Author: MIIX Capital

1. Research Report Highlights

1.1 Investment Logic

Pyth Network, as a Solana version of Chainlink, provides price data oracles and market data to blockchain projects. It provides "mission-critical level" price data in a secure and zero-latency manner for various asset categories such as cryptocurrencies, forex, commodities, and stocks.

Pyth Network currently offers over 350 different data sources from multiple exchanges including Cboe Global Markets, Jane Street, CMS, Binance OKX, Two Sigma, and others. The PYTH token is used for staking and governance within the Pyth Network, creating strong potential demand for stakeholders who want to influence the protocol's future direction.

The team background is mostly from Jump Trading, with a certain pump-and-dump coin attribute.

1.2 Valuation Explanation

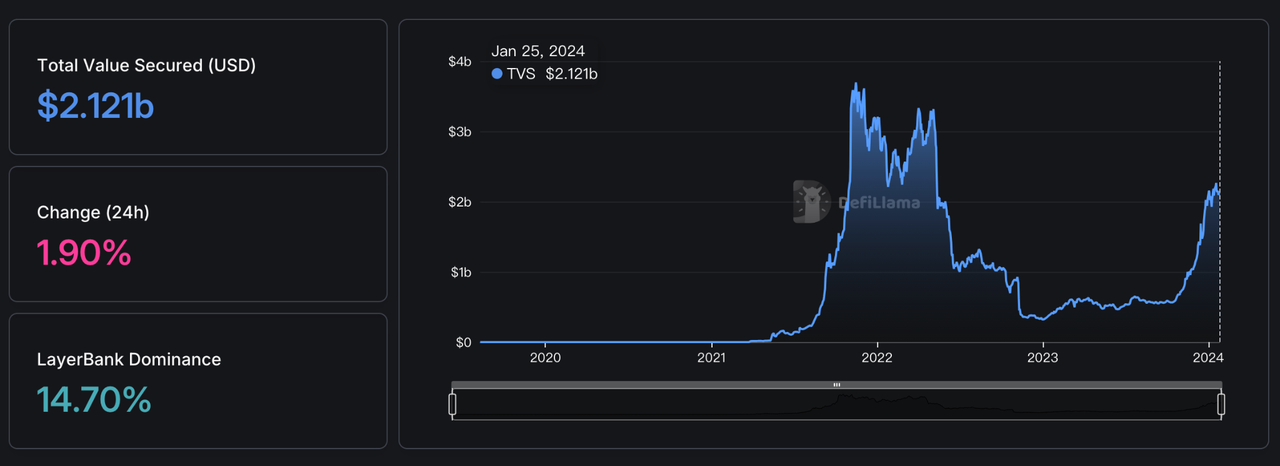

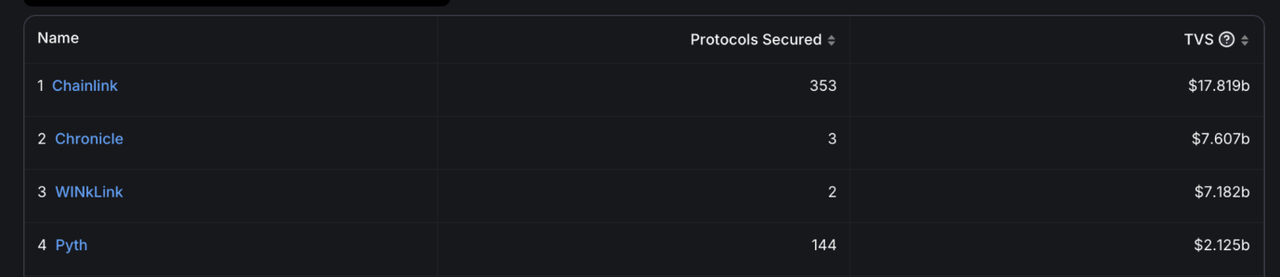

Currently, Chainlink's FDV has a 0.95% discount compared to the total collateral value (the total value of assets in the protocols served by its oracles). If the same indicator is considered, Pyth's total collateral value is 21.21 billion USD, so the fair FDV is around 20.14 billion USD (2.121B * 0.95).

$PYTH has 15% circulation at TGE, bringing its current market value close to 600 million USD, but the fair price is 0.3 USD. Based on on-chain demand, a price above 0.3 USD would overvalue $PYTH. Considering Pyth's future potential, a fair 2-3x premium is reasonable, around 0.7-0.9 USD. Buying $PYTH at a price lower than 0.25 USD (currently at a minimum of US$0.22) has significant potential for multiplication. If its trading price exceeds 0.70 USD, it may not be a good time to buy.

In the long run, Pyth Network has good potential and has some differentiated advantages over Chainlink, allowing it to capture a good market share.

1.3 Main Risks

Saturated data provider market

The current data provider market is already very saturated, and Pyth Network can only provide price information, which may result in a much lower data volume compared to its competitors. Although Pyth also provides confidence intervals, which may make it slightly prominent, other data providers are fully capable of adding this feature.

Risk of providing malicious data

Pyth mainly uses data aggregators to avoid publishers providing malicious data. (Authorized publishers can upload data for free).

Pyth Network has experienced data errors, with significant deviations in Bitcoin prices on its platform leading to market instability. Additionally, the project is initially based on Solana, which may face limitations and risks due to a single blockchain infrastructure.

Pyth's fee structure

Pyth's payment structure follows the "volunteer's dilemma" model in game theory: only when nodes cooperate with each other and jointly publish accurate data can each data update node receive the maximum token reward.

If users need individual payments to update information and can only access this information after payment, they may actually be more inclined to pay. However, due to the potential for freeloading (obtaining information without payment), users may actually be very unwilling to pay, or at least wait for information updates.

2. Project Overview

Pyth Network, developed by Douro Labs, is a next-generation price oracle solution aimed at providing valuable on-chain financial market data to projects, protocols, and the public through blockchain technology, including cryptocurrencies, stocks, forex, and commodities. Pyth Network collects first-hand data from over 90 trusted data providers, including well-known exchanges, market makers, and financial institutions, for use by smart contracts and other on-chain or off-chain applications.

2.1 Business Scope

Pyth Network's data business covers a wide range of asset categories, including cryptocurrencies, stocks, forex, ETFs, and commodities, with 250+ applications trusting Pyth data, including DEXs, lending protocols, and derivative platforms.

Additionally, Pyth Network is not limited to a specific blockchain, with 45+ blockchains actively receiving real-time market data from Pyth to power their DeFi ecosystems. Pyth's 80 million+ updates per day enable more precise and secure operations for your smart contracts.

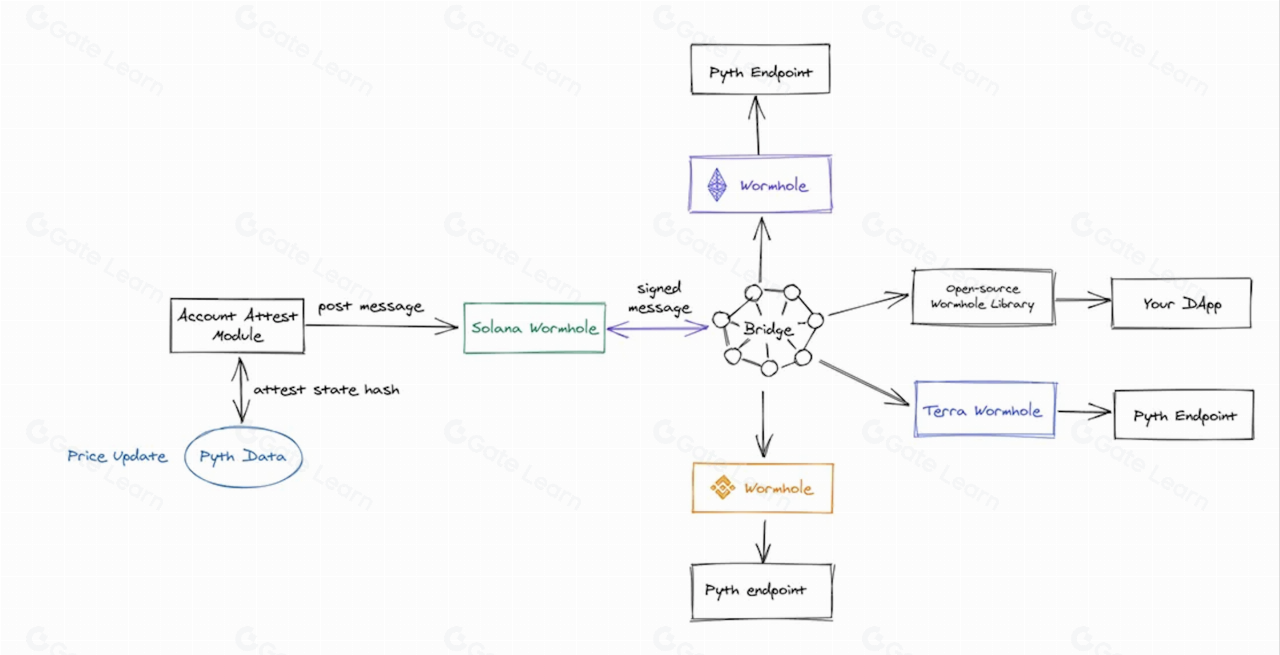

After over 400 data sources complete price publishing and data aggregation on Pythnet (Pyth's application chain), price updates will be cross-chain transmitted through Wormhole, extending asset price data to dozens of blockchains.

2.2 Founding Team

CEO: Michael Cahill

CEO of Douro Labs, the development company of Pyth. Previously worked on special projects at Jump Crypto.

COO: Ciaran Cronin

COO of Pyth Network's development company Douro Labs, previously worked at Jump Trading. Holds a Master's in Financial Economics from University College Cork.

CTO: Jayant Krishnamurthy

CTO of Douro Labs, Pyth's development company, and a software engineer at Jump Trading. Holds a Ph.D. in Computer Science from Carnegie Mellon University.

CIO: Harnaik Kalirai

Chief Integration Officer, former Chief Integration Officer at Jump Trading, with years of experience in system integration and operations, graduated from the University of Bedfordshire, UK.

In addition, it is understood that in addition to the above core executives, members of the Jump Trading team are also the most important code contributors to Pyth at present:

Jeff Schroeder: Chief Technology Officer at Jump Trading, primarily responsible for Pyth's core code;

Samir Islam: Chief Technology Officer at Jump Trading, holds a Master's in Computer Science from Oxford University, and has been involved in Pyth's code work;

Evan Gray: Vice President of Engineering at Jump Trading, involved in Pyth's code work;

Alex Davies: Head of Product Development at Jump Trading, one of the early 10 employees at Jump Trading's European division, also involved in Pyth's code work.

2.3 Investment Background

Rootdata disclosed that Pyth has received investments from institutions such as Delphi Digital, Ailliance Dao, GBV Capital, Republic Capital, HTX Venture, KuCoin Labs, and Ryze Labs, with a current market value exceeding 500 million USD. It is worth noting that PYTH also received a grant of 40,000 OP from the OP Foundation.

To support Pyth's development, the Pyth Data Association, headquartered in Switzerland, was established, with members including heavyweight institutions on Wall Street such as Jump, SBF's former employer Jane Street Capital, SIG, and market maker Virtu Financial.

2.4 Project Development Roadmap and Milestones

Phase 1: Completed

Covering hard-to-obtain off-chain data and easily comparable on-chain data, including U.S. stocks, cryptocurrencies, price + confidence intervals, market condition signals, TWAP, and advanced aggregation methods;

Collaborating with companies that have access to unique data sources and want to bring data on-chain;

Broadcasting raw data to Solana and distributing it to other L1 and L2;

Collaborating with a small group of dApps on all available L1 and L2;

Collaborating with strategic DeFi ecosystems;

Launching the website, version 0.1;

Launching various social media community channels.

Phase 2: In Progress

Expanding the data set coverage to include futures and forex, expanding TWAP, and adding volatility and other data indicators;

Adding data providers;

Increasing integration;

Adding support for the 1st layer;

Mainnet launch;

Launching staking, rewards, and governance features.

Phase 3: Upcoming

Expanding the data set coverage to include international stocks and futures;

Adding data providers;

Increasing integration;

Adding support for the 1st layer;

Introducing on-chain random numbers;

Introducing fees and cuts.

3. Product and Operations Status

3.1 Code and Product

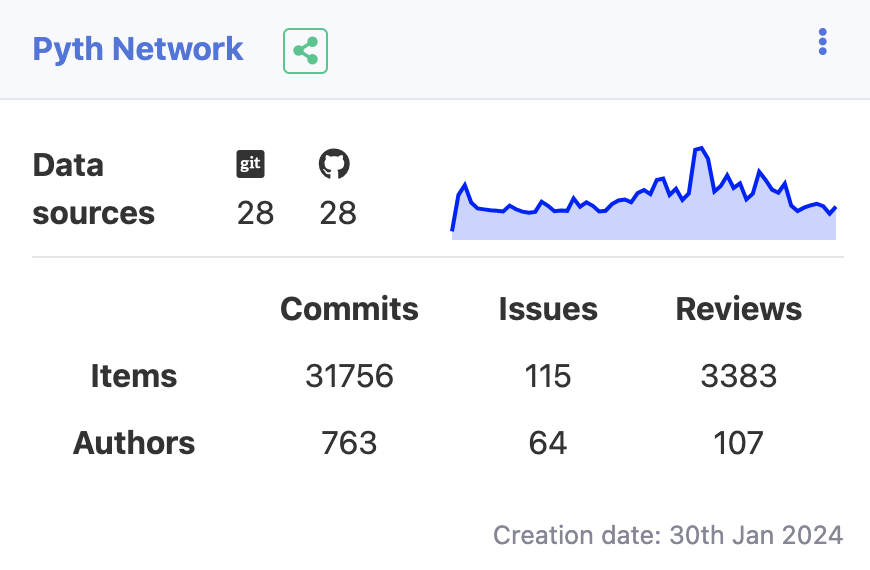

Pyth's Development Activity on GitHub:

Pyth Network's main repository is named

pythnet, showing a significant number of branches and stars, indicating a certain level of community participation. The presence of code updates, issues, and pull requests indicates ongoing development work;On their GitHub overview page, it can be seen that Pyth Network has multiple repositories, including

pyth-clientandpyth-client-js. Thepyth-clientrepository, containing the client API for on-chain Pyth programs, has received more attention than other repositories, indicating a particular interest from the community in the client API aspect of Pyth Network;The

pyth-clientrepository itself has an active issues section and pull requests, as well as actions for security and insights, further confirming that the codebase is undergoing continuous development and maintenance;Additional documentation about Pyth Network's integration with EVM (Ethereum Virtual Machine) suggests that they are also focused on providing real-time data to EVM contracts, reflecting broader development efforts beyond the direct repository.

The information provided indicates that Pyth Network has a certain level of development activity on GitHub, particularly with developers showing more interest in areas such as the client API.

Core Components of Pyth

Pyth consists of three core components: data providers (mainly exchanges), the Pyth protocol (designed to aggregate data from different providers and create a unified price and confidence interval for each price source every 400 milliseconds), and data users (i.e., end users such as applications on Pyth-supported blockchains, reading aggregated price sources and seamlessly integrating the data into their smart contract logic).

Core Mechanism of Pyth

Pyth's core mechanism, the Pull Price Update Model, is different from the push model used by most other oracles, and is the basis for its efficient and accurate data updates.

Most oracles currently use a push model, where the oracle runs a process off-chain and continuously sends transactions to update on-chain prices. In contrast, Pyth Network does not have this off-chain to on-chain push process, instead delegating this task to users of the Pyth Network.

Price updates in Pyth are also created on Pyth Network and transmitted off-chain through the Wormhole network. These updates are signed to allow Pyth on-chain programs to verify their authenticity. To update on-chain prices, anyone can submit validated update messages to the Pyth contract, which is a permissionless operation. Typically, users using Pyth Network prices will submit a transaction that both updates the price and uses that price in downstream applications.

It is important to note that on-chain prices can only move forward in time. If a user submits a Wormhole message with a newer price, the Pyth program will not fail, but it also will not update the price. This means that when users automatically update prices and interact with Pyth-driven applications, there is no guarantee that the price read by the application will be equal to the price submitted by the user.

Workflow of Pyth

Pyth is a protocol that allows market participants to publish pricing information on-chain for others to use. Data providers submit pricing information to Pyth's oracle program. Pyth has multiple data providers for each price source to enhance the system's accuracy and robustness. The on-chain oracle program on Pythnet combines the data submitted by providers to generate a single aggregate price and confidence interval. Applications read the price information generated by the oracle program. Specifically, Pyth allows users to "pull" prices onto the blockchain when needed (these prices are publicly available to everyone on the chain).

After obtaining prices from data institutions, to ensure the security and reliability of the data, the data will also be estimated within Pyth's own "confidence interval." For example, if the current price of ETH is $3,000, Pyth will calculate a range of approximately ±$30, providing an error range. A smaller range indicates higher accuracy and provides users with a good reference.

Delegators receive data from various institutions, and Pyth relies on existing data sources, historical performance, and historical data accuracy to assess the quality of the data sources and decide which data to use as Pyth's data providers.

Curators, like Delegators, operate on the Solana network. Their main role is to identify the data needed in the market and provide urgently needed data.

Prices are then aggregated using Pyth's own "confidence interval." For example, if one data source provides a price of $101±$1, and another publisher reports a price of $110±$10, Pyth aims for the total price to be closer to $101 rather than $110, and the total confidence interval should reflect the variation between the publisher prices.

After completing the price aggregation, if further operations are conducted on the Solana network, Wormhole is not needed. However, if subsequent operations are not on the Solana chain, Pyth and Wormhole's Layer1 cross-chain bridge function is used to make Pyth's oracle data available to all chains.

In addition, Pyth uses a reward and punishment mechanism to guide the behavior of data providers and users. Staking tokens ($PYTH) as a data provider, delegator, or curator and providing data to Pyth earns users tokens when there is a demand for data. Conversely, data providers who provide incorrect prices or delegators and curators who screen data quality incorrectly will be penalized, with the corresponding amount deducted from their staked tokens as compensation.

3.2 Official Website Data

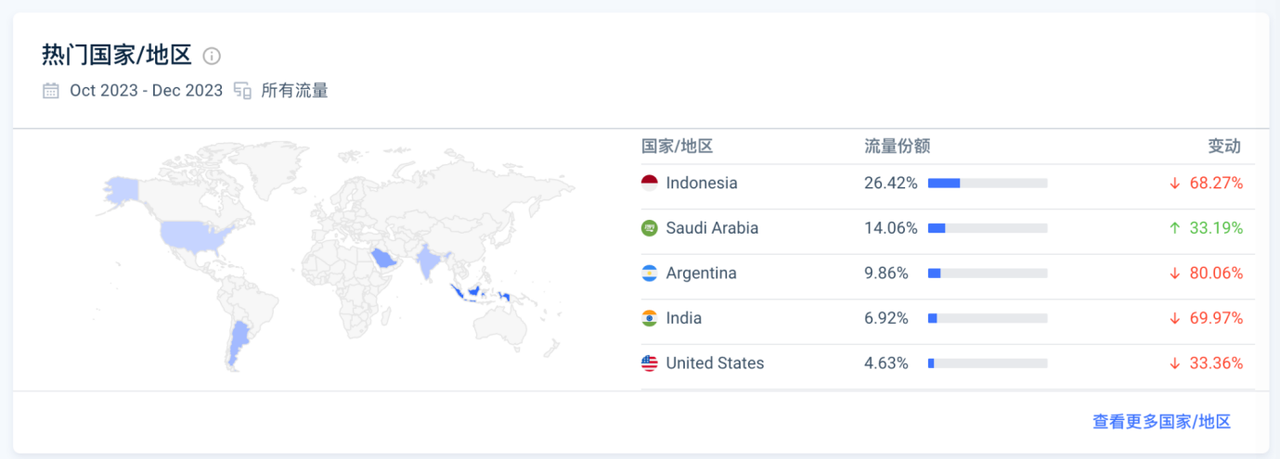

Time range: October to December 2023:

- Monthly visits: 1.479 million

- Average visit duration: 3 minutes 44 seconds

- Pages per visit: 3.82

The main traffic comes from Indonesia (26.42%), Saudi Arabia (14.06%), and Argentina (9.86%), with direct visits accounting for 49.70% and organic search accounting for 22.29%.

3.3 Social Media Data

3.4 Community Data

3.5 Market Heat (Promotion Data and Effectiveness)

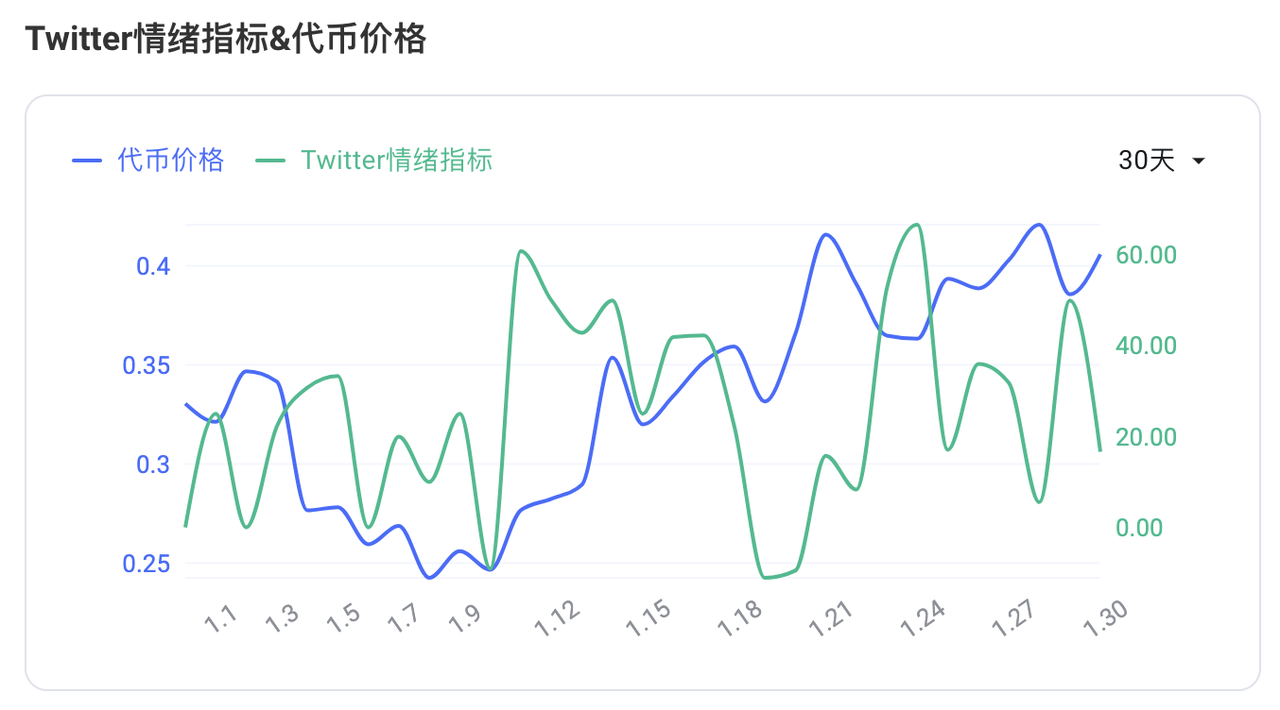

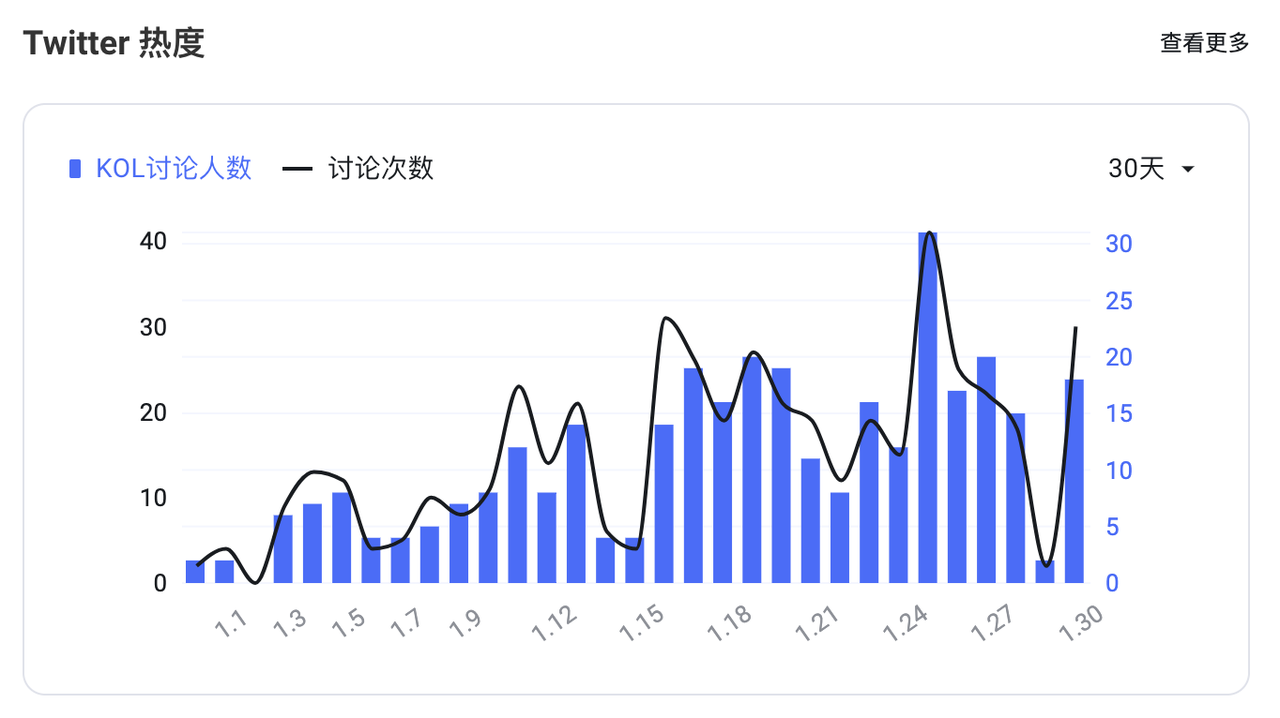

Sentiment index: 16.67, indicating relatively positive market sentiment.

Twitter discussions: 30, an increase of 1,400.00% compared to the previous period.

Twitter followers: 167,500, a 0.53% increase compared to the previous period.

The sentiment index scale ranges from -100 (very negative) to 100 (very positive), and the current index is 16.67, indicating a positive sentiment. Over the past year, there has been a significant increase in daily active users and user interactions.

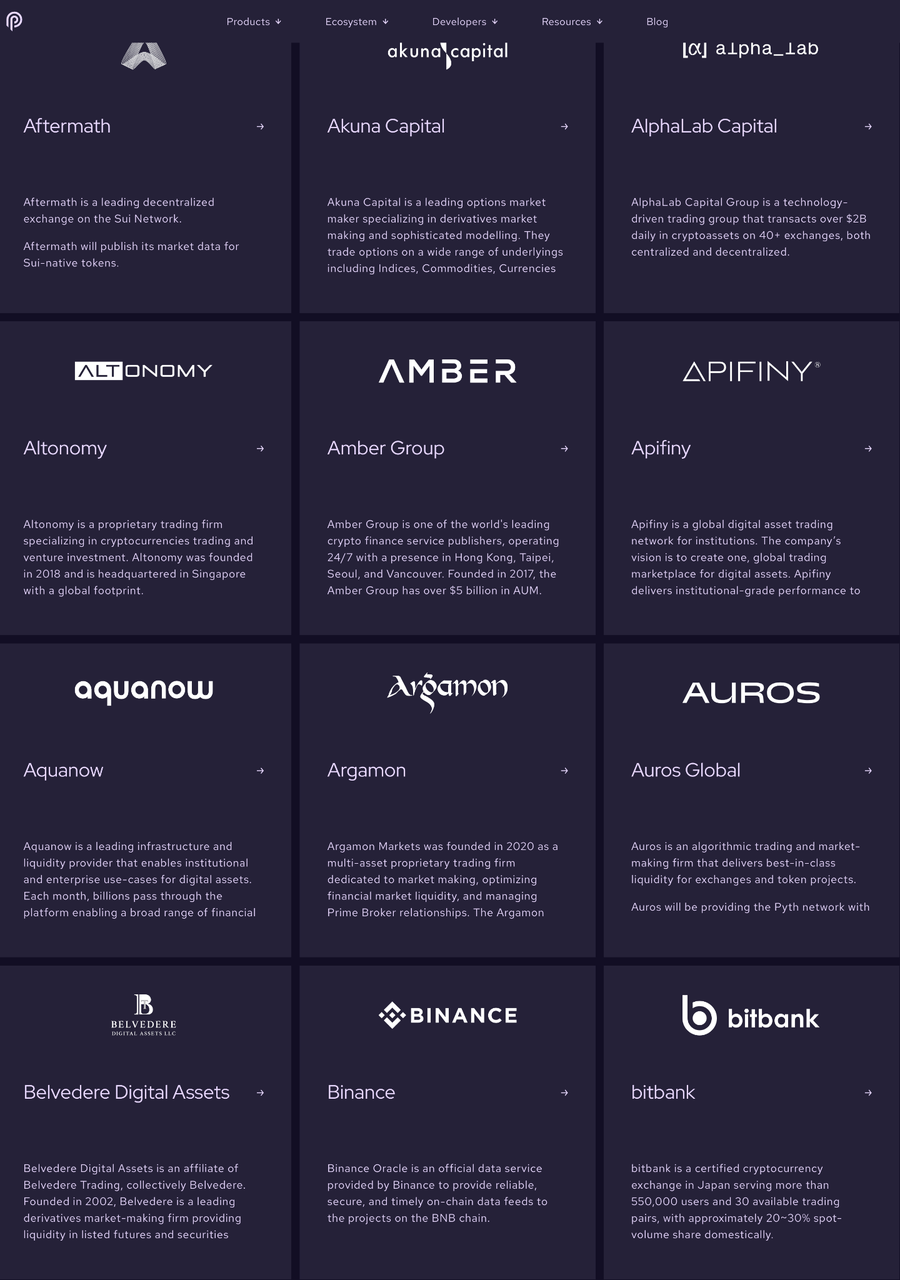

3.6 Partners

Publishers on the Pyth network include:

Pyth Network is currently the largest financial data oracle network, providing real-time price feed services for over 90 data providers, including traditional financial institutions, crypto markets, forex, and commodities. Pyth supports data from over 40 top institutions in traditional finance and the crypto market, such as Bloomberg, Hong Kong Stock Exchange, Nasdaq, Jump Trading, Virtu Financial, GTS, and Solana.

4. Business Analysis

4.1 Token Model Analysis

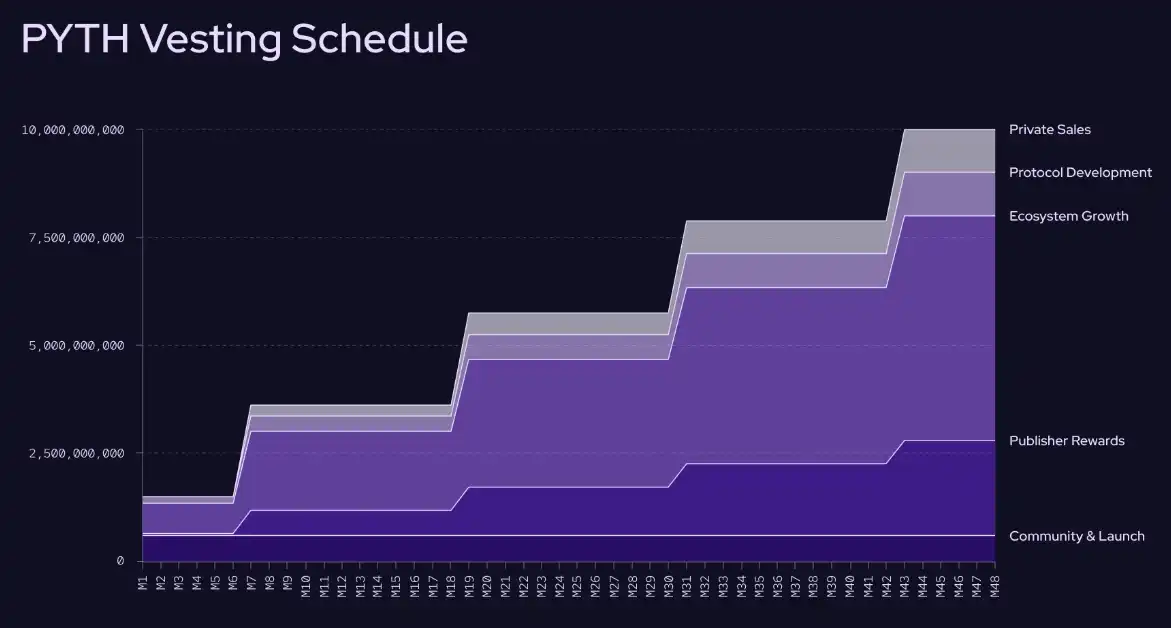

The maximum supply of PYTH tokens is 10 billion, with an initial circulation of 1.5 billion (15%). The remaining 85% of PYTH tokens are initially locked and will be unlocked 6, 18, 30, and 42 months after the initial token issuance.

Of the total allocation, 22% is allocated to network data providers, 52% to "ecosystem growth strategies," 10% to protocol development, 6% reserved for initial launch and related activities and plans, and 10% allocated to strategic contributors in two rounds of financing.

Please find the English translation below:

It should be noted that in May 2024, which is around the next Bitcoin halving, a significant portion of the tokens will be released. In addition, except for the community and the launch, all rewards will be released at the same rate and time (it is understood that the top 10 holders own 68.02% of the supply), creating significant uncertainty for secondary market investments.

4.2 Project Potential

In the traditional push model, DeFi protocols essentially sign contracts with oracles and subscribe to oracle services, enjoying price feed and push data for a period of time. This inevitably involves offline negotiations and time consumption.

In Pyth's current on-demand pull model, the collaboration between the protocol and the oracle appears more Web3-oriented: you don't even need to contact Pyth's business team offline, as you can complete the price data pull through deployment of development documents and smart contracts—contract triggering, gas fee payment, data pull, and post-pull usage are all automatically executed, reflecting a "permissionless" and "fully on-chain" nature.

Pyth's more Web3-oriented features give it a significant position in the crypto market and high potential. However, this potential cannot be immediately realized, nor is it determined by technology, but rather by market dominance.

4.3 Competitive Landscape

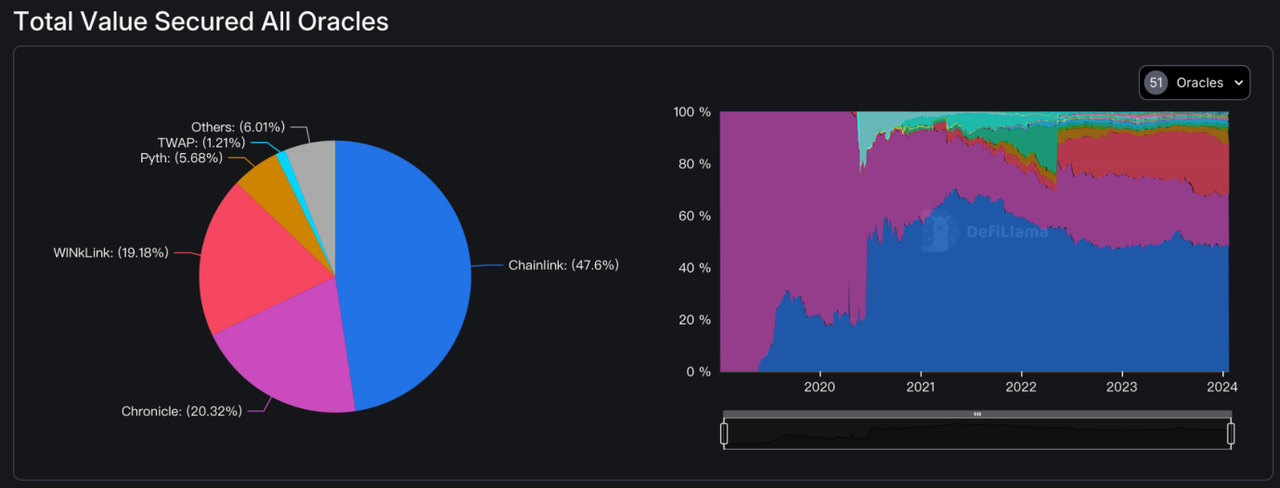

Pyth Network is currently considered the fourth-largest oracle project, with a total value locked (TVL) of $21.12 billion, second only to Chainlink, WINkLink, and Chronicle.

In terms of the number of serviced networks, Pyth ranks second, serving 144 networks, second only to Chainlink's 353. Recently, Pyth Network's price has been trending upwards and is expected to reach new highs in the coming months. Although long-term forecasts remain bullish, the price of Pyth Network ($PYTH) may take longer than expected to reach the $1 milestone.

Overall, Pyth Network holds a significant position in the decentralized finance oracle field with its fast and accurate data provision capabilities. While some of its centralized data sources may face criticism, its technical advantages and market application prospects make it a project worth paying attention to.

4.4 Profit Expectations Assessment

Currently, Chainlink's fully diluted valuation (FDV) is at a 0.95% discount compared to the total value locked (TVL) in the protocols served by its oracles.

If the same metric is considered, Pyth's total value locked is $21.21 billion, so the fair FDV is 2.121B * 0.95, or around $20.14 billion.

$PYTH has a 15% circulation at TGE, bringing its current market value close to $600 million, but the fair price is $0.3. Based on on-chain demand, a price higher than $0.3 would overvalue $PYTH.

However, we are currently in a bull market cycle, considering Pyth's future potential. Therefore, a fair 2-3x premium is reasonable, around $0.7-0.9.

Buying $PYTH at a price below $0.25 (currently at a minimum of US$0.22) has significant potential for doubling, but if its trading price exceeds $0.70, it may not be a good time to buy.

In the long run, Pyth Network has good potential and some differentiation advantages compared to Chainlink, allowing it to capture a good market share.

5. Conclusion & Recommendations

With the continued growth of the DeFi sector, the demand for reliable and real-time market data is increasing. Expanding into other asset categories such as stocks and commodities can increase its market share. Moving away from the tie to Solana and building its own Pythnet has also given the project more flexibility, and integration with other blockchain protocols and platforms can increase the usage scenarios and value of its data products.

As the global regulatory environment changes, there may be more regulatory requirements for on-chain data providers. As an infrastructure component, Pyth Network needs to ensure high security standards to defend against potential network attacks. Any significant issues with data accuracy could quickly erode market trust in its services.

The $PYTH token not only serves as fuel for transactions (i.e., paying gas fees) but also allows holders to share network revenue and participate in governance decisions. However, projects like Pyth, which are dedicated to infrastructure construction, are not eye-catching, and the oracle track is too narrow, with Chainlink already in the lead. It will be difficult for Pyth to capture its share in the short term, but the Pyth token may achieve 4-6x growth in the next cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。