Many of Solana's metrics saw significant growth in the fourth quarter of 2023, including market cap (423%), average daily fee payers (102%), DeFi TVL (303%), daily average DEX trading volume (961%), and daily average NFT trading volume (359%).

Author: Peter Horton

Translation: Frank, Foresight News

Highlights:

- Many of Solana's metrics saw quarter-over-quarter growth in the fourth quarter of 2023, including market cap (423%), average daily fee payers (102%), DeFi TVL (303%), daily average DEX trading volume (961%), and daily average NFT trading volume (359%).

- The Solana Foundation's annual Breakpoint conference drove ecosystem growth, with teams releasing significant announcements including Jupiter perpetual trading products and token issuance, Frankendancer, Backpack Exchange, and Render.

- The JTO airdrop and BONK listing on Coinbase further stimulated on-chain activity in December 2023.

- Catalysts for the first quarter of 2024 and beyond include the Jupiter airdrop, token expansion, and ongoing developments from Firedancer and TinyDancer.

Solana Introduction

Solana is a public open-source blockchain designed to provide scalability and smart contract support without sacrificing decentralization and security. It achieves this through a timestamp mechanism called Proof of History (PoH). With PoH, the network can order and batch transactions before processing them through a Proof of Stake (PoS) mechanism. Other design goals of Solana include sub-second settlement, low transaction costs, and support for all LLVM-compatible smart contract languages including Rust, C, C++, and Move.

Key Metrics

Financial Analysis

SOL was one of the leading cryptocurrencies in the fourth quarter of 2023 rebounding the crypto market. As of the end of 2023, SOL's market cap was $43.8 billion, a quarter-over-quarter increase of 423% and a year-over-year increase of 1106%.

In the fourth quarter of 2023, SOL's market cap surpassed ADA, USDC, and XRP, ranking fifth among all cryptocurrencies, while its market cap ranking at the beginning of 2023 was 17th.

Solana's quarterly revenue, measured by all fees collected by the protocol, increased by 19% when denominated in SOL, and more than doubled when denominated in USD, reaching $13.7 million. Half of these fees were burned, and the other half was distributed to block producers.

The tokens burned so far have not significantly reduced inflation, so the inflation rate at the end of the fourth quarter of 2023 was 5.6%—strictly measured as new tokens issued for validator rewards, excluding other token unlocks.

The inflation rate will continue to decrease at a rate of 15% per epoch until stabilizing at 1.5%. As of the writing of this article, 71.5% of eligible SOL is staked, meaning these holders choose not to dilute their holdings. Note that tokens held by Solana Labs or the Foundation, while not locked, do not all count as circulating. With the increase in fees, the annualized actual yield for SOL stakers increased by 58% to 1.7%.

One of the major narratives related to SOL in the third quarter of 2023 was how Alameda/FTX would handle SOL (now controlled by FTX Estate), as Alameda and FTX had purchased over 57 million SOL from the Solana Foundation and Solana Labs, but these tokens are subject to various unlocking schedules, with an average unlocking date in the fourth quarter of 2025.

FTX Estate has already unstaked and transferred most of the unlocked SOL, and upcoming unlocks can be viewed on Solana Compass and Gelato.

Network Analysis

Usage

Network activity measured by non-voting transactions and fee payers increased with the rise in SOL's price. For most of 2023, the daily number of fee payers hovered between 80,000 and 100,000. The Solana Foundation's Breakpoint conference in late October to November 2023 stimulated the growth in the first phase. Other events, including the JTO airdrop and the listing of BONK on Coinbase, further contributed to this growth.

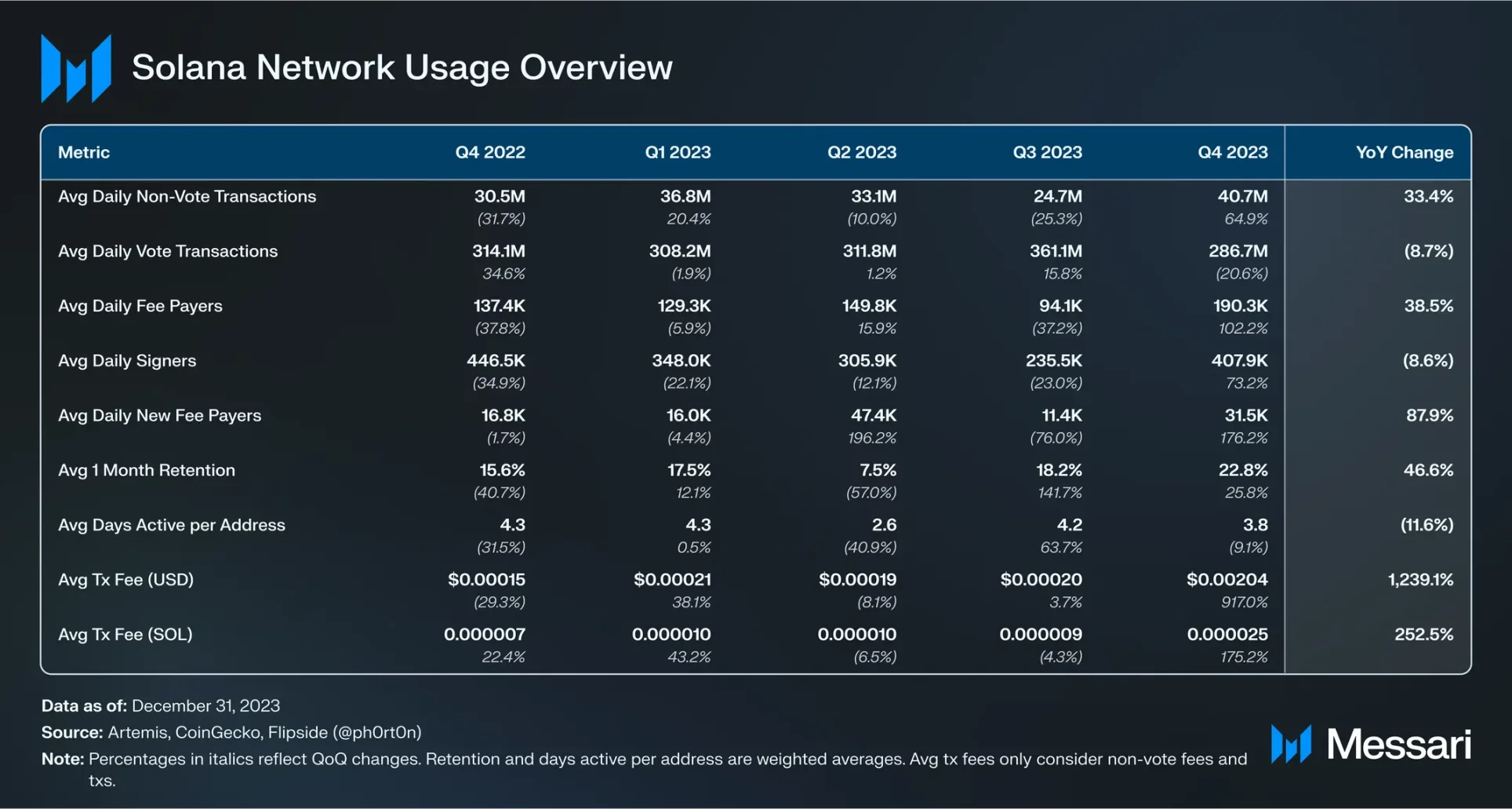

Overall, in this quarter, Solana's daily average fee payers increased by 102% quarter-over-quarter to 190,000, and the daily average non-voting transaction volume increased by 65% quarter-over-quarter to 41 million.

New fee payers followed a similar growth trend, reaching an annual high when excluding the abnormal activity in the second quarter. The daily average new fee payers increased by 176% quarter-over-quarter and 88% year-over-year to 32,000. The one-month retention rate of new fee payers in November 2023 was the highest for Solana in the entire year, reaching 25.6%.

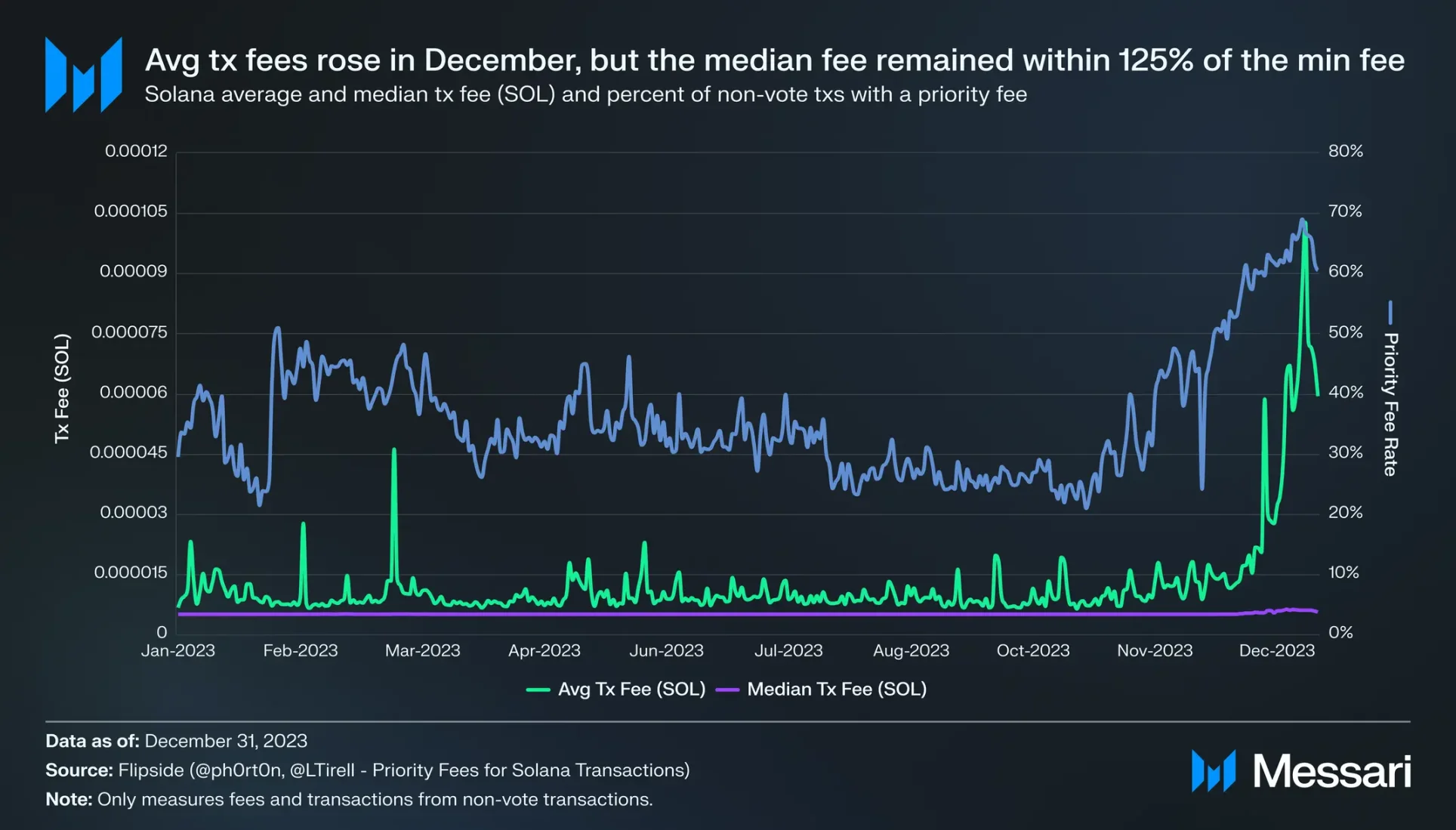

The increase in on-chain activity in December 2023 stimulated more transactions, including priority fee inclusion, leading to a 175% quarter-over-quarter increase in average transaction fees to 0.000025 SOL ($0.002). The daily priority fee rate reached a yearly high of nearly 69% on December 26, and the daily average transaction fee peaked on December 27 at 0.001 SOL, four times the average fee in the fourth quarter of 2023 and eleven times the average fee in the third quarter.

However, the median fee remained stable—the daily maximum median fee was 0.00000623 SOL, less than 1.25 times the fixed base trading fee of 0.000005 SOL (the median for most days). The difference between the relative growth of average transaction fees and median transaction fees indicates that the local fee market is successfully preventing a global fee spike.

Of course, Solana's fee markets are not perfect, and discussions about improving them intensified in the fourth quarter of 2023. The community is discussing some inefficiencies and controversial solutions, including:

- Issue: Inefficient resource pricing and allocation

- Potential solution: Basic fees determined by computational units

Solana Computational Units (CUs) estimate the computational effort required to validate transactions, similar to Ethereum's Gas units. Each transaction requires a certain number of CUs, with a maximum limit of 48 million CUs per block and 12 million CUs per account.

Unlike Ethereum, Solana's basic fees are not determined by computational units; instead, they are determined by the number of signatures, with most transactions having only one signature. While each transaction requests CUs, the actual usage is only known after execution. This leads to a lack of incentives for computational optimization: transactions often require more CUs than necessary, and developers do not prioritize minimizing computation when building programs.

One proposed solution is to price transactions based on CUs.

- Issue: Extra-protocol additional transactions

- Potential solution: Allocate 100% of the priority fee to validators

Half of each portion of the priority fee is burned, and the other half is sent to leaders, unlike Ethereum where 100% of the priority fee is sent to block producers. Burning half of the transaction fee can promote extra-protocol transactions with validators (such as Jito auctions).

The potential solution here is simple: allocate 100% of the priority fee to validators, as formally proposed in SIMD-0096.

- Issue: Existing spam transaction incentive measures

- Potential solution: Scheduler upgrade (V1.18) and economic upgrade (PRAW, write account EMA)

While multiple upgrades have reduced spam transactions, they have not completely eliminated them. With the increase in on-chain activity in December 2023, most computations were used for failed transactions.

There is some debate about the best way to further reduce spam transactions. Some attribute it mainly to the inefficiency of Solana's scheduler (block-building mechanism), while others believe an economic upgrade is necessary.

Scheduler

Solana's scheduler has the capability to build consecutive blocks using parallel threads, lacking a global transaction order, making the priority fee less effective in determining order.

The lack of deterministic ordering based on priority fees leads to a reliance on FIFO and differences in thread execution (network jitter). This incentivizes spam transactions to be prioritized for packaging.

Therefore, an upgrade to the scheduler is planned in V1.18, which will increase the dependency of transaction ordering on priority fees, reducing randomness and spam transactions.

Economic Upgrade

Solana's parallel execution engine requires prior knowledge of the dependencies declared by users. Transactions declaring dependencies on the same account cannot be executed in parallel, but if the transaction ultimately does not access the specified account, there is no penalty.

This leads to the issue of spam transactions, where transactions specify accounts that are ultimately not used. Spam transactions worsen the experience for other transactions that actually access the account, and also degrade overall network performance: the more specified accounts, the greater the likelihood of a replay peak.

To address this issue, there have been suggestions to introduce dynamic write account locking fees for each account (the greater the likelihood of a replay peak). At a macro level, the fee system would be a EIP-1559-style improvement for the local fee market. There is further debate about whether the pricing curve should be set by each account owner or by global parameters.

The former was proposed by Mango Markets developers in "SIMD-0016: Plan for Refundable Account Write (PRAW)," and the PRAW proposal has been active for over a year and is still under active discussion. In a recent post, Anatoly proposed the latter, a write account locking fee for each account, adjusted based on the exponential moving average of CUs used per block.

In both proposals, at least half of the write account locking fee would be refunded to the writing account. In addition to reducing spam transactions, these proposals also address the issue of how much sovereignty applications on a shared blockchain should have. While there is some debate, some argue that the spam transaction issue can mainly be mitigated through scheduler improvements, but this does not address the potential need to give applications more sovereignty.

Security and Decentralization

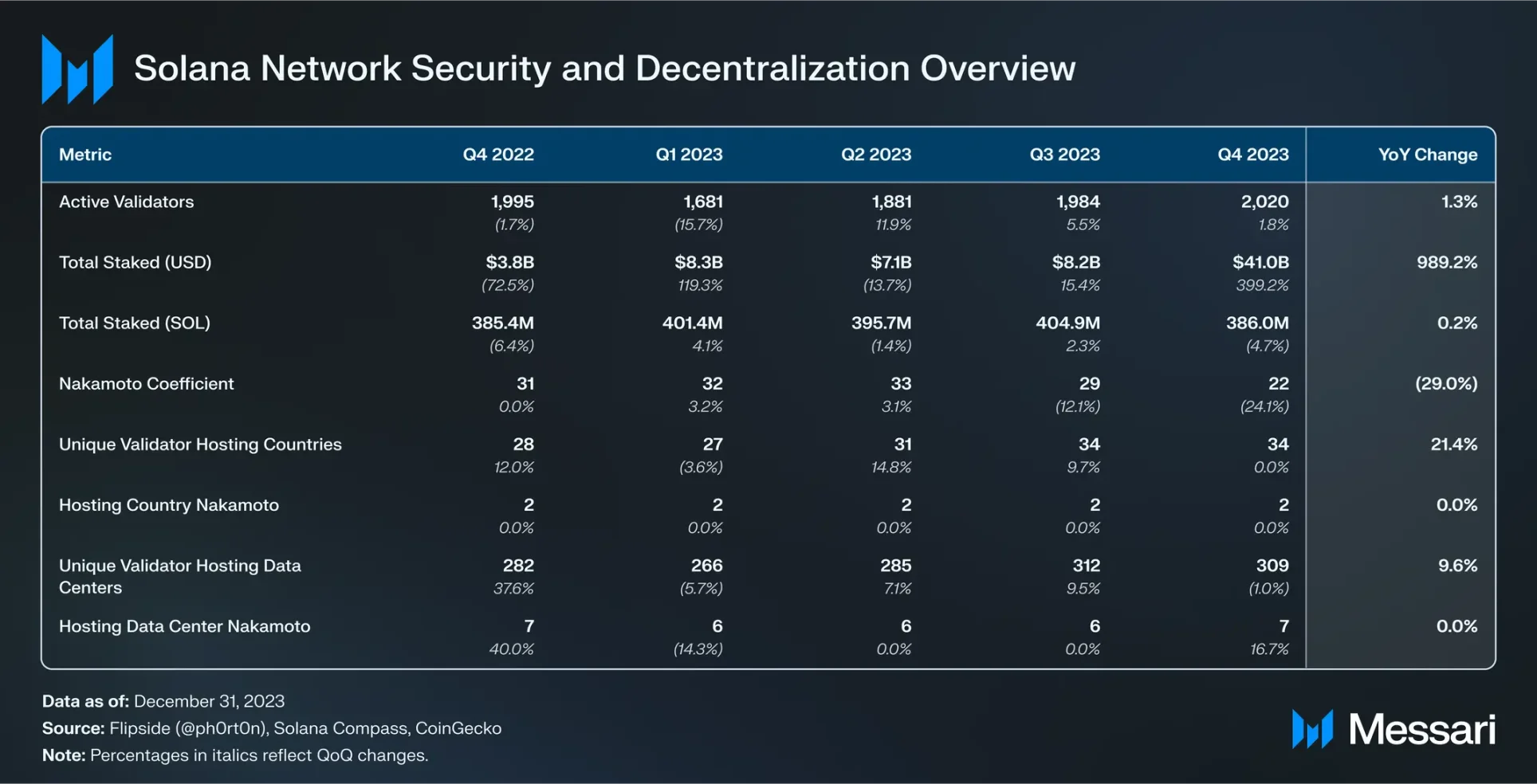

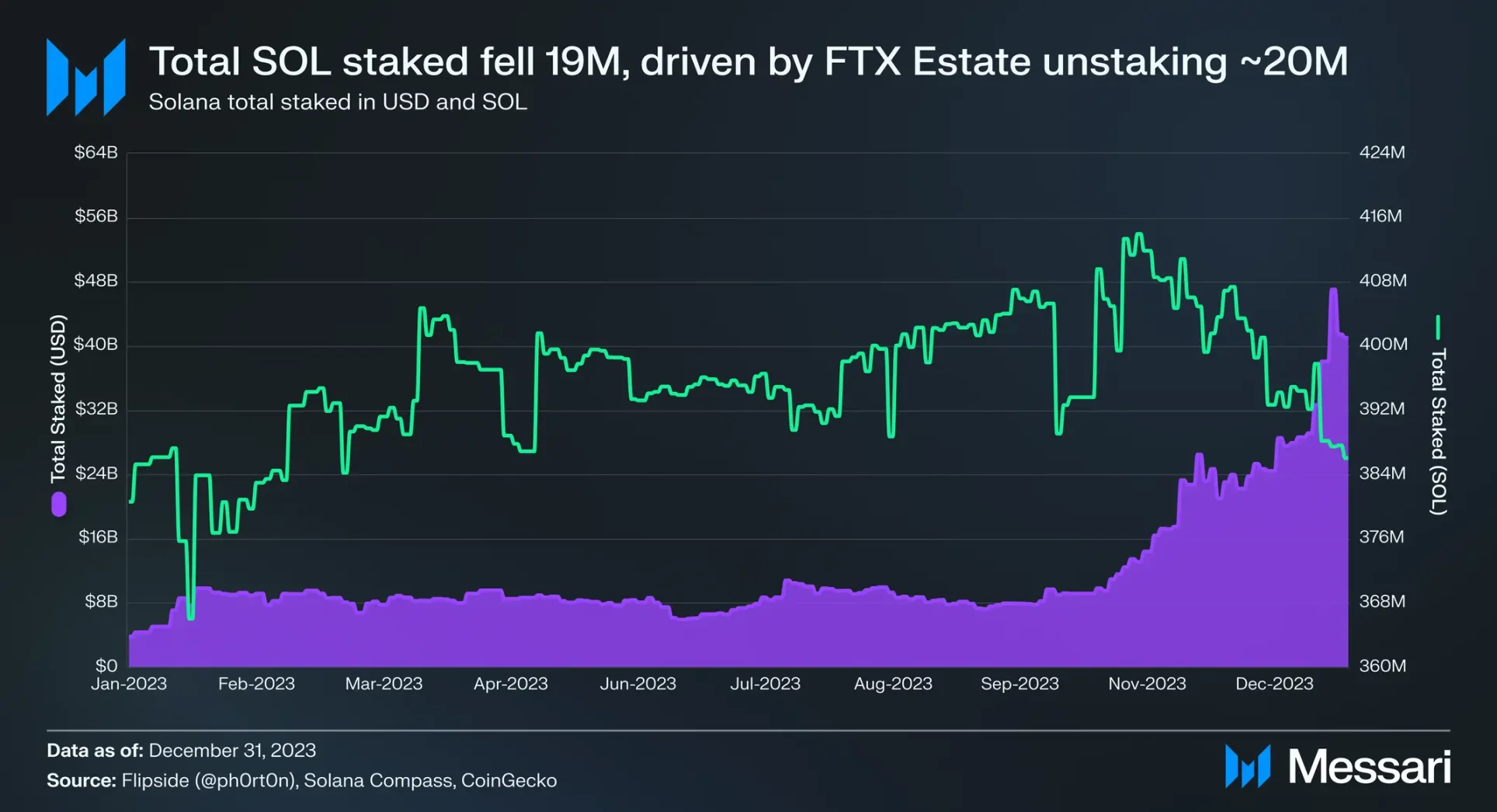

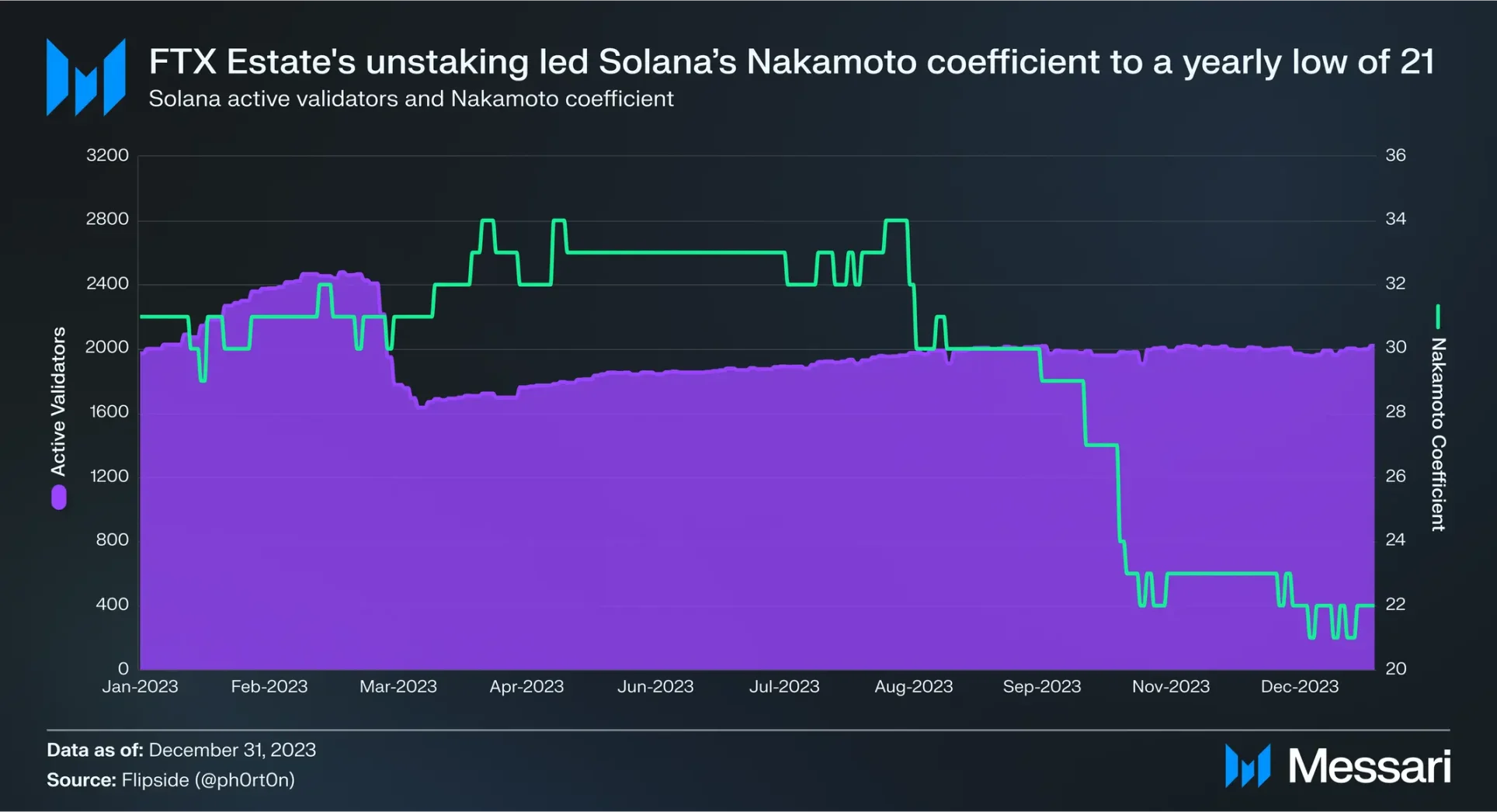

Staked SOL decreased by 19 million (5%) quarter-over-quarter, mainly due to FTX Estate unstaking around 20 million SOL. With the increase in SOL's price, the total staked amount denominated in USD increased by 399% quarter-over-quarter to $41 billion, ranking second among all networks, second only to Ethereum.

FTX Estate's unstaking has affected Solana's Nakamoto coefficient, as Alameda/FTX had previously staked with a wide range of validators. As of the writing of this article, Solana's Nakamoto coefficient is 22, the lowest in over a year, but still higher than the median for other networks.

Solana's Nakamoto coefficient benefits from the Solana Foundation's delegation program, which is currently delegating 68 million SOL. In early December 2023, the Foundation proposed changes to the program to help participating validators gradually achieve self-sufficiency over time.

The Nakamoto coefficient is the minimum number of nodes required to interrupt on-chain activity, and this metric can also be measured against other dimensions crucial for the resilience of the validator network, including validator location, hosting providers, and client distribution.

Solana's network has a total of 2020 validators, distributed across 34 countries/regions, a 21% increase year-over-year, with the United States leading with a 30% share. Solana's geographical Nakamoto coefficient is slightly below the 33.3% threshold, so the Solana Foundation pointed out in its October 2023 validator report that it plans to address the issue of the increased share of the United States over the past year.

At the end of 2023, the Superfast Cape Town validation node went live, becoming the network's first node in Africa.

Solana validators are hosted in 309 unique data centers, a 10% increase year-over-year, and the current Nakamoto coefficient for Solana's data centers is 7.

As reported in the validator report, Solana's hosting providers have a Nakamoto coefficient of 3, consisting of TeraSwitch, AWS, and OVH.

Solana currently has two clients: the original Solana Labs client and Jito Labs' MEV optimized branch. Currently, 48% of the share is running the Jito client, a 51% increase quarter-over-quarter and a 534% increase year-over-year. However, it does not provide the same client diversity as a client written from scratch. To address this, there are two upcoming clients that are written from scratch: Firedancer and Sig.

Firedancer is being developed by Jump Crypto using the C language. At Breakpoint, Jump announced that a version of Firedancer called "Frankendancer" has been launched on the testnet. Frankendancer runs new C-based code to implement "transaction propagation" functionality, such as sending transactions between validators and verifying signatures. It maintains the original Solana Labs client code for Runtime V2 (transaction processing) and the consensus mechanism.

The team also discussed the mechanism details of one of the first components needed for Firedancer to achieve 8 million TPS. Previously, Firedancer maintained over 1 million TPS in a test environment, while the Solana Labs client achieved approximately 55,000 TPS in a similar environment.

In addition to Firedancer, the Syndica team discussed details about Sig, the fourth validator client, which optimizes RPC reads to reduce slot latency—the time delay between the completion of two blocks. In other words, Sig aims to reduce latency by making certain types of user requests flow more smoothly from users to validators. It also emphasizes readability and simplicity, aiming to make it easier for developers to use.

As the release of Firedancer approaches, discussions about its impact on client diversity are heating up. Some believe that Firedancer can bring client diversity or higher throughput in the short term, but not both.

Anatoly and others believe that if more than one-third of validators run Firedancer as the primary client and the Solana Labs/Jito client as the secondary client, it would benefit client diversity without sacrificing the performance advantages of Firedancer. The secondary client can verify downloaded blocks, making it easier than running a full data propagation node. If the Firedancer client encounters errors or failures, validators can fall back to the secondary client. Therefore, it will bring security benefits in terms of client diversity. However, another high-performance client is needed to increase activity.

The lightweight client TinyDancer is also actively being developed. TinyDancer will allow users to verify the state without running a full node, increasing the network's trustlessness. "SIMD 64: Merged Transaction Receipts" in late October 2023 brought the development of lightweight clients one step closer. SIMD 64 inserted a mechanism into the core protocol for verifying the confirmed state of transactions without trusting RPC.

In exploring methods to build Rollups on Solana, Sovereign Labs developed a proof of concept that enables Simple Payment Verification (SPV) light clients on Solana without any changes to the Solana consensus.

Performance, Upgrades, and Roadmap

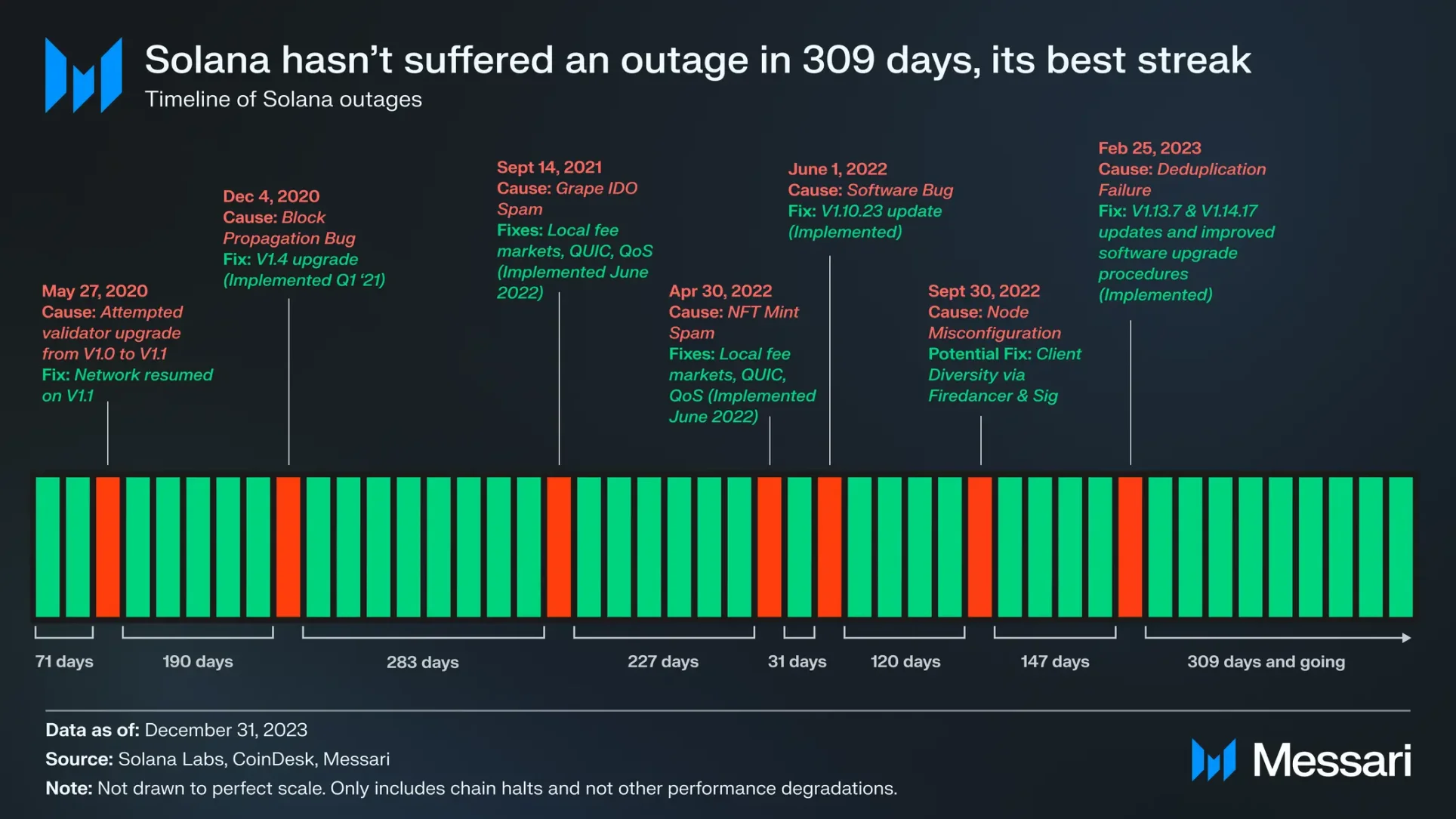

As of December 31, 2023, the Solana network has been in the longest continuous uninterrupted state, with a total duration of 309 days. This continuous record is the result of new technological features launched over the past year, such as QUIC, staking-weighted QoS, and local fee markets, as well as improvements to the network upgrade process. Although this does not mean that Solana will never crash again, it is worth acknowledging the successful work developers have done in improving the widely criticized issues.

After successfully upgrading to V1.16 at the end of the third quarter of 2023, the plan is to launch the V1.17 upgrade on the mainnet in the first quarter of 2024. It will bring further ZK support, possibly including Poseidon system calls, and elastic and performance updates, such as better estimation of computational units.

In addition to Firedancer and potential changes to the fee market, other upcoming features include token extensions, Program Runtime V2, and potential consensus/execution optimizations achieved through multiple concurrent leaders and asynchronous execution.

Token Extensions

Token extensions are part of the new SPL token standard, providing a set of configurable features for token issuers. Their design is primarily based on feedback from discussions with enterprises and financial institutions, but they also have use cases in more crypto-native DeFi and consumer applications, with over a dozen extensions, including:

- Confidential transfers: Privacy transfers have sparked most of the discussions related to token extensions. If enabled by the token creator, the source address, destination address, and token of the transaction will remain public. However, the transfer amount is hidden from everyone except for optional third-party auditors that can be added to the source address, destination address, and token.

- Transfer fees: Token issuers can add protocol-enforced fees to each token transfer, with options including fixed fees, variable fees, and a maximum fee per transfer. This extension has been implemented through tokens like Bonk Earn (BERN).

- Transfer hooks: Transfer hooks add more programmable logic to transfers beyond transfer fees, allowing token issuers to add conditions for the success of token transfers. Examples of such logic can include whether an account holds KYC tokens (which can be created through the NFT extension), whether it is on a compliance-related list, or whether it has conducted transactions before 2023, and more.

- Permanent delegation: Permanent delegation provides token issuers with full authority over the tokens, allowing them to freely burn or transfer any amount of tokens, even if the tokens are held by another account. This extension is most suitable for tokens representing off-chain assets or data that must comply with regulatory requirements. While this extension can be maliciously used, infrastructure providers have added features to warn users (if enabled).

- For more information about other extensions, please refer to Solana's documentation and Helius's blog.

The functionality supported by these extensions can largely be achieved on other networks, but currently requires developers to build their own infrastructure or obtain a licensed environment. Therefore, implementing them directly into the token program layer has several advantages:

- Infrastructure support: All major wallets, applications, and other infrastructure providers will support token extensions, making it more difficult for projects building their own solutions to achieve this level of ecosystem infrastructure support.

- Composability: Tokens and applications that were originally isolated in a licensed environment can coexist on the Solana mainnet with existing permissionless token experiences. Users do not need to cross chains, and applications and infrastructure providers do not need to support another network.

Token extensions are already present in Solana's open-source code, but before being recommended for use, the foundation and labs are waiting for the final steps, such as security audits. Token extensions may officially launch in mid-January 2024, although the privacy transfer extension will require further upgrades in 1.17 and 1.18 to be fully enabled.

Some tokens and applications have already experimented with token extensions. As mentioned above, BERN charges a 6.9% fee for each transfer, with the fee flowing to BERN holders, burning, developer funds, and BONK DAO. FluxBeam is a DEX that supports token extensions. It also has a Telegram bot service, FluxBot, and a UI tool for creating and managing extensions. Another project, The Vault by Hyperdrive, uses token extensions such as transfer hooks to create staked SOL derivatives, where staking rewards are separate from the derivative tokens.

Finally, major infrastructure providers, including Phantom, Solflare, Metaplex, and Helius, added support for token extensions in the fourth quarter of 2023 in preparation for the official release in January 2024.

Runtime V2

In short, Solana Program Runtime V2 is part of the Sealevel Virtual Machine (SVM), allowing Solana validators to execute programs (smart contracts). At Breakpoint, Solana Labs engineers showcased Program Runtime V2. The upgrade of Runtime V2 is primarily aimed at improving cost and API accessibility through software optimization.

With the average cost of execution reduced, the design space for programs is increased. Engineers can include more instructions in a program call, increasing the complexity of programs, which brings greater freedom to application developers.

Multiple Concurrent Leaders and Asynchronous Execution

Solana developers and researchers have also been working on long-term plans to further increase throughput and reduce latency. Solana co-founder and CEO of Solana Labs, Anatoly Yakovenko, recently shared his most exciting future projects, including:

- Multiple Concurrent Leaders: Slot leaders are responsible for producing blocks within a time interval. Currently, each slot has one leader. Anatoly suggests that having multiple leaders per epoch will reduce average latency, MEV, and censorship risks. However, there are still some unresolved issues, including how to allocate bandwidth among leaders and handle forks.

- Asynchronous Execution: Asynchronous execution aims to simplify transaction processing by decoupling execution from consensus. Currently, slot leaders manage transaction execution and scheduling (building and propagating blocks). In contrast, epoch leaders can focus solely on scheduling. Non-slot leader validators can opt out of immediate execution. The validator committee only reaches consensus on fork choice. Removing execution from the critical consensus path can reduce blockage time, improve efficiency, and mitigate peak latency issues related to execution. Validators will asynchronously execute transactions within a set time interval (such as an epoch). Full nodes can still execute transactions in real-time to serve end-users. For more information, please refer to Anatoly's recent article. He believes that asynchronous execution is a rare design with "almost no trade-offs."

Ecosystem Analysis

DeFi

Solana's DeFi TVL grew by 303% quarter-over-quarter and 505% year-over-year, reaching $1.5 billion, with the lending protocol MarginFi's TVL growing by 1404% to $337 million, jumping from sixth to first place. When the rewards program was launched on July 3, 2023, MarginFi's TVL was only $3.2 million. In the fourth quarter of 2023, it introduced several user experience upgrades, including PWA and a simplified UI, and teased YBX, a stablecoin supported by LST, which is set to be launched.

The TVL of the lending protocol Solend grew by 323% to $242 million quarter-over-quarter, with a 5% increase in market share. The first season of the rewards program started in August 2023 and ended with a teaser for the second season in early December. Unlike MarginFi, Solend already has a native token, so its rewards program has been and continues to be tied to the SLND token and other rewards, rather than potential airdrops. Solend also launched a native Android app, available for download in the Solana DApp store.

Kamino joined the lending competition in the fourth quarter of 2023, with its 2.0 upgrade including a new lending protocol. Since its launch in mid-November 2023, Kamino Lend has accumulated a TVL of $139 million. Within days of Kamino announcing plans for a future airdrop for the rewards program, its TVL roughly doubled. Kamino 2.0 also introduced a one-click leverage tool for SOL staking yields (cyclic xSOL/SOL) and tokens for long/short positions against USDC. Its initial liquidity treasury product had a year-end TVL of $88 million (but was not included in Solana's data to avoid double counting).

DeFi trading volume also saw significant growth, with daily average spot DEX trading volume increasing by 1116% to $359 million. In the fourth quarter of 2023, 45% of the trading volume used liquidity from Orca, followed by Raydium (with a 29% market share). Orca and Raydium rank third and fifth in Solana TVL, with $190 million and $133 million, respectively.

Although Phoenix's daily average market share of DEX TVL is 0.8%, its market share of DEX trading volume is over 9%. Phoenix is a fully on-chain limit order book DEX, praised for its capital-efficient design.

BONK-SOL ranked fourth in the token pair trading volume in the fourth quarter of 2023, just behind SOL/stablecoin and stablecoin/stablecoin pairs. The total trading volume of the token pair in the fourth quarter of 2023 was close to $1.3 billion, an 11,000% increase quarter-over-quarter. BONK is a mem, airdropped to Solana developers as a Christmas gift in 2022. In mid-December 2023, Coinbase listed BONK, with first-day trading volume reaching $238 million, making it the 12th highest in the exchange's history.

On average, 57% of DEX spot trading volume is conducted through the Jupiter trading aggregator, which is one of the most prominent DeFi protocols in the cryptocurrency space in the third quarter of 2023. It garnered attention with its announcement at Breakpoint and subsequently launched a new GMX-style perpetual trading product (shortly after Breakpoint), a stablecoin supported by a new SOL liquidity staking token (yet to be launched), and an airdrop. It plans to conduct the first round of a four-round airdrop in January 2024 (equivalent to 40% of the total supply), with the airdrop criteria finalized after multiple improvements based on community feedback.

Since its launch, the average daily trading volume of Jupiter's perpetual trading product has been $53 million. Another major participant, Drift, was one of the fastest-growing DeFi protocols on Solana in the third quarter of 2023. Its growth continued in the fourth quarter of 2023, with a tenfold increase in average daily trading volume to $23 million. At Breakpoint, Drift announced a $23.5 million Series A funding.

After a relatively stable period in 2023, the stablecoin market value on Solana grew by over $300 million, primarily due to the increase in USDC supply in December 2023. The liquidity and interoperability of USDC on Solana are expected to continue to grow through Circle's Cross-Chain Transfer Protocol (CCTP).

CCTP allows for the cross-network transfer of USDC without the need for wrapping USDC. It was launched on Solana's testnet in early November 2023, with the mainnet expected to launch in the first half of 2024. In mid-December 2023, Circle also launched EURC, a Euro-backed stablecoin, on Solana. Towards the end of the fourth quarter of 2023, Paxos announced plans to expand its NYDFS-regulated USDP stablecoin to Solana in mid-January 2024, making Solana the second network to support USDP after Ethereum.

Other notable DeFi-related events include Parcl V3 and rewards, Cube Exchange's $9 million funding and Litepaper release, OpenBook V2, Zeta rewards, Hashflow's expansion to Solana, Ondo's expansion to Solana, Rain.fi updates, SDX release, Starport litepaper release, Meteora Stimulus Package, Cypher's IDO, Fluidity's launch of Flash.Trade, and the release of LiquidProp beta, among others.

Liquidity Staking

Due to 72% of the eligible SOL supply being staked, liquidity staking protocols are crucial for building an ecosystem based on yield-bearing SOL. The incentive program has successfully increased the total staked SOL for liquidity staking—growing by 49% quarter-over-quarter, but still relatively low at 4.3%.

Jito has been driving the growth of Solana liquidity staking, and after launching a rewards system in mid-September 2023, Jito introduced its token JTO in early December, airdropping 10% of the total supply to JitoSOL holders, Jito client validators, and Jito MEV searchers.

With fewer than 10,000 eligible wallets and a distribution skewed towards smaller addresses, based on JTO's price at the end of the fourth quarter of 2023, the minimum airdrop amount is close to $10,000. JTO began trading on Coinbase on the day of its launch, becoming the highest-trading new listing token on the exchange since APE in March 2022 (before being quickly surpassed by BONK). The Jito Foundation also released its charter, which outlines the governance framework for JTO DAO, among other things.

Jito's TVL (calculated in SOL) grew by 164%, reaching 6.4 million SOL, with its market share increasing by 85% to 38%, second only to Marinade. Jito's development benefited from Lido discontinuing its Solana services—Lido held a market share of 24% at the end of the third quarter of 2023, which dropped to below 2% by the end of the fourth quarter.

As mentioned, Jito's MEV Solana client also saw growth, with a market share of 48%, a 51% increase quarter-over-quarter, and a recent rebound in MEV with increased on-chain activity.

At Breakpoint, Jito launched StakeNet, an open protocol for decentralized Solana staking pool operations. Currently, all Solana staking pools are managed by centralized participants, who store historical validator data from on-chain snapshots and off-chain sources on their own servers, then use their own delegation logic and parameters to rebalance stakes among validators and add or remove validators from the pool.

StakeNet brings all of this on-chain and introduces a guardian network that runs validator history and management programs. The validator history program stores encrypted validation data for each Solana validator for up to three years on-chain. The steward program manages delegation logic and validator scoring to operate the stake pool. Everything is on-chain, and delegation logic and parameters can be adjusted through on-chain governance. When it goes live, Jito will adopt StakeNet and hopes that other staking pools will do the same.

Although its market share decreased by 12%, Marinade's TVL, calculated in SOL, still grew by 26% quarter-over-quarter. Marinade already has a native token, MNDE, but in the third quarter of 2023, it launched a rewards program to compete with the growth of the updated tokenless protocol. In the third quarter of 2023, Marinade also launched Marinade Native, a native staking product to complement its liquidity staking service.

Marinade Native is an equity automation platform that routes stakes to over 100 top-performing validators without paying performance fees or introducing any smart contract risk. Marinade Native's TVL has reached $416 million.

Towards the end of 2023, Marinade launched Protected Staking Rewards (PSR). According to PSR, validators need to stake SOL to qualify for Marinade staking. If validators experience downtime or encounter other performance issues affecting their staking rewards, the staked SOL will be used to compensate any losses for Marinade stakers.

Blaze continues its ongoing BLZE airdrop, which began in August 2023, and after a 1234% quarter-over-quarter increase in the third quarter of 2023, its TVL in SOL grew by 344% in the fourth quarter, with a market share of 12%.

MarginFi launched its own liquidity staking protocol at the end of the third quarter of 2023, with LST distributing stakes to three validators operated by the MarginFi team. Its liquidity staking TVL in SOL saw a quarter-over-quarter growth of 188%, placing it among the top five liquidity staking protocols. As mentioned, the MarginFi team is preparing to launch a stablecoin supported by SOL-backed liquidity staking.

Sanctum further strengthened the liquidity staking ecosystem, providing liquidity and stability for Solana's liquidity staking and DeFi ecosystem. In early December 2023, Sanctum launched 2.0, introducing single-validator LST, upgraded multi-LST liquidity pools, and a zero-fee flash loan program, among other new products.

With the growth of LST in Solana's DeFi protocols, LST liquidity is becoming increasingly important, especially as users utilize them to counter SOL. This dynamic became apparent in mid-December 2023 when a user sold approximately $8 million worth of Marinade mSOL, causing its price to drop below SOL. While Sanctum provides unified LST liquidity pools, mSOL is still in the process of integration. Temporary unpegging also sparked debates among several lending protocols regarding best risk management and liquidation practices.

Consumer Applications

NFT

The daily average NFT trading volume on the Solana network saw a quarter-over-quarter growth of 356% to $4.8 million. Excluding Bitcoin, Solana's market share in NFT trading volume increased from 9% to 26% quarter-over-quarter.

Although Magic Eden regained the majority share by the end of the fourth quarter of 2023, the market share of NFT marketplace Tensor exceeded 80% in early December, compared to its market share of only 1.2% at the beginning of 2023.

The highest total trading volume in the fourth quarter of 2023 included Mad Lads (613,000 SOL), Tensorians (510,000 SOL), and Claynosaurz (171,000 SOL), all representing a shift in PFP NFTs towards brand building and practical applications.

Many notable Solana NFT collections saw significant increases in floor prices calculated in SOL. Mad Lads' in-house market value saw a 142% quarter-over-quarter increase, reaching 1.3 million SOL ($135 million), while Tensorians saw a 517% increase, reaching 800,000 SOL ($80 million)—making these two projects the top-tier projects in terms of market value calculated by floor price on Solana.

Social and Creator Platforms

Compressed NFT (cNFT) was the first successful use case of state compression, launched in early second quarter of 2023. State compression provides an economically efficient on-chain data storage method by hashing data into a Merkle tree and publishing its root hash on-chain. Depending on the level of composability, the cost of minting and storing 1 million cNFTs ranges from 5.3 to 63.7 SOL, compared to 24,000 SOL without compression.

cNFT supports new use cases across consumer, DePIN, and other domains, with DRiP being the most significant example of a consumer application that can only be achieved through cNFT. DRiP collaborates with artists to offer NFT art minting for free, with collections far larger than the normal 10,000. In the fourth quarter of 2023, DRiP minted over 35 million cNFTs, with an additional 4 million minted by Dialect, Helium, and other projects.

In early December 2023, DRiP introduced Droplet to power its in-app economy. Initially, Droplet was distributed to users based on different levels of engagement and automatically spent when users received collectibles from the platform.

In early December 2023, DRiP improved the system and launched Droplets 2.0, where users can still receive Droplets for free, but only through a rotating winning mechanism that refreshes every six hours. Users can now also purchase Droplets using tokens or fiat currency (supported by Sphere), and finally, users can directly gift Droplets to creators for potential rewards.

Droplets are converted to USDC and paid to creators, with DRIP paying out $143,000 to creators in the fourth quarter of 2023, with $84,000 paid out in December alone.

Other notable events include:

- Access funding: Creator monetization platform Access Protocol announced a $1.2 million seed round funding.

- Nina Protocol V2: Digital-native music platform Nina launched V2 in mid-November, allowing artists to register and sell or distribute music for free using email addresses. Nina uses Arweave and Solana to store music versions and facilitate transactions, with artists receiving 100% of the sales.

- Boba Guys Passport: The pearl milk tea chain Boba Guys launched a Solana-based loyalty program, minting cNFTs with the help of NFT tool company Crossmint, with over 8,124 cNFTs minted to date.

- SolLinked Masquerade: SolLinked added the "Masquerade" feature, a chat room where users can prove their on-chain assets in a privacy-protecting manner through Elusiv.

- Solarplex's "In-Post Minting": Web3 social media platform Solarplex added the "In-Post Minting" feature, allowing users to easily create NFTs and embed them into posts, automatically collecting NFTs for anyone who likes the post.

Gambling

Gaming as a specific major narrative for Solana has calmed down, but there were still many discussions and some updates at Breakpoint.

- Star Atlas, a game built on Solana, announced game features and a demo of the upcoming 2.2 version at Breakpoint. In the third quarter of 2023, Star Atlas launched a 2D open-world game called SAGE Labs, and it accounted for approximately 8% of Solana's total trading volume in the fourth quarter of 2023.

- The open-source on-chain gaming framework Magicblock detailed its vision for the Solana native game engine (you can learn about their workings and importance here).

- Discussions at Breakpoint revolved around the evolution and mechanism design in the gaming space, as well as strategies for maximizing user acquisition.

In mid-December 2023, Magicblock, Lamport DAO, and the Solana Foundation co-hosted the second Solana Speedrun, a game-themed hackathon offering up to $10,000 in prizes.

DePIN

Solana is becoming the center for DePIN applications, hosting DApps such as Helium, Hivemapper, Render, Teleport, and GenesysGo.

Notable events include:

- Render migration: In early November 2023, the decentralized computing network Render successfully completed the migration of its core on-chain infrastructure (including native tokens) from Ethereum and Polygon to Solana. The Render Foundation stated that Solana provides new features for the protocol, such as real-time streaming, dynamic NFTs, and composability with on-chain order books.

- Helium Mobile $20 Phone Plan: In early December 2023, Helium Mobile partnered with T-Mobile to launch a nationwide $20 per month phone plan, offering unlimited data, calls, and texts. It also released indoor and outdoor Helium Mobile Hotspots, allowing users to help create wireless network coverage in exchange for MOBILE rewards.

- Hivemapper updates: Hivemapper, aiming to create a decentralized global map, announced the start of licensing map data on behalf of paying customers. Later in the fourth quarter of 2023, Hivemapper released Scout, an open-source UI toolkit for real-time monitoring of street locations using Hivemapper dashcam images. Potential use cases include monitoring construction zones, gas station prices, and billboards.

- Teleport iOS app: The decentralized ride-sharing protocol Teleport launched its iOS app at the end of October 2023 and will begin operations in at least one city with enough drivers and passengers.

- Io.net public beta: The decentralized GPU aggregator io.net launched a public beta during Breakpoint, aggregating GPUs from Render, Filecoin, and its own network to build a decentralized cloud specifically for machine learning needs, with plans to launch its own token in the first quarter of 2024.

- IoTeX integration: Sensor network platform IoTeX integrated its W3bstream SDK with Solana, using zk-proofs to connect IoT devices equipped with specific-use case sensors (such as Hivemapper dashcams) to on-chain contracts.

- Nosana's AI Pivot: In mid-October 2023, the decentralized GPU network Nosana announced a pivot from CI/CD use cases to AI inference. The platform is currently in the beta testing phase, with over 100 GPU nodes and 47,000 completed inferences.

Payments

With low transaction costs, sub-second finality, and a network of thousands of nodes, Solana is poised to help drive mainstream payment processes—Visa announced that in the fourth quarter of 2023, it would expand its USDC settlement pilot to Solana. In addition to Visa's announcement, another significant win was the integration of Solana Pay into Shopify, with the payment platform Helio announcing its takeover of the Solana Pay Shopify plugin's operations in December 2023.

Other notable events for Solana-native payment infrastructure companies and applications this quarter include:

- Sphere early access: Sphere, the winner of the Solana Summer Camp hackathon, launched early access to its payment solution in early December 2023, featuring withdrawals, on-chain subscriptions, and universal checkout. It has provided support for the payment processes of multiple projects in the Solana ecosystem, including Squads, io.net, DRiP, and Helium Mobile.

- Code open-sourcing: The payment app and protocol Code is now focused on building micro-payment solutions and open-sourced its entire codebase at the end of November 2023.

- Elusiv payroll app: After launching private token swaps, Elusiv opened its private payroll app for registration.

- TipLink support for IRL events: TipLink allows users to send or claim Solana assets using links or QR codes. At Breakpoint, over 15 teams distributed over 5,000 claimed assets using TipLink, which also supported NFT distribution through QR codes for the "Artist in Residence" at the Miami Beach Basel Art Fair.

Infrastructure

Notable events related to infrastructure in the fourth quarter of 2023 include:

- Squads V4, Funding, and Fuse: Over $25 billion in assets are protected in Squads' multi-signature protocol. In early Q4 2023, Squads launched the V4 version, bringing UX redesign and new features, including the SquadsX browser extension wallet. Shortly after, it announced a $5.7 million strategic funding round led by Placeholder. At the Breakpoint conference, Squads Labs also announced the smart wallet Fuse—a PDA wallet supported by Squads' multi-signature protocol, expected to launch in Q1 2024.

- Pyth Airdrop: Pyth is a major price oracle for Solana DeFi protocols. In November 2023, it conducted a retrospective airdrop, with over 86,000 addresses across 27 blockchain networks eligible. Pyth did not create claiming contracts on each blockchain but airdropped all tokens on Solana. Despite some liquidity issues, Solana's network performance was relatively strong.

- Solana Mobile Updates: The Solana Mobile team announced several updates at Breakpoint, including new universalization features for integration with any chain. These updates also introduced wallet applications for direct integration into Safari via extensions and new game SDKs for Unity and Unreal Engine for easier integration of mobile wallet functionalities. Previously, Solana Mobile's Saga phone sales were disappointing, but with the rapid rise in BONK prices, they quickly sold out. It was realized that the BONK airdrops available to Saga phone users were more valuable than the cost of the phone, and several other projects have since airdropped tokens to Saga phone users.

- Phantom Cross-Chain Exchange: Phantom launched a service allowing users to transfer and exchange tokens directly within the wallet across Solana, Ethereum, and Polygon. Cross-chain is supported by Li.Fi and several other protocols, with exchange functionality supported by Jupiter and 0x.

- Wormhole Funding: Cross-chain protocol Wormhole announced the completion of a $225 million funding round, valuing the protocol at $25 billion. Wormhole is one of the leading protocols for cross-chain connections with Solana.

- Helius Updates: Developer tools company Helius made several updates in Q4 2023, including the launch of transaction Websockets and priority fee APIs, and support for alternative tokens (SPL, Token extensions, cNFTs, and inscriptions) in its digital asset standard API.

- Backpack Exchange and Wallet Updates: The Backpack wallet team launched the centralized exchange Backpack Exchange in mid-November 2023, enhancing transparency. Backpack also added an NFT collection locking feature, released a mobile wallet on Apple and Google Play stores, and open-sourced the Backpack Wallet extension app.

- Underdog Embedded Wallet: Underdog Protocol, an API for NFT-related needs, launched an embedded wallet tool in late November 2023, allowing users to claim and manage NFTs using social logins without the need to create a Web3 wallet first.

- Other Developments: ZK Anchor by Light, Armada's release, SolanaFM's Quantum release, updates to the "create-solana-dapp" tool, Google Cloud BigQuery support, Ironforge's RPC Gateway, Vybe token page, MPCVault integration, Trezor support, Space Operator public beta, SNIPER upgrade, and Eclipse testnet launch, among others.

Ecosystem Growth

The grants, hackathons, accelerators, and other initiatives launched by the Solana Foundation, Lamport DAO, Superteam, and other independent organizations have further propelled the ecosystem's development.

Notable events this quarter include:

Breakpoint: The Solana Foundation held its annual conference in Amsterdam from October 30 to November 3, 2023, with over 3000 attendees and 100+ sessions. Many teams made significant announcements during this event (see the full report here). Additionally, Breakpoint 2024 will take place in Singapore from September 19 to September 21, 2024.

Hyperdrive Hackathon: The Solana Foundation's online Hyperdrive hackathon concluded in mid-October 2023, with winners announced at Breakpoint. The AI-driven Telegram chatbot Fluxbot emerged as the overall champion, receiving a $50,000 prize. Other track winners (each project receiving $30,000) include:

- Mobile Consumer Tracking: SolLinked, a pay-as-you-go access, personnel-on-demand service starting from email.

- Crypto Infrastructure Track: epPlex, a protocol for minting self-destructing NFTs.

- AI Track: Wysdom, a Notion-like platform for collaborative Web3 development and research.

- Gaming and Entertainment Track: Solciv, a full-chain strategy game inspired by Civilization.

- Financial and Payment Direction: Starport (formerly known as Alexandria), a merged limit order book where orders can be filled with multiple assets, avoiding multiple hops and resulting transaction fees.

- Physical Infrastructure Network Track: Shaga, a P2P network for gaming computers.

- DAO and Network Status Tracking: Pubkey Link, an open-source Discord verification bot service.

In total, over 7000 participants submitted 907 projects, a record number for the Solana Foundation hackathon.

- Solana Labs Incubator: Solana Labs has launched an incubator for existing Solana projects or Web2 and Web3 projects considering Solana, providing support for development, fundraising, marketing, and more.

- Hong Kong Hackathon: The 2023 Solana Hackathon Tour concluded with the Solana x Circle Hong Kong Hackathon in mid-November 2023, with 13 teams participating in VC Pitch and Demo Day, marking a successful conclusion to the event.

- RetroPGF Round 1: OpenBlock Labs collaborated with the Solana Foundation to launch the Solana Retrospective Public Goods Funding (RetroPGF), with a prize pool of $250,000. Major winners include OpenBook, Cubik, and SOLfees.

- MtnDAO V5 Announcement: The announcement of the fifth edition of the MtnDAO Hackathon, scheduled to take place in Salt Lake City for one month in February 2024.

- Solana Crossroads Announcement: The Solana Allstars ambassador program, Step Finance, announced the second annual Solana Crossroads conference to be held in Istanbul in May 2024.

Summary

Solana ended the fourth quarter of 2023 with strong performance, and the annual Breakpoint conference by the Solana Foundation also contributed to the growth. Many significant announcements and releases were made by teams including Jupiter perpetual trading products and token issuance, Frankendancer, Backpack Exchange, and Render migration. The JTO airdrop and BONK listing on Coinbase further stimulated on-chain activity in December 2023.

In summary, this quarter saw a 423% increase in Solana's market capitalization, a 102% increase in daily active users, a 303% increase in DeFi TVL, a 961% increase in daily DEX trading volume, a 359% increase in daily NFT trading volume, and a 21% increase in stablecoin market capitalization compared to the previous quarter.

The catalysts for the upcoming first quarter of 2024 will include the Jupiter airdrop, token extensions, and ongoing developments with Firedancer and TinyDancer releases.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。