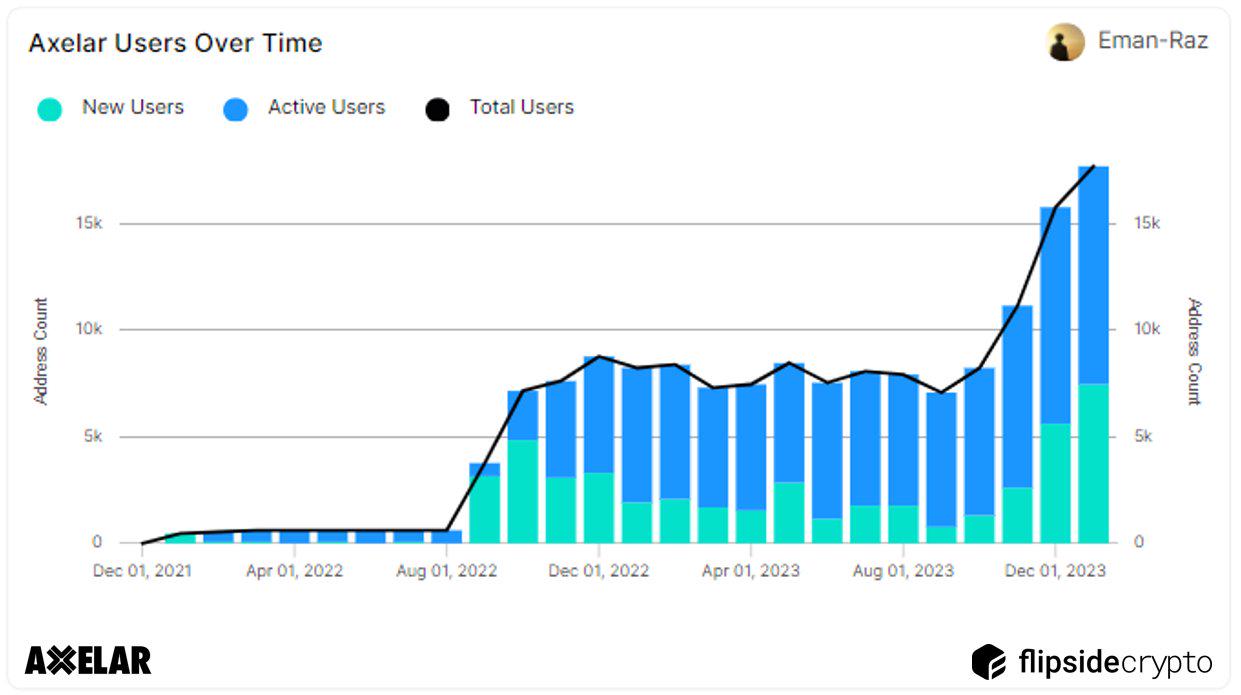

Since September 2023, a series of well-known Web3 projects have announced deep cooperation with the cross-chain interaction protocol Axelar, which has attracted attention and popularity for Axelar.

On January 26th, Centrifuge has integrated with the Celo blockchain through Axelar; on January 25th, Immutable completed integration with Axelar; in December of last year, the hybrid algorithm stablecoin protocol Frax Finance completed integration with Centrifuge through Axelar Network; at almost the same time, Axelar (AXL) announced integration with Vertex, making it another major DEX using Axelar services after dYdX, Uniswap, and Pancakeswap.

Currently, Axelar connects to over 56 blockchains, processing a transaction volume of up to $7 billion, and also provides services to traditional Web2 giants such as Microsoft and JPMorgan. The following will introduce Axelar, this high-quality project.

The starting point of Axelar's technical design is to provide seamless integration of Web3 for billions of users

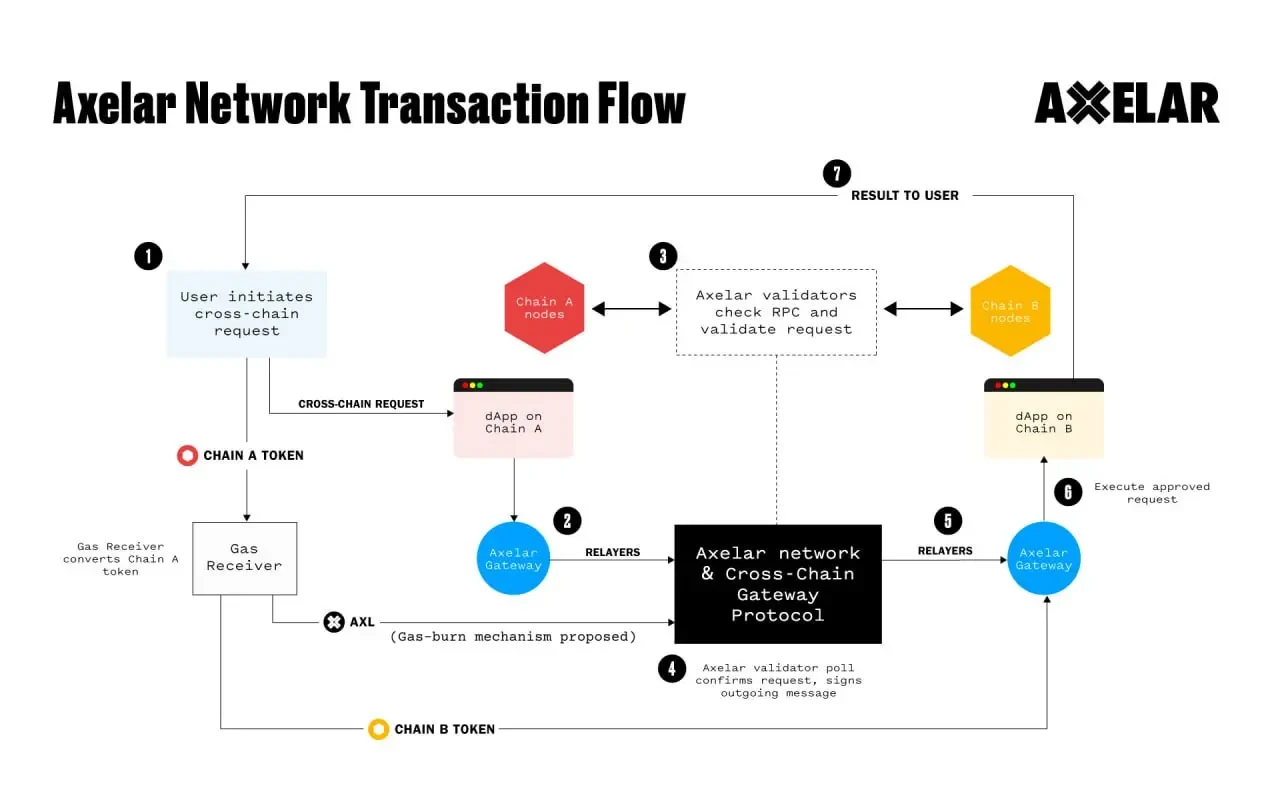

Axelar is an advanced cross-chain platform aimed at achieving Web3 interoperability. Through the cross-chain transfer protocol (CCTP) launched in partnership with Circle, Axelar not only provides powerful tools for developers but also offers the possibility of seamless access to blockchain technology for billions of users. This decentralized platform allows decentralized application (dApp) developers to easily achieve cross-chain communication through its unique protocol suite, tools, and APIs.

In terms of security, Axelar has taken three key measures: comprehensive adoption of open-source technology, implementation of a hub-and-spoke connection method rather than the traditional point-to-point method, and the establishment of a decentralized network consisting of 75 dynamic validators. These measures not only enhance the platform's security but also strengthen its stability and reliability.

What sets Axelar apart from other platforms is its secure cross-chain communication mechanism based on proof of stake (PoS). Unlike projects that rely on optimistic settings or federated multi-signatures, Axelar provides additional security through a dynamic validator network. Additionally, Axelar provides convenient tools and APIs for application developers, allowing them to build cross-chain applications without having to learn new programming languages.

Axelar's technology not only supports programmable interoperability but also has high scalability, enabling rapid connection to more blockchains and providing a one-stop cross-chain solution for decentralized applications.

The core of the Axelar network includes a decentralized validator network and a set of smart contracts to facilitate cross-chain interactions. In addition, Axelar's native token AXL plays multiple roles in the network, including paying transaction fees, participating in network consensus, and voting on governance proposals. AXL also supports the cross-chain transfer of various mainstream blockchain tokens, such as Ethereum and Avalanche. As of now, the total supply of AXL exceeds 1 billion, with a circulating supply of approximately 300 million.

Understanding Axelar's new economic model: Committed to achieving deflation, lowering the threshold for new chain connections to the main network

The AXL token in the Axelar network plays three key roles: paying network transaction fees, ensuring network security through staking, and weighted voting in governance. The initial token allocation arrangement aims to support these functions while balancing network usage and participant incentives.

A recent proposal for a new token economics focuses on reducing the inflation rate and implementing a gas burning mechanism. The original inflation rate for each external validation chain was 0.75%, resulting in a total inflation rate of 11.5%. However, the new proposal reduces this rate to 0.3%, thereby reducing the total inflation rate to 6.7%, seeking a balance between validator incentives and controlled network supply expansion.

Axelar proposes to implement a gas burning mechanism by removing gas fees from the circulating supply, countering inflation. Assuming a fixed gas fee of $0.5 per transaction and fees charged for transferring a certain amount of assets, this mechanism can remove approximately 104 million AXL annually, effectively offsetting a high inflation rate of up to 10%. Although Axelar has not yet reached the expected transaction volume, this mechanism demonstrates the potential path towards deflation.

Axelar is working to simplify the process of connecting new chains to its network and developing more permissionless connection pathways. This will allow developers to more easily integrate new chains into the Axelar network through smart contract templates. This strategy, combined with Ethereum-based infrastructure and services such as the DApp chain ecosystem and Rollups-as-a-Service, is expected to increase network usage and attractiveness, and may become an important driver of AXL token demand.

Through these strategies, Axelar aims to achieve long-term sustainability and growth of its token economics, while providing value and incentives to its network participants. With the continued expansion of the Axelar network and optimization of its token economic model, the platform is expected to occupy a more important position in the cryptocurrency field.

As cross-chain solutions, where does Axelar differ significantly from LayerZero and Wormhole?

LayerZero and Wormhole, two major cross-chain solutions, have also made significant strides in the industry in the past two years, but Axelar has a series of differences from them, which will be introduced to users one by one below.

- Differences in trust mechanisms and security: Axelar is more decentralized

In terms of trust and security mechanisms, Axelar differs significantly from LayerZero and Wormhole. LayerZero relies on the "Oracle" and "Relayer" roles to verify transactions, while Wormhole uses a limited set of "Guardians" for authoritative proof. In comparison, Axelar uses a delegated proof of stake (PoS) mechanism based on the Cosmos SDK, ensuring network security through a permissionless validator set consisting of 75 validators. This mechanism, based on economic incentives and penalties, provides a higher degree of decentralization and security, reducing reliance on a single or few entities.

- Axelar's Hub & Spoke model is more efficient than LayerZero's point-to-point model

Axelar's Hub & Spoke model is superior to LayerZero's point-to-point model. This structure is similar to a centralized airline network, increasing network efficiency and manageability by reducing the necessary connections and simplifying monitoring processes. In contrast, LayerZero's point-to-point model, while theoretically permissionless, often relies on specific entities in practice, such as Google Oracle, leading to limitations in security and activity.

- Axelar's Virtual Machine (AVM) can simplify cross-chain tasks and provide tools for developers

Another significant advantage of Axelar is its Virtual Machine (AVM), developed based on Cosmwasm, which provides the ability to connect new chains without permission and flexibility for cross-chain dApp development. This is not clearly evident in LayerZero and Wormhole. The AVM not only simplifies cross-chain tasks but also provides powerful tools for developers to more effectively expand and manage their multi-chain dApps.

- The essential difference between LayerZero and Axelar is that the latter tends to be more centralized in its communication protocol.

Although the name LayerZero implies a Layer 0 protocol, its functionality is more focused on application-level interoperability. In contrast, Axelar, with its structured consensus framework and centralized communication protocol, is closer to the essence of a Layer 0 protocol. While the latest update of LayerZero v2 introduces a decentralized validator network and executors, Axelar's intermediate consensus layer has already provided a solid foundation for message passing.

- The architecture choice of Wormhole Gateway tends to align with Axelar, and the former will bring more challenges to the latter.

The launch of Wormhole Gateway reflects the correctness of Axelar's architecture choice. The new design of Wormhole uses Cosmos SDK and IBC light clients, which is very similar to Axelar's approach. This indicates a strong market demand and recognition for the methods adopted by Axelar, while also foreshadowing increased competition that Axelar faces in this field.

Overall, Axelar stands at the forefront of cross-chain technology with its unique security mechanisms, efficient network structure, advanced virtual machine technology, and sensitive insight into market demand. While LayerZero and Wormhole each have their advantages, Axelar demonstrates its uniqueness in many key aspects, providing strong support for the future interoperability of the cryptocurrency world.

Axelar is showing stronger potential, but the future development path is not smooth due to environmental issues

The Axelar network is widely adopted by top decentralized exchanges (DEX) such as dYdX and Uniswap, as its backend technology supports multi-chain asset pair liquidity pools. For example, dYdX utilizes Axelar to support one-click deposits for users, while Uniswap deploys on Filecoin through Axelar. These use cases not only demonstrate Axelar's technical strength but also reflect its potential in providing seamless cross-chain interactions.

While the Axelar network demonstrates significant potential in the field of cross-chain communication, it also faces common security challenges of cross-chain protocols, such as fund loss and unauthorized token minting risks. The locking and minting mechanisms adopted by Axelar, while providing a certain level of security, have also attracted the attention of hackers. However, by taking measures such as allowing validator sets to collectively approve smart contract upgrades, Axelar is striving to enhance the decentralization and security of its network.

Axelar has successfully connected to 55 major chains, including Arbitrum, Avalanche, BNB Chain, etc. The strength of its technology lies in its ability to connect to networks with unique VM and consensus mechanisms. This extensive connectivity not only provides users with pathways to the entire ecosystem but also brings tremendous potential growth to the Axelar network itself.

With integrations from important platforms such as Immutable and Vertex Protocol, Axelar is gradually becoming a key component of multi-chain interoperability. Axelar's technology not only makes products more versatile and adaptable but also provides a smooth user experience for widely adopted DEX. In the future, with the development of the Ethereum ecosystem and the emergence of more L2 networks, Axelar's full-stack interoperability will be a key driver of its growth, expected to bring a broader and deeper impact to the world of Web3.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。