Original Title: "Zero-Knowledge Proof Technology: Lighting up the New Star of DeFi" Original Author: LZ

1. Introduction

Decentralized Finance (DeFi) is an important development direction in the current financial innovation field. In DeFi, the concealment of transaction information and the maintenance of user privacy are crucial. With the continuous expansion and deepening of DeFi, various projects are emerging and full of vitality. The application of Zero-Knowledge Proof (ZK) technology has opened up new possibilities for privacy protection in DeFi. ZK technology allows one party to prove to another party that they know certain information without revealing any specific details about that information. The application of this technology in DeFi projects such as ZigZag, Unyfy, and OKX's ZK DEX greatly strengthens the privacy protection capabilities of DeFi, especially for the protection of transaction information. It can be foreseen that the widespread application of ZK technology will bring innovation to the way DeFi and the entire cryptocurrency field are handled, driving the future development of the entire industry and achieving significant breakthroughs.

2. Privacy Challenges in DeFi

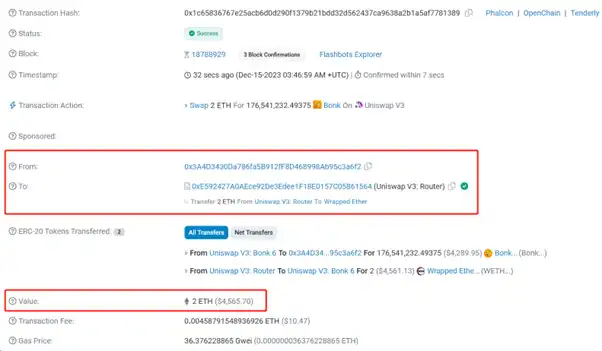

There are no secrets on the blockchain, and the transparency of data in DeFi is indisputable. For example, for a transaction on Uniswap V3, we can easily view the transaction details on the Etherscan website (as shown in Figure 1). Key information such as the sender (From), recipient (To), transaction amount (Value), and transaction fee (Transaction Fee) in these transactions are publicly accessible.

Figure 1: Transaction details publicly available on Etherscan

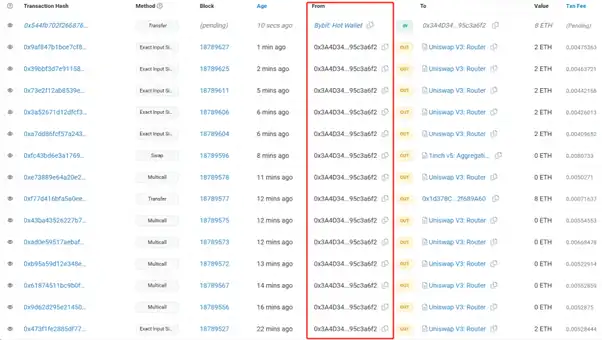

We can also view all transaction records under the address 0x3A4D…a6f2 (as shown in Figure 2), and under certain conditions, we may even be able to infer the real identity of this address in the real world.

Figure 2: All transaction lists for a specific address are publicly available on Etherscan

However, the transparency of data in DeFi may have some adverse effects. If you are a DeFi whale, each of your transactions may attract market attention. For example, when a whale withdraws 11.24 million WOO (equivalent to about 4.2 million USD) from Binance, this transaction will attract widespread attention. Similarly, any large payments or institutional-level trading activities may also attract public attention.

Other market participants may make buying and selling decisions based on these trading activities, which could have a detrimental impact on your investment strategy. For example, if you have invested a large amount of funds in a project, once your transactions are noticed by the market, other investors may follow suit, causing the asset price to rise and increasing your investment costs. In addition, your selling operations may also trigger market panic, leading to price declines and affecting your investment returns.

This situation highlights the urgent need for privacy protection for DeFi projects and users. If we do not want our transaction details to be publicly known, we can choose to keep certain information about DeFi transactions private.

ZK technology can hide transaction details while ensuring the legitimacy of transactions. Users need to submit two types of information: a transaction with partially hidden details (such as the recipient or amount) (i.e., a private transaction), and a ZK proof about these hidden details. Verifying the legitimacy of a private transaction is essentially verifying the corresponding ZK proof.

3. Unlocking the Potential of DeFi: Opportunities Brought by ZK Technology

3.1 The Role of ZK Technology in Resisting Front-Running Transactions

Suppose you are fortunate enough to learn that a large company is about to purchase a large amount of a certain asset. You may choose to purchase this asset before the company does. Then, when the company's large purchase behavior drives up the asset price, you can sell it to make a profit. In this case, your transaction ahead of the company's constitutes a front-running transaction.

Front-running transactions are an investment strategy in financial transactions, usually occurring on exchanges such as Uniswap. This is because transactions on the blockchain are public, and transaction confirmation takes a certain amount of time. Therefore, some malicious traders may use higher transaction gas fees to have their transactions confirmed by mining before others, in order to achieve front-running transactions.

Front-running transactions can cause harm to other traders because they change the original trading environment, making it difficult for other traders to carry out their transactions as planned. On the other hand, the purpose of attackers initiating front-running transactions is to profit for themselves, as they can profit before price changes occur. Therefore, many DeFi projects are also trying various ways to prevent front-running transactions from occurring.

ZK technology can play a key role in resisting front-running transactions. Below, we will use the example of a sandwich attack in a Decentralized Exchange (DEX), which is also a common type of front-running transaction, for a case analysis.

3.1.1 Case Analysis: Sandwich Attacks in DEXs

What is a Sandwich Attack?

Suppose there is a liquidity pool on a DEX with a reserve status of 100 ETH / 300,000 USDT. Alice initiates a transaction to purchase USDT, exchanging 20 ETH for USDT. When she submits the transaction, the DEX will return a result based on the current liquidity pool's reserve status, telling Alice that she can buy approximately 50,000 USDT. However, in reality, Alice only ends up with 45,714 USDT.

Here, let's first briefly understand why Alice was able to purchase 50,000 USDT with 20 ETH. The DEX uses an Automated Market Maker (AMM) model, which automatically calculates buying and selling prices using the Constant Product Market Maker algorithm (CPMM). CPMM is a widely used automatic market maker algorithm that maintains the constant product of two assets in the trading pool to provide liquidity and automatically adjust asset prices. In this example, Alice's ability to purchase USDT quantity is calculated using the formula 50,000=300,000-(100*300,000)/(100+20) (assuming no fees).

Alice did not buy the expected amount of USDT because she fell victim to a sandwich attack.

Sandwich attacks mainly occur in AMM-based DEXs. In a sandwich attack, the attacker places two transactions around the victim's regular transaction to manipulate asset prices and profit from the victim's losses. These two transactions are respectively the front-running transaction and the follow-up transaction, with the regular transaction in between.

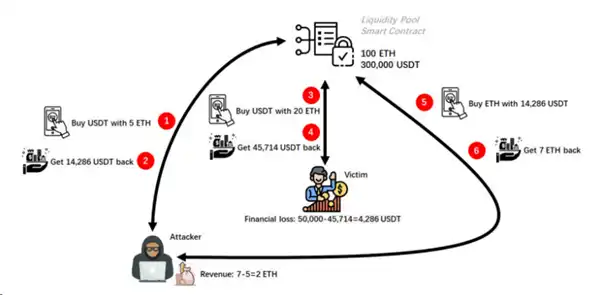

So, how exactly did Alice fall victim to a sandwich attack? As shown in Figure 3.

Figure 3: Sandwich attack process

Attacker's front-running transaction: Before Alice's purchase of USDT transaction is executed, the attacker also initiated a transaction to purchase USDT (front-running transaction) using 5 ETH. Moreover, the attacker paid a higher gas fee to the miner for this transaction than Alice, so the attacker's transaction will be executed before Alice's.

After the attacker's transaction to purchase USDT was executed, they received approximately 14,286 USDT from the liquidity pool, where 14,286≈300,000-(100*300,000)/(100+5). The reserve of the liquidity pool changed from the initial state of 100 ETH / 300,000 USDT to 105 ETH / 285,714 USDT. However, during the time from when Alice submitted her transaction to when it was executed, she was unaware of the change in the reserve status of the liquidity pool.

The victim's regular transaction: Subsequently, Alice's regular transaction began to execute.

After Alice's transaction to purchase USDT was executed, she received 45,714 USDT from the liquidity pool (based on the constant product function, 45,714≈285,714-(105*285,714)/(105+20)). The reserve of the liquidity pool changed from 105 ETH / 285,714 USDT to 125 ETH / 240,000 USDT. Therefore, Alice should have been able to buy 50,000 USDT with 20 ETH, but due to the changes in the liquidity pool caused by the attacker's transaction, she could only buy 45,714 USDT. Alice incurred a loss of approximately 4,286 USDT (4,286=50,000-45,714).

The attacker's follow-up transaction: Finally, the attacker initiated another transaction (follow-up transaction), exchanging 14,286 USDT for ETH (this 14,286 USDT was just purchased).

After the attacker's follow-up transaction was executed, they received 7 ETH from the liquidity pool (based on the constant product function, 7≈125-(125*240,000)/(240,000+14,286)). The reserve of the liquidity pool changed from 125 ETH / 240,000 USDT to 118 ETH / 254,286 USDT. Therefore, the attacker initially spent only 5 ETH, but ended up with 7 ETH, resulting in a profit of 2 ETH (2=7-5).

Throughout the entire process of the sandwich attack, the attacker initiated a total of two transactions, the front-running transaction and the follow-up transaction. The front-running transaction caused Alice to incur a loss of approximately 4,286 USDT. The combination of the front-running and follow-up transactions resulted in a profit of 2 ETH for the attacker.

In DEXs, the public nature of transactions is a key factor leading to the occurrence of sandwich attacks, especially in AMM protocols. These protocols make real-time transaction information on DEXs publicly available, providing attackers with the potential to conduct sandwich attacks by observing and analyzing transaction flows to find opportunities.

3.1.2 ZK Technology Can Resist Sandwich Attacks

The application of ZK technology can significantly reduce the likelihood of being affected by sandwich attacks. By using ZK technology to hide transaction volume, asset types, user or liquidity pool balances, user identities, transaction instructions, and other protocol-related information, the privacy of transaction data can be effectively enhanced. As a result, attackers find it difficult to obtain complete transaction information, making the implementation of sandwich attacks more challenging.

Furthermore, ZK technology not only helps resist sandwich attacks, but privacy transactions based on ZK can also increase the difficulty of judging user behavior patterns. Any third party attempting to analyze account transaction history, infer behavior patterns, explore active periods, transaction frequencies, or preferences through collecting blockchain data will face challenges. This analysis, known as behavior model inference, not only violates user privacy but also paves the way for honey pot attacks and phishing scams.

3.2 Preventing Liquidity Manipulation Based on ZK Technology

Liquidity manipulation and front-running transactions are both attack methods in DeFi, both involving using market information and transaction speed to gain benefits, but their specific strategies and operations are different.

Front-running transactions use information advantages, while liquidity manipulation uses market activity to mislead other traders. The former mainly profits by obtaining and using undisclosed important information, while the latter misleads other investors by creating false market activity, leading them to make unfavorable trading decisions.

ZK technology not only plays a key role in resisting front-running transactions, but it can also help prevent liquidity manipulation.

3.2.1 Case Analysis: Using Oracles for Liquidity Manipulation

Imagine you are buying apples in a busy fruit market. The market price usually fluctuates based on changes in supply and demand. You typically observe the price for a period of time and then decide whether to buy based on the average price. Now imagine a very wealthy buyer enters the market and is very eager to buy apples. They start buying a large quantity of apples, regardless of the price. This causes a short-term surge in the price of apples. If you still buy apples at this price, you may end up paying more than their actual value.

This example helps better understand the operation of the Time-Weighted Average Price (TWAP) oracle and the concept of liquidity manipulation. The behavior of deciding to buy apples based on the average price is similar to the operation of the TWAP oracle, and the wealthy buyer's large purchase of apples causing a price increase is similar to liquidity manipulation.

The TWAP oracle determines asset prices by calculating the average transaction price over a period of time. The closer the transaction is to the present, the greater its impact on the average price. If someone makes a large number of transactions or trades with a large amount of funds in the short term, it can significantly impact the average price of the asset, which is liquidity manipulation. Liquidity manipulation artificially raises or lowers asset prices, leading to inaccurate price information. If someone intentionally tries to raise asset prices using the TWAP oracle, they can make a large purchase of the asset with a large amount of funds in a short period, causing a temporary price increase. If there is a significant increase in the asset price within this time window, the TWAP oracle may consider this higher price as the asset price.

Implementing liquidity manipulation on the TWAP oracle can have a significant impact on DeFi protocols, especially for low-liquidity emerging tokens. These DeFi protocols typically make financial decisions based on asset prices, such as liquidation, borrowing, etc. If price information is inaccurate or unreliable, it can lead to incorrect decisions and result in losses for users. Therefore, preventing the TWAP oracle from being manipulated is crucial.

3.2.2 ZK Technology Can Resist Liquidity Manipulation

ZK-based technology can resist liquidity manipulation in the TWAP oracle. A smart contract can be designed to depend on the TWAP oracle to obtain asset prices. If an attacker engages in liquidity manipulation, the price obtained from the TWAP oracle may exceed the predetermined acceptable range. In this case, the contract will temporarily suspend its operation. Then, it will recalculate and confirm asset prices based on ZK technology.

To calculate asset prices using ZK technology, a wrapping contract needs to be added to the TWAP oracle. This contract can directly access N price reports or record N checkpoint values at any interval. Once N data points are available within a given interval, a ZK proof can be constructed to prove the median of the unsorted array of prices. The process of calculating asset prices based on ZK technology is as follows:

A matrix A of size N x N exists, such that when this matrix is multiplied by the column vector x, it produces the column vector y, such that y=Ax. A is a reversible permutation matrix, but it is not necessarily unique due to the possibility of duplicate price values, and A only contains binary values.

The values in y are ordered, i.e., { yi≤yi+1 ∀ i ∈ 0…N-1 }. Once again, it cannot be used because there may be duplicate price values.

The public output m of the circuit is the median value of y. The proof shows that y⌊N/2⌋=m, where N is a static value at the time of circuit compilation and must be odd.

Based on the above process, ZK technology outputs a tamper-resistant median value m. The median value m can to some extent prevent liquidity manipulation. To achieve this, we need to limit the values of y, so that in each block, the value of y is only inserted once, or the number of insertions is within an acceptable range.

3.3 Empowering Lending Platforms with ZK Technology

As mentioned above, ZK technology can resist front-running transactions and liquidity manipulation in DEXs. Can we further explore the potential application of ZK technology in other DeFi scenarios? For example, in lending, an important component of DeFi projects, ZK technology can also play a crucial role.

3.3.1 Key to Lending: How to Evaluate Borrower Credit

On traditional lending platforms, the loan application process usually covers five steps: application, credit assessment, loan approval, loan disbursement, and repayment. Among these, credit assessment is particularly important, as borrowers must prove their income meets the requirements and demonstrate the ability to repay the loan. During the assessment process, the platform conducts a thorough investigation of the borrower's credit history, including income, debt, and past repayment records, to ensure their ability to repay the loan. Only on this basis will the platform consider approving the loan application.

However, when you turn to DeFi lending platforms like Aave or Compound, the situation is different. Most DeFi lending platforms, due to their decentralized nature, lack traditional bank KYC (Know Your Customer) procedures and risk assessment processes, and cannot investigate the credit status of borrowers through credit bureaus. In this case, you may wonder, how will my credit be evaluated?

On DeFi lending platforms, you can prove your credit level through reputation tokens. Reputation tokens are a credit system based on blockchain technology, using digital tokens to represent and quantify a user's reputation. The quantity of reputation tokens becomes an important indicator for evaluating a user's reputation. The more tokens a user has, the better their reputation, and their credit rating increases accordingly, potentially allowing them to obtain a larger loan amount on DeFi lending platforms.

However, the generation of reputation tokens relies on a user's transaction history and financial information, which may infringe on user privacy.

3.3.2 Evaluating Borrower Credit: Reputation Tokens Based on ZK Technology

ZK technology can protect user privacy. The combination of ZK technology and reputation tokens can maintain and track a user's reputation in the network while protecting their privacy.

Users can use ZK technology to generate reputation tokens without disclosing their transaction history. On one hand, users can generate proofs of their transaction history based on ZK technology; on the other hand, a smart contract (commonly referred to as a reputation token generation contract) verifies this proof, and upon successful verification, reputation tokens are generated.

Additionally, on some DeFi lending platforms that require over-collateralization, reputation tokens can lower the collateral requirements, addressing the issue of excessive collateral and increasing market liquidity. The application of reputation tokens based on ZK technology is not limited to DeFi lending platforms and can also be widely used in insurance, medical assistance, and other fields.

4. Conclusion and Outlook

This article explores various applications of ZK technology in DeFi for privacy protection, particularly in resisting front-running transactions, liquidity manipulation, and lending. In the process of exploring DeFi, we face multiple challenges, especially those related to privacy and security. Privacy challenges in the DeFi ecosystem are a key issue, and ZK technology provides a unique solution that not only enhances privacy protection but also improves transaction efficiency and security. If you want to introduce ZK technology to your DApp, feel free to contact Salus.

Looking ahead, ZK technology may find further applications in deeper DeFi domains such as liquidity staking, derivative protocols, real-world assets, insurance, and more. Salus is dedicated to researching and exploring the application of ZK technology in DeFi and other Ethereum application layer projects. We invite blockchain researchers, technical developers, and all professionals in the web3 field worldwide to work together with us to promote the deep development and widespread application of ZK technology, driving the development of DeFi and the entire industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。