Transition from Uniswap's "sole dominance" to a "multi-superior" pattern.

Author: xiaoyu, DODO Research

The footsteps of spring always tread on muddy paths, and 2023 is a year of challenges and opportunities. We witnessed the release of Uniswap V4, UniswapX, the underlying code of Curve being attacked, and the emergence of new DEX rookies such as Maverick.

In this volatile market environment, DEXs have not only experienced technical challenges but also faced increasing competitive pressure. Nevertheless, many DEXs continue to innovate, introducing more secure and efficient trading mechanisms, attracting a large number of new users.

Over the past year, the DEX Weekly Brief closely monitored and reported on the latest trends and key data in the decentralized exchange (DEX) market. The DEX Annual Report condenses the DODO Research team's meticulous observation and analysis of the market throughout the year, delving into the significant trends and important findings in the DEX field in 2023 for reference.

I. Trading Volume & Market Share

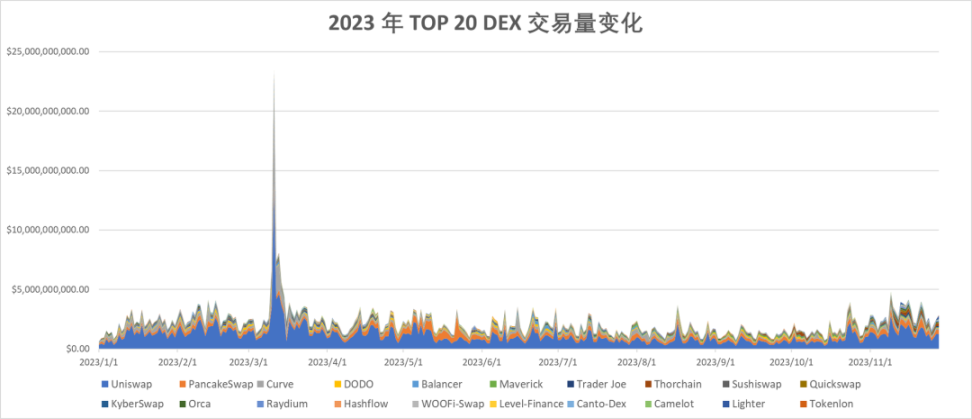

"The total DEX trading volume in 2023 remained high at the beginning and end of the year, while fluctuating at a low level for the rest of the time, showing a certain positive correlation with the overall market trend."

Starting from October, influenced by the expected impact of ETFs, the DEX total trading volume showed a significant increase and growth. There are clear signs of market trading volume recovery, and it is expected to continue growing in 2024.

Looking at individual trends, Uniswap performed steadily throughout the year, occupying a major market share. Other DEXs showed impressive performance in event-driven situations, such as Pancakeswap launching V3 on the BNB chain and Ethereum chain in April, increasing capital utilization and restructuring fee results, leading to a significant short-term growth in monthly trading volume and market share for the platform.

Starting from the end of October, the market style gradually changed: transitioning from Uniswap's "sole dominance" to a "multi-superior" pattern. Influenced by the active ecosystems of major public chains such as SOL and AVAX, these leading DEXs on these chains contributed a considerable trading volume, even surpassing the traditional mainstream DEXs on the Ethereum chain (see Weekly Brief for details). According to Defillama's data, on December 15th, the DEX trading volume on the Solana chain exceeded $1.2 billion, surpassing the long-standing leader, the Ethereum chain, for the first time.

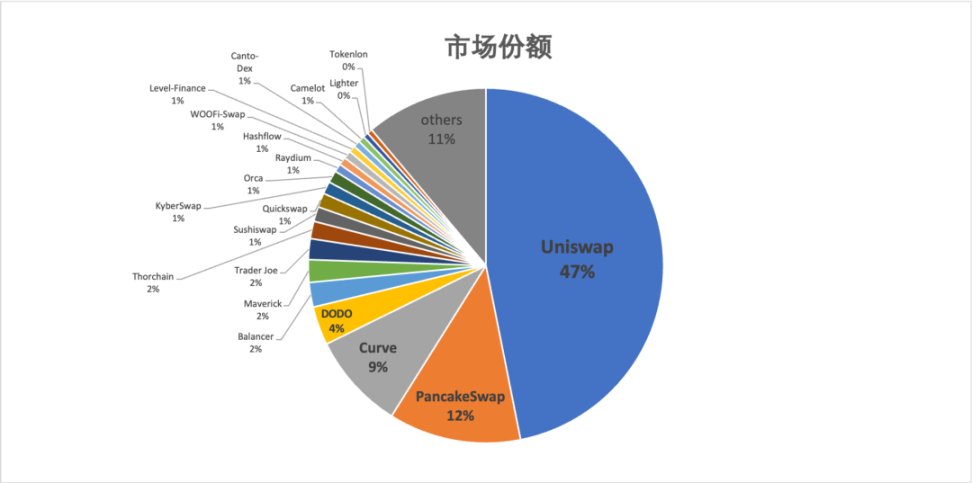

The pie chart shows the market share ranking of the top 20 DEXs, which collectively account for approximately 89% of the total DEX market share. Uniswap maintained its dominant position as the top player with 47% market share this year, maintaining a "tiered hierarchy" pattern for the overall DEX market.

Uniswap is in the first tier, with a rich product offering and widespread reputation, occupying half of the market share. The second tier includes Pancake, Curve, and DODO, collectively holding 25% of the market share. The third tier includes Balancer, Maverick, TraderJoe, Thorchain, among others, while the remaining DEXs are classified into the fourth tier.

The second tier consists of well-established exchanges with long operating times and mature, stable products. The third tier includes newcomers, with Maverick frequently breaking into the top 5 in market share since its launch at the beginning of the year due to its automatic liquidity balancing mechanism; Thorchain's unique minting mechanism also gained momentum in the market's recovery.

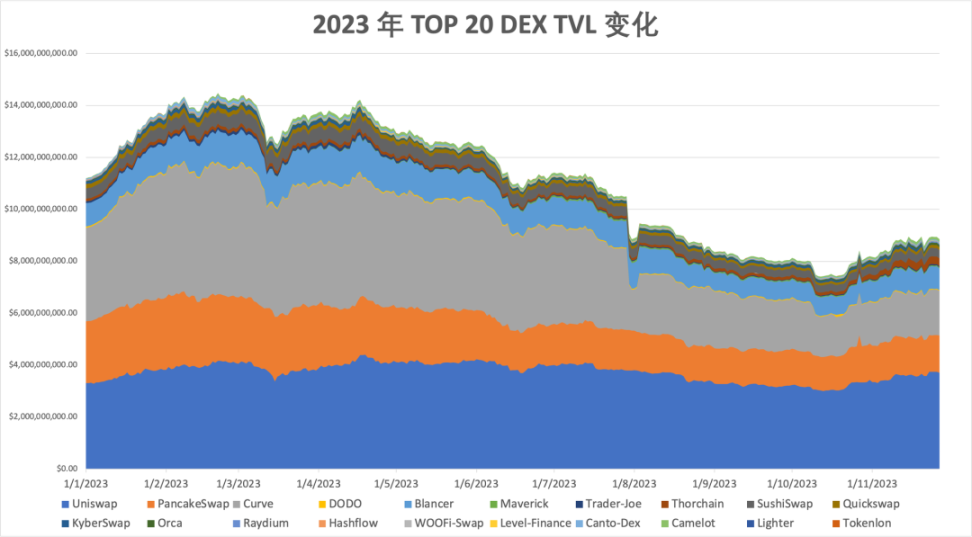

Represented by the TVL of the top 20, the overall DEX TVL no longer experienced a cliff-like decline as in 2022. After showing some recovery at the beginning of the year, the rate of decline in TVL gradually slowed down, with a turning point in October, indicating a possible reversal. The overall TVL scale is around $9 billion.

The vast majority of TVL is locked in the top exchanges: Curve, Pancakeswap, and Uniswap. Uniswap's TVL remained stable, while Curve's TVL significantly shrank after the hack incident, with little difference from Pancakeswap's TVL. Thorchain's TVL performed relatively well.

II. DEX Capital Efficiency

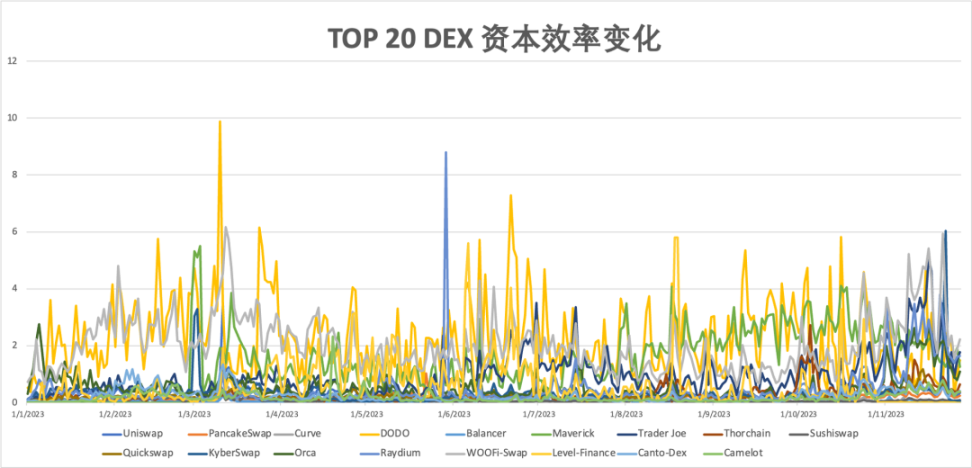

"Overall, the capital efficiency of the DEX track has shown a recovery, transitioning from local activity to global activity, with improved capital efficiency, indicating a warming market."

Looking at the capital efficiency of individual DEXs, the yellow line representing DODO led the market throughout the year, with only the gray line representing Curve maintaining activity at the beginning of the year. In the second half of the year, the green line representing Maverick emerged as a dark horse, performing well during the market's fluctuations.

III. Multi-Chain Deployment of DEX

"Overall, major DEXs are actively expanding to EVM-compatible public chains and L2 solutions."

This not only helps diversify the user base but also reflects DEXs' use of L2 solutions to reduce Ethereum-related costs and congestion (processing 4.5 times more transactions per second, saving 10 times the fees). Due to the different underlying architecture, the deployment cost of the Solana chain is relatively high, and currently, there is limited DEX support. Raydium and Orca are the main DEX platforms for handling exchanges on the SOL chain.

However, the Solana chain has high throughput and low transaction costs, so we have seen more cross-chain solutions emerge, allowing assets to move seamlessly between different blockchains. The cross-chain platform ThorChain provides native asset exchanges and performed well in Q4. Cosmos' IBC architecture achieves interoperability between different blockchains and is also a potential solution for DEX multi-chain deployment.

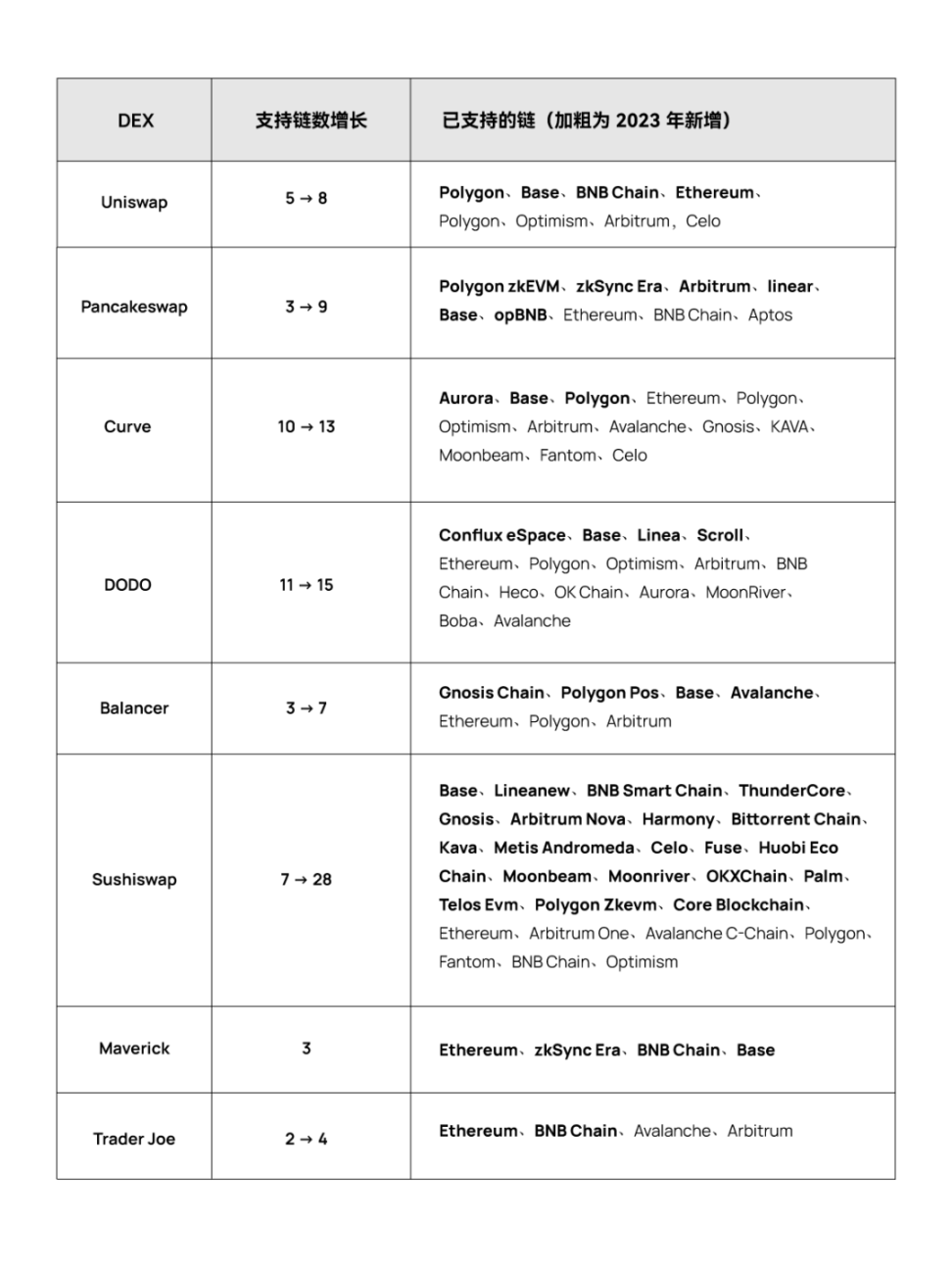

We have listed the multi-chain development status of common exchanges on Ethereum in the Top 20 market share:

IV. Comparison of DEX and CEX Market Share

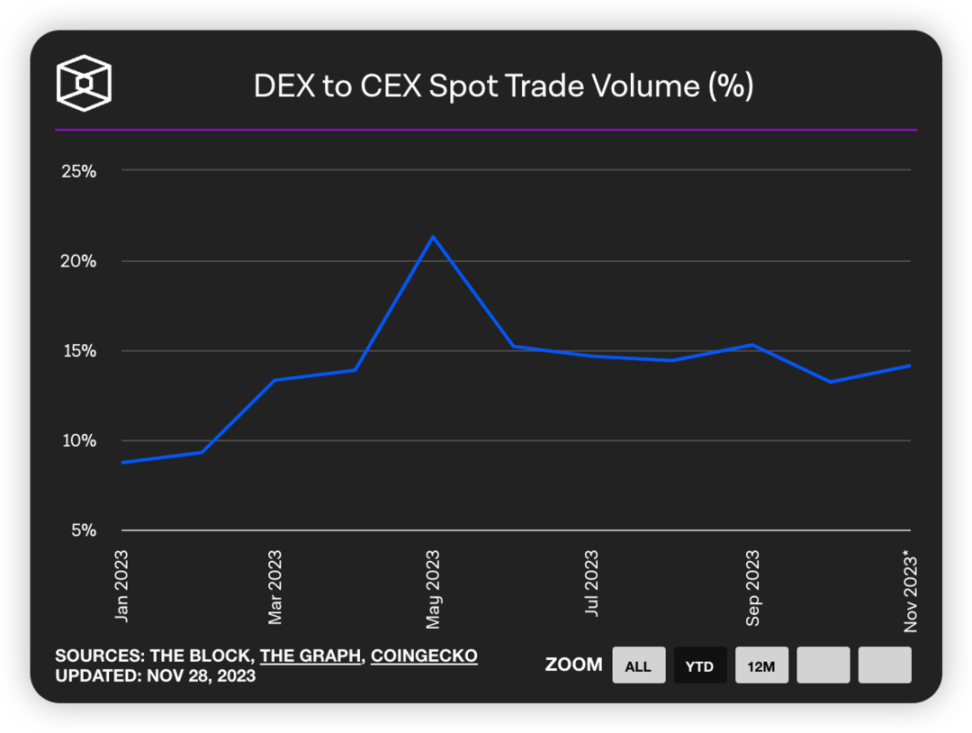

"The market share of DEX spot trading increased in the first two quarters, reaching a peak of 21.31%, setting a new historical high."

It later stabilized around 15%. This continues the trend from the previous year, where the trust crisis caused by the FTX scandal forced users to transfer assets to DEX. At the same time, the user experience of DEX has been further optimized, with platforms like Uniswap and Paraswap launching their own wallet apps.

Most importantly, DEX (especially AMM) allows users to add liquidity to long-tail tokens (such as meme tokens) without permission, bypassing regulatory issues or other factors, freeing them from the constraints of centralized exchange listings. Through DEX, projects can immediately attract liquidity, allowing for greater market participation. According to CoinGecko's data, the number of tokens listed on Uniswap is almost 20 times that of Coinbase and 3.4 times that of Binance.

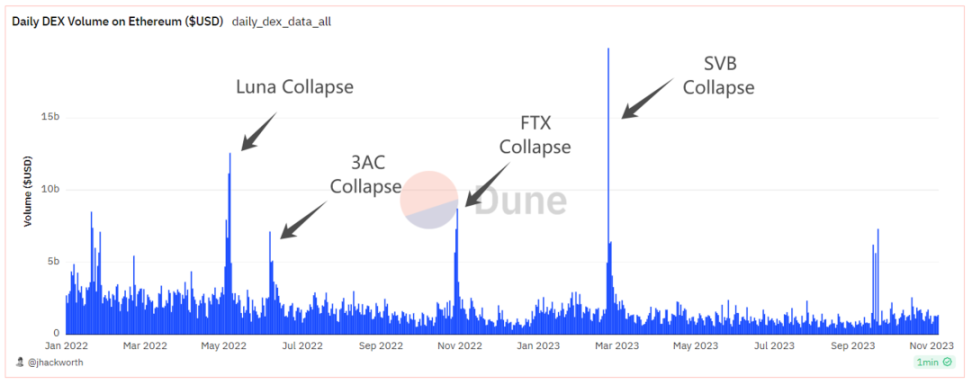

The most essential difference between DEX and CEX is that DEX repeats programmed actions: providing permissionless trading. On the days when centralized entities (such as FTX, BlockFi, Celsius, and Voyager) collapsed, DEX trading volume surged, setting record-breaking daily trading volumes. The collapse of SVB (and the decoupling of USDC) led to a record-breaking daily trading volume of ~$19.7 billion for DEX.

V. Mechanism Innovation of DEX

"MEV and widespread adoption remain challenges facing DEX, and many mechanism innovations have been introduced by DEX this year."

Representative examples include Uniswap X: allowing users to sign orders offline, and a solver Dutch auction execution; Maverick offering four modes, allowing for automatic price following or one-way or two-way liquidity adjustments; DODO V3 allowing LPs to entrust funds to professional market makers for active market making to increase returns.

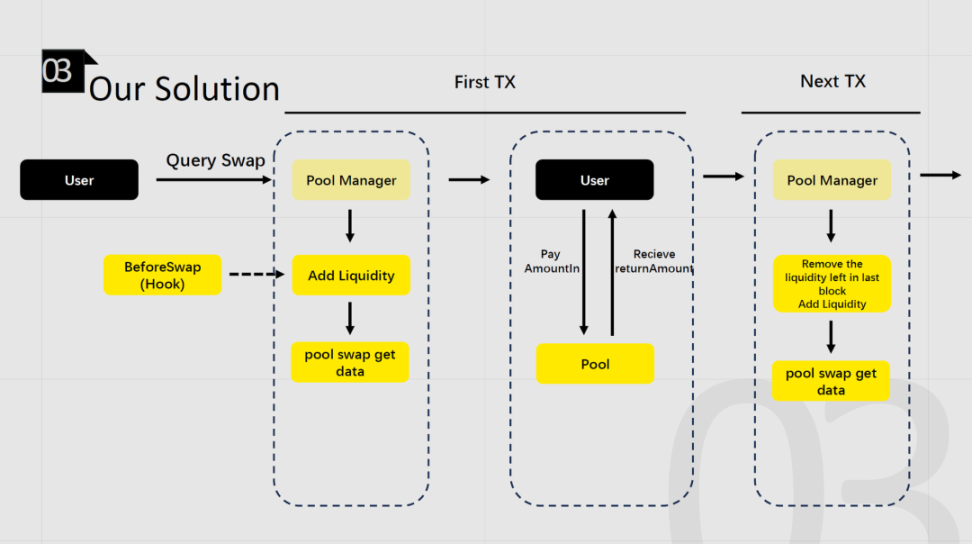

The Hook in Uniswap V4 allows for custom pool functionality, providing DEX with a platform for more innovative possibilities. Based on this, the DODO team developed Aggregator_Hook, creating a system that accurately maps liquidity positions from various DEX platforms to Uniswap V4 quotes, simplifying LP operations and enhancing user experience and market liquidity.

VI. Major Events of DEX

Product Updates

- Uniswap launched V4 and Uniswap X; Trader Joe launched AutoPool; Balancer is about to launch V3, and more.

- Uniswap introduced front-end fees, charging a 0.15% fee for trading certain tokens from October 17, sparking significant controversy in the community.

- Curve issued crvUSD stablecoin, with a total supply of ~$150 million.

- Uniswap and Paraswap launched wallet apps.

- DODO's Hook aggregator Aggregator_Hook won the Best Hook Usage Award at the Istanbul Hackathon.

Governance Tokens

- DODO suspended DODO emissions in the vDODO staking pool and reduced the vDODO withdrawal fee to 0%.

- Pancakeswap introduced the veCake token governance model, enhancing governance rights for $CAKE.

- Sushiswap proposed a new SUSHI economic model for trading fees, routing fees, staking fees, and partnerships.

User Experience

- DODO will introduce intelligent slippage prediction functionality.

- Matcha introduced a feature to view historical trades.

- Sushiswap automatically detects "tax tokens."

- Trader Joe's Quick-Picks intelligently recommends popular tokens.

- Pancakeswap's Dumb mode allows for automatic liquidation after expiration.

Hacker Attacks

- On July 30, Curve suffered a hacker attack due to a vulnerability in the underlying code version, resulting in a 51% decrease in TVL and a loss of $62 million, with approximately 79% of the funds successfully recovered.

- On September 20 and November 18, Balancer and Trader Joe's front-ends were attacked, resulting in losses of ~$238K and ~$87K, respectively.

- On November 23, KyberSwap suffered a hacker attack, resulting in the loss of approximately ~$4.8 million worth of crypto assets.

Summary and Outlook

DEX is the core infrastructure of DeFi, serving as a bridge for the circulation of different tokens, and LP assets are the cornerstone of many protocols in the DeFi ecosystem. TVL and trading volume reflect market activity, while capital efficiency reflects the response of different DEX mechanisms to capital utilization. This year may be a turning point for the market.

DEX has withstood the test of the market with its permissionless and unregulated operation. Various DEX platforms are making colorful and unremitting efforts to address crises and market pain points, constantly innovating. Nevertheless, DEX still faces challenges in its development, such as hacker attacks, MEV, and widespread adoption. However, the market is never short of newcomers, which is refreshing.

DEX is always evolving and never stops, and is poised to achieve a decentralized experience of trustless and barrier-free market making.

Why settle for a CEX for your next exchange?

References

https://marketplace.dexscreener.com/product/token-info\\\\*\\\\

https://dodotopia.notion.site/memecoin-ab277c208caf460dad997741ae282d51

https://www.scopescan.ai/pricing?network=eth

https://cloud.debank.com/

https://codex.arkhamintelligence.com/intel-to-earn-and-the-arkham-intel-exchange/exchange-concept

https://www.nansen.ai/plans-original

https://www.crunchbase.com/

https://www.similarweb.com/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。