In the field of lending agreements with a scale of hundreds of billions, can Timeswap stand out with its unique product design?

Author: Luke @Jane, BuidlerDAO

Author's Note 🔖: Lending is a major track with strong demand, not inferior to trading. However, the development of on-chain lending protocols is far behind that of trading protocols. Unlike the prosperity of on-chain trading protocols, most lending protocols currently only support a few mainstream assets and are far less competitive than centralized exchanges.

The rise of on-chain protocols depends on two forces — strong user demand and the explosion of new asset categories. These two have fostered the prosperity of on-chain protocols and have created their own unique barriers compared to CEX. We believe that lending protocols do not lack user demand and new asset supply, but what is currently lacking is an important catalyst — a suitable protocol design paradigm.

The essence of lending is the transfer of time value, and the pricing of interest rates is actually the pricing of time value. Traditional lending protocols use "oracle + governance parameters" for pricing, which has obvious limitations. However, Timeswap (https://timeswap.io/) takes a different approach by separating the time value in spot tokens, using AMM trading to price the time value, and providing a new and elegant lending solution. By breaking away from oracles, Timeswap can support any asset without permission, breaking the bottleneck of previous lending protocols and creating a competitive experience for both lenders and borrowers.

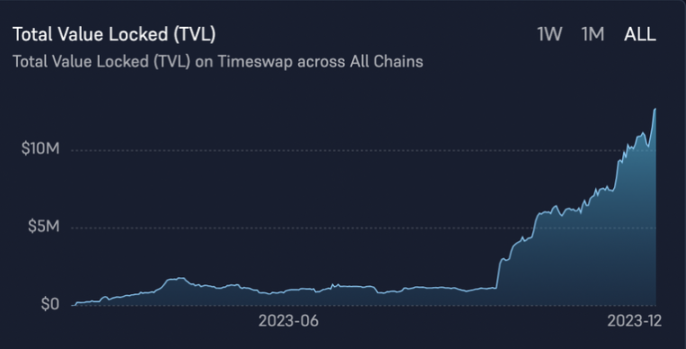

Timeswap's innovative protocol design, while also in line with market trends, leads us to believe that Timeswap has the potential to occupy a place in the hundred-billion-dollar lending protocol track. At the same time, Timeswap is still in a very early stage, with TVL just over $10M. Recently, it has gradually increased its operational activities (such as entering the LRT field), showing some good growth potential. Currently, Timeswap is using $TIME for liquidity incentives and plans to officially issue $TIME in Q1. Timeswap's last valuation was $40M FDV, and considering its potential, we believe that $TIME is an attractive target at this valuation and worth paying attention to 📈

The Achilles' Heel of Lending Protocols — Oracles and Governance

In the DeFi world, lending protocols may be the most "non-DeFi" type of protocol. The long-term vision of DeFi protocols is permissionless, non-custodial, and non-upgradable, while lending protocols heavily rely on governance and off-chain data (Oracle) due to their business characteristics.

The current model used by mainstream lending protocols is the over-collateralization model, which requires users to collateralize assets in excess in order to borrow. For example, collateralizing $100,000 worth of WBTC to borrow $50,000 worth of USDC. Over-collateralization is the only feasible lending model in the current DeFi world because in the crypto world, there is no identity, no court, and the only motivation for borrowers to repay is that the collateral is more valuable than the borrowed assets, with no concept of credit.

An increase in user debt interest or a relative decrease in WBTC price compared to USDC can lead to a situation where the user may be unable to cover their debt, and the borrower may default on repayment. Therefore, it is necessary to liquidate the user's position in advance, for example, starting liquidation when the price of WBTC drops to $80,000, allowing a third-party liquidator to take away collateral worth $80,000 and repay the $50,000 loan on behalf of the borrower. The liquidation threshold is crucial to ensure that liquidators have enough incentive to carry out liquidation, avoiding situations where they lack the motivation to liquidate in the event of a rapid price drop or insufficient market liquidity, leading to defaults.

From the above description, we can see that lending products need to know prices and market liquidity in order to initiate liquidation correctly. An asset may: 1) have trading pairs on multiple chains and multiple DEX/CEX; 2) its price and market liquidity cannot be easily obtained. For these two off-chain pieces of information, the former requires an oracle to provide the price, while the latter relies on governance — manually setting parameters such as LTV/Borrow Cap.

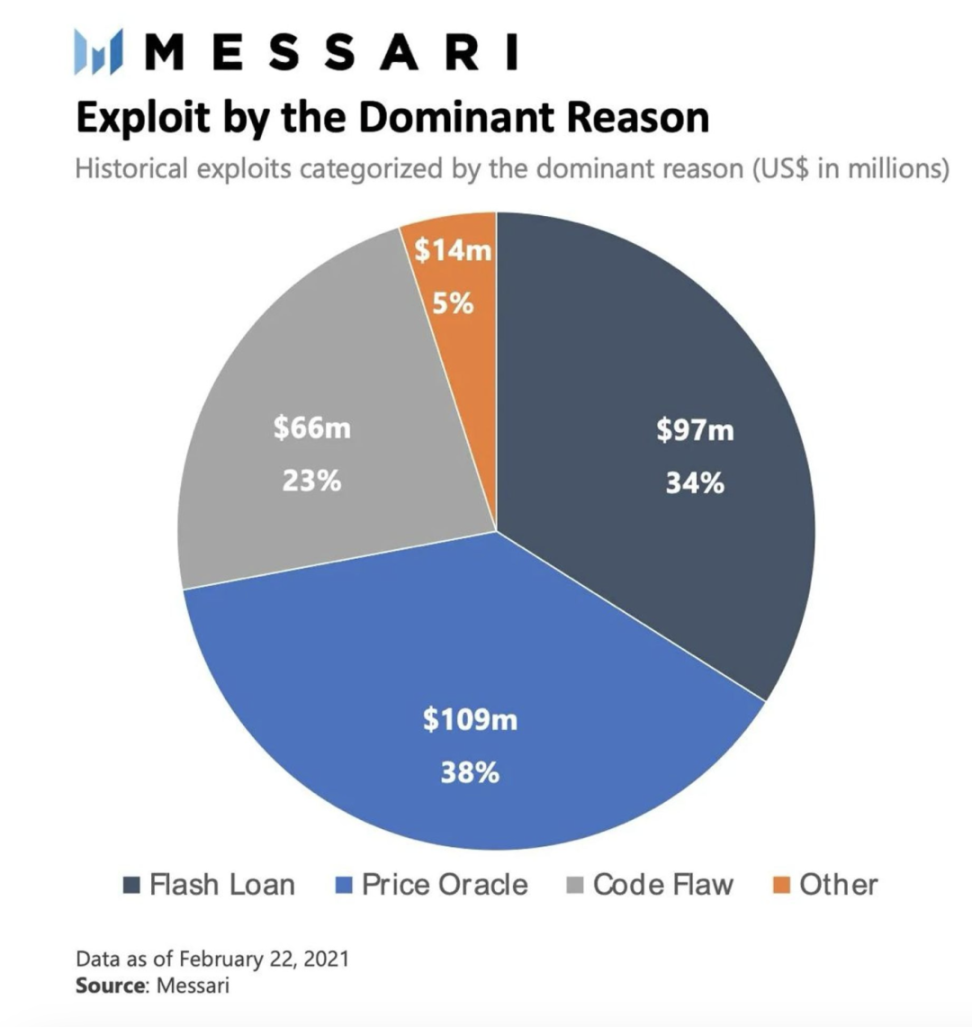

It is obvious that the current lending protocol paradigm has added many off-chain and human intervention elements, making it less trustless. This design is not only imperfect, but also makes lending protocols more risky and unable to scale. Trusting oracles is an additional form of trust and is subject to issues such as price feed errors/delays and accuracy problems. According to a report by Messari, as of February 2021, 38% of DeFi funds lost due to hacking events were related to oracle price feed issues, and the 34% share of flash loan attacks may also be related to price manipulation:

On the other hand, manually set governance parameters naturally cannot guarantee that they can always respond to various market emergencies. Both of these methods are not scalable and are difficult to support new asset types, such as LP Tokens/long-tail assets.

The limitations of the old lending paradigm are evident, as classic lending protocols are only suitable for a few mainstream assets with very conservative protocol parameters. Comparing the lending markets of CEX and on-chain lending, CEX can support lending for dozens of assets, while on-chain lending, exemplified by Aave and Compound, only supports lending for a dozen or so mainstream assets. From this perspective, the gap between decentralized and centralized lending markets is much greater than that between DEX and CEX.

For lending protocols, the most important competitive tool is asset support. New protocols often differentiate themselves by more aggressive asset listings, but under the old protocol design paradigm, this can easily lead to other risks. Even AAVE, which is only slightly more aggressive than Compound, has experienced defaults due to supporting CRV, and has been affected in every CRV incident. Most other more aggressive lending protocols have been severely attacked, and some have already closed:

- Venus has been in a state of insolvency after multiple attacks: https://twitter.com/WazzCrypto/status/1623078934836310017

- Mango suffered a price manipulation attack, losing over 100 million: https://twitter.com/mangomarkets/status/1579979342423396352

- Rari was attacked by price manipulation and the protocol is now closed: https://twitter.com/RariCapital/status/1455569653820973057

- … (There are really too many cases)

On-chain lending protocols have reached a bottleneck, but at the same time, new assets are constantly emerging on-chain. Therefore, we can see that among the top 20 tokens by volume on Uniswap, approximately 30-50% of the tokens are not listed on Binance, and more than half are not supported by Aave/Compound. In addition to long-tail assets, new types of assets are also unique to the on-chain world compared to CEX, such as LP Tokens. GMX's GLP and GM have a TVL of over 500M, which is 1/6 of the ETH TVL on ARB, and there are obvious lending scenarios. However, the demand for lending for these two types of assets is difficult to be met by CEX/existing lending protocols.

Timeswap's Unique Solution — Separation and Pricing of Time Value

There have been many lending protocols exploring the long-tail asset field, such as Euler, Silo, and many isolated pool mode protocols, but they have not broken free from the paradigm of classic lending protocols, just making improvements on the existing paradigm. Teller/Blend, on the other hand, eliminates the reliance on oracles but requires both lenders and borrowers to manually set interest rates, conducting peer-to-peer matching on-chain, which has a high threshold and low efficiency, especially evident in low-performance on-chain processes.

Timeswap is a very interesting protocol we recently discovered. They have eliminated the reliance on oracles/governance parameters by canceling the liquidation process. In contrast to Teller/Blend, Timeswap uses AMM to solve the allocation of responsibility between lenders/borrowers and the pricing of interest rates/risks, which is more suitable for the low-performance on-chain execution environment.

The essence of lending is the exchange of time value. Lenders are willing to sacrifice liquidity to sell the time value of funds to borrowers for a certain period. The protocol design of Timeswap also maintains this consistent train of thought, which is likely the origin of the name "Timeswap" ⏳.

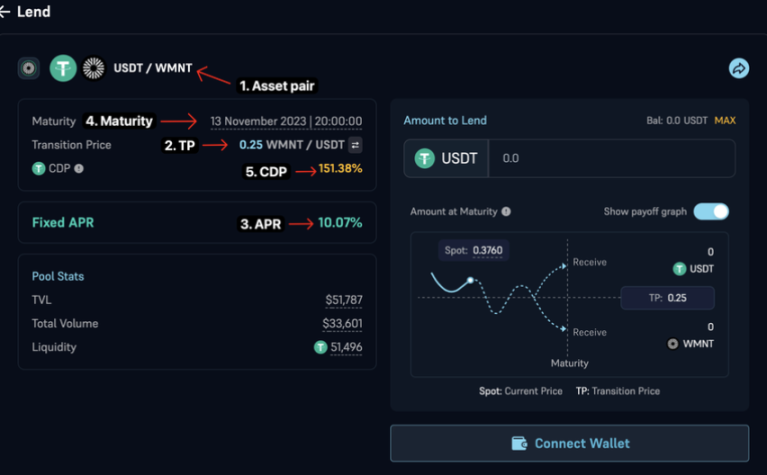

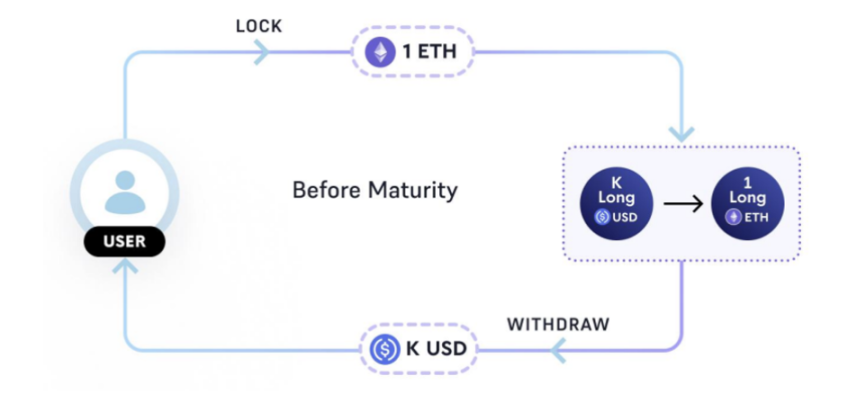

In Timeswap, there are different lending pools, and the creators of the pools will specify the token pairs (A/B), maturity date, and transition price (TP) when setting up the pools, as shown in the figure below. Different maturity dates and TPs will be divided into multiple pools.

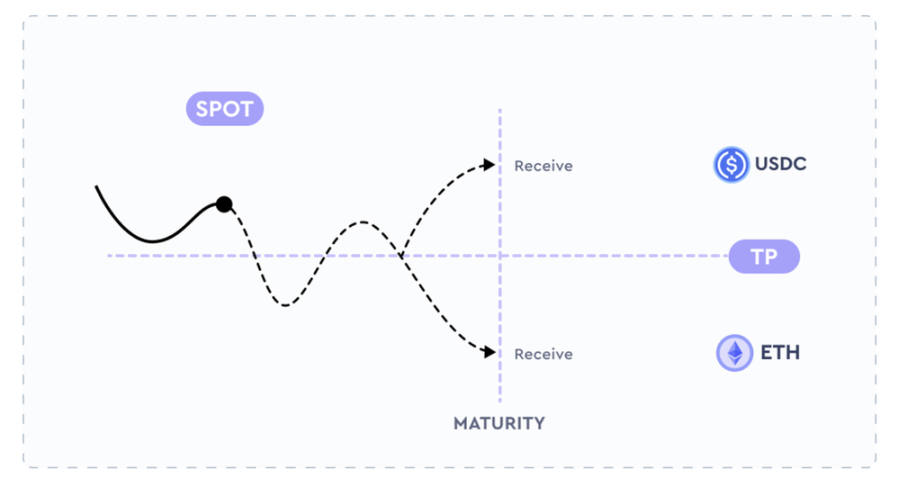

The design of Timswap does not involve forced liquidation and introduces the unique concept of transition price (TP). TP is the critical price at which the borrower's behavior switches. Taking the example of the USDC/ETH trading pair, when a borrower collateralizes ETH and borrows a certain amount of USDC, it can be anticipated that when the price of ETH is high, the borrower will repay to retrieve ETH, and when the price of ETH is low, the borrower will choose to default and continue holding USDC, with the collateral handed over to the lender, so the lender bears the loss without the need for a liquidator. In this process, the lender is similar to selling a put, and the fixed interest income is the option premium.

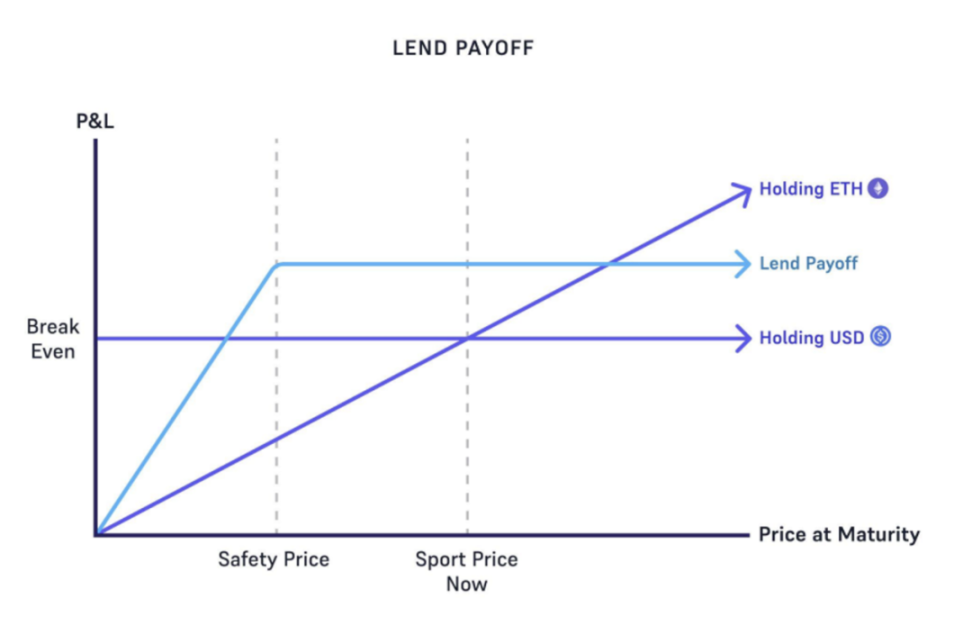

We can see that the lender's payoff curve is consistent with that of an option:

Lender Selling Time Value

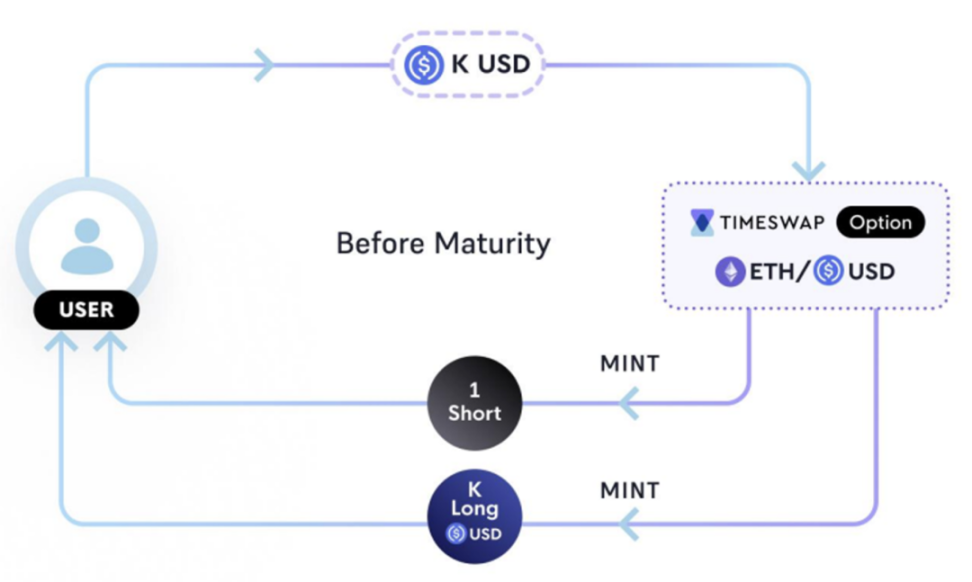

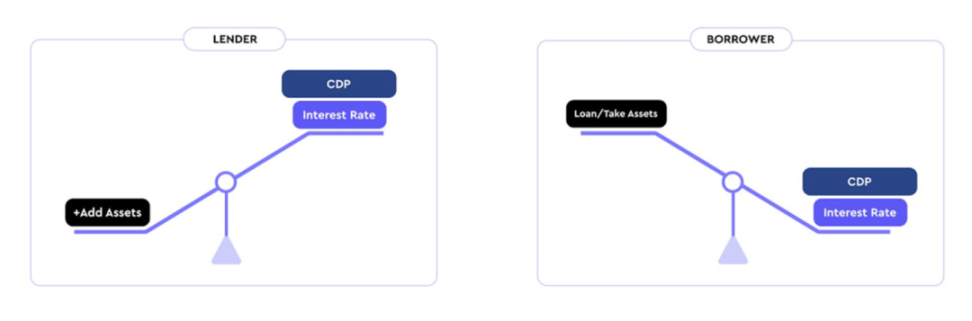

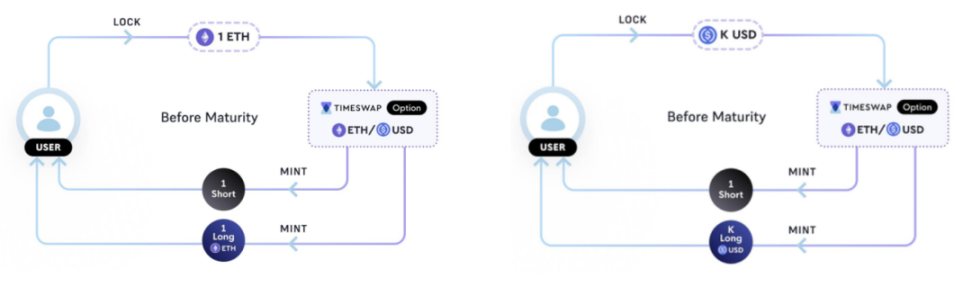

To carefully analyze the protocol design path of Timeswap, let's start from the perspective of the lender. Suppose that Xiaoming is a lender, ready to lend out K USDC for a period of 1 month. At this time, Xiaoming pays K USDC and receives two tokens in return:

- One token can be understood as a "promissory note," represented as Short in the figure. Through the promissory note, Xiaoming can retrieve the principal of K USDC after 1 month, but cannot use the funds during this month.

- The other token, represented as Long USDC in the figure, represents the time value of K USDC for one month. During this period, Xiaoming can freely trade this "time value."

In the Timeswap protocol, the contract that handles this separation of time value is called Time Option. Before maturity, this process can also be reversed. After maturity, Short can be exchanged for the principal, and Long USDC will lose its value.

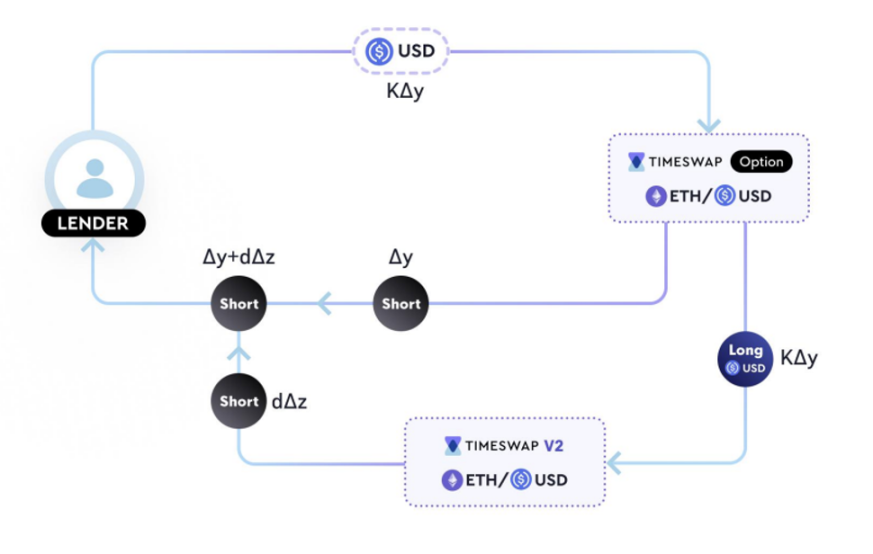

Relatively speaking, the price discovery logic for Short is clearer than for Long, so Timeswap uses Short to price Long. Based on the Time Option contract, Timeswap has developed Timeswap AMM for the exchange between the two derivative tokens (Long and Short).

Through AMM, the lender can exchange Long USDC for Short. After maturity, these additional Shorts can also be exchanged for spot assets, so these Shorts are the interest earned by the lender.

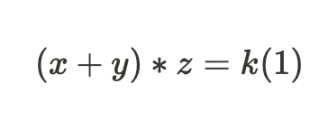

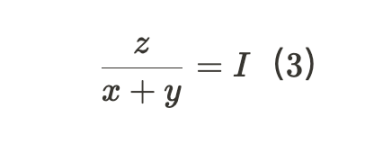

The specific AMM formula is as follows:

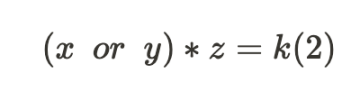

Where x represents the number of Long USDC tokens in the pool, and y represents the number of Long ETH tokens. However, because arbitrageurs will take away the asset with a higher external price from the pool, at any given time, there will only be Long USDC or Long ETH in the pool, meaning y = 0 or x = 0. Timeswap describes this characteristic as symmetry, so the actual formula that Timeswap uses is:

Where z represents the interest per second, and k is a constant product. The interest is paid in Short, so when the lender deposits Δx/Δy to exchange for Δz, the lender can withdraw Δz*d in Short based on the remaining time d.

The reason why the variable z is used in the AMM formula to indirectly achieve the exchange between Long and Short is because the lending protocol has the following two characteristics:

- The loan interest rate is inversely proportional to the utilization rate of the borrowed amount, meaning the higher the utilization rate, the higher the interest rate.

- At the same interest rate, the longer the borrowing period, the higher the cumulative interest, meaning it is positively correlated with the borrowing period.

This description refers to the interest rate, not the interest, so the formula needs to separate the time component from the interest. Long is the total interest, and by separating the time, we get the interest per second z. The interest rate formula is:

According to the previous logic, Long USDC is positively correlated with the deposited USDC, so when the lender deposits more USDC, x increases and z decreases, meaning the interest rate decreases, and vice versa. The interest rate and the funds are like a seesaw. The variable changes are consistent with the operation rules of the lending protocol. We believe that Timeswap has built an effective AMM formula.

So the complete process of lending for the lender is as follows:

By separating the time value into Long USDC through the Time Option contract, and then exchanging it for Short through AMM Swap, the lender sacrifices time value to earn interest. Because the interest can only be withdrawn after maturity and the total amount is fixed at the time of the swap, the effect for the lender is similar to a fixed interest rate.

Borrower Purchasing Time Value

While the lender sells time value, the borrower operates in the opposite direction, needing to purchase time value. To achieve this, we introduce another setting of Timeswap: the transition price (TP).

In the Timeswap protocol, the exchange rate between collateral and borrowed assets is always TP. Assuming 1 ETH = K USDC, i.e., TP = K, so depositing 1 ETH or K USDC into the Time Option contract will yield a Short and the corresponding Long:

When a lender deposits USDC, it represents lending funds, while when a borrower deposits ETH, it represents collateral. If the spot price is higher than TP, it is considered over-collateralized. When the spot price is lower than TP, the pool's function reverses, demonstrating the symmetry of the Timeswap protocol.

Because Short = K USDC - K Long USDC = ETH - Long ETH, we can deduce that ETH + K Long USDC = K USDC + Long ETH, leading to the relationship shown in the following diagram:

When a user deposits ETH, they can convert Long USD to Long ETH and retrieve USDC.

With this, the borrower's borrowing behavior can operate normally:

- Borrower deposits ETH, which can be seen as the process of depositing collateral. (Red area in the diagram)

- Borrower obtains Long USDC through Swap and exchanges it for real USDC, which can be seen as the process of borrowing USDC. At this moment, the Swap rate determines the interest rate, so for the borrower, Timeswap also functions as a fixed-rate protocol. (Yellow area in the diagram)

- The remaining Long ETH can be seen as collateral evidence. (Green area in the diagram)

When repaying, the borrower needs to reverse the process:

- Use USDC + Long ETH to obtain collateral ETH + Long USDC.

- Long USDC can be partially exchanged for Short, and then combined with Long + Short to merge into spot USDC, partially offsetting the USDC required for repayment in the previous step.

In summary, we have now fully explained the process of the borrower purchasing time value (borrowing).

Conclusion

Overall, the design of Timeswap is very clever. The Time Option contract separates the time value and principal of spot tokens, similar to how Pendle separates the current income of assets from the principal, making this part of the value more natural when traded and used. In contrast, some fixed-rate protocols forcibly lock tokens, leading to a price difference with spot assets to achieve fixed rates, which is actually a waste.

Timeswap's AMM design is also simple and fluid, similar to the feeling we had when we first saw the Uniswap formula. Through some clever ideas, the logic of variable changes in the formula is consistent with the business logic of user scenarios, making it a very elegant and classic AMM design approach.

Viewing Timeswap from Different Perspectives

Lender's Perspective

When a lender deposits funds:

- If the collateral price is higher than TP at maturity, the lender can retrieve the principal and earn fixed-rate income: Δz*d.

- If the collateral price is lower than TP at maturity and the borrower has no incentive to repay, the lender, at the TP price, receives collateral worth "principal + Δz*d" from the pool. This leads to a loss for the lender because the collateral's external market price is lower than TP. Therefore, when lending funds, the lender needs to have a certain judgment about future prices.

In the example above, the lender essentially sells an ETH Put with a strike price of TP, and the fixed income is the option premium. This design is similar to the popular structured financial product "Dual Currency" in centralized exchanges, meeting the common mindset of crypto users: having price judgments, being willing to "buy the dip" or "sell the top," and not excessively timing the market. In addition to purchasing Dual Currency, many users also have the habit of naked put selling or covered call selling.

Furthermore, Timeswap adds some flexibility, allowing lenders to withdraw funds before the maturity date. Borrowing is equivalent to selling a Put, and retrieving assets is equivalent to buying a Put or re-lending funds at the latest interest rate. Therefore, early withdrawal of assets is equivalent to trading options or doing interest rate swaps, with a risk of losing part of the principal.

Therefore, it is best for lenders to borrow money at high interest rates and withdraw money at low interest rates. For lenders who do not have the ability to judge interest rate changes, it is best to hold the debt until the maturity date, at which point they will receive the principal plus fixed income.

Borrower's Perspective

When borrowing, the borrower needs to deposit the collateral required for "principal + interest" into the protocol at once, i.e., prepaying all the interest. The borrower needs to repay before the maturity date, and if they fail to do so, the collateral is handed over to the lender to offset the principal and interest.

The capital efficiency depends on the TP setting. Taking ARB and USDC as an example, if the current ARB price is 2 and TP is 1, then each ARB can borrow 1 USD, with an LTV of 50%. The closer TP is to the market price, the higher the LTV and the higher the capital interest rate. However, at the same time, the lender bears higher risk, so generally the interest rate will also be higher.

Lender lending funds is similar to selling a Put, while borrower borrowing funds is similar to buying a Put, with the interest paid being the option premium. When the borrower repays, it is equivalent to selling the Put and retrieving part of the interest. This interest depends on the time of early repayment and will affect the actual interest rate borne by the borrower, but when the repayment date is close to the maturity date, this impact is very weak.

We can see that the maximum cost of the borrower's borrowing period is fixed, and early repayment does not affect the principal. This is different from the lender, as we can also see from the detailed explanation of the principles in the previous section:

- The lender, in the process, uses Δx of Long and AMM for Swap, so early withdrawal of the loan will affect the principal part.

- The borrower, in the process, only uses a quantity of d*Δz (prepaid interest) of Short and AMM for Swap.

Liquidity Provider's Perspective

Because Timeswap is a protocol based on AMM, pricing is completed through AMM, and LPs need to act as counterparties for both borrowers and lenders, holding both Long and Short, and serving as LPs. The process of becoming an LP is shown in the diagram above.

LPs can exchange Short for principal at maturity, and Long will be zeroed out. Short has the ability to truly exchange for principal at maturity, so the situation in which Short is purchased in the pool during LP liquidity provision directly determines whether LP will incur losses due to fluctuations in borrowing rates.

✨ Assuming LP provides liquidity, the first Borrow or Lend transaction occurs after a certain period of time.

Before the transaction:

- z remains unchanged, and the interest rate remains unchanged.

- The amount of Short that may be bought in future transactions is dΔz. As the time without transactions increases, d approaches 0, and dΔz also approaches 0, reducing the possibility of losses for the lender until it reaches 0.

After the transaction:

- If the transaction is a Borrow:

- z increases, the interest rate increases, Long in the AMM pool is bought, more Short remains in the pool, and LP earns additional interest income in addition to transaction fees.

- If the transaction is a Lend:

- z decreases, the interest rate decreases, Short in the AMM pool is bought, and LP incurs losses due to changes in interest rates.

Therefore, LPs need to make a certain judgment about the average interest rate in the future. Providing liquidity as an LP is a relatively low-risk decision when interest rates are low. When LPs withdraw early, they will go through the reverse process of the two images mentioned earlier. Depending on the situation, there may be some funds in the form of Short that can only be retrieved at maturity.

The Dawn is Coming, Can Timeswap Soar to the Top?

Timeswap at a Turning Point in Growth

Timeswap was founded by Ricsson Ngo in 2021. Ricsson Ngo is a master of financial applied mathematics, a serial entrepreneur, and a former editor of the most popular smart contract development course on Udemy. Ricsson was inspired by Uniswap and thought from first principles about how to use AMM to build a lending product without the need for permission or oracles, thus embarking on the entrepreneurial journey of Timeswap. On his Twitter, you can see his in-depth thoughts on time value and options.

Other core members of the team include:

- Harshita Singh, previously at Walmart India and ITC, and winner of the 2020 ETH India hackathon.

- Ameeth Devadas, former product management director at Aurigin, with a financial background and over 4 years of experience in crypto.

Timeswap launched its testnet in October 2021, its v1 version on the mainnet in March 2022, and its v2 version on the mainnet in February 2023. It is currently in a very early stage: TVL is approximately $13 million, with about 14,000 users, deployed on 7 chains (including Polygon, Ethereum, Arbitrum, etc.).

Source: https://analytics.timeswap.io/

It can be seen that from 231020 onwards, its TVL growth shows a clear turning point, as it launched Premine at this time, and participating in lending can earn $TIME token incentives. At the same time, TS also received incentives from STIP. This once again reflects the importance of token incentives for early protocols. Incentives can help the protocol try out suitable asset categories, attract the first wave of loyal users, and generate retention. "Fake volume" comes before real volume, and this is often the case in both Web2 and Web3.

The assets currently listed on TS are in the tens of millions, covering various categories, including mainstream assets, LP tokens, Vault tokens, long-tail tokens, LST, etc. For most of these assets, Timeswap is their first source of lending liquidity. Historically, Timeswap has collaborated with protocols such as Lido, GMX, Pendle, TraderJoe, Aura, and Stargate.

For mainstream assets, Timeswap competes with AAVE with certain advantages. Its fixed interest rates and no liquidation feature are borrower-friendly and can also promote the migration of a group of users. For lenders, the Timeswap experience is similar to structured finance on CEX, so there is also a clear supply of funds in the market.

However, user migration is always difficult. Leading protocols have better brands, TVL as a barrier, sufficient security budgets, and a long-term market-tested track record, so the potential of Timeswap to fully unleash its potential lies in long-tail assets and new asset categories (such as LP tokens, Vault tokens). The demand for these assets is evident, but old paradigm lending protocols and CEX cannot quickly and safely meet this demand, and the explosion of these assets is a long-term trend in the DeFi industry.

In conclusion, we believe that Timeswap has found initial product-market fit and is exploring suitable growth strategies to reach the next level of trading volume and influence.

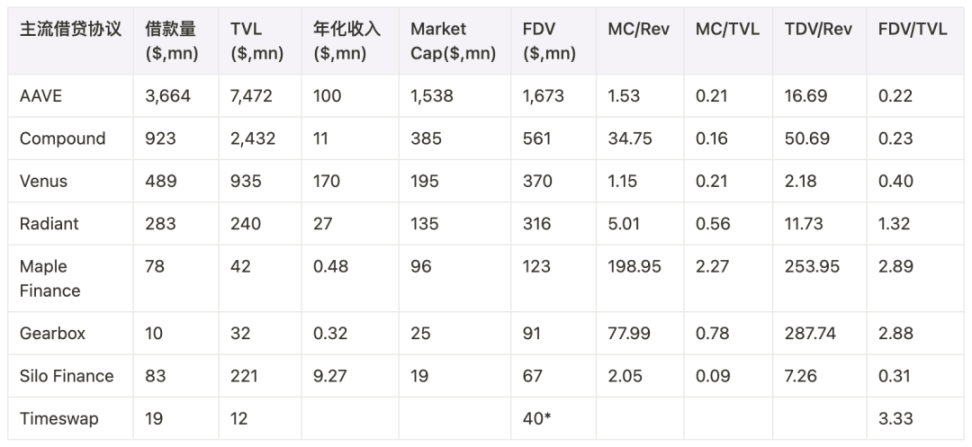

Valuation Levels of Mainstream Lending Protocols

From a quantitative perspective, comparing the valuation levels of current mainstream lending protocols, we can see that the ceiling of the lending track is relatively high. As a latecomer, Timeswap has ample room for development on one hand, but on the other hand, it needs to find unique survival and development strategies in the face of giants.

Source: Defillama, Tokenterminal, 2401

*: Seed round valuation in October 2021

The valuation levels of current lending protocols can be roughly divided into several categories:

- The first-tier AAVE and Compound: Both are far ahead in terms of borrowing volume, TVL, and market value; AAVE's market value is over $1.5 billion+.

- Top protocols in segmented markets such as Venus, Radiant, etc.: Venus is a top lending protocol on BSC, focusing on unique assets in the BSC market. Radiant has emerged in the lending track with a cross-chain + ARB narrative and ponzi tokenomics. Maple focuses on institutions and credit markets. These lending protocols do not have major innovations in their mechanisms, but they belong to a specific segmented market, with FDV of 1-3 billion.

- Euler belongs to innovative protocols, has a certain product-market fit, and has broken through the early stage of DeFi protocol development. Before being hacked, the borrowing volume was 225 million, and the FDV reached nearly $200 million.

- Lending protocols with single-point innovations such as Gearbox, Silo, etc.: Gearbox v2 supports leveraged lending strategies after borrowing, and Silo supports long-tail assets through isolated lending pools. The borrowing volumes of these two protocols are still in the millions, and their fully diluted market value is not over a billion, but in the tens of millions. These protocols have innovative mechanisms but are in the stage of not fully verifying product-market fit and have not yet exploded, belonging to the lower limit of Timeswap.

Currently, Timeswap belongs to the third category, with its previous round of financing (21.10) having an FDV of $40 million, led by @MulticoinCap, with @MechanismCap and @DeFianceCapital as co-investors. It also has a team of prestigious angel investors, including Polygon founder @sandeepnailwal, and former Coinbase executive @balajis. For reputation-focused DeFi protocols, this to some extent adds positive endorsement.

Seeking the Promised Land - Timeswap's Path to Value Advancement

Let's imagine the signs of TS's next development steps (internal factors) and potential catalysts and emerging trends (external factors) that could lead its intrinsic value to the next stage of hundreds of millions of dollars.

Some potential points may include:

Leveraging Hotspots to Find Narratives That Resonate More with the Community and Regular Users

From the perspective of successful adoption of the protocol, what can be done (technical feasibility) and what should be done (operational strategy) are not always completely equivalent. Lowering the threshold appropriately and gaining user acceptance is crucial. As Julian, the founder of the derivatives platform Aevo, recently tweeted, attracting user attention is a basic skill at present. Essentially, everyone is competing for the same liquidity, and whoever can capture a larger share of user mindshare and attention has a higher chance of success.

Source: https://twitter.com/juliankoh/status/1749047185080225835

The concept of Uniswap in the lending field proposed by Timeswap is more functionally descriptive, somewhat obscure, and difficult to convey value to a larger audience of DeFi users, let alone traditional institutional clients. How to more clearly convey its core value points to users, while leveraging the leverage of new narrative attention, may be the next step for Timeswap. Timeswap needs to find a narrative that makes it shine and elevate its business volume and brand reputation to the next level.

Recently, there has been a surge in LRT popularity, and Timeswap timely listed the LRT ETH lending market WETH/PT-weET, offering high $TIME token rewards. Through circular lending, the highest yield can reach over 160%. Although the pool depth is not large at the moment, we see this as a positive signal, indicating the team's ability to quickly respond to market trends and its strong business development and partnership capabilities.

Becoming the Leading Lending Protocol on a New Chain

In Timeswap's 2024 outlook, it lists an "aggressive" multi-chain expansion plan: expanding to multiple chains such as Monad, Berachain, X1, Solana, SUI, SEI, INJ, etc. Although the logic behind the team's choice of specific chains is not clear, from a liquidity perspective, new L2 chains typically have shallow liquidity, making pool prices easy to manipulate. This limits the AMM pricing value of Timeswap, allowing it to deploy on new chains early. New chains usually come with token incentives, boosting lending APY to attract users. If it can gain a leading position on a well-developed new chain, it can also bring significant incremental growth and brand exposure to Timeswap.

Potential Acceleration of Options Demand

This article mainly describes the principles and scenarios of Timeswap from the perspective of lending protocols, but at the same time, Timeswap is also an on-chain options protocol, cleverly implementing option pricing. Currently, the crypto options market is still in a very early stage, especially on-chain options protocols are still very niche. With characteristics of both lending protocols and options, Timeswap not only promotes effective price discovery but also implies the possibility of delving deeper into the on-chain options market in the future.

Although the turning point in the options market is not clear at the moment, with the entry of institutional clients who have more mature and substantial hedging needs, this may bring significant impetus to accelerate the development of this field. At that time, Timeswap may also focus on this feature and introduce a dedicated options UI. In addition, due to Timeswap's characteristics of options and structured products, it may also become the underlying infrastructure for many options protocols and CEX wealth management products.

Our Investment Judgment

Summary of Views

The on-chain lending protocol market has a high ceiling, with a relatively stable market structure in the past, dominated by market leaders, and is one of the few areas in crypto that has validated business models. However, the on-chain lending market is still very early, and today we have only illuminated a small corner of the big picture of on-chain lending protocols.

Long-tail assets, LP assets, and other emerging assets are the true gems of the on-chain and unstoppable trends. Support for these types of assets is the unique advantage of DeFi protocols. Timeswap's protocol design is innovative, simple, effective, and highly scalable, and it has the opportunity to unlock this part of the market, and even become a new leader and protocol paradigm. The team is already conceptualizing the V3 version of the protocol, and we look forward to its achieving better product-market fit.

Currently, Timeswap's operational actions are just beginning. On the positive side, Timeswap may be on the verge of an explosion, heading towards the stars and the sea. However, transformation is always difficult and full of uncertainty. The success of the protocol depends on whether subsequent operations can seize the opportunity, whether PMF can be verified on a larger scale, and whether it can capture the minds of the public. The current valuation of Timeswap is $40 million, and considering the ceiling of lending and the overall valuation of the track, combined with the evaluation of Timeswap's innovativeness, we believe that the current $40 million valuation still has investment potential and is worth betting on and continued attention.

Profit Strategy

Timeswap will undergo a TGE in Q1, and the economic model of $TIME, TGE method/price has not been announced yet. We will further analyze the investment value and participation method after the TGE details are announced. Currently, the way to obtain $TIME is to participate in the Pre-mine, and you can earn token incentives by being a Borrower/Lender on Timeswap, with most pools offering an annualized 30% to 100% $TIME incentive based on the last valuation of FDV.

At this stage, you can obtain $TIME by participating in the Pre-mine. The assets on Timeswap are mainly long-tail assets. To avoid the impact of collateral price risk and fully obtain rewards, a market-neutral strategy can be used, such as the following example using the USDC/ABR pool (collateralizing MNT to borrow ABR):

- In other lending protocols, borrow ARB using mainstream assets, for example, borrow 50 ARB.

- In Timeswap, as a Borrower, borrow U using ARB as collateral, for example, if TP is 1.2, then borrow 60 USDC using 50 ARB.

- Then, as a Lender, deposit the 60 USDC into Timeswap, where the collateral for the protocol is 50 ARB.

- In Timeswap, have two positions with consistent size and opposite directions, and regardless of the market price and TP relationship at maturity, you can always retrieve 50 ARB.

- At this point, you can repay ABR to the lending protocol used in step 1, completing the entire investment strategy.

The above process is a market-neutral mining strategy without ARB price exposure, and there is slight capital erosion due to the spread when depositing and withdrawing funds.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。