Author: David

On the eve of the results of the Bitcoin spot ETF, the cryptocurrency market experienced a flash crash this week.

After the panic, Ethereum ecosystem tokens such as LDO and ARB rebounded rapidly, and some smaller market cap Ethereum L2s such as Metis even reached higher points, indicating from another perspective the current market's optimism towards the Ethereum ecosystem.

However, as L2s have collectively risen, most projects in liquidity staking only have beta returns. What other narratives can be laid out around the Ethereum ecosystem?

Don't forget another grand but yet to be fully realized catalyst—re-staking and EigenLayer.

Based on the liquidity staking, the concept of re-staking has gradually evolved into a nested version of liquidity staking tokens (LST) called liquidity re-staking tokens (LRT) as capital always seeks efficiency and returns.

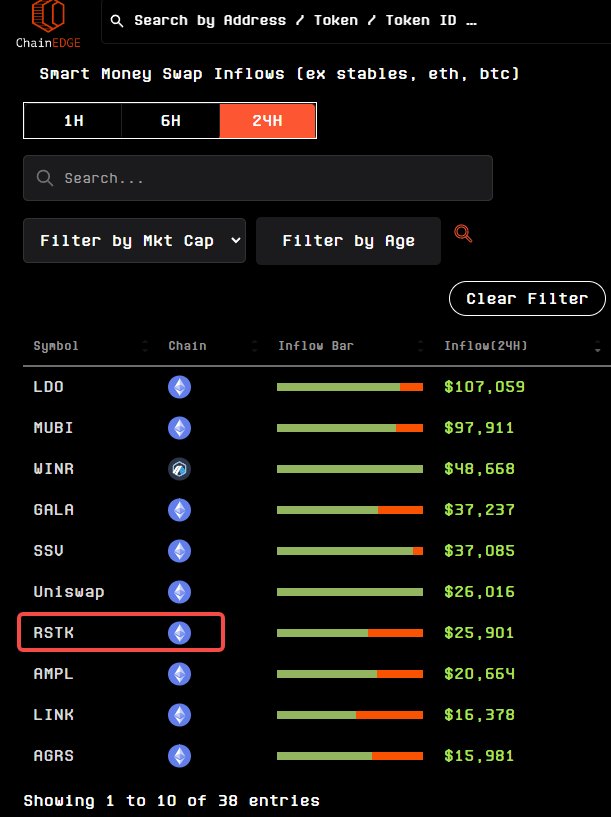

Outside of CEX, some tokens related to the LRT concept have recently seen decent gains.

It sounds somewhat familiar, but not completely understood the logic?

In this issue, we will help everyone quickly understand the logic of re-staking and LRT, and delve into those projects with low market value or unreleased tokens.

Review of Re-Staking and Liquidity Nesting

Re-staking is not a new concept.

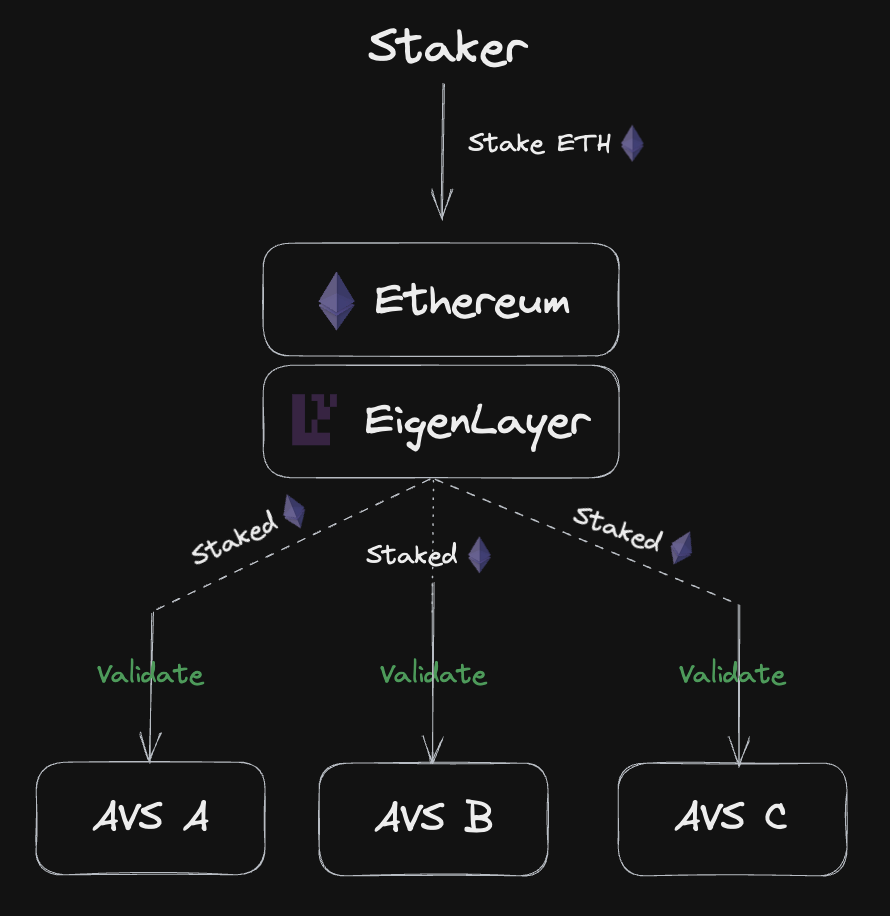

As early as June last year, EigenLayer introduced the concept of "re-staking" on Ethereum. It allows users to re-stake already staked Ethereum or liquidity staking tokens (LST) to provide additional security for various decentralized services on Ethereum and earn additional rewards for themselves.

We will not repeat the technical principles of EigenLayer here and assume that readers have a certain understanding of it.

On the contrary, if you are not concerned about the internal technical details of EigenLayer, it is easier to understand the logic of liquidity staking and re-staking:

In plain terms:

- For Ethereum, staking maintains security, while re-staking maintains even more security;

- And for investors, staking seeks returns, while re-staking seeks even more returns.

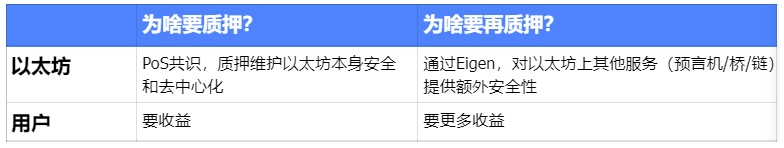

So, from an investment perspective, how is this method of seeking returns specifically implemented? The following figure is a simplified version of understanding:

- I have ETH, which I stake with the LSD service provider, such as Lido;

- I receive LST (liquidity staking tokens), such as stETH;

- I re-stake stETH into EigenLayer;

- I can earn returns from steps 1 and 3.

Obviously, before EigenLayer appeared, the LST in my hands could only obtain one type of return; with EigenLayer, I gained an additional layer of returns, theoretically not at a loss.

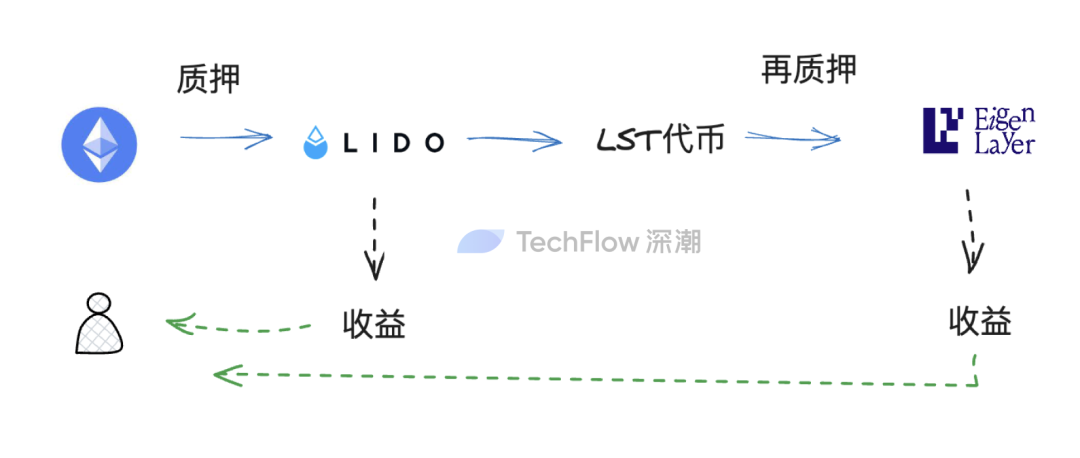

However, in the mature re-staking process above, there is a key issue: liquidity is locked.

Your LST re-staked into EigenLayer also loses the opportunity to earn returns by investing LST elsewhere.

As a re-staking layer, EigenLayer will return you returns based on your staked input, but it does not provide you with the same level of liquidity as holding the coin.

In the cryptocurrency market, which emphasizes capital efficiency, liquidity never sleeps. Speculative orientation actually does not accept the complete locking of token liquidity in one place without the ability to expand.

Therefore, the logic of seeking returns through "staking—re-staking" is not perfect.

To allow tokens to obtain more liquidity and opportunities, liquidity re-staking tokens (LRT) have emerged. In fact, the principle of LRT is very easy to understand, using a very common analogy:

Collateral.

I have ETH, which can be exchanged for LST (stETH) through liquidity staking. At this point, this stETH is actually a collateral, used to prove "I did stake ETH," but my original asset is only ETH itself.

Similarly, if I have LST, I can exchange it for a new collateral through re-staking, used to prove "I did re-stake stETH," but my original asset is still only ETH itself.

Essentially, this new collateral is LRT, namely liquidity re-staking tokens. You can use this new certificate to do more financial operations, such as collateral and borrowing, to address the liquidity lock-in situation in re-staking.

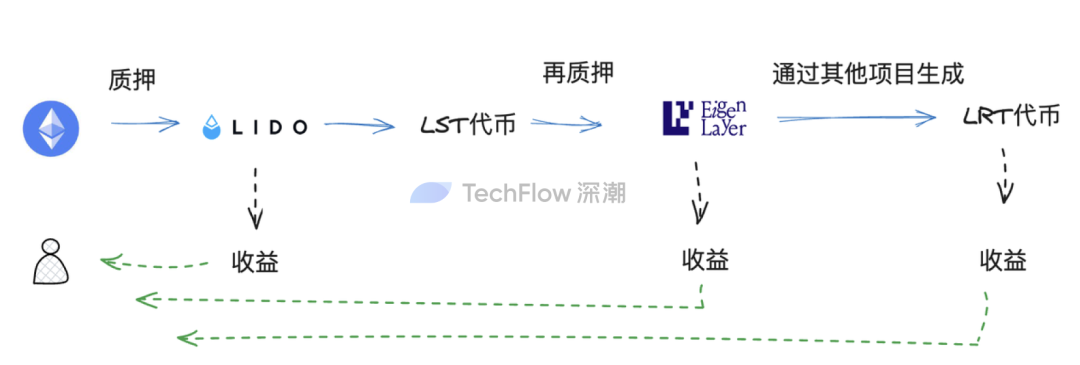

If you still cannot understand the principle, you might as well imagine a set of nested dolls with three layers.

With ETH, you can obtain LST, and with LST, you can obtain LRT. When you have three layers of nested dolls, you can use these three dolls to do different things (staking, re-staking, other income methods). With each layer of nesting, you have an additional opportunity to earn returns through liquidity.

So, as Ethereum receives renewed attention, how to solve the capital efficiency issue in EigenLayer re-staking may evolve into a new narrative for LRT.

Which related projects are worth paying attention to?

Projects related to LRT that attempt to solve the capital efficiency issue have already begun to attract attention in the current market, and some of them have achieved very good price performance.

However, from an investment research perspective, we are not inclined to introduce projects that have already been fully price discovered, such as SSV, etc. Therefore, in the next attempt to find projects, we are more inclined to the following two categories:

- Projects with tokens and low market value

- Projects without tokens

Low Market Value Projects with Tokens

SSV Network ($SSV): Seamless Re-employment of Liquidity Staking Projects

Previous liquidity staking projects that could do staking business could also do re-staking business, which is a kind of professional and seamless re-employment.

This logic is very evident in SSV.

On January 4th, SSV announced on Twitter that it has begun to enter the re-staking business, allowing the responsibilities of EigenLayer's validators to be decentralized to SSV, using SSV's distributed and non-custodial features to enhance the performance and security of its validators. This process not only increases the flexibility and distribution of validator operations, but also improves fault tolerance and performance, ultimately bringing users more returns and higher security.

At the same time, users can also earn additional rewards on top of their staked ETH assets.

It is worth mentioning that SSV's re-staking nodes are highly distributed, and it is currently possible to collaborate with 4 nodes including ANKR/Forbole/Dragon Stake/Shard Labs for re-staking services.

However, the SSV token has not shown significant gains in the past week. Considering that it is well-known in the liquidity staking track and re-staking is a professional niche, with a market value of around 3 billion, it is not particularly high, and there is still potential for performance in the re-staking narrative.

Restake Finance ($RSTK): The first modular liquidity re-staking protocol on EigenLayer

From the name of the project, it is clear that Restake Finance focuses on conducting re-staking related business on EigenLayer.

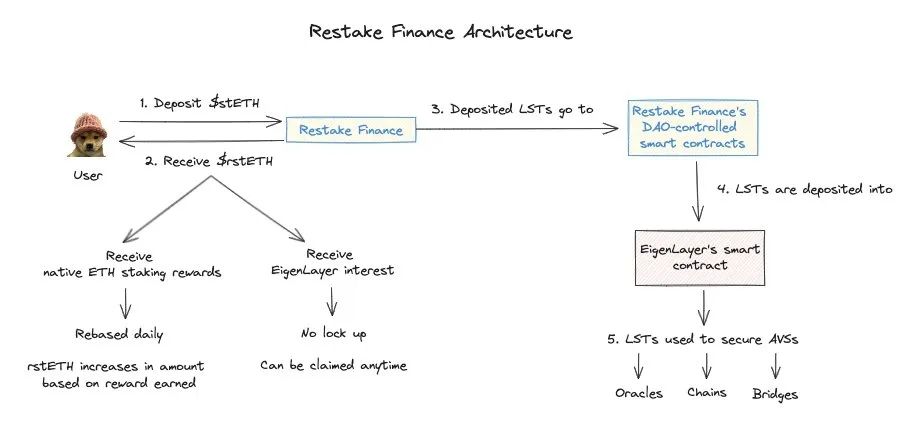

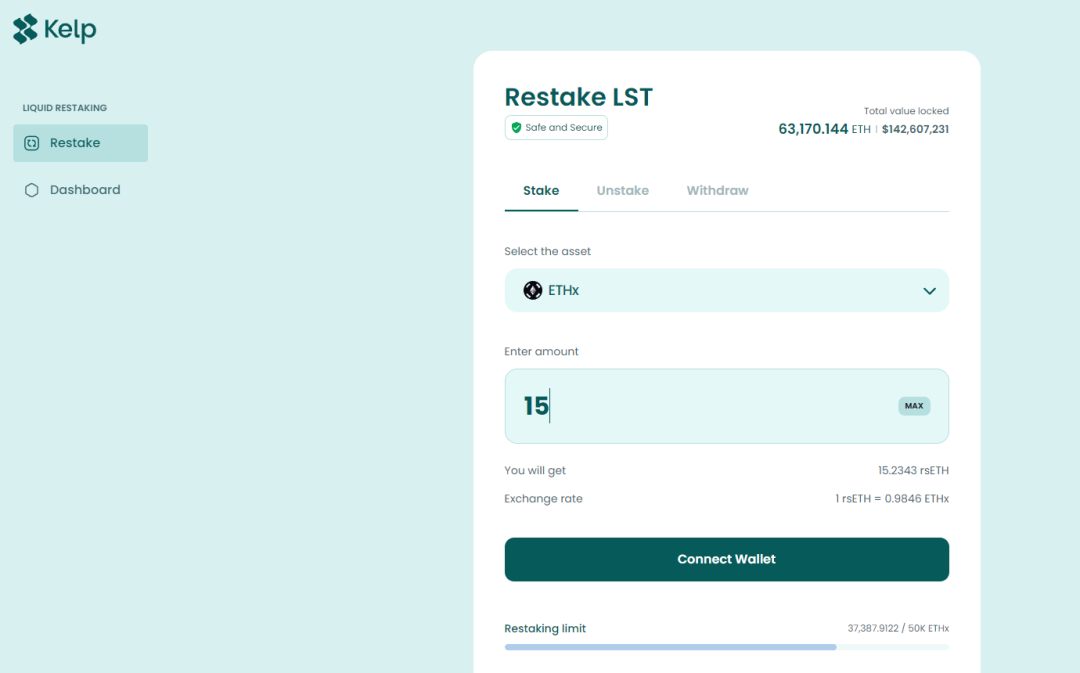

With an understanding of the operational logic of LRT mentioned earlier, the business of Restake Finance becomes very understandable:

- Users deposit LST generated from liquidity staking into Restake Finance;

- The project helps users deposit their LST into EigenLayer and allows users to generate reaked ETH (rstETH) as a re-staking certificate;

- Users can then use rstETH to earn returns in various DeFi platforms, while also receiving points from EigenLayer rewards (considering EigenLayer has not yet issued tokens).

Image source: Twitter user @jinglingcookies

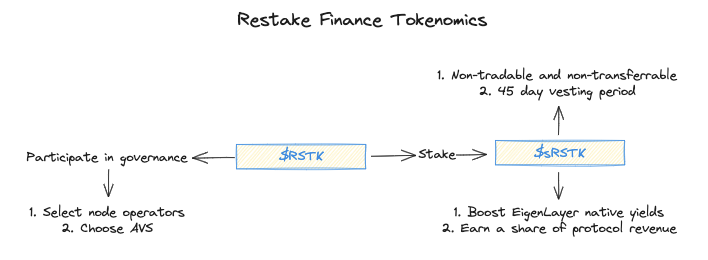

At the same time, the project's native token is called RSTK, built on Ethereum, and it has governance, staking, and income-increasing functions:

Governance:

- $RSTK holders may participate in the selection process of node operators and AVSs, which is equivalent to participating in the security guarantee of Ethereum-related components.

Income-increasing:

- $RSTK can be staked to increase the returns generated by EigenLayer. 5% of the accumulated re-staking rewards from the Restake Finance platform will be distributed to stakers, while also earning a share of the protocol's own income.

- Staking $RSTK will yield $sRSTK, which is used to track the user's governance and income-sharing rights and cannot be traded or transferred. If users want to redeem their $RSTK, there is a 45-day unlocking period.

- Acting as a successful agent for EigenLayer: $RSTK is designed to be a successful agent for EigenLayer. With more AVSs joining, wider adoption of EigenLayer, and higher returns and more protocol income, the value of $RSTK will increase.

Image source: Twitter user @jinglingcookies

Overall, the design of the token's functions is not particularly innovative, but it mainly revolves around staking to earn additional returns.

However, in terms of token performance, RSTK has recently had its moment in the spotlight.

From the opening on December 20th, RSTK has risen by nearly 20 times as of the time of writing; however, its market value is only around 38 million USD, and according to my observation, there has been smart money buying varying amounts of RSTK every day in the past week.

So, is RSTK undervalued?

Considering that SSV Network has also started re-staking related business and its current market value is 330 million USD. If re-staking business becomes a mainstream choice for mature liquidity staking projects, this probably means that RSTK has about 10 times the potential market value compared to mature projects. If compared directly with LDO, the potential is even greater, but considering LDO's leading position and the significant advantage of focusing on LSD's main business, such a comparison is not practical.

Therefore, I believe that in the long run, there are not many new projects with tokens that can be bet on in the current LRT narrative. The seamless re-employment of LSD projects at most accounts for beta returns, and projects like RSTK, which have been doing re-staking from the beginning, are more worthy of attention.

However, in the short term, with the uncertainty of the Bitcoin ETF, the possibility of extreme market changes increases. From an investment research perspective, it would be better to wait for the dust to settle and look for a stable entry point.

Stader Labs X KelpDAO ($SD): Supporting new organizations in re-staking

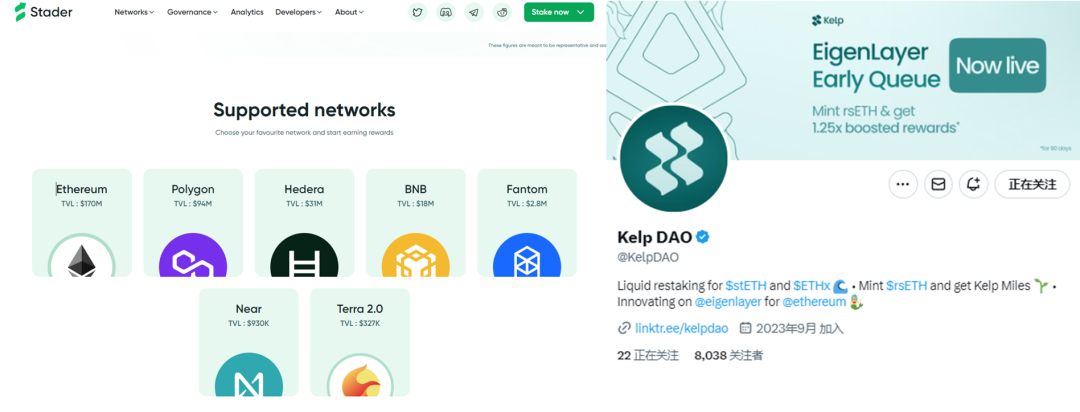

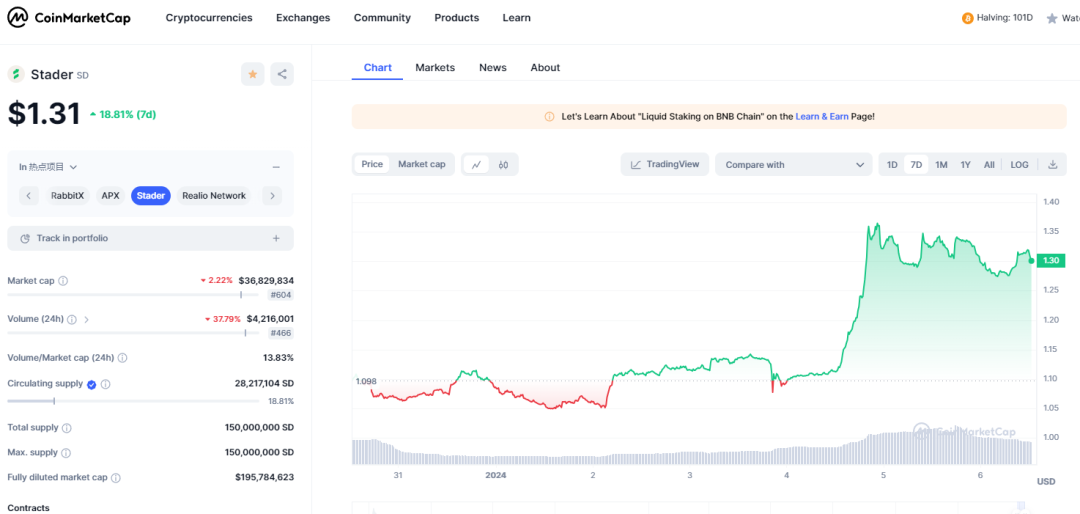

Stader Labs is not a newcomer, having already made a name for itself in the liquidity staking narrative brought about by the Shanghai upgrade last year. However, Stader's feature is its support for multi-chain staking, as seen on its official website, it supports staking on multiple L1 and L2 chains, not just Ethereum.

This multi-faceted approach also makes it very smooth to conduct LRT re-staking business.

Stader also supports an organization called Kelp DAO, which focuses on liquidity re-staking. The business model is similar to Restake Finance:

Depositing LST such as stETH into the Kelp protocol can yield rsETH tokens, which can then be used to conduct operations to earn returns. Additionally, due to its linkage with EigenLayer, it means that users can earn EigenLayer points from re-staking and use LRT for income, while also enjoying the income from LST.

As Kelp DAO currently does not have a token, the token associated with Stader Labs, SD, can be an object of interest.

SD has seen an increase of around 20% in the past week, with a market value close to RSTK, both in the range of around 35 million.

But unlike RSTK, SD is an old coin with new speculation, experiencing new performance after the re-staking narrative. Considering that Kelp DAO is only doing direct business without issuing a token, it may be possible to expect the synergistic effect of SD tokens and Kelp token issuance in the future, such as airdrops.

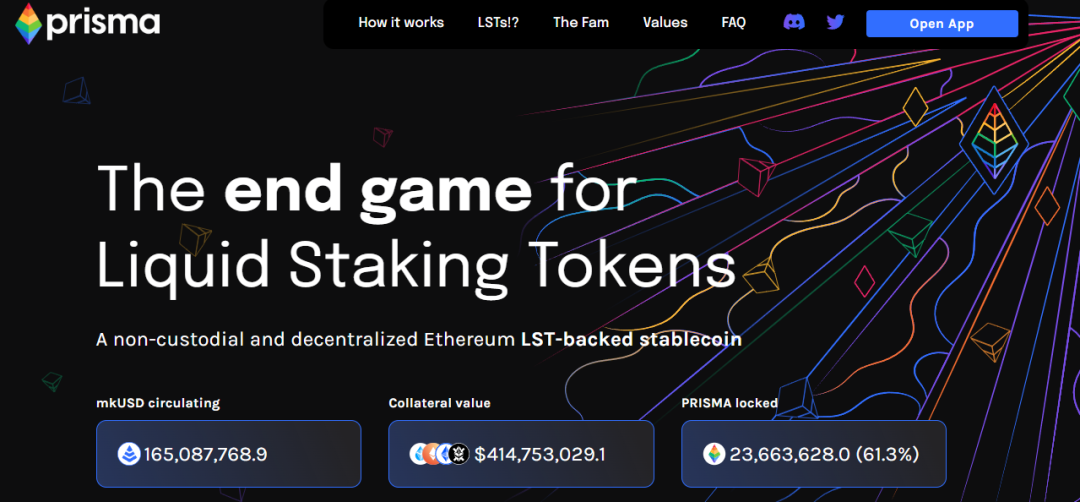

Prisma ($PRISMA): Not entirely related to LRT, another choice for LSDFi

The above two tokenized projects are directly focused on liberating liquidity on EigenLayer, but in reality, there is more than one way to liberate token liquidity.

There is still another approach in the market, which is not directly linked to EigenLayer, but generates income by releasing liquidity through its own resources. The representative project is Prisma.

Strictly speaking, this project is not LRT, but more like LSDFi.

Prisma entered the public eye about six months ago, and what caught attention at the time was its overly luxurious investment and endorsement lineup:

The project received endorsements from the founders of multiple projects such as Curve Finance, Convex Finance, Swell Network, and CoingeckoFinance, as well as participation from well-known project parties such as Frax Finance, Conic Finance, Tetranode, OK Venture, Llama Airforce, GBV, Agnostic Fund, Ankr Founders, MCEG, and Eric Chen.

Although the amount of funding has not been disclosed, it can be said that it has covered almost all top DeFi projects.

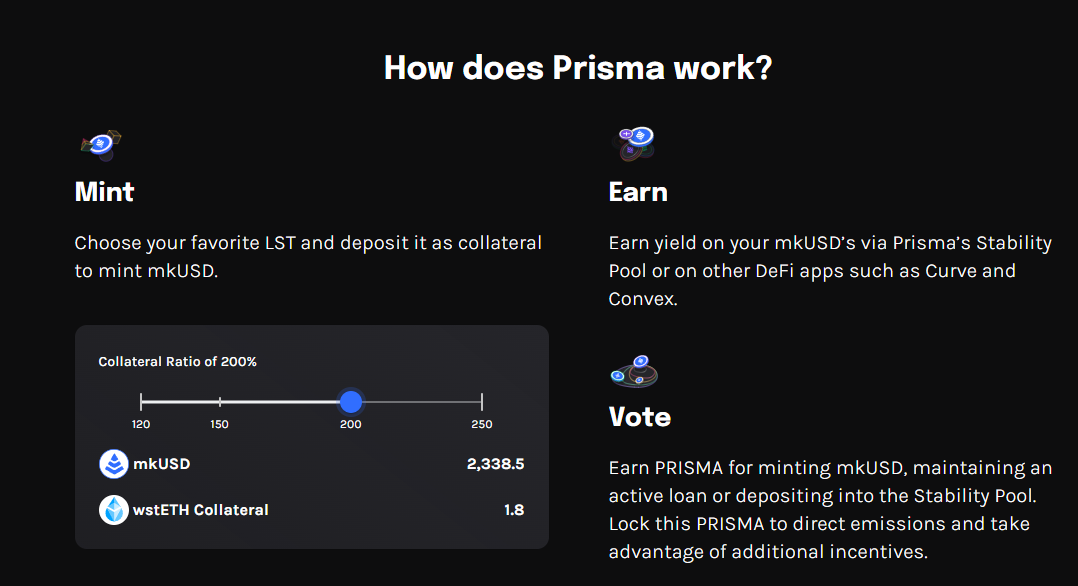

The way Prisma releases LST liquidity is as follows:

- Deposit LST into the Prisma protocol

- Mint a stablecoin called mkUSD

- Generate income through staking, mining, and borrowing behaviors in different DeFi protocols using mkUSD, thereby releasing the liquidity of LST

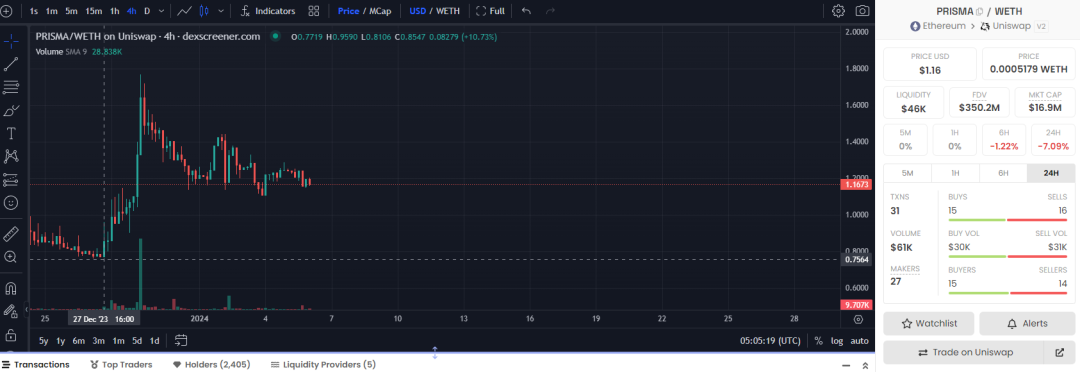

In terms of tokens, PRISMA has experienced fluctuations in the past month, with fluctuations of more than 100% between the high and low points, and the price is very unstable, but it has also seen good gains in the past week.

On the other hand, the token has a market value of only around 17 million, making it extremely susceptible to news-related impacts leading to rapid increases or declines.

Considering the luxurious endorsement lineup, why is the current market value of the project so low? The LSDFi narrative is somewhat attractive, but this does not necessarily mean that the project is undervalued. Instead, the following points need to be considered:

- The circulating market value of PRISMA does not take into account locked tokens, with approximately 22 million PRISMA not being calculated;

- Locked tokens can be withdrawn and dumped on the market at any time, which may affect the price;

- According to a tip from Twitter user @lurkaroundfind, Sun Ge owns 1/3 to 1/2 of the total PRISMA TVL, which is also an unstable factor.

However, instability + small market value actually implies a certain opportunity for action.

Overall, PRISMA has a very small market value, but with a luxurious endorsement and tapping into the LSDFi narrative, there is not a particularly large migration cost to shift to LRT in the future, and it cannot be ruled out that there may be some activity leveraging the narrative.

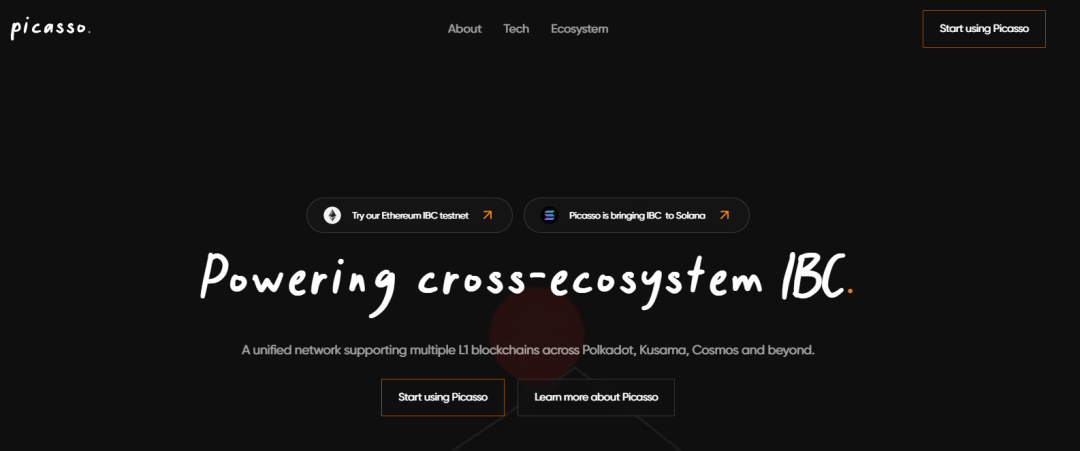

Picca Network ($PICA): Heading towards Solana's liquidity re-staking

If you feel that the projects in the liquidity re-staking narrative around Ethereum are too crowded, a feasible Plan B is to find targets with the same narrative in the popular Solana ecosystem.

One such target that meets this search criteria is Picasso Network.

The project itself aims to support multiple L1s, mainly facilitating cross-ecosystem blockchain communication between ecosystems such as Polkadot, Kusama, and Cosmos (IBC), and expanding to other networks such as Ethereum and Solana.

However, the project is currently targeting the blank space in the Solana ecosystem's liquidity re-staking track, attempting to achieve re-staking in the Solana ecosystem through IBC capabilities.

In specific execution, Picasso is launching a Restaking Vault plan, and aside from technical details, you can roughly understand Picasso as an EigenLayer on Solana. The implementation method is roughly as follows:

- Through Picasso's Solana>IBC connection, it provides a validator for Solana;

- Users can re-stake LST tokens such as mSOL/jSOL/Orca LP/bSOL from Solana liquidity staking projects (such as Marinade/Jito/Orca/Blaze) to the validator;

- While ensuring network security, earn re-staking income.

A potential opportunity is that Solana's liquidity staking rate is lower than ETH, with data showing that there is still approximately 8% of SOL that has not been staked. This is favorable for both liquidity staking and re-staking.

Given that Solana's liquidity staking projects have previously experienced a general rise, if the re-staking narrative on Ethereum gains momentum, market funds may also overflow into the same narrative on Solana once again.

In terms of tokens, Picasso has seen an increase of nearly double in the past week, with a market value of around 100 million USD. This market value is relatively high compared to the aforementioned liquidity re-staking projects on Ethereum. However, considering its IBC characteristics and the fact that its main business is not only liquidity re-staking, its market value cannot be directly compared to similar projects on Ethereum.

Considering that the Solana ecosystem did not perform impressively in the past week in relation to Ethereum-related projects, Picasso can be considered as an alternative in an investment portfolio, and operations can be carried out after observing the flow of funds to Solana.

Potential Projects without Tokens

In addition to the above-mentioned projects, there are also some projects in the LRT track that currently do not have tokens but are actively involved in re-staking.

Due to space constraints, only a simple list and description will be provided here. Interested readers can explore more information on the projects' social media and official websites.

Puffer Finance: Lowering the Validator Threshold through Native Re-staking

EigenLayer imposes a requirement of 32 ETH for nodes to run AVS. Puffer's re-staking function aims to lower this threshold to below 2 ETH, in an attempt to attract small nodes.

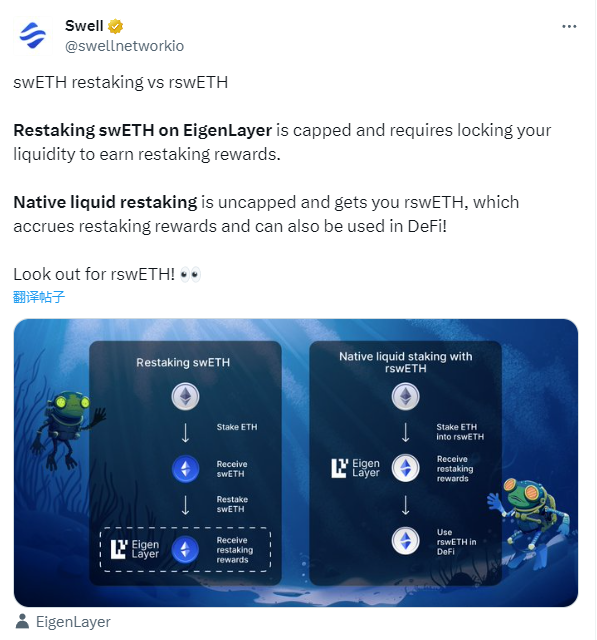

Swell: Re-staking Liquidity for Point Airdrops

Swell previously conducted liquidity staking on Ethereum and recently announced a re-staking function, allowing users to deposit ETH and exchange it for rswETH. Considering that Swell has not issued tokens, participating in re-staking can also increase the opportunity for earning points.

ether.fi: Providing a Seamless Re-staking Experience

This project is functionally similar to Swell and Puffer, and the total staked TVL has now reached around 120 million USD.

In addition to the above, there are still some projects not listed due to space limitations. However, if the LRT narrative becomes popular enough, these projects are likely to actively market themselves to attract users for re-staking, and it's only a matter of time before they are discovered.

Conclusion

Finally, during the research process, the author also pondered whether liquidity re-staking represents progress.

From the perspective of Ethereum, it does indeed further ensure the security of different projects through EigenLayer.

But from a practical benefit perspective, it seems more like a speculative leverage created for liquidity. Leverage means that although there is only one original asset, through token mapping and locking of rights, multiple derivative certificates can be created by continuously leveraging the original ETH.

On the positive side, these derivative certificates greatly activate liquidity in favorable conditions, and are more conducive to market speculation.

But on the negative side, various protocols issuing derivative certificates are interconnected due to liquidity, where holding A can borrow B, and borrowing B can activate C. Once a protocol itself encounters problems (hacking or self-harm) and has a large volume, the resulting risks are interconnected.

Leveraging in favorable conditions, dispersing in adverse conditions.

Ethereum has opened up a broad area, and EigenLayer is like building a racetrack on this open ground. For liquidity hungry for profits and willing to take risks, there is no better reason to run on the racetrack.

Liquidity never sleeps, pleasing liquidity is the eternal narrative theme of the crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。