撰文:Pzai,Foresight News

5 月 14 日,MetaMask 联合创始人 Dan Finlay 在播客中表示钱包团队仍在考虑为钱包推出原生代币。虽然目前似乎没有明确计划,但 Finlay 指出,在更宽松的特朗普政府监管体系下「有更多种类的代币发行是安全的」。

早在 2021 年,MetaMask 工程师 Erik Marks 便提出了代币发行的想法,而 ConsenSys CEO Joseph Lubin 在那年也发推文暗示代币引发市场关注。但现在,市场更加关注 ConsenSys 旗下 Layer 2 产品 Linea 的 TGE 进程。在 3 月 8 日,Linea 宣布不会在 2025 年一季度发币,引发社区对 TGE 进度的质疑。在这样的舆论环境下,ConsenSys 是否又将另辟蹊径,为广大钱包用户来个出其不意?

钱包大战下,发币为差异化竞争?

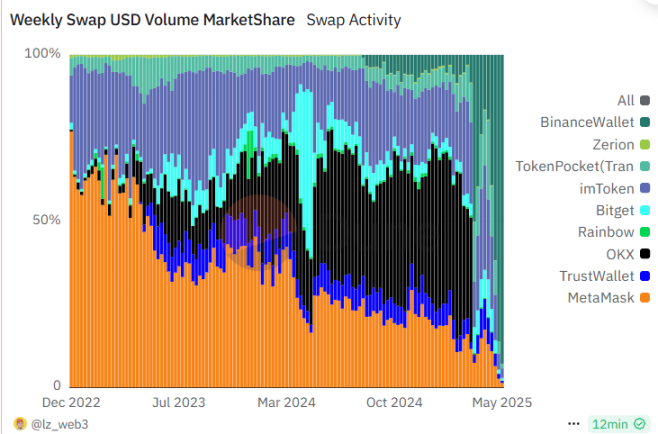

作为以太坊生态的头部钱包,尽管发币一再推迟,但 MetaMask 以其 300 万月活用户的庞大规模,使得代币空投预期始终是社区关注的焦点。而从交易数据上看,现今 Metamask Swap 的交易流量相对较小,长时间内单日交易额不足 1 亿美元,且远低于 Solana 链上平台交易量。而在市场流动性趋势大幅偏向 Solana 链的当下,Metamask 正在逐渐在交易市场中失去占比,从 2022 年底的 77% 到现今的不足 3 %。尽管 Metamask 通过 Snap 等工具积极对接开发者进行 Solana 等外链钱包的引入,但仍不敌各交易所钱包在交易产品上的迅猛增长。

在现今的市场环境下。MetaMask 可能通过 DAO 治理代币实现去中心化运营,并将代币功能与跨链交互深度绑定乃至手续费返现等,强化其作为多链枢纽的定位。这种「延迟满足」式策略虽略显 PUA,却也让社区持续使用 Swap 功能、参与跨链交易,以期提高空投权重。而随着各大交易所积极扩展钱包产品线和链上流动性的集聚,发币也不失为一次差异化竞争的机遇,以期回收流动性的同时提升用户活跃度。

另外,在市场环境转暖的同时,监管环境的松绑也为发币提供了合规基础。例如美国证券交易委员会(SEC)曾于去年 6 月起诉 ConsenSys,并指控 MetaMask 为未注册证券经纪商,涉嫌非法提供证券要约及交易服务,但随后在 2 月 28 日,SEC 便拟撤销对 ConsenSys 及 MetaMask 的执法诉讼。

Linea 拖延症下,钱包发币预期寥寥?

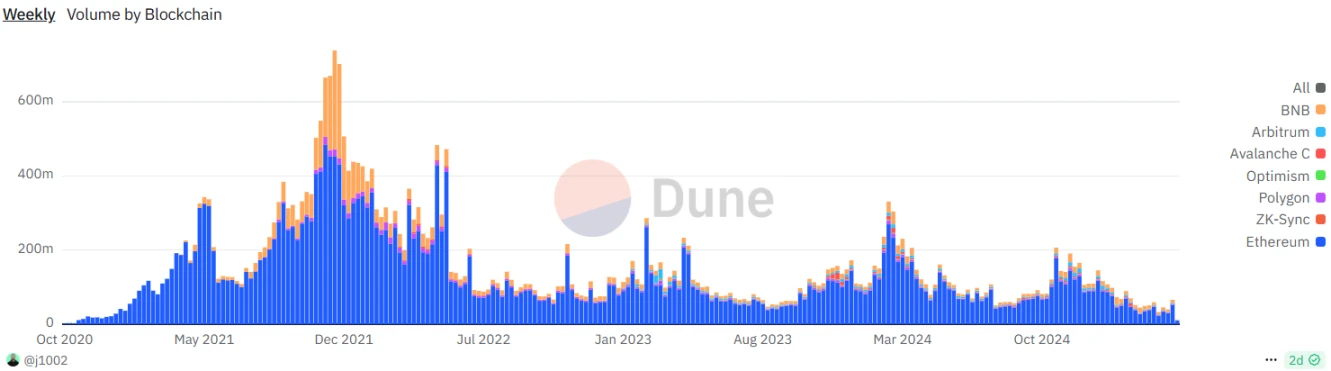

Linea 作为 ConsenSys 旗下的以太坊 Layer2 项目,自 2023 年主网上线便以「背靠 MetaMask」的明星光环吸引用户参与生态任务,并承诺通过 LXP(Linea Experience Points)积分体系向早期支持者空投代币。然而,原定于 2025 年第一季度的代币生成事件(TGE)被推迟至第二季度,官方给出的理由包括「代币经济学需完善」「法律流程复杂」等,但社区普遍认为这些说辞缺乏实质证据,质疑其本质是「无限拖延」的借口。且由于同期其他 Layer2(如 Starknet、zkSync)已成功发币,Linea 的进度落后导致用户资金被锁定在生态中,机会成本激增。

从数据面上,Linea 链上的资产正在不断流失至其他生态中,跨链资产规模已不足 3 亿美元。而 Linea 产品负责人 Declan Fox 表示,将在市场由熊转牛之后 TGE。在现有的市场趋势下,作为盘前交易的 FDV 稳定在 20-30 亿美元左右的公链项目,我们可以先行期待 Linea 的 TGE。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。