巨鲸的离场方式凸显市场透明度下降和风险教育的重要性。

撰文:Luke,火星财经

在金融市场的叙事中,没有什么比「聪明钱」的离场更能挑动交易员敏感的神经。而在加密世界,最「聪明」的钱,莫过于那些自混沌初开便存在的「化石级」比特币。最近,其中一位重量级玩家的举动,正让整个市场陷入沉思与不安。

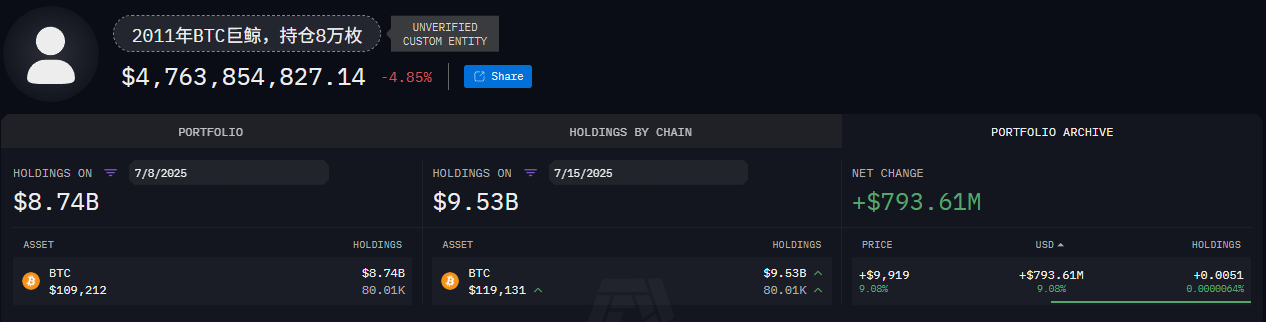

链上数据显示,一个自 2011 年以来便沉睡了长达十四年的比特币地址,已经苏醒。但它并非只是简单地动了一下。在过去几周内,它以一种冷静到令人不寒而栗的节奏,持续向外转移资产。截至目前,该地址已累计转出高达35,370枚比特币,按市价计算,总价值约41.6 亿美元。这批转出的比特币,已经占到了该地址总持仓的44.2%。

近一半的仓位,超过四十亿美元的财富,正在被一位持有成本几乎为零的远古巨鲸有条不紊地清算。这一系列操作如同一部精心编排的默剧,无声,却充满了戏剧张力。它迫使我们直面一个价值千金的问题:当这些见证了数轮牛熊、穿越了整个行业历史的「活化石」都开始大规模抛售时,我们是否已经站在了市场的顶部?

一位理性到可怕的「商业先驱」

要回答这个问题,我们首先需要厘清这位抛售者的身份画像。每当有早期地址异动,社区的第一反应总是指向那个神秘的名字——中本聪。然而,严谨的链上分析很快排除了这种可能性。

早在 2013 年,区块链研究员塞尔吉奥·德米安·勒纳(Sergio Demian Lerner)通过分析早期区块的「Patoshi 模式」,为我们描绘出了中本聪独特的挖矿指纹。勒纳发现,中本聪的挖矿行为更像是一位网络守护者,而非投机者。他有意识地控制并逐步降低自己的算力,以维护网络的去中心化,并且他挖出的绝大部分比特币至今从未动用。

而我们故事的主角,这位 2011 年的巨鲸,显然不属于「Patoshi」模式。他的行为模式更像是一位极具耐心和远见的「商业先驱」。他在比特币的蛮荒时代入场,或许是出于信仰,或许是出于投机,但他最终的目的,是在合适的时机将这笔数字财富兑现。十四年的等待,让一笔几乎可以忽略不计的投入,膨胀成了足以影响全球富豪榜的惊人资产。现在,他选择离场,这并非恐慌,也不是背叛,而是一个理性经济人在实现财富最大化后的必然选择。

理解了这一点,他的行为就变得不那么神秘,但却更加值得警惕。因为他不是一个冲动的散户,也不是一个需要追逐短期热点的基金经理。他是一个可以无视短期波动,只在宏观周期的关键节点进行操作的终极长线持有者。当这样一位参与者决定卖出将近一半的「传家宝」时,无论其动机是锁定利润、进行资产传承还是其他规划,其行动本身就是一个不容忽视的宏观信号。他认为,当前的价格,足以让他放弃未来一半的潜在涨幅,这本身就说明了问题。

专业退场:一堂价值 41.6 亿美元的「卖出」大师课

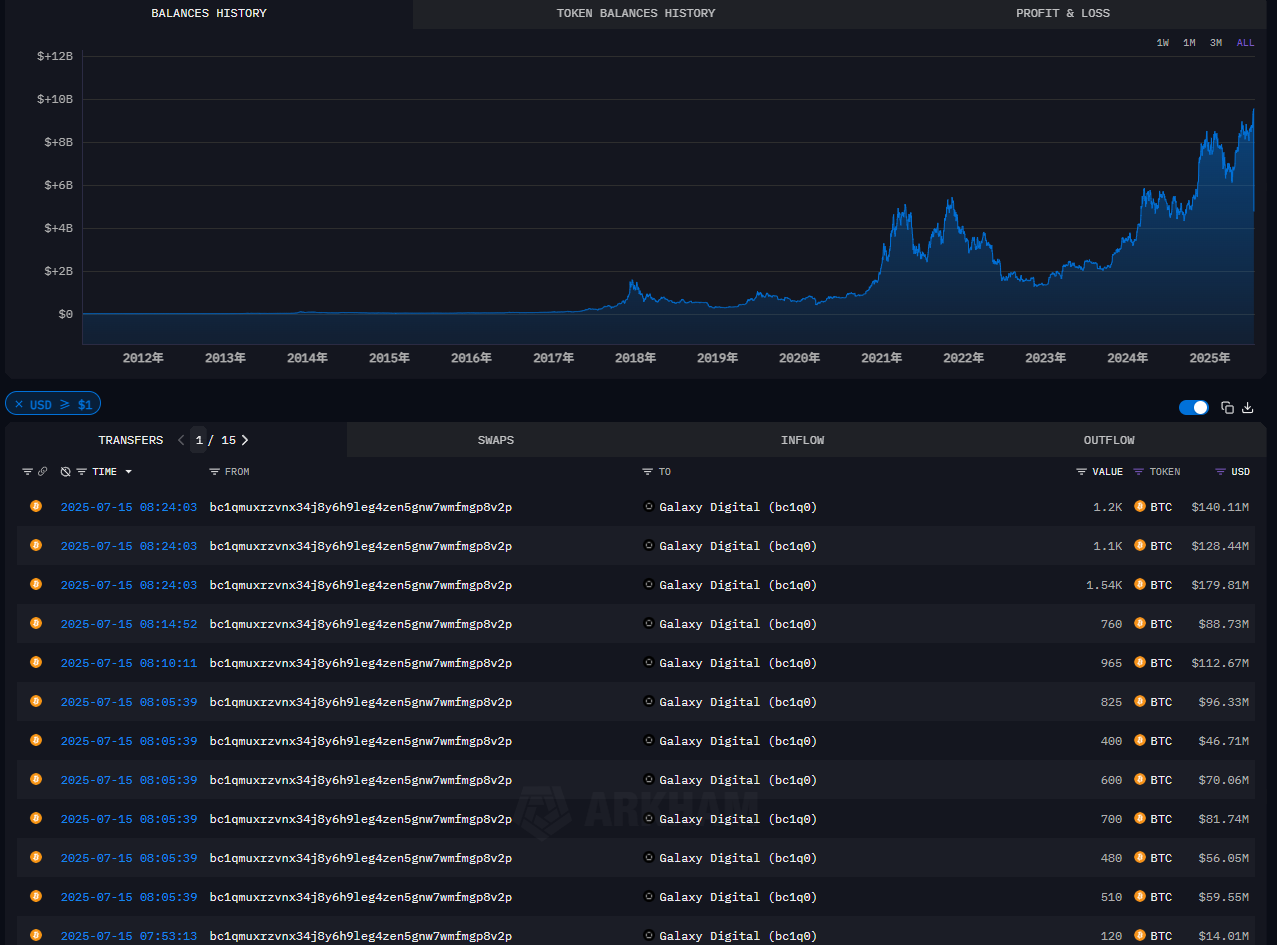

更值得市场深思的,是这次抛售的执行方式。这位巨鲸没有选择将数万枚比特币直接充入任何一家公开交易所的订单簿。他深知,如此巨大的卖单一旦公开出现,将瞬间摧毁市场信心,引发踩踏式抛售,其最终成交价将远低于当前市价。

他的选择,是加密金融发展至今最成熟的「大宗交易」解决方案——场外交易(Over-the-Counter, OTC)。链上路径清晰地显示,这笔价值超过 41 亿美元的比特币,最终的落脚点是华尔街资深人士迈克·诺沃格拉茨(Mike Novogratz)创立的数字资产金融服务公司——Galaxy Digital。

Galaxy Digital 的 OTC 交易台,正是为这类客户量身打造的。他们扮演的不是简单的中介,而是「首席交易对手」。他们用自己雄厚的资产负 - 债表先将这 35,370 枚比特币「接下」,为卖家提供一个确定性的成交价格,从而将市场波动的风险完全转移。然后,在接下来的数天、数周甚至数月里,Galaxy 的交易团队会利用复杂的算法交易系统,将这笔巨额订单拆分成无数笔无法被追踪的小额订单,悄无声息地在全球多个流动性池中进行消化。

这堪称一堂「卖出」的大师课。它向市场揭示了一个残酷的现实:当真正的巨鲸离场时,你可能根本不会在公开的订单簿上看到那张巨大的卖单。抛售的压力是真实存在的,但它被专业的金融机构「隐藏」了起来,化整为零,变成了市场日复一日的、看似正常的、难以察觉的持续性卖压。

诺沃格拉茨本人一直是加密货币机构化的鼓吹者,他曾表示,机构采用的「雪球已经开始滚下山坡」。而现在,他自己的公司正在完美地执行这场由远古巨鲸发起的、可能是史上最大规模之一的个人比特币清算。这构成了一种奇特的共生关系:机构化的基础设施,既为新资金的入场铺平了道路,也为旧神的优雅退场提供了完美的掩护。

历史的镜像:当巨鲸与政府共享同一本剧本

这位匿名巨鲸的操作并非孤例。一个看似与他毫无关联的实体——美国政府,在处理其罚没的比特币时,也采用了几乎完全相同的剧本。

通过对「丝绸之路」等暗网市场的打击,美国政府成为了全球最大的比特币持有者之一。如何处置这些价值数十亿美元的资产,同时又不扰乱市场,一度是令其头疼的难题。早年间,美国法警局通过公开拍卖的方式出售比特币,结果往往被投机者以极低的价格拍走,造成了国有资产的流失。

如今,美国政府也学聪明了。链上数据显示,近年来,美国司法部已将数以万计的、源自「丝绸之路」的比特币,分批转移至 Coinbase Prime——全球最大的合规加密货币交易所之一的机构级托管平台。其背后的逻辑与我们的巨鲸如出一辙:通过专业的、受监管的金融机构,进行有序、低市场冲击的清算。

当匿名的「化石级」巨鲸与全球最强大的主权实体,在处理巨额比特币时,不约而同地选择了相同的路径,这本身就说明,一个处理超大额加密资产的「行业标准」已经形成。这个标准的核心是专业、合规与风险最小化。但对于普通投资者而言,这也意味着市场的透明度正在以另一种方式下降。最大的买卖行为,正在从公开市场转向私密的 OTC 柜台,市场的价格发现机制,正在被一层机构化的「幕布」所遮蔽。

结论:是顶部信号,还是时代交替?

现在,让我们回到最初的问题:这是否意味着市场已经触顶?

从悲观的角度看,这无疑是一个强烈的警示信号。一位持有比特币超过十四年、穿越数次牛熊周期的「终极胜利者」,正在以百亿人民币的规模套现离场。这可以被解读为,在他看来,当前市场的风险收益比,已经不再具备长线持有的吸引力。这种「聪明钱」的撤离,是经典的顶部特征之一。

然而,从更宏观的视角来看,答案或许更为复杂。这次抛售,可能不仅仅是一个战术性的「逃顶」,更可能是一场战略性的「时代交替」。

首先,这位巨鲸的离场,是通过一个高度成熟的机构化通道完成的。能够消化他 41.6 亿美元抛压的这套系统,同样也能为新的 41.6 亿甚至 416 亿美元的机构资金入场提供服务。旧有资金的退出与新增资金的流入,可能正在同一个被隐藏的战场上进行博弈。

其次,这可能是一场代际财富转移。一位 2011 年的参与者,在十四年后,无论市场处于什么阶段,都有充分的理由进行资产多元化配置或进行财富传承规划。他的卖出,可能更多地是基于其个人生命周期的需求,而非对市场顶部的精准判断。

因此,将这次事件简单地定义为「触顶信号」或许是片面的。它更像是一个时代的里程碑。它标志着比特币的「蛮荒西部时代」的终结——那个时代,巨鲸的每一次异动都会引发市场的血雨腥风。同时,它也宣告了「机构博弈时代」的真正到来——在这个新时代,最大的买卖双方在公众视野之外进行着安静而庞大的交易,市场的深度和复杂性都已远超往昔。

对于普通投资者而言,这位化石巨鲸的抛售,与其说是一个明确的离场信号,不如说是一次深刻的风险教育。它提醒我们,在我们看不见的地方,市场的结构正在发生深刻的变革。那些最古老、最聪明的玩家正在离场,而他们离场的方式,预示着未来市场的游戏规则将更加专业、更加复杂,也更加「不透明」。顶部或许尚未来临,但游戏,确实已经变得不一样了。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。