Small demand is not a problem, but costs may be a long-term issue.

Author: @smyyguy

Translation: Luccy, BlockBeats

Editor's note: @smyyguy discussed the significant success of Celestia in integration and marketing in this article, pointing out the large number of chains to be launched by RaaS in the coming months. @smyyguy believes that Celestia is an excellent choice for those building Rollups and there are multiple options for using it. However, he also pointed out that most rollups built by RaaS will not provide too much demand for users. BlockBeats translated the original text as follows:

I spent some time processing Celestia data and have some thoughts on the future.

Current on-chain activity

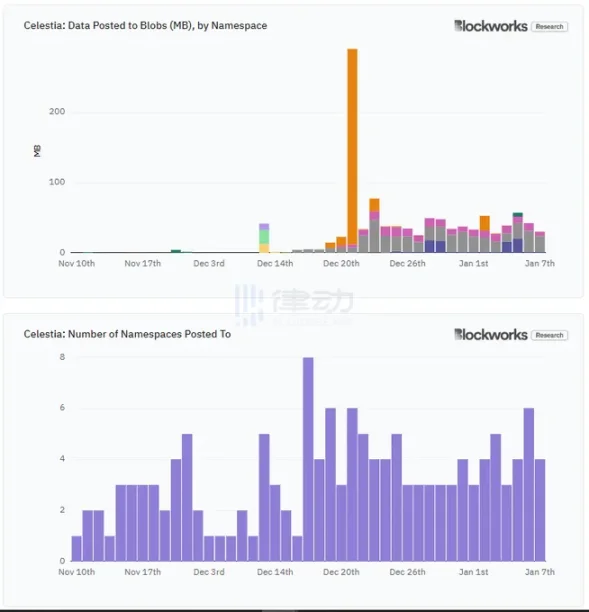

Celestia was launched just two months ago. So far, users have published data to a total of 56 namespaces. We can see that users are publishing 30-50 MB of data to 3-6 namespaces per day.

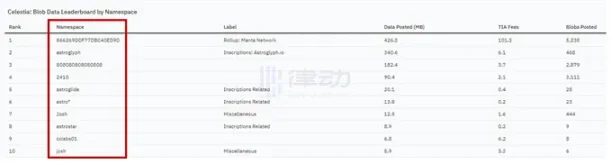

87% of all data published to Celestia has been sent to 3 namespaces:

@astroglyph_io, an inscription service that allows users to publish any data to Celestia · @MantaNetwork, an OP Stack rollup launched with @Calderaxyz · 808080808080808, an unknown namespace, but looks like a rollup

In contrast, the Ethereum mainnet currently has about 15 rollups, publishing about 700 MB of data per day, and Arbitrum and OP mainnets are publishing about 120 MB/day and 80 MB/day, respectively. After EIP-4844 goes live, Ethereum will initially support up to 5,400 MB/day.

Ethereum prioritizes scarce block space, while Celestia is built on abundant block space. The network has a block time of 15 seconds, a block size of 8 MB, and currently supports up to 46,080 MB/day. In other words, Celestia is currently using only 0.1% of its data capacity. For a chain created two months ago, I wouldn't consider 0.1% tracking record as a worrying sign of lack of demand.

Costs

The current data utilization rate is 0.1%, and the total cost is significantly low. Celestia generates about 5 TIA or $65 in fees per day. This means that Celestia users are paying 0.024 - 0.24 TIA, or $0.31 to $3.12, for each MB of data published.

Today's costs are low, but what about the future? If Celestia achieves a daily data capacity of 46,080 MB at a TIA price of $13, the network will generate approximately $5.2 million in annual fees. This would be 65 times the data published to Ethereum currently.

If growth continues, users will be forced to participate in bidding wars, so costs will increase as user price tolerance increases. The network can vote to increase the block size from 8 MB, but is limited by the number of light nodes and the maximum size bottleneck of Cosmos SDK.

User demand

So, where will the 65x increase in demand come from?

- High TPS general chain?

- A group of application-specific rollups?

- Game-centric chains?

It's hard to say, but even so, the cost is still negligible relative to current valuations. But just because you can't point out the source of today's demand and explicitly say that this is the reason for Celestia's future growth, doesn't mean it won't happen.

My guess is that game + high TPS rollup will suffice. EIP-4844 seems to not have achieved L2 with transactions lower than a cent, but Celestia has.

IMO, this is a big issue. It's clear that we will see a surge of chains launched by RaaS that utilize Celestia in the coming months. The Celestia team absolutely has a grasp on their integration and marketing. Anyone building a Rollup knows Celestia + can choose to use it.

But from the early situation, most RaaS-built rollups will not provide much for users. So where will the sustainable demand for DA come from?

Fee model

You may have also noticed the differences in fees that users pay to publish data. It is entirely driven by @MantaNetwork, who pays about 10 times more in fees than others!

Celestia uses a simple first-price auction fee mechanism, similar to Ethereum before EIP-1559. This suboptimal design fails to provide users with a simple way to bid for fair inclusion prices, leading to bidding wars and users paying excessively high fees for block space.

Since Celestia is specifically built for DA, there are no competing transaction types or high-value DeFi transactions that would increase the Gas cost of publishing DAs, thus alleviating most concerns about the fee model.

Once the existing data capacity reaches its maximum, more robust mechanisms can be prioritized.

In conclusion, I am excited about what Celestia is doing. They have a strong team, a strong vision, and a strong product. I'm not worried about the current undercharging, but I think they need to emphasize this repeatedly in the future. Integrating other products may make sense.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。