The trading volume of Bonk has increased by 20 times, while the trading volume of ETH tools has decreased by about 80%.

Author: ONCHAIN WIZARD

Translation: Deep Tide TechFlow

Chaindege released this week's Smart Money Weekly Report, delving into the latest trends in the cryptocurrency market, especially the significant shift in trading volume and liquidity from Ethereum to Solana's meme.

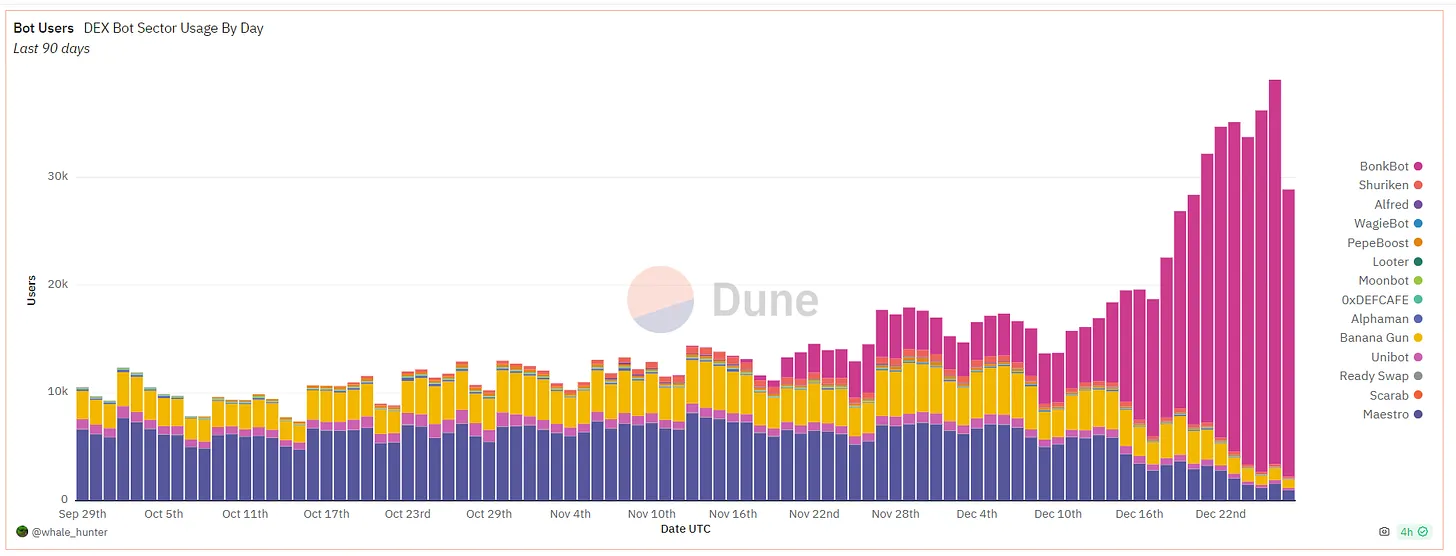

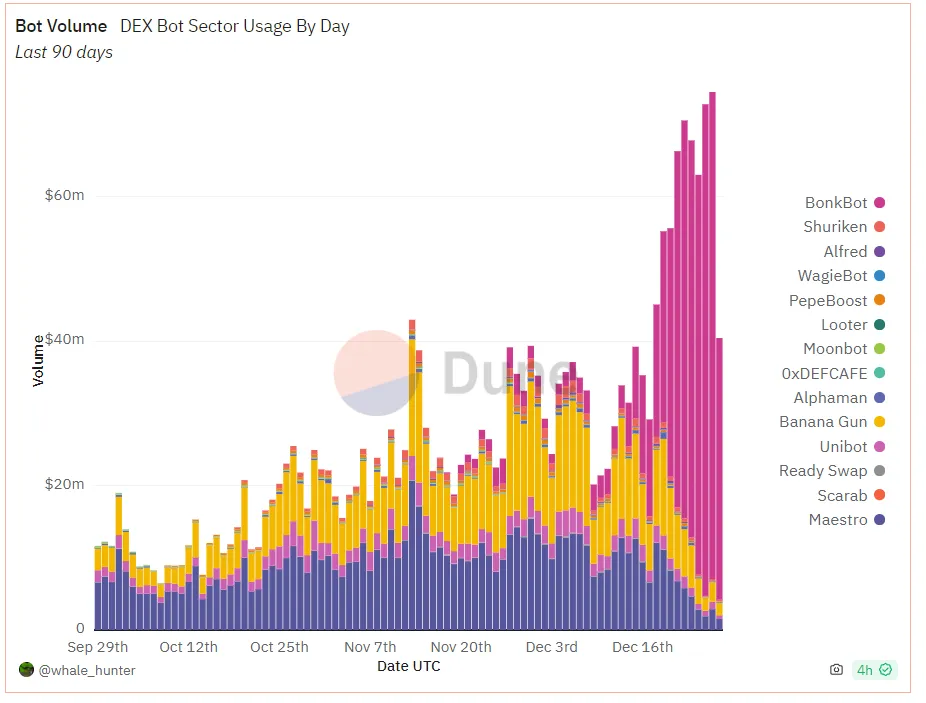

Before we begin this article, it is very important to note that in the past two weeks, the market for trading any token on ETH/ARB/AVAX has been very weak. All trading volume, users, and liquidity have shifted to meme coins on SOL. The best way to visualize this shift is to look at the user/trading volume changes on TG trading tools.

Bonkbot (the main TG bot for SOL) had fewer daily users than Maestro on December 13, and since then, the number of users has increased 6 times, reaching 36,000 people yesterday. As of yesterday, Bonk's TG bot user share has increased from 34% to 91%. In terms of attention/liquidity/trading volume, this is a significant shift, leading to weak or even declining price trends for ERC20 tokens.

From a trading volume perspective, this shift is even more pronounced. On December 13, Bonk's trading volume was $3 million, while the total for Maestro and Banana was $27 million. Yesterday, Bonk's trading volume was $67 million, while the total for Maestro+Banana was $5.6 million. In other words, Bonk's trading volume has increased by 20 times, while the trading volume of ETH tools has decreased by about 80%.

As expected, most popular ETH DEX token prices peaked around the 13th and have been trending downward. So, if you are looking for a reversal in ETH recovery/ERC20 tokens, observing the DEX trading bot dashboard to see the flow of Degen is a good choice.

chainEDGE Weekly Report: December 27, 2023

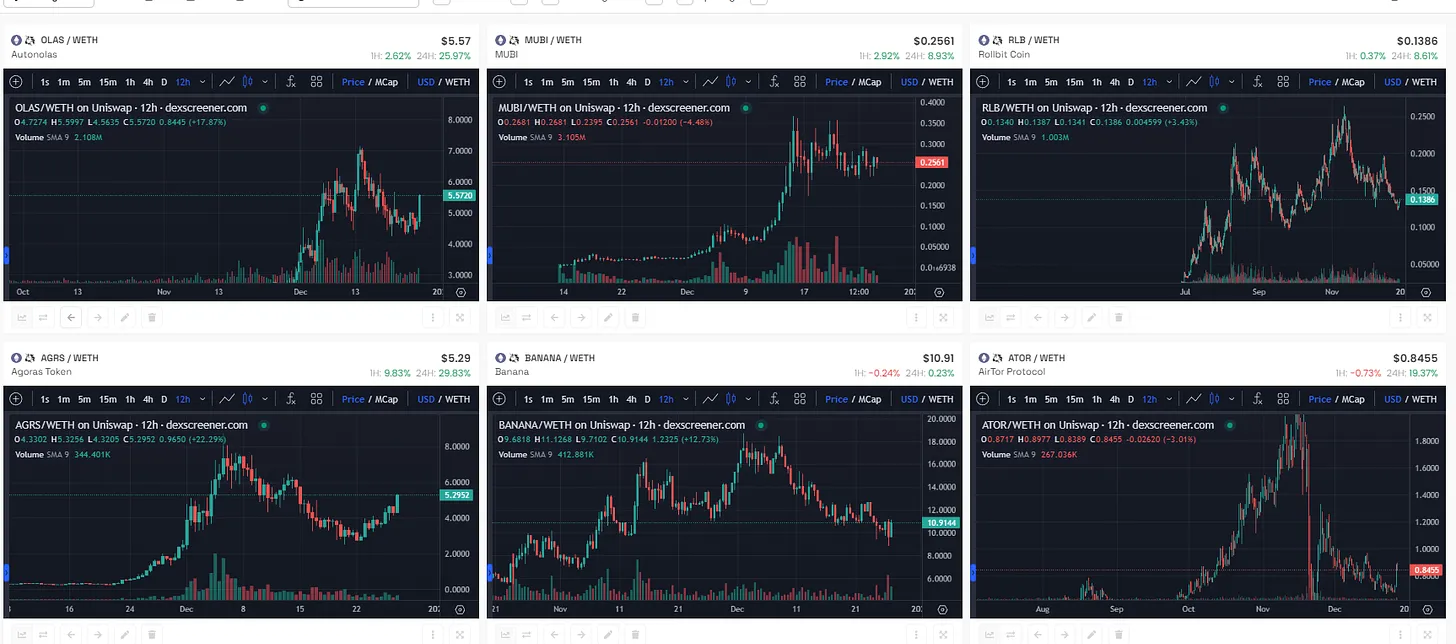

According to the number of holders with over $10,000, the current favorite tokens of smart money are OLAS, AGRS, MUBI, BANANA, $VAULT, MXH, and HYPR. Overall, as attention/trading volume/liquidity has shifted away from ERC20 tokens, smart money token holdings have been on a comprehensive downward trend.

Among these tokens, a few tokens that have seen accumulation (or at least remained stable) since December 13 include:

- OLAS (up 2%)

- MXH (a newer token)

- HYPR (stable)

As for smart money holdings of newer tokens with $20,000:

- KOI $103,000/5 wallets (meaning 5 smart money wallets hold $103,000 worth of KOI)

- MXH $298,000/27 wallets

- MARK $181,000/5 wallets

- FI $167,000/5 wallets

- OMNI $159,000/8 wallets

- RSTK $102,000/7 wallets

- MZERO $64,000/6 wallets

- vMINT $47,000/4 wallets

- TUX (operational) $26,000/2 wallets

- UEFN $20,000/12 wallets

Overall, we have seen the entire market (including smart money) shift towards meme coins on SOL and more fundamental projects on ETH. Upon deeper analysis, the flow of funds is towards artificial intelligence, BRC20, and then more specific projects such as HYPR, BANANA, MXH.

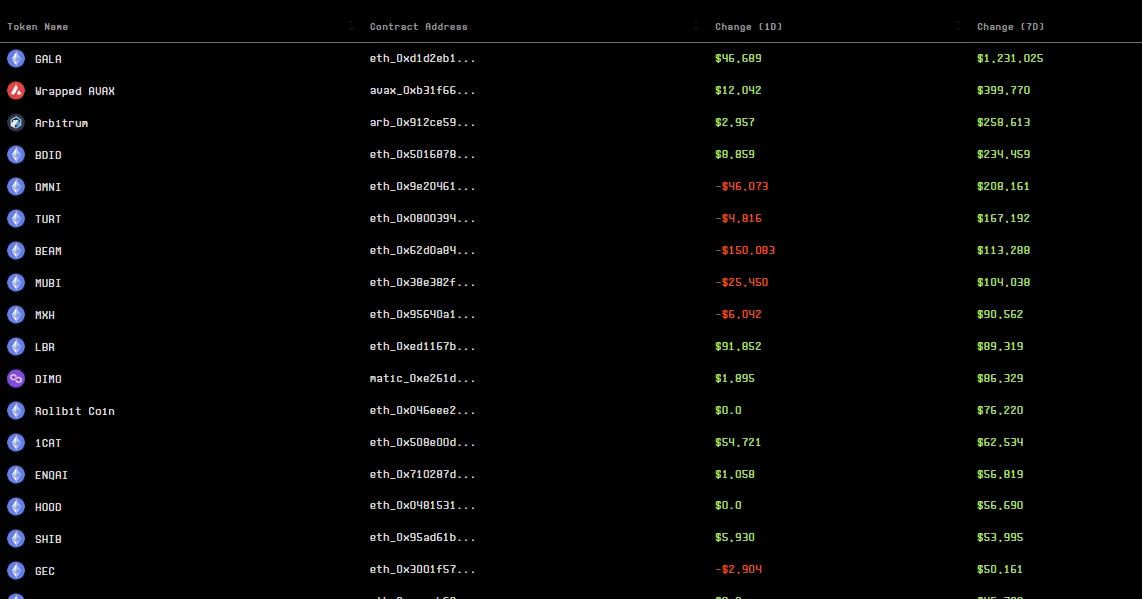

Looking at the exchange flow over the past week, attention to coins on AVAX and ARB via EVM has cooled down and mainly returned to ETH. Notably, BDID, OMNI, TURT, MUBI, MXH, LBR, 1CAT, and ENQAI each had net purchases of over $50,000.

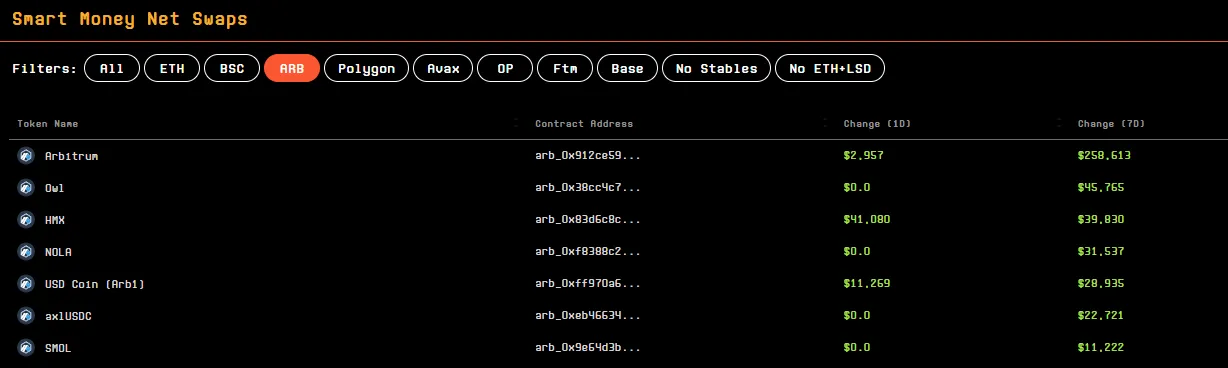

In terms of non-ETH flow, we see OWL, HMX, NOLA, and SMOL leading on ARB, while the flow on other major EVM chains is quite weak.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。