Will Bitcoin replicate the path of gold after the ETF is listed?

Authored by: LTP Research

What is an ETF

"An exchange-traded fund (ETF) is a type of investment security that is similar to a mutual fund. Typically, an ETF will track a specific index, industry, commodity, or other asset, but unlike mutual funds, ETFs can be bought and sold on a stock exchange like ordinary stocks. ETFs can be designed to track anything from the price of a single commodity to a large and diverse portfolio of securities. ETFs can even be designed to track specific investment strategies." - Investopedia

Characteristics of ETFs

- Diversification: ETFs usually hold a diversified portfolio of assets, but they can also hold a single asset, such as the Bitcoin spot ETF we will discuss later.

- Exchange-traded: ETFs can be traded on stock exchanges like stocks.

- Transparency: ETFs regularly disclose their holdings, providing transparency.

- Low cost: Compared to mutual funds, ETFs typically have lower expense ratios.

- Tax efficiency: The structure of ETFs can minimize taxable events for investors.

- Investment convenience: ETFs are available to a wide range of investors, including individual investors, institutions, and financial advisors.

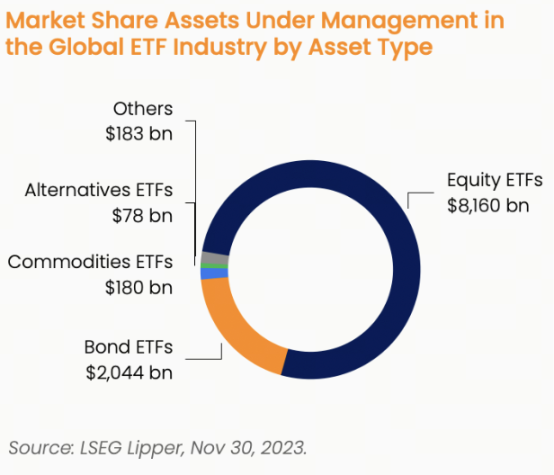

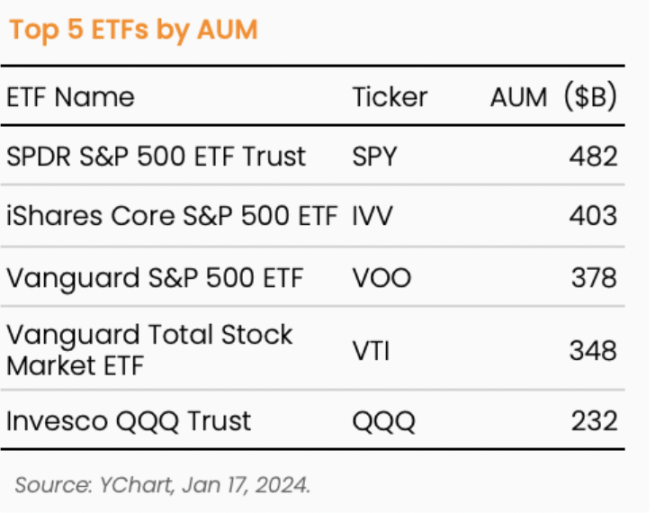

According to JPMorgan Chase's 2023 ETF Handbook, there are currently over 11,000 ETFs listed globally, offering a wide range of characteristics and choices. In recent years, ETFs have gained significant attention and popularity in the market, attracting a large influx of funds and market interest.

In addition to the characteristics mentioned earlier, ETFs also provide opportunities for active management strategies, specific industries and themes, and various other investment opportunities. These factors have contributed to the growth and diversification of the ETF market.

Liquidity of ETFs

The liquidity of ETFs is generally high due to their open structure. This means that the supply of ETF shares is not limited, and can be adjusted based on market demand through the creation and redemption process.

As long as the ETF is not in the process of liquidation, Authorized Participants (APs) have the ability to create new ETF shares by delivering underlying assets to the ETF sponsor. In exchange, the ETF sponsor provides equivalent ETF shares to the AP, which can then sell these shares on the exchange to meet investors' demand. This creation process occurs in the primary market, also known as cash trading.

This open structure allows the supply of ETFs to be adjusted based on market demand, maintaining high liquidity. Investors can buy or sell ETF shares at market prices at any time, making ETFs a flexible and convenient investment tool.

Once ETF shares are created, investors can freely buy and sell these shares on the secondary market, without involving the ETF sponsor. This characteristic of free trading makes ETFs highly liquid, allowing investors to quickly trade with other market participants at market prices.

Of course, the liquidity of ETFs is usually influenced by multiple factors. Firstly, the liquidity of the underlying assets is an important factor. If the underlying assets held by the ETF are easy to buy and sell, the liquidity of the ETF is usually higher. Secondly, trading volume also affects liquidity. If the trading volume of the ETF is large, it means there are more buyers and sellers, increasing trading opportunities and liquidity. Finally, market conditions can also affect the liquidity of ETFs. In situations of significant market volatility or tight liquidity, the liquidity of ETFs may decrease.

When making investment decisions, investors should pay attention to the differences in liquidity between different ETFs. Some widely traded ETFs usually have higher liquidity, while some smaller-scale or focused on specific industries or regions may have lower liquidity. Investors should carefully assess the liquidity of ETFs based on their investment objectives and risk tolerance, and ensure that they can buy or sell shares when needed.

Bitcoin ETF

What is Bitcoin?

Bitcoin was originally designed by Satoshi Nakamoto in 2008 as a peer-to-peer electronic cash payment system. The creation of Bitcoin coincided with the aftermath of the financial crisis. One of the visions of the founder was that people could no longer rely entirely on centralized financial systems and could use Bitcoin as one of the payment methods.

The decentralized ledger technology used behind Bitcoin is commonly referred to as blockchain technology. As more and more people understand Bitcoin over time, more and more people also began to accept, hold, and invest in Bitcoin.

However, the high transaction fees associated with Bitcoin have made it less practical as a widely adopted payment method. Therefore, Bitcoin has primarily evolved into an alternative investment tool, a type of commodity, with some likening it to "digital gold."

What is a Bitcoin ETF?

A Bitcoin ETF refers to a type of fund that can be traded on compliant traditional financial exchanges, such as NYSE and NASDAQ. Bitcoin ETFs allow investors to track the price of Bitcoin and benefit from it without needing to purchase and hold Bitcoin.

In the world of crypto, if you want to invest in any digital asset, you need to use centralized or decentralized exchanges to purchase digital currencies. The investment process is relatively cumbersome, and after investing, you still need to store digital currencies.

Furthermore, due to compliance issues with most crypto exchanges, many institutional investors are unable to invest in digital currencies through this method.

The emergence of Bitcoin ETFs can solve this problem. Bitcoin ETFs are compliant products aimed at traditional investors, allowing them to invest in this new type of asset while leaving the actual purchase and custody of Bitcoin to professionals, removing technical barriers.

Types of Bitcoin ETFs

There are currently two types of Bitcoin ETF products in the market. One is the earlier listed Bitcoin futures ETF, which tracks the price of Bitcoin futures. The other is the spot ETF, which was just approved by the SEC on January 10th, tracking the price of Bitcoin spot.

Compared to spot ETFs, futures ETFs have higher holding costs because if investors want to hold futures ETFs for the long term, they need to pay additional costs for rolling over the futures when they expire. This is one of the important reasons why the demand for Bitcoin spot ETFs is so high.

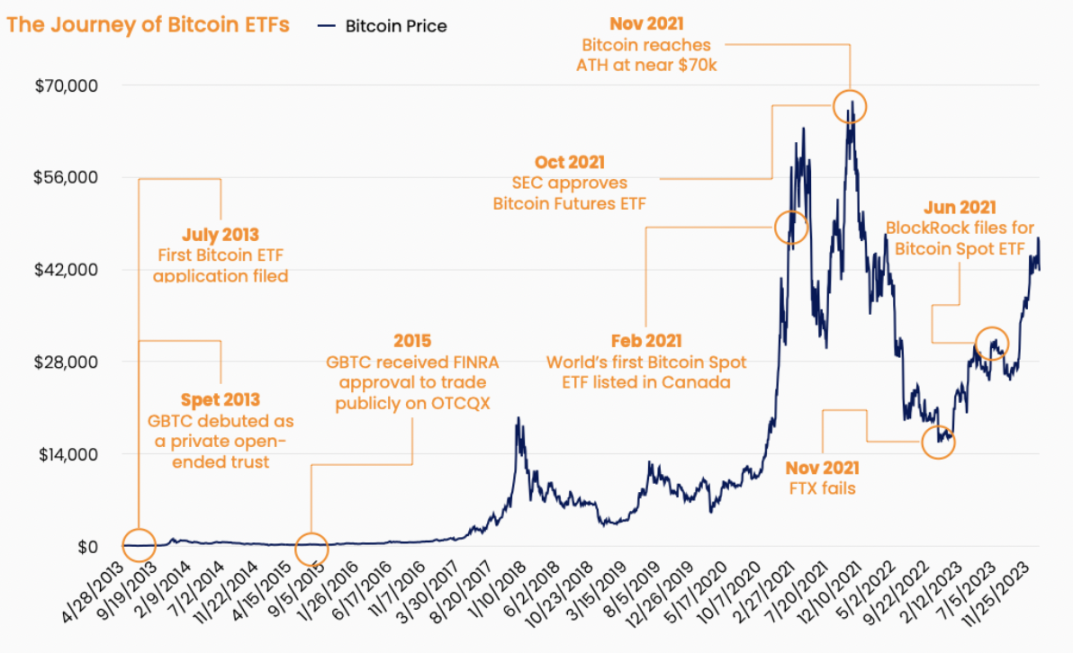

History of Bitcoin ETF Development

Ten and a half years ago

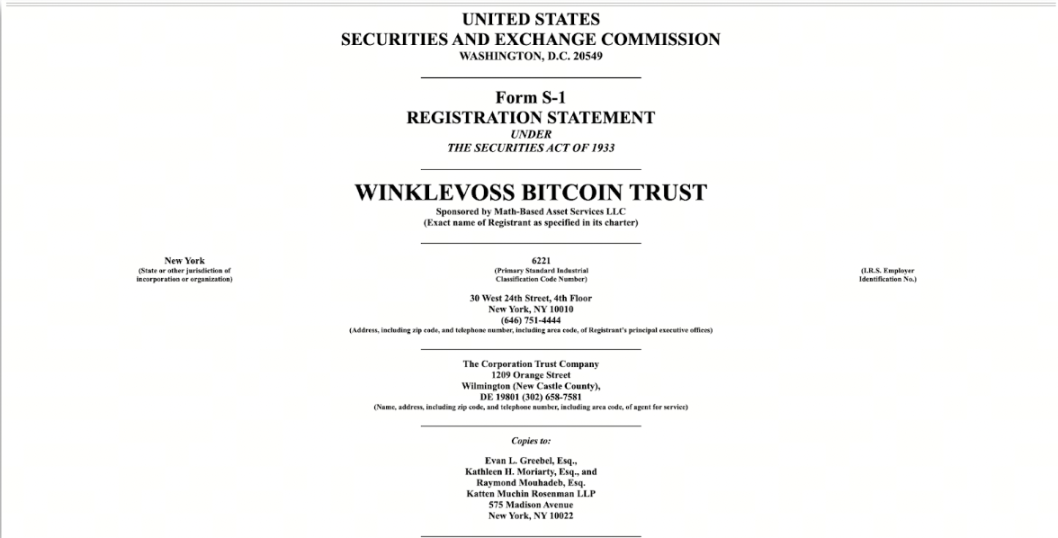

The first fund to formally apply for a Bitcoin ETF with the SEC was the Winklevoss Bitcoin Shares by the Winklevoss brothers in June 2003, ten and a half years ago. At that time, the market value of Bitcoin had just exceeded one billion dollars, with a price of $87 (now the market value exceeds 800 billion dollars, with a price of $42,640).

Unfortunately, this ETF application was rejected by the SEC in March 2017 after more than three years of review. The reason for the SEC's rejection was the existence of fraud risks in the Bitcoin market and the lack of compliance.

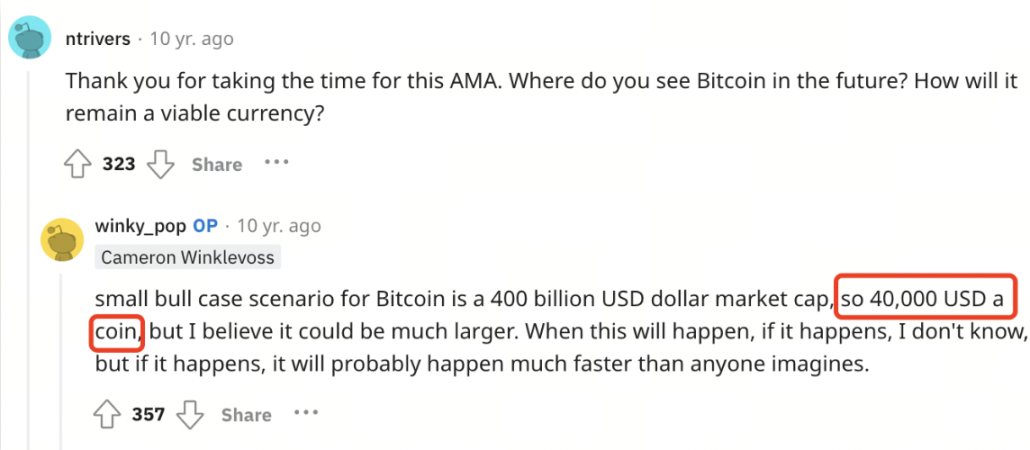

It's interesting that Winklevoss predicted over 40,000 USD or even higher for the price of Bitcoin ten years ago.

In the years that followed, there were multiple Bitcoin ETF applications, all of which were rejected by the SEC. It wasn't until Gary Gensler took over as SEC chairman from Jay Clayton.

The First Bitcoin Futures ETF

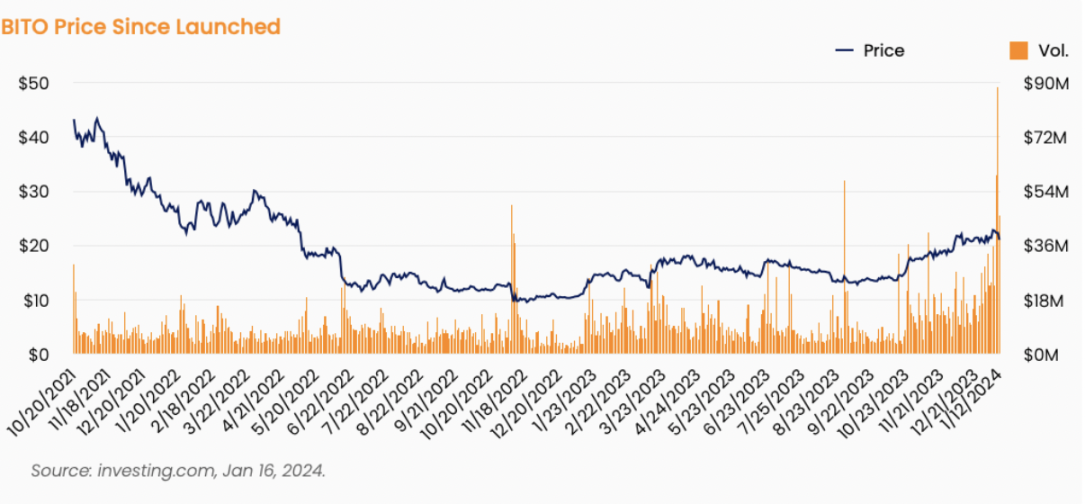

The first Bitcoin fund formally approved by the SEC was the ProShares' BITO. However, BITO invests in Bitcoin futures rather than spot. On October 19, 2021, BITO's trading volume reached 550 million USD on its first day of trading.

Until Grayscale's GBTC converted to an ETF, BITO had always been the largest digital asset ETF.

Although the crypto market finally welcomed its first ETF in the world's largest financial market, it was later realized that the date of BITO's launch was actually the worst time.

When BITO was launched, the price of Bitcoin was around 62,000 USD, and 20 days later it quickly rose to a historical high of nearly 70,000 USD. However, this was followed by a rapid decline. A year after BITO was issued, the price of Bitcoin was less than 20,000 USD.

Bitcoin Spot ETF

After more than a decade of development, on January 10, 2024, the U.S. SEC finally approved a Bitcoin spot ETF. This is related to Grayscale winning a lawsuit against the SEC in August 2023. The SEC did not provide sufficient reasons to reject Grayscale's conversion of GBTC to a spot ETF.

On January 10th of this year, a total of 11 Bitcoin spot ETFs, including GBTC, were approved by the SEC and officially listed on compliant exchanges in the United States. The world's largest asset management company, BlackRock, is among them.

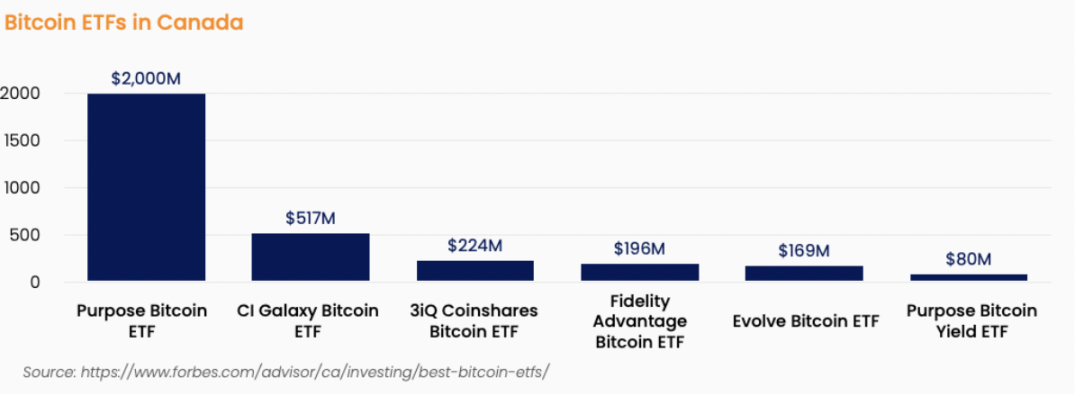

It is worth noting that while Bitcoin spot ETFs have just been approved for listing in the U.S. market, other countries, such as Canada, had Bitcoin spot ETFs several years ago.

Market Overview

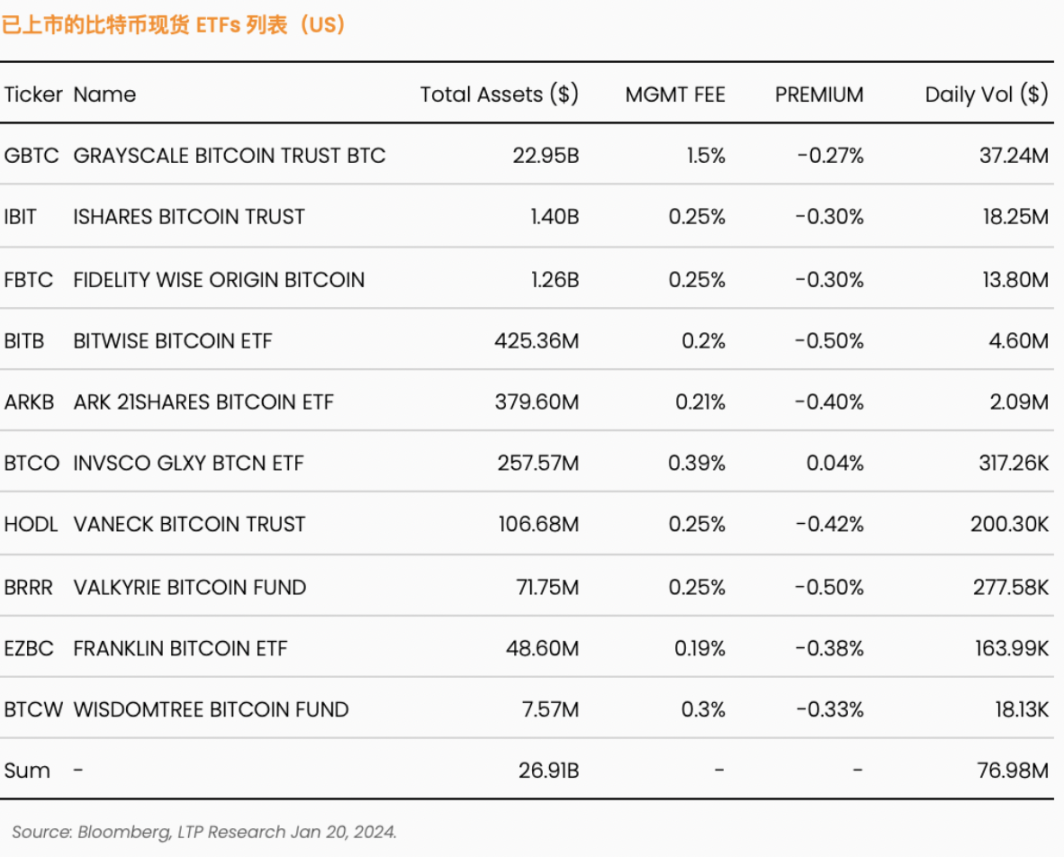

As previously mentioned, as of January 17, 2024, there are a total of 11 Bitcoin spot ETFs in the U.S. market, as shown in the table below.

The largest fund is Grayscale's GBTC, with a market value of over 25 billion USD. GBTC has been in a state of outflow every day since officially becoming an ETF. According to BitMEX Research, the outflows from GBTC in the past three days were $95m, $478m, and $590m, totaling $1.16b. The main reasons for the large outflows from GBTC are twofold.

First, many GBTC investors are actually in a profitable state but have no way to cash out. Previously, GBTC could only convert BTC into GBTC shares and then trade on the OTC market, but could not convert GBTC into BTC, leading to a discount of nearly 50%. Now that it has officially become an ETF, many investors are starting to cash out their GBTC.

The second reason is that GBTC's management fees are too high. Most ETFs have management fees between 0.2% and 0.3%, with few exceeding 0.5%, while GBTC's management fee is as high as 1.5%. Therefore, even if investors still want to invest in Bitcoin, selling GBTC and buying ETFs issued by other institutions may be a better choice.

In terms of trading activity, GBTC has the highest trading volume, accounting for about half of the total trading volume of all ETFs. Next is IBIT, issued by BlackRock, with daily trading volumes of approximately $1040m, $585m, and $371m over the first three days, totaling about $2b. Considering all Bitcoin spot ETFs, the total trading volume over the past three days is close to $10b.

According to Eric Balchunas, a senior ETF analyst at Bloomberg, there were approximately 500 new ETFs in the market in 2023, with a total trading volume of about $450m on January 16th, and the highest trading volume was $45m. In comparison, one fund like IBIT seems to be able to compete with all funds in the past year in terms of trading volume.

Although this data may sound shocking, it is not difficult to understand when carefully considered. In the traditional financial industry, there has not been a new asset class for a long time. Even if new ETFs are listed, the assets behind the ETFs have been around for a long time.

We can compare this to the crypto market, where, when it is not very hot, apart from the top few currencies, there is almost no trading volume for the remaining altcoins. When the market picks up, the main trading activity will still revolve around mainstream coins and new hotspots. Currently, crypto assets are a new asset class for the traditional market and naturally receive a lot of attention.

GBTC - Grayscale

As mentioned earlier, GBTC is the first trust fund issued by Grayscale in 2013. In addition to BTC, Grayscale has also issued trust funds for multiple digital currencies, including ETH, SOL, LTC, XPR, and others. As of now, Grayscale's total assets under management amount to $34.76b, making it the largest asset management company in the crypto field.

Grayscale is a subsidiary of Digital Currency Group (DCG), a venture capital company in the crypto field founded by Barry Silbert in 2013. According to the DCG website, it has invested in nearly 200 projects spanning exchanges, wallets, stablecoins, and almost all areas of crypto.

FBTC - Fidelity

FBTC is issued by Fidelity, one of the largest asset management and brokerage companies in the U.S. financial market. Fidelity is one of the earliest traditional companies to explore the crypto field.

Fidelity has been interested in Bitcoin since 2014 and began exploring it. In 2018, Fidelity Investments established a subsidiary called Fidelity Digital Assets, focusing on digital asset business. The company currently provides custody, trading, and asset management services for digital assets.

It's interesting that Fidelity Investments is where many early players in crypto started. Due to Fidelity's early exploration of crypto, many people began to learn and research digital currencies and started related businesses at Fidelity Investments. However, due to starting too early, combined with the tumultuous development of crypto and its rapid expansion, many people who started at Fidelity Investments eventually left and are now scattered throughout the crypto industry.

According to official data disclosed by Fidelity, as of September 2023, Fidelity's AUM is approximately $44 trillion.

IBIT - BlackRock

BlackRock is the world's largest asset management company, managing over $10 trillion in assets. BlackRock submitted its application for a Bitcoin spot ETF on June 15, 2023. The price of Bitcoin on that day was around $25,000, and since then, the price of Bitcoin has not fallen below that level. The market has high expectations for BlackRock's application.

In fact, we can see that IBIT is the most popular Bitcoin spot ETF in the market, second only to GBTC, with the highest trading volume. In addition to Bitcoin, according to CEO Larry Fink, BlackRock plans to issue a spot ETF for Ethereum as well.

As of January 16, BlackRock holds approximately 11,500 bitcoins, surpassing Tesla to become the third-largest publicly traded company holding the most bitcoins.

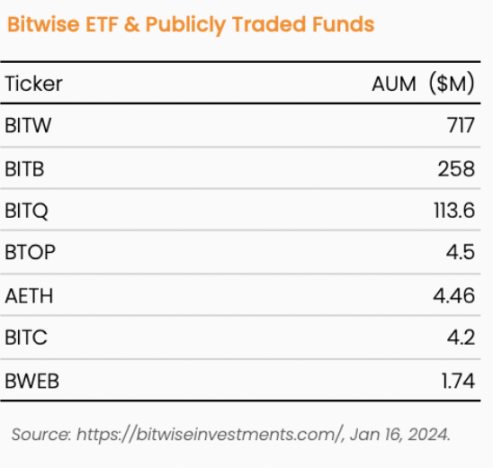

BITB - Bitwise

Bitwise Investments is a company focused on managing digital asset index funds, established in the United States in 2017.

Currently, Bitwise has seven publicly traded funds, including a Bitcoin spot ETF, as well as several private funds. However, except for BITB, the other funds do not directly invest in any digital assets but achieve the goal of investing in digital currencies through investments in CME Bitcoin or Ethereum futures contracts, or stocks of blockchain-related publicly traded companies.

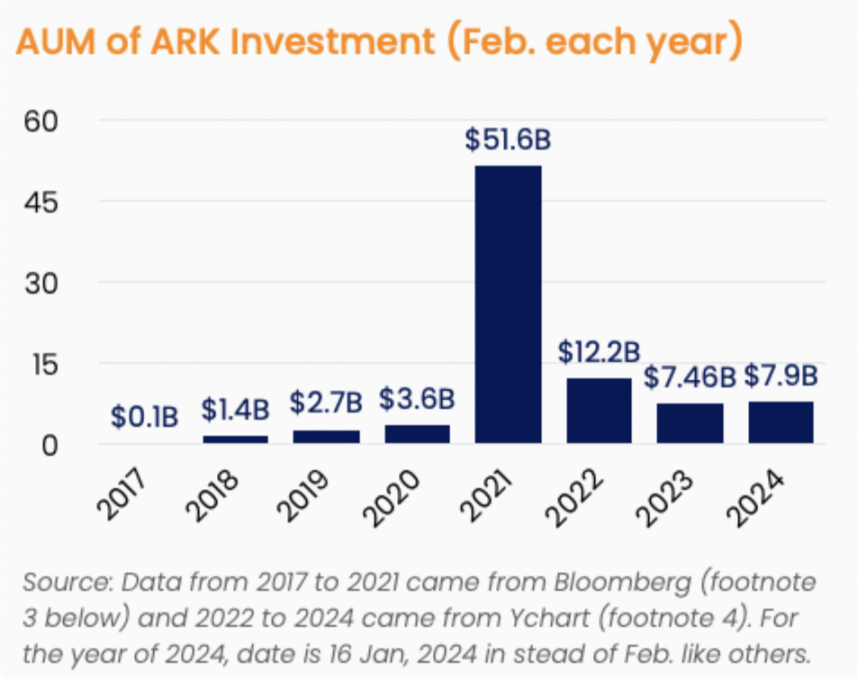

ARKB - ARK & 21Shares

ARKB is a Bitcoin spot ETF jointly issued by two companies, ARK Investment and 21Shares. ARK was founded by Cathie Wood in 2014, focusing on investments in the field of technological innovation, and therefore has a great interest in blockchain and digital assets. Since its establishment, ARK Investment has grown rapidly, reaching its peak AUM of over $50 billion in 2021, but has since performed modestly, with AUM currently at approximately $7.9 billion.

21Shares is similar to Bitwise, focusing on index products for digital assets. 21Shares' parent company, 21.co, is the largest digital asset unicorn company in Switzerland. Also, due to its headquarters in Switzerland, 21Shares operates in the European/Asian markets in addition to the U.S. market and successfully issued the world's first physically backed ETP (Ticker: ABTC) on Nasdaq Dubai in 2018, bringing compliant digital asset products to the Middle Eastern market.

HODL - VANECK

VanEck is an asset management company established 66 years ago, managing over $76 billion in assets. Similar to Fidelity, VanEck is a traditional financial company that relatively early explored Bitcoin and blockchain.

As early as 2017, VanEck applied to the SEC for a BTC futures ETF, and in the same year, its subsidiary MarketVector also released a series of index products focused on digital assets. In 2020, VanEck issued a Bitcoin spot ETN product, VBTC, in Europe.

Interestingly, the ticker for VanEck's Bitcoin spot ETF, "HODL," actually originated from a misspelling on the Bitcointalk forum but was intentionally adopted, meaning to continue holding Bitcoin regardless of price changes. Later, this word was also understood as "Hold On for Dear Life." Similarly, there is another word, "BUIDL," which originally meant "BUILD."

BTCO - Invesco & Galaxy

Invesco is an asset management company based in the United States, established 46 years ago. As of Q4 2023, Invesco manages over $1.58 trillion in assets, ranking among the top asset management companies in the world. The well-known index QQQ is a product issued by Invesco.

Another collaborating company of the issuer of BTCO is Galaxy, a financial company specializing in digital assets established in 2018. The company currently provides asset management, consulting, and trading services. Galaxy's asset management department manages $5.3 billion in assets. In this BTCO collaboration, Galaxy is responsible for the execution of Bitcoin purchases and sales.

EZBC - Franklin Templeton

Franklin Templeton is an old-established asset management company with a history of 77 years. As of November 2023, the company's AUM is $1.4 trillion.

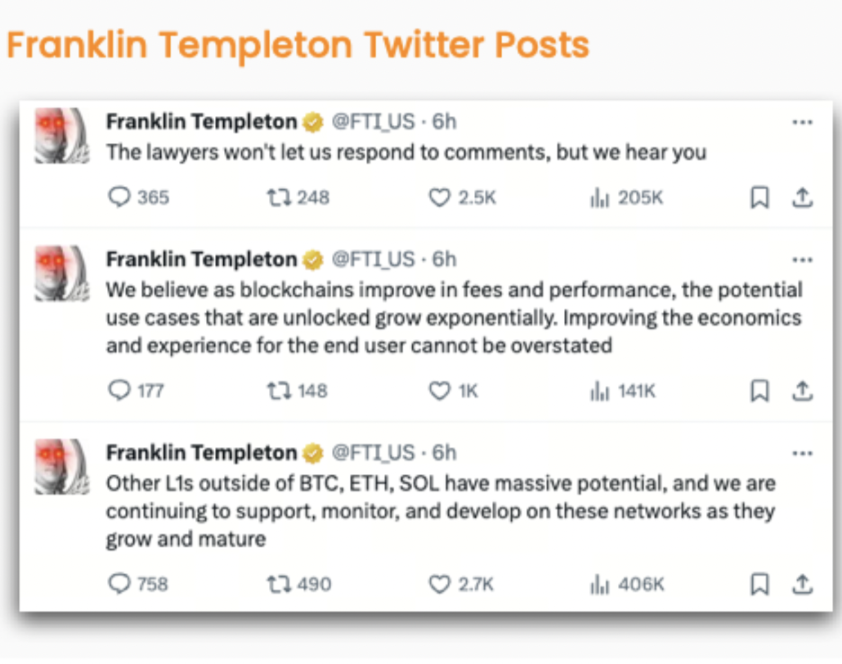

Unlike other traditional asset management companies, Franklin Templeton is more active on social media and seems to be more closely connected to the culture of the crypto world, providing opinions on the development of other digital currencies in addition to Bitcoin ETFs.

BRRR - Valkyrie

Valkyrie is a financial company focused on digital asset management, established in 2020, and is the youngest company among all the issuers of Bitcoin spot ETFs this time.

In addition to BRRR, Valkyrie has also issued a Bitcoin futures ETF and other digital currency trust funds.

BTCW - WisdomTree

WisdomTree is an asset management company based in the United States, with AUM of $99.5 billion as of January 16, 2024. It is worth noting that WisdomTree has also developed a consumer-level mobile app, WisdomTree Prime, that supports investment in blockchain assets.

Investors can directly invest in Bitcoin, Ethereum, electronic gold, and other electronic funds issued by WisdomTree through the WisdomTree Prime app.

Handing over the pricing power of Bitcoin to Wall Street?

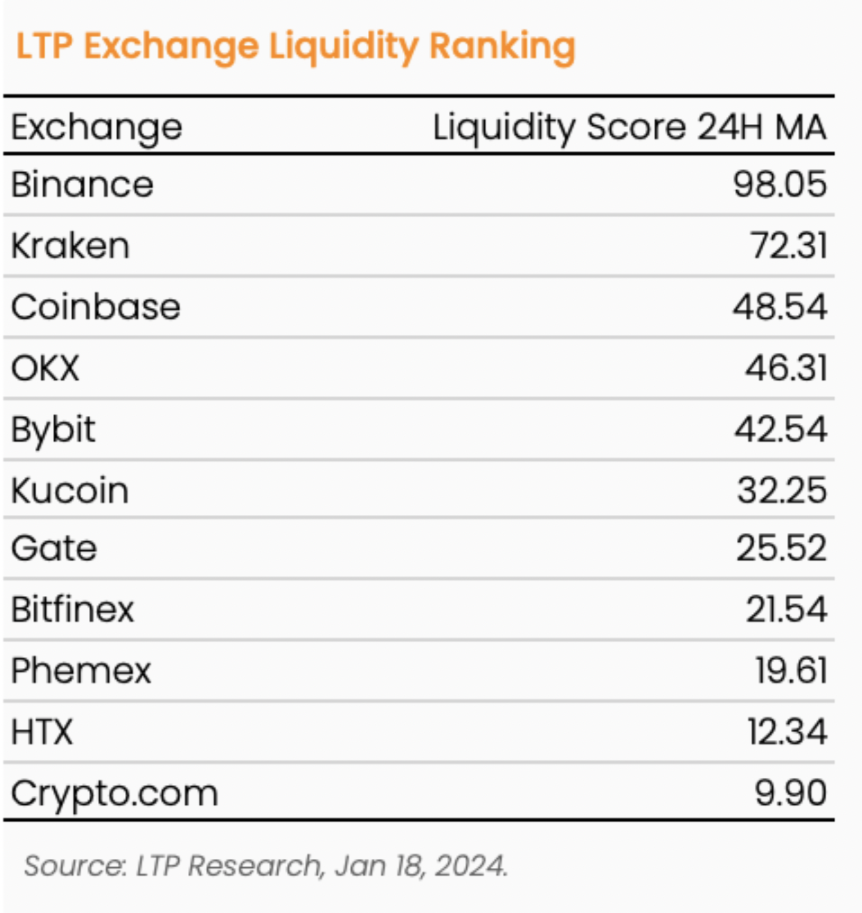

It is well known that before the appearance of Bitcoin spot ETFs, Bitcoin trading was conducted on digital currency exchanges, with the vast majority of trading volume coming from the Binance exchange.

According to LTP Research's ranking of digital currency exchanges, Binance has the best liquidity among exchanges and accounts for over half of the market's trading volume.

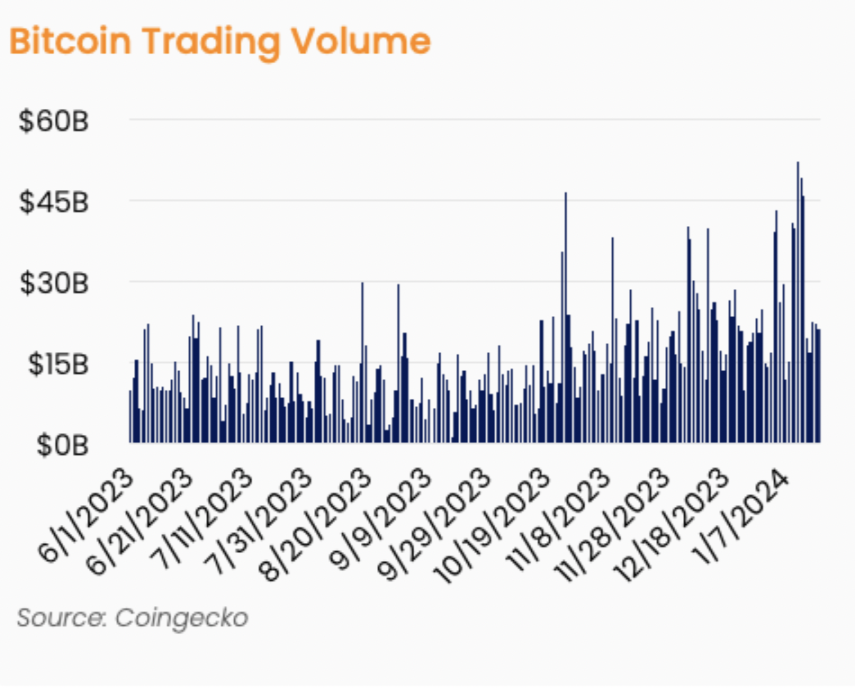

Naturally, the best place for liquidity is also the place for pricing. As mentioned earlier, after the Bitcoin spot ETF was launched, the trading volume reached nearly $1 billion in the first three trading days, averaging $330 million per day. In contrast, the average daily trading volume of Bitcoin from June of last year to January 18 of this year was $15 billion, 45 times that of the spot ETF.

However, it is important to note that the $15 billion trading volume includes all exchanges in the crypto market, including some zero-cost trades or fake volume. If we only consider the most active Bitcoin trading pair, BTCUSDT, on Binance, the average daily trading volume from June of last year to now is around $1.21 billion, about four times that of the spot ETF.

From the perspective of trading volume alone, it is difficult to determine where the pricing power lies and can only serve as a reference.

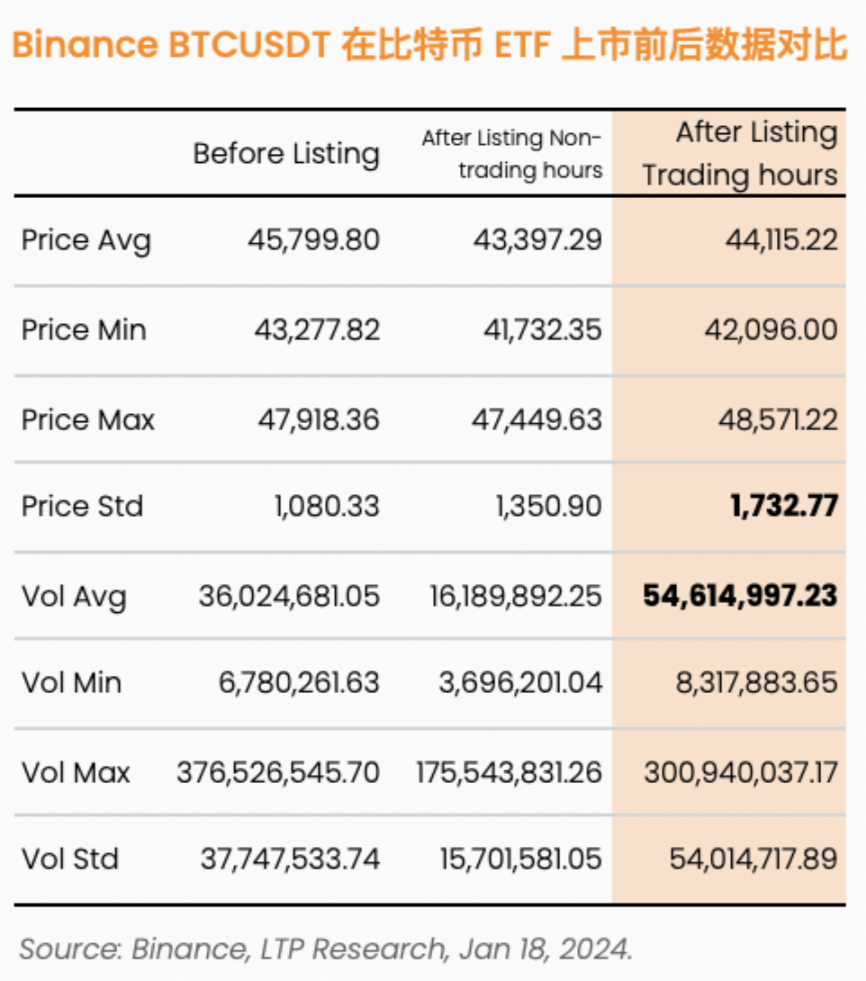

To further verify this hypothesis, I obtained Bitcoin BTCUSDT trading data from Binance's API from January 7 to 18, with a time interval of 15 minutes.

These data were then divided into three groups: the first group consisted of data before the start of Bitcoin ETF trading on January 11, the second group consisted of trading outside regular U.S. market hours starting on January 11, and the third group consisted of data from January 11 to 17, totaling four trading days during regular market hours. The statistical results are as follows.

A simple comparison of the data seems to indicate that Bitcoin trading on Binance was indeed affected by the launch of the Bitcoin spot ETF. Price fluctuations increased significantly during trading hours after the launch. Before the launch, the standard deviation of Bitcoin price fluctuations was 1080, which increased to 1350 after the launch outside of trading hours, and further increased to 1732 during trading hours.

There was also a noticeable increase in average trading volume during U.S. market hours.

It is important to note that the above data analysis is not a rigorous academic study, and more rigorous methods and additional data support would be needed to obtain more precise conclusions.

Looking ahead, what are we expecting?

The approval of a Bitcoin spot ETF by the U.S. SEC has long been anticipated by the entire cryptocurrency community. The reason is simply the expectation of a compliant traditional financial channel for allocating Bitcoin.

During the last bull market, it was evident that the GBTC trust fund had a significant impact on the price of Bitcoin, and it seemed that traditional finance was also recognizing this emerging asset. A Bitcoin spot ETF would mean a compliant traditional financial allocation channel, making it easy for the world's largest financial market to purchase Bitcoin.

Bitcoin is often promoted as digital gold, with significant value for allocation. The performance of gold ETFs after approval has led to speculation about the potential price performance of Bitcoin.

When the GLD ETF was listed on the NYSE in November 2004, the price of physical gold was around $440, and it has since skyrocketed to around $2000. Given this performance of physical gold, it is easy to imagine a similar scenario for Bitcoin as digital gold.

Many institutions have expressed the view that once the ETF is launched, a significant amount of funds will flow in, making Bitcoin an important choice for asset allocation. Whether based on the scale of U.S. asset management, assuming a certain proportion will be allocated to Bitcoin ETFs, or by analogy with the proportion of the Canadian Bitcoin spot ETF, we can expect fantastic figures.

Will things develop as we expect?

Although Bitcoin is referred to as digital gold, does it really possess the characteristics of "gold"?

The most important investment value of gold is its ability to resist risk, making it the most important safe-haven asset. As the saying goes, "In prosperous times, invest in real estate; in troubled times, invest in gold."

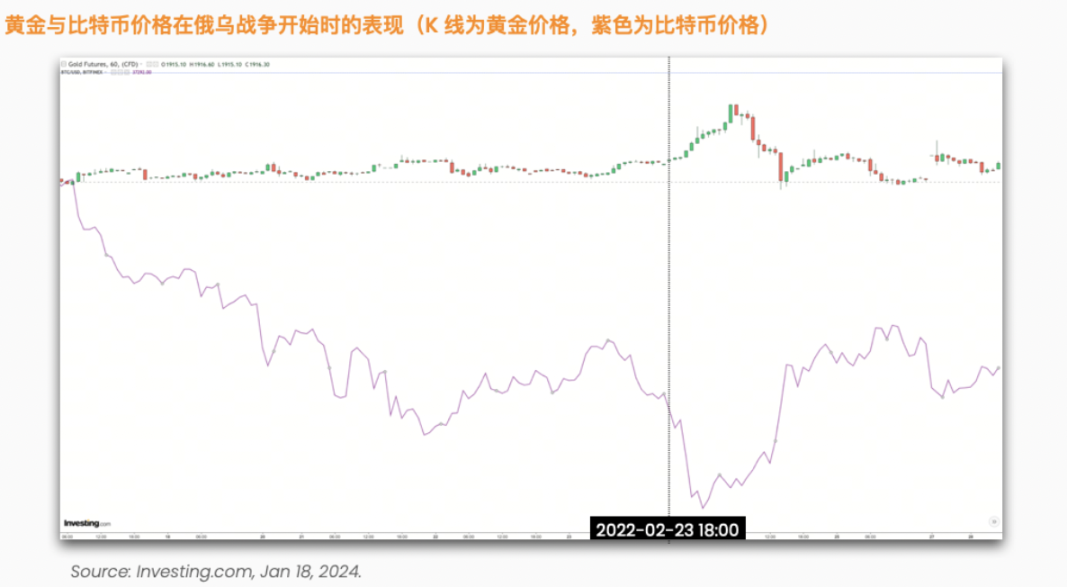

The chart below shows the price reactions of Bitcoin and gold when news of the Russia-Ukraine war first broke out. On February 24, 2022, the price of gold was stimulated by the Russia-Ukraine conflict, rising from an opening price of $1911 to a high of $1976. On the other hand, Bitcoin initially reacted with a decline, dropping from $37,278 to $34,459 on the same day before rebounding.

The market's initial reaction did not consider Bitcoin as a safe-haven asset, and the concept of digital gold seems to be less convincing.

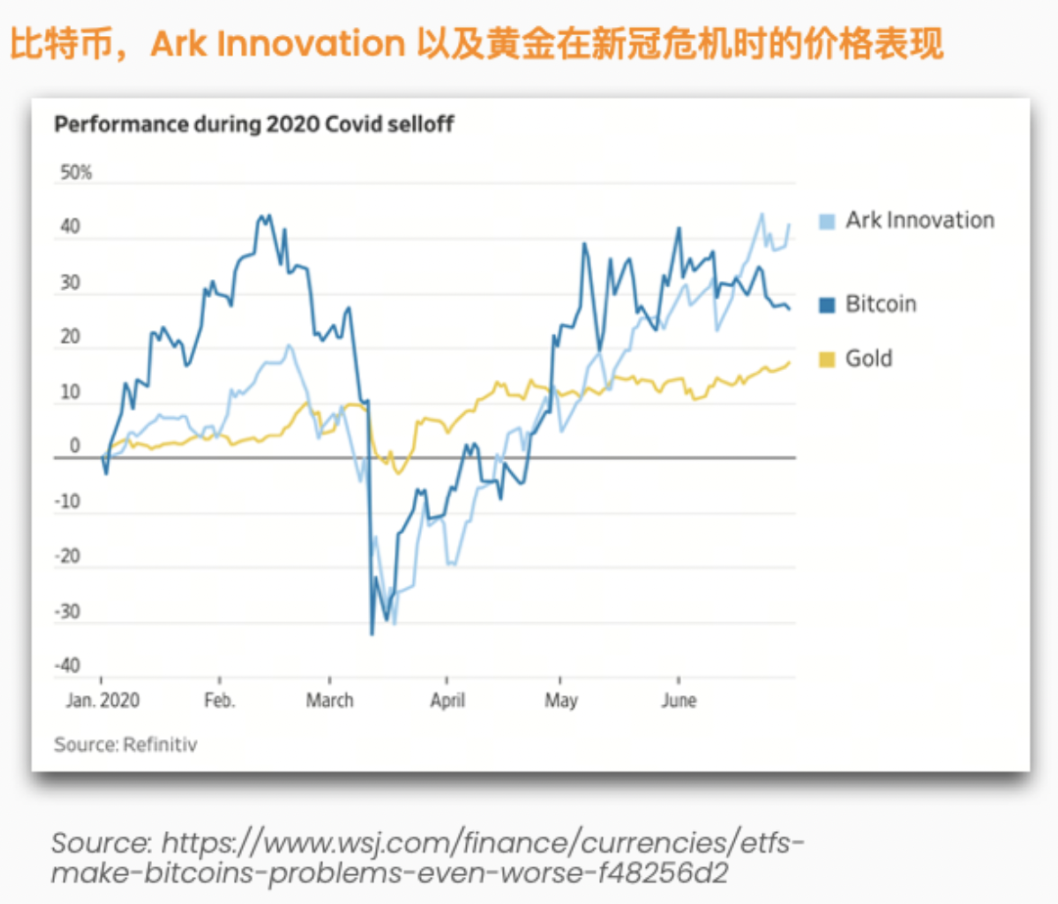

The left chart shows the price performance of gold, Bitcoin, and the Ark Innovation fund during the COVID-19 crisis.

Bitcoin's performance does not seem to resemble that of "electronic gold" at all. As a highly liquid asset, Bitcoin seems to be the first to be abandoned in times of poor macroeconomic conditions or tight liquidity.

If things do not develop in the direction we expect, and Bitcoin cannot be considered electronic gold but rather a highly liquid speculative product, what will be the next step for Bitcoin ETFs?

The launch of the first Bitcoin futures ETF in the U.S. market led to a significant drop in the price of Bitcoin. Hopefully, the launch of a Bitcoin spot ETF will bring about a different outcome.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。