Note: Due to the strict prohibition of token issuance in mainland China, this article is a study of industry law and information exchange in the context of relevant laws and regulations overseas.

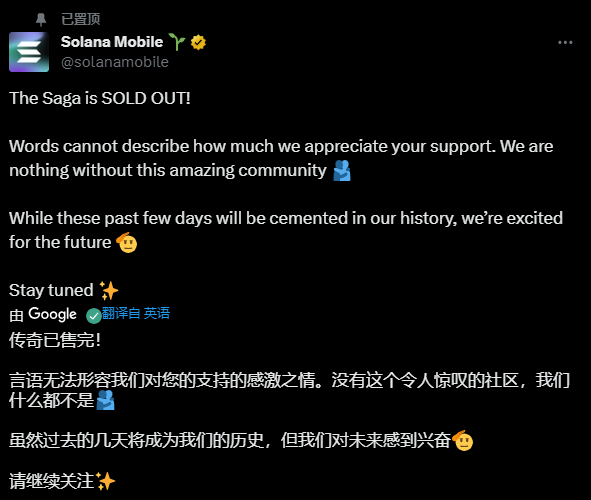

Recently, due to the sharp rise of BONK coin, the previously unsold Web3 mobile phone Solana SAGA has sold out, and the price on the second-hand platform eBay has soared to 10 times the official price (official price $599), reaching $5000, which is 5 times the price of an iPhone 15 Pro. In response, Solana Mobile's official announcement could hardly contain their excitement, stating, "Although the past few days will become our history, we are excited about the future."

In addition to receiving BONK coins when purchasing the SAGA phone, according to Solana's official announcement, users can also obtain related rights to the Solana ecosystem, Sol coins, and exclusive NFT minting rights. Kyle Samani, the founder of Multicoin Capital, further stated on Twitter that he believes SAGA users will be able to receive more airdrops from the Solana ecosystem in the future. Therefore, many speculate that the SAGA phone may continue to rise. The high probability of Solana entering the mobile manufacturing industry is likely due to its layout in its own ecosystem. Lawyer Mankun speculated that hardware issuance may also be beneficial for certain applications of future Depin.

Setting aside these points, the marketing method of "buying a phone and receiving tokens" has also prompted some project parties to use their ingenuity. Is the marketing method of "buying physical goods and receiving tokens" legally feasible? If feasible, what should be considered to seek legal compliance?

01. Risks of Token Legal Nature Identification

If the airdropped token is deemed a security, according to the current regulatory policies of major countries and regions, the act of airdropping tokens may be considered as the issuance or sale of securities, and requires prior approval or exemption from the regulatory authorities. For example, in Hong Kong, if the token exhibits characteristics of traditional securities (such as sharing profits or rights to debt repayment), the product will be regulated under the Securities and Futures Ordinance, and issuance or sale to the public will require approval or exemption from the Hong Kong Securities and Futures Commission. Similarly, in Singapore, if the token is classified as a Capital Markets Product (CMP) under the Securities and Futures Act (SFA), such as securities, bonds, derivative contracts, collective investment schemes, etc., it will be regulated by the Monetary Authority of Singapore, and issuance or sale will require prior approval or exemption from the regulatory authorities.

If the airdropped token is not considered a security, its issuance and sale will not be subject to securities-related laws and regulations, but this does not mean that there are no restrictions under other areas of laws and regulations.

02. Risks of Advertising Content

Regardless of the marketing method, the ultimate goal is to attract consumers. Therefore, any marketing method needs to consider consumer-related laws and regulations. The marketing method of "buying physical goods and receiving tokens" is no exception in terms of advertising and consumer rights protection laws and regulations. In general, this marketing method needs to ensure that the marketing content is truthful, accurate, and not misleading to consumers, as otherwise it may constitute fraud.

Specifically, if the marketing method of giving tokens involves descriptions or statements about the tokens themselves, these descriptions or statements must also be true and verifiable, and must not be exaggerated or imply that the token has investment value, can be exchanged for cash or other currencies, can be traded on any platform, or can be used to purchase any goods or services, etc. Any of these implications may be considered as misleading advertising, leading to unnecessary trouble in the future.

In the case of SAGA, the price of the BONK coin it gave away once exceeded the price of the SAGA phone. Especially when there is a related interest between the physical goods and the token issuer, it may be investigated by relevant authorities for potential "market manipulation" and unfair competition.

03. Recommendations from Lawyer Mankun

In the future, the marketing method of "buying physical goods and receiving tokens" may be used as a means of blockchain technology application, and it may have various legal risks. Enterprises and users need to conduct compliance analysis and operations based on the legal environment of different countries.

Lawyer Mankun recommends that before conducting similar marketing activities, enterprises should fully understand the legal regulations and regulatory attitudes of the target market, formulate reasonable compliance strategies and risk control measures, and communicate and coordinate with relevant authorities in a timely manner. Similarly, users are advised to carefully read the relevant agreements and terms before participating in such activities, understand their rights and obligations, and avoid being deceived due to blind following.

Original author: Lawyer Mankun (Senior Lawyer at Shanghai Mankun Law Firm)

Lawyer Mankun graduated from Zhejiang University (Bachelor of Laws) and Kyushu University in Japan (Master of International Economic Law and Commercial Law). Throughout his practice, he has focused on foreign-related legal disputes, complex corporate disputes, and legal services in large-scale investment and financing projects. His years of experience in commercial legal services enable him to provide feasible solutions based on clients' commercial demands.

Main Business Areas:

Resolution of cross-border civil and commercial disputes, Web3.0 investment and financing contract disputes, legal services for new economy enterprises

Typical Cases:

- Corporate Disputes

Participated in commercial arbitration involving a well-known Japanese listed company and a Taiwanese-headquartered food and beverage enterprise group's procurement contract dispute, ultimately successfully obtaining compensation for losses amounting to over a hundred million.

Engaged in a comprehensive demonstration and intense debate on whether the software purchased by a leading blockchain server manufacturer from its supplier meets quality standards.

Represented a domestic leading listed heavy equipment manufacturing company in providing a full set of solutions for its construction dispute in a European engineering project, ultimately reaching a satisfactory out-of-court settlement.

- Intellectual Property Disputes

Participated in a patent infringement and trade secret dispute case between a Japanese multinational chemical company and a domestic well-known chemical design unit, successfully initiating on-site inspection by the court, greatly solving the problem of "difficulties in evidence" in intellectual property cases.

- Investment and Financing Projects

Represented a leading domestic real estate investment and asset management company in a city renewal project in Guangzhou, which involved multiple historical land issues and vague government department policies.

Represented a leading domestic real estate investment and asset management company in the acquisition of a large-scale comprehensive commercial complex in Shanghai.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。