Author: Siddhant Kejriwal

Article translated by: Block unicorn

To start the article, let's first introduce the advantages and disadvantages of the Bitcoin second-layer network, so that everyone can better assess Bitcoin's second-layer projects.

Advantages

Enhanced scalability: Second-layer solutions significantly increase transaction throughput, surpassing the capabilities of the Bitcoin base layer.

Lower transaction fees: By processing transactions off the main chain, second-layer networks can greatly reduce transaction costs.

Smart contract functionality: Platforms like Stack and Rootstock have introduced smart contracts and DApps, expanding the utility of Bitcoin.

Improved privacy protection: Some second-layer solutions provide enhanced privacy features for transactions that are not available on the Bitcoin mainnet.

Disadvantages

User complexity: The second-layer ecosystem introduces additional complexity for end users, which may hinder adoption.

Security reliance on the base layer: While leveraging Bitcoin's security, second-layer solutions may face unique vulnerabilities that do not exist on the mainnet.

Fragmented liquidity: Liquidity may be dispersed among different second-layer solutions, exacerbating the complexity of trading and other financial activities.

Developer learning curve: Understanding new protocols, languages, and environments may slow down development and innovation within the ecosystem.

Introduction

In the field of cryptocurrency, the Bitcoin network stands out in terms of value, security, and decentralization. As of February 2024, this groundbreaking blockchain has a market value of over one trillion US dollars, demonstrating its enduring appeal and robustness.

Bitcoin is often hailed as "digital gold" and is the cornerstone and most sought-after asset in the cryptocurrency field. It is appreciated for its properties as a store of value and "inflation hedge." Its unparalleled status makes Bitcoin the largest held cryptocurrency asset globally, clearly demonstrating its profound impact on investors and the trust it has garnered.

The widespread adoption of Bitcoin has laid the foundation for the success of the Lightning Network, an innovative second-layer solution aimed at achieving faster and more efficient payments on top of the Bitcoin network.

While the Lightning Network marks a significant leap forward, addressing some long-standing scalability issues that have plagued Bitcoin, it has also sparked a realization among its users and developers: the potential of the Bitcoin network is far from fully realized. This growing sentiment has paved the way for pioneering projects seeking to unleash new capabilities within this ancient blockchain.

One such transformative development is Bitcoin Ordinals, which greatly expands the range of possibilities for the Bitcoin network. The Ordinals project demonstrates the diversity of Bitcoin beyond peer-to-peer payments, igniting a renaissance among developers by directly engraving unique digital artifacts onto the Bitcoin blockchain. Inspired by the immutable security of the Bitcoin blockchain, these developers are now exploring and building complex smart contracts and second-layer execution environments, promising to further enrich the ecosystem.

This analysis delves into the vibrant development of Bitcoin's second-layer innovations, surpassing the capabilities offered by the Lightning Network. It aims to elucidate the cutting-edge solutions continually emerging within the Bitcoin ecosystem. This article highlights how developers are leveraging the network's unparalleled security and trust to build smarter, more functional applications. As we embark on this exploration, we will unveil pioneering efforts to enhance Bitcoin's utility and solidify its position as the cornerstone of the crypto world.

SegWit and Taproot – Elevating Bitcoin's Upgrades

The evolution of Bitcoin is characterized by continuous innovation and adaptation, with two milestone upgrades, Segregated Witness (SegWit) and Taproot, playing crucial roles in its ongoing revolution. These upgrades address some of the most pressing challenges facing the network and lay the groundwork for new developments and expansions within the Bitcoin ecosystem.

SegWit: Improving Memory Efficiency

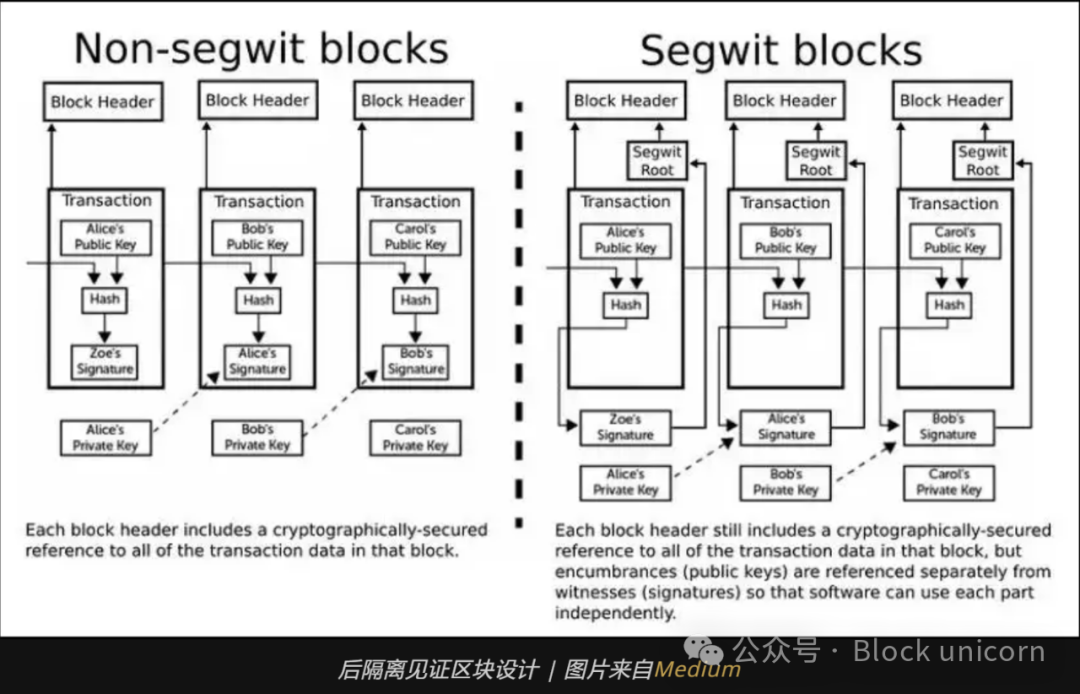

SegWit, implemented in 2017, is a groundbreaking upgrade aimed at addressing Bitcoin's scalability challenges:

Increased block capacity: By separating digital signatures (i.e., "witnesses") from transaction data (or "segregating" them), SegWit effectively reduces the size of transactions, allowing more transactions to fit into a single block without increasing the block size limit. Under optimal conditions, SegWit theoretically enables Bitcoin blocks to support transactions of up to 4 MB.

Addressed transaction malleability: SegWit resolves a significant security issue by allowing modification of transaction details before blockchain confirmation. This improvement enhances security and promotes the development of second-layer solutions like the Lightning Network, enhancing transaction speed and efficiency.

Taproot: Making Bitcoin Smarter

While SegWit laid the foundation for enhancing Bitcoin's scalability and security, the Taproot upgrade, activated in November 2021, brought additional improvements, focusing on privacy, efficiency, and smart contract functionality:

Schnorr signatures: Replacing the ECDSA signature scheme, Schnorr signatures allow multiple signatures to be aggregated into one. This merging simplifies and strengthens complex Bitcoin transactions, making them indistinguishable from simple transactions on the blockchain.

Enhanced privacy and efficiency: By making multi-signature transactions appear similar to regular transactions, Taproot enhances user privacy and optimizes blockchain space, thereby increasing transaction throughput and reducing fees.

Smart contract functionality: Taproot facilitates the deployment of more complex and efficient smart contracts on the Bitcoin network, enabling developers to create innovative applications that leverage Bitcoin's security and decentralization.

The upgrades of SegWit and Taproot are not just technical improvements; they are transformative milestones that significantly expand Bitcoin's capabilities beyond its original purpose as a peer-to-peer electronic cash system. These upgrades lay the foundation for the vibrant development of the Bitcoin second-layer ecosystem that we will explore next.

Bitcoin Ecosystem

The Lightning Network is the first major Bitcoin scalability solution, introducing micro-payments for Bitcoin. It processes a large volume of off-chain transactions by creating second-layer payment channels and settles the final state on-chain, increasing the capacity of the Bitcoin network.

While the Lightning Network further enhances Bitcoin's utility as a store of value by making it more suitable for daily value exchange, SegWit and Taproot have endowed the network with capabilities far beyond this initial purpose. The latest Bitcoin scalability solutions leverage the features of Bitcoin that have been largely untapped over the years—its value as the most secure and decentralized distributed ledger.

Following the Taproot upgrade, second-layer solutions for Bitcoin have dynamically improved Bitcoin's efficiency and expanded its capabilities by introducing the following features:

Programmability:

Smart contracts: Support for complex and programmable smart contracts, achieving finality within the Bitcoin network.

Token standards: Creation of new token issuance standards, expanding the scope of decentralized finance.

DeFi inclusivity: Prior to these updates, due to Bitcoin's rigidity and lack of programmability, Bitcoin was largely absent from the DeFi space.

DApps: Building applications on the Bitcoin network to enhance its utility.

Scalability: A key innovation in the Bitcoin ecosystem is the creation of high-throughput networks, enhancing Bitcoin's scalability through modular blockchain design, where the Bitcoin mainnet ensures the finality of applications and transactions executed on the second layer.

NFTs: In addition to ordinals, networks built on the Bitcoin network are creating non-fungible token standards and building an NFT ecosystem.

Synthetic Bitcoin: Second-layer solutions are collaborating with the Bitcoin mainnet to create trust-minimized two-way pegs, issuing synthetic versions on the second layer and implementing DeFi on Bitcoin.

The evolution of Bitcoin and Ethereum reflects a shared vision of enhancing scalability, security, and efficiency, despite adopting different technological approaches.

The transition of Ethereum to Ethereum 2.0 and its Rollup-centric roadmap highlight the strategic focus on optimizing the mainnet to serve as a secure and decentralized foundation for second-layer scaling solutions. Key upgrades such as Danksharding aim to enhance Ethereum's support for Rollup, increasing throughput, reducing transaction costs, while maintaining the network's decentralized ethos.

Similar evolution is taking place in the Bitcoin ecosystem, with second-layer solutions like Stacks and Liquid Network introducing smart contract capabilities. These innovations leverage Bitcoin's unparalleled security and decentralization to build efficient virtual machines and application layers on top of the Bitcoin blockchain. Just as Ethereum's Rollup leverages the advantages of the mainnet to provide scalable solutions, Bitcoin's second-layer projects extend its utility beyond simple transactions by leveraging the properties of the core blockchain.

This trend of building on a solid Bitcoin foundation reflects Ethereum's strategic emphasis on the broader trend of the blockchain space towards second-layer solutions. These solutions enhance functionality without sacrificing decentralization and security principles.

The following section will explore leading scalability solutions in the Bitcoin network, particularly Rootstock, Stacks, and Liquid Network.

Rootstock (RSK)

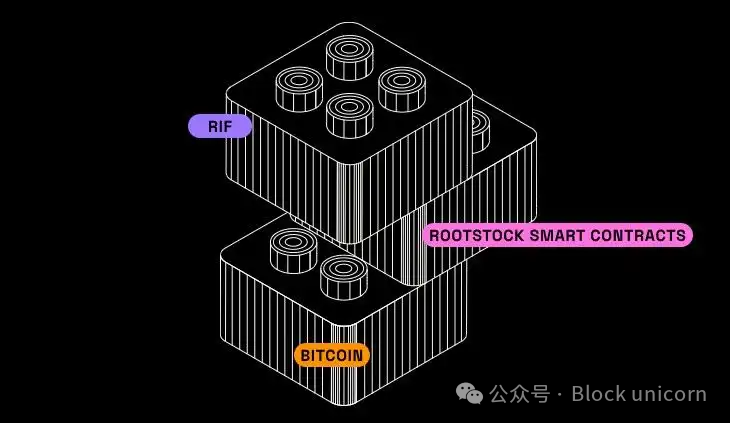

Rootstock (RSK, token: RIF) represents a significant advancement in integrating smart contract functionality with the security and widespread acceptance of the Bitcoin network. As a sidechain anchored to Bitcoin, RSK enables the deployment of decentralized applications (DApps) and smart contracts without compromising Bitcoin's core principles.

This analysis will explore the key features and components of the RSK network, highlighting its unique position in the blockchain ecosystem.

Bi-Directional Anchoring with Bitcoin and RBTC

RSK uses a native cryptocurrency called RBTC, pegged 1:1 to Bitcoin (BTC). This anchoring mechanism is achieved through bridging, ensuring secure and seamless conversion between BTC and RBTC. Users can also deploy smart contracts and use DApps on the RSK network.

Merge-Mining with Bitcoin

RSK's security model utilizes merge-mining, leveraging Bitcoin's existing mining infrastructure. This approach allows Bitcoin miners to simultaneously mine Bitcoin and RSK blocks using the same computational work. Merge-mining enhances RSK's security without additional energy consumption, aligning with Bitcoin's proof-of-work (PoW) consensus mechanism. Miners earn most of the RSK network transaction fees from the blocks they mine.

RSK Virtual Machine (RVM)

RVM is fully compatible with Ethereum's Virtual Machine (EVM), allowing the execution of Ethereum-designed smart contracts on the RSK network. This compatibility enables developers to deploy their existing Ethereum DApps on RSK, leveraging Bitcoin's security while benefiting from Ethereum's smart contract capabilities. RVM processes smart contracts and runs DApps, fostering a rich decentralized application ecosystem.

Decentralized Federation and Security Measures

The federation further enhances RSK's security and functionality. A group of semi-trusted third parties is crucial in managing bi-directional anchoring and providing additional features such as Oracle information and transaction acceleration, contributing to the network's security.

Scalability Solutions and RIF Services

To address scalability issues, RSK combines off-chain transaction solutions and integrates with the Rootstock Infrastructure Framework (RIF), offering a range of services to enhance user experience and scalability. These services include RIF Storage, RIF Identity, and RIF Payments, supporting various applications and use cases within the RSK ecosystem.

Rootstock Ecosystem and DApps

The RSK ecosystem hosts a variety of decentralized applications, including Sovryn, a comprehensive DeFi protocol; Money on Chain, offering crypto-collateralized stablecoins and decentralized staking; Liquality, a cross-chain wallet with built-in exchange functionality; and Tropykus, a lending protocol tailored for emerging markets with flexible repayment options.

In summary, RSK seamlessly integrates Bitcoin's finality and liquidity with Ethereum's smart contract versatility and adaptability, creating a unique and powerful platform for decentralized applications. By leveraging merge-mining, bi-directional anchoring with Bitcoin, and compatibility with EVM, RSK not only enhances the functionality of the Bitcoin network but also opens new pathways for developers and users seeking interaction with a broader blockchain ecosystem.

Stacks Network

The Stacks network is a Layer 2 solution built on the Bitcoin blockchain, aiming to expand Bitcoin's functionality by introducing smart contracts and DApps while leveraging Bitcoin's unparalleled security and finality.

Here is a comprehensive analysis of the Stacks network and its features:

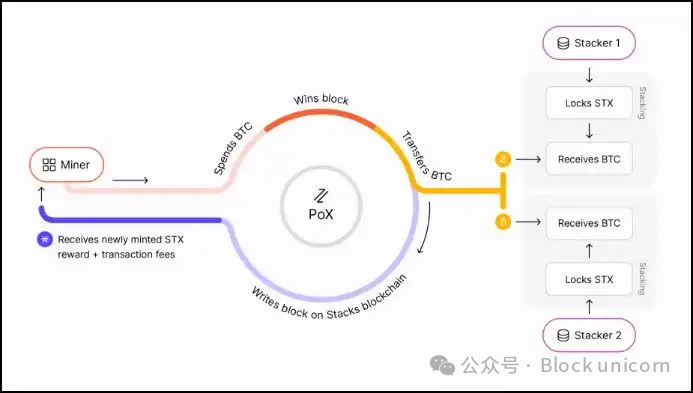

Proof of Transfer (PoX) Consensus Protocol

Stacks innovates through its Proof of Transfer consensus mechanism, connecting Stacks to the Bitcoin blockchain. This unique protocol allows the creation of new Stacks (STX) blocks, with miners earning STX tokens through their efforts. Simultaneously, STX holders (referred to as "stackers") can earn Bitcoin by participating in the network's consensus, fostering a symbiotic relationship between the two ecosystems.

Satoshi Hard Fork

Named after Bitcoin's anonymous creator, the Satoshi Hard Fork represents a significant upgrade aimed at improving transaction speed, enhancing block generation through a term-based system, and strengthening the security of Stacks transactions by incorporating the hash value of Stacks micro-blocks into Bitcoin blocks. This upgrade addresses the issue of minor extractable value (MEV) and introduces sBTC, a trustless synthetic representation of Bitcoin on Stacks, pegged 1:1 to BTC.

Clarity Smart Contracts

Stacks uses the Clarity language for smart contract development, emphasizing security and predictability. Clarity's design aims to prevent common errors and vulnerabilities in smart contract development, making it an ideal choice for developers looking to build on a secure platform.

STX Token

The native token STX plays a crucial role in the operation of the Stacks network, including transaction fees and stacking rewards. The token economics of STX are closely related to Bitcoin, influencing miners' commitment to the network.

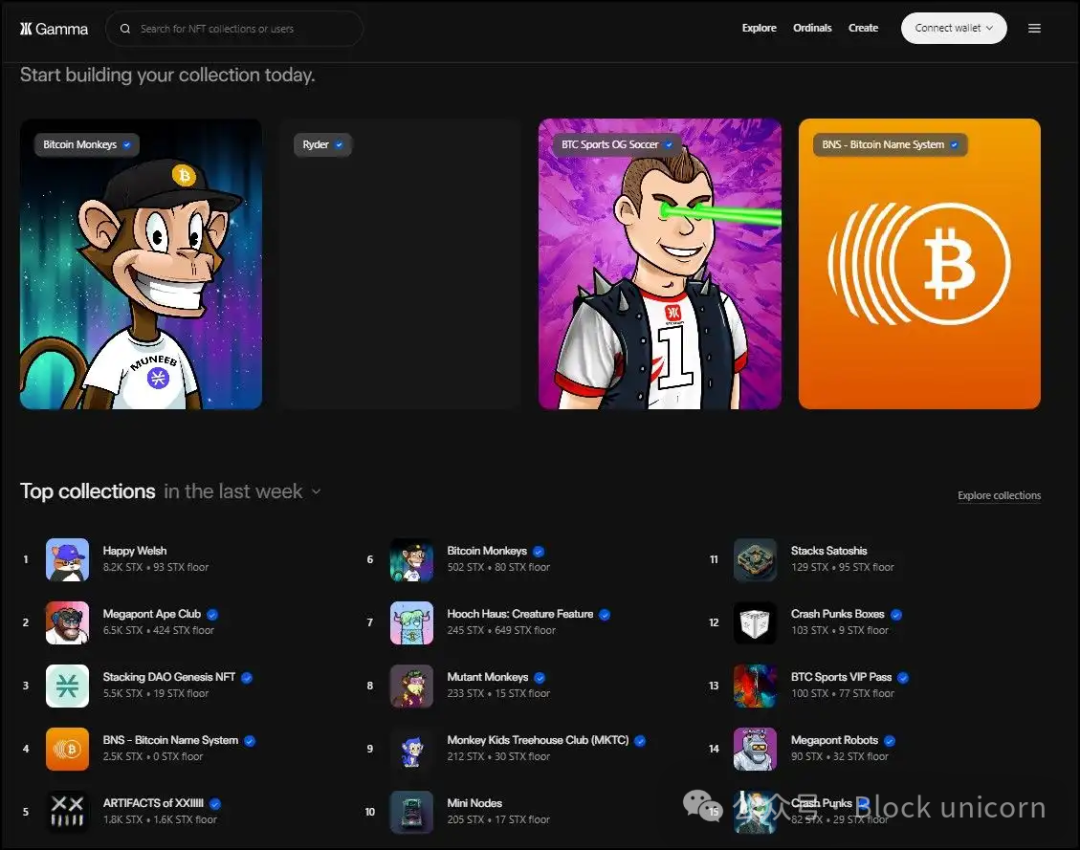

Stacks Ecosystem

The Stacks ecosystem is vibrant and diverse, encompassing Bitcoin NFTs, the Bitcoin Naming System (BNS), and various DApps such as Boom, Arkadiko, StackingDAO, and Arcane. These applications cover DeFi, yield, stacking, and NFT platforms, showcasing the multifunctionality and potential for development within the Stacks network.

Stacks distinguishes itself from other Layer 2 solutions by recording its entire transaction history on the Bitcoin blockchain, claiming the same security and immutability as Bitcoin. Additionally, Stacks is exploring integrating rollup upgrades to enhance scalability and functionality.

In conclusion, Stacks demonstrates the evolving landscape of blockchain technology, where the fundamental principles of Bitcoin are expanded to create a more functional and flexible ecosystem. Through its innovative consensus mechanism, smart contract capabilities, and ongoing development efforts, Stacks aims to unleash the full potential of Bitcoin as a platform for decentralized applications and financial tools.

Liquid Network

Liquid Network is a Layer 2 solution designed to enhance the Bitcoin ecosystem by providing faster, more confidential transactions and enabling the issuance of digital assets. Operating as a sidechain to Bitcoin, the network is built on the open-source Elements platform, which is based on the Bitcoin codebase. Elements facilitates the creation of independent blockchains or sidechains that can connect to other Layer 1 chains and provide features such as confidential transactions, federated two-way pegs, asset issuance, and Schnorr signatures.

Key Features and Operation of the Liquid Network Sidechain

The Liquid Network supports seamless transfer of Bitcoin between the Bitcoin network and the Liquid Network through two-way pegging, allowing the minting of Liquid Network Bitcoin (L-BTC) on the Liquid Network sidechain. This process is facilitated by a consortium called the Liquid Network Federation, consisting of major exchanges, financial institutions, and Bitcoin-centric companies globally, ensuring no single point of failure due to its decentralized nature.

Roles of Participants in the Liquid Network:

Block Signers: Responsible for generating blocks every minute and ensuring the security and consistency of the Liquid blockchain through a federated consensus model. The model requires a supermajority to make decisions, enhancing the security and reliability of the network.

Watchmen: This role involves managing the Bitcoin held by the federation, overseeing the peg-in and peg-out processes between Bitcoin and the Liquid Network, and ensuring the integrity of funds moved across networks.

Asset Issuance and Confidential Transactions

The Liquid Network has the capability to issue assets, opening up possibilities for tokenizing fiat currencies, cryptocurrencies other than Bitcoin, digital collectibles, and more. These issued assets are assigned unique identifiers, and their transaction details can be kept confidential, providing privacy protection for users on the network.

Advantages and Use Cases

The network is designed to improve Bitcoin transaction speed and confidentiality. With a block time of just one minute and the ability for transactions to achieve final confirmation quickly, the Liquid Network is particularly beneficial for traders and institutions requiring fast, private transactions. The issuance of digital assets, including stablecoins and security tokens, further expands the utility of Bitcoin.

The Liquid Network introduces features such as confidential transactions and asset issuance without compromising the security premise of Bitcoin, allowing for a variety of applications, from financial instruments to gaming assets. Through the operation of the Liquid Network Federation, a certain level of decentralization is ensured, with federation members playing a key role in maintaining the integrity and functionality of the network.

Essentially, the Liquid Network leverages Bitcoin's robust security model to enhance the issuance and trading of digital assets, addressing specific needs in the cryptocurrency ecosystem that the Bitcoin main chain cannot meet.

Other Emerging Bitcoin Layer 2 Solutions

While Rootstock, Stacks, Lightning Network, and Liquid are among the most widely recognized Bitcoin-centric innovations in the ecosystem, many other projects are building a wide range of scaling solutions, trusted bridges, and innovative Bitcoin layers. Let's list some of the more notable ones:

Babylon

Babylon aims to extend Bitcoin to a Proof of Stake (PoS) economy. It introduces the Bitcoin PoS protocol, allowing Bitcoin holders to earn rewards from their idle Bitcoin without the need for third-party trust, bridges, or locking their Bitcoin on another chain. This is achieved through a trustless, self-custodial mechanism that empowers them to validate PoS chains and earn rewards.

Key features of the Babylon approach include:

Trustless staking: Bitcoin holders can self-custody their locked Bitcoin to earn the right to validate PoS chains, emphasizing an ecosystem without the need for third-party trust.

Security against PoS attacks: The protocol aims to provide complete security to resist PoS attacks, ensuring the safety of staked assets.

Fast unlocking and scalable re-staking: These features aim to provide maximum liquidity and rewards for Bitcoin stakers, allowing them to benefit from staking without significant drawbacks.

Ecosystem partnerships: Babylon's ecosystem includes partnerships with various blockchain projects, aiming to enhance the practicality and security of Bitcoin in the decentralized economy.

Interlay

Interlay focuses on integrating Bitcoin with decentralized finance (DeFi) across multiple blockchains, providing a comprehensive platform for trading, lending, borrowing, and creating leveraged positions using BTC. The project has introduced iBTC, a trustless representation of Bitcoin in DeFi, protected by a decentralized network and insurance mechanisms, in line with the description provided.

Key aspects of Interlay include:

Modular approach: Interlay is designed as a modular, programmable layer between Bitcoin and multi-chain ecosystems, providing novel decentralized use cases for BTC.

Control of private keys: Users maintain control of their private keys when participating in DeFi activities, emphasizing security and user sovereignty.

iBTC: This mechanism allows users to securely lock their BTC, mint iBTC at a 1:1 ratio, and participate in DeFi activities across various blockchains. iBTC can be redeemed for native BTC on Bitcoin, ensuring trustless interaction.

Security and trustworthiness: Interlay is built on cutting-edge, peer-reviewed research and audited by leading blockchain security companies, aiming to provide its users with a high level of security and trustworthiness.

Decentralized governance: Interlay is governed by the community through voting rights of the governance (INTR) token, allowing stakeholders to participate in decision-making.

Mintlayer

Mintlayer is a high-performance blockchain solution designed to enhance token interoperability and achieve efficient asset trading and system functionality, aiming to change the current state of DeFi. Built on top of Bitcoin, it aims to address current blockchain limitations by providing the following features:

Regulated tokenization: Supports compliant tokenization of assets such as equities and real estate, supporting complex token economic models without the need for native chain tokens as GAS.

Decentralized trading: Improves scalability and security through a unique consensus mechanism, facilitating decentralized trading.

Cost efficiency and throughput: Reduces transaction costs and increases throughput through transaction batching and the Lightning Network.

Bitcoin compatibility: Maintains compatibility with Bitcoin, enabling two-way pegging and cross-chain transfers.

Enhanced privacy: Provides enhanced privacy features through UTXO structure and optional "confidential transaction" mode.

Mintlayer's innovative approach aims to leverage Bitcoin's infrastructure to create a more inclusive, efficient, and secure DeFi ecosystem to cater to a wider range of financial market applications.

Threshold Network

Threshold Network enhances the sovereignty of users on public blockchains by utilizing threshold cryptography to protect digital assets. Key features and functionalities of Threshold Network include:

tBTC: A decentralized bridge for Bitcoin in DeFi, allowing users to deposit and redeem BTC without intermediaries, facilitating seamless integration of Bitcoin with the DeFi ecosystem.

TACo Plugin: Provides end-to-end decentralized encryption for DApps, ensuring privacy and security by managing access to data encrypted by independent threshold node groups.

DAO Governance Model: The network operates using a DAO governance model, allowing T token holders to participate in the decision-making process, reflecting a community-driven approach to network governance.

Security and Decentralization: Threshold utilizes threshold cryptography to distribute operations among independent parties, enhancing security, reducing trust assumptions, and ensuring privacy on public blockchains.

The network aims to provide a secure, private, and decentralized infrastructure for digital assets, supported by a robust governance framework that empowers users and token holders.

Drivechain

Drivechain proposes a method for Bitcoin to interact with sidechains through BIPs 300 and 301, enabling new features and applications without compromising the security of the main blockchain. Key points of Drivechain include:

Peer-to-peer Bitcoin sidechains: Drivechain allows the creation, deletion, and transfer of BTC between Bitcoin and sidechains, enabling users to opt for new features or trade-offs.

Permissionless innovation: It emphasizes that anyone can create new blockchain projects and enable Bitcoin to adopt beneficial features from other cryptocurrencies, fostering an environment for innovation.

Zero-risk solution: Drivechain is proposed as a zero-risk solution that can be easily rolled back if needed, addressing significant challenges of Bitcoin such as scalability and flexibility.

BIPs 300 and 301: These Bitcoin Improvement Proposals detail the technical mechanisms behind Drivechain's operation, including "mining delegation" and "blind merged mining" to facilitate interaction between sidechains.

Drivechain's approach to enhancing Bitcoin's functionality through sidechains aims to provide a scalable, flexible, and secure framework for developing new applications and features within the Bitcoin ecosystem.

Are Bitcoin and Ethereum's Layer 2 Networks Equivalent?

Many of the discussed Bitcoin Layer 2 networks share a common claim - inheriting Bitcoin's security, finality, and decentralization. Let's delve into this claim, critically analyze it, and compare it with the prominent Layer 2 architecture on Ethereum.

Ethereum's Layer 2 Solutions and Validator Interaction

In Ethereum's Layer 2 solutions, such as Optimistic Rollups and zk-Rollups, validators on the Ethereum network play a crucial role in ensuring the security and integrity of Layer 2 transactions. These solutions involve the following mechanisms:

Optimistic Rollup requires validators to challenge fraudulent transactions during a dispute period, assuming transactions are valid unless evidence proves otherwise.

zk-Rollups use zero-knowledge proofs, allowing validators to verify transaction correctness without viewing complete data, ensuring privacy and scalability while maintaining security.

This model means that Ethereum's Layer 2 solutions directly leverage Ethereum's mainnet security mechanisms, including its validators, to ensure the integrity of Layer 2 transactions. Validators are provided with the necessary data (or proofs, in the case of zk-rollup) to reconstruct the Layer 2 state and verify transactions, closely tying the security of Layer 2 to Ethereum's mainnet.

Bitcoin's Layer 2 Solutions and Validator Interaction

After Taproot, Bitcoin has enhanced its ability to conduct more complex transactions and smart contracts by improving efficiency and privacy. However, Bitcoin's consensus mechanism and its approach to Layer 2 solutions, such as using the Stacks protocol, Rootstock (RSK), or Liquid Network, do not fundamentally change the role of Bitcoin validators in directly verifying Layer 2 block data.

Bitcoin validators continue to protect the network by verifying and confirming transactions in Bitcoin blocks, without directly participating in the execution or verification of Layer 2 transactions. Therefore, Bitcoin's Layer 2 solutions rely on their own security and consensus mechanisms, despite being anchored to the finality and security of the Bitcoin blockchain.

Impact

This operational difference implies that while Ethereum's Layer 2 solutions can inherit security directly from the Ethereum mainnet through active validator verification, Bitcoin's Layer 2 networks may not inherit security from Bitcoin in the same direct manner. They benefit from the finality of transactions resolved on the Bitcoin mainnet, but rely on their own security protocols for internal verification within Layer 2.

As a result, Bitcoin's Layer 2 networks may face the challenge that if the security mechanisms of Layer 2 are compromised without direct intervention from Bitcoin validators, malicious transactions may achieve finality. This necessitates robust Layer 2-specific security measures and may introduce trust assumptions different from Ethereum's Layer 2 solutions.

However, this does not necessarily weaken the security of Bitcoin's Layer 2 solutions; instead, it underscores the importance of designing and implementing robust security models for these Layer 2 networks. It also emphasizes the need for users to understand the specific trust assumptions and security guarantees of any Layer 2 solution they use, whether on Bitcoin or Ethereum.

Challenges for Bitcoin's Layer 2 Ecosystem

The Bitcoin Layer 2 (L2) ecosystem is at a critical stage of development, facing a range of challenges spanning technological, economic, and regulatory domains. Addressing these challenges is crucial for fostering growth, adoption, and innovation in the field. Here is a comprehensive examination of nine key obstacles, including relevant examples and supporting data:

Technical limitations: Unlike Ethereum's Layer 2 solutions, where validators actively participate in verifying Layer 2 transactions, Bitcoin's Layer 2 solutions such as Stacks and RSK rely on independent security mechanisms. This divergence requires robust independent security models, potentially limiting the possibility of directly inheriting security from the Bitcoin blockchain.

Ethereum-centric DeFi: Ethereum's dominant position in the DeFi space benefits from active developer participation and a plethora of DApps. For example, data from DeFi Llama shows that Ethereum's DeFi platforms lock up billions of dollars in value, highlighting the challenge of attracting similar participation in Bitcoin-based DeFi.

Bootstrapping new liquidity: New Bitcoin Layer 2 platforms must provide compelling reasons to attract liquidity away from established ecosystems. Initiatives such as liquidity mining on Ethereum have demonstrated that incentive mechanisms can attract significant capital; Bitcoin's Layer 2 may need similar strategies.

Developer learning curve: Developers must contend with the complexity of Bitcoin-specific programming languages (e.g., Clarity for Stacks) and unique consensus mechanisms, which may slow down development and innovation.

Interoperability and integration: The ability for assets to freely move across chains, as demonstrated by wrapped tokens like WBTC on Ethereum, underscores the importance of interoperability. Bitcoin Layer 2 solutions must develop or integrate cross-chain communication protocols to facilitate similar functionality.

User adoption and experience: The success of platforms like Uniswap demonstrates the value of user-friendly design in attracting non-technical users to the DeFi space. Bitcoin Layer 2 solutions must prioritize simplifying user interactions to enhance adoption.

Regulatory and security concerns: With the ongoing evolution of global regulatory frameworks, Bitcoin Layer 2 projects must remain flexible to comply with diverse legal requirements while ensuring the highest level of security to prevent hacks and exploits.

Network effects and ecosystem development: Developing a thriving ecosystem involves not only attracting developers and users but also building a community and fostering partnerships. Ethereum's annual Devcon is a prime example, showcasing how community engagement drives ecosystem growth.

Scalability and throughput: Ensuring that Bitcoin Layer 2 can handle high transaction volumes without sacrificing performance is crucial. Solutions like zk-Rollups on Ethereum demonstrate the potential to increase throughput while maintaining security, a pattern that Bitcoin Layer 2 can draw from.

Addressing these challenges requires a multifaceted approach, including technological innovation, strategic incentives, regulatory navigation, and community building. The evolution of the Bitcoin Layer 2 ecosystem depends on its ability to adapt and overcome these obstacles, unlocking new possibilities beyond Bitcoin's original design as a digital currency. As the blockchain space continues to mature, solutions developed to address these challenges will not only shape the future of Bitcoin Layer 2 but also influence the broader landscape of decentralized finance and blockchain technology.

Is Bitcoin still considered a commodity?

The SEC's acceptance of Bitcoin as a commodity and its differentiation from securities is an important milestone that brings clarity to Bitcoin's regulatory environment. This classification is primarily based on Bitcoin's characteristics as a decentralized digital currency, designed primarily for value storage and exchange, without the involvement of a central issuer or promise of returns, which are typical features of securities.

The emergence of second-layer solutions supporting smart contracts on the Bitcoin network brings it closer to the functionality of Ethereum. Therefore, could the classification of Bitcoin be challenged? Let's analyze this idea:

Unchanged Core Consensus of Bitcoin

The second-layer solutions discussed above operate on Bitcoin without altering its underlying consensus mechanism. Bitcoin's primary function as a peer-to-peer transaction network and the role of miners in securing the network remain unchanged.

The architectural separation between Bitcoin and its second layer ensures that the innovations and complexities introduced by the second layer do not affect Bitcoin's consensus.

Functionality and Regulatory Perspective on Classification

From a regulatory perspective, the classification of assets as commodities or securities often depends on their issuance, the expectation of profit from the efforts of others, and the degree of decentralization. The addition of second-layer functionality does not necessarily imply an expectation of profit or involvement of a centralized party responsible for the asset, which are important considerations in the classification of securities.

Precedents of Other Commodities

The evolution of products and services around traditional commodities (such as gold or oil) has added utility or financialized aspects but has not changed the fundamental classification of the underlying commodity. Similarly, the development of second-layer solutions on Bitcoin can be seen as analogous enhancements, expanding utility without fundamentally altering the core characteristics of the commodity.

In conclusion, while the development of second-layer solutions on the Bitcoin network enhances its utility and brings its functionality closer to that of Ethereum, they do not fundamentally violate Bitcoin's classification as a commodity. The core principles and functionality of the Bitcoin network remain centered on its role as a digital value store and exchange medium, with second-layer solutions serving as complementary enhancements to its fundamental nature rather than modifications.

Concluding Thoughts

As the Bitcoin ecosystem embraces new developments, it finds itself at a fascinating crossroads, increasingly converging with Ethereum in terms of functionality and innovation. While Bitcoin remains unparalleled as a value store, its technical framework has traditionally lagged behind Ethereum in supporting the complex infrastructure required for DeFi.

In contrast, while Ethereum has not been widely recognized for its value storage properties, it dominates the DeFi space, hosting the majority of activity and innovation. This divergence highlights the unique strengths and trade-offs between these two leading cryptocurrencies. Therefore, the value proposition of each cryptocurrency depends on the traits prioritized by investors and users: the unparalleled security and value storage offered by Bitcoin, or the dynamic and extensive DeFi ecosystem realized by Ethereum.

As these two ecosystems continue to evolve, the interaction between these fundamental characteristics will continue to shape the future of the digital asset space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。