Stacks is the first compliant security token issuance project approved by the SEC.

Written by: Jake Pahor

Translated by: DeepTechFlow

2024 is an important year for Bitcoin, with the approval of Bitcoin ETF and the halving event being two major catalysts. Does Stack, as the smart contract layer of Bitcoin, still have Alpha opportunities? Cryptocurrency researcher Jake Pahor detailed the introduction of Stack, and DeepTechFlow translated the entire article.

Overview

Stacks is the smart contract layer of Bitcoin. Traditionally, Bitcoin is considered a store of value or digital gold.

Stacks can provide novel use cases for BTC holders, including:

Bitcoin-backed loans

Bitcoin DeFi

Trading NFTs using Bitcoin

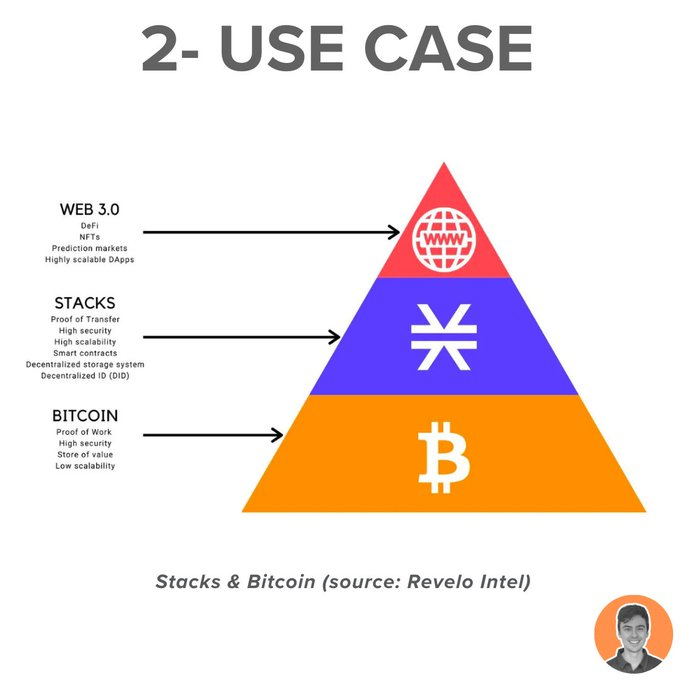

Use Cases

Stacks aims to bring DeFi to Bitcoin, unlocking over $900 billion of crypto capital.

It utilizes the Bitcoin network as a settlement layer and adds smart contracts and programmability. Applications will run on the Stacks blockchain itself, rather than on centralized servers.

The Stacks ecosystem is continuously evolving, with over 30 teams actively participating in Stacks development.

Some notable projects include:

Alex (DEX)

StackingDAO (liquidity staking)

Arkadiko (CDP)

Stacks aims to help expand the Bitcoin economy.

Adoption

Currently, the TVL on the Stacks chain has reached a historical high of $63 million. This is approximately 6 times higher than the low point in September 2023 ($10 million TVL).

Trading volume has also significantly increased over the past few months. Adoption of NFTs, DEX, and domain services has also seen a sharp increase.

Revenue

Stacking ensures the security of the Stacks network and provides actual returns in BTC to stakers (currently around 7%). The returns are related to network activity. As activity grows and blocks become more valuable, the price of BTC will rise, resulting in higher returns for STX stakeholders.

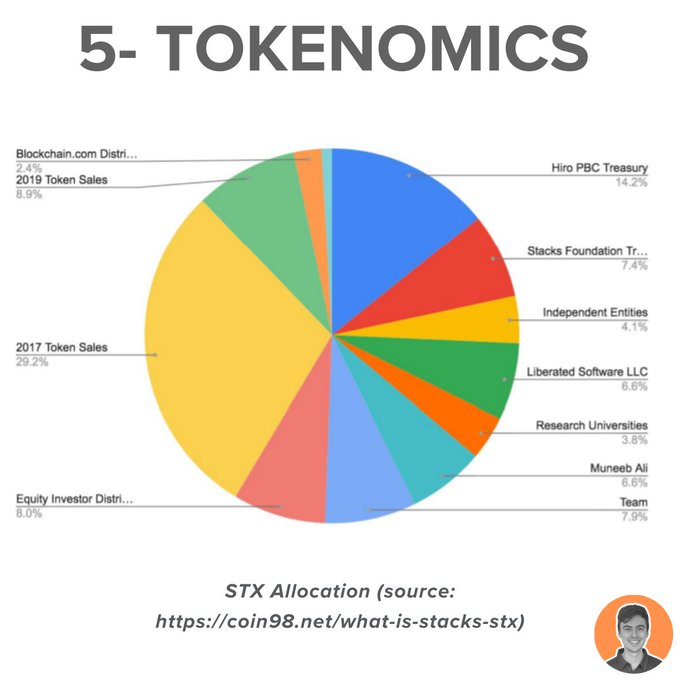

Token Economics

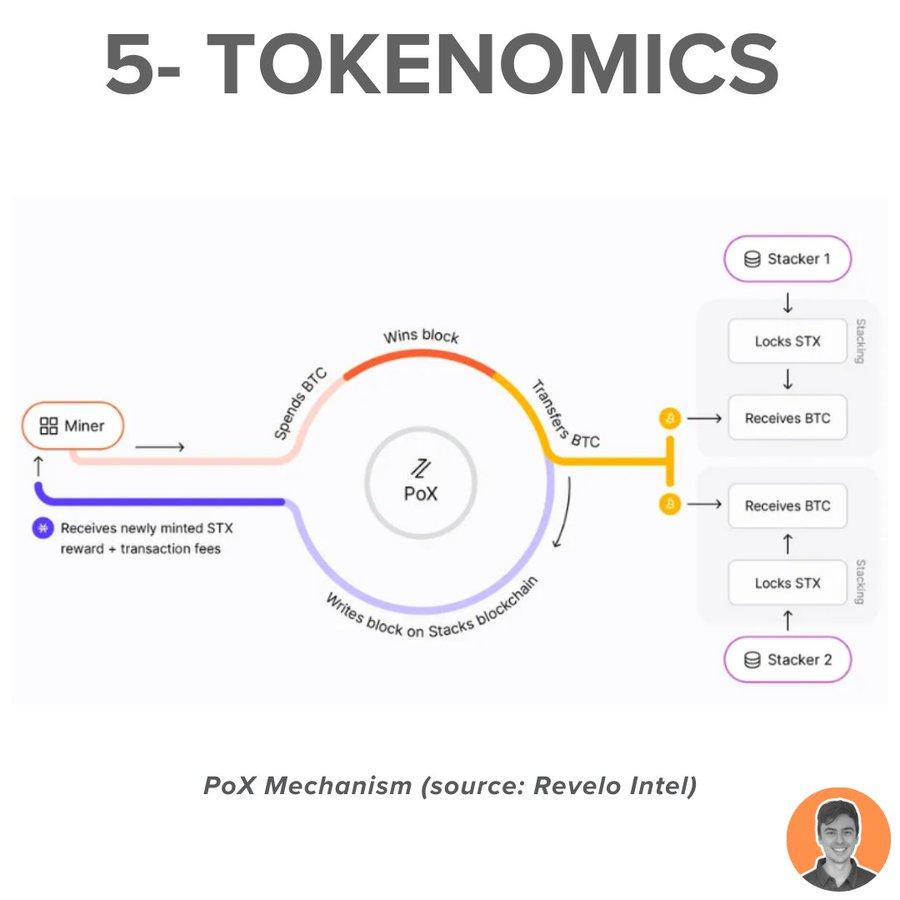

Proof of Transfer (PoX) is the mechanism of the Stacks blockchain. Miners validate transactions by bidding with BTC to earn STX rewards.

STX is the native token of Stacks and can be used for:

Paying transaction fees

Stacking (locking the network to earn BTC rewards)

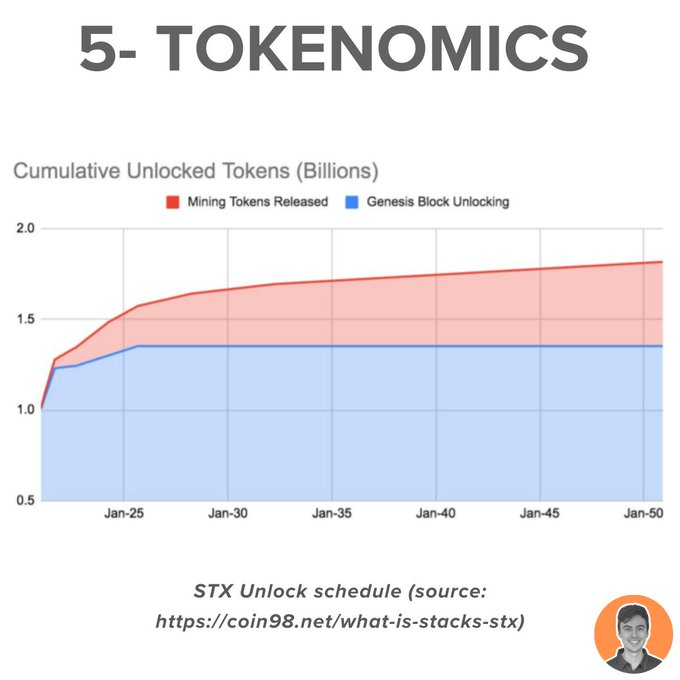

Similar to Bitcoin, Stacks also implements a halving plan, reducing miner rewards to half of their previous value.

STX also has a fixed and predictable future supply, halving every 4 years. By 2050, the total supply of STX is expected to reach 1.82 billion.

Current supply data includes:

Circulating supply of 1.43 billion

Maximum supply of 1.82 billion

Market cap of $2.6 billion

FDV of $3.3 billion

Market cap/FDV of 0.79

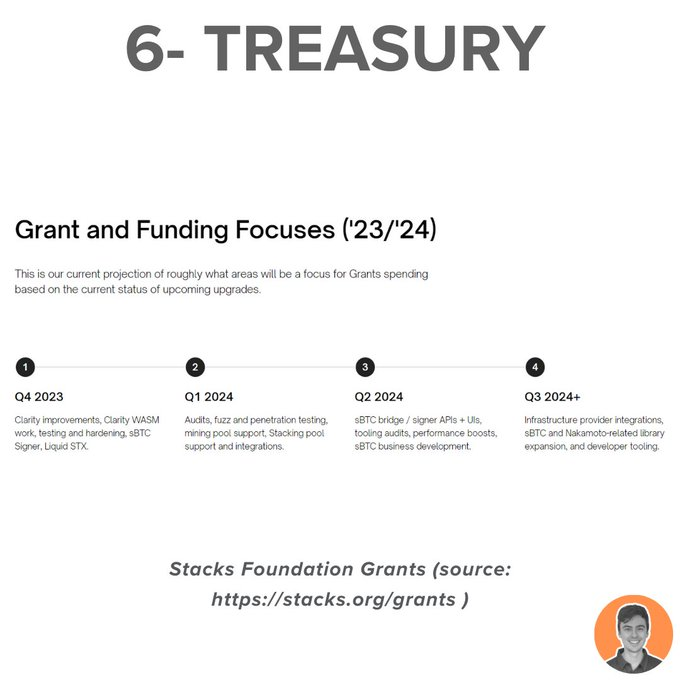

Treasury

Based on the token unlocking schedule, there are two main treasuries:

Hiro PBC Treasury: holds 200 million STX, approximately $366 million

Stacks Foundation Treasury: holds 100 million STX, approximately $183 million

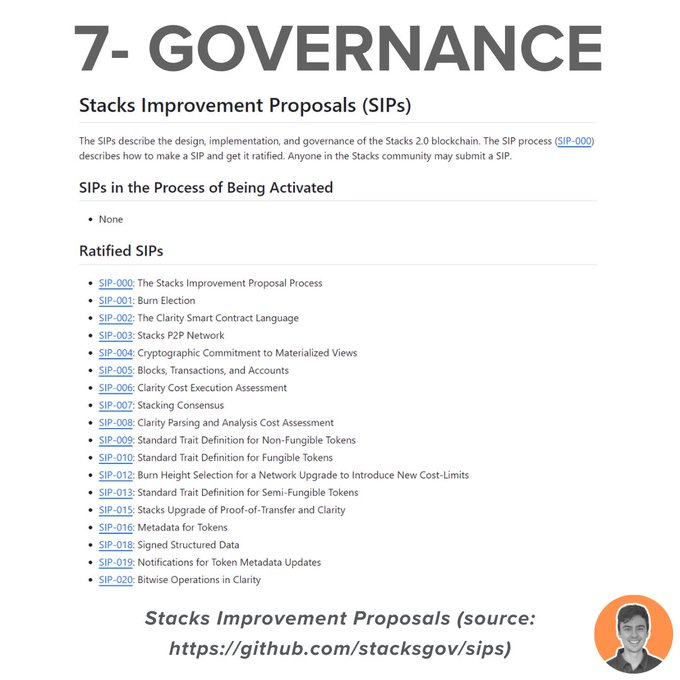

Governance

Anyone in the Stacks community can submit SIPs (Stacks Improvement Proposals).

Subsequently, the guidance committee discusses and votes on each SIP. Joining this committee requires approval from the Stacks Foundation Board, making the process still quite centralized.

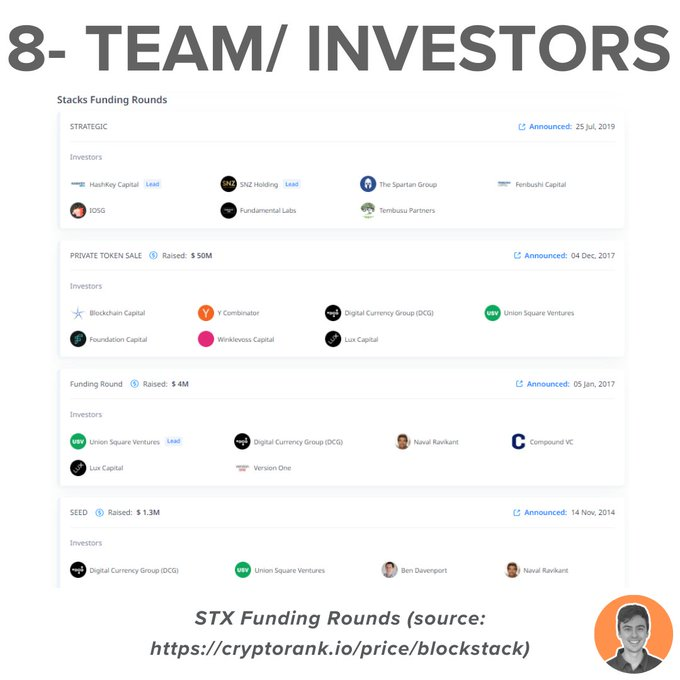

Team and Investors

Stacks was founded by Muneeb Ali and Ryan Shea in 2017.

Over the years, it has raised over $45 million through multiple rounds of financing, private placements, and ICOs.

Notable investors include Hashkey, SNZ Holding, Blockchain Capital, DCG, Winklevoss Capital, and Naval.

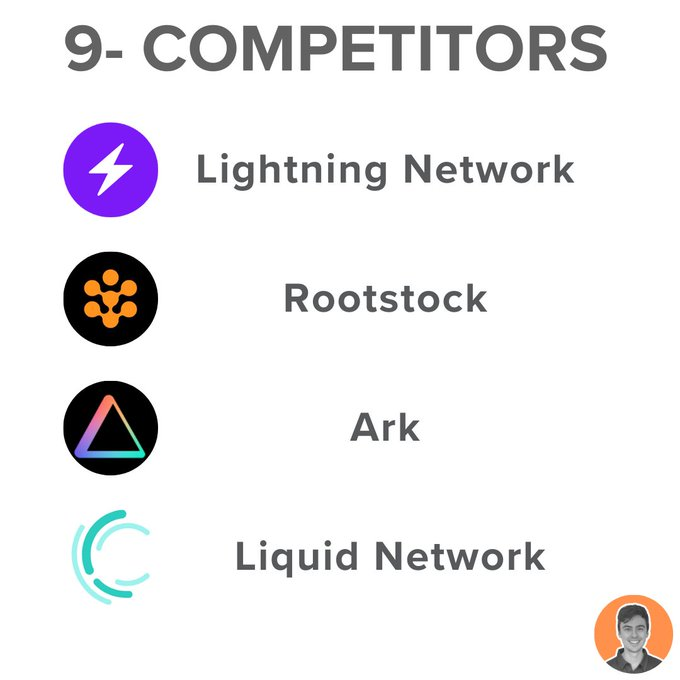

Competitors

There are other solutions to Bitcoin's inefficiency issue, including Bitcoin Lightning Network, RSK, Ark, and Liquid. However, Stacks is unique as it is the only project with its own token, giving it a significant competitive advantage.

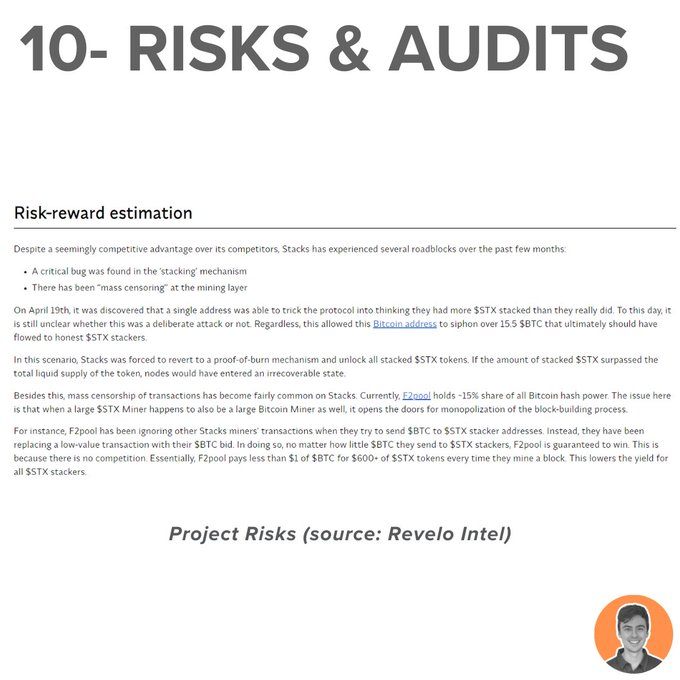

Risks

In recent months, Stacks has faced several issues:

Discovery of a critical flaw in the "Stacking" mechanism

"Large-scale review" event in the mining layer

Interesting, Stacks is the first compliant security token issuance project approved by the SEC.

(Read more: Exclusive interpretation of the first SEC-compliant project Blockstack (STX) CEO: The road to compliance)

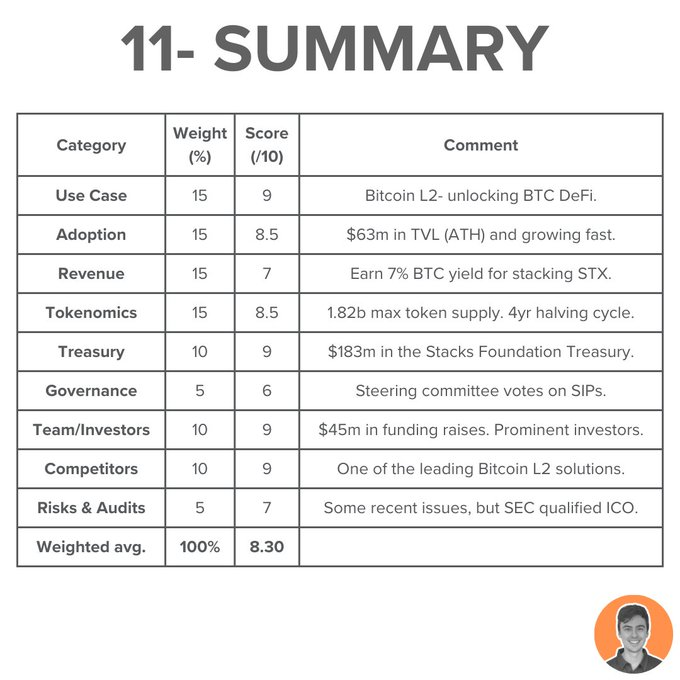

Summary

The Bitcoin ecosystem has tremendous growth potential, and Stacks is a project that I am closely following.

There are many ongoing and upcoming catalysts in the Bitcoin ecosystem:

• Approval of BTC ETF

• BTC halving (April 2024)

• Satoshi upgrade

• sBTC launch

• Bitcoin DeFi and NFT trading

Taking all of this into account, on a scale of ten, I would give Stacks a score of 8.3, and I look forward to seeing better performance from Stacks!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。