Original Title: "Osmosis Protocol Data Analysis"

Original Source: E2M Research

E2M Research: Shawn (October 2023)

Osmosis is a cross-chain DEX application chain built on the Cosmos SDK, and has become the most widely connected and liquid chain in the Cosmos ecosystem.

1. Liquidity Data

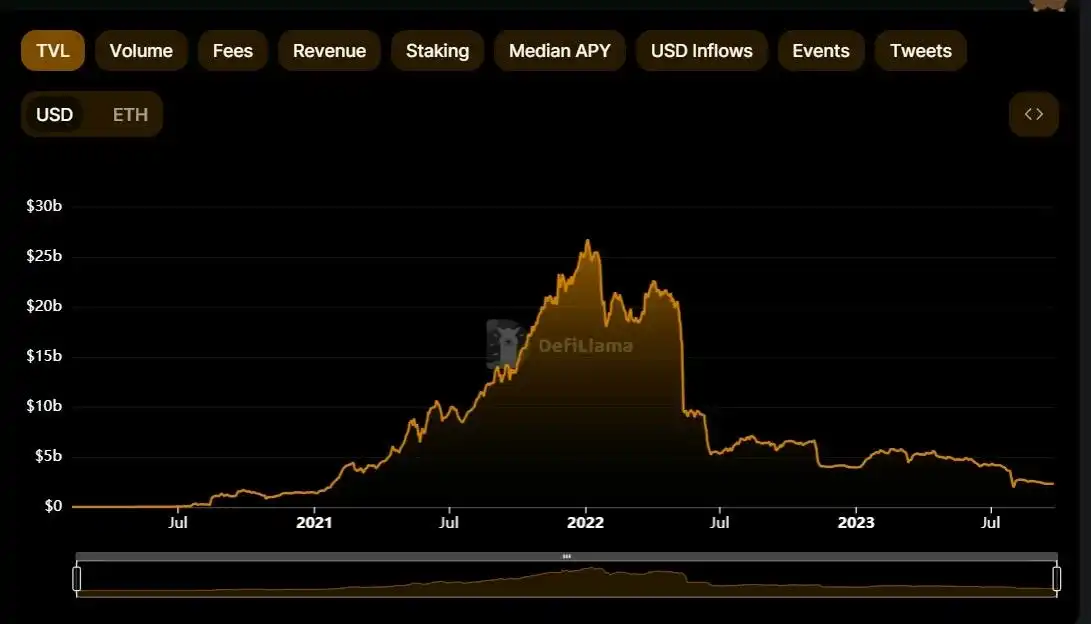

The project was launched in June 2021, and the TVL has been on the rise since then, reaching its peak in March 2022 at around $1.8 billion. Since mid-2022, the TVL has sharply declined and has now dropped to around $80 million.

Data Source: https://defillama.com/protocol/osmosis-dex

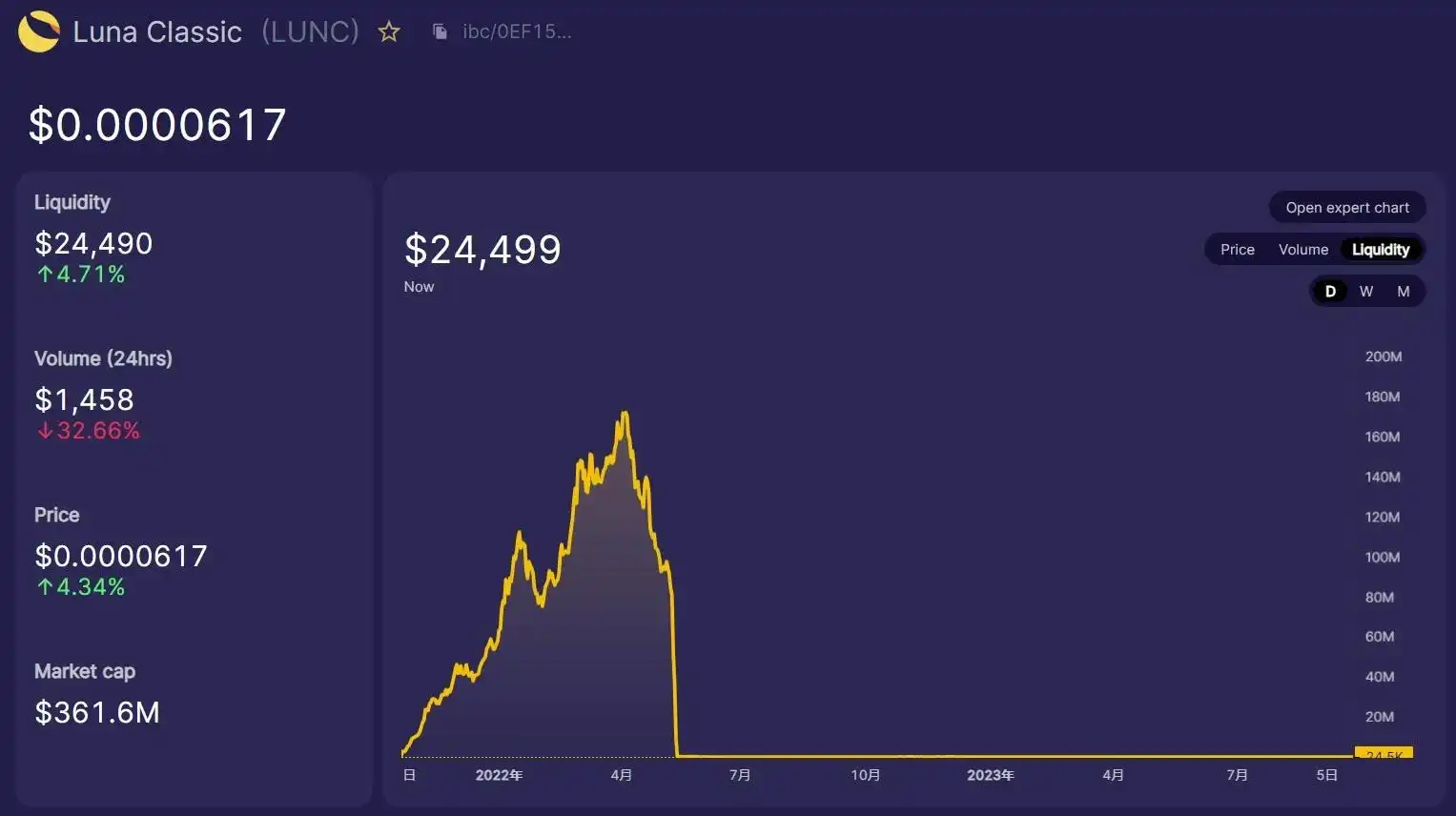

Where UST reached approximately $200 million at its peak:

Data Source: https://info.osmosis.zone/token/USTC

While LUNA reached approximately $170 million at its peak:

Data Source: https://info.osmosis.zone/token/LUNC

OSMO reached approximately $700 million at its peak:

Data Source: https://info.osmosis.zone/token/OSMO

ATOM's highest TVL was approximately $400 million:

Data Source: https://info.osmosis.zone/token/ATOM

Other major assets are roughly estimated as follows:

JUNO: $80 million

STARS: $50 million

AKT: $50 million

SCRT: $20 million

Adding other assets, the total TVL is basically consistent with the data provided by Defillama.

The total TVL of LUNA+UST is approximately $370 million, accounting for about 20%. Therefore, it can be seen that although the TVL of Osmosis has sharply declined due to the LUNA incident, its proportion is not very high. The main reason for the decline is still due to the drop in token prices in the Cosmos ecosystem (but there is also the reason of public pessimism towards the Cosmos ecosystem due to the LUNA incident).

The decline from $1.8 billion to $80 million represents a decrease of 95.6%. Comparing with other mainstream DEX data,

Uniswap decreased from $10 billion to $3.2 billion, a decrease of about 68%:

Data Source: https://defillama.com/protocol/uniswap

Curve decreased from $25 billion to $2.3 billion, a decrease of 90.8%:

Data Source: https://defillama.com/protocol/curve-dex

Another reason is that the Cosmos ecosystem does not have native stablecoins like USDT and USDC, which leads to its TVL being more affected by price fluctuations.

2. Trading Data

The trading volume on Osmosis reached its peak in early 2022, with a monthly trading volume of about $3 billion. It gradually declined thereafter, with a monthly trading volume of about $200 million in 2023:

Data Source: https://defillama.com/protocol/osmosis-dex

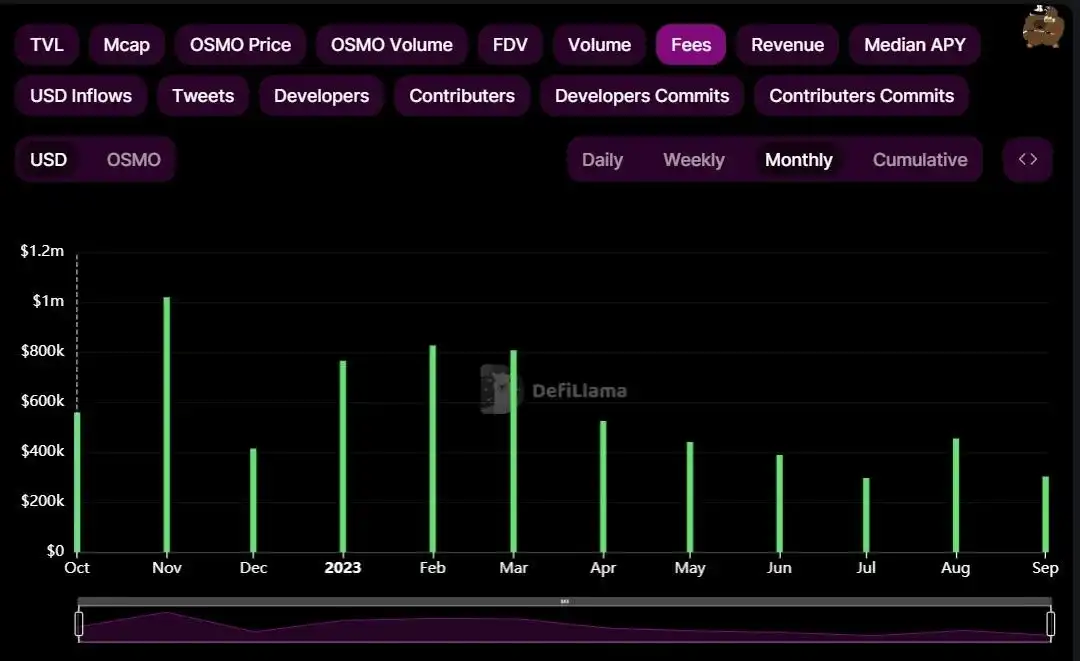

A certain fee will be charged for trading on Osmosis, with most pools charging a fee of 0.2% or 0.3%, and the fees are currently all allocated to liquidity providers. Since January 2023, the average monthly fee income has been about $500,000.

Data Source: https://defillama.com/protocol/osmosis-dex

3. Network Data

Osmosis is a DEX application chain built on the Cosmos SDK, so we need to analyze its network data.

According to MapOfZones data, there are a total of 62 chains connected to the Cosmos ecosystem through IBC, with Osmosis being connected to the most chains, reaching 59:

Data Source: https://mapofzones.com/home

This is higher than the 54 chains connected to the Cosmos Hub and the 46 chains connected to Axelar. The Cosmos Hub is the first chain in the Cosmos ecosystem, while Axelar is the largest cross-chain bridge in the Cosmos ecosystem, through which a large amount of Ethereum assets are bridged to the Cosmos ecosystem.

In terms of connectivity, Osmosis is different from contract-based DEX projects. Only assets connected to Osmosis through IBC can be traded on it, and in this respect, other DEX projects in the Cosmos ecosystem find it difficult to compete with Osmosis, which is a significant advantage for Osmosis.

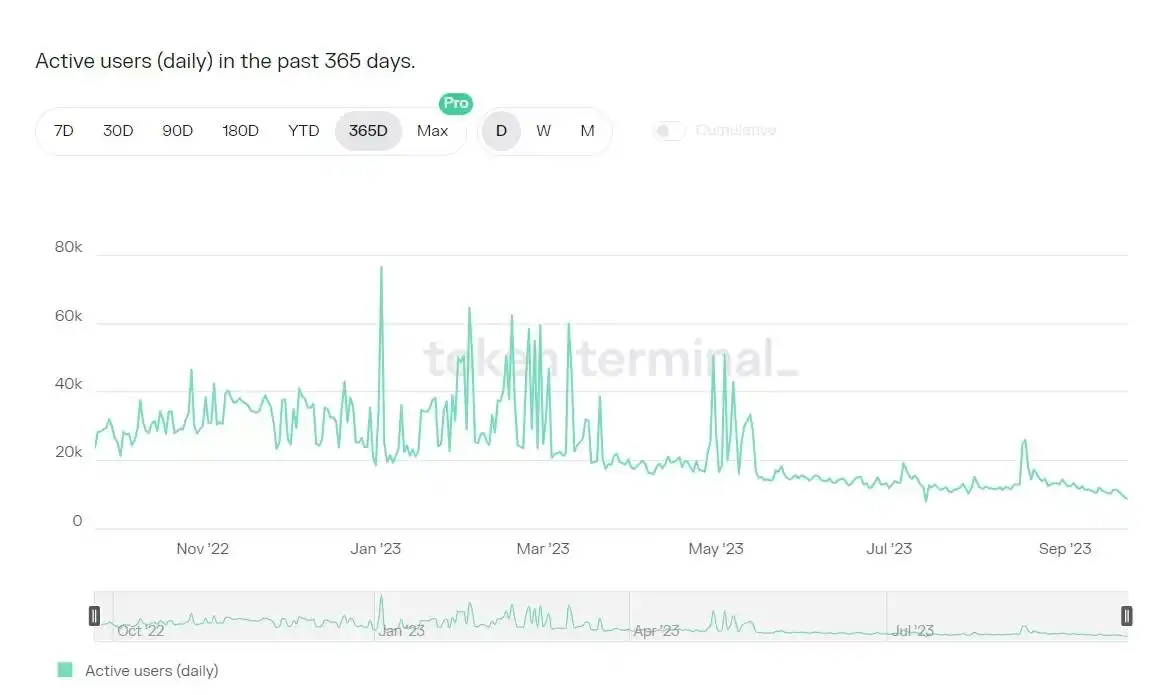

Its daily active users are currently between 10,000 and 20,000:

Data Source: https://tokenterminal.com/terminal/projects/osmosis

It ranks 5th among mainstream DEX projects. PancakeSwap has 69,000, and Uniswap has 50,000:

Data Source: https://tokenterminal.com/terminal?panel=userdau_

4. Ecosystem Data

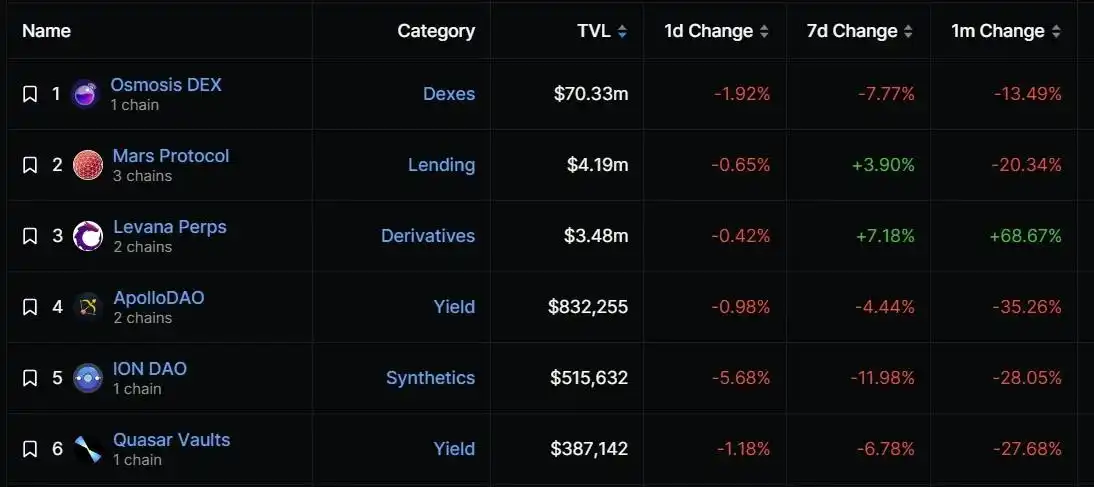

Osmosis is primarily focused on Osmosis DEX on-chain, while there are also some projects building other types of DeFi projects on the chain.

For example, Mars Protocol is a major lending protocol, Levana Perps is a perpetual contract platform, and Quasar is a yield protocol around DEX.

Data Source: https://defillama.com/chain/Osmosis

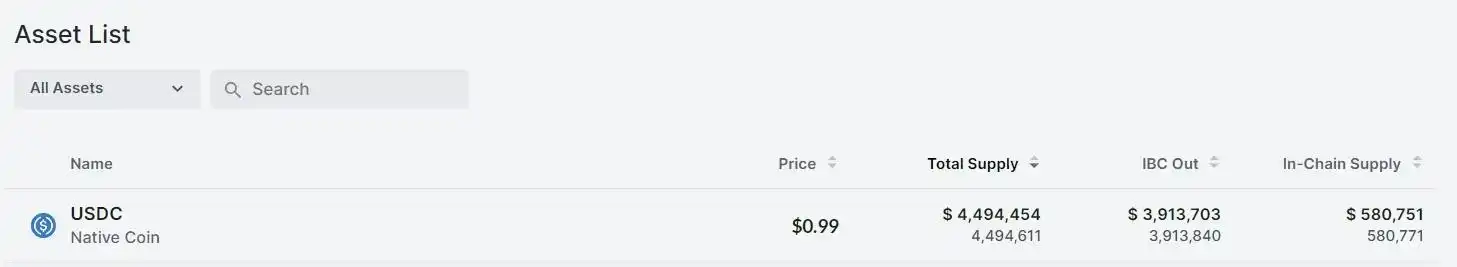

In terms of stablecoins, due to Circle issuing native USDC assets on the Noble chain, Osmosis has native stablecoin support, but the current adoption rate is still relatively low.

The total amount of USDC currently issued on the Noble chain is around $4.5 million:

Data Source: https://www.mintscan.io/noble/assets

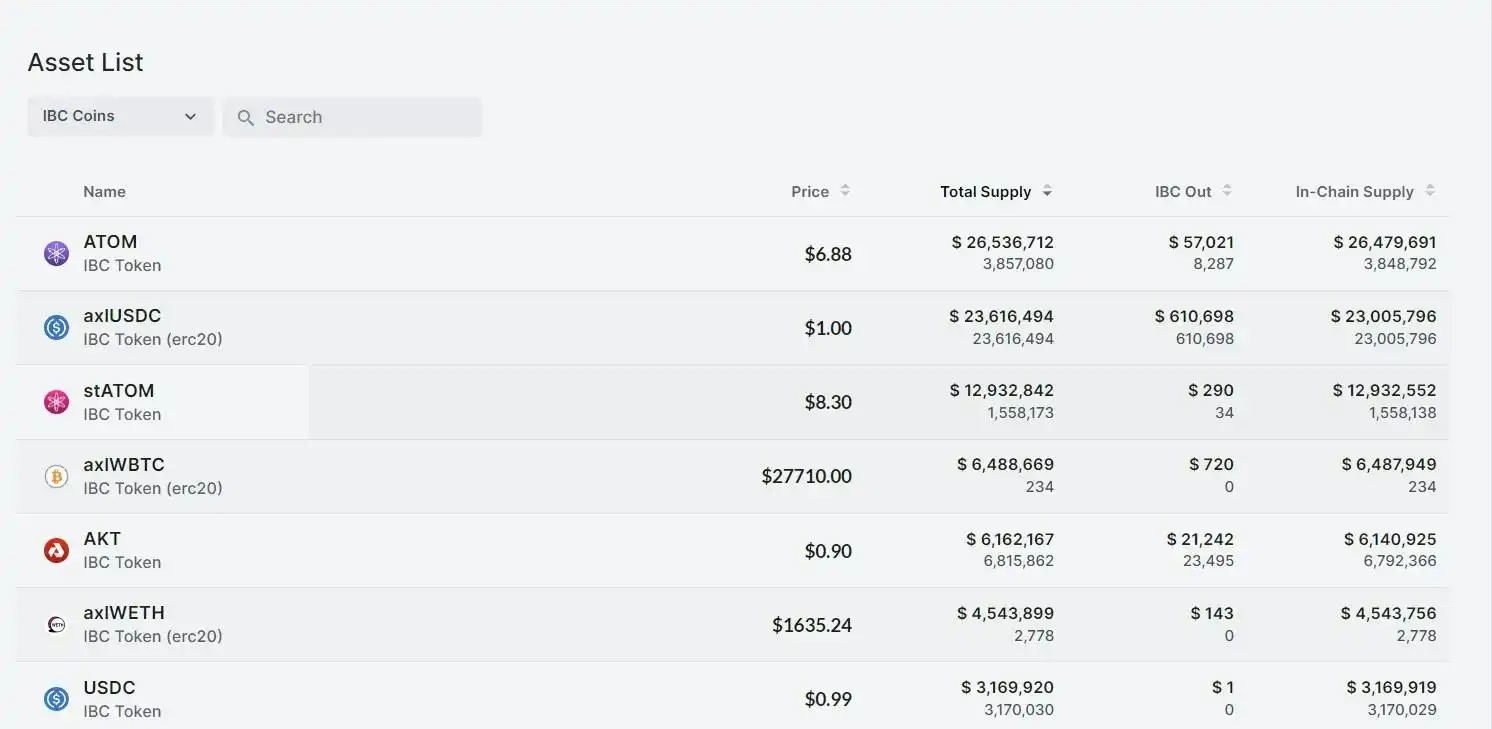

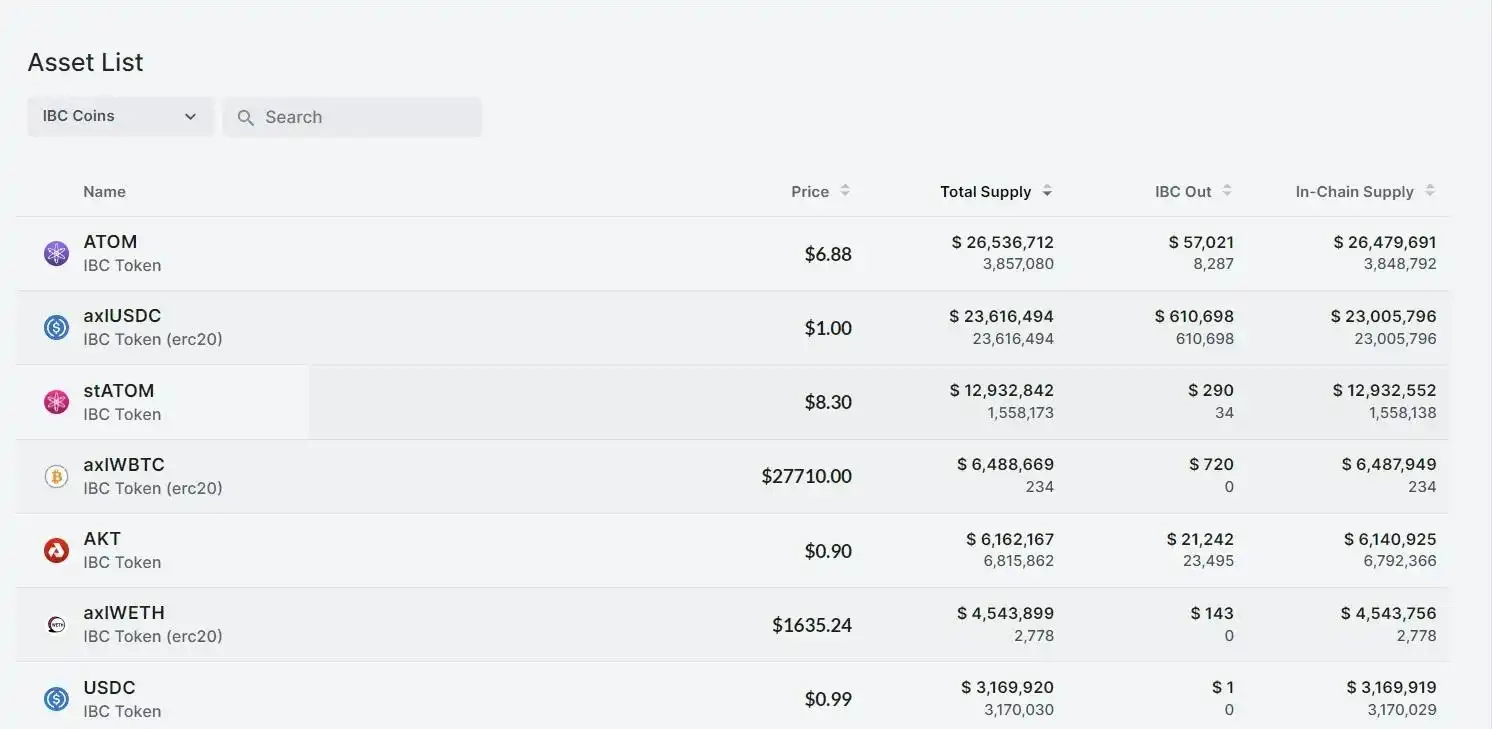

However, the amount cross-chain to Osmosis is only about $3.2 million, with the majority still being axlUSDC from Axelar, and the native USDT stablecoin from the Kava chain is only about $600,000.

Data Source: https://www.mintscan.io/osmosis/assets

5. Token Data

The OSMO token is a governance token that allows staking token holders to determine the future of the protocol, including every implementation detail. OSMO will initially be used for:

· Voting for protocol upgrades and governance roles

· Allocating mining rewards to different liquidity pools

· Serving as the gas token for the Osmosis chain

There are also proposals currently being discussed regarding the allocation of transaction fees to OSMO token holders.

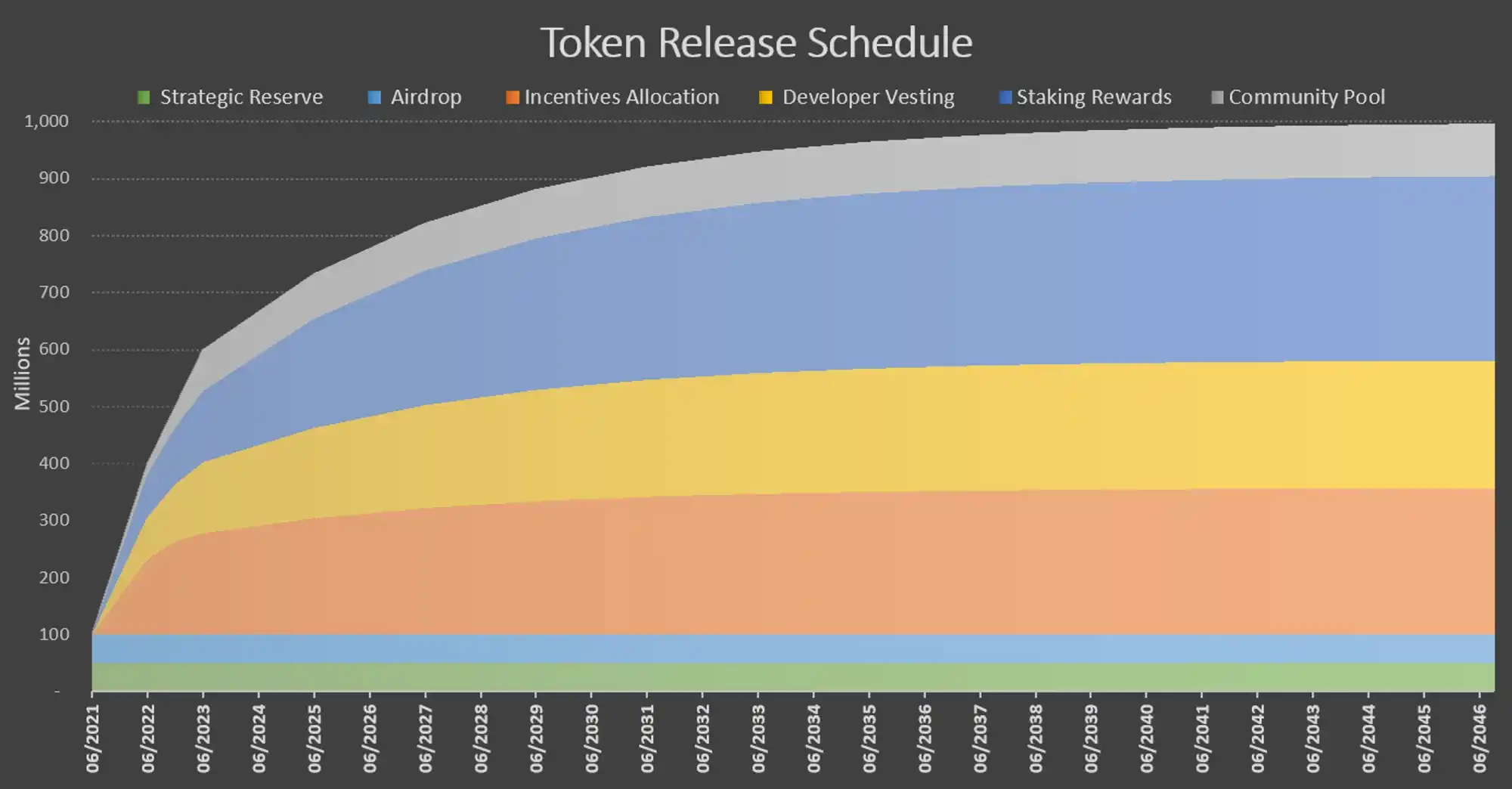

The following is the release schedule for OSMO tokens, with an initial circulation of 100 million tokens, including 50 million airdropped and 50 million in strategic reserves. The remaining 900 million tokens will be distributed at a rate of 300 million in the first year, followed by a 1/3 reduction each year for staking incentives, developer rewards, liquidity incentives, and community treasury, until fully released.

However, in the recent OSMO 2.0 update, the community passed a proposal to reduce inflation and extend the release schedule. The proposal reduced the inflation rate by 50%, so the current weekly release of OSMO tokens is approximately 1.28 million. The allocation ratio is as follows: Staking: 50%, Liquidity pool rewards: 20%, Community pool: 5%, Developer rewards: 25%.

Data Source: https://osmosis.zone/blog/unveiling-osmo-2-0

According to Coingecko's data, the current price of the OSMO token is $0.29, reaching its historical low, and is still in a continuous decline. The circulating market cap is approximately $180 million, with a fully diluted valuation of about $290 million.

At the current price, the daily release of OSMO tokens is about $53,000, and about $19.43 million annually.

Data Source: https://www.coingecko.com/

Based on the current protocol income of $500,000 per month, the annual income is approximately $6 million, 18000 / 600 = 30 times;

6. Comprehensive Analysis

Taking all of the above into consideration, Osmosis has become the network and liquidity center of the Cosmos ecosystem, which will create a strong network effect.

For example, in the upcoming dYdX Chain, if one wants to cross-chain USDC from Ethereum or Arbitrum to dYdX Chain, the official solution requires crossing to Osmosis through Axelar, and then exchanging for native Noble version USDC to recharge to dYdX Chain, which will bring significant liquidity to Osmosis.

At the same time, new projects built on the Cosmos SDK will airdrop to OSMO stakers, such as the recent Celestia, which will further strengthen its dominant position. As more projects are built using the Cosmos SDK in the future, the exchange of their native tokens will need to be done through other DEX protocols, and Osmosis, with the largest liquidity and strongest network connectivity, will inevitably become the preferred choice for projects, further enhancing its network effect.

It can be seen that the success of Osmosis is closely related to the prosperity of the Cosmos, and with the development of the Cosmos ecosystem, Osmosis will capture a large amount of trading value and become the DeFi center of the Cosmos ecosystem.

However, from another perspective, if the Cosmos ecosystem fails to develop well and instead fails in competition with Layer 2 or other public chains such as Solana, it will lead to a crisis for Osmosis. We have recently seen, for example, that projects built on the Cosmos SDK, such as Canto, have announced a transition to Layer 2, and the rapid development of Base chain and other projects has put pressure on the development of Cosmos, but there are also upcoming application chains built on the Cosmos SDK such as dYdX Chain and Celestia.

If the development of dydx v4 does not meet expectations and encounters significant resistance during migration, it may indicate that the narrative of the application chain is not valid, which will have a negative impact on other observing projects, leading to further shrinkage of the Cosmos ecosystem.

Of course, Osmosis will also face competition from other rivals within the Cosmos ecosystem, such as Kujira, Crescent, and Astroport.

Therefore, if changes are observed in the following indicators, it indicates that Osmosis's advantage is diminishing:

The development of dYdX Chain is not as expected, and the migration process faces significant resistance;

The number of chains connected to the entire Cosmos ecosystem through IBC is decreasing;

Osmosis's network position in IBC is declining (e.g., the decrease in the number of chains connected to Osmosis and the increase in the number of chains connected to other DEX);

Other network activity indicators, such as the decrease in the number of native stablecoins, and the decrease in daily trading volume, etc.

Conversely, if the above indicators are observed to be increasing, it indicates that Osmosis's network position is strengthening.

As for the development of the Cosmos ecosystem, it involves the competition between sovereign application chains and Layer 2, which will be an important direction for the future development of blockchain. The author believes that the scalability of current Layer 2 is still unable to meet the needs of large-scale users. Once the market turns around and on-chain activities become prosperous, Layer 2 will still face congestion and high fees, and Layer 2 cannot completely solve all problems. Some large projects still need the form of sovereign chains to meet specific needs, as can be seen from the migration of dydx and MakerDao considering using Solana for backend forking. Therefore, in the near future, it will still be an era of coexistence of Layer 2 and sovereign application chains, with the Ethereum ecosystem as the main one and other ecosystems as secondary.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。