The article is about NFT, but it's more than just NFT.

Author: Nakamoto Uikyou

Key Takeaways:

The true business model of NFT is not just about buying and selling scarcity and collectible value, but using misleading information to attract a very small number of final buyers — winning trust with high-priced NFTs and selling other NFTs at falsely appraised prices.

The individual "consensus price" has been mistakenly confused with the market's "consensus price," but individual transaction prices are by no means the "market consensus price." In fact, the limited real buyers of NFTs and the market depth determine that its pricing mechanism cannot be the commonly perceived "consensus pricing."

Issuing NFTs has almost no threshold and cost, which means the so-called "scarcity" of NFTs is an illusion. Similar "scarce" NFTs are mass-produced, making them not only not scarce, but even overly abundant.

The market has actually priced NFTs with false scarcity and substantial abundance. The hidden consensus of the market is that it does not recognize the pricing of NFTs, resulting in NFTs having only prices but no buyers.

Most investors and issuing teams cannot make money from NFTs. Investors are unlikely to buy NFTs that have skyrocketed in price, but are likely to become the "last buyer" of a mispriced NFT (possibly the only real buyer); most issuing teams merely mechanically inherit the product form of NFTs, without realizing that it takes substantial financial resources and courage to have a chance to create a blue-chip NFT like BAYC.

The seemingly fair NFT trading market and data platforms are part of a deception, using absurd statistical data to mislead investors and issuing teams in their evaluation and pricing.

It is necessary to correct the mistaken understanding of the NFT market and stop the misallocation of resources in order to revitalize the NFT race.

This article is about NFT, but it's more than just NFT. There are still many illusions in the market that need to be exposed, and this article aims to stimulate further discussion.

The venture capital world has an unspoken maxim: when everyone rushes to invest in a sector, it is no longer a high-return track.

Profit-seeking behavior creates a balance — any obvious profit space will be quickly depleted, so that the true excess profit is either ignored or rarely encountered. (That's why I love opportunities that traders don't understand.)

Although this is not an unassailable doctrine, it often works in the investment and business fields, which is why I have always been puzzled by the thriving NFT market two years ago:

Since issuing NFTs is a business model so simple that almost everyone can profit without risk, where does the huge profit come from?

Since the profit path of NFTs has been understood by everyone overnight, and almost everyone has been inspired to imagine the future business landscape, how can it still be called a potential track?

Crowding and growth, low threshold and high returns are almost impossible to coexist. If they do, one of them must be false.

Failure to understand this relationship will inevitably lead to profit-seeking irrationality and various disastrous decisions.

This article will strive to clarify why the reality of most NFT/class NFT assets is not as people perceive it.

Two years have passed, and the market's understanding of NFTs has not progressed much. There are still a large number of teams investing huge costs in a track based on false assumptions. Even in the face of such a bleak market, there are still teams tirelessly issuing new NFTs, hoping that their NFTs will break into the blue-chip sector. As I begin to write this article, there are still 30 projects waiting to be minted on CryptoSlam, not to mention the constant stream of new NFTs on the BTC chain driven by the Bitcoin ecosystem.

Bitcoin Frogs

The profit motive can inspire endless creativity in people, but more often than not, it leads people to follow and get lost in manipulation and deception. The free market allows people to make free choices, but it also allows people to create illusions freely and be deceived by illusions freely.

The important significance of interpreting illusions is that we will begin to learn to protect ourselves, and the market will stop investing resources in the wrong direction.

I. Market Size of NFTs

The NFT track research reports have always loved to mention the total market value of NFTs and describe it as a huge market, especially when it was a staggering $30 trillion two years ago (November 2021); at the same time, the reports also delight in the incremental users it has created for WEB3.0, with nearly 5 million independent users and over 12.6 million cumulative buyers still in the NFT market at the time of writing.

Perhaps due to human cognitive bias, people are more willing to seek supportive information for the potential of the NFT market and the widespread gold than to try to prove that the prosperity is not true.

So, whether it was two years ago or today, when the market value has shrunk by 99% to a mere $6.7 billion, almost no one questions the calculation method of the NFT market value.

NFT market value = floor price (sometimes average price) * total supply; and the total market value of the NFT market is the simple sum of the market values of all NFTs.

This formula is not reasonable for valuing general securities, and it is even more absurd for valuing the NFT market, with an invalidity no less than using the national GDP to measure the living standards of each family.

In general, the lower the circulating market value of a stock, the more likely it is to experience a value bubble and valuation deviation. The real circulation of most NFT series is only 1%-2% of the total supply, and the circulation of non-blue-chip NFTs is even lower. Most importantly, as will be explained later, because the price of NFTs does not come from sufficient capital games, the utility of reflecting value will be even worse.

Invalid high prices and ignored low circulation rates make up paper wealth, and it is this kind of ordinary "accounting method" that leads market participants to overestimate the product value and market potential of NFTs, ultimately being fooled by false prosperity.

Ignoring the irrelevance of indicators and conclusions is one aspect, and some obvious data that could falsify the prosperity of the NFT market is rarely mentioned, such as, as of November 28th, the cumulative trading volume of NFTs was $86 billion — still less than the total trading volume of Bitcoin on Binance in two months.

The stock market is full of all kinds of fraudsters, with the only exception being trading volume.

The NFT market is far from as large as people imagine. When we reorganize all the available data, we will find that the only thing that can be called "huge" in this market is its bubble.

II. Measuring Liquidity: The Real Buyers of the NFT Market

I have been thinking about what indicators, in addition to cumulative trading volume, can effectively measure the size and liquidity of the NFT market.

A scientist friend (@darmonren) inspired me. He told me that he had casually crawled the trading data of Cryptopunks and found, after a simple sorting, that the vast majority of punks had never been traded.

This discovery unveiled the veil of the liquidity dilemma in the NFT market, leading to a conjecture: perhaps the reason for the lack of liquidity in the NFT market is that most NFTs do not have real buyers.

To verify the conjecture, I crawled data from blue-chip NFTs other than Cryptopunks, and some interesting statistical results began to emerge. Next, I will use BAYC as an example to explain one by one.

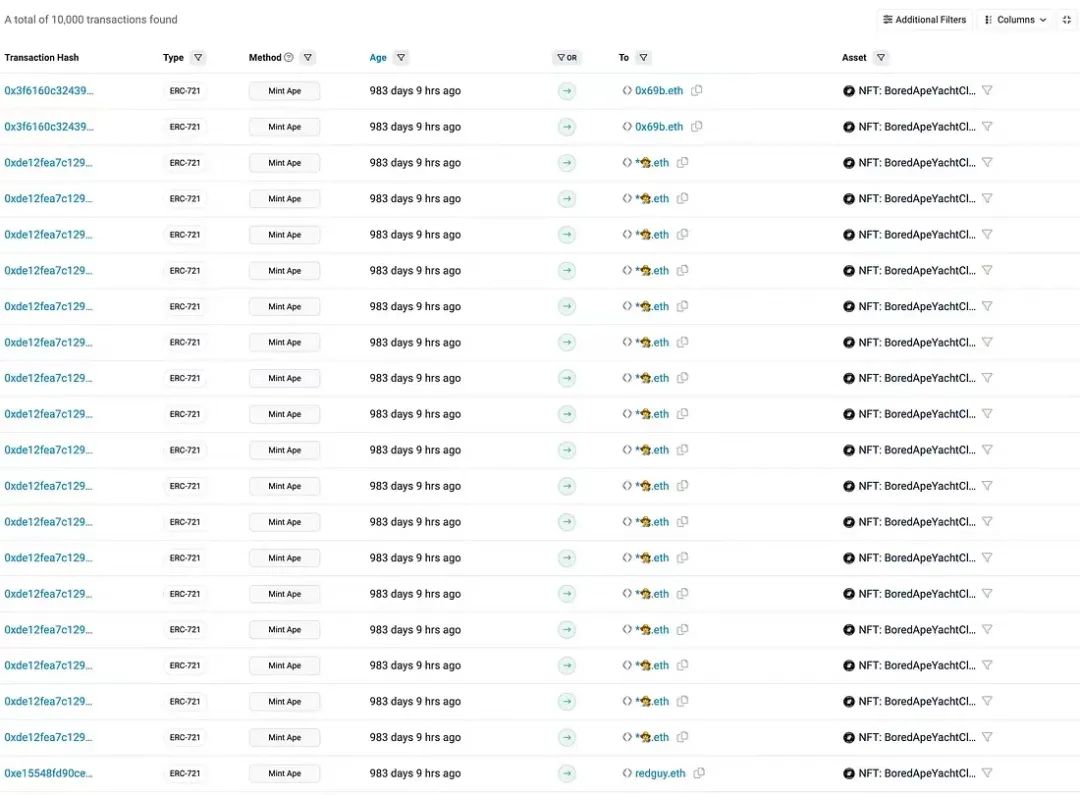

As of November 28, 2023, Etherscan recorded a total of 36,990 BAYC transactions on 8 major NFT marketplaces. It should be noted that these are not all the transfer histories of BAYC, but a subset of them.

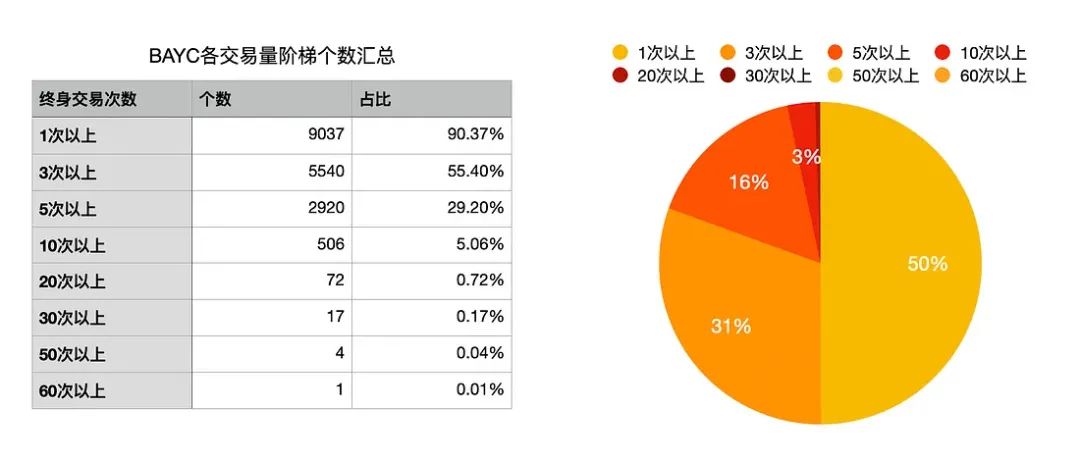

As shown in the figure, out of 10,000 BAYC in 36,990 transactions, 10% have not been traded at all to this day, 71% of BAYC have been traded less than 5 times in their lifetime, and there are less than 20 BAYC that have changed hands more than 30 times in the market, with only 4 BAYC having been traded more than 50 times, and none of them have been traded more than 100 times.

These data have undergone preliminary cross-validation.

I separately took out 100 extreme values with trading frequencies of 10 or more and only 1, and compared their corresponding token IDs with the sales data recorded on Cryptoslam.

Cryptoslam also captured data from other unnamed marketplaces in addition to the 8 mentioned trading markets. When all the trading histories of a BAYC ID are limited to these 8 marketplaces, the data on both sides are consistent. The sample tokens with trading frequencies of only 1 also have consistent historical data on both sides.

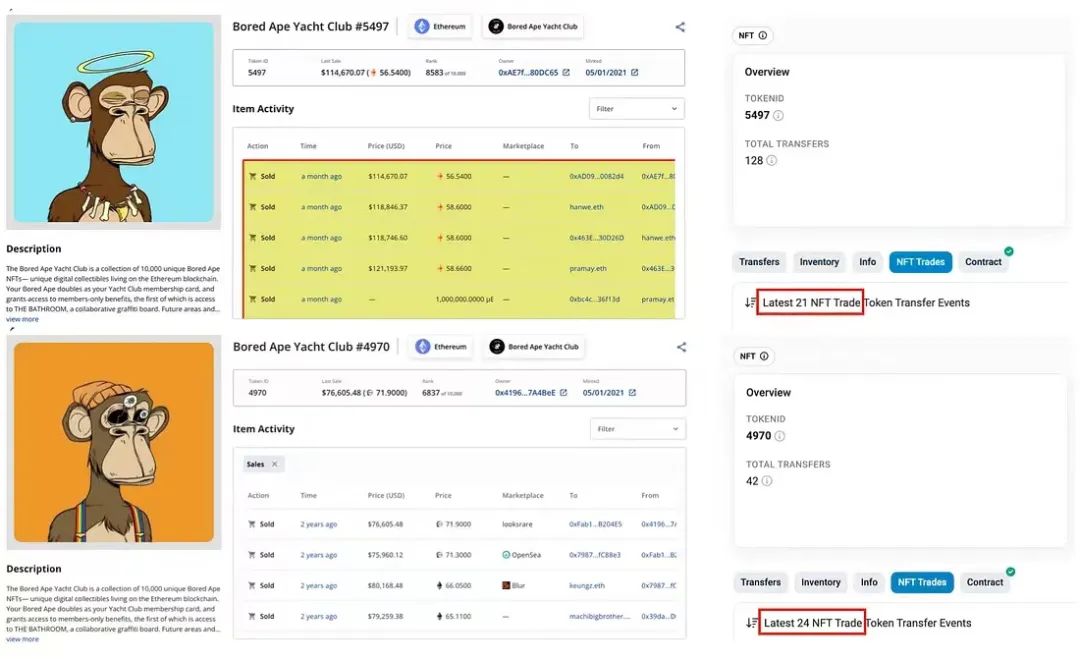

However, some discrepancies have appeared, such as BAYC #5497. The trading frequency I crawled from the NFT Trade records on Etherscan is 21 times, while the trading frequency recorded on Cryptoslam is 54 times, with 21 times being the trading data on blur and Opensea, and the additional 33 times occurring in other trading markets not recorded by Etherscan.

And for example, BAYC #4970, the historical trading frequency recorded on Cryptoslam is 17 times, while the one crawled from Etherscan is 24 times.

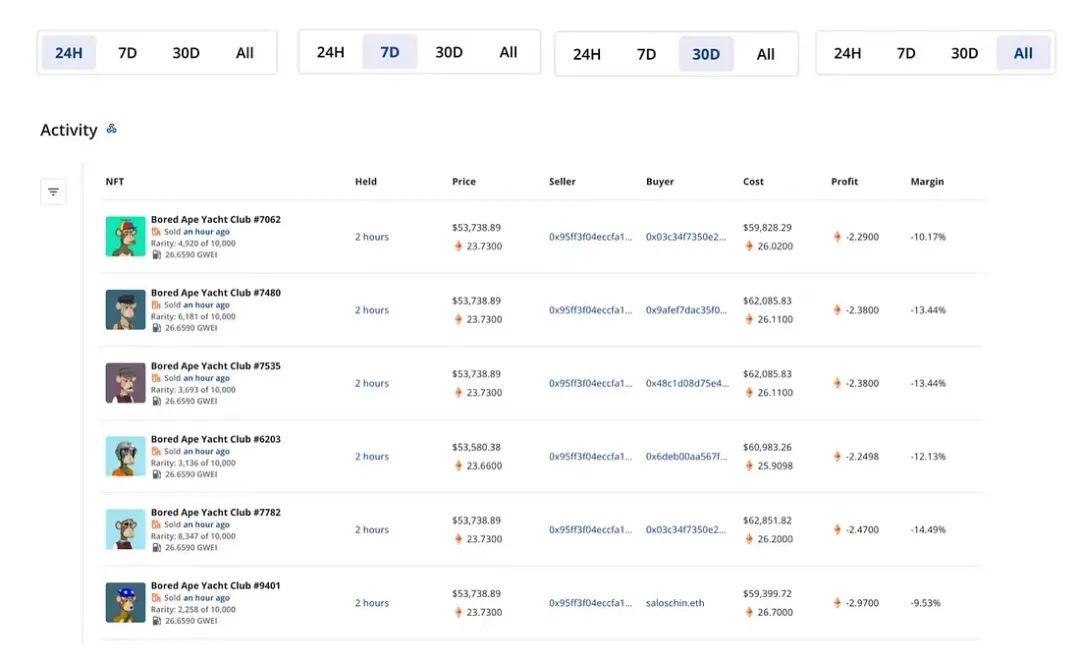

In fact, the discrepancies are concentrated in those BAYCs on the active list on Cryptoslam, with an almost 100% coverage rate. It is easy to notice that the 24-hour, 7-day, and 30-day activity lists are the same batch of BAYCs, with no change in ranking, all of which are frequently traded on unnamed exchanges, resulting in the historical trading frequency displayed on Cryptoslam being generally higher than that recorded by Etherscan.

Regardless of what caused the surge in turnover for these BAYCs, since we are measuring the distribution of BAYC turnover over the long term, these sudden extreme outliers should be excluded.

Therefore, this has no impact on the conclusion — 99% of BAYCs have no market (no turnover potential) because they do not have a certain number of buyers.

Among the remaining 1%, if we consider each turnover as a new independent buyer, then less than 30% — 17 BAYCs have 30 or more buyers.

In other words, in the past 950 days, each of these 17 BAYCs had fewer than 30 people willing to buy; and out of 10,000 BAYCs, only 1 had 60 historical buyers.

This data distribution also applies to other blue-chip NFTs.

BAYC has a listing rate of 2% on Opensea.

Some may ask, if at least 90% of BAYCs have been traded at least once, how can we conclude that NFTs have no buyers?

In fact, just by looking at the listing rates of various NFT series on Opensea, we can see the clues. Almost all blue-chip NFTs with a circulation of 10,000 have a listing rate of only 1%-2% — that is, 100–200 are listed on the market.

If the NFTs with trading records are all truly sold, why is the listing rate so low?

According to the crawled data, a total of 1729 BAYCs have only one lifetime trading record. So, if these 1729 BAYCs were all purchased by independent real buyers, how could only 200 be listed and circulated in the market? Market makers have a motive to control the listing rate, but market participants aiming for profit have no reason not to sell after buying, allowing funds to subjectively stagnate.

Now, I think everyone should thoroughly understand why the NFT market lacks liquidity.

III. Lower Liquidity Than Imagined

We often talk about liquidity, and now it's time to give it a clear definition. I have observed that when people talk about the liquidity of NFTs, they mostly refer to both the liquidity of NFTs as assets themselves and the stock funds in this sub-market.

Asset liquidity refers to the speed and ease with which an asset can be sold at a fair market value. Assets with good liquidity can be sold quickly at the current market price without significant discounts and without paying high transaction fees.

On the other hand, stock funds in the market refer to the abundance of funds in this market, which depends on the comparison between the amount of funds and the number of assets. It is the liquidity on the liability side.

The lack of liquidity in the NFT market is both on the asset side and the liability side.

First, NFT marketplaces have made the issuance and distribution of NFT assets extremely simple, resulting in the supply of NFT assets growing like a virus, and the dramatic increase in tradable NFTs has put pressure on the overall market liquidity.

Second, the characteristics of non-fungible tokens mean that each NFT itself is a sub-market, even for PFP series, each NFT in the series operates in its own separate trading environment, ultimately leading to the fragmentation of liquidity.

The nature of NFTs themselves leads to fragmented liquidity, and the lack of mechanisms to observe the marginal changes in liquidity in the NFT market exacerbates the liquidity problem. In the FT market, once the marginal amount of funds in the market changes, the price will also change, and the exit and increase in liquidity in the FT market will inevitably be reflected in the price.

But in the NFT market, the marginal amount of liquidity and price are isolated from each other, and the withdrawal of funds from the market cannot directly reflect in the price; and even if there is no incremental funds in the market, the rotation of existing funds alone can drive up the selling price of NFTs, thereby inflating the entire NFT market's market value.

When there is no mechanism in the NFT market to measure and lock up existing funds, it leads to a false prosperity — even though there is almost no remaining liquidity in the market, the NFT's nominal price and total market value can still remain high.

For NFT investors, the lack of buying interest/trading counterparties and the survivorship bias creating a myth of sudden wealth ultimately result in them being lured in at high prices, only to not win the lottery NFT and instead become the "last buyer."

IV. Fallacy of Consensus Pricing

So, can we trust the prices of NFTs?

In the past, it was said that the prices of NFTs can be trusted because from the widespread discussions, it seems that both market participants and observers agree that the pricing mechanism of NFTs is "consensus pricing."

Consensus and scarcity are the explanations people have found for the high prices of NFTs.

In my opinion, "consensus pricing" is the kind of elegant but vague expression that the crypto market has always loved, and the widespread acceptance of such expressions is itself a typical irrationality of the crypto market.

Once the logical starting point of the "consensus pricing" viewpoint is reviewed, it is easy to find that the "consensus" here actually means indicators of notoriety and group emotional characteristics, each corresponding to an assumption:

Assumption 1: NFT issuers with high notoriety and a large fan base have a naturally broad and solid consensus foundation, because the fans of celebrities will fervently enter, providing liquidity and turnover, thereby giving NFTs appreciation potential.

Assumption 2: Different groups of people are all looking for a sense of belonging and self-expression, and are willing to pay a high price for NFTs that satisfy their emotional needs.

This is not consensus pricing, it is notoriety pricing and emotional pricing.

The notoriety assumption is easily refuted by the plummeting prices and real on-chain data — that is, the real market consensus refutes it.

Take Jay Bear as an example, it once seemed to be "hot" in the market, but in fact, its issuance ratio is not even as high as that of BAYC and Punk (the issuance ratio = issuance quantity/total trading frequency, I use it to roughly measure the average turnover rate of a series of NFTs).

The mfer and azuki, known for their "emotional value," actually have a higher issuance ratio (even higher than BAYC and Cryptopunks), making their "consensus" more reliable. I guess this is related to user positioning. Fans of celebrities are not the audience for NFTs, and the number of fans of a celebrity (or those willing to spend money) among the NFT audience is not necessarily more than those who like Japanese anime or those who shout "long live the scoundrels."

In other words, it is obviously more difficult to turn celebrity fans into NFT audiences or find celebrity fans from the NFT audience than to tap into the emotional needs of the NFT audience.

However, even though emotions can stimulate people's willingness to trade more than notoriety, the results still do not form the so-called "consensus."

As mentioned earlier, each NFT actually corresponds to a single sub-market. If 99% of NFTs have only one or two customers for their entire lifetime, or cannot even find a buyer, then who forms their consensus? If a NFT has fewer than 30 historical customers, is the consensus of 30 people really a consensus?

How can we find fair prices for thousands of personalized markets?

In price theory, NFTs confuse individual "agreed prices" with the market's "consensus price." In reality, with limited real buyers of NFTs, 81% of NFT holders in already traded NFTs have fewer than 5 counterparts, including market makers buying and selling to themselves. The depth of NFT prices and turnover frequency determines that they cannot have a "consensus price," and the pricing mechanism is not the so-called "consensus pricing," but rather speculative pricing by a limited number of investors — that is, buying based on expectations of NFT growth rather than recognition of value.

But this is not the only reason why the prices of NFTs are not trustworthy.

V. The Emperor's New Clothes: The Illusion of NFT Scarcity

Another factor used to price NFTs is scarcity, but once we understand the proliferation of NFTs on the asset side, the narrative of NFT scarcity falls apart.

The NFT business model revolves around the narrative of scarcity, essentially selling scarcity at a high price — a direct copy of the luxury goods business model.

I can understand the origin of this logic to some extent. Some scattered market theories from classical economics have dominated the thinking of participants in the NFT market.

Although people do not fully agree that the invisible hand is the ideal way to organize economic activities, they have indeed applied it one-sidedly to the NFT market.

We simply know how supply and demand determine prices. Without considering elasticity, oversupply leads to price decreases, and scarcity leads to price increases.

NFT issuers want the result of "price increases," so they artificially create "scarcity."

The first step is to switch concepts, claiming that the uniqueness of non-fungible tokens equals scarcity. Not only that, issuers will divide attributes into levels among a pile of NFTs, making "scarcity" even "scarcer."

But it is clear that the market's real demand for NFTs has not been taken into account.

Prices are influenced by supply but determined by demand. People's demand for NFTs is based on consumption and investment. Consumption demand emphasizes value for money, and NFTs clearly cannot support high prices in terms of value for money, leaving only investment demand. However, as NFTs that can be continuously produced, they can have very low consumption value, but they do not have the investment value of truly scarce (but never lacking a market) collectibles.

In the real art market, the prices of paintings also follow a Pareto distribution, with the works of a few famous artists fetching high prices, while the works of most painters cannot sell at high prices.

The peculiarity of the market lies in the fact that although the illusion of scarcity has been created, the market has not easily bought into it on a large scale.

Data results show that none of the top ten blue-chip PFPs have been fully bought and sold (in fact, the willingness to trade the "most favored" 200 is also quite limited). There is currently no yardstick to measure the real demand for NFTs in the market, but the excess supply of NFTs is a clear fact. Although the supply of a series of NFTs is limited, the total supply of NFT assets in the entire market is excessive.

The number of new NFT issuances each month from October 2023 to January 2024

This precisely indicates that the exorbitant myths and trillion-dollar market value of NFTs attract not so much "buyers" as they do the issuers supplying NFTs.

But from the ultimate results of most NFTs being relatively unknown, it is clear that the vast majority of issuers have not understood what truly makes NFTs successful.

VI. Who Inflated the Bubble

Due to limited real demand and liquidity, issuing, selling, or investing in NFTs is not a profitable endeavor, especially when the investment cost is high.

But how was it initially packaged as a trillion-dollar industry full of excess profits?

In 2021, I once reviewed the history of the NFT market, talking extensively about digital scarcity, cultural change, and the expression of crypto culture. Now it seems that the most important insight from writing that article was discovering that the reason NFTs became a business opportunity began with various crypto art markets actively promoting sensational high-priced auction events in 2020 (especially Nifty Gateway and Async Art), and culminated with Beeple, Pak, and Cryptopunks being showcased at Christie's and Sotheby's.

In other words, it was the crypto art market and traditional auction houses that progressively boosted the heat and pricing of the NFT market.

In 2020, AsyncArt facilitated the auction of "First Supper" for $344,915 in its second month of launch, followed by several hundred thousand dollar transactions occurring frequently.

In October-December 2020, Nifty Gateway held three curated auctions for Beeple, with a total transaction value of 258 ETH (valued at approximately $180,600 at the time).

In December 2020, Pak became the first crypto artist to earn over $1 million.

In March 2021, Beeple's "Everydays: The First 5,000 Days (2008–21)" sold for a staggering $69.34 million, and in the same month, Sotheby's announced that it would hold an auction for Pak in April, marking its official entry into the NFT field.

But the most important event was in February 2021, when CryptoPunks 6965 sold for 800 ETH (equivalent to $1.5 million), followed by CryptoPunks #7804 selling for a high price equivalent to $7.5 million on March 11. As a result, Christie's announced in the following month (April 8) that it would auction Cryptopunks at its 21st Century Evening Sale.

The emergence of PFPs and the rapid expansion of NFT asset scale began after this time.

On April 23, 2021, BAYC was launched for minting at a price of 0.08 ETH.

On May 3, 2021, Meebits were launched for minting.

On July 1, 2021, Cool Cat.

On July 28, 2021, World of Women.

On September 9, 2021, CrypToadz.

On October 17, 2021, Doodles were open for minting.

On December 12, 2021, CloneX.

On January 12, 2022, Azuki.

On March 31, 2022, Beanz.

On April 16, 2022, Moonbirds.

The above are the issuance dates of the top ten blue-chip PFPs across the entire network.

The myth written for Cryptopunks by the crypto art market and traditional auction houses inspired the most sensitive and capital-savvy group of gold diggers in this market — so BAYC emerged.

"People create history from the conditions inherited from the past."

— Karl Marx

Bull markets always arrive in this way — certain elements of random events are deliberately magnified, turning into oral narratives and replicable products.

As the pioneer and founder of PFP, Cryptopunks and BAYC have basically established the issuance framework for all subsequent NFTs — BAYC imitates the product structure of Cryptopunks, while other NFTs imitate the business model and promotion scenarios of BAYC (on the surface).

VII. The Magician's Illusion — NFT Price Manipulation

For the NFT market at the time, the founding team of BAYC was a masterful genius in terms of a strategic strike.

While most people were still in the dark about NFTs, the BAYC team had already planned how to use illusions and people's cognitive deficiencies to create the next myth around BAYC.

As mentioned before, only market makers have the motive to control the NFT listing rate — controlling the market began at the time of minting.

I crawled 5000 minting data of BAYC, and in this sample, which is close to half of the total, I found: 668 unique addresses participated in minting, with one address minting 16% of BAYC (800), and 46% of BAYC (2311) concentrated in 20 addresses.

Furthermore, over 87% of BAYC was minted in bulk by a single address (minting more than 4 at a time).

Partial BAYC minting records

During the first sale of BAYC, the number of minters was far less than 1400. We reasonably suspect that they quietly completed the minting within the team, and the minting tax set the first psychological barrier for the price of BAYC, complementing the first step of its highly controlled market.

The second step was to create a price myth.

From a trading perspective, the biggest difference between NFTs and FTs is that price manipulation of NFTs is much simpler. NFTs do not need to go through the process of price suppression and chip recovery; market makers can accurately avoid tokens that are not in their hands, making only the tokens in their hands the high-priced targets.

The nature and trading method of NFTs dictate that market makers can decide who to buy and who not to buy.

If we were participating in the FT or stock securities market, as long as we chose the right target, we would inevitably benefit from the growth (whether it is due to capital speculation or fundamental improvement), and even if there were no influx of retail investors in the end, we could still have an exit opportunity in the indiscriminate rise by market makers.

But NFTs are not like that. For ordinary investors, the only way to exit with liquidity is through other retail investors.

The brilliance of the BAYC team lies in creating "prices."

As we mentioned before, FTs have indiscriminate prices. At the same time, the value of one FT is equal to the value of another FT, and the price of FT is the real "consensus price," determined by the real-time bargaining of buyers and sellers, supported by trading volume. In other words, "trading" can change the price.

But NFTs are not like this. The price of the other 9999 NFTs is determined by the sky-high price NFT serving as the price anchor.

This is the reason they must create a price myth, and it is precisely because of this that there are a large number of price gaps in BAYC — selling for hundreds of ETH in the first sale, or the first sale price being only 3 ETH, and then suddenly increasing 139 times in the second sale.

Why is a price gap absolutely impossible to be a natural price increase?

Because those huge transactions of BAYC were not listed on the market, and there were almost no records of them being listed for auction. All the transaction records were direct transactions.

Looking at it from another angle, how could a BAYC that has never experienced market pricing suddenly be worth millions of dollars overnight?

Sky-high price gaps in NFTs

Market makers and sellers may set their prices at a high level, but buyers, whether for consumption or investment, have no reason to buy at a high price with a price gap. In reality, this is the case. The number of transactions for sky-high priced BAYC is extremely limited — not because no one is buying, but because after one or two sky-high transactions, they are no longer listed on the market.

The buyers who "pick up" the sky-high priced items are not real buyers.

But are there any real buyers?

Yes, they exist, but they are extremely rare. As mentioned above, the number of real buyers does not exceed the market listing volume.

The few real buyers are the ones who believe in the "scarcity narrative" and the potential for appreciation of NFTs, those who do not see the risk, only see the rise, and believe they can win the lottery — in other words, the real target audience of NFT issuers.

The participants are investing with a lottery mentality, but who the "winning lottery ticket" is, is entirely determined by the market makers. And their sole purpose is to list at different price levels after the high price rise, ensuring that there are buyers at each price level, in other words — "just sell it."

The real business model for profitable NFTs is to raise the price of NFTs and find a few buyers who believe the narrative.

The significant increase in the price of individual BAYC, the raising of the floor price, and the control of the listing rate are the most important links in this process.

The price of NFTs has nothing to do with scarcity, consensus, or intrinsic value. The "scarcity narrative" packages a bunch of bad assets together and forges them into gold, just like the subprime mortgage crisis in the past —

This can be done because in the NFT trading market, "raising the floor price" only requires the listing price to increase, not the actual value or the last lowest transaction price.

That's right, the floor price of NFTs is not raised only when there is a transaction — the floor price listed on the NFT trading market (at least Opensea) is the listing price, not the last lowest transaction price.

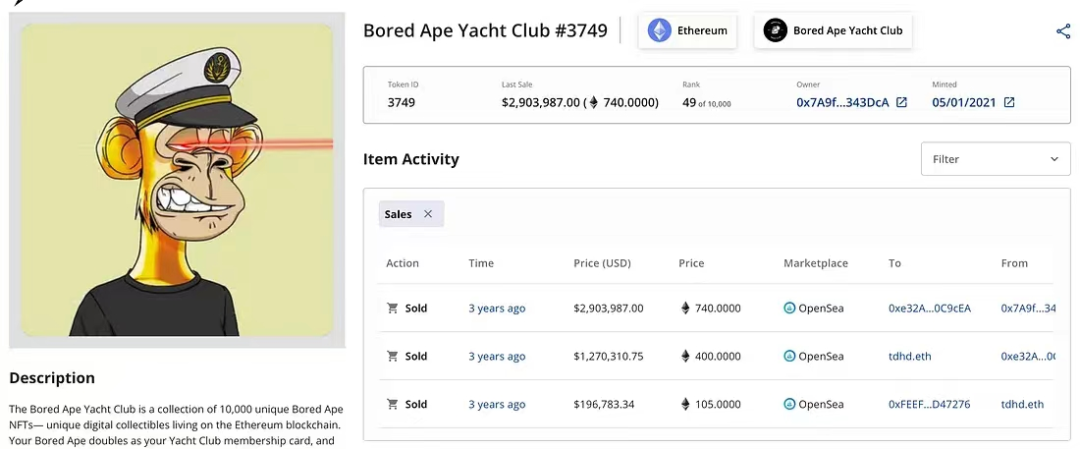

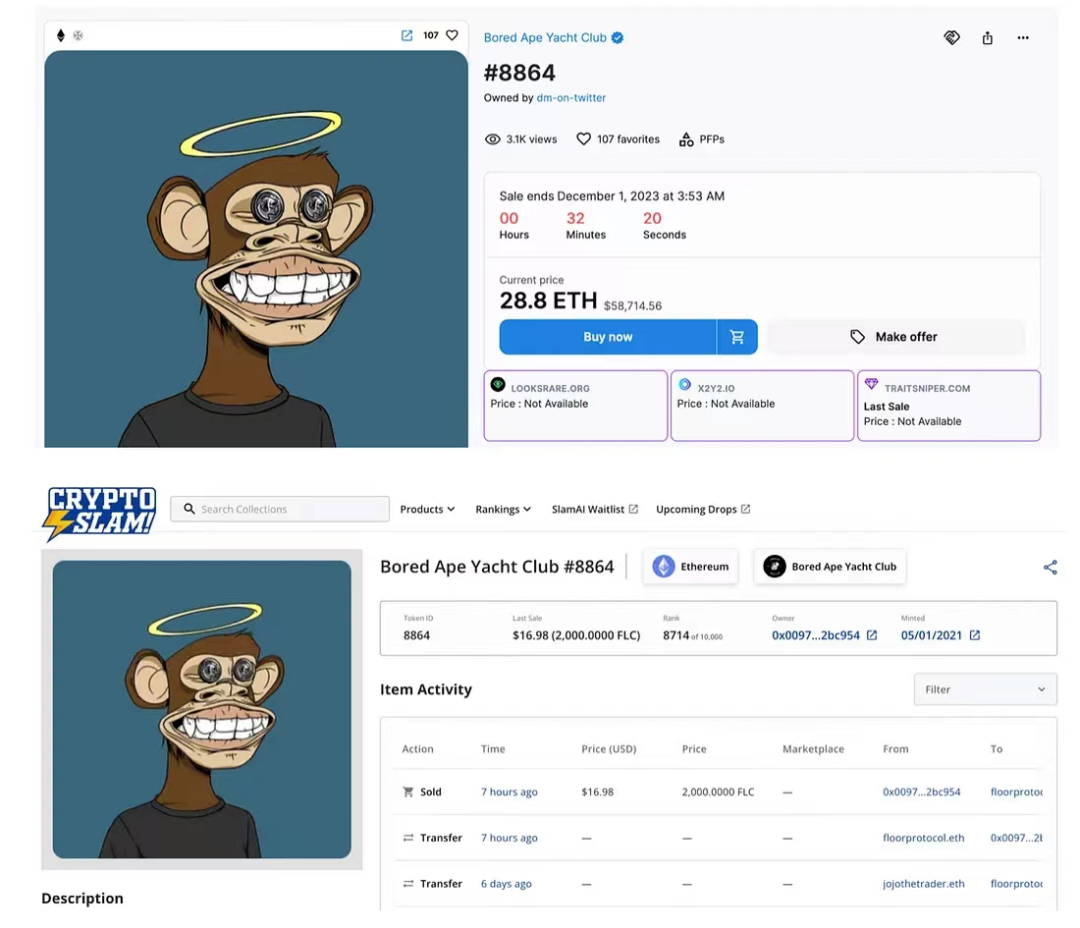

Taking BAYC as an example, on December 1, 2023, the floor price of BAYC on Opensea was 28.8 ETH, which is the current listing price of BAYC#8864. Opensea shows that its last transaction occurred 6 days ago at a price of 29.4 ETH, but Cryptoslam shows that it was traded 8 hours ago at an unnamed exchange for $16.98.

BAYC#8864 had a lower lowest transaction price at the same time than the floor price shown on Opensea

BAYC#9196 was traded 2 hours ago at an unnamed exchange for 19.9 ETH, and BAYC#7410 was traded 1 hour ago for 28.1 WETH, all of these prices occurred within 24 hours, and they are all lower than the price of 28.8 ETH, but Opensea shows that the floor price of BAYC is 28.8 ETH.

Seemingly fair and open NFT issuance platforms and trading markets are part of the price manipulation.

And they are also the biggest winners of this illusion.

VIII. The True Colors of Market Value Maintenance

In addition, we can also prove the scarcity of real buyers of NFTs through a phenomenon: the price of BAYC has not returned to the minting cost line to this day.

In a long-term stagnant market, the reasonable development of prices is to gradually return to the cost line.

The first visible cost line for BAYC is the minting price, and the second cost line is the lowest price of 90% of BAYC's initial sale (ranging from 2 ETH to 1000 ETH). Assuming that both minting and initial sales were all done by real buyers, after a long period of market stagnation, the listing price on the market can always have a large discrepancy, but the floor price will return to the cost line.

But as it stands now, on December 1, 2023, the floor price of BAYC on Opensea was 28.8 ETH, still far from the minting price and the lowest price of the initial sale.

When things go against the natural order, there must be a demon.

The possible reason is that there is no existing market real buyer's cost line at 0.08 ETH, or even lower than 20 ETH, which means that no market real buyer bought BAYC at minting and the lowest initial sale price, and this indirectly indicates that the floor price is still controlled by market makers. ```

Either way, there are very few low-price buyers who still hope to make a big profit, but reluctance to sell does not mean a lack of willingness to list for sale. The listing rate of BAYC on Opensea is 2%, and the overall market listing rate is 3.43%, which means that only over 300 BAYC are circulating for sale in the market. The price distribution is still manipulated by market makers, so the number of real buyers of BAYC must be lower than the listing quantity (343), and almost no buyer's cost line is at the minting price.

So far, we finally understand what kind of carefully woven net NFT buyers are facing.

But not everyone is as adept at this as auction houses and the BAYC team.

NFT is a market where only the platform that has collected tolls has an absolute advantage. For most participants, participating in this market is almost unprofitable, both for buyers and sellers. Issuing NFTs is not a lucrative business — NFT issuance is simple, but finding buyers for NFTs requires financial resources and courage, relying on investing a huge amount of resources in the right place. The success of BAYC and other blue-chip NFTs lies in the team's strong financial resources and a deep understanding of market operations. They understood from the beginning how to use illusions to lure people into the market, but many people still do not understand the market, so they are still hoping for the NFT market to somehow regain its former glory.

IX. Conclusion

I have always wanted to write a truly insightful article about the NFT market, and that's how this article came about.

The things mentioned in the article are not some new cognition; they should have existed vaguely in the minds of most people who have deeply participated in the NFT market.

However, I feel it is still necessary to systematically clarify the past market's mistaken assumptions about NFTs. We cannot prove what NFTs are at the moment, but we can prove what they are not — they are not inherently scarce, and may even be too abundant; their pricing is based on manipulation rather than consensus; NFTs are a market with extremely limited liquidity and buyers, and most NFTs have almost no real buyers, and their huge market size comes from a ridiculous formula; the high returns of the NFT business are by no means achievable with low entry barriers.

And those seemingly professional NFT marketplaces, data platforms, including top auction houses, are also part of the illusion, they are happy to deepen people's misunderstandings about the market, and disguise some incorrect valuation factors as professional indicators, and they have no motivation to expose this magic trick.

Realizing the malfunction of the NFT market is equally important — it has not improved the overall economic welfare of the crypto industry as expected, and worse, it has led to incorrect resource allocation, for both investors and entrepreneurial teams.

The current NFT is neither a good investment nor a good business. We should not continue to go further in the wrong direction. If the NFT market itself does not have liquidity, how can we release liquidity through NFTfi? If NFTs do not even have real buyers, how can they be used for pawn and liquidation? If the price of NFTs is a castle in the air, how can the market approve lending and collateral based on market price?

Recognize the situation, discard illusions, prepare for the struggle, and thus there is hope for the reshaping of the NFT sector. If NFTs cannot be priced based on scarcity and consensus, then we should start boldly trying out new pricing mechanisms; if we realize that individual NFTs lack trading depth, when developing NFTfi, we will start considering aggregating scarce and dispersed liquidity, develop new indicators to select NFTs with real buyers and liquidity for lending or pawn, rather than just determining life and death based on "blue-chip" status.

As a fighter against anxiety, I also hope to take this opportunity to convey a fact — reality is not as we see it, sky-high prices and huge profits are often lies that lure people in, and if you want to seize an opportunity, it's best to first understand how the magician takes the coin from our pocket.

When you fully understand how profits appear and disappear in a fervent narrative, you may start to understand why "those who make money are always someone else."

Myth does not exist, and magicians are not simple professionals; perfect scams also rely on strong capital.

At the same time, the price scam of NFTs is not a special case, deception is both common and inevitable. If we have some weaknesses that allow us to be deceived, then there will definitely be deceivers waiting for the opportunity to deceive us. This means that we need to learn to guard against misleading stories and focus on defending against the negative aspects of the market.

We don't need to demand an absolutely perfect industry, but we need a relatively healthy ecosystem, and hopefully, this is a good start.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。