Authored by: Carl, Techub News

On February 4th, Salvadoran President Nayib Bukele, who made Bitcoin a legal tender during his term, was re-elected with a 87% of the vote.

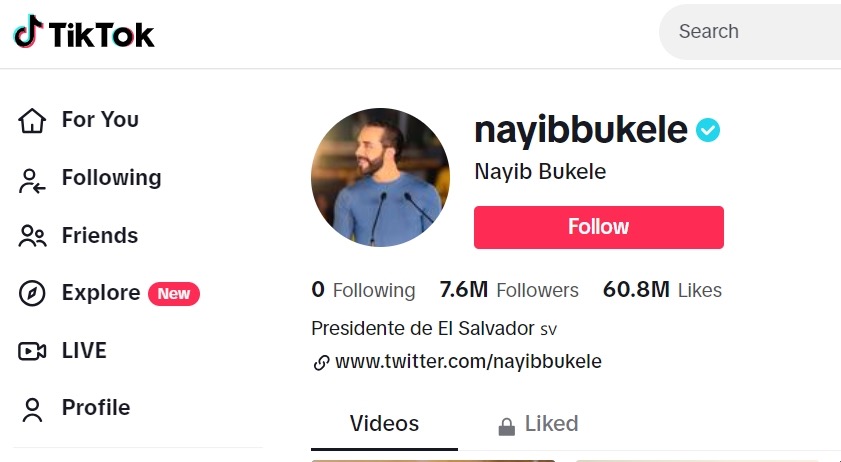

Over two years ago, El Salvador became the focus of attention for becoming the first country to adopt Bitcoin as a legal tender, and the Bitcoin-supporting President Nayib Bukele became an "international" KOL. Nayib Bukele currently has 7.6 million followers on Tiktok, exceeding El Salvador's total population (6.3 million).

After more than two years of recognizing Bitcoin as legal tender, El Salvador's Bitcoin policy has sparked numerous controversies, including opposition from the International Monetary Fund, nearly $70 million in losses from speculation, and low usage rates. However, Nayib Bukele's successful re-election seems to prove to the outside world that El Salvador's Bitcoin experiment has not failed as reported by the mainstream media.

National Speculation, from Losses to Profits

In June 2021, the Salvadoran Congress passed a bill approving Bitcoin as the country's legal tender. Three months later, on September 7, the bill officially took effect, making El Salvador the first country in the world to adopt Bitcoin as legal tender.

On September 7, Nayib Bukele announced that the government had purchased the first batch of 200 Bitcoins, and in the following two weeks, approximately 700 Bitcoins were purchased. El Salvador's actions were ridiculed by the media as "the president leading the national speculation."

At that time, the cryptocurrency industry was in the midst of a bull market, with the price of Bitcoin around $50,000 in September 2021, reaching a peak of $69,000 in November. Subsequently, the price of Bitcoin plummeted, hitting a low of $15,450 in November 2022.

During the decline, Nayib Bukele announced multiple purchases at low points. By mid-2022, El Salvador had spent approximately $100 million on Bitcoin purchases, with an average price of nearly $46,000.

At this price, at the lowest point of the Bitcoin price, the value of the Bitcoins purchased by El Salvador had shrunk by about two-thirds, resulting in a loss of $66 million.

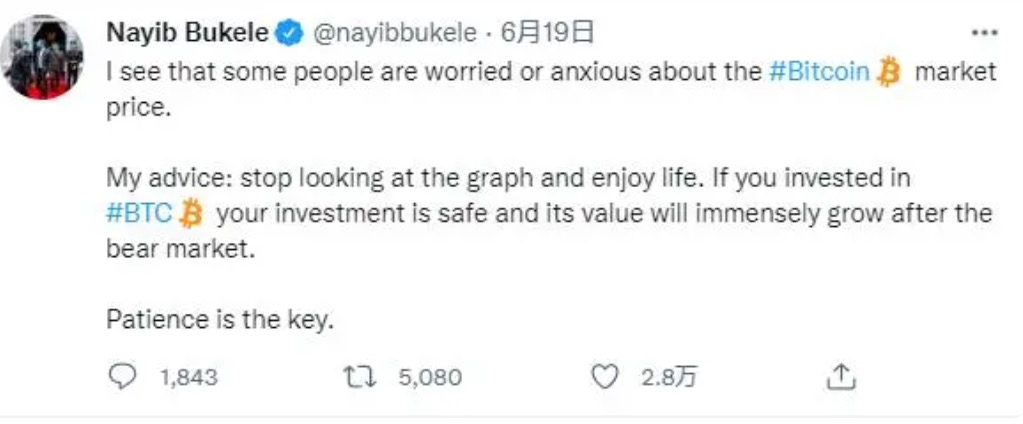

In response to social criticism, Nayib Bukele stated, "Stop looking at the charts and enjoy life. Its value will increase significantly after the bear market. Patience is key."

Recent market trends seem to prove Nayib Bukele right. Although the bull market has not truly arrived, El Salvador's Bitcoin investment is close to turning a profit. When the United States approved a Bitcoin spot ETF, El Salvador made a profit of $12.6 million from its Bitcoin investment.

Despite the significant fluctuations in the price of Bitcoin, El Salvador has not given up. El Salvador's Vice President Felix Ulloa recently stated that during Nayib Bukele's second term, Bitcoin will continue to be El Salvador's legal tender.

IMF: Significant Risks

As a Central American country known for poverty and violence, El Salvador's pioneering practice with Bitcoin is not well-regarded by the outside world.

In a statement in November 2021, the International Monetary Fund (IMF) expressed that Bitcoin should not be used as legal tender in El Salvador, as it poses "significant risks" to consumer protection, financial integrity, and financial stability. El Salvador must immediately implement stronger regulation and supervision, and protect the safety of dollar and Bitcoin funds through measures such as isolating reserve assets.

El Salvador rejected the IMF's advice, with its Minister of Finance stating that no international organization could force El Salvador to do anything, and that Bitcoin is a "sovereign" issue.

In response to El Salvador's policy, a group of U.S. senators jointly proposed the El Salvador Cryptocurrency Accountability Act, requiring the State Department to report on El Salvador's legislation to adopt Bitcoin as legal tender and plans to mitigate potential risks to the U.S. financial system. For nearly 20 years, El Salvador has used the U.S. dollar as its legal tender.

In response, Nayib Bukele stated that the U.S. has zero jurisdiction over sovereign and independent countries and should stay away from their internal affairs.

In early 2022, credit rating agency Fitch downgraded El Salvador's long-term foreign currency issuer default rating (IDR) from "B-" to "CCC." Fitch stated that El Salvador faces a $1.2 billion financing gap in 2022, which will increase to $2.5 billion by 2023, with nearly $1.2 billion in external debt maturing.

In January 2023, Nayib Bukele stated, "For the past year, almost all traditional international news media have stated that El Salvador would default on its debt before January 2023 due to its bet on Bitcoin. However, $800 million in bonds have been fully repaid."

However, after a delegation from the International Monetary Fund visited El Salvador, they responded that there was no risk in El Salvador because the use of Bitcoin is still limited. Due to Bitcoin's legal tender status, government encouragement of using crypto assets, and promotion of tokenized bonds, the usage of Bitcoin in El Salvador may increase, and potential risks still exist.

According to a recent survey by Chayanika Deka, 12% of the local population in El Salvador used Bitcoin to pay for goods and services at least once in 2023, compared to 24.4% in 2022.

In September 2023, a negotiating team from the International Monetary Fund stated after visiting El Salvador that the visit was "very productive." Although they do not support the use of Bitcoin as legal tender, they are working with El Salvador to address "technical issues" and minimize the risks associated with the country's adoption of Bitcoin as legal tender.

Tether, Binance, and Others Enter the Scene

However, from the results of over two years of practice, Bitcoin has not made El Salvador worse off, and El Salvador has made some good progress in the cryptocurrency field.

To promote the implementation of Bitcoin as legal tender, El Salvador established the National Bitcoin Office at the end of 2022, aimed at managing all projects related to cryptocurrencies. In early 2023, the Salvadoran Congress approved a bill on issuing digital assets, establishing a legal framework for all digital assets, allowing for the public issuance and transfer of digital assets, laying the legal foundation for its Bitcoin bonds.

In December 2023, the National Bitcoin Office announced that the Bitcoin bond "Volcano Bond" had been approved and is expected to be issued on the RWA securitization platform Bitfinex in the first quarter of 2024. In April of last year, Bitfinex obtained a digital asset license from El Salvador.

The cryptocurrency exchange Binance has also entered El Salvador. In August of last year, the Central Reserve Bank of El Salvador granted Binance a Bitcoin service provider license, and the National Cryptocurrency Committee granted Binance a cryptocurrency service provider license.

In June 2023, stablecoin giant Tether announced that it had participated in a renewable energy project in El Salvador worth billions of dollars, with plans to invest $1 billion in building the "Volcano Energy" renewable energy power plant, utilizing solar and wind energy in volcanic areas, aiming to create one of the world's largest Bitcoin mining facilities.

In May 2023, Jack Mallers, CEO of the Lightning Network payment app Strike, stated that Strike had relocated its global headquarters to El Salvador in response to the increasing anti-cryptocurrency regulations in the United States.

Recently, El Salvador also approved an immigration law granting citizenship to foreigners who donate Bitcoin to the Salvadoran government and economic development projects.

Previously, the Salvadoran government, in collaboration with Tether, launched a free visa program, allowing foreigners to obtain residency permits and citizenship by investing $1 million in cryptocurrency in El Salvador. According to Reuters, some foreign cryptocurrency promoters have already immigrated to El Salvador and are mainly concentrated in beach communities.

Image Source: Bitcoin Beach

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。