2023 Ethereum Ecosystem Year-End Review

Author: Day | Plain Language Blockchain / Source

Accompanied by the new bull market, the Bitcoin narrative has become the main theme, and the Ethereum ecosystem, which has been bullish during the bear market, has gradually weakened. In addition, with the strong emergence of Solana, the cryptocurrency industry seems to have ushered in the beginning of 2024 with the narrative of "the rise of new public chains."

Although the price of Ethereum doubled in the past year, it has still been criticized by many people, and there have even been concerns about significant issues in Vitalik's decision-making. The main reason for this phenomenon is that people's expectations for ETH are too high (at least to outperform Bitcoin). Additionally, it is also related to the overly impressive performance of SOL. Today, let's take stock of the new changes in the Ethereum ecosystem over the past year. (FUD: Fear, Uncertainty, Doubt, refers to the negative sentiments spread by people that cause panic among investors.)

01

Ethereum Enters Deflation Completely

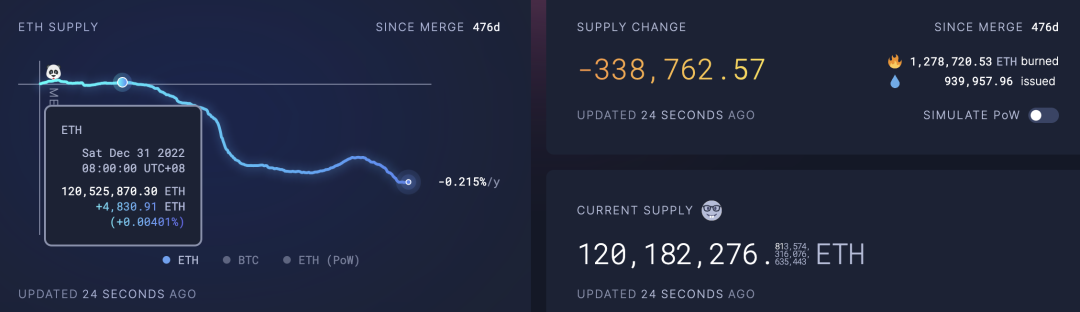

Since the beginning of the year, the number of Ethereum has decreased from 120.5 million to the current 120.1 million, with a total of 340,000 tokens destroyed, worth $750 million. With the arrival of the bull market, the amount of destruction is bound to increase significantly.

Changes in Ethereum's total supply, source: ultrasound.money

02

LSD Track Explosion

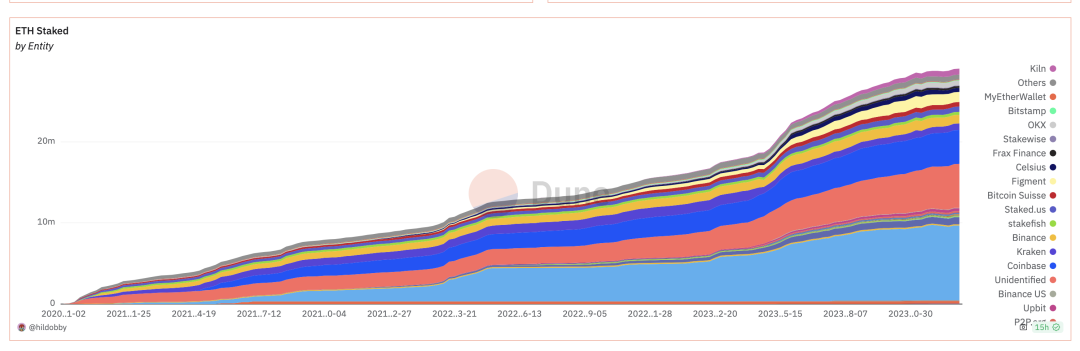

Since Ethereum completed the merge in September 2022, it has become a hot spot in the first quarter of 2023. As the bear market came to an end, the stable annualized return of around 4% attracted a large amount of funds to participate. Projects such as Lido, RPL, SSV, and other LSD projects experienced a wave of explosive growth, and the Ethereum staking rate continued to rise. As of January 3, 2023, the staking amount reached 28.8 million tokens.

Changes in Ethereum staking amount, source: dune.com

With the continuous expansion of staking funds and the upcoming Shanghai upgrade, a small number of project parties began to target this part of the funds and launched their own DeFi products. Through layer-by-layer nesting, they increased the utilization rate of staking funds. After the wealth effect appeared, more institutions and funds began to enter and lay out related tracks, thereby giving rise to the development of LSDFi-related tracks and gradually improving the related infrastructure of LSD.

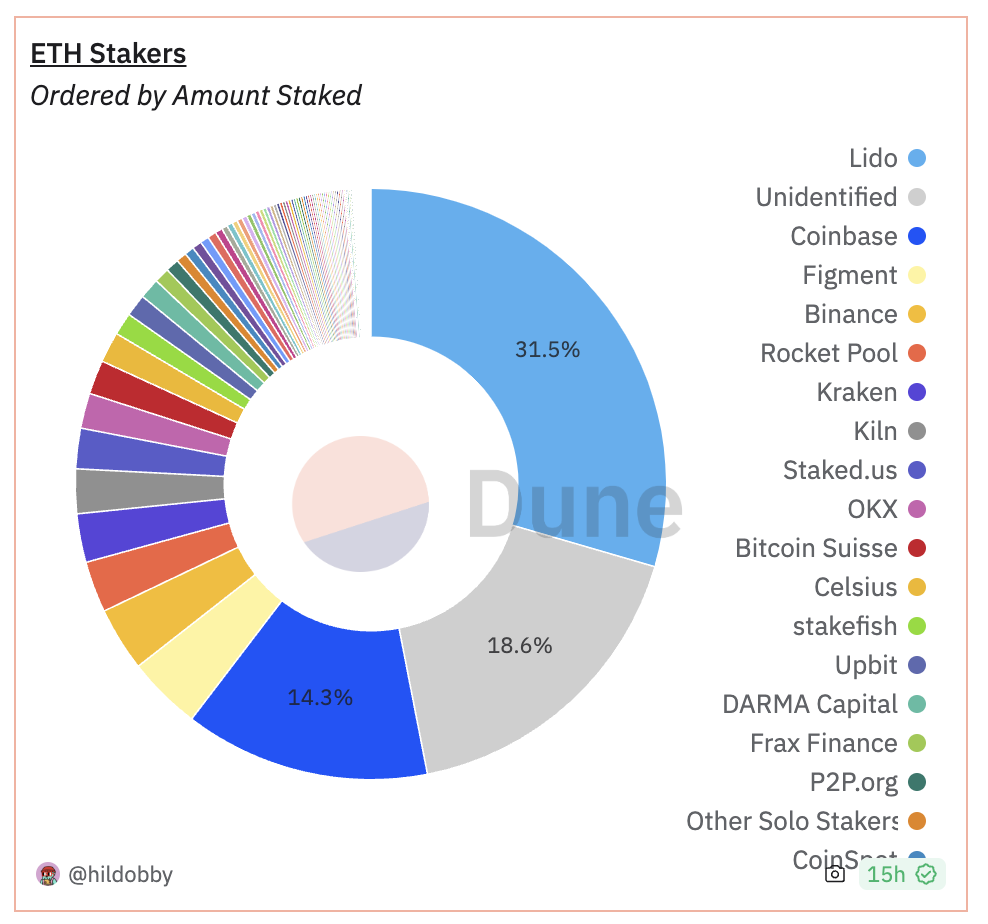

Where there is a positive aspect, there are also dissatisfactory aspects. With the increase in staking rate, Lido's share of the Ethereum staking market will exceed one-third, and the staking track is too centralized. The market has begun to worry about whether Lido's growth threatens the consensus security of the Ethereum mainnet. There are various opinions on whether Lido's centralization poses a threat.

On December 28, Vitalik mentioned the Distributed Validator Technology (DVT) from the perspective of solving related problems from the centralization of staking to the decentralization of validation. On November 28, 2023, Lido DAO had already begun to adopt DVT technology provided by Obol Network and SSV Network.

Market share of various staking track projects, source: dune.com

With the arrival of the bull market, coupled with the rise of Ethereum, the Ethereum staking track has become an almost certain market size of hundreds of billions of dollars. With the development of the industry, stable finance will gradually become a necessity for some people. The development and innovation of related tracks are worth looking forward to.

03

Layer2 Blossoms

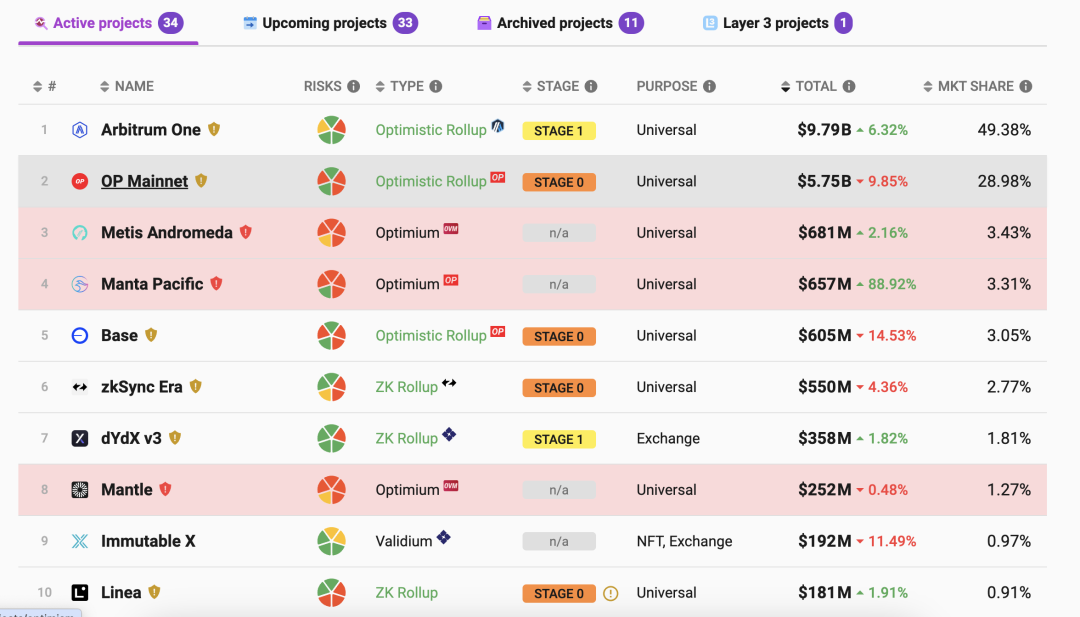

Layer2 has become an important part of Ethereum's ecosystem. Each Layer2 has made different progress in various aspects. Let's briefly review each chain's characteristics.

Layer2 TVL top ten rankings, source: L2 Beat

Optimism

With the establishment of the bear market bottom in 2022, Optimism's price experienced a wave of growth at the beginning of 2023. Although its ecosystem is clearly weaker than Arbitrum in various aspects, the project has found a different path, relying on modularization and one-click chain issuance technology OP Stack, and has cooperated with multiple projects, including BASE, opBNB, Manta Network, DeBank, and many other well-known projects that have chosen to use OP Stack technology. Recently, due to the confirmation of the specific time for the Cancun upgrade, Layer2 such as Optimism has once again attracted attention.

Arbitrum

In the first quarter of last year, with the issuance of Arbitrum's token, the Arbitrum ecosystem experienced a major outbreak, even being called "Arbitrum Summer." Representative projects include GMX, MAGIC, RDNT, GNS, AIDOGE, and others, most of which have been launched on BN.

However, "institutional tokens" like Optimism and Arbitrum have the same problem, which is high market value and low circulation. Over the past year, watching the circulation market value of these two Layer2 chains skyrocket, but the token price remains stagnant, they have become a complete "ATM" for institutions. The projects are generally good, but they only benefit institutional investors.

zkSync & StarkNet

zkSync and StarkNet can be said to be the "PUA" (pick-up artist) duo in the industry, making a fortune from transaction fees, completely countering the "sheep party." Especially StarkNet, the project has been engaging in various controversial operations, causing a rift between the community and the project party. The sheep party is itching with hatred, while zkSync continues to push forward, and there are even rumors of a token launch in 2025. However, the progress of ZK is generally slow, and there is nothing noteworthy to mention in 2023.

Base

Base attracted a considerable amount of funds in the short term due to the wealth effect of its ecosystem, rising with several waves of traffic. However, most of the ecosystem projects did not last long. In early August, as the mainnet of Base was about to go live, the meme token Bald, with a market value exceeding $100 million in just two days, caused a huge wealth effect, attracting FOMO users to enter. Unfortunately, the project eventually rug pulled, but the funds that entered were left behind.

Shortly thereafter, the social track project Friend Tech, with the Ponzi scheme gameplay and the backing of Paradigm, became one of the few phenomenal products in the bear market, bringing tens of thousands of users to the Base chain, solidifying Base's position in Layer2. However, Friend Tech is currently in a cold state.

Blast

Launched on November 21, relying on its own traffic and the Ponzi scheme of Airdrop expectations, despite the issue of centralized wallet management, it still managed to surpass $1 billion in TVL in about two months after its launch, becoming another stable financial destination for large capital users in the industry.

Manta Pacific

In less than three weeks, TVL surged from $30 million to $650 million, using the same financial method as Blast, attracting funds to stake for Airdrops through the New Paradigm activity. The selling point is a shorter staking period compared to Blast, with a high fund utilization rate.

Metis

With the Cancun upgrade approaching, Metis has risen unexpectedly in the market in the short term, and TVL has also risen to the top three in a short period. Due to the problem of excessive centralization of Sequencers in most Layer2 chains, Metis is doing exactly what is needed to decentralize the Sequencer solution. Whether it is driven by technology or capital is a matter of opinion.

ZKFair

By using Gas fee Airdrop to distribute 100% of the tokens to all community users, it short-term attracted user participation. After the Gas fee Airdrop activity started, in less than a week, the on-chain gas consumption exceeded 60 million USDC, the number of active addresses exceeded 200,000, and the TVL exceeded 1.2 billion. The recent activity has declined somewhat after ending, emphasizing fair distribution. It can be said to be very conscientious for users who have been continuously "PUA" by zkSync and StarkNet. As for the subsequent development, it is worth continuous attention.

It can be seen that the development of Layer2 is each using its own advantages. With the improvement of the market, the speed of rise is getting faster and more straightforward. Many no longer need to accumulate slowly over several months or even years, but occupy the market through a series of stimuli and short-term outbreaks. Whether it can continue in the long term remains to be seen.

04

Dex Bot Emergence

It can be said that before the BRC20 inscription rose, almost 90% of the issuance of native tokens was on Ethereum. There would be dozens to hundreds of new projects generated every day, and some players would watch the on-chain dynamics every day, hoping to achieve higher-than-expected returns. With the increase in players, good tools are like a tiger's wings for investors, and Dex Bot emerged in this environment.

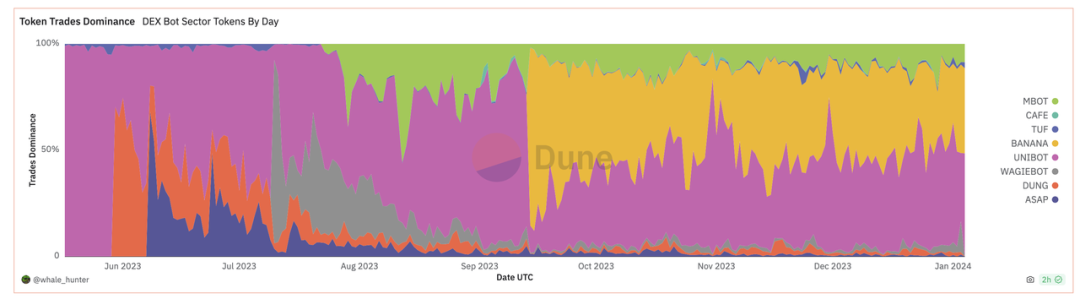

In mid-May, the Unibot project was established and became a phenomenal product in just over two months, making millions of dollars in profits in the bear market environment, causing the entire track and related concepts to be hyped. However, after the launch of Banana Gun in September, its better operational experience compressed Unibot's market share. And recently, due to being overshadowed by Bitcoin and SOL, the on-chain transaction volume on the Ethereum chain has plummeted, naturally reducing the demand for Dex Bot. However, as a new narrative that emerged this year, it is worth continuous attention.

Dex BOT trading market share, source: dune.com

04

Ethereum Inscription & Meme

The emergence of the Ethereum inscription protocol Ethscriptions can be said to be a complete replica of the Bitcoin Ordinals protocol. From the beginning, it has been rejected by many people. The mainstream view is that it is reversing history. However, due to the outbreak of the Bitcoin ecosystem, among other reasons, it has also been brought along.**

Currently, in the entire Ethereum inscription track, apart from ETHs, there are no other prominent presences. Although there have been some minor innovations and the emergence of runes+NFT, most of them are short-term speculation, a FOMO wave, and then nothing. In addition, the hot trend of inscription casting on new public chains is also lively, testing the performance of various public chains. However, most of them are short-term prosperity, and as long as you dare to take over, they are all in a buried state, without exception.** Whether there will be new narratives and new things in the subsequent track remains to be seen.**(Note: FOMO: Fear Of Missing Out)

Meme, as one of the mainstream narratives in the previous round, brought about phenomenal projects such as doge and shib. In this round, the emergence of PEPE further stimulated activity on the Ethereum chain. In mid-2023, users began to FUD institutional tokens, and projects went online just to dump their chips, leaving retail investors always at the bottom.

Meme coins just happen to solve this pain point. Relatively speaking, fair distribution, community-driven, no threshold, anyone can participate, and the subsequent popularity of BRC20 is also related to this. Although many projects have extremely high short-term popularity, once the hype dies down, there is no follow-up. However, it is indeed the closest track for retail investors.

05

Others

Apart from the above, the performance of other tracks is mediocre.

In the DeFi track, RWA represented by Maker has begun to expand outward, but the response is mediocre. The old DeFi represented by Uniswap has begun to expand inward, making some minor innovations in technology and launching a full-chain expansion plan, hoping to further capture more market share.

The blockchain game track is completely extinguished. Although some blockchain games have been launched on other chains, and there is some promotion for full-chain games, there has been no explosive hit that completely ignites the market.

In the NFT track, although Yuga Labs has made some efforts in the gaming aspect, the response is mediocre. Its own NFT has not made much progress in this year. Azuki raised 20,000 Ethereum at the end of June, but the product provided directly copied Red Bean, draining the liquidity of the NFT market, and the Red Bean series also experienced a downturn. Regarding the NFT trading market, OpenSea's valuation has been reduced from the previous tens of billions to 1.4 billion, or even less, with institutions losing more than 90%. Blur is also continuously eating away at OpenSea's market share. Projects on Ethereum have already captured market share, and it can be said that it is currently a fiercely competitive market, making it extremely difficult to achieve results. However, Bitcoin is the opposite and can directly copy Ethereum, completely an undeveloped virgin territory.

06

Conclusion

The above is some of the new innovations I have personally noticed about Ethereum this year. Concepts such as account abstraction and AI, although under construction, have not produced phenomenal products, so they are not listed one by one.

On the other hand, due to Ethereum's recent poor performance, many people have started to FUD, believing that the reason is the significant issues in Vitalik's decision-making at the development level of Ethereum, and the delegation of tax authority will lead to warlords in Layer2, weakening Ethereum's value capture. There are differing opinions on this.

Finally, regarding what to look forward to next for Ethereum: one is the Cancun upgrade, which is favorable for Layer2; the other is the approval of the Ethereum ETF application after the Bitcoin ETF is approved.

In 2024, do you have more confidence in the development of the Bitcoin ecosystem or the Ethereum ecosystem? Welcome to discuss in the comments section.

Source: https://mp.weixin.qq.com/s/5n4rC4s_toDC7NQ2KnEO8g

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。