Market share is not decreasing but increasing, Launchpool is launching new projects one after another, and the inscription market is "better late than never"…

Author: Gou, Foresight News

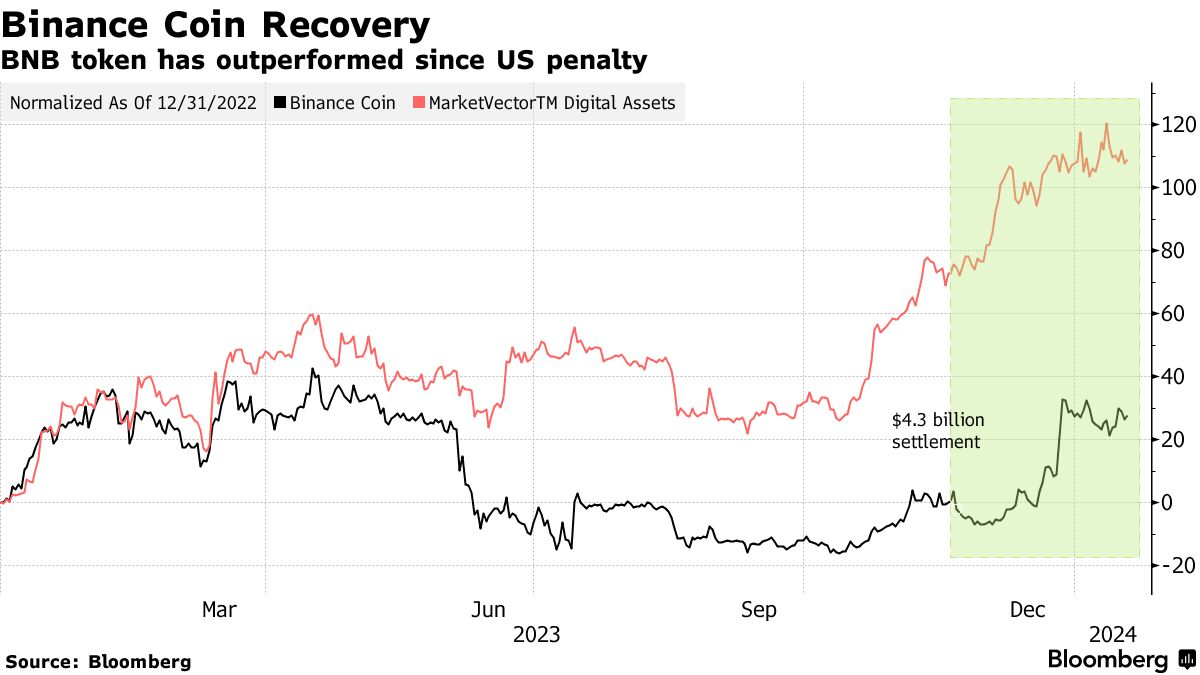

It has been more than two months since Zhao Changpeng stepped down as CEO of Binance and a series of "Binance incidents" such as Binance being fined billions of dollars. Although Binance is still fiercely battling with US regulatory agencies, the emotions that once made everyone sigh have gradually dissipated.

In these two months, the cryptocurrency market has witnessed a historic moment: the SEC approved the application for a Bitcoin spot ETF, officially integrating cryptocurrencies into the traditional financial market. Looking back over the past two months, with the catalysis of the approval of the Bitcoin spot ETF, the cryptocurrency market has begun to accelerate forward again. And Binance, which many people thought might suffer a "serious setback," has become more resilient in the "70 days after the disaster."

Market share rebounds for the first time in nearly a year

Data is the most indicative indicator of the situation of an exchange. Looking at the data from the past few months, we can see that Binance, which has been continuously suppressed by regulations last year, showed signs of "bottoming out and rebounding" after the dust settled.

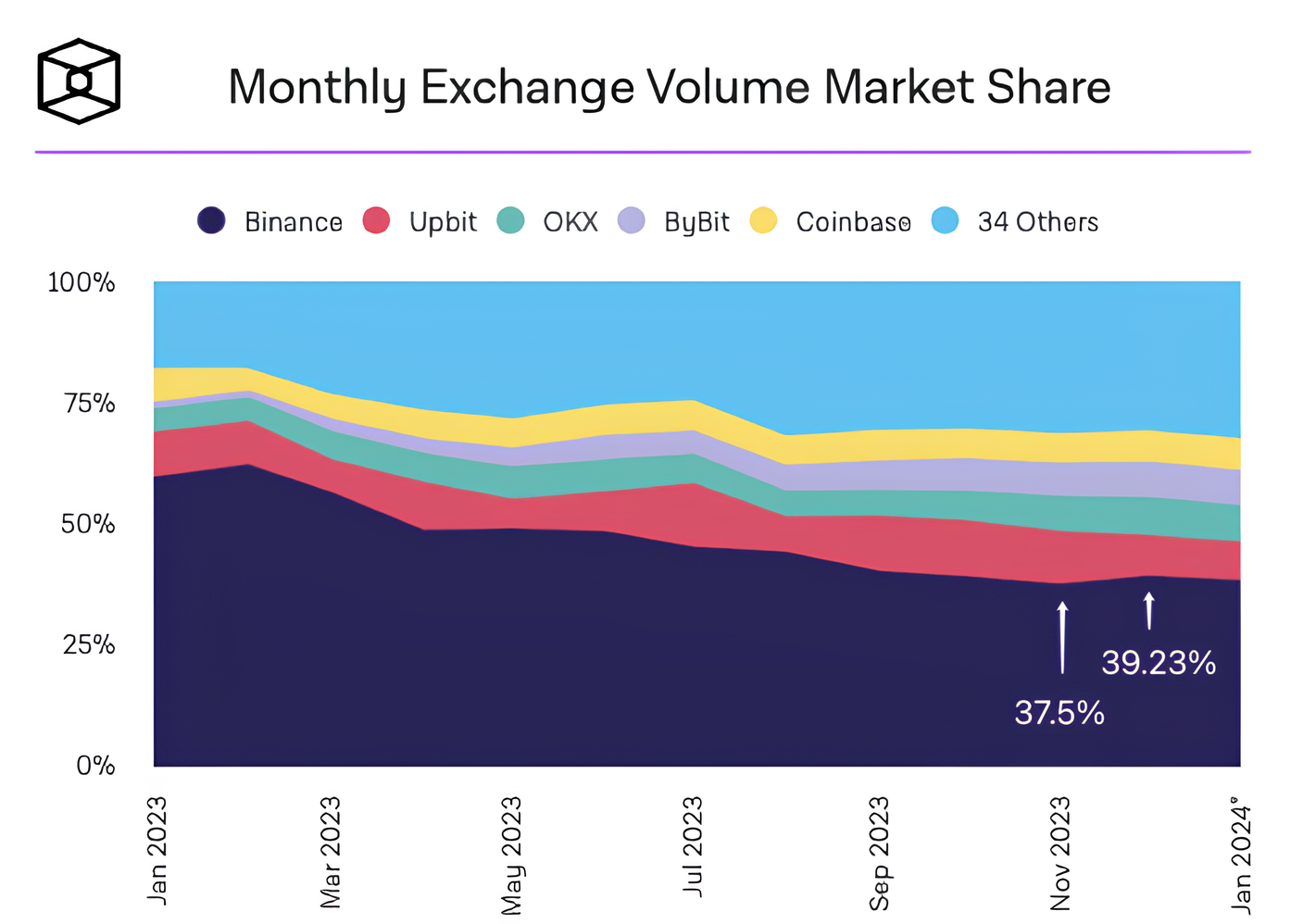

Starting from the beginning of 2023, according to the market share data calculated based on monthly trading volume, Binance showed a continuous decline. According to data from The Block, including exchanges that support and do not support USD, Binance's monthly trading volume market share peaked at 62.25% in February 2023 and had dropped to 37.5% by November of the same year. After the darkest moment, this data rebounded for the first time in nearly a year in December, rising to nearly 40% (the highest rebound ratio during the period of declining share did not exceed 0.2%, which can be almost negligible).

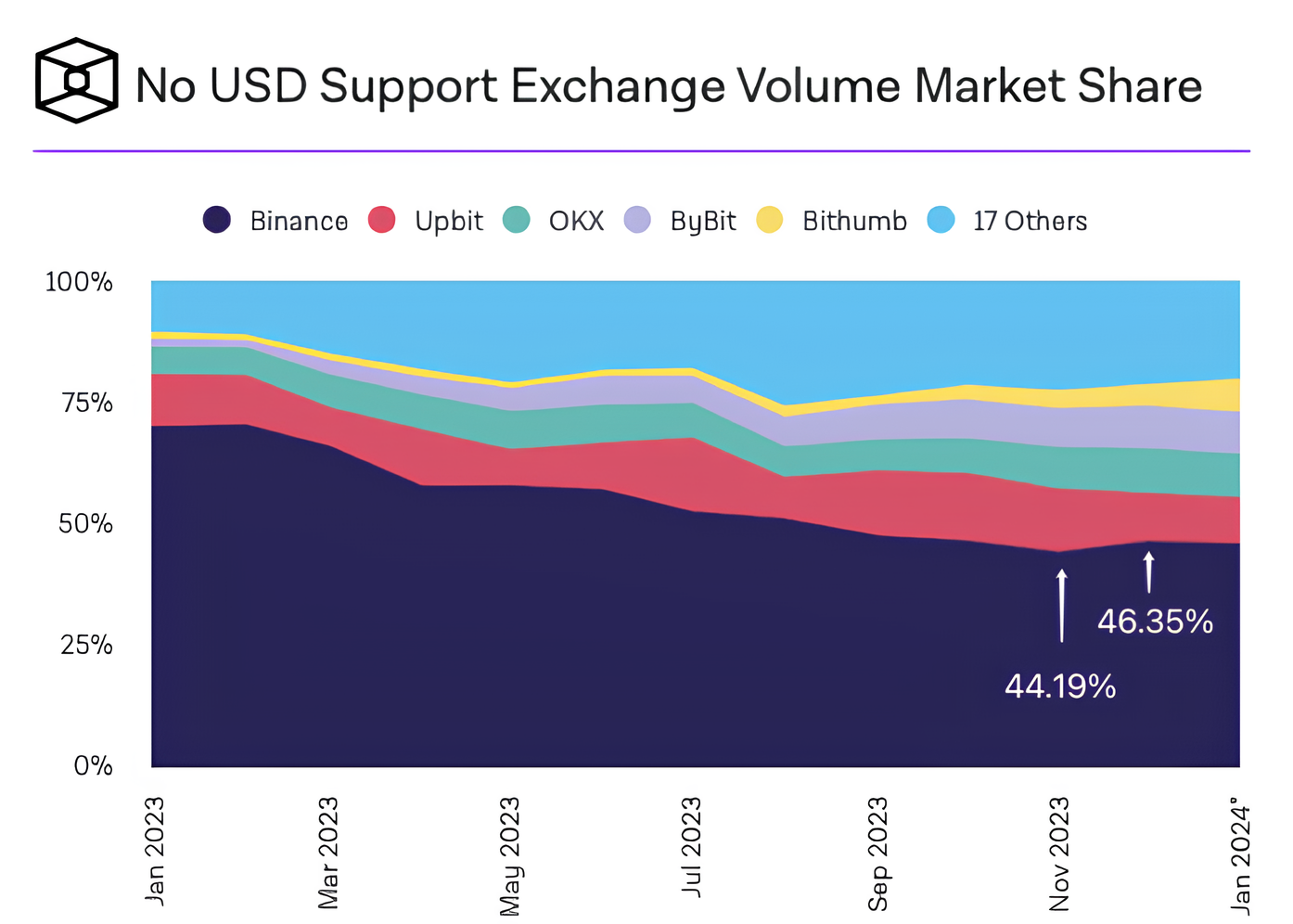

If only exchanges that do not support USD trading are considered, Binance's share has also risen from 44.19% in November of last year to 46.35%.

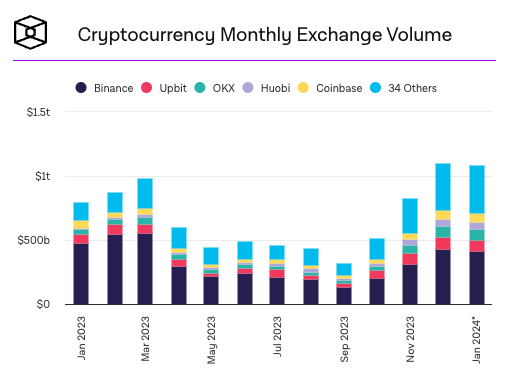

In addition, not only in terms of proportion, in terms of the absolute value of trading volume, Binance also achieved a month-on-month growth in December, increasing by 39.5% from $310.13 billion in November to $432.65 billion.

From the statistical data, it can be seen that although all the above data showed a slight decline in January, they still remained stable and did not show a significant decline as before.

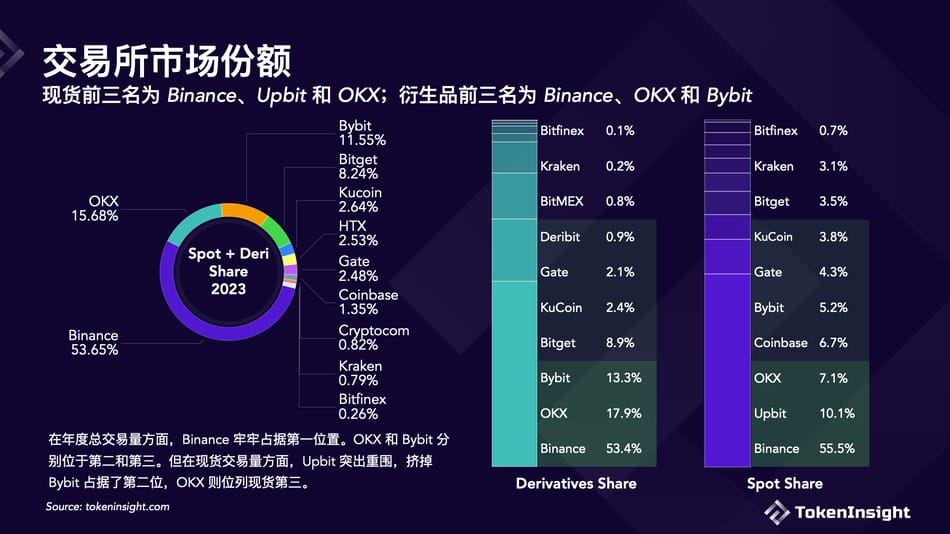

Breaking down into each type of trading product, according to TokenInsight's "Cryptocurrency Exchange 2023 Annual Report," in 2023, Binance's spot and derivative trading share was 53.7%, which is a decrease from 60.1% in 2022, but still occupies the first place in the market. If split into spot and derivative trading for comparison, Binance still maintains a market-leading position with shares of 55.5% and 53.4% respectively.

In addition, on the evening of January 18th, Beijing time, Bloomberg published an article stating that according to DefiLlama data, since reaching a settlement agreement with US regulatory agencies on November 21, Binance has recorded a net inflow of $4.6 billion, far exceeding the inflow of funds from other exchanges. Up to now in January (as of the 18th), the Binance platform has attracted $3.5 billion in funds, surpassing the monthly inflow of funds in any month since November 2022.

Image source: Bloomberg

The advancing Launchpool and the value return of BNB

Since mid-December, Binance has frequently launched 6 new Launchpool projects, a period that previously lasted for over half a year for the launch of 6 projects. The Launchpool, where users use FDUSD, TUSD, and BNB to participate in staking "mining" to obtain rewards in new project tokens, is one of Binance's major strengths. Although various exchanges have corresponding products, Binance's Launchpool and Launchpad are undoubtedly the focus of the market.

According to Binance's data, the participation amount for the 6 recently launched projects in Launchpool has been as high as several billion US dollars each time, with the number of participants ranging from tens of thousands to hundreds of thousands. Along with the enthusiasm of user participation is the gradual increase in the issuance of the new stablecoin FDUSD.

First Digital USD (FDUSD) is a US dollar stablecoin initially announced by Hong Kong digital asset trust company First Digital in June 2023. According to information provided by First Digital Labs, as of November 30, 2023, the issuance of FDUSD was approximately 966 million, and by December 31, it had risen to over 1.8 billion. According to CoinGecko data, the current issuance of FDUSD may be close to 2.6 billion (specific data still needs to wait for official statistics).

In addition to the benefit to FDUSD, BNB has also recently reversed its decline.

In 2022 and 2023, influenced by the overall market sentiment and the heavy blows from regulatory agencies, the price of BNB dropped from over $500 at the beginning of 2022 to around $180. Although it rebounded to nearly $400 at the end of 2022, it fell back to around $200 last year under the influence of various regulatory actions.

After the regulatory crackdown and the stimulation of intensive Launchpool activities, BNB rebounded from around $200 to nearly $340, outperforming the average market increase and to some extent, rebuilding market confidence in BNB.

It is worth mentioning that along with all these changes is not only the landing of regulations, but also the appointment of the new CEO, Richard Teng. The recent changes at Binance may also be related to Richard Teng's repeated emphasis on the strategic path centered on users.

Change is not just about data

In addition to the "visual" achievements at the data level, Binance has been advancing on all fronts in recent months.

In terms of globalization, on the 16th of this month, Binance announced in a blog post that after obtaining a cryptocurrency asset trading and brokerage license in Thailand, the cryptocurrency asset trading and brokerage platform under Gulf Binance, Gulf Binance, has officially commenced full operations in Thailand, under the name Binance TH by Gulf Binance (Binance TH), open to all eligible users.

Binance stated in a blog post that the Binance TH platform has adopted an order book designed specifically for Thai baht trading pairs, allowing Thai users to trade using local currency. Additionally, through integration with the order book of Binance Kazakhstan, a cryptocurrency asset exchange regulated by the Astana International Financial Centre (AFSA) in Kazakhstan, users can also access cryptocurrency brokerage services through the Binance TH platform.

In terms of exchange functions, Binance highlighted the latest developments in copy trading functionality. Binance's copy trading feature was launched in October last year, with an average weekly trading volume exceeding $2 billion in the three months following its launch. According to a blog post released on the 16th of this month, the latest update to Binance's copy trading feature includes simulated copy trading, private chat rooms, and the introduction of the Sharpe ratio indicator to help users better evaluate the performance of copy trading providers.

Rohit Wad, Chief Technology Officer of Binance, stated that copy trading is intended to establish a social trading platform. In fact, the author believes that copy trading is a product that can increase user stickiness. Users will gradually form usage habits for the product through interactions with experienced investors, and this will also help Binance further solidify its leading position in the industry.

Furthermore, successfully passing the SOC 2 Type II compliance audit is also an important milestone for Binance. SOC 2, developed by the American Institute of Certified Public Accountants (AICPA), audits an enterprise's control measures for data security, availability, processing integrity, confidentiality, and privacy. For cryptocurrency exchanges, which are often criticized for being "opaque," passing the SOC 2 audit is an affirmation of Binance's internal control mechanisms.

Binance Web3 Wallet Launches Inscription Market

The product that has recently garnered the most attention at Binance is undoubtedly the Binance Web3 Wallet. In the realm of Web3 wallets, early pioneers such as OKX and Bitget Wallet enjoyed the first wave of industry dividends, leveraging the user base of the exchange itself and the continuous integration of new projects and features.

In this regard, Binance seemed somewhat slow to react, but in order to catch up with the "homework" it missed, Binance has been playing catch-up. Earlier this month, Binance released an update to the Web3 wallet, adding support for 29 DEX and 15 cross-chain bridges, integrating 19 DApps including 1inch, Compound, Convex, Curve, CyberConnect, Frax Finance, GMX, MakerDAO, Maverick, and Radiant Capital, and adding support for opBNB and Linea.

Amid community anticipation, the Inscription Market finally landed on the Binance Web3 Wallet on February 1st. The Binance Inscription Market integrates Unisat, supporting over 60,000 popular BRC-20 tokens, and supports multiple other chains through DApps, as well as a BTC transaction accelerator designed to speed up transactions. With continuous iterative optimization, it is believed that Binance can provide even more satisfactory results. As a "new concept" in the Web3 market, although many wallets have long supported inscription trading and other functions, given that it is still in its early stages, Binance still has the opportunity to "overtake on the bend" in this field.

Binance's "Three Pillars"

After years of development, Binance has formed an overall structure consisting of "exchange + Binance Labs + Binance Web3 Wallet."

The exchange is always at the core, with Binance Labs serving as an affiliated investment and incubation structure that leverages the high-quality resources and accumulated financial advantages brought by its leading position in the industry to support the faster development of high-quality projects. For projects, after issuing tokens, there is no need to worry about listing on exchanges and establishing token liquidity, and Binance can also use this advantage to attract more high-quality projects and excellent teams in need of support, attracting more users. The two complement each other.

As a new product, the Web3 Wallet not only lowers the entry barrier for new users into Web3 but also provides convenience for existing exchange users to transition to the on-chain market. In the future, users can interact with various DApps directly in a single app, without the need to switch between different tools for different scenarios. In the next market cycle, Binance's accumulated advantages will further expand, and the three pillars of exchange, investment incubation, and Web3 Wallet will further integrate to form a closed-loop ecosystem for the exchange.

In the past year of 2023, as Binance expanded its scale, it paid a painful price for its early rapid growth, and the decline in market share confirmed the saying "easy to conquer, hard to defend." Fortunately, at present, Binance has already found a balance between offense and defense.

Entering 2024, Binance, which has already emerged from nearly a year of gloom, is looking towards the future and starting anew.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。