As a decentralized protocol, LandX connects landowners with native crypto investors through a blockchain-based perpetual commodity treasury.

Authored by: Revelo Intel

Translated by: DeepTechFlow

LandX is currently running on the Ethereum mainnet and Arbitrum, aiming to bring real-world agricultural assets into the decentralized finance (DeFi) space, providing a way for DeFi users to access the agricultural sector. Funds deposited are used to support real farmers, and returns are given to users in the form of commodity valuation.

In addition, LandX's token LNDX has recently been launched. In the context of RWA narrative, is LNDX a project worth participating in?

LandX Background

LandX Finance is a blockchain protocol designed to bring real-world assets (RWA) into the decentralized finance (DeFi) world through a perpetual commodity treasury.

By introducing agricultural RWA on-chain, the protocol can provide investment opportunities for investors and expose them to asset categories unrelated to DeFi and cryptocurrencies.

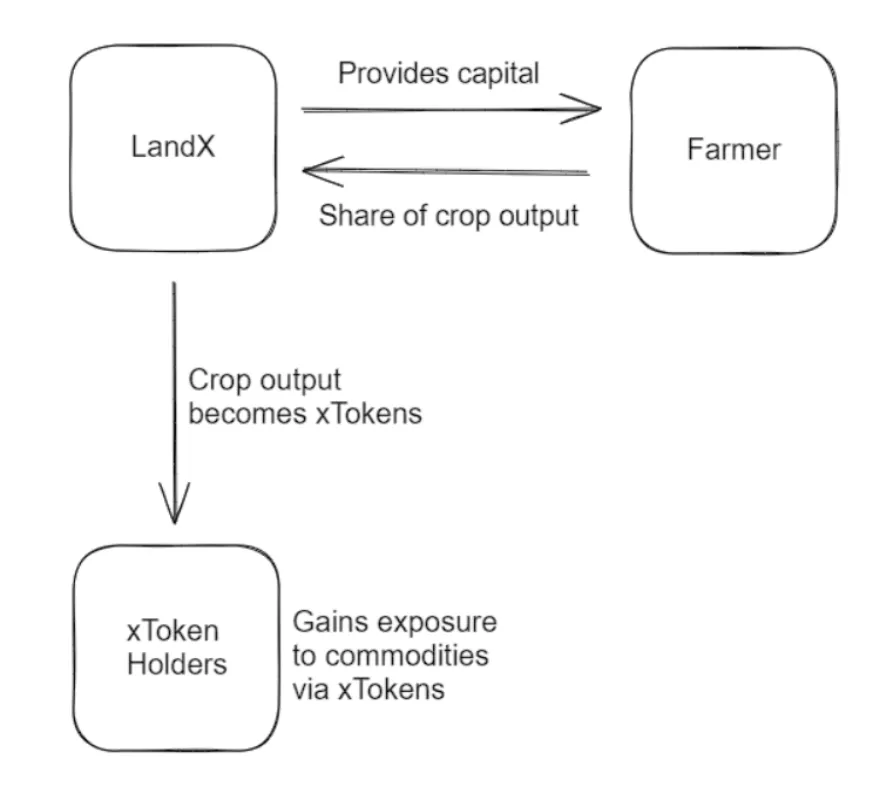

As a decentralized protocol, LandX connects landowners with native crypto investors through a blockchain-based perpetual commodity treasury, making it possible to generate real yields entirely on-chain.

Farmers can raise funds from the DeFi ecosystem to pay regular crop shares as returns, and these crop share payment obligations are tokenized in the form of ERC-20 tokens and represented on-chain as xTokens.

LandX's platform focuses on four crops: corn, wheat, rice, and soybeans.

$xBasket is an index token that holders can equally divide into 4 portions to invest in all 4 crops.

LandX Operation

LandX introduces a new way to utilize farmland through tokens and NFTs.

On one hand, NFTs are used to represent legal and economic contracts backed by farmland, ensuring a reliable and secure coordination system between parties.

On the other hand, after extensive qualification review, farmers commit to a certain percentage of annual harvests through a legal contract (referred to as retention rights).

In return, they receive xTokens equivalent to the agreed-upon crop shares. These tokens are then sold to interested investors, providing upfront capital for farmers.

To hedge potential uncertainties, LandX requires farmers to retain 12 months of crop share payments and a 12-month deposit on the platform.

Additionally, the protocol ensures independent legal agreements give LandX the right to ownership of collateral (farmland) in the event of unpaid loans.

Perpetual Commodity Treasury

The LandX protocol facilitates agreements between borrowers (farmers) and investors through a tokenized perpetual commodity treasury based on blockchain.

This enables investors to obtain returns guaranteed by legal contracts backed by underlying farmland.

The perpetual commodity treasury trades at market-determined principal prices and provides permanent daily commodity-based returns for token holders.

These products are traded through an internal market that utilizes Chainlink Oracle data services to update product prices.

This means they can be exchanged into stablecoins such as $USDC with zero slippage 24/7.

xTokens and cTokens

xToken is a perpetual commodity treasury that pays the annual returns of 1 cToken, providing a stable source of income for investors.

- xTokens are tradable on the open market.

One of the main benefits of xTokens is their ability to hedge against inflation. This is achieved by providing exposure to farmland crop output, historically considered a reliable inflation hedge tool.

cTokens are on-chain commodities representing 1 kilogram of the underlying product, providing tangible ownership of physical assets.

cTokens can be exchanged into $USDC within the LandX dApp. They are not tradable on the open market.

cTokens can be exchanged based on the market value of the underlying commodity.

LandX Launch

LandX launched yesterday and quickly attracted funds. At launch, it provided $2 million of xTokens/USDC liquidity.

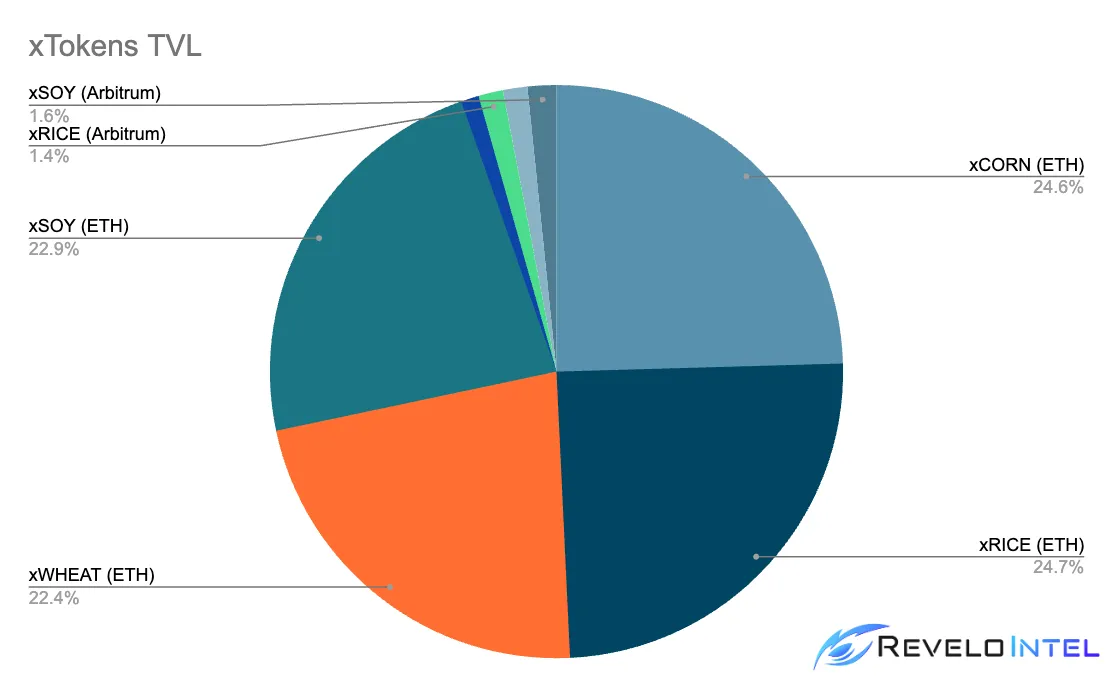

The project is available on the Ethereum mainnet and Arbitrum at launch, with $ETH occupying the majority of the protocol's TVL.

xBasket is usable on the Ethereum mainnet, with a TVL of approximately $412,000.

LNDX Token Economics

LNDX is the native governance token of LandX.

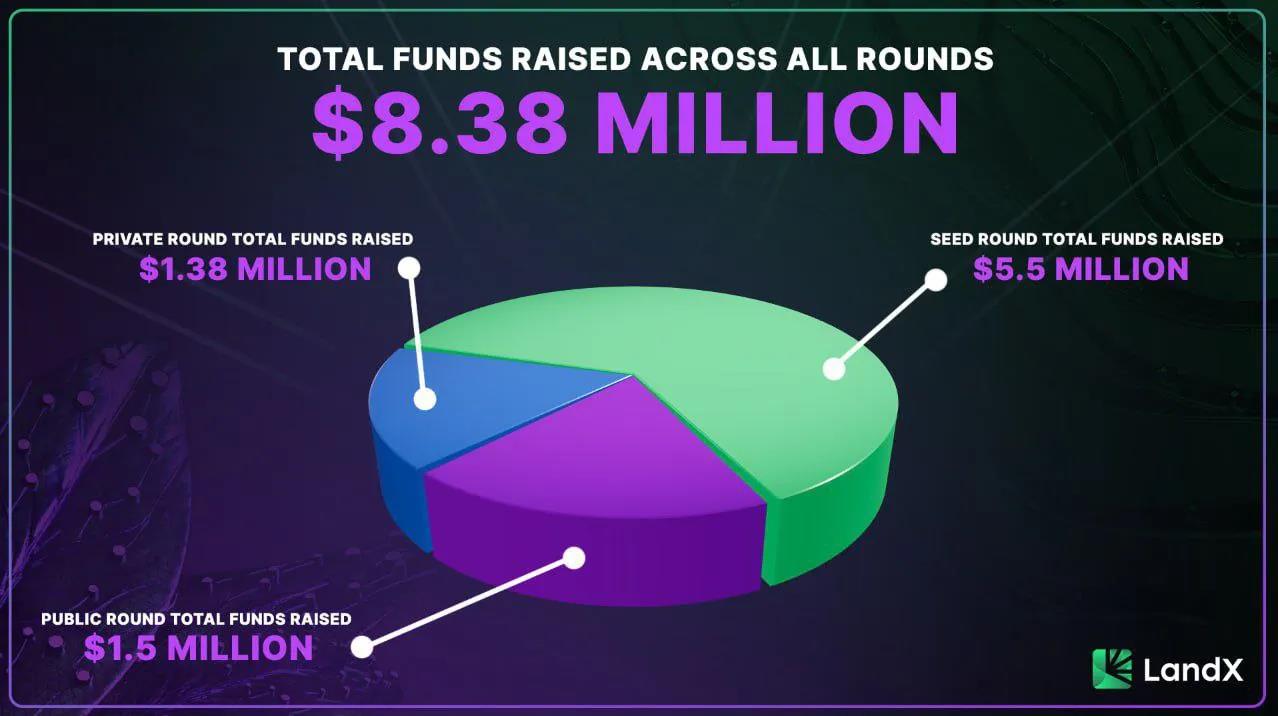

The project raised approximately $8.3 million in total:

It allows users to receive representative tokens called veLDNX, which earn a certain percentage of protocol revenue and allow holders to participate in governance.

LandX charges a 3% fee for land financing and a 0.25% fee for regular crop share payments. The allocation of these fees is as follows:

60% goes to $LNDX holders

35% goes to LandX Lab operations

5% goes to LandX Choice Fund, used to support regenerative agriculture initiatives, land steward education, and other practices

In addition to DAO voting rights, $LNDX holders also have the potential to become validators for LandX. Validators are responsible for bringing new farmers into the protocol and ensuring the platform's smooth operation.

Future Plans

Currently, the core team is executing plans and making decisions. As TVL increases, the organization will undergo corporatization and introduce a board of directors to become more decentralized. Governance will become increasingly important as the protocol develops.

LandX will fly drones over its land, allowing users to view the fields at harvest time, providing assurance for xToken holders.

LandX founder 0xLandWalker stated that the most difficult decision made was to limit the platform's offerings to only wheat, rice, soybeans, and corn.

The team welcomes others to fork the protocol and expand the types of crops offered, but LandX will focus on their 4 main commodities and provide financing in these areas.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。