3次美联储降息概率在今日CPI数据发布后创下历史新高

今日美国CPI数据的发布震动了加密市场。通胀率为3.0%,低于预期的3.1%,这意味着价格上涨的速度低于专家的预期。

更有趣的是,这使得2025年3次美联储降息的概率达到了历史最高点。

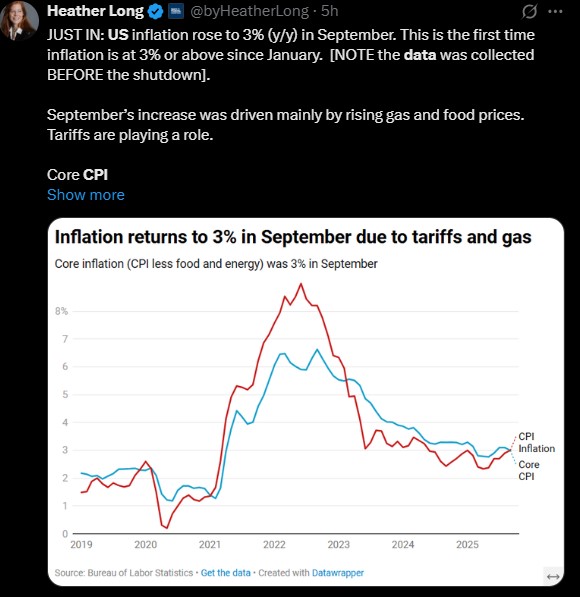

Heather Long,首席经济学家和分析师表示,这是自1月以来通胀首次保持在3%左右。价格上涨主要是由于汽油和食品,关税也增加了压力。即便如此,报告仍被称为“低于预期”。

月度价格上涨仅为0.2%,显示通胀正在放缓。因此,人们现在认为美联储可能会很快开始降息。

Kalshi数据表明2025年3次美联储降息的概率为85%

10月28日至29日的下一次美联储会议将非常重要。随着美国CPI数据降温和新增就业岗位减少,委员会面临支持经济而非维持高利率的压力。

根据美联储降息的最新消息,跟踪交易者预期的Kalshi预测市场显示,在今日CPI数据新闻发布后,2025年3次美联储降息的概率激增至85%。这意味着大多数人相信美联储将在明年降息三次以帮助经济。

由于通胀看起来稳定,关税和燃料价格仍然很高,政策利率的下降已成为当前金融界最大的新闻之一。

加密市场反应:恐惧与贪婪指数降至30

尽管华尔街对今日的CPI数据发布表示满意,但市场仍然紧张。加密恐惧与贪婪指数降至30(“恐惧”),这表明交易者仍然谨慎,不准备冒大风险。

仅有2500万美元的空头交易被平仓——这个数字很小,显示人们在数据发布前并没有进行太多押注。随着美中贸易协议谈判、关税讨论以及3次美联储降息的消息围绕着行业,交易者在等待更多的明确信息。

此外,白宫表示下个月可能没有通胀报告,这让投资者更加不确定。因此,10月的美联储会议比以往任何时候都更为重要。

比特币和以太坊在10月23日左右短暂反弹,但价格很快又下跌。专家表示,这显示出加密货币现在与全球经济新闻的紧密关联。

注意:根据我的分析,作为一名加密专家,当降息概率上升时,价格通常会上涨,因为这意味着资金成本更低和流动性增加。但由于贸易紧张局势和低交易量,人们变得谨慎。

许多投资者现在在问——为什么加密市场今天下跌,即使美联储明年可能降息?

结论2025年展望:货币宽松能否复兴风险资产?

现在通胀正在降温,3次美联储降息的概率创下历史新高,大家都想知道委员会是否会最终确认这一点。

如果他们同意开始降低利率,这可能会为股票和加密货币带来新的活力,使市场再次上涨。

但如果他们再等一段时间,我们可能会看到更多的波动。上涨的燃料价格、关税和疲弱的就业数据仍然是主要担忧。

免责声明:本文仅供一般信息参考,不构成财务建议。在投资加密市场之前,请务必自行研究(DYOR)。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。