Student author | @elliett2077

Supervising teacher | @CryptoScott_ETH

First release date | 2023.8.11

- Derivatives are divided into perpetual contracts, options, interest rates, synthetic assets, volatility indices, etc. This article mainly discusses the technical, market, and frontier developments of decentralized perpetual contract exchanges in the derivatives track segmentation.

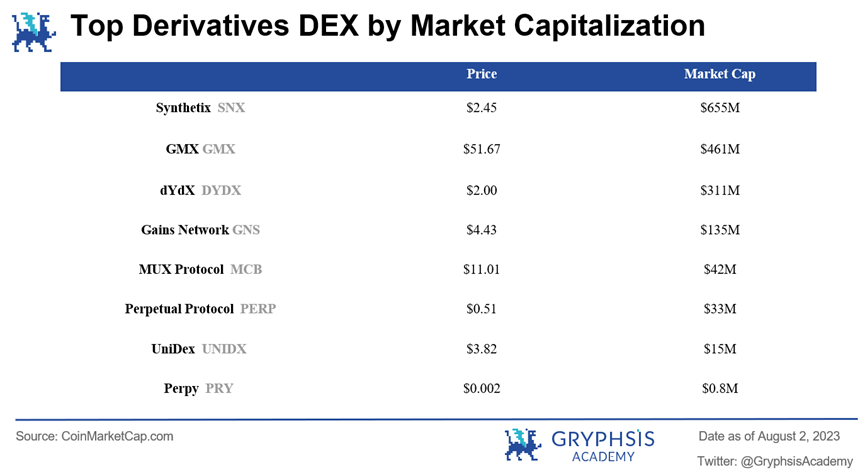

- In recent years, the derivatives DEX track has developed rapidly, with a market value exceeding 2 billion USD, accounting for approximately 7.9% of the total DeFi market value. The DeFi Summer and FTX's bankruptcy have catalyzed the rapid development of derivatives DEX. However, from the market structure perspective, derivative trading is absolutely dominated by CEX, with DEX only accounting for 3% of the total trading volume.

- Factors such as strong competition from CEX, constraints of on-chain order books, hinder the development of derivatives DEX. At the same time, the substantial trading demand for derivatives and the low penetration rate of DEX are driving factors for industry development.

- In terms of competitive landscape, nearly 90% of on-chain derivative trading occurs on Layer 2; order book DEX performs significantly better than fund pool types, with dYdX holding an absolute dominant position; GMX and dYdX have high fee income, but gTrade has stronger profitability.

- Perpetual contract DEX is mainly divided into two categories: order book and fund pool:

a. Order Book

Essentially a matching mechanism that matches buy and sell orders. However, it relies on liquidity providers and carries regulatory risks. Representative project: dYdX.

b. Fund Pool

Single asset DAI as LP: no principal guarantee, buffer mechanism. Representative project: gTrade.

Basket of assets as LP: provides overall liquidity. Representative project: GMX.

Synthetic assets: global debt, reducing spot friction. Representative project: Kwenta.

vAMM model: protects collateral, zero impermanent loss. Representative project: Perpetua Protocol.

- The competition in perpetual contract DEX is fierce, and the breakthrough lies in four aspects: first, how to leverage the Ethereum upgrade to improve performance; second, providing the best market prices through aggregated liquidity; third, developing on-chain copy trading to attract more users and expand trading volume; fourth, integrating traditional assets to compensate for the shortcomings of futures exchanges and meet diverse needs.

DeFi was born in 2018 and reached an unprecedented peak during the DeFi Summer in 2020. With the continuous development and maturity of spot DEX, derivative DEX has gradually flourished. Three years after DeFi Summer, the market value of derivative DEX led by dYdX, GMX, and SNX has exceeded 2 billion USD, accounting for approximately 7.9% of the total DeFi market value.

If DeFi Summer was the big bang of derivative DEX, from silence, "bang," everything was born, dazzling. Then FTX's bankruptcy can be said to be the supernova eruption in the development of derivative DEX. The explosion illuminated the entire crypto market, and the material and energy it left behind also triggered the formation of new stars. FTX's downfall has unprecedentedly cast doubt on centralized exchanges. At this moment, the era of decentralized derivative exchanges has arrived.

Attributed to valuation bubbles and the withdrawal of a large amount of capital, from 2022 to 2023, the total market value of DeFi protocols was 17.9 billion USD, a staggering 72.9% decrease. Although 2022 was a cold winter for DeFi protocols, the market situation for derivatives is relatively optimistic, with a 65.0% overall year-on-year decrease, but the market share has risen to 7.9%, surpassing yield aggregators, thanks to the strong growth of decentralized perpetual contract exchanges such as GMX and Gains Network.

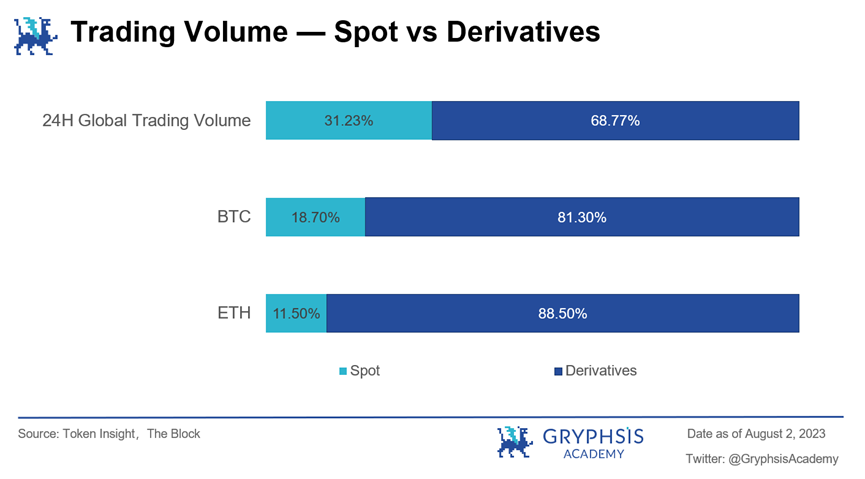

Overview of the Derivatives Market: Rapid growth in derivative trading volume, far exceeding spot trading.

In traditional asset categories, the trading volume of derivatives far exceeds that of the spot market. Taking the foreign exchange market as an example, the turnover of derivatives is three times that of spot. In recent years, influenced by the pandemic and economic fluctuations, derivative trading has increased significantly. In 2022, the global futures and options trading volume reached 83.848 billion lots, a 33.98% year-on-year increase.

In the cryptocurrency world, according to TokenInsight data, derivative trading now accounts for 68.77% of the entire cryptocurrency market, only twice that of spot trading, a proportion lower than traditional assets. The Block shows that the ratio of spot to derivative trading volume for the two major mainstream crypto assets, Ethereum and Bitcoin, is 0.13 and 0.23, respectively, with derivative volume far exceeding spot volume.

In January 2023, the trading volume of cryptocurrency derivatives increased by 76.1% compared to December 2022, reaching 20.4 trillion USD. With the gradual improvement and maturation of the cryptocurrency market, its development trend is similar to traditional financial markets, and the scale of various derivative products will continue to expand, far exceeding spot trading, with enormous potential.

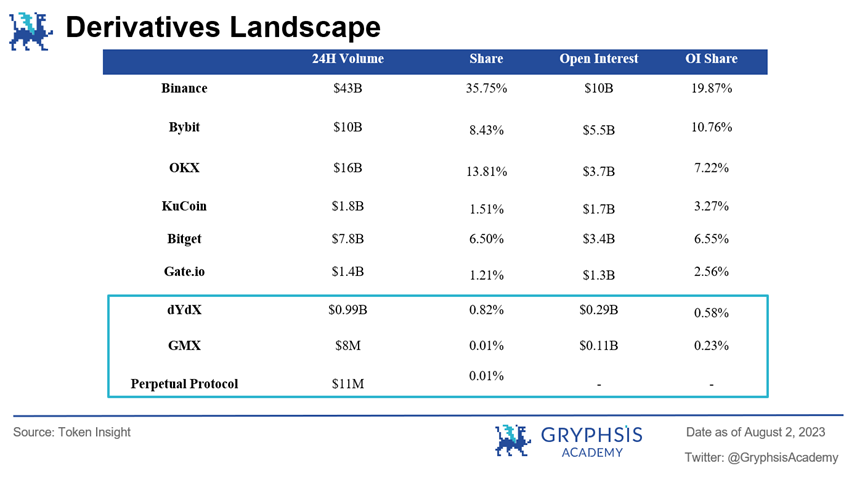

Horizontal Comparison: The vast majority of derivative trading occurs on CEX, with a very low proportion on DEX.

Currently, only 3% of all derivative trading volume occurs on DEX, with the remaining 97% executed on CEX. Among the top ten exchanges by derivative trading volume, only dYdX has a place. The derivative market is absolutely dominated by CEX, with derivative DEX occupying a very small market share, unable to shake the position of CEX.

Vertical Comparison: The market share of derivative DEX is significantly lower than that of spot DEX.

In the derivative market, DEX trading volume only accounts for 1.3% of the total trading volume; while in the spot market, this ratio is close to 6%, with the largest centralized exchange Binance holding a market share of only 16.95%, half of its derivative market share. This indicates that within decentralized exchanges, derivatives are far less mature than spot trading, with significant room for growth.

- Intense Competition of Centralized Exchanges

While the FTX incident did shake users' confidence in centralized exchanges and raised awareness of the risks related to central entity custody, DEX still lags behind CEX in many aspects, including higher trading fees and entry barriers, limited trading functions, and the risk of fund loss. Therefore, DEX still has a long way to go before achieving mass adoption.

- Constraints of On-Chain Order Book

Although the order book model performs well in liquidity depth and price discovery, implementing a fully on-chain order book system is challenging even for perpetual contract DEX with the highest trading volume, such as dYdX, due to technical limitations. Therefore, dYdX needs to rely on Amazon Web Services for order matching off-chain, rather than complete on-chain matching.

In addition, the order book model also faces potential regulatory risks. The order book model requires deep liquidity, so its smooth operation heavily depends on market makers. In the United States, market makers are subject to strict regulation by financial authorities such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), and need to comply with securities laws and government anti-money laundering requirements. The FTX incident further exposed the risks faced by market makers, which could directly affect the stability of order book exchanges such as dYdX.

- Lack of Viable Models

Although the current AMM model has many innovative designs and improvements to address its shortcomings, such as virtual automated market makers (vAMM), hybrid AMM, MEV-capture AMM, etc., the current designs are still imperfect and require a lot of trial and continuous product iteration.

Furthermore, most current derivative protocols are inspired by the Uniswap V2 spot market model, all of which have an unlimited liquidity pool and an automated market maker model. However, this model's flaw is the high requirements for LP risk management systems and LP incentives, which need strong risk control and high incentives to hedge against high risks and stimulate LP motivation.

- Urgent Need for Mechanism Innovation and Improved User Experience

The success of the GMX model has led many teams to imitate it, and many GMX imitations have appeared on the market, such as Vela Exchange, Mummy Finance, Level Finance, etc. However, due to the similarity in mechanisms and implementation, these products are struggling to stand out and are finding it difficult to surpass imitators in terms of trading volume and fee income. It is also difficult for them to match the centralized exchanges in terms of user experience, with 24/7 customer service and a complete fund recovery mechanism.

- Greater Demand for Derivative Trading than Spot Trading

According to the law of development, cryptocurrency derivatives trading volume will far exceed spot trading, just like in traditional finance, indicating the enormous potential of derivatives. In addition, for decentralized exchanges, the trading volume of Uniswap and Pancakeswap at their peak was less than 10 times that of centralized exchanges, while the trading volume of decentralized derivative exchanges is still several orders of magnitude lower (Binance's daily derivative trading volume has already exceeded 50 billion USD, while the total daily trading volume of all decentralized derivative exchanges is still around 100 million USD).

- Low DEX Penetration Rate

In the derivative market, centralized exchanges Binance, OKX, and Bybit occupy the majority of the market, with any one of them alone having derivative trading volume far exceeding the total trading volume of DEX. For derivative DEX, the key is how to carve out a piece of the pie from centralized exchanges.

Fortunately, increasingly stringent regulatory policies have provided a breathing space for DEX. The FTX bankruptcy, SEC investigations into Binance and Coinbase, these events have made users worried about whether they should look for other trading opportunities if regulatory agencies were to ban centralized exchanges. This will bring more short-term demand to DEX. However, in the long run, how DEX can reduce trading costs and improve user experience is the key to retaining users.

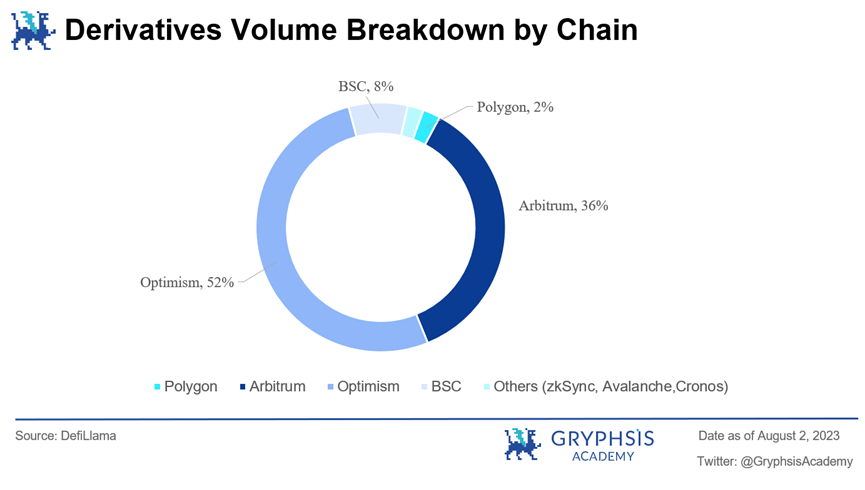

Public Chain Distribution:

Derivative trading mainly occurs on Layer 2, with Optimism dominating with a $9.01 billion on-chain monthly trading volume, accounting for 50% of the market share, while Arbitrum accounts for $6.3 billion, or 35%, and BSC's on-chain trading volume is $1.33 billion, or 8%, with the remaining public chains sharing 10% of the market share. It is worth mentioning that in the past month, the on-chain derivative trading volume on zkSync Era has increased tenfold, with a total trading volume of $39.4 million in July, four times that of Solana.

It is worth mentioning that many leading derivative protocols on Layer 1 and other public chains are gradually expanding to Layer 2, such as Level Finance, born on BSC, which has recently launched on Arbitrum, and Futureswap, native to Avalanche, is also deploying its V3 version on Arbitrum. Layer 2, with its superior performance and low fees, has not only nurtured new protocols but also attracted the deployment of established protocols.

Trading Volume:

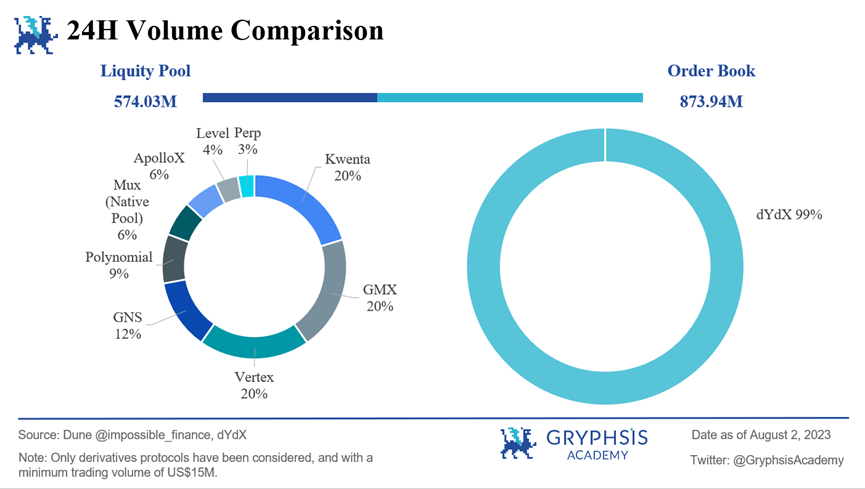

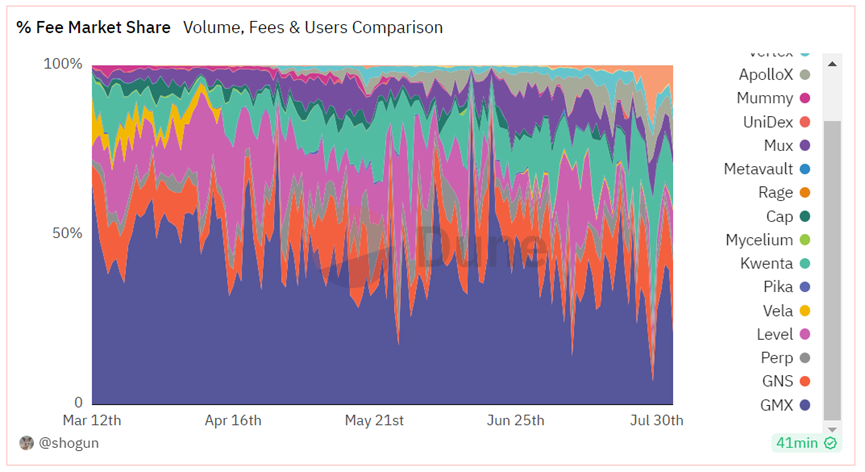

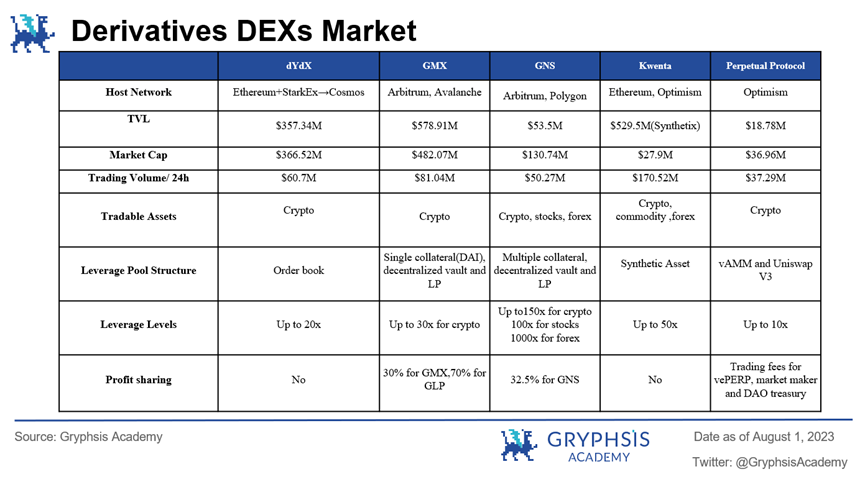

In comparison to 24-hour trading volume, order book DEX is significantly higher than fund pool DEX, with dYdX in the order book DEX holding an absolute dominant position, being the largest and most used perpetual contract in the market, with a daily trading volume of $873.94 million, which is 1.5 times the total trading volume of all fund pool perpetual contract DEX. In the fund pool DEX, Kwenta, GMX, and Vertex have daily trading volumes exceeding $100 million, each accounting for 20% of the total trading volume, while gTrade accounts for 12%, or $68 million.

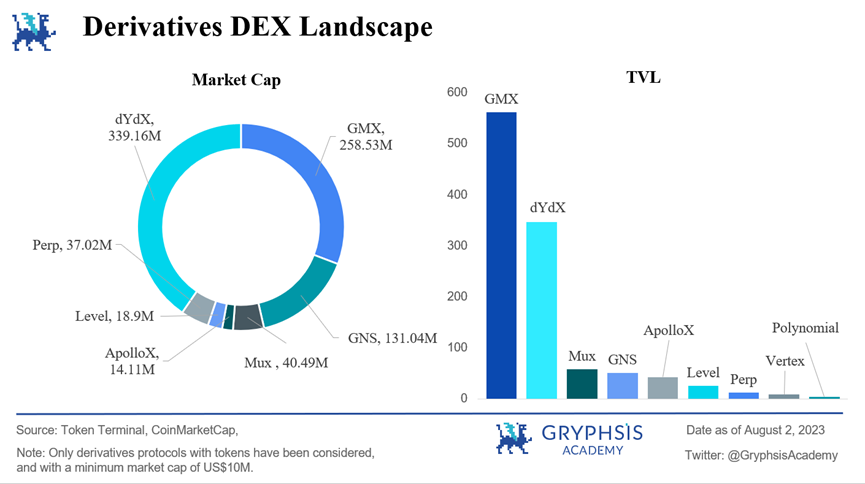

Market Value, TVL:

In terms of market value, dYdX still maintains its lead, accounting for one-third of the total market value of derivative DEX at $339 million, with GMX and gTrade ranking second and third at $258 million and $131 million, respectively. In terms of TVL, GMX's total asset value of $560 million exceeds the total lock-up value of all other protocols. The reason GMX's trading volume is not as high as dYdX's but its TVL far exceeds is that dYdX operates on an order book mechanism, providing liquidity through market makers without requiring a large number of LPs. (Kwenta's liquidity is backed by Synthetix, so it is not included in the statistics).

It is worth noting that MUX has a market value of only $40 million, but its lock-up amount surpasses gTrade, reaching $58 million. This is due to its unique profit distribution mechanism, where holding $MCB and $MUX does not directly generate income; only pledging to hold $veMUX allows users to share platform profits, with the pledge ratio weighted by the pledge time.

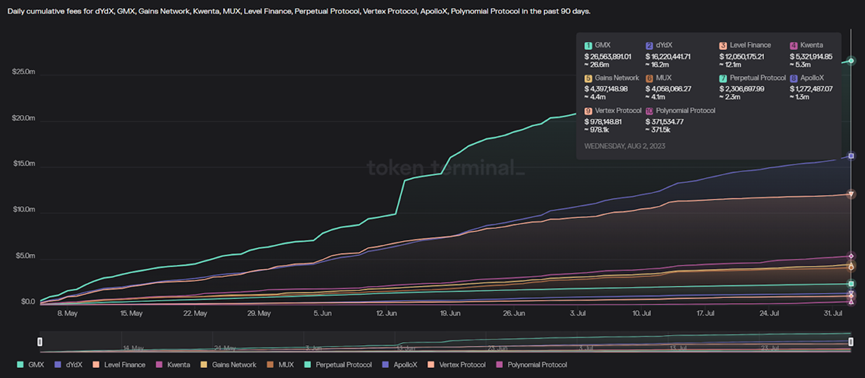

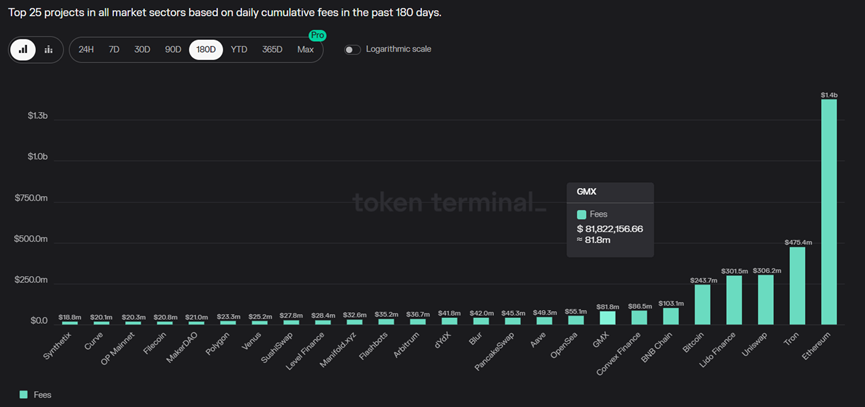

Fees:

In terms of fees, GMX is far ahead, with a cumulative income of $26.6 million over 90 days, maintaining a strong performance since last year, particularly during bearish market periods. However, due to 70% of GMX's fee income being used to incentivize GLP, GMX's income potential is relatively small, with only $8 million in income over the past 90 days. Although dYdX's trading fees are not as eye-catching as GMX's, totaling only $16.2 million, all of its fees belong to the protocol. Additionally, facing fierce competition, dYdX allocates $16 million for token incentives, resulting in average profitability.

Currently, dYdX has not fully achieved decentralization, but in the V4 version, it will allocate fees to users. Level ranks third in fees, reaching $12.1 million, but 45% is used to incentivize liquidity, and 20% is used to reward stakers, resulting in a net loss of $5.6 million over the past 90 days. gTrade charges fees for opening and closing positions, with 40% of market order fees and 15% of limit order fees allocated to $GNS stakers. Despite the fees being less than GMX at $4.4 million, gTrade's final profit exceeds GMX's at $3.7 million. In summary, GMX and dYdX have high fee income and strong fee-capturing capabilities, but gTrade has stronger profitability.

Source: Tokenterminal (2023.8.2)

Source: Tokenterminal (2023.8.2)

Based on different implementation principles, the mainstream perpetual contract protocols on the market can be divided into two categories, order book mode and liquidity pool mode, with the liquidity pool mode further divided into single asset LP, basket of assets LP, synthetic assets, and vAMM mode.

Also known as peer-to-peer, the protocol provides liquidity through market makers, with users and market makers acting as counterparties, and the platform matching buy and sell orders, with prices determined by market dynamics. The order book mechanism is adopted by most centralized exchanges, with greater liquidity depth than the other modes, but to some extent, it has centralized drawbacks.

Representative project: dYdX.

Characteristics:

- Price discovery: Through buy and sell orders in the order book, the market can freely determine the price of assets, without being controlled by centralized institutions.

- Transparency: The order book publicly displays buy and sell orders in the market, allowing traders to clearly understand market supply and demand and price levels.

- Higher trading costs: In situations of low market liquidity, there may be significant bid-ask spreads, requiring users to wait longer to complete trades.

- Smooth user experience: The user experience of the order book mode is closest to traditional CEX, supporting market, limit, and stop-loss settings for both contract and spot trading, with a relatively low entry barrier.

- High gas costs: The off-chain matching and on-chain settlement model requires most operations to be conducted on-chain. During congestion on the ETH mainnet, the high gas fees, often tens of dollars, may deter many retail users.

Also known as peer-to-pool, the protocol typically attracts LPs to form a liquidity pool, with users trading against the liquidity pool, and prices provided by oracles.

1) Single asset LP

Pledgers deposit a single asset (often a stablecoin, such as DAI) into the treasury to form a liquidity pool, with users trading against the protocol, and pledgers earning profits from traders' losses.

Representative project: gTrade

Characteristics:

- Over-collateralization: The initial value ratio of DAI to gDAI is 1:1. If the overall platform traders are collectively at a loss, the balance of DAI in the insurance fund increases, exceeding the total amount of DAI deposited by pledgers, resulting in over-collateralization (insurance fund collateral ratio >1). Insurance fund collateral ratio = insurance fund balance / total DAI deposited by LPs.

- Theoretically not risk-free: The biggest difference from the traditional LP model is that LP providers may face direct losses (non-impermanent losses). Pledging DAI as the counterparty to traders, their profits depend on the traders' losses. If the platform incurs losses, pledgers theoretically cannot retrieve all of their assets.

- Buffer mechanism: Although LPs theoretically do not guarantee profits, when the overall profit and loss is negative, part of the trading fees is used as a buffer by the insurance fund, with these funds entering gDAI to protect pledgers' funds and incentivize them to stay in the insurance fund.

2) Basket of assets LP

Users provide liquidity by purchasing and pledging a basket of assets, rather than providing two tokens in equal proportions (e.g., pledging $100 worth of ETH and $100 worth of USDT), providing "global liquidity." Taking GMX as an example, users directly purchase and pledge the liquidity tokens GLP issued by the GMX protocol, with the GLP index composed of the prices of a basket of assets such as ETH, WBTC, LINK, UNI, USDC, etc.

Representative project: GMX

Source: GMX (2023.7.20)

In summary, users provide global liquidity by pledging GLP to participate in GMX market making.

Characteristics:

- Zero slippage: The counterparties are a basket of assets, and the prices are quoted by oracles, so there is no slippage even for large trades.

- Infinite liquidity: As long as there are assets in GLP, there is liquidity for any trading pair, and the depth can be integrated.

- Permissionless: Anyone can fairly participate in platform market making, and profits are equally distributed based on GMX and GLP holdings.

- Gamblers and the house: Traders and the liquidity pool are counterparties, engaging in a zero-sum game, where the profits earned by traders are the losses of the liquidity pool, and vice versa. In the long run, GMX traders' losses bring higher annualized returns to GLP than the market average. Statistically, trader failure is a high probability event, where gamblers always lose to the house, and high leverage increases their probability of loss.

3) Synthetic Assets

Synthetic assets are mirror simulations of target assets. For example, using sUSD to represent the price of the US dollar, and sGold to represent the price of gold. Essentially, they are derivative tokens anchored to the prices of other assets through an oracle-feeding mechanism, with liquidity sourced from a shared debt pool, requiring DeFi protocols to help users issue and exist in standardized token form on the blockchain.

Representative project: Synthetix—Kwenta

This model is divided into two parts: minting and trading.

First, minters over-collateralize a certain asset in the protocol and mint synthetic stablecoin assets. At this point, minters can receive a share of the fees based on the asset ratio and also bear a proportionate share of the global variable debt.

Second, traders can obtain synthetic assets through minting or over-the-counter trading, and use these synthetic assets for long or short positions.

For example, Ellie pledged $500 worth of $SNX in Synthetix and minted $100 worth of sUSD. Assuming the total debt pool is worth $200, all in sUSD. At this point, Ellie in Synthetix: assets $500 $SNX, debt $100 sUSD, collateralization ratio 500%, debt ratio 50%.

Scenario 1: Ellie is bullish on BTC, so she exchanged all $100 worth of sUSD for sBTC (another synthetic asset). One week later, BTC price rises by 50%, and the total debt pool value is $250 ($150 sBTC and $100 sUSD). Since Ellie bears 50% of the global debt, at this point, Ellie in Synthetix: assets $500 $SNX, debt $125 sUSD, collateralization ratio 400%, potential profit $150 sBTC - $125 sUSD = $25. At the same time, she also needs to add collateral or repay sUSD to increase the collateralization ratio.

Scenario 2: Ellie chooses to hold $100 worth of sUSD. One week later, BTC price rises by 50%, and the global debt increases to $250, the same as in scenario 1. Ellie also bears 50%, i.e., $125 of the debt, resulting in a loss of $125 sUSD - $100 sUSD = $25. At this point, the profit goes to the holder of sBTC.

From the above examples, it can be seen that the characteristics of this model are:

- Global debt changes at any time: All synthetic assets form the debt pool, and the value of the global debt changes with the quantity, variety, and price changes of the synthetic assets in the pool.

- Minters bear the risk of all the debt in the system.

- All $SNX pledgers are counterparties to each other.

4) AMM Mode

Market makers pre-deposit a certain amount of assets as the base position to form a trading pool, without the need for users to place orders. Instead, an algorithmic "robot" calculates the real-time exchange rate between two or more assets, enabling "instant trading" without the need to place orders and wait.

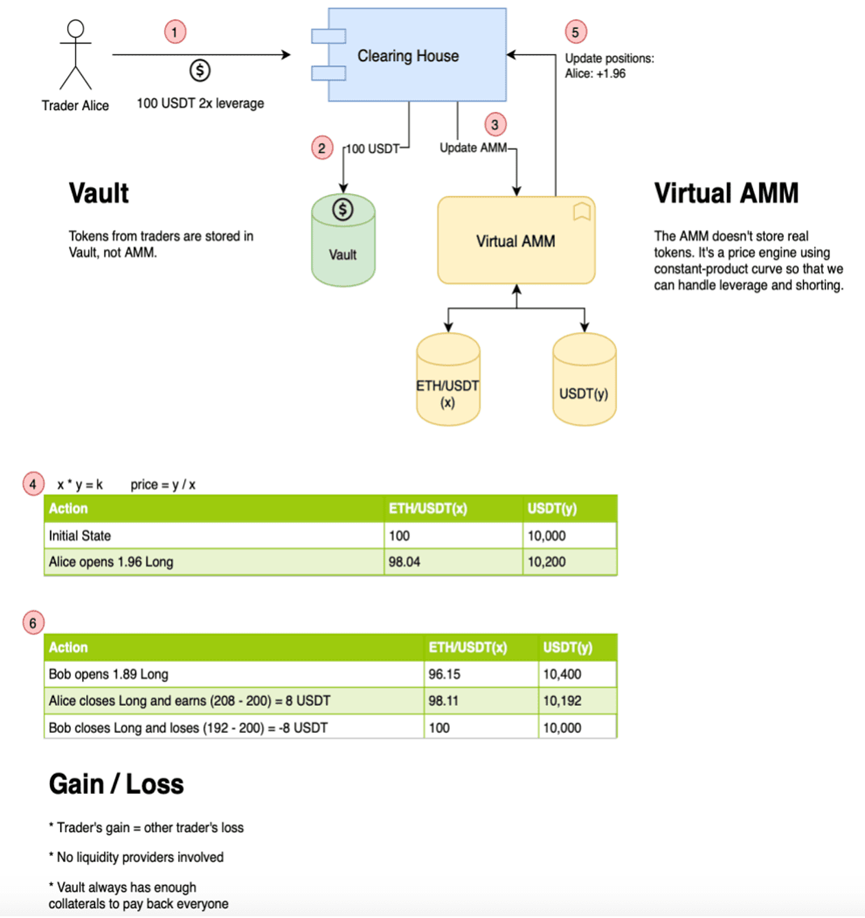

5) vAMM Mode

An innovation based on AMM, namely Virtual Automated Market Maker, where the funds of liquidity providers are stored in a smart contract vault, and users only trade in the virtual asset pool, separating funds from trading and effectively isolating risk.

Representative project: Perpetual Protocol

AMM trading platform = AMM automated pricing algorithm + liquidity providers (LP)

vAMM trading platform = AMM automated pricing algorithm

The basic model of vAMM is: x*y=K, but vAMM itself does not store the actual asset pool (K). The value of K is manually set by the vAMM operator at startup and can be increased or decreased at any time according to the latest market conditions. The real assets are stored in a smart contract insurance vault, which manages all the collateral of the vAMM, and the operator has no authority to move the collateral.

Taking Perpetual Protocol as an example, its V2 uses Uniswap V3 as the execution layer, using aggregated liquidity for market making. Users need to use USDC as collateral, which is stored in the insurance vault, and the protocol updates the vAMM based on the insurance vault data, and vAMM provides quotes.

In summary, vAMM only serves as a pricing mechanism and does not provide liquidity itself; its LP needs to rely on other protocols.

Characteristics:

- Extremely high trading efficiency: The automation of vAMM means it does not need to wait for market makers in traditional markets to manually adjust prices and place orders, but instead executes in real-time through smart contracts, improving the speed and efficiency of trading.

- Zero impermanent loss: Since there is no real liquidity and no LP providers (traders are counterparties to each other), vAMM only serves as a price discovery mechanism, so there is no issue of impermanent loss.

- Leveraged trading: With the separation of the vault and trading, and through a reasonable liquidation mechanism, traders can engage in leveraged trading in the virtual pool, maximizing the efficiency of fund utilization.

- Limited liquidity: It depends on the depth of the LP, and the liquidity of different trading pairs cannot be shared.

Source: Perpetual Protocol

In summary, dYdX is a non-custodial, decentralized perpetual contract trading platform, offering comprehensive exposure to over 35 assets, with leverage of up to 20x. The core team consists of software engineers from well-known cryptocurrency companies such as Coinbase.

Although it is a decentralized exchange, like most centralized exchanges, dYdX uses off-chain order books and on-chain settlement for trading, and is one of the few DeFi protocols that has not yet introduced a governance token despite operating for several years.

dYdX combines lending, leveraged trading, and perpetual contracts. Leveraged trading includes a borrowing function, where users' deposited funds automatically form a fund pool. If the funds are insufficient for trading, they are automatically borrowed with interest paid. It's important to note that dYdX's leveraged trading is currently only friendly to users making large trades. If a single order is less than 20 ETH, users can only choose to take the order and need to pay a high fee for taking small orders to compensate for gas costs.

dYdX's perpetual contracts run on both Layer 1 and Layer 2, with Layer 2 using StarkWare's Layer 2 solution. Currently, dYdX V4's public testnet went live on July 5, 2023, with plans to move away from Ethereum and develop an independent blockchain in the Cosmos ecosystem for greater scalability.

Since its launch in 2017, dYdX has experienced rapid business growth and has consistently been a leader in derivative DEX, with trading volume far exceeding its competitors. As of August 4th, the platform has 101,288 unique users, with a USDC deposit volume of $4.7M, fluctuating significantly. In September 2021, it reached a peak of $142.7M, with a total annual trading volume of $275.46B, growing at a rate of 26%. The platform has collected $66.99M in fees, but due to spending $96.5M on token incentives, the protocol has been in a negative profit state for the past 365 days, with a net income of -$15.8M.

Gains Network is a decentralized leveraged trading platform on the Polygon and Arbitrum chains, with gTrade being the trading protocol on the platform. Its liquidity is provided through the DAI treasury, offering trading pairs including cryptocurrencies, commodities, and forex.

gTrade's core advantage lies in its multiple and sophisticated risk control mechanisms. It manages trading risk through Price Impact, Rollover Fee, and Funding Fee.

- Price Impact: This refers to the additional spread, where the larger the position, the worse the asset liquidity, resulting in a greater price increase. This is used to prevent the risk of oracle manipulation and facilitate the listing of small coins.

- Rollover Fee: This controls traders' use of lower leverage.

- Funding Fee: This minimizes the gap between long and short unclosed contracts to prevent significant risk exposure on one side.

After its launch, gTrade's performance was average until it expanded to the Arbitrum network on January 1, 2023, after which its trading volume significantly increased. Currently, gTrade has a market share of about 12-15%, with 15,959 unique users and a total trading volume of $39.51B.

GMX is a perpetual contract trading DEX, initially deployed on BSC, and began its public version on Arbitrum in 2021, integrating with the Avalanche network in 2022.

Zero Slippage: GMX has abandoned the Automated Market Maker (AMM) model and uses an oracle-based pricing method. GMX only needs to inject funds into the pool, and users can complete a perpetual contract trade based on oracle pricing. The protocol will exchange based on the real price from the oracle, with no slippage costs during the exchange process, and it avoids the issue of the trading engine needing to match orders off-chain.

GLP Fund Pool: The GLP pool is a multi-asset pool, containing mainstream tokens such as USDC/BTC/AVAX, to support users' long or short contract demands. When a user goes long on Bitcoin, it's like "renting" Bitcoin from the pool. Conversely, when a user goes short on Bitcoin, it's like "renting" stablecoins from the pool. This allows the GLP pool to earn LP fees for the protocol, and all profits are distributed to GMX and GLP pledgers.

Fully Decentralized: GMX's exchange data is entirely on-chain, and there is no need for KYC. All assets are held in smart contracts, which are open-source, and all operational data is publicly transparent.

Unique Product Innovations and the expected airdrop on Arbitrum have propelled GMX's rapid growth. As of August 4, 2023, GMX's total annual trading volume reached $34.63B. In the past three months, GMX's market share in the fund pool derivative DEX category has declined, with a peak of 50% in April 2023. The platform has 117,097 unique users. Over the past 180 days, it has collected $81.8M in total fee income, ranking 8th among all protocols, even surpassing veteran protocols such as Pancakeswap and dYdX.

Source: Tokenterminal (2023.8.4)

Source: Dune@shogun (2023.8.4)

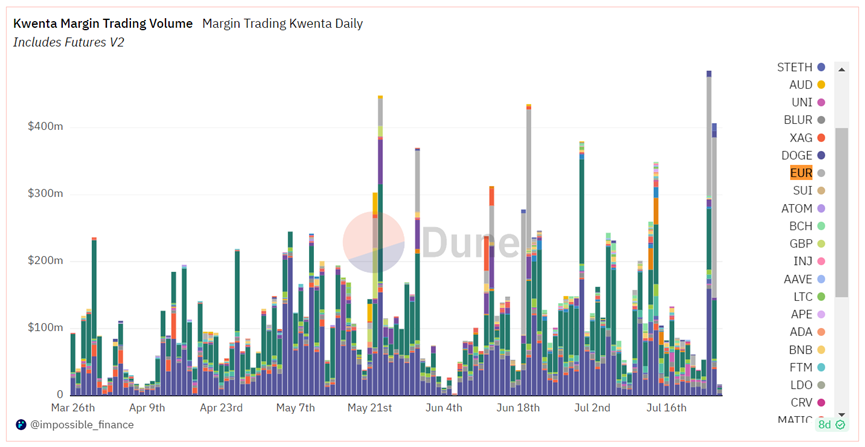

Kwenta is a derivative trading platform based on the Synthetix protocol, supporting cryptocurrencies, forex, as well as commodities such as gold and silver. Kwenta acts as the front end for Synthetix, with Synthetix providing the liquidity pool behind Kwenta. Traders on Kwenta can trade against the Synthetix debt pool, which is composed of sUSD provided by SNX stakers.

Synthetix manages the underlying protocol for liquidity management and contract provision, while Kwenta focuses on user experience and interface design. Currently, Kwenta offers over 42 cryptocurrency, forex, and commodity pairs, with leverage of up to 50x.

Infinite Liquidity and Zero Slippage: Kwenta adopts Synthetix's dynamic debt pool model, providing near-infinite liquidity for all trading pairs (within the protocol's safety parameters). Additionally, similar to GMX, Kwenta uses oracles to directly feed index prices as the reference price, eliminating spread and thus avoiding slippage.

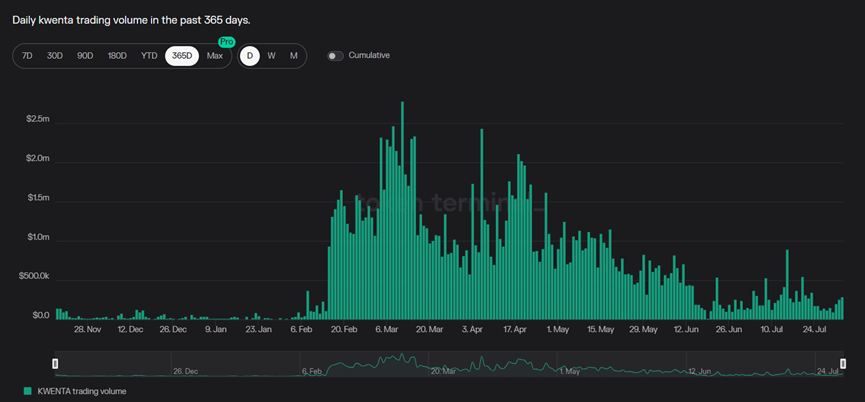

In October 2020, Kwenta launched on the Optimism public chain, and since February 2023, its business has seen rapid growth, with the highest daily trading volume reaching $2.8M and a total annual trading volume of $55.21B. The annual fee income is $22.59M, with 154,560 unique users. Its main trading pairs include Euro, sBTC, and sETH.

Source: Tokenterminal (2023.8.4)

Source: Dune@impossiblefinance (2023.8.4)

The DeFi Summer has stimulated the emergence of numerous new protocols, intensifying the competition in the perpetual contract DEX space. Both new and established protocols are considering how to iterate and innovate, as change is the only constant. Faced with challenges, we believe that the breakthrough lies in four aspects: first, leveraging the Ethereum upgrade for performance improvements; second, providing the best market prices through aggregated liquidity; third, developing on-chain copy trading to attract more users and expand trading volume; fourth, integrating traditional assets to address the shortcomings of futures exchanges and meet diverse needs.

In the past, many DEX protocols deployed on Alt Layer 1 chains such as BSC and Solana for lower trading costs and higher throughput. However, this came at the cost of sacrificing some security, as seen in the May attack on Level Finance on the BSC chain, resulting in a loss of $1M.

But with the development of Layer 2, many projects originally on Alt Layer 1 have migrated to Layer 2, such as Level Finance and GMX deploying on Arbitrum. Layer 2, leveraging the unparalleled security of Ethereum compared to Alt Layer 1, combined with reduced costs and improved speed after the upgrade, will attract more DEX protocols, providing a superior underlying infrastructure for DEX.

Compared to CEX, DEX has two core disadvantages: slow transaction speed and high transaction costs. This is due to Ethereum's low throughput, but Ethereum's upgrade and scaling are expected to completely solve this problem. The upcoming Cancun upgrade at the end of 2023 will introduce "Blob Transaction," expected to save 90% of storage fees. This will significantly reduce on-chain transaction GAS fees, lowering DEX transaction costs. With more Blobs added to the Ethereum blockchain in the future, throughput is expected to further increase, and transaction speed is expected to greatly improve.

dYdX has chosen to leave Ethereum and move to the Cosmos application chain because they want their chain's consensus layer to be more modular, sacrificing some security for scalability in the "impossible triangle." However, with the launch of Stack solutions by Layer 2 solutions like Optimism and zkSync, the "impossible triangle" seems no longer impossible.

Taking OP Stack as an example, it allows developers to build modular blockchains that can be easily customized to meet specific project requirements while relying on Ethereum to ensure security. The Stack solution balances security and improves Ethereum's scalability, providing DEX with better options on Layer 2, with large DEX even able to deploy Layer 2 application chains based on Layer 2 Stack.

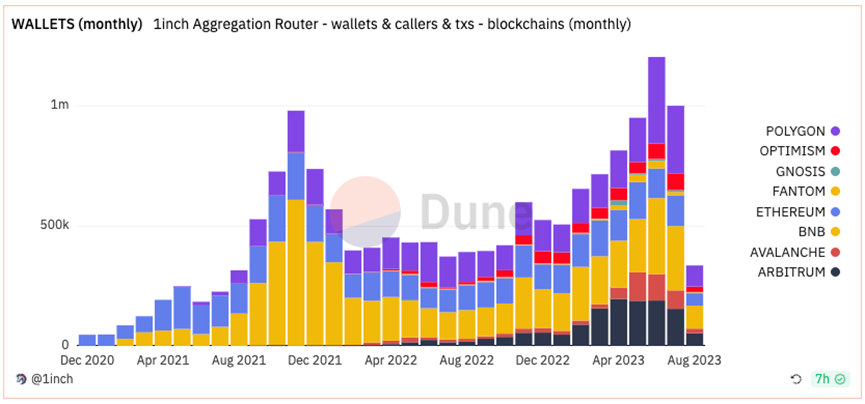

From a data perspective, in 2022, due to the FTX crisis, trader confidence was severely affected, leading to significant outflows from mainstream centralized exchanges, and a 72.9% drop in the market value of DeFi tokens. However, spot aggregators were not affected and even saw an increase. For example, 1inch Network saw a 13% growth in independent users in Q4, exceeding 2.4 million.

Source: Dune@1inch (2023.8.10)

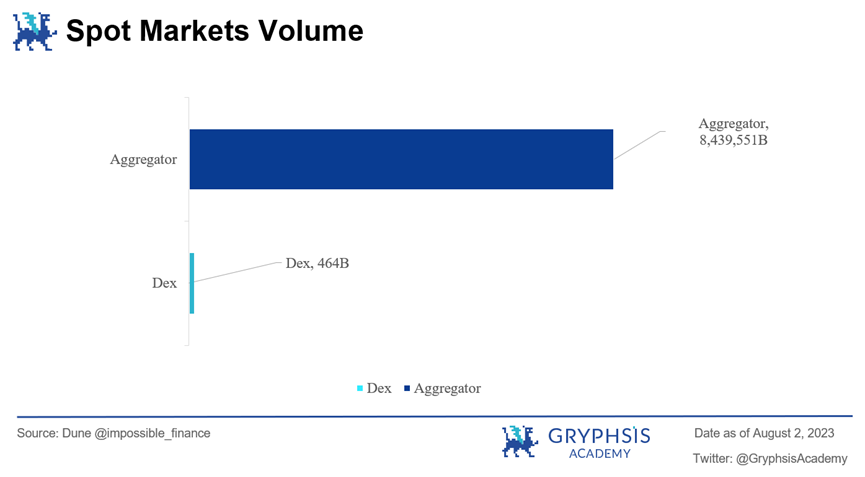

In the overall DeFi spot market, the trading volume of aggregators is nearly 20,000 times that of DEX, demonstrating the irreplaceable advantages of aggregators. Conversely, derivative aggregators have not yet developed relatively mature products, indicating significant growth potential. It is worth mentioning that on July 17th, the largest DEX protocol, Uniswap, launched UniswapX, a protocol that can aggregate decentralized exchange pool liquidity.

This protocol features aggregated liquidity, introduces third-party Fillers, and enables one-click cross-chain transactions, providing traders with the best prices that a single liquidity pool cannot offer. As a leading DEX, Uniswap accounts for 65% of the overall DEX trading volume. The fact that even DEX of this scale is moving towards aggregation further indicates the need for derivative DEX to move in the same direction.

Similar to spot aggregators like 1inch, Odos, and DeFillamaSwap, the goal of derivative aggregators is to use their algorithms to compare various protocols and find the best trading platform in terms of price and fees, facilitating the most effective trading path.

The benefits of derivative aggregators include:

- Smooth trading experience: Aggregators focus on optimizing the interface and user experience, making the trading experience similar to centralized exchanges.

- Liquidity comparable to CEX: Aggregators can integrate liquidity from DEX, CEX, LP, funds, and market makers, providing depth that surpasses typical DEX.

- Rich asset categories: Due to liquidity depth and risk management considerations, single DEX platforms have fewer asset categories, and adding assets often requires permission. Aggregators can combine asset categories from many DEX platforms, including assets that do not meet the conditions for trading on many perpetual contract protocols.

- Sustainable profitability: Traditional derivative DEX platforms need to allocate a portion of trading fees to LP or pay interest to attract deposits. However, aggregators do not need to provide liquidity themselves, so they do not need to increase yield or transaction fees to attract LP.

- Effective avoidance of token inflation: Aggregators do not need to attract liquidity by splitting revenue or distributing tokens as rewards to users. All fee income goes to the protocol, and tokens do not face inflation and selling pressure, significantly increasing their value capture capability and investment value.

- Low deployment threshold for new chains: Traditional perpetual contract DEX platforms are only deployed on one or two public chains, and the main difficulty lies in the high cost of attracting liquidity when expanding to new chains, which to some extent restricts the protocol's expansion. Aggregators can save liquidity incentives on new chains, enabling low-cost addition of multiple chains without liquidity restrictions.

- Optimal returns and Delta neutrality: Currently, the perpetual contract market has many GMX Forks with similar technical architectures and mechanisms, making it difficult to achieve differentiation. However, aggregators can find the highest-yielding DEX among many GMX Forks, maximizing returns for traders. Additionally, each aggregated liquidity pool acts as a counterparty for hedging, enabling LP to provide Delta neutrality through various on-chain asset combinations.

Challenges for aggregators: Potential price differences between protocols

Due to funding rates, liquidity depth, long and short positions, and other reasons, the same trading pair may have different pricing on different protocols. For derivative aggregators, the goal is not just to integrate liquidity on the frontend interface but also to balance and integrate price differences between protocols to provide traders with unified pricing.

Without unified pricing, aggregators are like a comprehensive DeFi webpage that collects prices from various protocols but does not fundamentally internalize integration. Unified pricing is the essence of aggregation, significantly improving user experience and reducing the learning curve, maximizing user benefits. Whether to smooth out price differences through algorithms or collaborate with underlying protocols depends on the capabilities of the aggregator.

In summary, derivative aggregators effectively combine the advantages of CEX and DEX, offering a smooth experience like CEX and trustworthiness like DEX, with massive liquidity and high composability, providing them with significant room for development. However, the challenge of unifying asset prices remains.

Currently, derivative aggregators are a vast blue ocean, with few mature products. The main protocols include: Uniswap X, UniDEX, MUX, and Sushiswap DEX aggregator.

MUX, originally a prototype of MCDEX, is a decentralized perpetual contract exchange driven by AMM deployed on Arbitrum. On December 1, 2022, MCDEX officially closed and was rebranded as MUX Protocol. MUX is deployed on Arbitrum, BSC, Avalanche, and Fantom, with a mechanism similar to GMX, allowing leverage of up to 100x. Its V2 version has added Liquity Routing, where when traders open positions on MUX, the MUX aggregator dynamically compares the trading prices offered by various protocols and recommends the underlying protocol with the most suitable liquidity depth, maximizing the reduction of the trader's overall costs.

Its advantages include:

Cross-chain Liquidity Sharing: In the upcoming V3 version, MUX will also support cross-chain aggregation, allowing its products to be used on public chains such as Arbitrum, Optimism, BSC, Avalanche, Fantom, etc. The MUXLP funds pools on different public chains can borrow from each other and share liquidity.

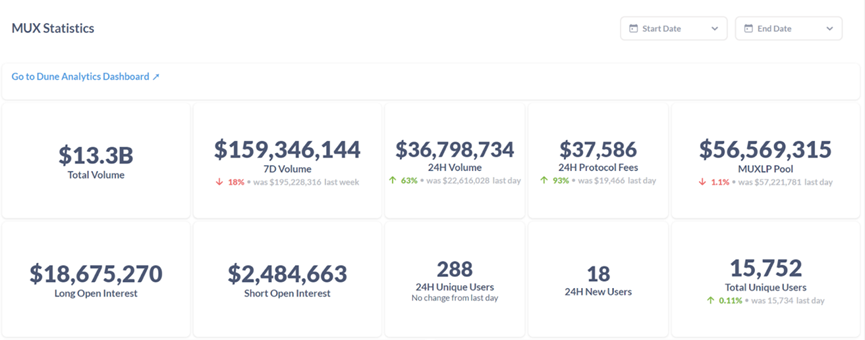

Unified Pricing: To address the issue of pricing differences, MUX will overcome this by deep collaboration with underlying protocols and absorbing price differences, providing traders with unified pricing for cross-chain positions. Traders do not need to be distracted by the liquidity providers behind the aggregator, they only need to focus on the unified trading interface. Currently, MUX's 7-day trading volume has reached $159M, surpassing Perpetual Protocol, showing promising development.

Source: MUX Statistics

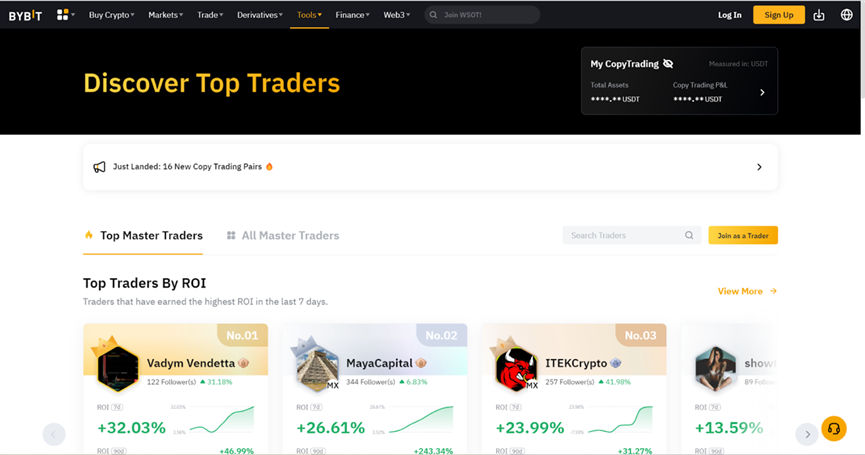

Copy trading, also known as social trading, refers to users on the platform copying the trading strategies of traders or KOLs. This method is commonly used on centralized exchanges, as it can help build the exchange's brand, attract traffic, reduce user operating costs, capture trading opportunities, and help the traders earn a share of the profits.

From a data perspective, for example, in 2022, driven by copy trading and contract trading, Bitget's total trading volume increased by over 300%. The platform's one-click copy trading product attracted over 80,000 traders and over 338,000 copiers, with profitable trades exceeding 42 million, making Bitget the only CEX to achieve counter-trend growth in derivative trading within six months of the FTX disaster.

Source: Nansen

Off-chain copy trading mainly consists of two modes: the first is the trading display of aggregation platforms, and the second is the one-click copy trading of trading platforms.

The first type of aggregation platform focuses on the "trading + community" business model, with typical examples being Pionex and Xueqiu. These platforms aggregate data from major exchanges through API access, gathering real-time trading data from many professional traders and KOLs. Ordinary investors can see the real-time operations of these experts on their accounts through the platform, which is more transparent and real compared to traditional "order screenshots."

Additionally, aggregation platforms create a community for communication, where users can identify real trading experts from the data through chat rooms and performance rankings, and receive guidance and advice from these experts. For professional traders and KOLs, aggregation platforms are the best promotional and traffic-generating tools, and paid subscriptions can bring substantial income. For users, it is an authoritative learning community with data-backed endorsements. For the platform, it not only attracts users and builds its brand but also provides alternative and practical user education.

Source: Pionex

The second type is the copy trading products of major exchanges, with Bitget and Bybit being typical examples. When users meet specific conditions (usually performance and follower count), they can apply to become a leader. Leaders showcase their positions to attract other users to copy their trades and share around 10% of the net profits of their followers.

Source: Bybit

Both modes have their pros and cons. The advantage of aggregation platforms is the comprehensive integration of data from major exchanges, providing convenience and completeness. They also conduct alternative user education through the community, increasing user stickiness. The downside is that copy trading is not convenient and requires external data access.

The advantage of exchange copy trading is the convenience of operation, the screening and promotion mechanisms for leaders, and the comprehensive risk control, providing security for user funds. However, the downside is that users can only blindly copy based on performance, without understanding the leader's reputation, trading logic, and quantitative indicators, which increases investment risk and is not conducive to user retention.

On-chain copy trading platforms can integrate with aggregators, combining the advantages of the above two modes.

- They integrate trading data from all protocols, list the performance rankings of traders, and match the best copy trading based on DEX liquidity depth.

- By creating a community for communication and linking wallet addresses with social media accounts like Twitter, they can showcase the investment logic and industry insights of the leaders.

- On-chain copy trading does not require permission, allowing anyone to become a leader and copy the trading strategies of others.

Currently, there are not many perpetual contract DEX projects with copy trading functionality, with the main protocols being Perpy Finance and SFTX.

Perpy is an on-chain copy trading protocol based on GMX. Any trader can create a vault in Perpy, attract copiers through Twitter, and the vault is directly linked to GMX through smart contracts. We can think of traders as fund managers who establish their own funds on Perpy, attract copiers for investment through social media, and are responsible for trading operations and collecting management fees. In short, traders and copiers have a fund manager-investor relationship, with copiers entrusting their funds to the traders for management and investment.

After launching in 2023, Perpy Finance's total trading volume reached $50M, while another protocol, STFX, reached $7.7M. Both projects have relatively low trading volumes, indicating that the on-chain copy trading market for derivatives is still in its early growth stage.

In 2022, the global on-exchange futures and options trading volume for traditional assets reached a new high for five consecutive years, showing strong growth. However, whether it is CEX or DEX, most products are related to crypto assets. Can DEX break free from the world of cryptocurrencies and enter the broader traditional asset derivatives market?

Using gTrade as an example, on August 1st, gTrade's open interest for traditional assets (commodities and forex) was $16M, accounting for 42% of the total volume. At its peak, the open interest for traditional assets reached three times that of cryptocurrencies, making a significant contribution to fees. However, this volume only represents a fraction of the trading volume for traditional asset derivatives, with much more potential waiting to be explored.

Compared to traditional futures commodity exchanges and CEX, DEX has the following advantages:

- Permissionless nature: Anyone can develop new products on the protocol without any authorization or approval, and anyone can trade these products without KYC authentication. This means that it can be more flexible and easier to add trading categories for traditional assets.

- Resistance to censorship: DEX can effectively resist manipulation by centralized institutions. In the face of increasingly strict central institutional scrutiny and delisting trends, DEX has a broader potential market.

- 24/7 trading: DEX can meet the personalized hedging needs of the market around the clock, overcoming the time limitations of traditional futures exchanges. In the future, DEX derivatives can include not only BTC and ETH but also agricultural products (soybeans, corn, and palm oil), metals (zinc, gold, and nickel), energy (crude oil, asphalt, and coking coal), and more.

Faced with such broad hedging demand for traditional assets, perpetual contract DEX has the opportunity to further expand the market and focus on developing traditional asset trading, creating differentiated advantages in specific asset trading within internal competition. DEX does not need to become the next Binance but should become the first decentralized Chicago Mercantile Exchange (CME).

Competition among decentralized perpetual contract trading platforms has become fierce. In the face of challenges, token and LP incentives are only temporary measures, and innovation and breakthroughs in mechanisms are the fundamental way forward.

- Seizing the opportunity, leveraging Ethereum upgrades to improve DEX infrastructure and increase throughput limits.

- Consolidating multiple sources of liquidity through aggregators and optimizing price to enhance the operational experience of DEX.

- Learning from centralized exchanges' copy trading functionality, introducing on-chain copy trading to simplify investment steps and lower the trading threshold.

- Exploring new paths, breaking free from the crypto world, and leveraging blockchain advantages to embrace the massive demand for traditional asset derivatives.

Decentralized exchanges already have advantages such as non-custody and high transparency. If they can provide the same quality of user experience and liquidity as centralized exchanges on this basis, the era of decentralized exchanges can be eagerly anticipated.

References

[1] https://uniswap.org/whitepaper-uniswapx.pdf

[2] https://blog.uniswap.org/uniswapx-protocol

[3] https://www.shfe.com.cn/upload/20230320/1679301499457.pdf

[4] https://news.marsbit.co/20230409091626346085.html

[5] https://dune.com/hagaetc/dex-metrics

[6] https://tokeninsight.com/zh/research/analysts-pick/beginners-guide-to-crypto-derivatives-kwenta-case-study

[7] https://tokeninsight.com/zh/research/market-analysis/crypto-decentralized-derivatives-exchange-2022-q3-report?_gl=1*19w2acb*_ga*MTE4MjUzMjMyMy4xNjg5MTY2MDY0*_ga_3F9MFYLVT6*MTY4OTI1Mzk4Mi4xMC4wLjE2ODkyNTM5ODIuNjAuMC4w

[8] https://foresightnews.pro/article/detail/20783

[9] https://dune.com/leveluptrading/gtrade-gains-network-gns

[10] https://dune.com/shogun/perpetual-dexs-overview

[11] https://foresightnews.pro/article/detail/23808

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。