Metaplanet Bitcoin Equity Raise Targets 210K BTC by End of 2027

I n a bold move to strengthen its place in Bitcoin history, Japanese tech firm Metaplanet has launched Asia’s biggest Bitcoin-focused equity raise. The company announced it will raise ¥770.9 billion, or about $5.4 billion, by issuing 555 million shares through a unique financial method called moving strike warrants. This method, used for the first time in Japan, allows shares to be issued at a premium to the current market price, something only possible because of Metaplanet’s high market activity and strong liquidity.

Recently the company showed up with a 8888 BTC total count after the latest purchase of 1088 Bitcoin on 1, June 2025.

Japan’s First Bitcoin-Focused Premium Equity Raise

This step makes Metaplanet the first organisation in Japan to issue such warrants with a premium. It showcases investors’ confidence in the company’s vision as well as Bitcoin’s potential in the long-run. The funds raised through this will go toward one clear objective that is, acquiring this digital currency.

Metaplanet has set the goals high. The organisation aims to hold 100,000 BTC by the end of 2026 and 210,000 BTC by the end of 2027. That would give them authority of about 1% of all the Bitcoin that will ever exist, a huge step in the digital currency industry.

In a statement, the company’s CEO Simon Gerovich thanked its shareholders and focused on its long-term focus:

“We are honored to be on this journey with you. Metaplanet is accelerating into the future, powered by Bitcoin.”

Source: Simon Gerovich X Handle

He also posted that this plan follows a previous 210 million plan which was highly successful. They raised about $650 million in the 60 trading days, with a BTC yield of positive 189%. Company’s share price has also increased 3x after this. Now Metaplanet gains the position under top 10 BTC holders at the global level.

Following MicroStrategy’s Playbook

This strategy mirrors what Michael Saylor, chairman of MicroStrategy (now called Strategy), has been doing for years. On June 2, Strategy announced a new plan to raise more money, this time through the sale of 2.5 million shares of its 10% Series A Perpetual Stride Preferred Stock (ticker: STRD). The company plans to use these funds to buy more of this digital asset and support general business needs. They own a total of 590,955 BTC with their latest purchase of this month.

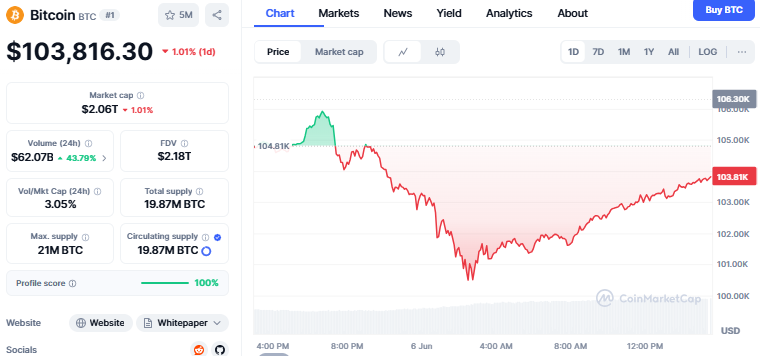

Saylor’s aggressive buying of the said cryptocurrency has turned MicroStrategy into a corporate crypto giant, and it’s clear that Metaplanet is now aiming for a similar role in Asia. The currency now stands at $103,816 with a decrease of 1.01% and increased trading volume of 43.79%.

Source: CoinMarketCap

Trump’s Media Firm Joins the Bitcoin Race

Adding more firepower to this digital asset's growing corporate support, Trump Media & Technology Group also revealed major funding moves. On May 31, the company raised $1.44 billion through stock offerings and another $1 billion via convertible bonds. The total $2.32 billion will be used to build a BTC treasury and support related efforts.

This shows a strong trend: Major public companies are treating this digital currency as a long-term asset, one that could help them grow and protect value over time.

What This Means for BTC?

Bitcoin is now more than just a digital form of money for tech experts. Many businesses worldwide are treating it as a strategic reserve asset. The steps taken by Metaplanet and other top companies show more support for Bitcoin’s future in international finance.

Not only are these companies purchasing small amount BTC, but they are spending billions of dollars on it. If this becomes a pattern, additional institutions may join, making it more valuable and popular in the upcoming years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。