With the advancement of technology, the development of digitization and decentralization has accelerated the interaction and integration of the real world and the virtual world, leading to a redistribution of power, control, and data ownership.

In this context, the decentralized physical infrastructure network (DePIN) has emerged, providing us with a new perspective on the interaction between the real world and the virtual world. According to Messari's report, the entire track is currently valued at approximately $9 billion and is expected to grow to a scale of $35 trillion by 2028. Whether it's the early emergence of Arweave and Filecoin, the takeoff during the previous bull market of Helium, or the recent highly anticipated Render Network, they all belong to this field.

As a promising field in the Web3.0 domain, the DePIN track has attracted much attention in recent years and is one of the most likely to create economic value in the short term. This article is specially written to discuss the basic logic, development prospects, and legal risks of the DePIN track.

Basic Logic of the DePIN Track

DePIN (Decentralised Physical Infrastructure Networks) is a decentralized physical infrastructure network that uses blockchain technology and token incentives to motivate individuals and businesses worldwide to build any physical infrastructure (WiFi, hard drive storage, batteries, etc.) in a decentralized manner and provide services to anyone. The core lies in users obtaining returns by providing services through renting hardware, such as WiFi hotspots in wireless networks or home solar batteries in energy networks. These networks are built in a decentralized manner by contributors from around the world. In return, these individuals and entities receive financial compensation and network ownership through token incentives.

This concept was born in 2022 when Messari, a blockchain data research institution based in New York, conducted a survey to solicit an official title for "Web3 physical infrastructure." In this survey, titles such as Proof of Physical Work (PoPw), Token Incentivized Physical Network (TIPIN), EdgeFi, and Decentralized Physical Infrastructure Networks (DePIN) were all considered. Ultimately, DePIN emerged as the winner in the vote and began to attract attention from some people.

The biggest difference from traditional networks is that DePIN uses tokens to deploy physical infrastructure, leveraging blockchain technology to build and operate real-world physical infrastructure and hardware networks in a permissionless, trustless, and programmable manner, creating large-scale network effects and unlocking innovative DApps based on real-world data.

In simple terms, DePIN is an ecosystem of physical infrastructure networks owned and monetized by users, device users, and businesses. It enables individuals distributed globally to collectively build, maintain, and operate shared physical infrastructure networks without a single centralized entity. This ecosystem includes several parts: cloud networks (VPN, CDN, file storage, databases), wireless (5G, IoT), sensor networks, and energy networks.

In such a system, individuals or organizations can contribute labor or other resources by maintaining and improving infrastructure to obtain corresponding assets (mainly cryptographic assets). These cryptographic assets, as rewards, can be used to access infrastructure or for transactions.

In terms of operation, DePIN is based on decentralization and blockchain technology. Firstly, DePIN relies on individual hardware devices, also known as nodes. These nodes can be personal computers, dedicated servers, or IoT devices. These devices collectively form a decentralized network without any central nodes or authoritative institutions. This decentralized characteristic makes DePIN more secure and transparent.

Secondly, DePIN uses blockchain technology to manage and protect the network. Blockchain is a public, transparent, and tamper-proof digital ledger that records all transactions and interactions on the network, ensuring that all nodes adhere to the network's rules.

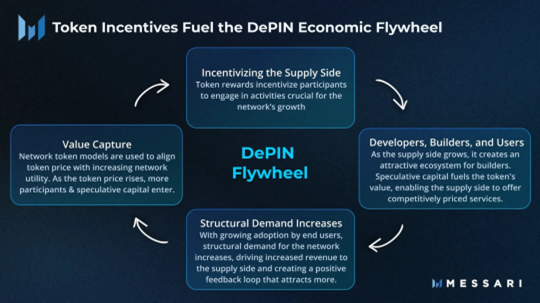

In addition, to encourage node participation and contribution of resources, DePIN uses an incentive mechanism, often based on cryptocurrency. Nodes can obtain rewards by participating in the network and contributing their resources. With sufficient resource supply, price competition will arise, and adequate resources and good prices will promote demand, giving value capture to the tokens, thereby driving price increases and attracting more resource providers.

Development Prospects of the DePIN Track

Application Areas of DePIN

DePIN is divided into two main areas: digital resource networks and physical resource networks. The digital resource network includes storage, computing, and bandwidth, while the physical resource network focuses on hardware-related areas such as wireless networks, geographic spatial networks, mobile networks, and energy networks.

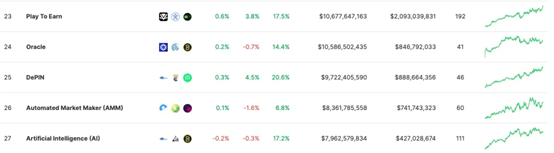

According to Coingecko data, the DePIN sector currently includes a total of 45 projects with issued tokens, ranking 25th among various sectors, with a total value of $9.7 billion, surpassing sectors such as AMM and AI, and second only to the oracle and P2E sectors.

In a report by Messari, the total potential market size of the DePIN sector is estimated to be around $22 trillion, and it may reach $35 trillion by 2028.

In addition to excellent performance in the secondary market, DePIN is gradually gaining favor from the market and institutions. For example, on April 14, 2023, the decentralized camera network Natix Network received a $3.5 million investment led by Blockchange Ventures, and on November 30, 2023, DePIN provider Grove completed a $7.9 million financing round. Additionally, Solana, which is very favorable to DePIN, awarded bonuses to 5 related products such as Shaga and Dain at the 8th hackathon event announced on November 4, 2023. The IoTeX Foundation had previously provided nearly a million dollars in development funding to 15 DePIN-related projects.

Among the top 10 companies in the DePIN sector are "server networks" Filecoin, Arweave, Sia, and Storj in the digital resource network (DRN) category, "wireless networks" Helium and Pollen Mobile in the physical resource network (PRN) category, "sensor networks" Hivemapper and DIMO, and "energy networks" React Protocol and Arkreen. The following section will briefly introduce the current representative projects in the DePIN track:

Filecoin & Arweave

In the traditional data storage field, the high pricing of centralized cloud storage on the supply side and the low resource utilization on the consumption side have created dilemmas for users and enterprises, as well as risks such as data leaks. In response to this phenomenon, Filecoin and Arweave are breaking the situation by providing decentralized storage at lower prices to offer users different services.

Let's start with Filecoin. From the supply side, Filecoin is a decentralized distributed storage network that incentivizes users to provide storage space through token incentives (providing more storage space is directly related to obtaining more block rewards). In about a month after the launch of the test network, its storage space reached 4PB, with Chinese miners (storage space providers) playing a significant role. The current storage space has reached 24EiB.

It is worth noting that Filecoin is built on top of the IPFS protocol, which is already a widely recognized distributed file system. By storing user data on nodes in the network, Filecoin achieves decentralized and secure data storage. In addition, Filecoin leverages the advantages of IPFS, giving it strong technical capabilities in the field of decentralized storage, and also supports smart contracts, allowing developers to build various storage-based applications.

Currently, Filecoin has established partnerships with many well-known blockchain projects and companies. For example, NFT.Storage uses Filecoin to provide a simple decentralized storage solution for NFT content and metadata, while the Shoah Foundation and the Internet Archive use Filecoin to back up their content. It is worth noting that the world's largest NFT marketplace, OpenSea, also uses Filecoin for NFT metadata storage, further promoting the development of its ecosystem.

Now, let's take a look at Arweave. It has some similarities with Filecoin in incentivizing the supply side. Through token incentives, users provide storage space, and the reward amount depends on the amount of stored data and the frequency of data access. However, Arweave is a decentralized permanent storage network, and once data is uploaded to the Arweave network, it will be permanently stored on the blockchain.

How does Arweave incentivize users to provide storage space? Its core uses a mechanism called "Proof of Access," which aims to prove the accessibility of data in the network. In simple terms, miners are required to provide a randomly selected previously stored data block as "access proof" during the block creation process.

Render Network

The business of Render Network is to match computing power and artistic rendering demands. The role of computing power supply is called node operator, and the number has been stable, with 326 Render node operators currently providing computing power.

Originally deployed on the Polygon network, the community decided to migrate from Polygon to Solana in March 2023 and build the BME (Burn and Mint Equilibrium) model on Solana. The BME model describes a state of relative balance between burned tokens and minted tokens in an ideal process and specific consumption markets. It is a mature token model applied in projects such as Helium.

In this model, users use RNDR tokens to purchase GPU rendering services, and the tokens used after the task is completed will be destroyed. Service providers' rewards are distributed using newly issued tokens, based not only on task completion metrics but also on other comprehensive factors such as customer satisfaction. As a result, RNDR tokens have more consumption scenarios in the entire economy, and the supply-demand relationship of tokens can be balanced according to the algorithm between burning and minting tokens, evolving the entire business model from a simple C2C to a more managed B2C model.

On November 2, 2023, the Render Foundation announced that Render Network had successfully upgraded its core infrastructure from Ethereum to Solana and launched an incentive program to encourage users to upgrade $RNDR on Ethereum to a new token, $RENDER, on Solana.

Helium

Helium is one of the oldest and most well-known DePIN projects, a decentralized wireless network protocol that incentivizes users to deploy gateways to drive a global network based on LoRaWan technology. Initially, it built its own Layer1 network, but adoption was hindered. In April 2023, it completed the migration to the Solana network, aiming to reach a larger user base and liquidity and fully leverage the efficiency of the Solana network for further expansion.

$HNT is the primary economic asset in the Helium ecosystem, and the only way to pay for network data transmission fees is by burning $HNT. It is currently valued at $1.29 billion and was delisted from spot trading pairs on Binance in October 2022.

In 2023, Helium issued two new tokens, $Mobile and $IOT, which are subDAO governance tokens for Helium Mobile and Helium IOT, respectively, aiming to achieve governance separation. $Mobile is earned from 5G hotspot services in Helium Mobile, while $IOT is used to reward nodes focused on running IoT. $HNT remains the primary asset in the Helium ecosystem, the only token that can pay for network data transmission.

Hivemapper

Hivemapper is a blockchain-based map network where contributors can collect data by installing Hivemapper's dashcams and earn $HONEY tokens as rewards. The token distribution and settlement are all on the Solana network. The dashcams in Hivemapper are similar to mining machines and are integrated with Hivemapper's application, uploading street view images as data.

In just one year, Hivemapper has mapped approximately 91 million kilometers of roadways, covering 10% of the total global road mileage, with over 6 million kilometers being unique. With the delivery of over 8,000 dashcams globally, drivers are helping to create the freshest maps in the world every day.

Hivemapper's revenue comes from selling dashcams and selling map data APIs. The price of each dashcam is $300 (advanced models are $649), and the conservative estimate for annual revenue exceeds $2 million. The price of the $Honey token cannot be too low, otherwise, there will be no demand for dashcams, and the maps will not be effectively expanded, leading the entire business into a deadlock. The token has not yet been listed on mainstream exchanges and is mainly traded on Orca, with a high FDV currently at $2.4 billion, but with a circulation of only 2.6%. High FDV and low circulation were once a major characteristic of SBF-related tokens, making the price very susceptible to rapid fluctuations.

Tekkon

Tekkon is a Japanese project where users can earn token rewards by taking photos of local infrastructure such as utility poles and manhole covers, or reporting damaged infrastructure to help improve the local area.

Whole Earth Coin (WEC) is Tekkon's reward token, and in Japan, WEC can be exchanged for cash on Line Pay.

The initial issuance is 300 million tokens, with no maximum limit. When the initial tokens are exhausted, if the user base continues to grow, the system will issue new tokens to reward users. Of the initial 300 million tokens, 20% is for ecosystem development, 20% for in-app Fix and Earn, 25% for public sale, 15% for private placement, and the remaining 20% belongs to the team.

Tekkon promises to give the token more functionality, forming a complete ecosystem flywheel, such as public utility companies using WEC to purchase infrastructure photo data, token burning or further rewarding infrastructure hunters, attracting more public utility companies to participate. This indicates that Tekkon plans to establish a more complete and sustainable ecosystem.

Advantages and Prospects of DePIN

The mechanism of various DePIN projects fundamentally integrates resources: incentivizing users to share resources through token incentives, allowing resources to flow efficiently to the demand side. Compared to centralized traditional infrastructure, DePIN, like DeFi compared to CeFi, to some extent reduces the role of intermediaries, making resources flow more smoothly between the supply and demand sides.

1. Breaking Price Monopoly

In the field of infrastructure construction, the problem of oligopoly in centralized markets has been significant. Especially in traditional storage and computing, this is a capital-intensive industry, with giants like AWS, Azure, and Google Cloud holding prices, and users often lack bargaining power, being forced to accept high prices or even lacking real choice.

However, the emergence of DePIN has brought new vitality to this situation. The mechanism presented by DePIN projects is essentially a revolutionary market change. Its decentralized nature means that the barriers to enterprise participation will be significantly reduced, no longer subject to the monopoly of a few centralized giants. DePIN projects incentivize users with tokens to form networks by providing resources, thereby achieving a transition from capital-intensive industries to P2P or P2B models. This greatly reduces the barriers to enterprise participation, breaks price monopolies, and gives users more cost-effective choices. By incentivizing users to share resources and establish a free competitive ecosystem, DePIN makes the market more open, transparent, and competitive.

2. Full Utilization of Idle Resources and the Development of the Sharing Economy

In traditional economic models, many resources remain idle and fail to realize their potential value. This waste of resources not only has a negative impact on the economy but also creates significant pressure on the environment and society, including idle computing power, storage, and energy.

However, the emergence of DePIN provides a new solution to this dilemma. Many users hold a lot of idle resources, whether it's storage, computing power, or data. The key is how to mobilize these resources. Through incentive mechanisms, DePIN encourages users to share and utilize their resources, maximizing resource utilization. This includes not only data storage, computing power, and other resources but also environmental resources. For example, React Protocol connects batteries to the power market to stabilize the grid by connecting batteries and sharing surplus power, contributing to clean energy supply and providing an additional way for users with limited resources to earn money. This initiative not only reduces resource waste but also contributes to a more sustainable development for society.

3. Efficient Circulation of Funds and Resources

DePIN establishes a decentralized ecosystem that directly connects supply and demand, enabling the direct transfer of value, allowing funds and resources to flow more quickly, thereby improving transaction efficiency and transparency. This mechanism not only reduces transaction costs but also provides market participants with more opportunities and flexibility.

In summary, the DePIN track covers a wide range of categories, including storage, computing, data collection and sharing, communication technology, etc. These existing markets all present varying degrees of competition. However, the development of DePIN is still in its early stages and faces many limitations and challenges. In the short term, the DePIN field faces challenges such as product experience, establishing competitive advantages, regulatory compliance, and talent shortages. However, in the long run, whether it's from the perspective of lowering barriers, innovation, or utilizing idle resources and money flow, the emergence of DePIN will have a profound impact on the market. The market changes it brings will affect the supply chain, industrial structure, and the evolution of the entire economic ecosystem.

Legal Risks of the DeFIN Track

DePIN has the potential to closely connect the real world with the virtual world, and the innovative operating model of token incentives can effectively reshape traditional industries, efficiently and cost-effectively integrate existing hardware resources, and promote the more rapid and effective allocation of social resources. However, in the current regulatory context in our country, it still faces the following legal risks.

Administrative Regulatory Risk: Does it fall under the "mining" activities prohibited in our country?

From the operation mode of DePIN, it mainly uses token incentives to encourage users to purchase project hardware. Compared to traditional industries, it has the advantages of breaking price monopolies, promoting the utilization of idle funds, promoting the development of the sharing economy, and facilitating the efficient circulation of funds. In this mode, users can continuously earn token rewards after purchasing and installing hardware devices by providing the data information or storage of digital resources required by the project. So, does this method fall under the "mining" activities prohibited by our country's administrative regulations?

At the beginning of the birth of cryptocurrencies such as Bitcoin and Ethereum, the blockchain ecosystem of Bitcoin and Ethereum was still in the exploration stage, and "proof of work" was the only way to mine coins. With the popularization of blockchain technology and cryptocurrencies, there were large-scale "mining farms" in our country, which not only consumed a large amount of energy but also seriously damaged the local ecological environment.

In this context, in September 2021, the National Development and Reform Commission and other departments issued the "Notice on Rectifying Virtual Currency 'Mining' Activities" (referred to as "Document 1283"), which defines "mining" activities as the process of producing virtual currency through specialized "mining machines," which consumes a large amount of energy and has a large carbon footprint, contributes little to the national economy, and has limited driving effects on industrial development and technological progress. In this context, the regulatory authorities in our country are rectifying domestic "mining" activities mainly due to the huge energy consumption and carbon emissions caused by "mining" activities. However, in DePIN projects, the use of hardware devices such as dashcams, storage space, routers, or digital resources to earn project token rewards, unlike the "proof of work" model, does not consume a large amount of energy or produce a large amount of carbon emissions, making it difficult to be classified as virtual currency "mining" activities prohibited by domestic regulations.

Criminal Risk: Various risks faced in the token issuance and promotion process

The core of DePIN projects lies in the management of the market value of incentive tokens. Only by maintaining the incentive tokens in a good price range to ensure the returns of participating users can the project ecosystem continue to expand. This inevitably involves the trading of cryptocurrencies.

In this regard, our country issued the "Announcement on the Prevention of Risks from Token Issuance and Financing" in 2017 (referred to as "Announcement 9.4") and the "Notice on Further Preventing and Dealing with the Risks of Speculation in Virtual Currency Trading" in 2021 (referred to as "Notice 9.24"). Announcement 9.4 explicitly states that token issuance and financing refers to the illegal public financing activities of raising bitcoins, ethers, and other so-called "virtual currencies" through the illegal issuance and circulation of tokens by the financing subject, essentially an illegal public financing activity without approval, involving illegal issuance of token vouchers, illegal issuance of securities, illegal fundraising, financial fraud, and pyramid schemes.

Especially when the project has not been fully developed, or its consensus mechanism has not yet reached a fully decentralized level, the operation and operation of the project still highly depend on centralized management, which means that the operating entity behind the project has the ability to directly control, operate the issuance of tokens, set prices, and fluctuations. Based on the opacity of information and the limited understanding of blockchain technology by investors, it often faces a greater risk of fraudulent issuance and insider trading. In this context, the token issuance behavior in DePIN projects is very similar to ICO activities and still faces high regulatory risks. In the financial regulatory context of our country, it is easily identified as a new type of illegal fundraising activity derived from blockchain technology, suspected of illegally absorbing public deposits. If the subjective purpose of the project party is illegal possession, it may further constitute the crime of fundraising fraud.

In addition, based on the complex operating model of DePIN projects, the promotion and trading process after issuance will involve upstream and downstream roles such as hardware providers and channel agents. In the process of marketing hardware sales, channel agents may use joint ground promotion teams to quickly open the market through invitation rebates and viral growth mechanisms. In this process, if the invitation rebate method is used and the rebate chain reaches three levels or more, it may involve the criminal risk of organizing and leading pyramid schemes. In the token trading process, it is also highly likely that criminals will use the purchase of tokens to disperse and exchange the black money generated by upstream crimes, thereby completing the process of laundering dirty money.

Data Security Risk: Compliance Issues for Data Outbound in Special Industry Sectors

In the era of big data, data is as powerful a resource in the market as oil, and even an important factor for national economic development. The "Opinions on Building a More Perfect Factor Market Allocation Mechanism" issued by the Central Committee of the Communist Party of China and the State Council in 2020 proposed to accelerate the cultivation of the data factor market, emphasizing the need to strengthen the integration and security protection of data resources. The "Opinions on Building a Better Data Basic System to Play the Role of Data Elements" approved at the 26th meeting of the Central Committee for Comprehensive Deepening of Reform in 2022 also clearly pointed out that data, as a new factor of production, is the foundation of digitization, networking, and intelligence, and has rapidly integrated into various aspects of production, distribution, circulation, consumption, and social service management, profoundly changing the mode of production, lifestyle, and social governance. The enormous social and economic value behind data has made it one of the five major factors of production in our country. At the same time, information technology has broken geographical restrictions, allowing data to flow across borders globally. However, while cross-border data promotes international cooperation, economic growth, and accelerates innovation, it also poses severe challenges to data sovereignty, national security, and personal information protection.

In the DePIN project, for example, with Hivemapper and Tekkon, many projects in the market revolve around providing core resources of data information in special fields such as maps and vehicles to overseas demand. Currently, the domestic regulatory authorities attach great importance to the compliance issues of the outbound of data in these special fields.

On the one hand, the collection and analysis of various consumer data is a prerequisite for enterprises to understand customer needs, provide customized services, and develop new market opportunities, which is crucial for enhancing the core competitiveness of enterprises.

On the other hand, the various business and operational information generated by these enterprises in their business activities often relate to the operating conditions of the enterprises themselves and even involve the commercial secrets of the enterprises, closely related to the competitive development of the enterprises. At the same time, for special industry sectors that rapidly digitize their product systems, service channels, and operational methods, the risks and secondary risks caused by data leakage, damage, and the loss of important data assets not only pose fatal threats to individual institutions or enterprises but also quickly spread to the entire industry, endangering the stability of the entire economic and social order.

From the perspective of national security, data such as maps and vehicle data are important strategic resources for the country. Taking the Hivemapper project mentioned earlier as an example, users need to drive to collect geographical information from various streets and record high-definition 4k videos. Such videos and geographical data are sensitive information in various countries. If users capture special national government departments or sites used for military or confidential experimental purposes, this data involves elements such as personal privacy, commercial secrets of enterprises, social governance, national defense, and security, embodying the current development and future trends of a country.

The cross-border flow of data will allow data collected or generated within the country to be instantly controlled by foreign institutions or accessible to them, exposing a large amount of personal sensitive information of citizens, business information of enterprises, operational management information, and regulatory information to the view of other countries. In fact, this will lead to the sending country losing its exclusive control and jurisdiction over the relevant data, directly threatening the market security and national data sovereignty of our country.

Conclusion

The model innovation of the DePIN track, while promoting the transformation of economic development models and optimizing resource allocation, still faces multiple unfavorable factors brought about by technological, regulatory, and market risks. In this regard, we should maintain a positive and cautious attitude towards the development of technology. With the improvement of external regulatory norms and the strengthening of compliance awareness by project parties, we believe that in the near future, with the development and application of blockchain technology and the Internet of Things, the unique model innovation of the DePIN project will definitely achieve the development of a shared, green, and sustainable economy, empower the real economy, inject vitality into the development of Web3.0, and bring new development opportunities.

References:

Chain Security Research: "Is 'Mining' in DePIN Projects Legal in China?"

Chu Yan: "Research on the Business Model and Related Legal Issues of DePIN Projects."

Sun Yu: "Criminal Legal Regulation Dilemma and Way Out of Virtual Currency-Related Crimes," in Youth Crime Issues, 2021, Issue 5.

Wang Guan: "Criminal Legal Regulation Based on ICO Behavior Using Blockchain Technology," in Eastern Jurisprudence, 2019, Issue 3.

Ruan Ziqing: "Security Risks of Cross-Border Flow of Financial Data and Criminal Law Protection," in Shanghai Legal Research, 2022, Volume 5.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。