Authors/DAVID BAILEY, SPENCER NICHOLS

Translator/Ning

The following is a brief analysis of the outflow of GBTC by "Bitcoin Magazine". It is not a strict mathematical calculation, but only serves as information for investors to understand the current selling situation of GBTC from a macro perspective and to estimate the possible scale of future fund outflows.

01. Grayscale's Outflow of Funds, Net Inflow of Bitcoin ETF

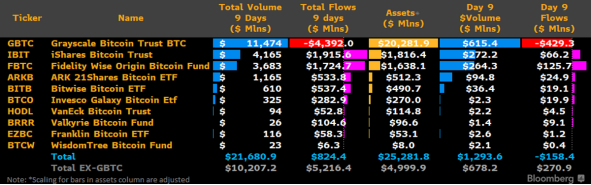

January 25, 2024 - Since the launch of the Bitcoin spot ETF, the market has been caught in a whirlwind of selling, initiated not by others, but by Grayscale Bitcoin Trust (GBTC), which was once one of the world's largest Bitcoin funds, holding over 630,000 bitcoins. After the closed-end fund was converted into a spot ETF, GBTC's BTC holdings (3% of the total 21 million bitcoins) lost over $4 billion in the first 9 days of ETF trading, while at the same time, other ETF participants saw an inflow of about $5.2 billion. As shown in the table below, the funds are still in a net inflow state, but from the market's perspective, despite the SEC's approval, the price of BTC is still declining. The destination of the net inflow of $824 million remains a big question mark.

When predicting the recent price impact of the Bitcoin spot ETF, it is essential to understand the duration and scale of GBTC outflows. The following will combine the reasons for GBTC outflows, sellers, and relative inventory analysis to estimate the duration and scale of outflows. From the conclusion, although there is still significant selling pressure, the digestion of this pressure is a long-term positive for Bitcoin's continued development.

02. GBTC Awakening: Investors' Game

There is no doubt that the arbitrage trading triggered by GBTC was a key driver of the Bitcoin bull market from 2020 to 2021. Due to the difficulty for early institutional investors to directly purchase BTC, there were many GBTC buyers, leading to a prevalent premium situation (i.e., the net asset value was higher than the market price). This premium drove market participants (3AC, Babel, Celsius, Blockfi, Voyager, etc.) to purchase fund shares at net asset value and boost their book value to earn premium returns. Essentially, the premium drove demand for GBTC purchases, thereby forming a preference for the spot Bitcoin price among institutions.

Although the premium drove the market during the bull market in 2020 and brought in billions of dollars, after that, with the special mechanism of GBTC's difficulty in redemption combined with the market downturn, the trust began trading at a price lower than its net asset value in February 2021 - a negative premium. The negative premium of GBTC basically led to a decrease in the balance sheet of the entire crypto industry.

In May 2022, the Terra default triggered a chain liquidation of GBTC shares by various parties such as 3AC and Babel, further lowering the GBTC price. Since then, GBTC has transformed from a price creator to a price burden, and it remains so. The reason is that investors who were originally trading GBTC but suffered bankruptcy due to difficulties in redeeming and liquidating are still slowly selling GBTC shares. A typical example is FTX, which ultimately liquidated 20,000 BTC in the first 8 days of spot Bitcoin ETF trading to repay creditors.

It is worth mentioning the negative premium of GBTC and its impact on the demand for spot Bitcoin. This negative premium incentivizes investors to go long on GBTC while shorting BTC, until the net asset value of GBTC rises to obtain BTC-denominated returns. This pattern further increases the selling demand for spot Bitcoin.

Source: ycharts.com

Nevertheless, there are still substantial liquidation assets holding GBTC, and they will continue to liquidate from Grayscale's inventory of 600,000 BTC (as of January 26, 2024, it was 512,000 BTC).

The following will focus on different segmented markets of GBTC shareholders and analyze the potential additional fund outflows based on the financial strategies of each segmented market.

Optimal Strategies for Different GBTC Shareholders

The question is simple: out of the approximately 600,000 bitcoins in the trust, how many are likely to exit GBTC? Subsequently, in the outflow of funds, how much will flow back into Bitcoin products or Bitcoin, largely offsetting the selling pressure? To answer these questions, the key is the motivations of GBTC shareholders and their holding strategies.

Two key factors driving GBTC outflows are as follows: fees (up to 1.5% annual fee) and special sales by shareholders due to differing financial conditions (cost basis, tax advantages, bankruptcy, etc.).

① Liquidation Assets

Estimated ownership: 15% (89.5 million shares | 77,000 BTC)

As of January 22, 2024, FTX has liquidated all of its 22 million GBTC shares (about 20,000 BTC). Other bankrupt parties, including GBTC's sister company Genesis Global (36 million shares/about 32,000 BTC) and another undisclosed entity holding about 31 million shares (about 28,000 BTC).

To reiterate, liquidation assets hold approximately 15.5% of GBTC shares (90 million shares/about 80,000 BTC), and most or all of these shares are likely to be sold soon to repay creditors. FTX has already sold 22 million shares (about 20,000 BTC), and it is currently unclear whether Genesis and the other party have sold their shares. In summary, a large portion of the liquidation sales has likely already been absorbed by the market.

The challenge with liquidation assets is that the sales may not take as long as expected, but rather be more of a forced one-time payment, while other types of shareholders are more likely to exit their positions in a more enduring manner. Therefore, once legal issues are resolved, it is very likely that 100% of the shares of bankrupt assets will be sold.

② Retail Brokerage and Retirement Accounts

Estimated ownership: 50% (286.5 million shares | 255,000 BTC)

Next are retail brokerage account shareholders. GBTC, as one of the first passive products targeting retail investors launched in 2013, holds a large number of retail shares. It is estimated that retail investors hold about 50% of GBTC shares (286.5 million shares/about 255,000 bitcoins). As it stands, these are the most challenging shares to handle, as the core of whether holders sell or not depends on the price of BTC, which in turn determines the tax situation for each purchase of shares.

If the price of Bitcoin rises, most retail shareholders will realize profits, meaning that they will exit GBTC at that time, generating taxable capital gains (about 15% to 35%). Considering this, investors may choose to continue holding to gain more profits. Conversely, if the price of Bitcoin continues to decline, more GBTC investors will not consider taxes and are more likely to exit. A potential negative feedback loop will slightly increase the group of sellers who can exit without paying taxes. Given the unique availability of GBTC for early Bitcoin supporters, most retail investors will choose to hold. As a rough estimate, a 25% sale of retail brokerage accounts is feasible, but this will vary depending on the trend of Bitcoin prices.

Next, another category is retail investors who distribute through IRAs (retirement accounts) and are eligible for tax-free status. These investors are extremely sensitive to fees, and given the special nature of IRAs, they can choose to sell without triggering a taxable event. With GBTC's annual fee as high as 1.5% (six times that of GBTC's competitors), it is certain that a large portion of this segmented market will exit GBTC and choose other spot ETFs. About 75% of them may exit, while other shareholders may ignore this fee due to Grayscale's unique liquidity and scale. From the perspective of spot Bitcoin demand in retirement accounts, the positive aspect is that GBTC shares will flow into other spot ETF products.

③Institutional Holders

Estimated ownership: 35% (200,000,000 shares | 180,000 BTC)

Institutions hold approximately 180,000 bitcoins, including participants such as FirTree and Saba Capital, as well as hedge funds looking to arbitrage the discount of GBTC and the price difference of spot Bitcoin. The core principle is to go long on GBTC and short Bitcoin to gain a differential position and obtain the net asset value return of GBTC.

It is worth noting that the identity of this type of holder is opaque and their market behavior is difficult to predict. They also serve as a barometer for traditional financial demand for Bitcoin. For those who hold GBTC purely for the aforementioned arbitrage trading, it can be assumed that they will not repurchase Bitcoin through any other mechanism. We estimate that this type of investor holds about 25% of all GBTC shares (143 million shares/about 130,000 BTC). This figure is not accurate, but it can be inferred that over 50% of traditional institutions will exit in cash rather than continue to purchase Bitcoin products or physical Bitcoin.

For Bitcoin native funds and whales (accounting for about 5% of the total shares), the GBTC shares they sell are likely to be converted into spot Bitcoin for continued holding, thus having minimal impact on the Bitcoin price. As for cryptocurrency native investors (accounting for about 5% of the total shares), they may exit GBTC in exchange for cash and other non-Bitcoin crypto assets. Considering the conversion of cash and Bitcoin by these two groups (57 million shares/about 50,000 BTC), overall, they will have a neutral to slightly negative impact on the Bitcoin price.

03. Total Outflow of GBTC and Net Impact on Bitcoin

It is worth noting that the above predictions have a high degree of uncertainty, but considering the liquidation assets, retail brokerage accounts, retirement accounts, and institutional investors, the following is a rough estimate of the overall redemption situation.

Estimated Details of Outflow:

- The total estimated outflow of GBTC is 250,000 to 350,000 BTC;

- An estimated 100,000 to 150,000 BTC will leave the trust and be converted into cash;

- 150,000 to 200,000 BTC from the outflow of GBTC will flow into other trusts or products;

- GBTC will retain 250,000 to 350,000 bitcoins;

- Net selling pressure of 100,000 to 150,000 BTC.

As of January 26, 2024, approximately 115,000 bitcoins have flowed out of GBTC. Combining Alameda's sales records (about 20,000 bitcoins), it is estimated that out of the remaining 95,000 bitcoins, half have been converted into cash, and the other half have been converted into Bitcoin or other Bitcoin products, meaning that the impact of GBTC outflows on the market is relatively neutral.

Estimated Pending Outflow:

- Liquidation accounts: 55,000 BTC;

- Retail brokerage accounts: 65,000 - 75,000 BTC;

- Retirement accounts: 10,000 - 12,250 BTC;

- Institutional investors: 35,000 - 40,000 BTC;

- Estimated total outflow: ~135,000 - 230,000 BTC.

Note: As mentioned earlier, the data is only an estimate and discussion, and should not be interpreted as financial advice. It is intended to give readers an understanding of the overall outflow situation. In addition, the predictions are based on the current market conditions.

04. Slowly and Quickly, Farewell to the Bear Market

Overall, we estimate that the market has already absorbed approximately 30-45% of the estimated GBTC outflow (115,000 BTC out of an estimated total outflow of 250,000-300,000 BTC), and the remaining 55-70% of the estimated outflow will be completed in the next 20-30 trading days. Given that some of the GBTC outflow funds will flow into other spot ETF products or Bitcoin, GBTC sales may bring about a net selling pressure of 150,000 - 200,000 BTC.

On the other hand, the market situation is gradually becoming clear: GBTC will eventually gradually relinquish its relative monopoly on the Bitcoin market, and after the settlement of selling pressure, the future selling pressure on Bitcoin products will continue to decrease. Although the remaining GBTC outflows will take time and may cause a series of liquidation effects, with the gradual expansion of spot ETFs, Bitcoin will still have enough room for upward movement.

Of course, considering the halving, that's another story.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。