As explorers of the Bitcoin metaverse, why do they want to create a new Bitcoin Layer2?

Author: BlockBeats

With the approval of the BTC ETF, the Bitcoin ecosystem is entering a golden age, and many people believe that the main bull market will erupt in the Bitcoin field. We are honored to invite Jeff, the founder of Merlin Chain, a pioneer in the Bitcoin ecosystem. Merlin Chain is a BTC Layer2 that focuses on serving Bitcoin native users, assets, and protocols, and achieves the security sharing of Bitcoin Layer1 through ZK technology. It is an undeniable force in the current Bitcoin ecosystem.

The original intention of Bitmap and BRC-420 design

BlockBeats: The market response to Bitmap.Game and BRC-420 is very good. Can you share the original intention of creating these two projects?

Jeff: Bitmap is a completely decentralized and trustless asset we saw in the market. Each inscription on it represents specific data of a specific block, such as all transaction information, fees, and mined bitcoins.

The asset itself is completely decentralized, and anyone can inscribe it, so the community is very large. However, when it was just inscribed, its market value was only 2 million US dollars. We hope to develop some applications for this large community and provide some practicality, so we launched Bitmap.Game, a metaverse on Bitcoin.

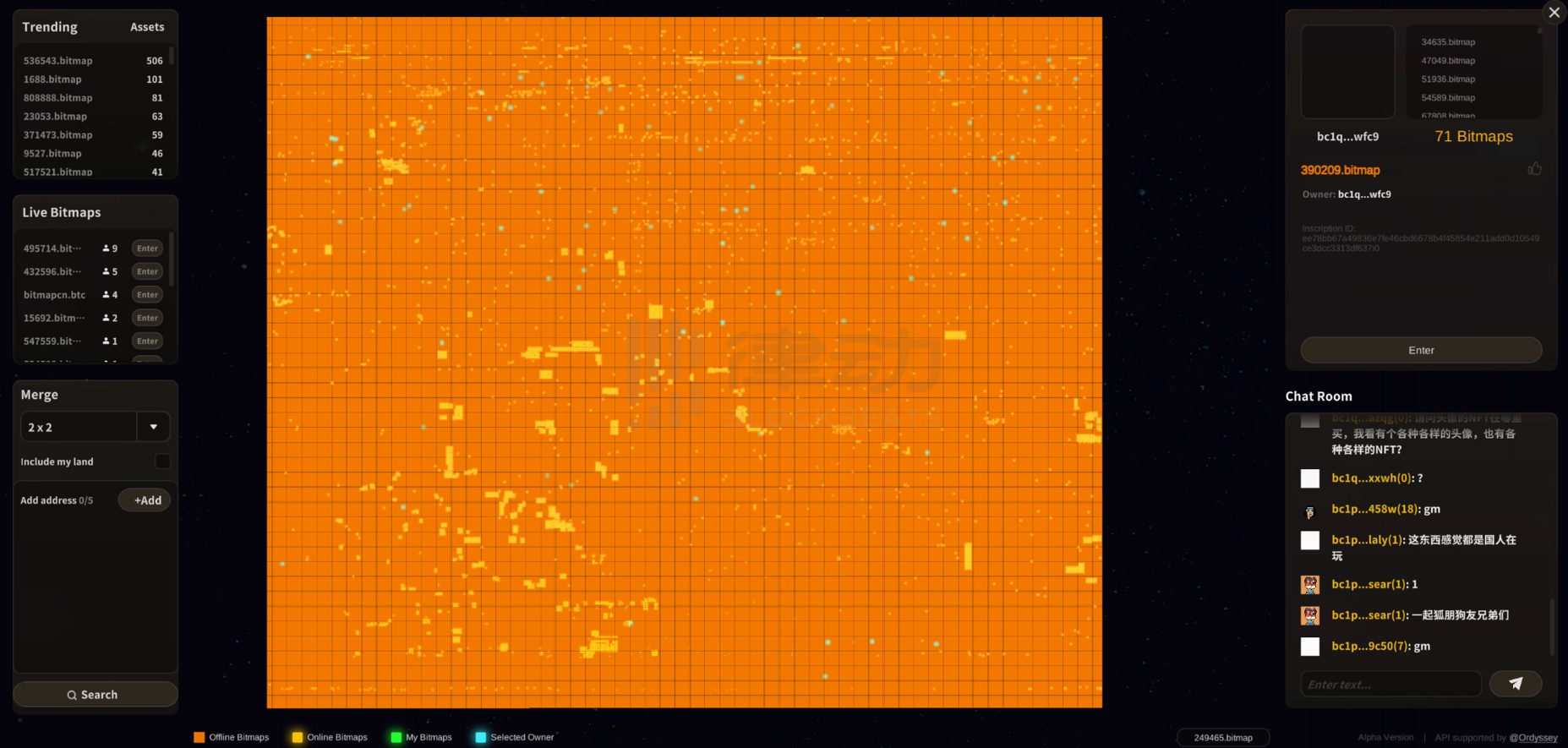

The yellow dots on the map are the current online users, and when zoomed in, you can see each person's plot:

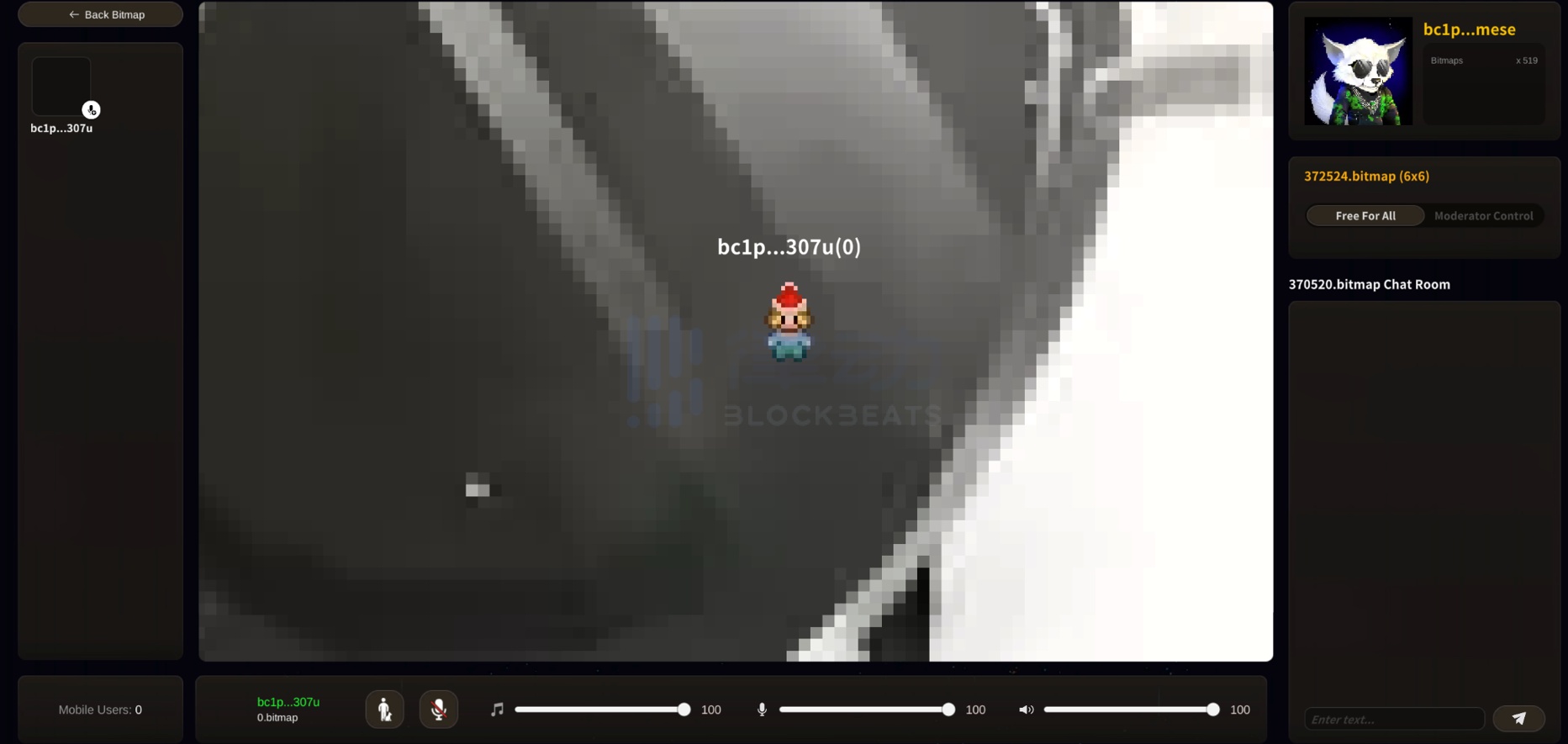

All the pictures and content on the plot, or all visible content in our product, are on-chain data. Everyone has different wallet assets and can choose to use these assets as the cover of the plot. Upon entering a specific plot, you can see all the avatars and the game play, game scenes, etc. in that room, all of which are on-chain assets.

When we launched Bitmap.Game, our original intention was to build a client-agnostic, server-independent, decentralized, and permissionless product. Because all the data comes from the chain, not in our hands, even if we no longer operate, others can choose to build their own client to continue development, and anyone can compete to develop similar products. We believe that such products are the future direction of development, which may be unique, but it is indeed our original intention.

As for BRC-420, we call it an asset protocol for data modularization and tokenization. In other words, we can turn any data into a module and tokenize it to make it an asset. For example, there is a DLC called Bitmap.town, which contains over 600 metaverse game assets, such as animations, scripts, avatars, music, etc. They are packaged into a DLC and then tokenized. Once the project is released, all content will be fully on-chain, and users can access it themselves, build their own content based on it, and hold these tokens without relying on the team that developed the DLC.

So far, the trading volume of BRC-420 assets is large, and the increase, number of holders, and market value are all good. Although it was initially called a metaverse protocol, BRC-420 actually has no necessary connection with the metaverse. We hope to see more innovative gameplay based on decentralized product structures and fully on-chain modular combinable asset protocols in the future.

BlockBeats: This is a bit like turning inscriptions into a game card, turning Bitcoin into a game console, and players can copy games into it. How do you think these functional features will impact the development of the entire Bitcoin ecosystem?

Jeff: Among all the teams in the Bitcoin ecosystem, we are considered the most unique because we do things that have not appeared in other ecosystems. At first, we did a lot of things based on recursion, such as recursive graffiti, recursive on-chain forums; later, we created Bitmap, a completely decentralized data package; and then we launched BRC-420.

First, I believe that any new ecosystem needs its own narrative. Doing the same thing as Ethereum in the Bitcoin ecosystem, or vice versa, seems uninnovative. Just like after the blue box became popular, there appeared a 420 protocol on every chain, with boxes of various colors. We must do something that has not appeared before, create a new narrative, in order to drive the development of the Bitcoin ecosystem. For example, if a lot of content on Ethereum is not on-chain, then we need to combine on-chain content.

The second is the new product model under the new narrative, which can be seen in many products based on BRC-420. For example, Mineral has created a gameplay that combines DeFi and computing power; some on-chain games based on Bitmap, such as Bitmap Valley and Bitmap War, all use the BRC-420 protocol to issue assets, and operate products based on these assets on the second layer network: first issue BRC-420 assets, then convert them into graphic coins, or airdrop tokens, and then build products based on these assets on the second layer network. I think the innovation of the entire product model will continue to emerge with the overall trend.

The last one is composability. I believe this is the greatest productivity innovation of blockchain, but it is rarely mentioned in ecosystems like Ethereum. I believe you are also familiar with the term "DeFi Lego." The essence of DeFi is the composability of different Legos. From Uniswap to liquidity mining, to Compound, and then to Curve, etc., smart contracts have led to the explosion of innovation in the entire industry, all stemming from composability. Bitcoin can solve composability in terms of content. For example, if you create a game with 20 modules, I can quickly create a new game based on 15 of those modules without having to reinvent the wheel. I think we have grasped the most unique innovation in the Bitcoin ecosystem, rather than replaying the gameplay of Ethereum.

Jeff's entrepreneurial journey in the Bitcoin ecosystem

BlockBeats: From your speech, we can feel that you have a very deep understanding of Bitcoin and the entire crypto industry. Did you ever consider starting a business in other ecosystems before the outbreak of this round of the Bitcoin ecosystem?

Jeff: Starting Bitmap Tech this time is actually my first time starting a business in Web3. I have always been in Web2 entrepreneurship before. I have always believed in the spirit of blockchain. The reason why I did not choose to start a business in the blockchain field before is that I did not find a real entry point that could improve productivity.

As a user of the Internet generation, we deeply feel the improvement in productivity brought about by the Internet. We can attend meetings through video, access more information on the network, and many people can see the world that only a few people could see before, and so on. Therefore, I believe that productivity innovation is a core key point.

Before, whether it was in the ICO in 2017 or the DeFi in 2020, I did not find an entry point that I liked, so I have always focused on Web2 entrepreneurship. In fact, my previous company was also involved in the metaverse field, with about 40 to 45 million users worldwide.

Choosing to start a business in Bitcoin this time is actually quite coincidental. When we decided to take another look at Web3, we happened to encounter the rise of the Ordinals ecosystem, and I feel very lucky.

Next, the market trend is gradually returning to the early encryption culture of Bitcoin, which reignites my original intention to start a Web3 business. In my opinion, the Ethereum ecosystem is too institutionalized, with too many established rules, clearly defined gameplay, and a high degree of centralization. For example, it requires following Vitalik Buterin's entrepreneurship, following the Ethereum Foundation's entrepreneurship, and then seeking VC, exchanges, and so on. This kind of gameplay makes me feel that it loses the original intention of encryption.

The completely on-chain concept advocated by Ordinals aligns with my belief in permissionless composability, and it coincides with my own beliefs. Therefore, in this wave, I chose to start a business in the Bitcoin ecosystem.

BlockBeats: It's clear that you are a firm believer in Bitcoin. Can you share how you first got in touch with Bitcoin? Why are you now so firmly convinced of the future of Bitcoin?

Jeff: I actually got in touch with Bitcoin very early. In 2012, I received an investment from a VC and founded my first company in China. This investment institution also happened to invest in Coinbase and Ripple. At that time, I was also an early scholar in computer science, but later shifted to political science and sociology during my high school and undergraduate studies in the United States. The combination of these backgrounds filled me with faith when I first encountered Bitcoin.

At that time, many programmers did not trust Bitcoin and thought the technology was outdated. Many liberal arts students found it too esoteric and did not have much of a feeling for it. However, after reading the Bitcoin whitepaper for the first time, I wholeheartedly immersed myself in it. Therefore, I and the first group of people in China who got in touch with Bitcoin became good friends. We discussed methods of purchasing together and later traded together. I believe in Bitcoin without any specific reason; it's a matter of faith.

I think Bitcoin and Ordinals are very similar, both being anti-fragile and having no weaknesses. Even if the price drops very low, even if everyone dislikes it, it will still exist forever, not be eliminated, and not be wiped out by a single document. That's what I liked the most at the time. Because the world is fragile, with various problems in different countries and regions, it needs something anti-fragile. So, more than ten years ago, I had an immense faith in Bitcoin, and last year, I also began to believe in the Ordinals ecosystem.

BlockBeats: It seems like you are a very punk person. Has this belief in the Bitcoin ecosystem influenced your project positioning and development direction?

Jeff: First, we hope to find the most unique innovation in the Bitcoin ecosystem and never retrace the old path of Ethereum. As entrepreneurs, we are eager to challenge uncertainty, as this is what sparks innovation. Following the paths already taken by others lacks freshness.

Second, our belief in the ecosystem is also a belief in people. When we started building Ordinals products, it was around May or June of last year, and at that time, almost all of Ordinals' assets were close to zero. The entire Bitcoin ecosystem and Ordinals were ridiculed by the outside world and looked down upon. When I was outside, almost no one around me knew that I was working on Ordinals because once it was mentioned, many people would think it was a scam or a game for kids.

However, in that situation, we found that there were 5 to 10 Twitter Spaces every night, including English and Mandarin, where a group of developers gathered to huddle together and envision new things. In fact, the pressure of learning at that time was much greater than it is now. There were new protocols, new standards, and new innovations every day. I could feel the vitality of the entire ecosystem, and everyone's faith and dedication to this matter were very high. This made me feel the purity of an early industry and the dedication and faith of the users and developers around this ecosystem.

Therefore, whether it is the Layer2 we are currently working on or future new products, they will revolve around these users and assets. We sincerely hope to build and participate in this ecosystem for the long term, truly becoming a part of these local communities, including local assets. Compared to many other projects that quickly introduce Ethereum assets and mechanisms, we are more willing to build and innovate around the existing users and assets.

Current development status of BTC L2 and Merlin Chain's innovative approach

BlockBeats: Can you share why you decided to establish Merlin Chain?

Jeff: Three or four months ago, I often discussed with others that it is difficult to play on Bitcoin Layer1. You will find that all users are constantly participating in new token launches. As soon as one asset is finished, and its value stops rising, everyone runs to the next asset for a new launch. It's a constant hustle, but it's unclear what everyone is busy with.

Most of the assets that rise quickly and have high market values are things from three months ago, and it's now very difficult to produce new assets. This is because the narrative is not fresh, the application scenarios are too limited, and the financial liquidity and leverage are too weak. Therefore, to make this ecosystem more prosperous, it is currently necessary to implement these functions in a virtual machine environment.

Therefore, Bitcoin's Layer2 is an actual user demand, not a fantasy demand. In addition to this, there is also a demand from capital because it is not possible to invest on Layer1, and it's all Fair Launch. Therefore, investors will choose to invest in Layer2.

The reason we want to do Layer2 is actually for our community, users, and the things we want to do ourselves. For example, in the past six months, there have always been people asking us why we don't use Bitmap to create games, or why we don't do Play-to-Earn (P2E). This is because doing these things requires a virtual machine, which is not possible on Layer1. All users and the ecosystem are calling for this demand, so three months ago, we decided to establish a true Bitcoin Native scaling solution.

BlockBeats: What are the differences/advantages of Merlin Chain compared to other L2 solutions?

Jeff: The biggest feature is that we want to first serve the native users of Bitcoin and explore native innovations with native users and native assets. We believe that if we cannot serve the basic users well, and instead start by serving Ethereum users, where most users are Ethereum users and the assets are ETH and USDT, then it's difficult to say that this chain is a Bitcoin Layer2, even though such chains are still being called Bitcoin Layer2.

Based on this, three months ago, we collaborated with Particle to create a Bitcoin wallet solution. Regardless of whether you use Unisat or OKX, any Bitcoin wallet can seamlessly switch between Layer1 and Layer2. This added a lot of time and cost, but we felt it was necessary and essential to serve Bitcoin users well.

The second feature is serving Bitcoin assets, such as ORDI, SATS, RATS, and so on. Currently, most so-called Bitcoin Layer2 solutions have Ethereum assets on them, and some even have BNB Chain assets. We believe that it is necessary for Bitcoin assets and the community to be the first to use them before we can further explore what kind of innovation ARC-20 and BRC-420 can bring, rather than innovating with Ethereum and USDT, which is not real innovation.

The third thing is a natural progression, which is embracing native Bitcoin innovation. Only by putting real Bitcoin users, protocols, builders, project parties, and native Bitcoin assets into a virtual machine can we expect innovation to emerge. If it's all about Ethereum, it is impossible for Bitcoin innovation to occur.

Currently, the total market value of Bitcoin-related assets is only about 4 billion US dollars, which is a long way to go compared to the market value of Bitcoin. We want to embrace these assets and users, and then explore model innovation together with them.

The first Launchpad we are going to launch is the People's Launchpad developed by Particle, which will use the BRC-20 protocol and bring some innovation in the issuance of native Bitcoin assets.

In terms of technology, we believe that being EVM compatible is not an innovation, as everyone is EVM compatible. Our innovation lies in building our own cross-chain bridge, which allows us to cross-chain any assets we want, such as Bitmap, BRC-420, ARC-420, which currently no other chain supports besides us. Another innovation is that we have built ZK Rollup to further compress the volume of ZK proofs and construct a DA Layer that inherits the security of Bitcoin. All of these will be showcased in our GitBook. However, many teams are exploring this direction with us, and there are no unreleased things that can be considered our own technological innovation.

In terms of the ecosystem, we have People's Launchpad, Mineral, Bitmap War, and games from MOBOX. We hope to serve more of these existing Bitcoin ecosystem products because these communities are very active, easy to launch, and can generate traffic and income easily.

Jeff Talks about the Future Outlook of Merlin Chain and the Bitcoin Ecosystem

BlockBeats: How will the launch method of Merlin Chain differ from other projects?

Jeff: Assets on Bitcoin Layer1 have a characteristic: the more holders there are, the more inscriptions there will be, the higher the cost will be, and the return expectations of everyone will also increase, making it difficult for asset prices to rise. People's Launchpad will adopt a similar issuance method to Bitcoin Layer1, but it can reduce costs, increase the number of holders, and make the entire issuance process more interesting. All tokens issued on it will use a valuation of $100,000. People may have high expectations for Merlin Chain, thinking that it should reach a market value of several billion or even tens of billions, but we will still allocate a certain share and conduct a fair launch at a valuation of $100,000 on People's Launchpad.

I think this will be a way of issuance that is community-oriented, fair, fun, and allows users to obtain assets at a lower cost.

BlockBeats: Will there be any recent news from Merlin Chain? What is the future roadmap like?

Jeff: In early February, we will announce a token staking reward program, allowing early users to provide liquidity at zero cost while receiving token rewards. Our mainnet testnet will also go live in early February, and products such as People's Launchpad, iZUMi Finance's MerlinSwap, and Bitmap War will also go live.

In the first half of the year, we will conduct some developer ecosystem activities to attract more builders because we do not want to directly transfer Ethereum DApps here and play with the same model. Therefore, we have invested in and incubated many native projects, using Bitcoin's methods to create DApps. One of the products can receive any token on Layer2 for inscribing Layer1 assets, similar to cross-chain token forging, which is very native to Bitcoin.

We will have two developer incentive programs this year to encourage more people to build in a native Bitcoin way, achieve more users, better liquidity, and more innovative products.

BlockBeats: Many people are saying that this bull market will mainly occur in Bitcoin. What are your thoughts? Can you share your expectations for the development of the Bitcoin ecosystem?

Jeff: I agree. Ethereum assets already have too many ways to generate income, including DeFi, lending, and the yield from PoS itself, but Ethereum's market value is still less than one-third of Bitcoin's.

Bitcoin's market value accounts for more than 50% of the entire cryptocurrency market. If income-generating functions are introduced, the financial derivative returns and liquidity that this capital volume can bring are something that other ecosystems cannot achieve no matter how innovative they are. Therefore, I think the demand for income-generating assets in Bitcoin alone is enough to trigger a bull market.

There is also a lot of room for imagination for new assets on Bitcoin. During a bull market, the total market value of ERC-20 tokens is actually similar to the market value of ETH itself, while the market value of Bitcoin assets is still only one two-hundredth of Bitcoin's market value. The process of striving from one two-hundredth to one hundred percent, which means all Bitcoin assets rising 200 times, I believe can be called a bull market. This 200-fold gap will have a significant impact on the entire cryptocurrency market, and there are currently no similar opportunities in other markets.

BlockBeats: In the development of the Bitcoin ecosystem, what role do you think Merlin Chain will play? How will it empower Bitcoin projects and assets?

Jeff: Merlin Chain will help BRC-20, BRC-420, Bitmap, and other assets to circulate better on Layer2, issue more effectively, and gain more leverage. We hope to accompany these native assets in exploring opportunities and new innovative methods, helping them grow from 0.5% of the market value to 100%.

Once the ecosystem has a certain level of liquidity, and the trading volume, users, and DeFi infrastructure mature, Bitcoin holders and even whales will have the opportunity to generate income using Bitcoin as a single asset, thereby amplifying liquidity. By serving native assets and users, increasing trading volume, and using this to attract Bitcoin OGs to put money into income-generating financial products, we aim to create a positive cycle, which is what Merlin Chain wants to do.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。