*This report is co-produced by Beosin, ACAMS, and ABCP

Introduction

2025 is a critical year for establishing the global regulatory landscape for virtual assets and also a year of challenges for anti-money laundering compliance. From the rollout of the U.S. "GENIUS Act," the comprehensive implementation of the EU MiCA, to the legislative passage of Hong Kong's "Stablecoin Ordinance" and the advancement of the ASPIRe roadmap, major jurisdictions worldwide are accelerating the construction of a systematic and multidimensional regulatory framework. At the same time, virtual asset crimes are exhibiting characteristics of cross-border, organized, and technical nature, posing severe challenges to traditional anti-money laundering systems.

This report is initiated by Beosin, co-authored with the Association of Certified Anti-Money Laundering Specialists (ACAMS) and the Association of Blockchain Compliance Professionals (ABCP). Based on the global anti-money laundering and regulatory dynamics of virtual assets in 2025, it systematically reviews the regulatory situation in major countries and regions, deeply analyzes the characteristics of virtual asset crimes and money laundering techniques, and focuses on emerging technology trends such as the x402 payment protocol, dedicated chains for stablecoins, and prediction markets. It aims to present an annual overview of depth and reference value to industry practitioners, regulatory agencies, and researchers from an objective and professional perspective.

1. Global Analysis of Anti-Money Laundering and Regulatory Trends for Virtual Assets

2025 is viewed as a watershed year in the history of global virtual asset regulation. If the past decade was a "watching and trial-and-error period" for regulatory agencies regarding this emerging asset class, then 2025 marks the official "recognition" and "systemization" of the global regulatory framework. As blockchain technology becomes deeply embedded in global financial infrastructure, governments are no longer merely viewing virtual assets from the perspective of anti-money laundering (AML) and combating the financing of terrorism (CFT) but are recognizing them as core components of the future digital economy. Consequently, they are constructing a multidimensional governance system encompassing prudential regulation, market conduct, investor protection, and systemic risk prevention.

This year, the regulatory focus shows a profound paradigm shift: regulators are moving from passively responding to market innovations to proactively setting technical standards and market access rules through legislation. Notably, with the enactment of the U.S. "GENIUS Act," the comprehensive implementation of the EU "Markets in Crypto-Assets Regulation" (MiCA), and the legislative passage of Hong Kong's "Stablecoin Ordinance" along with the advancement of the "ASPIRe" strategic roadmap, major global financial centers have essentially completed the closed loop of top-level design. This trend of moving from "ambiguous exploration" to "rule formation" not only clears legal obstacles for the large-scale entry of traditional financial institutions (TradFi) but also presents unprecedented challenges to the compliance survival capabilities of native crypto enterprises.

A deeper logic lies in the fact that the tightening and clarification of regulations actually pave the way for the "decriminalization" and "financialization" of virtual assets, which has positive implications for the long-term healthy development of the industry. With the improvement of the regulatory framework, the space for regulatory arbitrage is effectively compressed, fostering further separation between illegal funds and compliant markets, and steering the overall ecosystem towards more standardized and transparent development. The boundaries between compliant markets and illegal activities are becoming increasingly clear, enhancing the confidence of market participants and laying the foundation for the integration of virtual assets into the mainstream financial system.

1.1 Global Regulatory Situation of Virtual Assets in Major Countries and Regions in 2025

1.1.1 United States

Regulatory Situation: In July 2025, the U.S. officially passed the "GENIUS Act," establishing a regulatory framework for payment stablecoins, marking the first time the U.S. legislated at the federal level to recognize and regulate stablecoins:

● Clear classification of stablecoins as neither securities nor commodities;

● Issuers must hold a 1:1 reserve (cash or U.S. Treasury bonds due within 93 days);

● Establishment of a "Stablecoin Certification Review Committee," restricting technology giants (such as Meta and Apple) from issuing stablecoins;

● Strengthening of KYC, AML, and consumer protection measures;

● Foreign issuers (such as Tether) must register in the U.S., or they will be banned from the market.

Learning from the painful lessons of the collapse of Terra/Luna and the misappropriation of user assets by FTX, the "GENIUS Act" has established nearly stringent standards for managing reserve assets. The act mandates that issuers must hold 1:1 reserve assets, and permissible assets are limited to cash or U.S. Treasury Bills with a maturity of 93 days or less. This regulation excludes high-risk assets such as commercial paper and corporate bonds, ensuring the high liquidity and security of the underlying assets of stablecoins.

A more critical institutional innovation is the separation of bankruptcy and priority of claims. The act alters the applicable logic of bankruptcy law, clearly stipulating that in the event of an issuer's bankruptcy or insolvency, stablecoin holders possess "first priority claims" on the reserve assets, superior to other general unsecured creditors of the issuer. This clause fundamentally addresses the risk of user funds becoming "unsecured debts," greatly enhancing institutional investors' confidence in using stablecoins for large value settlements. This legal certainty is a prerequisite for traditional financial institutions to boldly incorporate stablecoins into their core businesses and lays a legal trust foundation for new technological applications such as the "x402 payment protocol" mentioned in subsequent chapters.

Currently, the U.S. virtual asset industry is regulated by multiple agencies in a coordinated manner: the Securities and Exchange Commission (SEC) supervises virtual currencies with securities characteristics; the Commodity Futures Trading Commission (CFTC) oversees virtual currency futures contracts; the Office of the Comptroller of the Currency (OCC) is responsible for the regulation of stablecoin issuance, custody, and payments; and the Financial Crimes Enforcement Network (FinCEN) combats money laundering and other illegal activities.

While establishing strict standards, regulators are also easing restrictions on traditional financial institutions. The Federal Reserve revoked previous restrictions on banks engaging in cryptocurrency businesses, allowing banks to decide whether to offer custody, payment, and issuance services for crypto assets, as long as they establish a robust risk management system. In December 2025, the Federal Deposit Insurance Corporation (FDIC) further approved proposals to implement the application process for the "GENIUS Act," clarifying the specific procedures for bank subsidiaries to apply for stablecoin issuance. However, due to concerns over antitrust and data privacy, the act established a "Stablecoin Certification Review Committee" and imposed additional restrictions on large tech companies (such as Meta and Apple) issuing stablecoins. This differentiated treatment reflects regulators' vigilance towards the "commercial data + financial monopoly" model, aiming to prevent tech giants from using their vast user networks to create super-sovereign closed-loop economies.

1.1.2 Hong Kong

Regulatory Situation: In February 2025, the Hong Kong Securities and Futures Commission (SFC) released a forward-looking "ASPIRe" regulatory roadmap, aiming to comprehensively reshape Hong Kong's virtual asset financial ecosystem through five pillars.

● Access (Entry): Simplifying market access through regulatory clarity. The focus in 2025 is to fill regulatory gaps in over-the-counter (OTC) trading and custody services by establishing a licensing system that allows compliant entities to enter the market more smoothly while excluding illegal OTC from the formal financial system.

● Safeguards: Optimizing compliance burdens. Regulators acknowledge that previous one-size-fits-all rules (such as extremely high ratios of cold wallet storage requirements) may have stifled operational efficiency, so they are shifting to a risk-based regulatory approach, exploring adjustments to custody technology standards and storage ratios based on technological advancements.

● Products: Enriching product offerings. The SFC has indicated it will expand the range of tradable assets and services based on investor types (retail vs. professional), breaking away from previous limitations to only a few mainstream coins.

● Infrastructure: Modernizing regulatory infrastructure. Utilizing regulatory technology (RegTech) to enhance reporting and monitoring efficiency, strengthening inter-departmental intelligence sharing among the SFC, Hong Kong Monetary Authority (HKMA), and the Police Force in response to increasingly complex on-chain crimes.

● Relationships: Strengthening ecosystem links. Enhancing cooperation with global regulatory bodies to promote cross-border law enforcement collaboration and rebuilding market confidence through investor education.

In May 2025, Hong Kong's Legislative Council passed the "Stablecoin Ordinance," which officially took effect in August 2025. As a result, Hong Kong became one of the few jurisdictions in Asia to implement institutional regulatory oversight for stablecoins:

*For detailed interpretation of the "Stablecoin Ordinance," please refer to the complete report.

In response to issues exposed in the JPEX case, where unlicensed OTC entities (like street exchange shops) became conduits for fraudulent funds, the Hong Kong government completed consultations on the licensing system for OTC and custodians in June 2025 and initiated legislative procedures in the second half of the year.

● OTC Regulation: Managed by the SFC, focusing on combating money laundering risks and requiring OTC vendors to conduct strict customer real-name registration and transaction limit management. This move directly counters the cash laundering paths used by "black and grey market guarantee platforms" described in Chapter Two of this report.

● Custodial Regulation: The SFC will establish a dedicated custodial license (Type 13 RA), incorporating independent custodians into the regulatory framework. This ends the previous situation where only VATP affiliates could legally provide custody, allowing professional third-party custodial institutions (such as banks and trust companies) to obtain licenses independently and provide safer asset custody services to the market.

The improvement of the regulatory framework for virtual assets has provided solid support for law enforcement practice. In August 2024, the Hong Kong Police Force’s Organized Crime and Triad Investigation Bureau (OCTB) issued a formal letter of thanks to a cryptocurrency exchange, recognizing the contribution of the exchange's investigative team in a major kidnapping case. The letter was personally signed by Senior Superintendent of OCTB, Ouyang Zhao Gang, especially naming and thanking a member of the exchange's investigative team, who recently joined the ABCP as a member of the executive committee. In the letter, the Hong Kong Police expressed gratitude for the investigator's help in successfully identifying suspects in a criminal group, thus advancing the resolution of the case.

The exchange provided key leads through its Financial Crimes Compliance team’s intelligence analysis, assisting police in tracking down suspects. This case illustrates how criminals may utilize cryptocurrency as a funding transfer tool across various types of criminal activities, such as laundering ransom payments post-kidnapping or cross-border fund flows. Yet, leveraging expertise in blockchain analysis and professional investigative techniques, private analysis firms and law enforcement can effectively trace on-chain fund flows, identify unusual patterns, and pinpoint suspects, significantly enhancing investigative efficiency. This letter of thanks not only highlights the effectiveness of public-private collaboration in combating emerging tech crimes but also serves as a positive example for blockchain analysis and intelligence companies like Beosin and ABCP, demonstrating that professional blockchain investigation capabilities can play a crucial role across diverse criminal scenarios.

1.1.3 European Union

Regulatory Situation: Although some provisions of the "Markets in Crypto-Assets Regulation" (MiCA) came into effect in 2024, the regulation did not achieve complete coverage across the 27 EU member states and three European Economic Area countries until December 30, 2024, realizing unified regulatory rules.

MiCA classifies stablecoins into Electronic Money Tokens (EMTs) and Asset-Referenced Tokens (ARTs). EMTs maintain asset value by referencing an official currency (i.e., stablecoins backed by fiat), while ARTs stabilize value by referencing a combination of various values or rights. MiCA stipulates that issuers of EMTs must be EU-authorized credit institutions (i.e., banks) or electronic money institutions (EMIs). This means issuers without EMI licenses in the EU cannot list their tokens on exchanges within the EU. This regulation has imposed a devastating blow to Tether (USDT). Due to Tether's delayed application for or failure to obtain an EU license, major exchanges such as Coinbase, OKX, and Bitstamp have announced that they will delist USDT for European users by the end of 2024 to the beginning of 2025.

● Requiring stablecoin issuers to publish white papers that disclose detailed information about the issuer, stablecoin characteristics, associated rights and obligations, underlying technologies, risk factors, and asset reserves;

● Any marketing communications related to stablecoin trading must be clear and explicit, avoiding sensational statements to control hype risks from the outset;

● Issuers must ensure 100% of the underlying asset reserves and report periodically to ensure the stablecoin value remains stable;

● The daily trading volume of a single ART or EMT cannot exceed 5 million euros, and if the market value of an ART or EMT exceeds 500 million euros, the issuer must report to regulators and undertake additional compliance measures;

● An ART’s usage within a single currency zone must cease issuance once it exceeds 1 million transactions or 200 million euros in transaction volume (based on quarterly averages);

● Only euro-backed stablecoins can be used for daily goods and services payments, restricting the usage of non-euro stablecoins within the EU.

According to Decta's "2025 Euro Stablecoin Trends Report," within 12 months of MiCA's implementation, the market capitalization of major euro stablecoins increased by 102%, completely reversing the downward trend of the previous year:

● EURC (Circle): As the euro stablecoin issued by Circle, its trading volume increased an astonishing 1139% after MiCA's implementation, controlling over 50% of the market share in circulation, becoming the de facto leader in the euro stablecoin market.

● EURS (Stasis): As an established euro stablecoin, its market capitalization surged from 38 million dollars to 283 million dollars, with a growth rate exceeding 600%.

● EURCV (Société Générale - Forge): The EURCV issued by the subsidiary of French bank Société Générale represents an attempt of traditional banks to enter this domain. Its trading volume increased by 343%, though the base was small, it symbolizes significant meaning—stablecoins issued by banks are starting to gain liquidity in the DeFi space.

In addition, the "Digital Operational Resilience Act" (DORA) officially came into effect on January 17, 2025. Although DORA is not exclusively aimed at the crypto industry but covers all financial institutions, its impact on crypto firms is particularly profound.

● Core Requirement: DORA requires financial entities to establish extremely high IT security standards to withstand cyber attacks and technological failures. It empowers regulatory agencies to directly supervise key third-party ICT service providers (such as cloud service providers and node service providers).

● Industry Impact: This means that crypto exchanges and custodians not only need to manage their systems but also must be responsible for the stability of the on-chain infrastructure they depend on (such as oracles and node networks). This aligns with the "risks of manipulation in prediction market oracles" discussed in Chapter Four of this report—regulators are starting to pay attention to the single point of failure risks in decentralized infrastructures.

Furthermore, the newly established EU Anti-Money Laundering Agency (AMLA) began operations in 2025, directly supervising high-risk CASPs, particularly emphasizing monitoring cross-border transactions and privacy coins, aligning with the global trend of combating crypto money laundering.

*For interpretations of the regulatory situations in more countries and regions, please refer to the complete annual report.

II. Global Virtual Asset Crime Situation

In 2025, the rapid expansion of the virtual currency ecosystem and technological innovation also brought a comprehensive upgrade of criminal methods. From on-chain attacks, cross-chain money laundering, to generative AI fraud scenarios and dark web quick payment scenarios, virtual currency crimes exhibit more pronounced characteristics of concealment, intelligence, and cross-border activity.

Transnational criminal organizations are rapidly expanding in terms of organizational scale, business chains, and methods, demonstrating unprecedented escalation in their cross-border collaboration and risk spillover capabilities. From earlier precise fraud and mid-phase technical attacks to later stages of laundering illicit funds, every aspect is managed by professional teams, constructing a cross-border cooperative organizational system using encrypted communication tools and networks of offshore companies, forming a closed-loop model of “headquarters command + regional execution + global money laundering.”

The theft incident at the Bybit exchange in February 2025 marked a significant event indicative of large-scale operations by transnational criminal groups. Additionally, the fourth-quarter exposure of the Southeast Asia Prince Group’s Chen Zhi case further revealed the "industry coverage + global money laundering" characteristics of such criminal networks. This "corporatized crime ecology" presents immense challenges to traditional judicial cooperation and regulatory mechanisms in terms of speed and technical capabilities.

2.1 Guarantee Platforms as Main Channels Linking Black and Grey Markets

In black and grey market trading scenarios, the lack of mutual trust between the parties is one of the core pain points; this issue has directly led to the emergence of the intermediary role of "guarantees." These guarantee platforms essentially involve transaction models where a third-party guarantor (including individuals, smart programs, or service agencies) intervenes, bearing the intermediary guarantee responsibilities throughout the transaction process, thereby building trust for both parties in the transaction and promoting cooperation.

Guarantee platforms have emerged as a new type of intermediation platform in the black and grey market, with both user scale and funding scale growing exponentially in recent years. Data from Beosin indicates that as of December 15, 2025, the current mainstream guarantee platforms have had over 549,400 pledged users, over 2.54 million pledged instances, and over 15 billion USDT in pledged fund flow. Among these, over 330,000 pledged users and over 1.26 million pledged instances were recorded in 2025, with pledged fund flow exceeding 8.7 billion USDT. Currently, guarantee platforms operate primarily through anonymous chat applications (such as Telegram) by forming groups and related channels to provide comprehensive services to the black and grey markets.

In 2025, the U.S. intensified sanctions against Southeast Asian cybercrime. In May, the U.S. announced sanctions against Funnull Technology Inc. in the Philippines involved in virtual asset pig-butchering scams, as well as their executives; in October, it sanctioned the "Prince Group" of Cambodia and 146 related individuals, freezing 127,271 bitcoins (valued at approximately $15 billion at the time) and formally severing connections between the Huai Wang Group and the U.S. financial system; in November, it imposed sanctions on organizations involved in cyber fraud in Myanmar. This series of sanctions forced Southeast Asian criminal organizations represented by Huai Wang guarantees to halt or adjust their operations.

2.1.1 Huai Wang Guarantee

Among guarantee platforms, the most representative platform is "Huai Wang Guarantee" (which changed its name to "Hao Wang Guarantee" in October 2024 to avoid regulatory scrutiny), previously affiliated with the Huai Wang Group. The Huai Wang Group originated from Huai Wang Currency Exchange (Cambodia) Co., Ltd., which claims to have been established in August 2014 and is a large financial group that holds multiple financial licenses, including payments, banking, and insurance. Huai Wang Guarantee quickly developed into the largest guarantee platform on Telegram under the endorsement of the Huai Wang Group, setting up a three-tier structure of "main group - sub-group - business group," managed by 10 core administrators in the main group; sub-groups are categorized by business type (including "entertainment fund guarantee group," "payment exchange guarantee group," etc.), and business groups are private groups for one-on-one client dealings.

In addition to Telegram, the guarantee platform also receives large order inquiries through chat applications like WhatsApp and Tudou, requiring settlement to be conducted using virtual currencies such as USDT and TRX, rejecting direct transactions in fiat currency.

As of May 2025, Huai Wang Guarantee’s active public groups on Telegram reached 9,289, with each public group containing between 1,000 to 5,000 members, associated with 12,000 private business groups, with "entertainment fund matching groups" accounting for 23%.

In mid-May 2025, Huai Wang Guarantee was banned by Telegram, and the platform announced its suspension of operations. The immediate cause for the ban may be the U.S. sanctions. On May 1, 2025, the U.S. Department of the Treasury's Financial Crimes Enforcement Network announced that the Huai Wang Group had been designated as a "foreign financial institution of primary money laundering concern," intended to be placed on the "311" list. Being placed on the "311" list will cut access to the U.S. dollar settlement system, meaning the Huai Wang Group can no longer complete dollar transactions through the U.S. financial system. Moreover, exchanges and wallet service providers in the blockchain sector will also not be able to provide services to them.

2.1.2 Tudou Guarantee

Due to the ban on Huai Wang Guarantee's core operational groups on Telegram, its business faced suspension and urgently needed to maintain operations through external connections. To quickly restore operations, Huai Wang Guarantee adopted a dual-binding strategy of "equity connection + business uptake":

● Equity connection

Directly acquiring 30% of "Tudou Guarantee's" shares, providing a means to access Tudou Guarantee while avoiding the regulatory sensitivities that could arise from directly restarting the original brand, thus ensuring the continuity of guarantee operations.

● Business uptake

Upon completing the equity acquisition, Huai Wang Guarantee immediately guided original platform users to transfer to Tudou Guarantee and other associated platforms, essentially extending the business logic of the original Huai Wang Guarantee.

On-chain Address Status

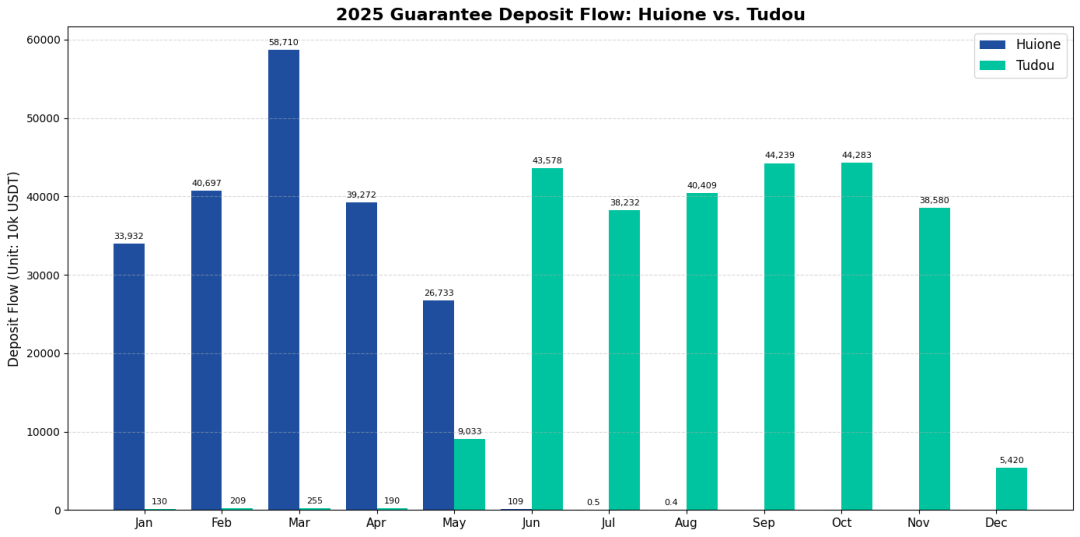

As of December 15, 2025, the annual flow of pledged addresses for Huai Wang Guarantee reached 1.995 billion USDT. As shown in the graph below, the financial flow of Huai Wang Guarantee significantly declined and continued to shrink due to the impact of the Telegram ban in May 2025.

In 2025, Huai Wang Guarantee had over 400,000 total active on-chain addresses, while Tudou Guarantee had over 120,000 active addresses. In December, impacted by the operational status of Huai Wang payments, the flow of pledged addresses significantly decreased. Previously, Huai Wang payments had used Tudou Guarantee’s pledged addresses for fund laundering operations, further supporting the connection between Huai Wang and Tudou Guarantee. As seen in the reference chart, after the ban on Huai Wang Guarantee in May 2025, influx funds into Tudou Guarantee's pledged addresses markedly increased.

*For more on-chain data and content regarding guarantee platforms, please refer to the complete annual report.

2.2 Analysis of Money Laundering Techniques for Virtual Assets

As a result of the deep integration of blockchain technology and financial innovation, virtual assets play a positive role in enhancing the efficiency of financial systems, activating market innovation vitality, and strengthening inclusive financial services. However, it is important to note that their inherent characteristics of anonymity, convenient cross-border circulation, and decentralization provide a new breeding ground for money laundering and illegal fundraising activities, posing severe challenges to judicial practices. Currently, the number of virtual asset money laundering criminal cases and the amounts involved continue to rise, with methods evolving, directly threatening the order and security of financial markets.

2.2.1 Stablecoin Money Laundering

Currently, the trend of diverting multiple stablecoins is evident, and the money laundering scenarios for different stablecoins show marked differences. Below are representative stablecoin cases from this year:

● USDT remains the "fundamentally laundering vehicle"

USDT continues to be the choice for money laundering. In the "Xin Kang Jia Financial Pyramid Scheme Case" exposed in July 2025, the platform involved used stablecoins for payment, transferring 1.8 billion USDT to a shell company in the Cayman Islands through a mixer just 48 hours before the collapse, leaving the funds of many investors unaccounted for. TRC20-USDT on the Tron network, known for its high throughput and low fees, has become the preferred option for small, high-frequency transfers in telecom network fraud and other black and grey market activities.

● USDC has become a "cross-border transition channel"

USDC's application in the laundering of funds post-hacker attacks has increased. After the Cetus Protocol hack in May 2025, 3.27 million USDC involved was quickly converted into 1,089 ETH through cross-chain protocols, with an average cross-chain operation time of only 17 minutes.

● DAI has become the "tool for avoiding freezing"

Due to its decentralized nature, DAI has become the stablecoin choice for evading freezing sanctions. The difficulty in freezing assets involved is extremely high due to the absence of a single issuing party. The North Korean Lazarus hacking group laundered over 30% of the $840 million worth of DeFi assets stolen this year by converting USDC to DAI through the MakerDAO ecosystem.

● Niche coins like A7A5 have become "dedicated tools for evading sanctions"

This coin is supported by Russian institutions and designed to provide cross-border payment services for sanctioned entities; since its launch in January 2025, it has facilitated the transfer of $70.8 billion in funds.

2.2.2 Privacy / Mixing Tools for Money Laundering

Cross-chain bridges, mixers, and privacy chains (such as Monero and Zcash) are playing an increasingly significant role in the path of virtual asset money laundering. Hackers and scam teams utilize these tools to achieve rapid fund transfers, obfuscate transaction paths, and complicate tracing for law enforcement agencies.

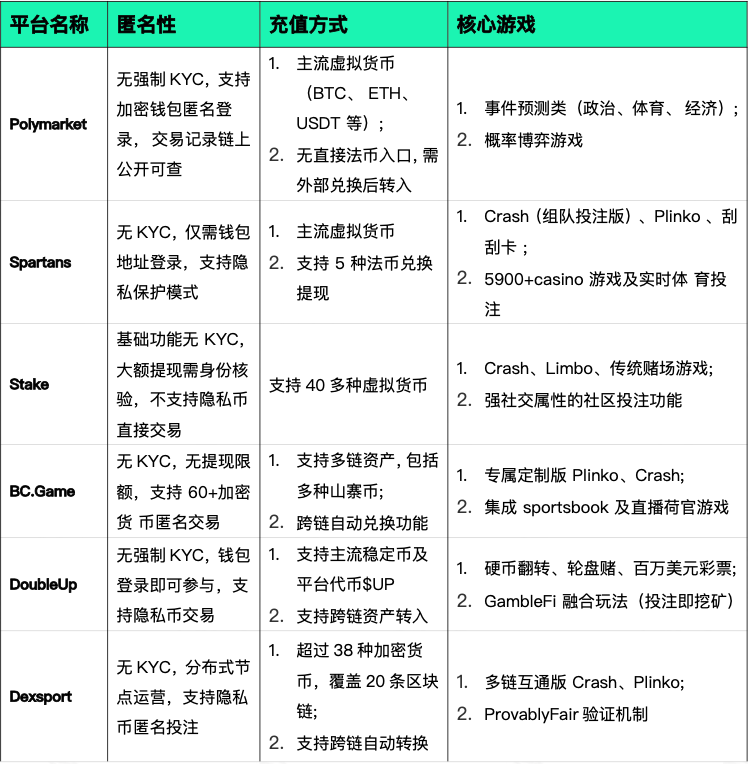

2.2.3 Online Gambling Platform Money Laundering

Unlicensed gambling platforms use virtual assets to achieve rapid and anonymous fund settlements. Online gambling platforms (especially illegal platforms operating across borders) are "heavy users" of virtual assets. These platforms typically do not accept direct deposits in fiat currency; instead, they require users to convert fiat into stablecoins or mainstream virtual assets before transferring to the designated addresses of the platform, with betting funds, settlements, and withdrawals all completed using virtual assets. These funds may then be converted back and forth between cryptocurrencies, circulate cross-border, or be withdrawn as fiat currency, ultimately integrating into the formal economy. This operation not only conceals the source of criminal proceeds but also increases the difficulty for law enforcement to track and combat these activities, effectively creating a complete black industrial chain from gambling to money laundering.

*For more data and content, please refer to the complete annual report.

Conclusion

The virtual asset industry in 2025 is at a critical stage intertwined with regulatory systematization, professionalization of crime, and deep technological innovation. The global regulatory shift from vague exploration to rule formation not only clears legal obstacles for traditional financial institutions entering the virtual asset market but also clarifies the boundaries between compliant and illegal markets, steadily advancing the virtual asset industry towards more standardized and transparent development. The internationalization and industrial upgrade of virtual asset crimes have rendered the regulatory and enforcement capabilities of single regions inadequate to address the complex crime scenarios, making global regulatory cooperation and law enforcement assistance a trend in anti-money laundering efforts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。