Author: AYLO

Translator: Deep Tide TechFlow

This article delves into the key DeFi aggregator Jupiter on the Solana network and its upcoming JUP token airdrop. The article analyzes the uniqueness of Jupiter, the potential of the JUP token, and its significant position in the Solana ecosystem. In addition, it provides in-depth insights into the pricing, market expectations, and potential returns of the JUP token.

Following the tremendous success of the Jito airdrop, with a market value exceeding $4.5 billion at one point, the next major event on the Solana network is the JUP token airdrop, which is the token of the Jupiter platform, an important DeFi aggregator on Solana.

This airdrop is scheduled for January 31 and is the most anticipated event in Solana's history.

What are the features of Jupiter? Can JUP fulfill its promises? At what price should we sell? Or when should we buy?

In this report, I will delve into Jupiter's product line, future plans, and the potential opportunities brought by the JUP airdrop.

Jupiter: A One-Stop DeFi Service Platform on Solana

Since its establishment in October 2021, Jupiter has been committed to creating the best decentralized trading experience on Solana. The platform aims to achieve this by integrating various DeFi functions into one application and providing the smoothest possible user experience.

Although Jupiter was initially conceived as an exchange engine, the protocol has undergone significant developments, including various products to meet the needs of different users, such as Dollar-Cost Averaging (DCA), limit orders, perpetual trading, and the recently launched launchpad platform.

In my opinion, the DCA tool may be the best product in DeFi at the moment.

Source: Jupiter Exchange

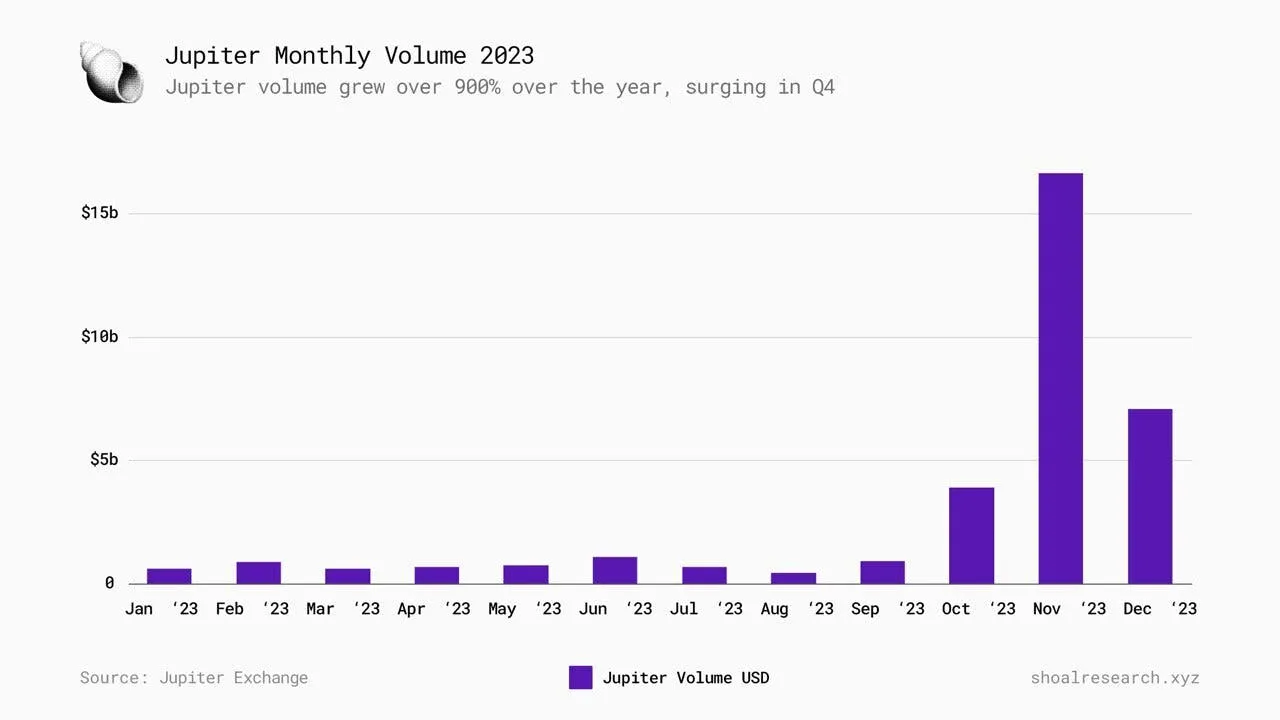

Jupiter's growth in 2023 has been outstanding, with monthly trading volume increasing approximately tenfold, from $650 million in January to $7.1 billion in December. It is worth noting that after Breakpoint announced the JUP token, the monthly trading volume in November reached a historical high, exceeding $16 billion.

Jupiter's 2023 monthly trading volume

For comparison, Uniswap's monthly trading volume during the same period ranged from a minimum of $174 billion to a maximum of over $700 billion.

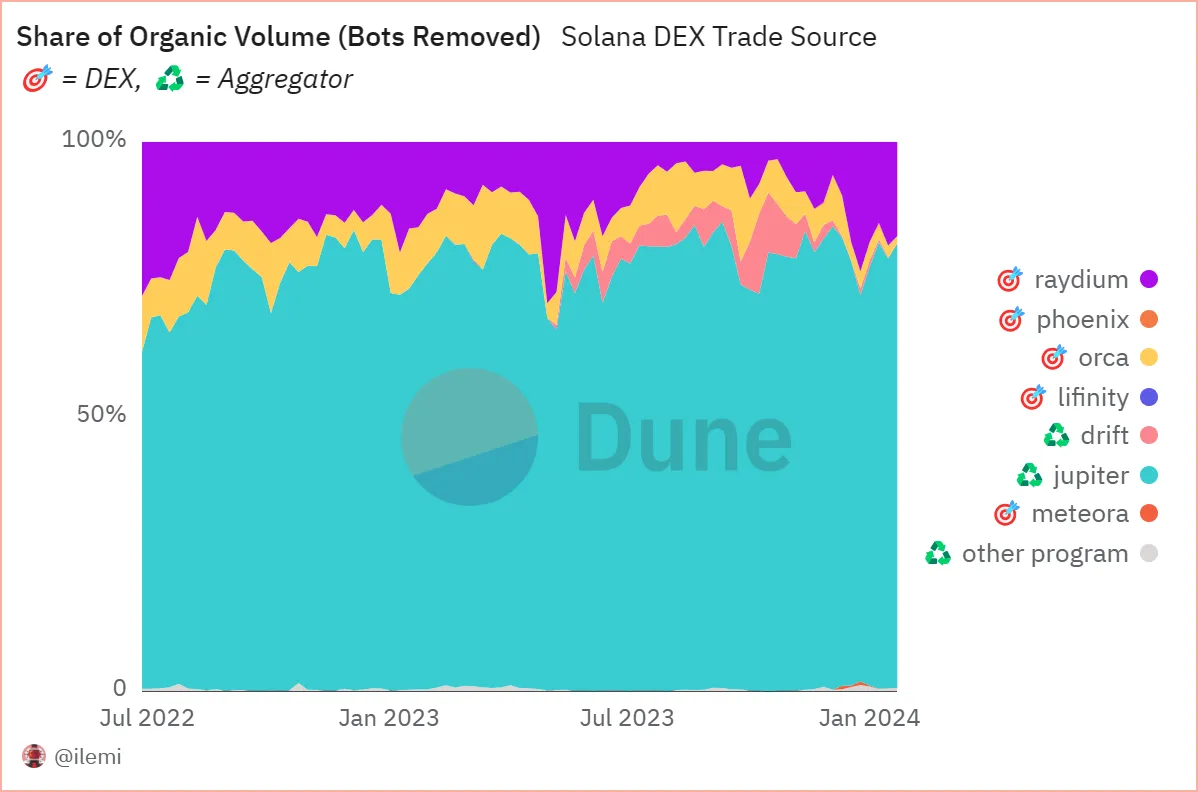

Now, Jupiter has processed over $66.5 billion in trading volume and over 1.2 million transactions, becoming a key layer in the Solana ecosystem. It accounts for over 70% of the organic trading volume in all DEXs on Solana and has become the preferred platform for traders on Solana.

Source: Dune Analytics

Nevertheless, Jupiter continues to innovate, aiming to improve existing features and launch new products consistent with its three main business model pillars:

- Providing the best possible user experience

- Maximizing the potential of Solana's technological capabilities

- Improving the overall liquidity of Solana

Given its unique positioning, I believe Jupiter is a bet on two aspects:

- Long-term adoption of Solana: 2023 has been a year of recovery for Solana as network activity rebounds. I believe it has great potential for development and will capture a larger share of the L1 market. This could benefit Jupiter.

- Mainstreaming of DeFi: The future of trading lies on-chain, and even traditional financial institutions' CEOs like Larry Fink of BlackRock are beginning to talk about "tokenization of every financial asset." Therefore, the idea that Jupiter could facilitate this shift is not far-fetched.

The recently announced JUP token further reflects the strategic step Jupiter is taking in this direction.

JUP: Symbol of DeFi 2.0

The JUP token symbolizes a significant milestone in the development and philosophy of Jupiter. Just as Uniswap's governance token UNI symbolizes the first wave of DeFi on Ethereum, JUP also aims to become the essence of DeFi 2.0 on Solana.

JUP is designed as a governance token that will allow holders to influence key aspects of the ecosystem. This includes voting on critical aspects of the token itself, such as the timing of initial liquidity provision, future emissions after initial minting, and key ecosystem initiatives.

Source: Jupiter Exchange

The main goals of the token are:

- Attracting new capital flows and users to inject vitality into the Solana ecosystem

- Creating momentum for the introduction of new ecosystem tokens: JUP is prepared to be a catalyst for introducing more ecosystem tokens

- Building a strong distributed JUP community

As outlined by the anonymous co-founder Meow, JUP aspires to establish "the most effective, forward-looking, decentralized, non-internal voting DAO in DAO history."

In addition, the utility of JUP will evolve over time, depending on the direction the community takes. The potential future uses of the token may include:

- Fee reductions for perpetual exchanges

- Access and allocation to the launchpad platform

- Fee sharing for Automated Market Makers (AMMs)

However, Meow explicitly stated that they will not initiate revenue sharing until they have expanded the user base by at least tenfold.

Token Economics

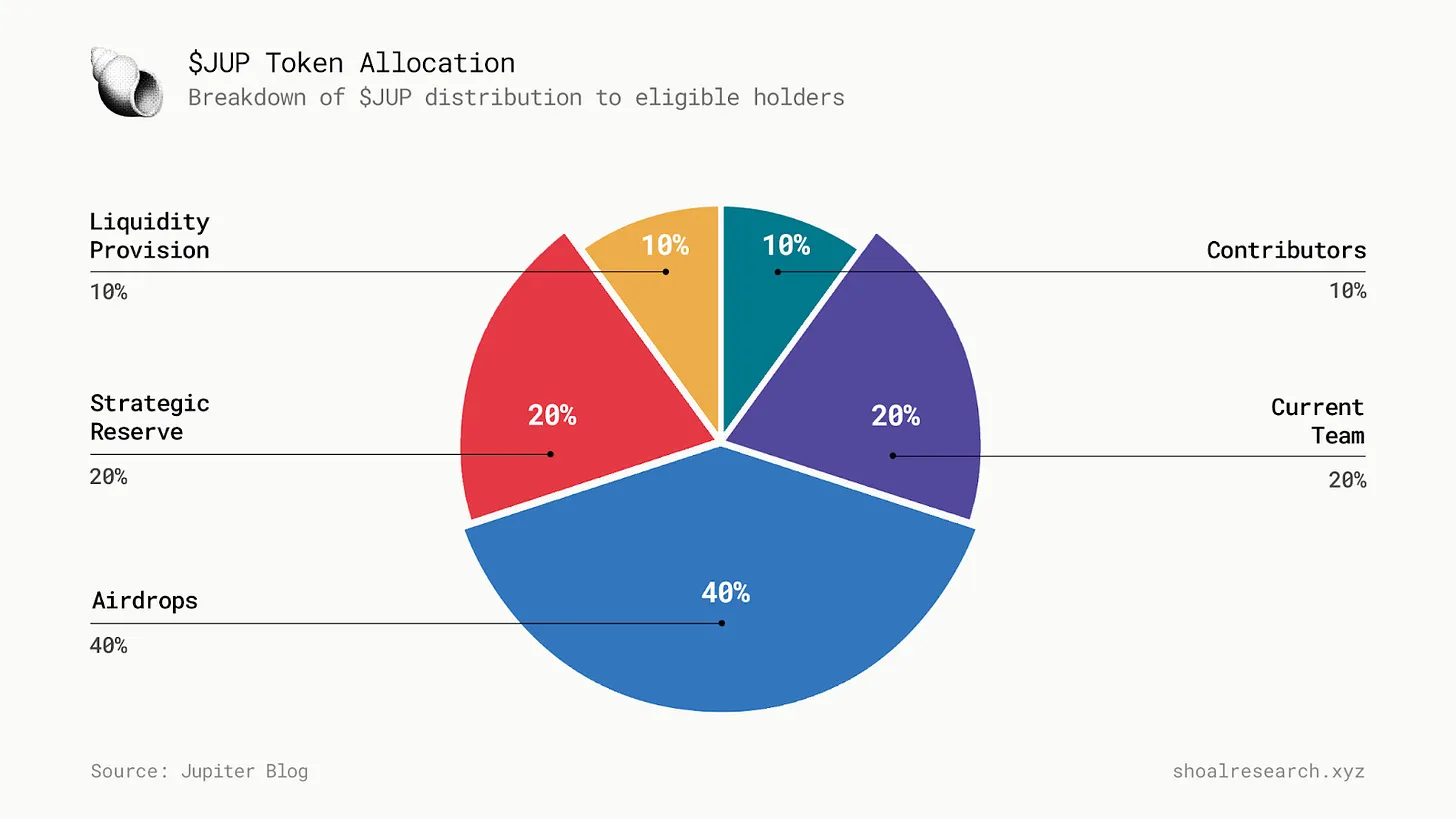

Token economics reflects the spirit of the project, and Jupiter's vision is to keep it as simple as possible. The maximum supply of JUP is 10 billion, and the token distribution is evenly split between two cold wallets—the team wallet and the community wallet. The team wallet will be used for current team, treasury, and liquidity provision allocations, while the community wallet will be used for airdrops and various early contributors.

Airdrop Details

The first round of the airdrop is scheduled for January 31, with an initial distribution of 10% of the total supply to the community. The airdrop distribution is as follows:

Equal distribution to all wallets (2%): 2 billion tokens will be evenly distributed to all users who have used Jupiter before November 2, 2023, equivalent to approximately 200 JUP per user.

Tiered scoring based on unadjusted quantities (7%): The distribution is roughly as follows:

- Tier 1: Top 2000 users, each receiving 100,000 tokens (estimated trading volume exceeding 1 million)

- Tier 2: Next 10,000 users, each receiving 20,000 tokens (estimated trading volume exceeding 100,000)

- Tier 3: Next 50,000 users, each receiving 3,000 tokens (estimated trading volume exceeding 10,000)

- Tier 4: Next 150,000 users, each receiving 1,000 tokens (estimated trading volume exceeding 1,000)

- Community members (including Discord, Twitter users, and developers, accounting for 1%): 1 billion tokens will be allocated to the most valuable contributors and community members.

Additionally, there will be three more rounds of airdrops in the future.

JUP Token Valuation and Comparison with JTO

A common question that arises with a new airdrop is determining the fair value of the token.

While there is no direct way to answer this question, one approach could be to compare and analyze the recent airdrop of the JTO token on Solana.

JTO is the governance token of Jito Lab, a liquidity staking platform built on Solana. The airdrop distributed 10% of the JTO supply to approximately 10,000 users. At its peak, the airdrop was valued at over $4.5 billion.

JTO Price Analysis

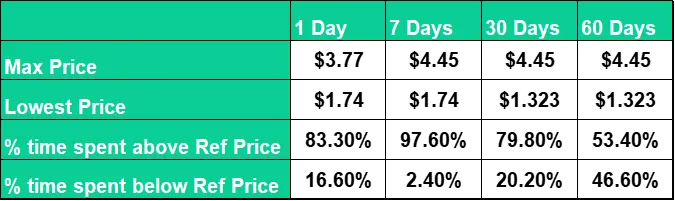

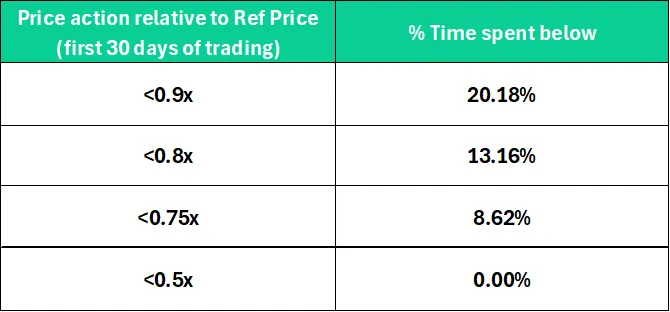

Using the initial listing price of $2.13 on Binance (after initial market fluctuations) as a reference price, here is a summary of the price trend after JTO was listed:

Source: Binance

Several trends can be observed from this table:

- Initially, on the first day of trading, the token price exhibited strong fluctuations from $1.74 to $3.77. Additionally, the price was above the initial listing price of $2.13 for 83% of the time.

- Furthermore, it is noteworthy that the first week of trading was indeed positive for JTO. The token's trading price was above its reference price for over 97% of the time and reached a historical high of $4.45 (ATH).

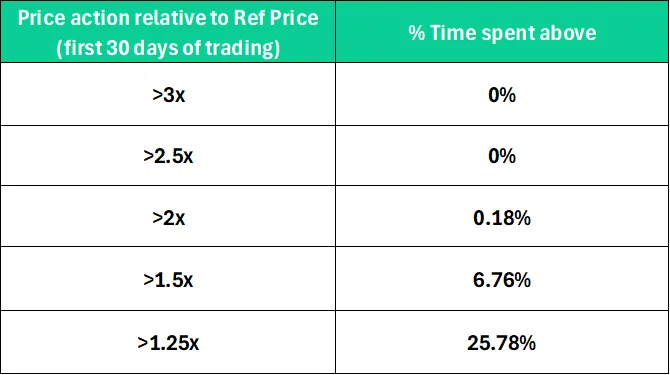

Looking at the percentage of time spent in different price ranges, we can see that JTO did not stay at its ATH level for long, with only 0.18% of the time being at more than double the reference price of $2.13.

Additionally, we can see that JTO did not experience a drop of more than 50% from the initial listing price. It spent only about 8.6% of the time at a drop of over 25%.

While the price behavior of JUP may not completely mimic the path of JTO, some assumptions can be made:

- The first trading day of JUP is expected to exhibit significant volatility, potentially providing opportunities for short-term traders.

- The launch of JUP may excite investors in the market, leading to a potential local high in the first week of trading. A rapid price increase, exceeding double the initial listing price, may indicate a selling opportunity.

- Conversely, if the drop exceeds 50% from the initial listing price, it may be interpreted as a buying opportunity.

Overbought Indicator: JTO FDV / LDO FDV Ratio

Jito is similar to the Lido protocol. The main difference is that Jito is on Solana, while Lido is on Ethereum. Therefore, a reasonable pricing method at the launch of JTO is to look at the relationship between the fully diluted valuation (FDV) of JTO and the FDV of LDO. Through this comparison, we can understand the market's valuation of JTO relative to similar products on Ethereum.

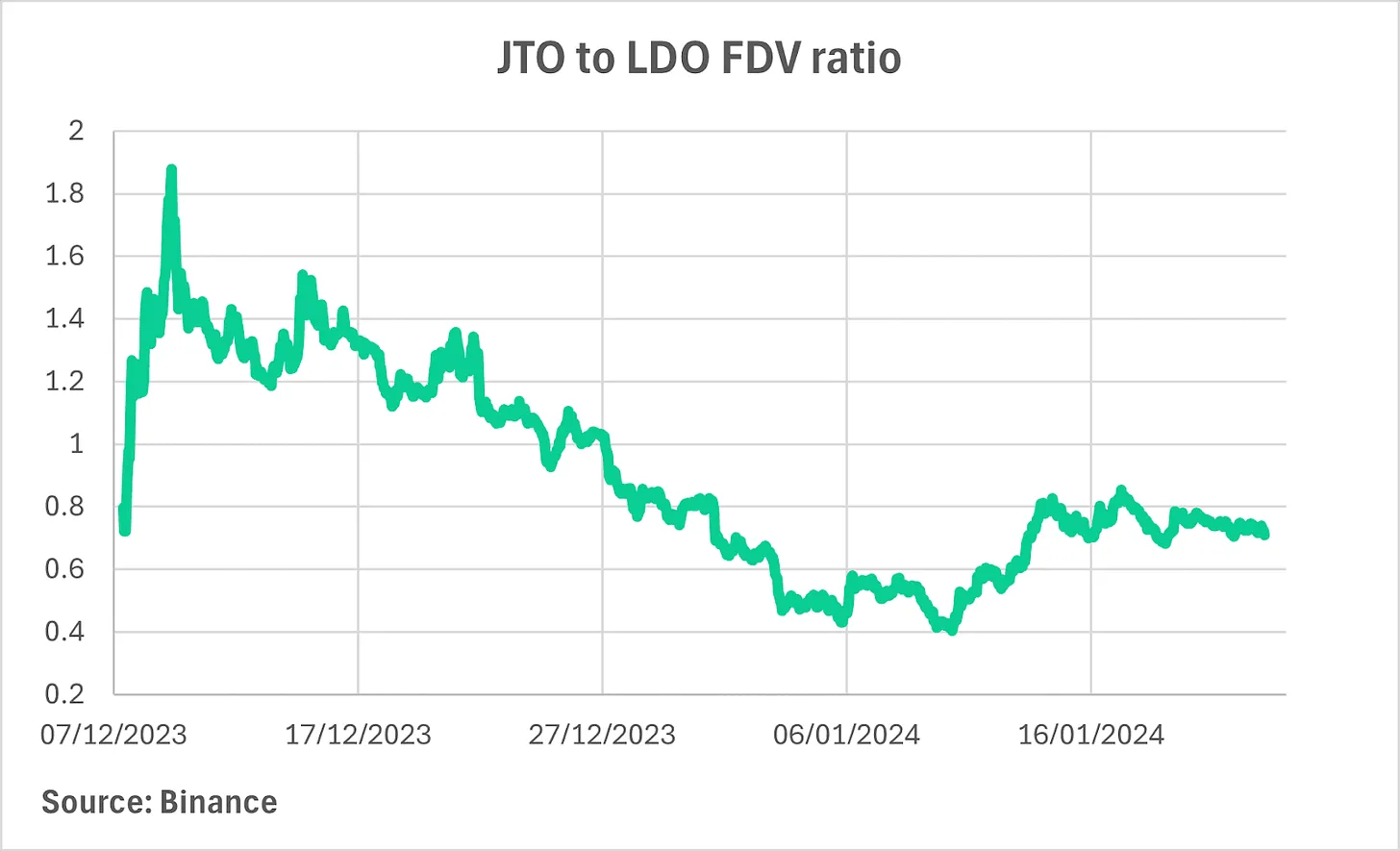

Here is the JTO FDV / LDO FDV ratio over time since the establishment of JTO:

We observe that JTO quickly surpassed LDO FDV after its launch, reaching a ratio of nearly 1.9, indicating that its FDV was twice that of LDO. However, this peak likely reflected market frenzy, and the market quickly repositioned the price of JTO to lower levels. In the subsequent weeks, the JTO / LDO FDV ratio trended downward until a strong rebound to the 0.7-0.8 level at the 0.4 mark. It seems that the market has ultimately settled on a fair value within this range. This is very close to the average level of 0.9 over the past few months.

We can conclude that a ratio exceeding 1.6 represents a clear overbought signal for JTO, while 0.4 represents a strong oversold signal.

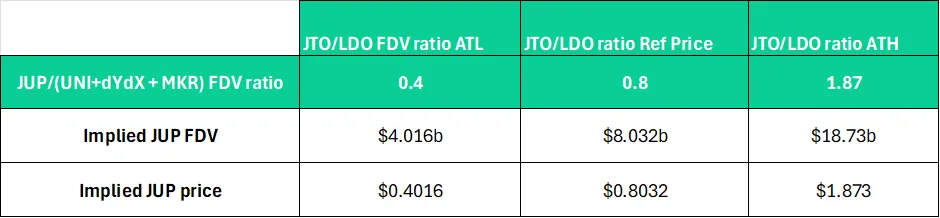

Applying this Valuation to JUP

Just as LDO serves as a relative peer to JTO, we need to find a comparable benchmark for JUP on Ethereum.

Given that Jupiter is the largest decentralized exchange on Solana, featuring Automated Market Makers (AMMs), DCA, perpetual trading, and a launchpad, finding a single project on Ethereum with a comparable range is challenging. Therefore, I have decided to interpret a combination of Uniswap, dYdX, and DAO Maker as the projects closest to JUP. Hence, their combined token FDV at the time of writing is approximately $10.04 billion.

We can use the FDV figures for this combination and the key levels of the JTO/LDO FDV ratio to estimate the price of JUP under different scenarios.

Source: Binance

By adopting this relative valuation analysis, we can enhance decision-making during the airdrop:

However, it is worth noting that the JTO has a relatively high daily Beta value of 0.86 with Solana. Therefore, the price trend of JTO is closely related to Solana, and it is likely that JUP will also follow a similar pattern. Therefore, the current market conditions may significantly impact the enthusiasm generated by this airdrop.

At the time of writing, the trading price of Solana is between $80-82, which is a decrease of over 30% from the previous level of $120-130, indicating that the market conditions may not be as bullish as during the JTO airdrop.

When comparing the price of JTO a month before the airdrop with the recent SOL price, it is evident that the market conditions have changed. Therefore, it seems reasonable to assume that this may have a negative impact on the price of JUP.

Potential Airdrop Returns

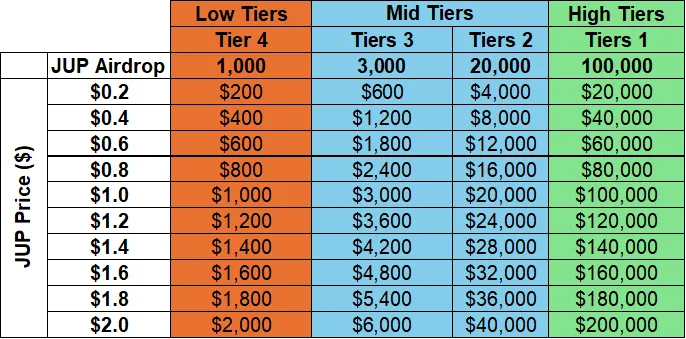

Can the rewards from this airdrop be as significant as those of JTO? Let's analyze it together.

By referencing the different rewards given at each level, we can deduce the potential airdrop returns for JUP at given prices:

Source: Jupiter Exchange

In contrast, here are the rewards for different levels and key prices of JTO:

Source: Jito Labs

Even at the lowest point of $1.323, the rewards for each level of the JTO airdrop are significantly higher than the potential rewards for the JUP airdrop. Even at a price of $2, it exceeds our valuation for JUP ($20,000 versus $2,000).

For example, to match the rewards for the lowest JUP level with the rewards for the lowest level of JTO at its historical low, the trading price of JUP would need to exceed $20. This would imply a $200 billion FDV, a figure that is completely unrealistic.

However, it must be emphasized that the JTO airdrop was concentrated among 10,000 users, while JUP is distributing its tokens to nearly 1 million users. This also means that there may be fewer initial buyers for JUP compared to JTO.

The market also did not anticipate that JTO would eventually reach such a large market value, and the expectations surrounding JUP seem to be very high, which is a key difference to consider. When everyone expects the same thing, things rarely unfold as expected.

Therefore, while the JUP airdrop may not provide individual users with as significant rewards as the JTO airdrop, its impact on a broader user base makes it one of the most important airdrops on Solana to date.

We are likely to see a significant increase in on-chain activity after the JUP airdrop. It will be an incentive for many, and for degen seeking higher returns, it is very common behavior to take further risks with what they perceive as "free money" (from the JUP airdrop).

Lastly, but equally important, as people profit from JUP and move into SOL, SOL may benefit from increased buying pressure. However, it is clear that the market is not very bullish in the short term, making it difficult to gauge SOL's performance in lower time frames.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。