V2 will become the "liquidity layer" of DeFi across multiple chains and DEX, which means capital efficiency, automated strategies, actual returns, and user-friendly experience across ecosystems.

By: Luccy

On November 14th, SteakHut completed a seed round of financing led by Varys Capital, with participation from Blizzard, Avalaunch, angel investors, BenQi founder Hansen, Camelot founder Ironboots, and GMX founder Coinflipcanada.

SteakHut is a LP dynamic management + liquidity mining platform based on Trader Joe, and its native token STEAK has risen by 70.80% in the past 7 days. According to coingecko data, as of the time of writing, the price of STEAK is $2.13.

In addition, the team announced the launch of the new SteakHut Liquidity V2 on November 21, 2023. This is the first decentralized market-making platform for Web3, which brings unlimited possibilities to SteakHut's products and opens the door to attract more users.

Liquidity management solution based on Trader Joe

SteakHut belongs to the UniV3-Fi track project. Due to the dominance of Uniswap V3 on the ETH mainnet and the relatively closed Uniswap ecosystem, the LP user ecosystem of Uniswap V3 is also relatively closed, with the user profile mainly consisting of institutions, quantitative teams, arbitrage robots, and DeFi Degen, with minimal growth in DeFi retail users.

As a V3 Fi project, this also indirectly limits the user growth of SteakHut. Therefore, from this perspective, the development of SteakHut and the 70% increase in STEAK price in a week are attributed to TraderJoe. According to DefiLlama data, at the time of writing, TraderJoe is the third largest DEX in terms of trading volume on Avalanche.

Due to the fact that SteakHut mainly serves TraderJoe, the success of Trader Joe also means the success of SteakHut. The growth logic of SteakHut mainly comes from TraderJoe V2 adopting the DLAMM (Liquidity Book) mechanism and the increase in share in the Avalanche and Arbitrum ecosystems.

In August of last year, Trade Joe launched the v2 version of "Liquidity Book". Liquidity Book introduces concentrated liquidity into DEX, which is a way of using "price bins" to discretize liquidity and then aggregate it, achieving "discrete concentrated liquidity". By grouping liquidity, the liquidity of asset pairs is arranged in different "discrete bins", each with a specific price, allowing users to provide liquidity for multiple bins at the same time.

The method of building discrete concentrated liquidity on Liquidity Books can be seen in: "6 ways to build discrete concentrated liquidity, how Liquidity Book changes the DeFi landscape on Avalanche"

In simple terms, Trade Joe V2 AMM is similar to an order book, using non-continuous liquidity, with the minimum price precision based on proportion rather than a fixed value, and vertically aggregated liquidity brings better composability, based on LP-acquired trading fees and effective TVL for liquidity incentives.

In Trade Joe V2, liquidity is vertically aggregated through each bin, while in Uniswap V3, liquidity is horizontally aggregated. The main advantage of vertical aggregation is that it allows for liquidity substitution.

Currently, Trade Joe V2 dominates on Avalanche, its influence on Arbitrum is continuously increasing, and it provides much-needed capital efficiency on the BNB chain. As Trade Joe V2 continues to develop, liquidity management will become crucial. This is where SteakHut comes in.

Building the liquidity layer of DeFi

With SteakHut Liquidity, users can deposit tokens into liquidity containers with specific price ranges. This essentially automates the user's liquidity management process to stay in the relevant area, and most importantly, users can earn as much profit as possible, and these profits come from providing LP rather than token emissions.

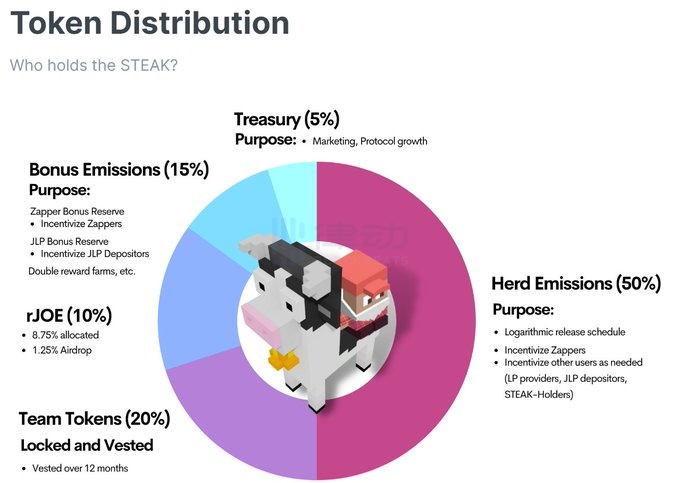

These rewards include a considerable amount of real returns. Specifically, users who deposit LP tokens into SteakHut will receive 80-97% of the platform's total revenue. The remaining portion belongs to users who stake STEAK tokens. And since the maximum supply of STEAK is only 5 million, all rewards paid to STEAK token holders will be in the form of JOE tokens.

In addition, STEAK follows in the footsteps of JOE to become an On-Chain Tradable Token (OFT). This means that the supply is distributed on Avalanche, Arbitrum, BNB Chain, and any other places where JoeV2 is most likely to expand in the future.

Features of SteakHut Liquidity V2

Based on SteakHut Liquidity, the team announced the launch of a new SteakHut model, namely SteakHut Liquidity V2. According to the official blog, it has the following features:

- Automated liquidity strategies: Break down the barriers to entry for concentrated liquidity through automated liquidity strategies, designed and backtested to maintain liquidity optimization.

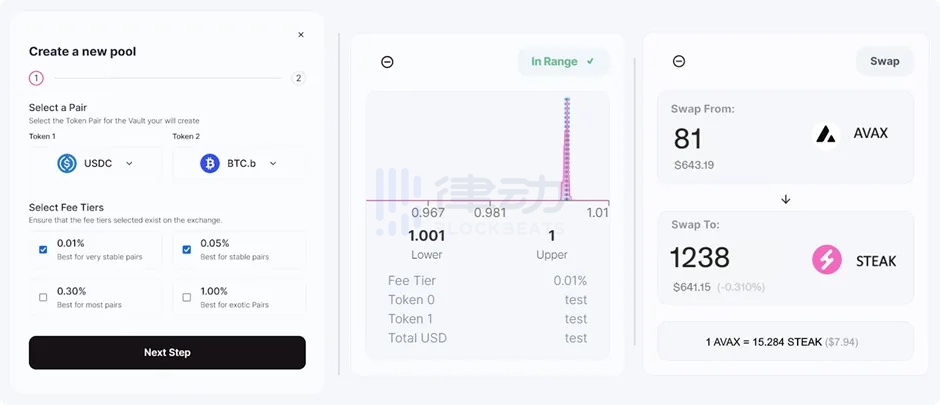

- Permissionless treasury creation: Easily create and manage your own liquidity treasury directly through the SteakHut platform.

- Composable liquidity allocation: Utilize our flexible smart contracts to deploy up to 20 liquidity ranges for each treasury and enjoy cross-fee layer liquidity allocation.

- Increased capital efficiency: Optimize your liquidity through SteakHut, automatically reposition and rebalance liquidity. This helps create deep and capital-efficient markets for your tokens, all of which can be seamlessly managed through a single platform.

- Concentrated liquidity farm: Earn additional returns on concentrated liquidity positions through SteakHut's farm option, increasing your liquidity returns.

- Earn performance fees: Create and manage your own liquidity strategies and share with your community to start earning performance fees.

Among them, permissionless treasury means that DAOs can create a custom strategy that only applies to its members. Additionally, the treasury is part of SteakHut's "Liquidity as a Service" (LAAS) program, and during the construction phase, SteakHut is also collaborating with as many well-known DeFi projects as possible. Therefore, some community members also refer to it as the "liquidity layer of DeFi".

Rethinking liquidity

SteakHut has taken into account the needs of liquidity providers and has planned an experience to provide retail-friendly and institutional-grade market-making solutions for managing on-chain liquidity. With SteakHut Liquidity, you can access the most composable and flexible smart contracts in the Web3 ecosystem, allowing you to control your liquidity.

Liquidity providers will be able to access a range of automated liquidity strategies directly from the SteakHut dApp, including all key CLMM, and can join custom strategies or easily deploy their own strategies, fully controlling their entire investment portfolio from a professional platform.

SteakHut Liquidity V2 is completely permissionless. Deploy your own liquidity pool, choose up to 20 liquidity ranges, and have full control using SteakHut's inventory management tools.

The liquidity management tool suite allows liquidity managers to dynamically and proactively manage liquidity strategies based on market conditions. This will enable liquidity managers to deploy risk management into their strategies and deploy capital more actively.

Token swapping also allows flexibility in liquidity management, allowing strategists to change token treasury ratios as needed. Slippage limits and DEX aggregation allow exchanges to be completed with minimal impact and controlled by the manager.

SteakHut's subgraphs allow liquidity providers and managers to instantly access all key metrics and gain deep insights into their liquidity strategies. This allows users to reliably track performance based on key benchmarks, view token composition to create hedging strategies, and view income data.

SteakHut is creating the "liquidity layer of Web3", with smart contracts designed to allow cross-compatible liquidity management across all key CLMMs across multiple blockchains. This will enable liquidity providers and market makers to easily manage and optimize liquidity for all major AMMs and blockchains through a dedicated platform. Users can switch directly between blockchains and CLMMs, managing a diversified portfolio of liquidity strategies.

SteakHut made its first appearance on the Avalanche blockchain, then deployed on Arbitrum One and the Ethereum mainnet, and will expand to all major blockchains and CLMMs. Considering that Trader Joe and its Liquidity Book have already performed well, once LB's narrative becomes more popular, the position of STEAK will become more stable.

Further reading:

Introducing: SteakHut Liquidity V2;

Compared with Uniswap V3, what problems does Trader Joe's Liquidity Book solve?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。