Author: Jian Shu

I. Introduction

Berachain was launched at the end of 2021 as an EVM-compatible L1 focused on DeFi, built on top of the Cosmos SDK, and utilizing the Proof of Liquidity (PoL) consensus mechanism.

Development History

Berachain originated from the meme chain of Smoking Bear NFTs, which can be traced back to the Bong Bears NFT series launched in August 2021. Subsequently, this NFT rebase produced new collections such as Boo Bears, Baby Bears, Band Bears, and Bit Bears.

After experiencing the bull and bear markets in the crypto industry, the core members of the Berachain team deeply recognized the significance of liquidity to DeFi. They decided to design an L1 public chain based on the successful aspects of previous DeFi projects while avoiding their shortcomings, leading to the birth of Berachain. Subsequently, the Berachain team designed the Proof of Liquidity (PoL) validation mechanism, indirectly laying the foundation for Berachain's three-token model.

On November 28, 2023, Berachain started its internal testing.

On January 11, 2024, the day when the Bitcoin spot ETF was approved, Berachain's public testnet "Artio" was officially launched. According to official sources, over 30 native protocols are under development, and protocols from other networks such as Pendle, Redacted, Sudoswap, and Abracadabra also plan to be deployed on Berachain's testnet and mainnet.

According to insider information, Berachain is scheduled to launch its mainnet in Q2 2024.

Financing Situation

On April 20, 2023, Berachain secured a $42 million financing round led by Polychain, with participation from institutions such as Hack VC and OKX Ventures, valuing the company at $4.2 billion.

Team Background

Berachain was established by an anonymous team, with co-founders including Smokey the Bera, Papa Bear, Homme Bera, and Dev Bear, and the recent addition of Baloo the Bera as Vice President of Engineering (former Engineering Manager at Mysten Labs). Other team members are unknown. Most of the project team members were early participants in and investors of cryptocurrencies around 2015, with a deep understanding and research of DeFi and public chains. Although it is an anonymous team, the ability to secure a $42 million financing indicates their extensive connections and resources in the crypto field.

II. Mechanism Interpretation

According to co-founder Smokey the Bera, Berachain was established to address on-chain liquidity issues. If a chain loses its liquidity, it will quickly become a "ghost town," a conclusion drawn by the Berachain team after experiencing DeFi Summer.

Now let's see how Berachain cleverly addresses on-chain liquidity issues.

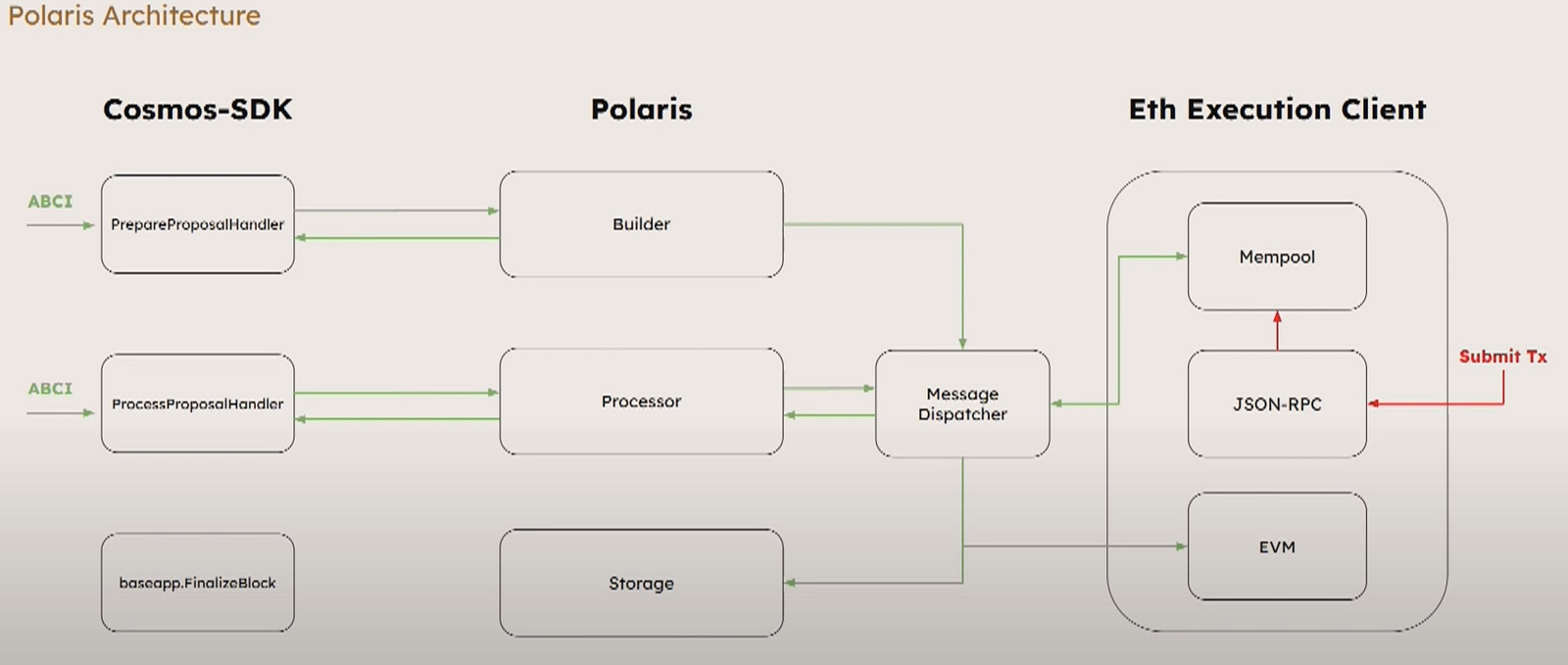

Polaris EVM

Berachain is built on the Polaris EVM, which is used as the EVM basic operating system built on top of the Cosmos SDK. Polaris uses message passing to connect the EVM and Cosmos SDK, separating block construction, processing, and storage from execution. Polaris EVM also provides developers with state precompilation and the creation of custom modules, allowing developers to create more efficient and powerful smart contracts.

What are the advantages of using the Polaris EVM framework?

1) Ethereum developer-friendly

Berachain is EVM-compatible, making it friendly to Ethereum developers and more likely to attract developers from other EVM chains.

2) Strong cross-chain interoperability

As a Cosmos sidechain, Berachain naturally relies on IBC support. IBC, as the most powerful cross-chain communication protocol, eliminates barriers for liquidity from other networks flowing into Berachain.

PoL Proof Mechanism

Utilizing the PoL mechanism to introduce liquidity of mainstream assets into Berachain is the team's approach to solving liquidity issues.

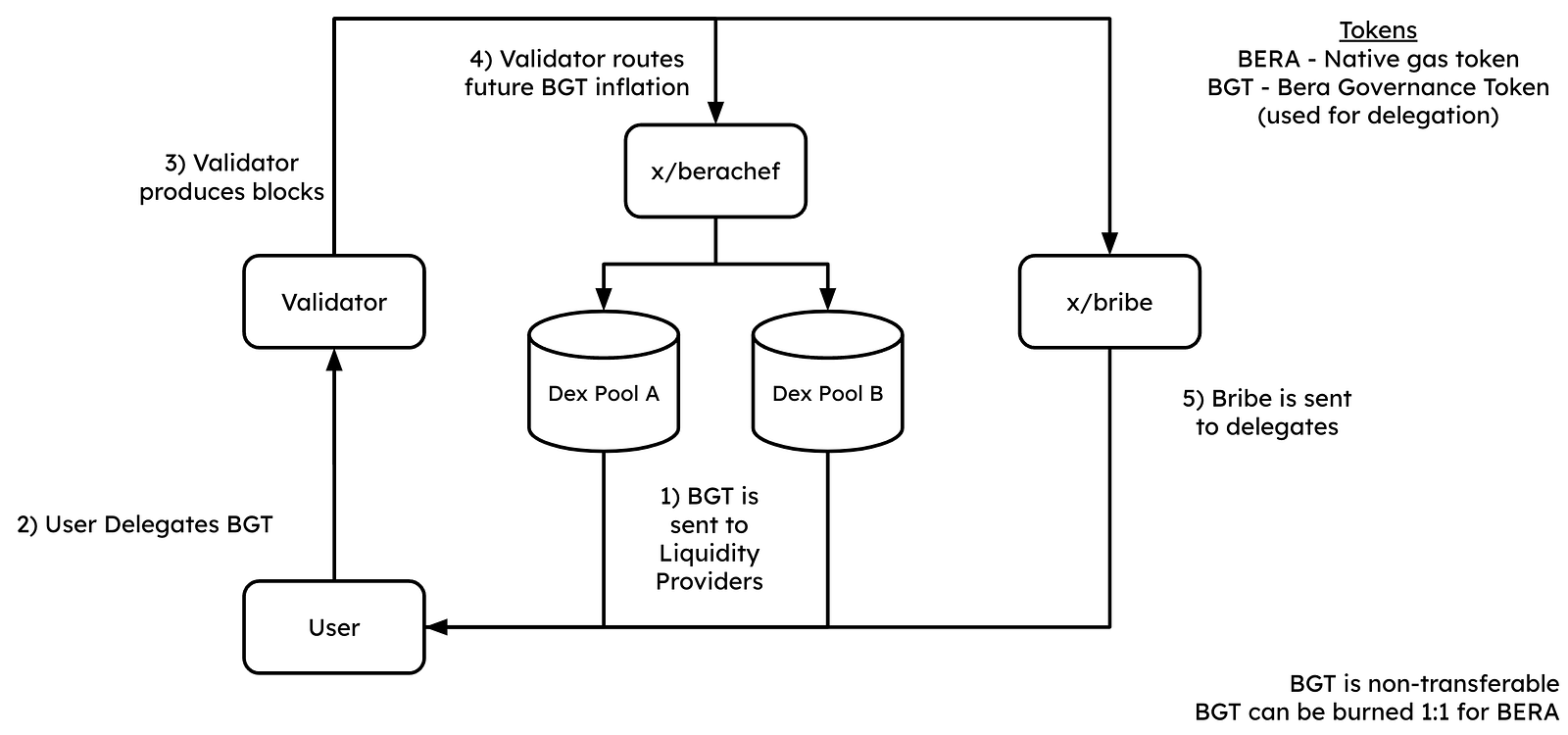

The PoL proof mechanism is as shown in the above figure:

1) Users provide liquidity to the BEX (Berachain's native DEX) pool to obtain BGT, the governance token, detailed in the "Three-Token Model" section.

2) Users delegate BGT to validators, who generate blocks based on the proportionate weight of the delegated BGT.

3) Delegators and validators receive rewards (BERA and HONEY) from the chain.

4) Validators can vote on the inflation status of BGT in any liquidity pool.

5) Bribes are distributed from validators to their delegators.

What are the advantages of PoL compared to PoS?

1) Incentivizes liquidity, enhances security

The only way to earn the governance token BGT on Berachain is by providing liquidity to BEX, and not all tokens can be staked, enhancing security and incentivizing liquidity. In contrast, the traditional PoS mechanism to enhance on-chain security may lead to reduced liquidity.

2) More decentralized inflation

In PoS public chains like Ethereum, the pathway for token issuance is only through emission to ETH stakers. In the PoL mechanism, BGT is not directly allocated to validators but to providers of liquidity for certain assets, making the issuance of tokens not exclusive to holders of a single token. The new token inflation in PoL is more fair compared to traditional PoS networks, addressing the concentration of stake issue in PoS mechanisms.

3) Coordinates the relationship between asset issuance protocols and validators

The PoL mechanism incentivizes protocols to collaborate with validators, enabling:

- Validators to control the flow of BGT, incentivizing protocol issuance of liquidity pools

- Protocols to help validators gain more governance power by bribing BGT holders

Three-Token Model

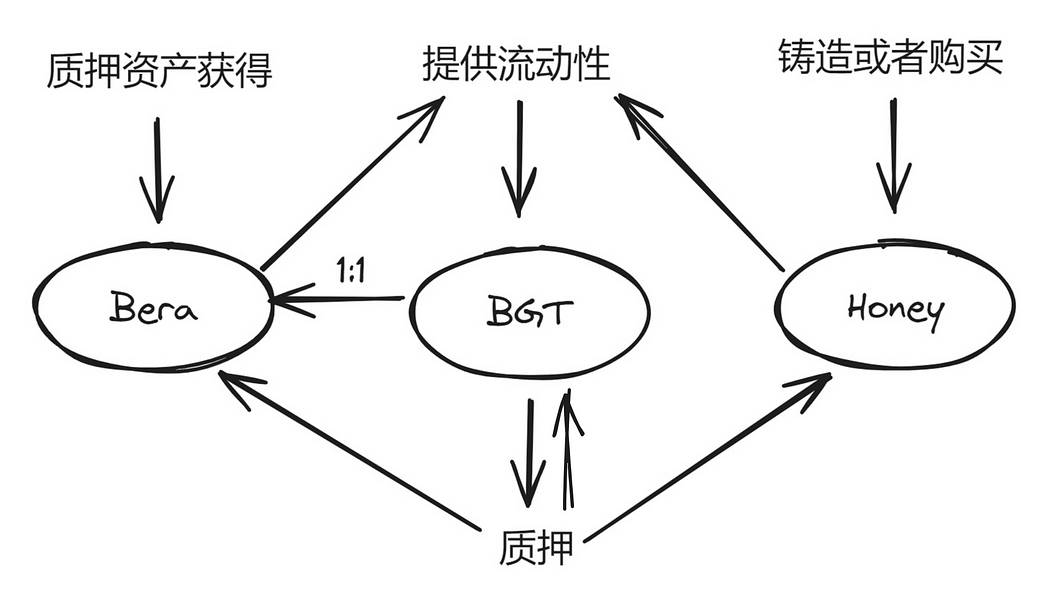

Berachain's three tokens are BGT (governance token), BERA (Gas Token), and HONEY (stablecoin).

BGT: Governance token, non-transferable, can only be obtained by providing LP for certain assets on BEX.

BERA: Gas Token, obtained through 1:1 burning of BGT or validation rewards.

HONEY: Native over-collateralized USD stablecoin, serving as a medium for protocol income distribution.

Operation Mode

- Users provide liquidity on Berachain (BERA, HONEY, or other trading pairs) and receive BGT rewards.

- Delegating governance rights in BGT to validators can earn BERA + HONEY.

The three-token model systematically builds liquidity, where:

- Governance token (BGT) and on-chain Gas token (BERA) are separated.

- The only way to obtain BGT is by providing liquidity to BEX.

This means that Berachain's staking supports mainstream assets from other chains. Unlike PoS public chains, where staking rewards can only be obtained by staking a specific token, Berachain users have a more diverse range of assets to stake for obtaining BGT, further stimulating liquidity.

Berachain's three-token model draws on the experiences and lessons of many DeFi projects. For example, the decentralization of governance rights is inspired by Curve, stimulating the competition for governance rights by asset issuers. Honey draws inspiration from Terra's native stablecoin concept, adding more liquidity to the protocol.

III. Overview of Key Ecosystem Projects

the honeyjar

the honey jar is the entry point to the Berachain ecosystem, holding significant influence in the community. It is responsible for educating users, incubating and promoting ecosystem projects, and facilitating collaborations. Its website is designed to resemble a computer desktop, with all Berachain-related information organized in various "software" sections.

Currently, the honey jar has launched Honey Comb NFT, but has not committed to any specific empowerment. However, as a core community NFT project of Berachain, it offers benefits from multiple projects, including airdrops, whitelists, APY boosts, and free NFT minting, all from collaborative agreements within the Berachain ecosystem.

Also noteworthy are the projects mentioned by the honey jar's founder, Jani, on Twitter.

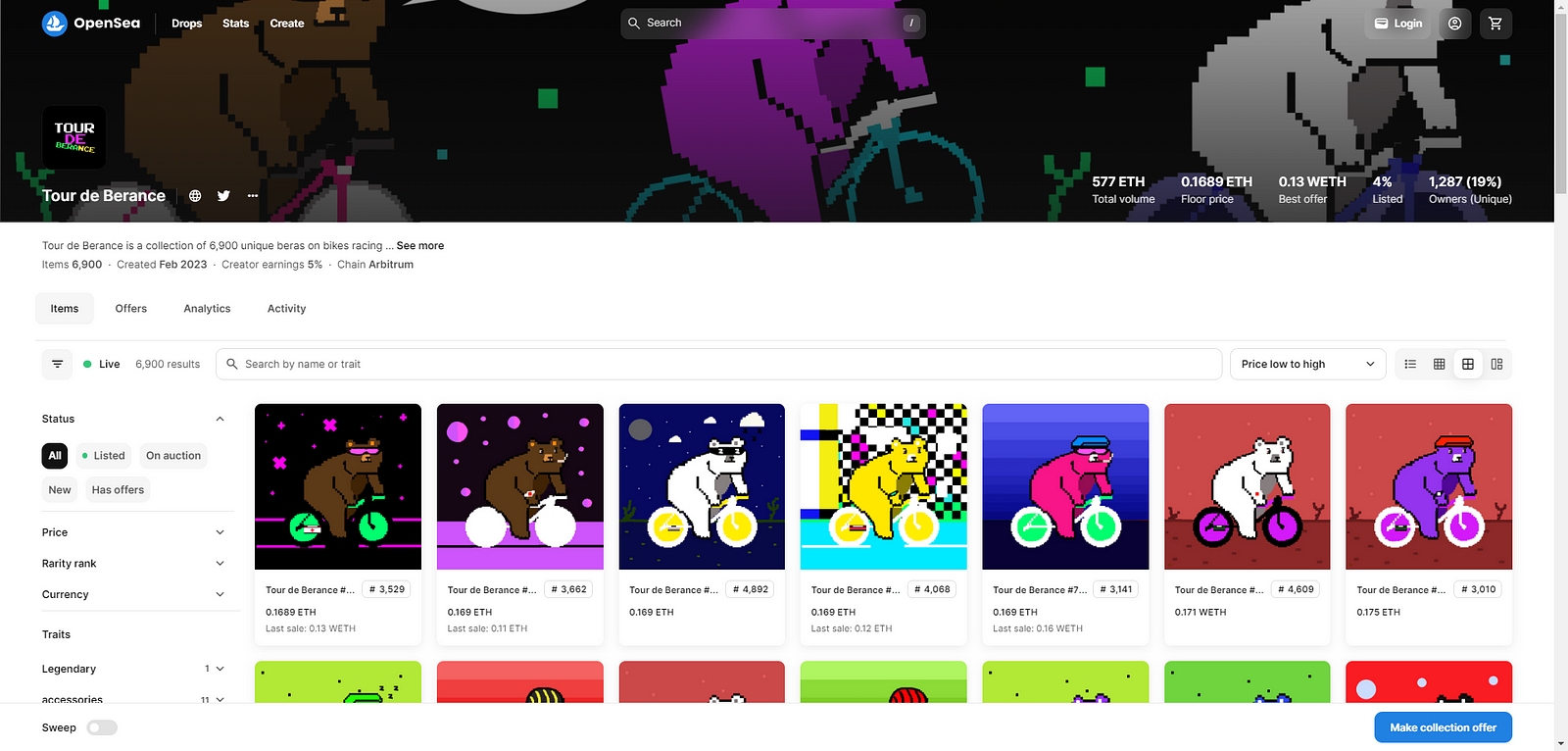

Beradrome

Beradrome is the DEX and Restaking liquidity market on Berachain, featuring ve (3,3) token economics, built-in bribes, voting mechanisms, and a year ago launched an NFT series called "Tour de Berance," often jokingly referred to as "Beras on Bikes." The team has explicitly stated that holders of this NFT series will enjoy rebase benefits upon the launch of Berachain and may receive airdrops of BERO or hiBERO tokens in the future. Additionally, holders of Tour de Berance have already received airdrops of oWIG from another project launched by the team on the Base chain.

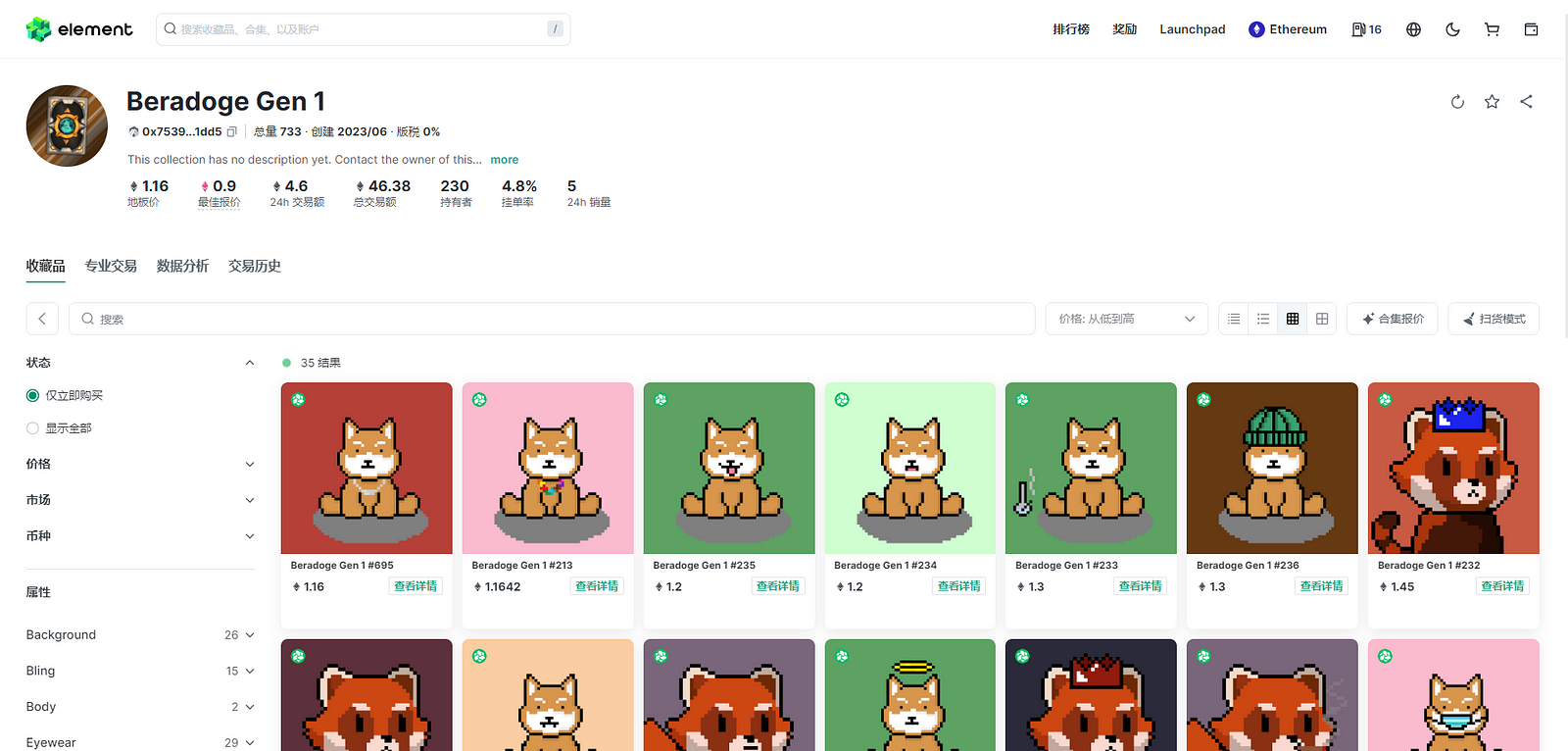

Beradoge

Beradoge (BDOGE) is a prominent meme project on Berachain. The project has two NFT series, "Beradoge Gen 1" and the recently minted "Mibidiots." According to the project, holders of these NFT series will be granted "a bunch of useless stuff" or "a bunch of BDOGE." There are also rumors that BDOGE may be airdropped to holders of NFTs from other Berachain projects.

Sudoswap

Sudoswap is a full-chain NFT AMM liquidity market that raised $12.5 million in a private funding round at the end of 2022. Its focus on liquidity innovation aligns with the central idea of Berachain, and it has already announced plans to deploy the protocol after the launch of the Berachain mainnet. Once Berachain is live, Sudoswap is expected to support bridging of blue-chip NFTs and incentivize many NFTs from the mainnet to bridge to Berachain, making it one of the first NFT markets to join Berachain.

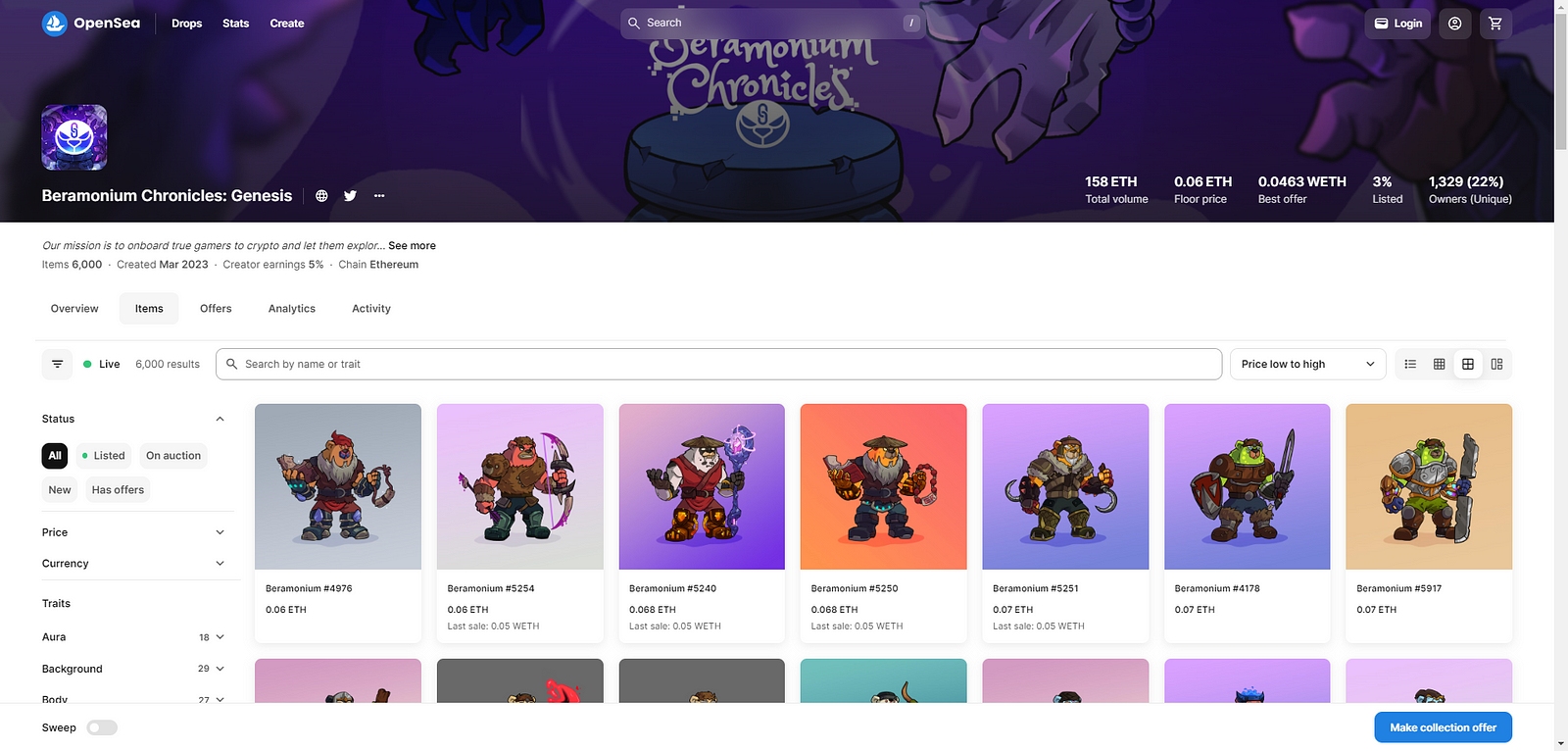

Beramonium

Beramonium is the blockchain game of Berachain, and they have released an idle role-playing game called "Gemhunters." In this game, players can have their Beramium Genesis beras perform tasks to obtain gems, which can be exchanged for NFTs from other well-known Berachain projects, such as Honey Combs, Beradoges, etc. The minting price for this NFT is 0.045 ETH.

Redacted Cartel

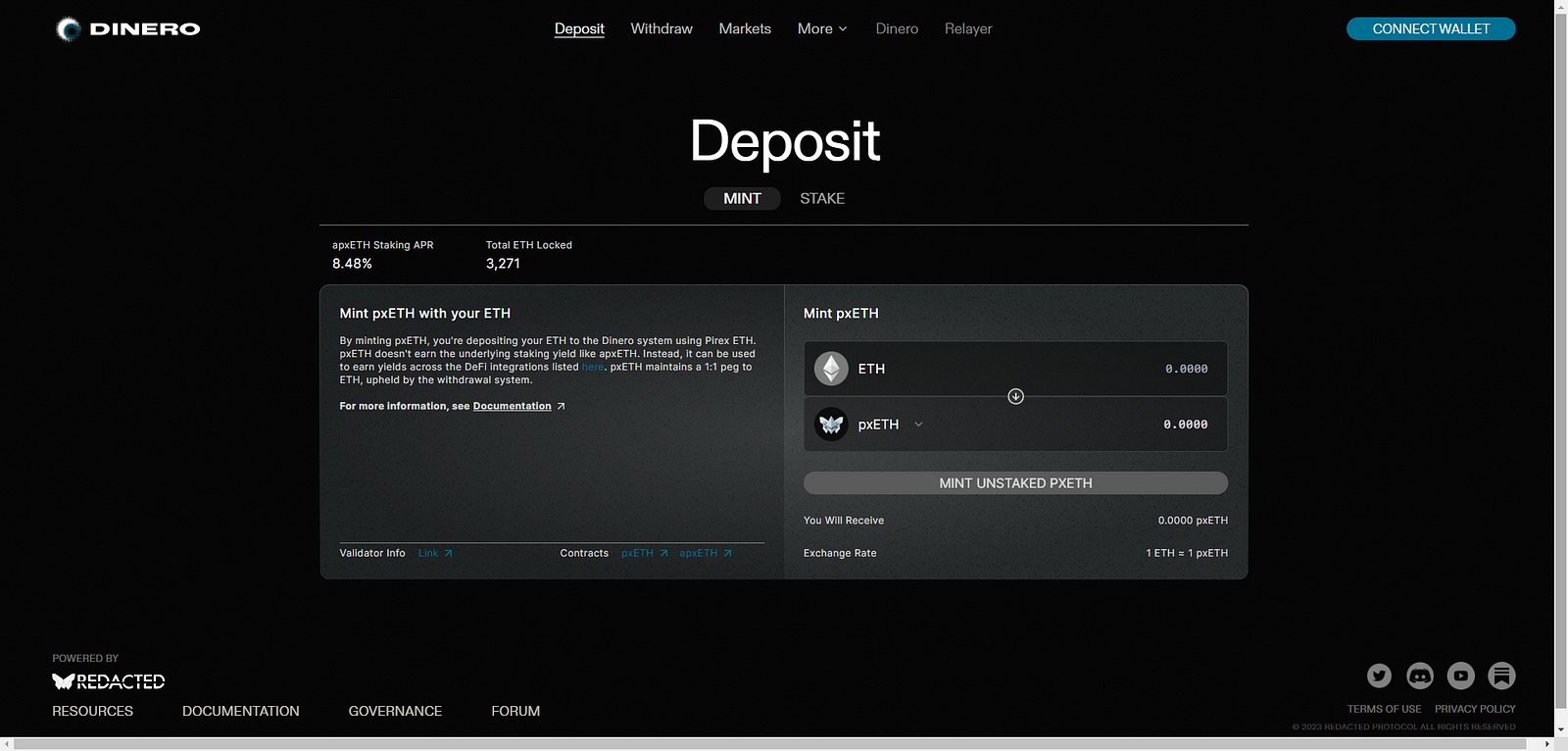

Redacted Cartel is a DeFi yield protocol incubated by the New Order team, with multiple sub-products covering bribery market trading and LSD liquidity staking. It has previously announced plans to deploy a new project on Berachain, but there are currently no further details. With Berachain's built-in voting bribery mechanism, it can be expected that DeFi yield ecosystem projects like Redacted Cartel will have the opportunity to shine on the bear chain.

Ecosystem Project Summary Link: https://docs.google.com/spreadsheets/d/1tLOrxMnws6NX-0JMAIKH1ULFmjDYv2LVvYG8Lbv2kpU/edit#gid=659852632

Conclusion

Berachain's distinctive three-token economic model separates gas and governance, maximizing liquidity release and avoiding harm to active users participating in the network (such as users contributing significant transactions and gas), resolving the contradiction between active participation in governance staking and liquidity. Therefore, we are very optimistic that Berachain will lead DeFi innovation and create high liquidity and high capital efficiency DeFi protocols.

As user numbers grow and fee income increases, Berachain will further attract more users and ecosystem projects. Coupled with Berachain's governance reward mechanism, this will create a positive feedback loop.

However, it is important to maintain rationality, and the future development of Berachain needs to be monitored, including the development of the project itself, the growth of the ecosystem, and the security of the protocol, among other factors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。