What are the characteristics of the new generation of cryptocurrency exchange accounts?

Source: OKX

On December 23, 2020, OKX announced the launch of the Unified Account system and began global public testing, quietly changing users' habits.

Three years later, the industry-leading Unified Account system pioneered by the veteran cryptocurrency exchange OKX remains at the forefront. The three main reasons behind this are: OKX insists on simplifying product operation experience, adheres to user needs in product functionality, and most importantly, continues to innovate in product iteration.

The first-generation cryptocurrency exchange accounts only had simple fiat accounts and spot accounts, which could only meet users' basic needs for deposits, withdrawals, and spot trading, with limited functionality. The second-generation cryptocurrency exchange accounts tended to be more diverse and functional, with users having at least fiat accounts, spot accounts, margin accounts, perpetual swap accounts, futures accounts, and options accounts, among others, greatly increasing the playability. However, because these accounts were not interconnected, users needed to transfer funds back and forth to the corresponding accounts when conducting different types of trades, resulting in inefficient and cumbersome operations, existing fund barriers, and lower fund utilization rates, especially in extreme market conditions.

To further enhance the user trading experience, OKX, with its profound technical expertise, has begun to promote the arrival of the third generation of cryptocurrency exchange accounts, which has epoch-making and industry-inspiring significance.

Account framework and applicable users

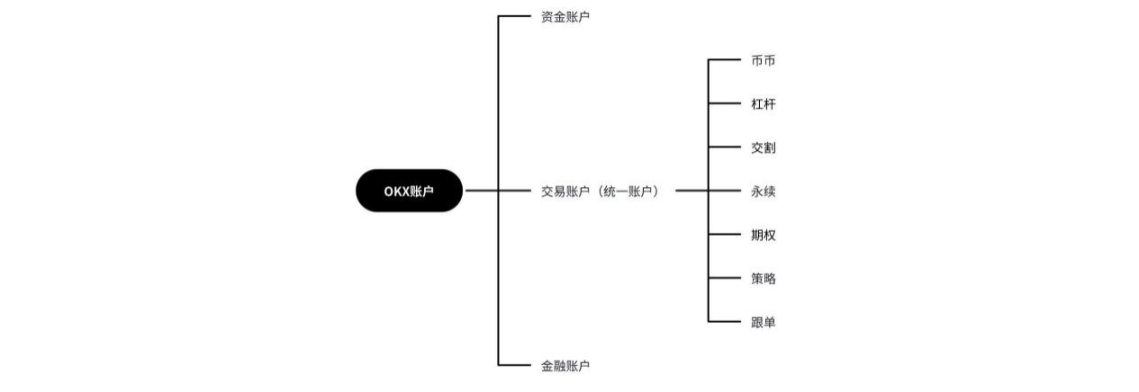

The OKX Unified Account allows users to buy and sell various cryptocurrency derivative products with different settlement currencies through a single trading account. It is divided into three types: fund account, trading account, and financial account. The fund account and financial account are mainly used for savings and wealth management, while the trading account, which is the focus today, allows users to conduct spot, margin, futures contracts, perpetual contracts, options contracts, and up to 14 trading strategies, as well as spot contract copying, without the need for fund transfers, greatly enhancing the convenience of trading at the operational level.

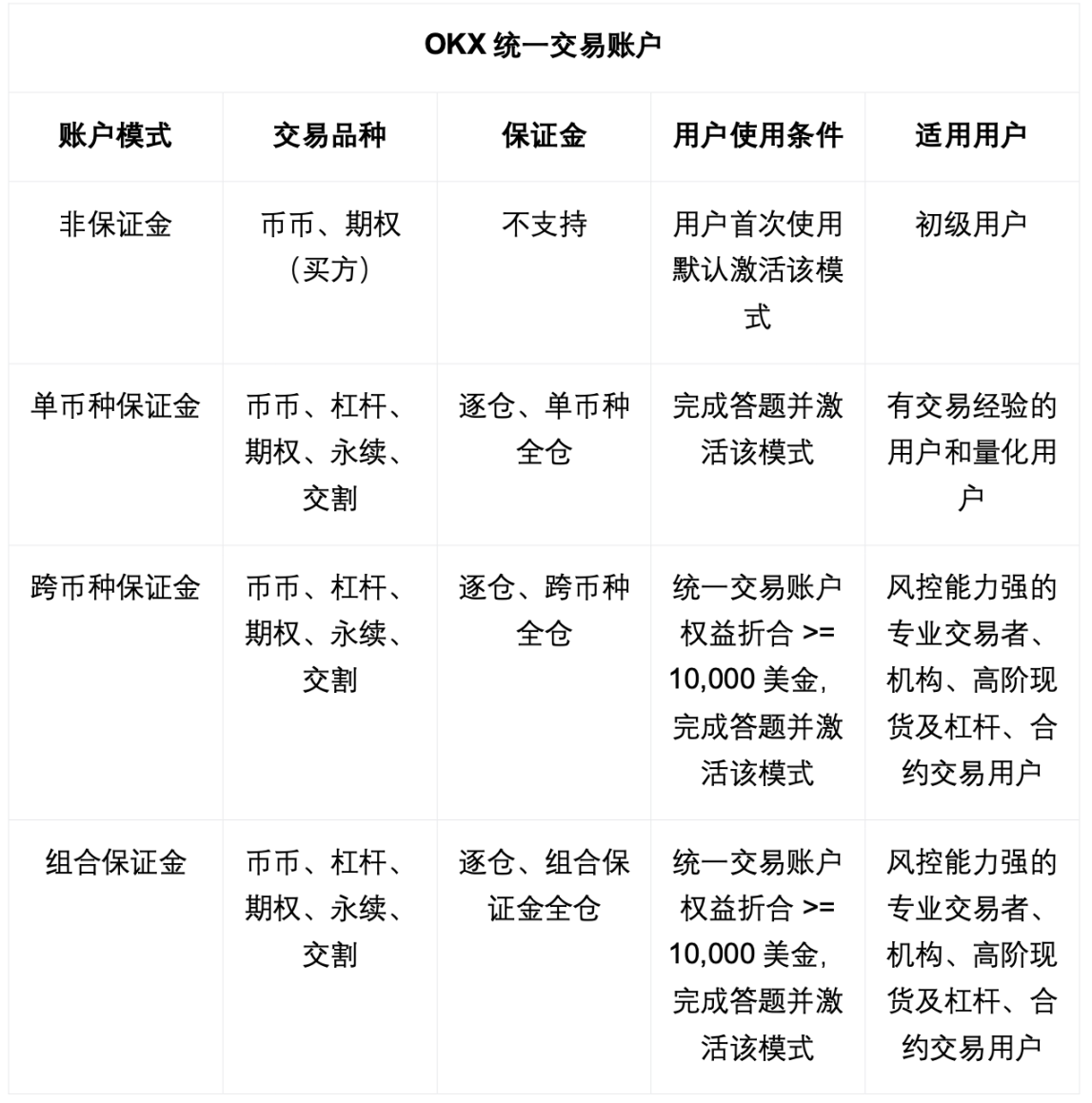

For different types of users, the OKX Unified Account provides a total of four account modes, including simple trading mode, single currency margin mode, cross-currency margin mode, and composite margin mode, from simple to advanced modes, to accurately adapt to users' trading needs.

Account advantages and use cases

In the non-margin mode, users can simultaneously conduct spot and options trading in the same account, but it does not support margin, futures contracts, and perpetual contracts. The OKX non-margin mode is designed to protect novice users by avoiding direct participation in complex derivative trading with high leverage, thus establishing a relatively safe and risk-controlled trading environment for novice users through "subtraction".

The single currency full margin mode is the most widely used mode, allowing users to conduct spot, margin, options, perpetual contracts, and futures contracts in the same account, as well as hedging and arbitrage of derivative products with the same settlement currency. All trading pairs with the same settlement currency share the margin, and trading profits and losses can offset each other. For example, two contracts both denominated in BTC will share the margin. Positions and margins are independent for trading pairs with different settlement currencies, and trading profits and losses cannot be shared. Compared to the second-generation independent account mode, the single currency margin mode greatly simplifies the trading process, is very smooth, and isolates the risks of different currencies, improving the efficiency of account funds utilization.

The cross-currency full margin mode is the most representative mode in the OKX Unified Account, allowing the same types of trading as the single currency margin mode, hedging and arbitrage of derivative products with the same or different settlement currencies, and trading of derivative products for a currency not held. The difference is that all trading pairs share the margin, and trading profits and losses can offset each other, supporting cross-currency full margin mode. For example, multiple trades such as BTC contracts and ETH contracts can share a single margin, increasing the thickness of the margin. Compared to the single currency margin mechanism, this mode converts all encrypted assets into U-based margins based on the conversion rate for all positions, breaking the account restrictions between different currencies, reducing the risk of liquidation, and further improving the efficiency of fund utilization. For example, under the independent mode, the liquidation risks of BTC contracts and ETH contracts in a downtrend were 20,000 U and 2,000 U respectively, but under the cross-currency full margin mode, the liquidation risks may be reduced to 1,000 U for both, reducing the risk of liquidation.

In the composite margin full margin mode, complex hedging combinations and option combinations can be conducted, as well as hedging and arbitrage between derivatives and spot for the same underlying asset, and trading of derivative products for a currency not held. For example, holding only BTC but being able to trade ETHUSDT perpetual contracts. All trading pairs share the margin, and profits and losses can offset each other, not supporting risk hedging. By constructing a certain scale of hedging combinations, reducing risk exposure, and effectively reducing the maintenance margin requirements, the fund utilization rate is further improved. For example, when the user's position scale is large, the hedging structure is good, and there are option hedging/spot hedging strategies, the margin requirements are lower.

Users can flexibly choose from the four account modes of the OKX Unified Account according to their needs, reducing the probability of liquidation in extreme market conditions and improving the efficiency of fund utilization.

Product highlights and technological innovation

As the most comprehensive and advanced account system in the industry, the OKX Unified Account has many noteworthy features.

Taking the composite margin full margin mode as an example, it mainly has three core functions: profit and loss hedging, risk hedging, and trading type hedging. Especially when users conduct trading type hedging, this mode not only supports hedging between derivatives, but also exclusively supports spot and derivative hedging. In addition, when users conduct spot and derivative hedging, their account spot assets are not locked and can be flexibly used.

The single currency margin mode sets up two layers of risk checks, the first layer is called risk control order cancellation check, and the second layer is called pre-liquidation check. This ensures that users can trade normally, avoiding order cancellations due to insufficient margin, partial liquidation of positions, or even full liquidation.

Many exchanges are still unable to achieve cross-currency full margin mode. This mode not only supports users to conduct spot, margin, options, perpetual contracts, and futures contracts in the same account, as well as hedging and arbitrage of derivative products with the same or different settlement currencies, but also has very fast margin calculation and settlement speed. This is because OKX, through exclusive backend verification and calculation rules, converts all encrypted assets into U-based margins based on the conversion rate for all positions.

In addition, in the cross-currency full margin mode, it also supports automatic borrowing of assets. Users can choose to "enable borrowing" or "disable borrowing" in the settings according to their needs. When the borrowing mode is enabled, if the effective margin value in USD in the account is sufficient, users can still achieve "coinless trading" when the balance of a certain currency is insufficient, greatly enhancing the convenience of trading.

For example, if a user only holds SOL but wants to buy ORDI, and there is no SOL/ORDI trading pair on the exchange, only SOL/USDT and ORDI/USDT trading pairs, with the borrowing function enabled, the user can directly use SOL to buy ORDI. This is because the system will lend USDT to the user interest-free for purchasing ORDI, improving the user's trading convenience and reducing trading fees.

The third generation of cryptocurrency exchange accounts

With the continuous development of the cryptocurrency market, the derivative market in the cryptocurrency industry has shown strong growth momentum, attracting more and more investors and institutions to participate. Especially against the backdrop of gradually clear regulatory environment and further market maturity, it is expected to continue to grow. However, the current drawbacks of the second-generation cryptocurrency accounts have exacerbated, and the demand for efficient and simple trading methods and experiences from users has become more urgent.

As the most important scene for the circulation of cryptocurrency assets, the OKX Unified Account has overcome the challenge of calculating different businesses such as spot, margin, options, perpetual contracts, and futures contracts in a unified trading account. By setting up four account modes including simple trading mode, single currency margin mode, cross-currency margin mode, and composite margin mode, it can accurately adapt to different user trading needs, solving the problem of redundancy and complexity in the second-generation accounts. It greatly improves the smoothness and convenience of trading, reduces the risk of liquidation through margin sharing, and increases fund utilization efficiency, achieving the integration of the internal financial ecosystem and efficient and convenient trading of user assets, redefining the third-generation trading account system.

As a global leader in cryptocurrency and Web3 technology companies, in recent years, OKX has not only provided high liquidity trading globally but also committed to promoting the development of financial tools, providing users with more trading and investment choices. By continuously leading financial technology solutions to promote higher-level products, OKX provides investors with more innovative financial tools, including Web3 wallets, CeFi structured products, and more, thereby promoting the large-scale adoption of the cryptocurrency industry and setting an example for the industry. The cryptocurrency industry will continue to see more exciting innovations.

It can be imagined that in the future, with the emergence of various new financial tools in the cryptocurrency industry, providing users with a wider and more convenient range of services, greatly reducing their entry barriers, may become a "new growth engine," helping the cryptocurrency industry reach the next peak.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。