experts are questioning whether EthenaLabs' new project USDe can maintain its ~27% Annual Percentage Yield (APY) while avoiding a situation similar to Anchor where investors suffered losses.

After announcing its funding on July 12, 2023, EthenaLabs reignited the enthusiasm for DeFi by creating a digital currency pegged to the US dollar using LST (stETH). This raises the question of whether it will fully utilize Ethereum's Layer 1 and Layer 2, or if it will follow in the footsteps of LUNA, becoming the next major failure in the crypto market.

Why USDe and Stablecoins Matter?

Stablecoins have become key participants in the decentralized currency market, significantly impacting market dynamics. They play a crucial role in supporting trading and increasing stability in the crypto market, whether on centralized or decentralized platforms, especially amidst the continuous volatility of the crypto market.

In the past two years, the stablecoin sector has experienced significant growth, with on-chain transaction volumes exceeding $9.4 trillion this year. They account for over 40% of the Total Value Locked (TVL) in DeFi, dominating trading. Data shows that over 90% of order book trades and over 79% of on-chain transactions involve stablecoins.

Source: X: Route2FI

AllianceBernstein, a globally leading asset management company with $7.25 trillion in assets under management (AUM), predicts that the stablecoin market could reach $28 trillion by 2028. This forecast indicates a significant growth opportunity from the current $138 billion market value (previously peaked at $187 billion).

The increasing acceptance of stablecoins and their consistent performance in both centralized and decentralized environments demonstrate their indispensable role in the crypto ecosystem. Optimistically, their potential for race track growth is as high as 2000%, presenting significant opportunities for investors and market participants to interact with projects like EthenaLabs' USDe.

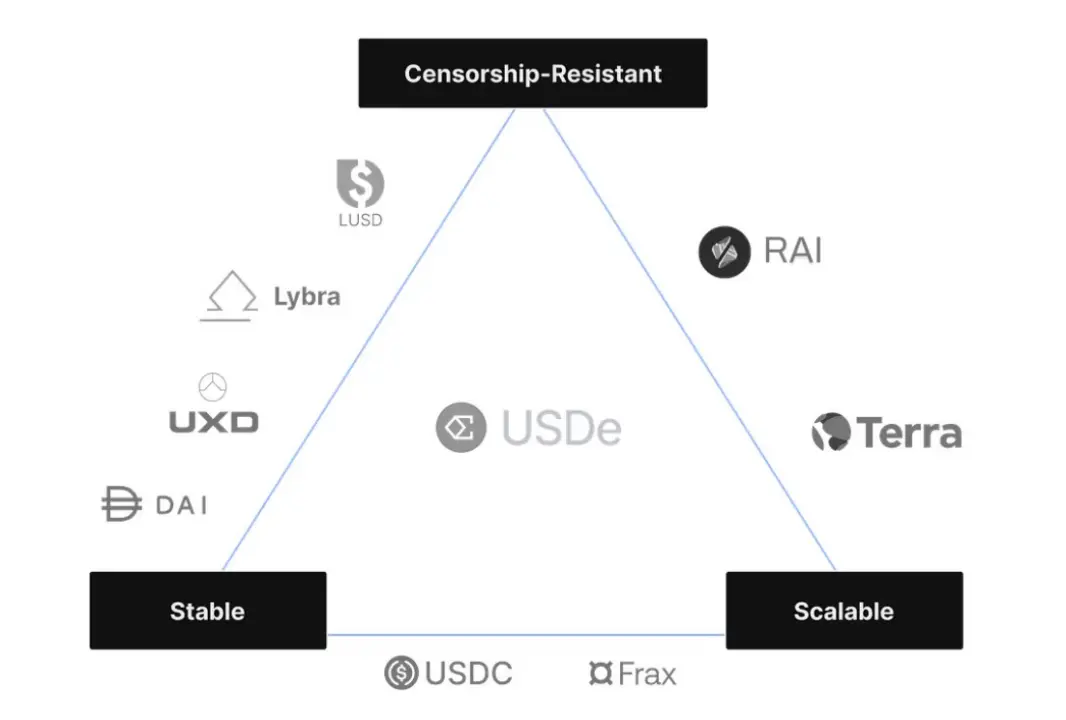

Specifically, USDe aims to meet this growing demand by providing an anti-censorship, scalable, and stable market option.

Project Overview

Inspired by Arthur Hayes' "Dust to Crust" article, EthenaLabs is dedicated to creating a derivative-backed stablecoin to address significant issues of crypto reliance on traditional banks. Their goal is to provide a decentralized, permissionless savings product for a wide audience. EthenaLabs' synthetic dollar USDe aims to be the first crypto-native, anti-censorship, scalable, and stable financial solution, achieved through Delta hedging of collateralized Ethereum.

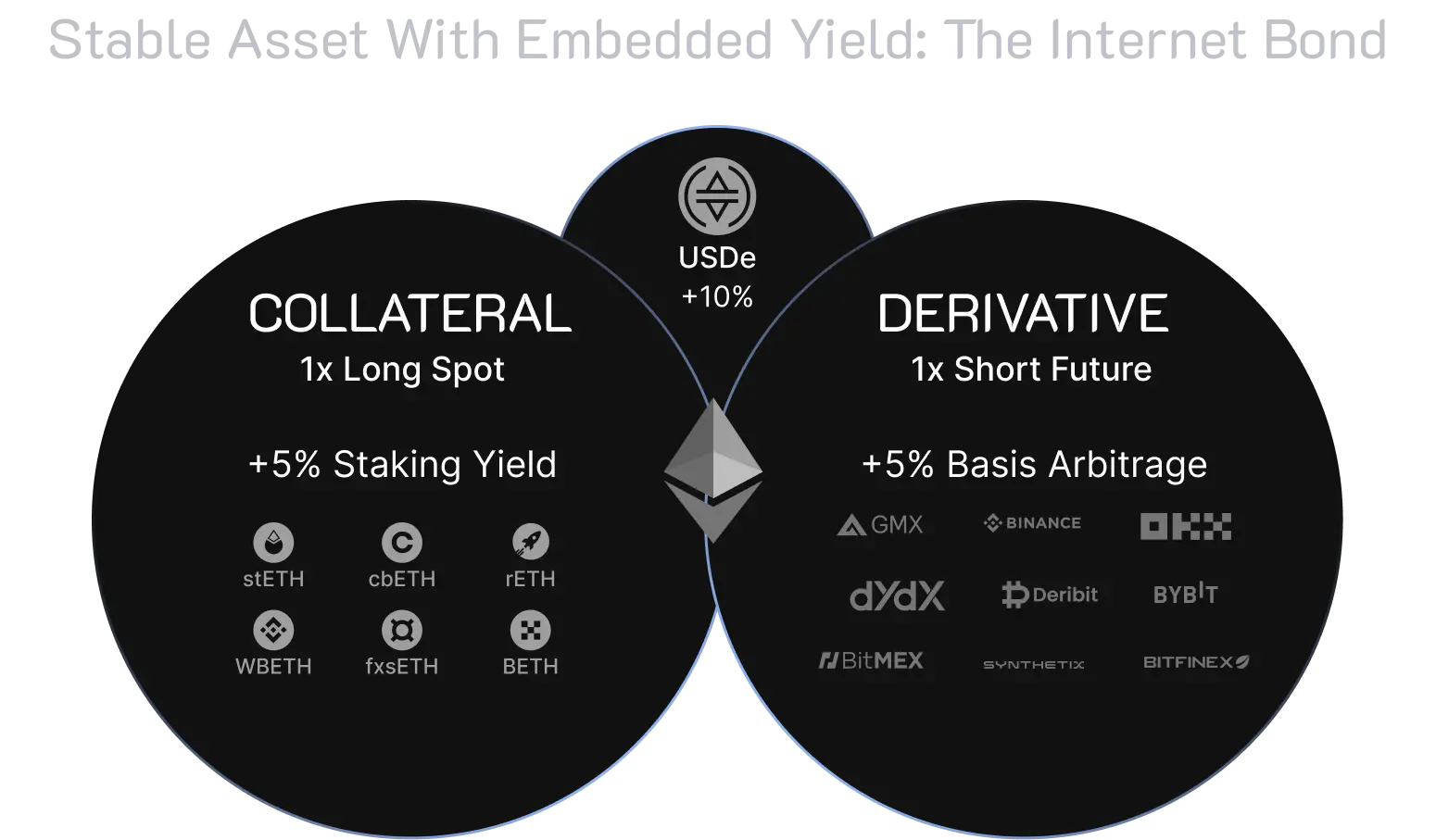

EthenaLabs plans to introduce a product called "Internet Bond" alongside USDe. According to EthenaLabs Gitbook, this will be a crypto-native, yield-generating, USD-denominated savings tool based on collateralized Ethereum returns and utilizing funding and basis differentials in perpetual contracts and futures markets.

EthenaLabs stands out with its unique mission and innovative approach. Unlike other CDP projects such as Maker's DAI, Liquity's LUSD, and Curve's crvUSD, EthenaLabs' USDe generates its USD value and yield through two main strategies:

Utilizing stETH and its inherent yield.

Taking ETH short positions to balance Delta and utilize perpetual/futures funding rates.

This strategy allows the protocol to synthetically create a Delta-neutral CDP, combining spot deposits of stETH with corresponding short positions established through collaborations with CEXs like ByBit and Binance.

Holding Ethena's sUSDe (collateralized USDe) essentially becomes a basis trade, balancing the spot stETH position with short ETH positions in the market. This setup provides users with exposure to the yield differential between these positions, currently generating approximately a 27% yield.

Source: EthenaLabs Gitbook

USDe: Key Risks and EthenaLabs' Mitigation Measures

Before delving into the risk and return analysis of collateralizing USDe, it is important to address several potential risks associated with EthenaLabs:

● Custodial Risk

EthenaLabs uses Over-the-Counter Escrow Settlement (OES) providers to custody assets, creating a dependency on the operational capabilities of these providers. Challenges in executing key functions such as deposits, withdrawals, and exchanges could impact the protocol's efficiency and the minting/redemption functions of USDe.

Mitigation Strategy: Diversified custodial providers: EthenaLabs effectively manages concentration risk by diversifying collateral across multiple OES providers to minimize risk.

● Centralized Exchange (CEX) Risk

The protocol uses derivatives on centralized exchanges (e.g., Binance, Bybit) to balance the collateral's Delta. Risks arise if the exchanges become unavailable.

Mitigation Strategy: Diversified CEX channels: By diversifying the exchanges holding the assets, EthenaLabs reduces the risk of any single exchange failure.

● Collateral Risk

Differences between collateral assets (stETH) and the underlying assets (ETH) in perpetual futures positions introduce "collateral risk." Significant errors in LST could lead to liquidity issues.

Mitigation Strategy: Active monitoring and partnerships: EthenaLabs actively monitors the on-chain integrity of stETH and maintains contact with liquidity sources, prepared to replace collateral when necessary.

● Liquidation Risk

Incurring liquidation risk by collateralizing stETH in short ETHUSD and ETHUSDT positions, especially if the price difference between ETH and stETH significantly widens.

Mitigation Strategy: Systematic collateral management: EthenaLabs has processes in place for rebalancing collateral, asset transfers, and utilizing insurance funds to mitigate liquidation risk.

i. Systematic collateral rebalancing

Ethena will systematically delegate additional collateral in any risk scenario to improve our margin position for hedging.

ii. Asset transfers and collateral cycling

Ethena can temporarily cycle delegated collateral between exchanges to support specific situations.

iii. Insurance fund deployment

Ethena has the capability to swiftly deploy insurance funds to support hedging positions on exchanges.

iv. Protecting collateral value

In extreme scenarios, such as critical smart contract flaws in collateralized Ethereum assets, Ethena will take immediate action to mitigate risk, with the sole motivation of protecting the value of the collateral. This includes closing hedging derivative positions to avoid liquidation risk becoming a concern, and converting affected assets into alternative assets.

● Funding Risk

Sustained negative funding rates may reduce Ethena's returns.

Mitigation Strategy: Insurance fund as a return protector: The insurance fund acts as a safety net when overall returns are negative, ensuring the stability of the collateral.

● Collateral Withdrawal Queue/Slashing Risk

ETH withdrawals may result in long queues, which could have a negative impact on stETH.

Mitigation Strategy: This is primarily dependent on the performance of stETH and Lido, and EthenaLabs does not have a direct mitigation strategy.

● Regulatory Risk

Concerns about regulatory control over USDT, USDC, and DeFi could impact the growth of USDe in Total Value Locked (TVL), including difficulties in user attraction and retention.

Mitigation Strategy: EU-based operations and MiCA licensing: By operating in accordance with EU's MiCA regulations, EthenaLabs positions itself to effectively adapt to regulatory changes, reducing the impact of potential legal changes.

EthenaLabs has developed a comprehensive approach to managing various risks in its operations, emphasizing the importance of diversification, active monitoring, and strategic planning in protecting the protocol and its users.

Comparison with Anchor: Are the Returns Worth It?

Investors are encouraged to conduct their own research, especially when considering USDe, which offers a high stablecoin yield of approximately 27%. This yield is comparable to the situation with the Anchor protocol, highlighting the systemic risk in the market, where the failure of a single protocol could lead to broader financial turmoil.

The decline of Anchor is primarily due to inherent risks in the UST design, which depend on reflexive mechanisms related to the price of Luna. There is a risk of catastrophic devaluation of UST if the price of Luna significantly declines. Anchor provides UST (or aUST) yields to borrowers based on a fixed Terra ratio, regardless of market conditions, with a promised annualized rate of 19.45%.

Additionally, the "real yield" from collateralized bAssets in Anchor is only about 5.81%, significantly lower than the payout rate. This difference, coupled with its reliance on Luna's performance, sets the stage for a financial crisis.

For those interested in learning more about the collapse of Luna and UST, including the Anchor mechanism, we have previously detailed this in articles titled "Demystifying Anchor" and "The Collapse of Anchor."

For USDe, how its returns are generated, the risks involved, and its marketing strategy are significantly different from Anchor:

Transparent marketing: Unlike Anchor's promotion of "risk-free" returns, USDe's marketing directly outlines the risks and returns. Its sources of returns from perpetual contracts (perps) and collateralized Ethereum (stETH) are clearly communicated, setting realistic expectations.

Real returns: sUSDe does not promise unsustainable high deposit rates. Instead, it provides actual returns from its underlying assets, avoiding the trap of incentivizing borrowers with rates that cannot be supported by asset returns.

Avoiding self-collateralization: Unlike models that use their own tokens as collateral, sUSDe relies on stETH. This shift from collateralizing with the project's own token to a more stable asset like stETH significantly alters the risk dynamics. The focus shifts from speculative risks associated with the project token to more manageable liquidity risks with ETH and stETH, as well as other risks mentioned above.

Comparing USDe to the collapse of UST is misleading, as they have fundamental differences in risk structure and operational models. The focus for USDe investors should be on understanding the specificities of perpetual funding, centralized exchange liquidity, and custodial risks, rather than unsustainable high-yield strategies seen in the UST model.

Overall, compared to Terra's UST, USDe presents a more thoughtful and potentially safer option in risk mitigation and product structure. By leveraging native returns and effectively managing risks from derivative sources, USDe stands out not only for its yield opportunities but also for its strategic design and risk management practices.

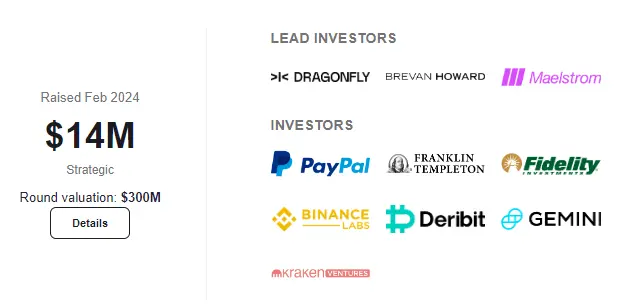

Outstanding Team and Support

Under the leadership of @leptokurtic_, the Ethena team has successfully completed three rounds of funding, attracting significant participation from centralized exchanges, market makers, DeFi innovators, and traditional financial institutions. This broad support underscores the project's credibility and potential impact on the ecosystem.

Under tight deadlines, the team demonstrated excellent planning and coordination, ensuring the protocol was ready for mainnet release. They prioritized risk management and security, conducting thorough audits before release.

Source: ICO Analytics: Ethena

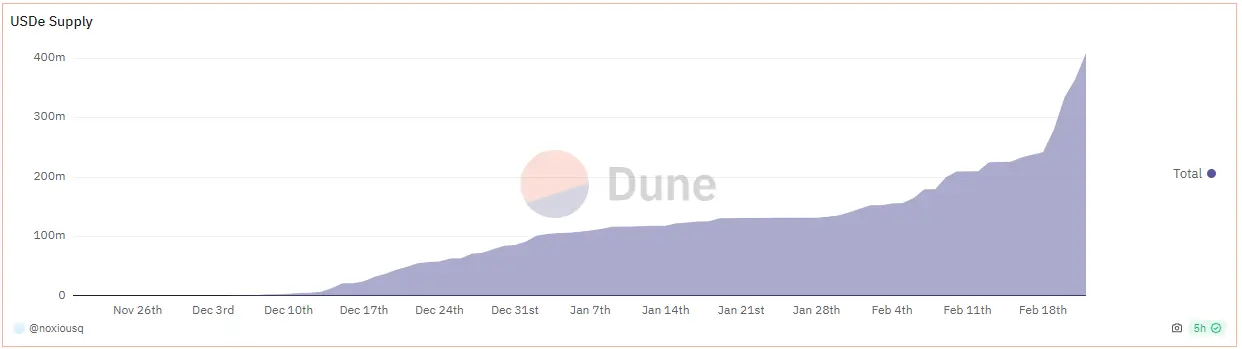

The successful Shard airdrop activity demonstrates the market's interest in decentralized stablecoins. Since early December 2023, the Total Value Locked (TVL) has increased by 135 times, reaching over $4.1 billion, marking an impressive start to the initiative.

Source: @noxiousq Dune Analytics

This momentum indicates strong demand for products like USDe, attracting not only a significant TVL but also the attention of investors who support its vision. As USDe moves forward, it aims to introduce the next billion dollars of TVL into the DeFi space, potentially opening up new opportunities similar to those seen during the Luna cycle. It prompts the question: does this mark the beginning of another transformative phase in decentralized finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。