原文来源:0xTodd

最近我存了一些钱在 Uniswap V4,所以认真地研究了一下 Uni 的钩子。很多人其实私下里跟我说过,说 Uni 推出 V4 后没有感受到 V3 上线时那种惊艳感。主要是「钩子」本身这个概念就过于抽象,要直接背锅。

Hook 与其被直译为钩子,个人愚见,还不如意译为插件。钩子本身就是给池子增加一些超越 Uni 本身的功能。它的文档里连篇累牍地强调了在什么时间可以调用钩子,其实大多数人并不关心,还不如说一下钩子到底能干什么。

【钩子的用途举例】

--比如说,它可以让你建的池子,例如 ETH-USDT 仅限某些特定地址才能使用;

--又或者,它可以让你的池子在繁忙时多收手续费,在空闲时少收手续费;

--再或者,它甚至可以让你的池子可以不用 X*Y=K 这个曲线(PS :估计当时被 Curve 刺激到了)。

总而言之,你可以自由开发各种各样的你需要,而 Uni 官方可能永远不会推出的功能。

有点像 Steam 上的创意工坊,都是官方不再做了,让其他人自由创造的感觉。

还有一个变化是,过去 Uni 上盈利的生态位就两个,LP 和交易者,而且两者是互相掏对方兜儿。V4 之后有钩子了,其实是让一些脚本小子也有盈利位了。

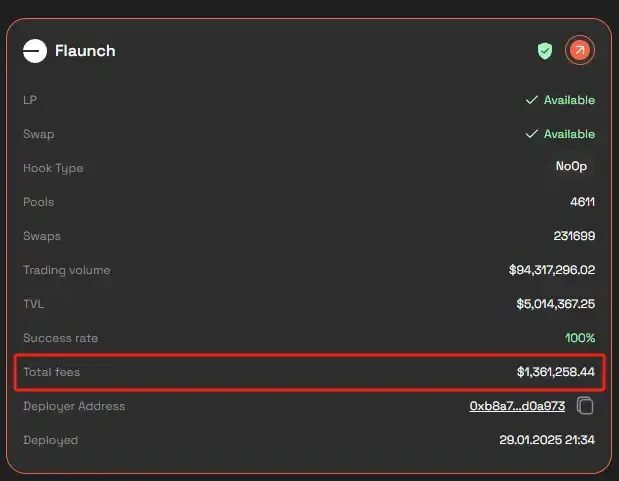

你写一个钩子,别人建池子的时候可以付费使用你的钩子(卖.. 钩.. 子?)。每个池子可以用 1 个钩子插件,但是 1 套钩子插件可以给无数个池子订阅,边际成本相当低。有个网站叫 Hook Rank 里面收录了几百个钩子,能看到各种钩子赚到了多少钱。目前大家最常用的一个钩子之一 Flaunch,我看开发者已经赚到了 100 多万美金了。

它是干嘛的呢?用它的钩子,可以让你在给 meme 币创建池子的时候,把这个池子的手续费任意比例,例如 80% 指向给自己的钱包,然后 20% 用于回购。

幸好川普儿子发 $Trump 的时候不知道有这个功能,不然他还不把所有费用都指向未来世界金融?

另外,俗话说,只有竞争对手最懂你,后面 Pancake 也果断引入了钩子,只不过不叫 V4 而是称之为 Pancake infinity,当然这是另外一个故事了有空再聊。总而言之,钩子还是挺有意思的一个东西,足以冠之以 V4 之名。

再转发一例钩子的实际用例。

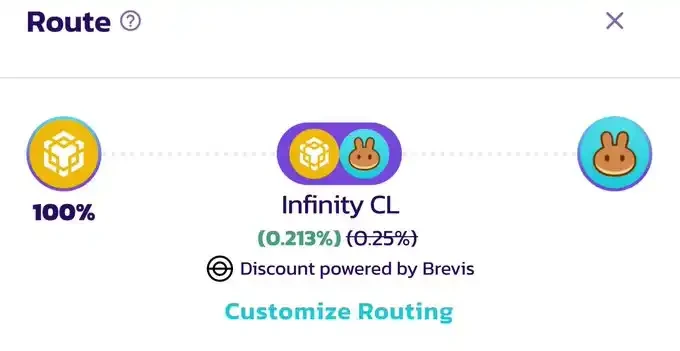

自从 Pancake 也推出 Infinity(也就是 V4 ) 之后,BSC 链的钩子也开始发展了。比如 Brevis 这个钩子居然在链上做出了 VIP 账户的效果:长期拿 $CAKE 的人,交易 CAKE-BNB 这个带这个钩子的池子时,手续费就比别人低;再比如说成交量的比较高的链上大户,手续费也能别被人更低。

推测这个钩子是在交易前做一次触发,让特殊的账户对应特殊的费率。它成功把这套再熟悉不过的业务,在不改变 Pancake 底层的前提下,以第三方智能合约就做出来了,确实挺有想法的。

另外,考虑到每个池子通常只能带一个钩子,所以这个池子很有可能未来变成 Pancake 的钦点池之一。

Brevis 本行是做 ZK 的,是 YZI Labs 的 Portfolio。之前讲过做 ZK 属于目前行业难度最高的一档,现在亲自下场去做一个钩子,自然不是难事。

而且如果后面能和 Pancake 强绑, 推出各种各样的钩子功能,没准以后 Pancake 作为一个 DEX,能比币安的主站的交易功能还多。而推各种钩子的 Brevis 成为 Pancake Infinity 时代的一号功臣。

期待钩子新时代。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。