34% of the total tokens will be given to TVL providers.

Author: CapitalismLab

Magpie's subDAO @Eigenpiexyz_io for LRT launched a points activity today, which is the biggest cake for TVL providers in the LRT project so far. The project has unique features, plus Magpie's subDAO has had considerable earnings before, with a constant value.

This thread will analyze Eigenpie's airdrop gameplay, mechanism, prospects, and expected returns to help you maximize your earnings.

A. Airdrop Gameplay

Currently, storing stETH and other LST can earn triple rewards:

- Eigenpie points, corresponding to 10% of the total airdrop

- Eigenlayer points (available for deposit on February 5th)

- Eigenpie corresponding to 24% of the IDO share, with a low valuation of 3M FDV

- Basic earnings from stored LST (e.g., if mETH APR is 7%, you can continue to enjoy 7%)

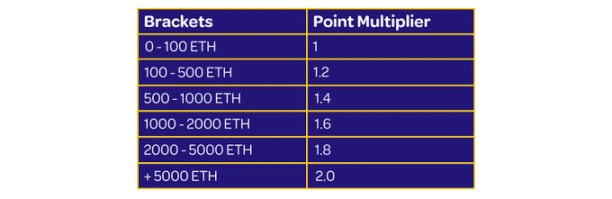

Points will provide benefits based on the total fleet size, with larger fleets receiving greater benefits, up to double, so it's best to huddle together for warmth.

B. Mechanism

Eigenpie isolates LRT (ILRT), providing a token to isolate the risk for each LST, as shown in the table below.

Currently, Eigenlayer has so many LSTs. If a project accepts all LSTs indiscriminately, it would have to bear the risk of all underlying LSTs. Once a security issue arises with a certain LST, it could have a devastating impact.

So Eigenpie's ILRT can isolate the risk.

Isolating the risk also isolates the liquidity. Will this be a problem? Not really. Supporting LRTs with LSTs, as opposed to supporting Native Staking LRTs, has the advantage of fully utilizing the liquidity of underlying LSTs. Individual pairs like mrETH/rETH, mmETH/mETH are actually more conducive to collaborating with LST projects to incentivize liquidity.

C. Prospects

What are the advantages of this project? After all, it was launched a bit late, but there is currently a gap in demand that has not been filled: LSTs listed on Eigenlayer are eager to participate in the LRT narrative, and Eigenpie currently seems to be the best solution, with each LST having its own independent LRT without worrying about making a wedding dress for others. LSTs with higher interest rates, like mETH, can also continue to leverage their advantages.

When can minted mstETH and others be traded on DEX? Will they be listed on Pendle?

It is obvious that the project team has a strong willingness and ability to promote these. All of this can bring generous bribe returns to Magpie's subDAOs, such as Cakepie and Penpie.

If you are not familiar with Magpie's architecture, you can refer to our previous tweet.

D. Expected Returns

Let's first look at the token economy:

- IDO: 40%

- Airdrop: 10%

- Incentives: 35%

- Magpie Treasury: 15% (as usual, not for sale, staking dividends go to vlMGP)

It's basically a FairLaunch operation, with the main difference being that most Fairlaunches currently have a lot of whitelisting, while this IDO whitelist is mostly transparently given to TVL providers.

The benefits given to TVL providers are:

- 10% of the total airdrop

- 60% of the IDO share, with IDO accounting for 40% of the total, at a $3M FDV valuation

In other words, 10% + 60% * 40% = 34% of the total will be given to TVL providers, accounting for approximately 70% of the initial circulation, and there will be no VC selling pressure in the future.

Currently, the LRT narrative is very hot. Even the $7M TVL of $RSTK has a $35M market cap and an $180M FDV. Several other projects that have been released have very high valuations as well.

Eigenpie's final TVL is likely to be much higher than RSTK. If we benchmark against $RSTK's FDV, the total profit for TVL providers could reach: 10% * 180 + 60% * 40% * (180-3) = $60M.

Assuming the coins are issued two months later, with an average TVL of $200M, it could also achieve an APR of (60/2)/200*12 = 180%, not including the earnings from the underlying Eigenlayer points. As an early provider in the first 15 days, there is also a double points increase.

Let's take a look at the previous subDAO IDO of magpie and the increase to date:

- Penpie, IDO 3M FDV, 14x

- Radpie, average of 7.5M FDV for two rounds of IDO, 1.4x

- Cakepie, IDO 20M FDV, 2.4x

This foray into the larger LRT track market not only offers a 3M FDV, but the airdrop and IDO shares given to TVL providers are several times that of PNP in the same year. I wonder if the returns will replicate or even surpass those.

Summary

- Airdrops require huddling together for greater gains

- The unique mechanism isolates the risk of ILRT for each LST

- Another advantage is the ability to fully utilize the resources accumulated by Magpie's Pendle/Pancake to accelerate development

- The vast majority of benefits are transparently given to TVL providers, and the IDO quota is from a transparent Fairlaunch.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。