Currently, Optimistic Rollups still occupy the largest market share, and the growth and development of zk-Rollups also need time to validate.

Author: MIIX Capital

Introduction

The Gas Fee issue and its limited TPS are the biggest problems affecting the widespread adoption and large-scale implementation of public chains, thus giving rise to Layer2 scaling solutions. Layer2 technology has gone through the development process of state channels, Plasma, and Rollups, with each technological transition representing an iteration and improvement over the previous generation of technology.

Due to the insufficient scalability of OP and the long exit period, the latest roadmap for ETH is centered around the upgrade path with ZK Rollup as the core, including Optimism, which currently uses OP technology, actively exploring the OP+ZK hybrid proof solution. However, as of now, Optimistic Rollups still occupy the largest market share, and the growth and development of zk-Rollups also need time to validate.

1. Overview of Layer2 Competition

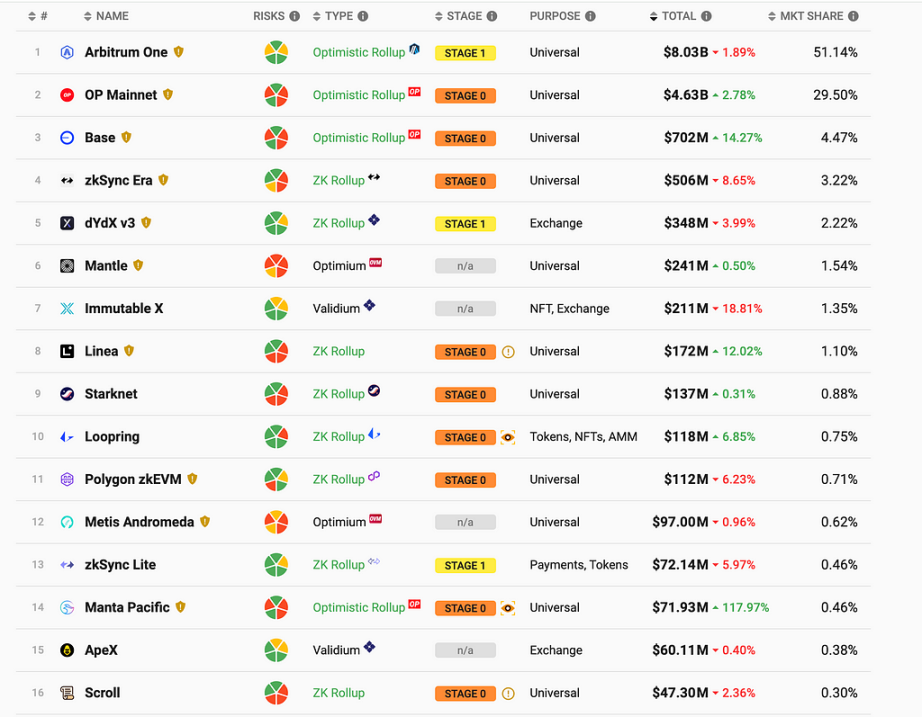

Looking at the Layer2 competition, the competition is currently very fierce. The following are the rankings of the mainnet projects based on TVL:

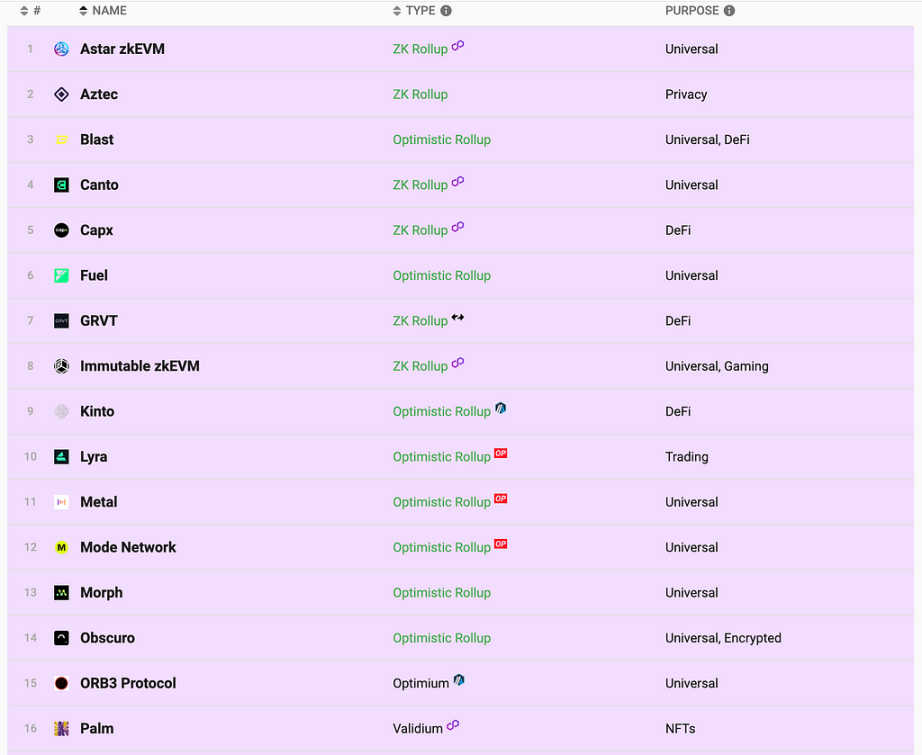

The following are the Layer2 projects in the testing phase:

From the data, among the mainnet Layer2 projects, OP technology still occupies the majority of TVL, mainly due to the good user experience and high TPS of OP technology, allowing this type of Layer2 to firmly occupy the first-mover advantage in the ecosystem.

2. Optimistic Rollups and zk-Rollups

2.1 Optimistic Rollups

Optimistic Rollups are a second-layer scaling solution based on optimistic verification, assuming that the submitted blocks are correct unless challenged. It also requires the Rollup Operator to aggregate many off-chain transactions into a batch, then calculate the new state (such as balances, contract states, etc.) generated by the batch transactions and generate an off-chain state update. This default state is considered correct and does not require additional verification. However, after the state update is submitted, there is a fixed challenge period during which anyone can challenge the validity of the submitted state update by providing evidence of fraud. The entire transaction related to the challenged state will be verified through EVM execution. If the state update is proven to be incorrect, the submitter will be penalized (deducting the deposit), and the on-chain state will roll back to the correct state. If no one challenges the state update during the challenge period, or if the challenge is proven to be incorrect, the on-chain state will be updated according to the submitted state update.

2.2 ZK-Rollups

ZK-Rollups are a second-layer scaling solution based on zero-knowledge proofs. First, the Rollup Operator aggregates multiple off-chain transactions into a batch, then uses zero-knowledge proofs (such as zk-SNARKs or zk-STARKs) to generate a concise proof file that can verify the validity of the entire batch of transactions without the need to individually check each transaction. The proof and related data are then submitted to the main chain, and after the main chain verifies the correctness of the proof, it ensures that the transactions are valid. Once the main chain verification is successful, the on-chain contracts will update the on-chain state based on the data in the proof. This means that even though the transactions are conducted off-chain, the on-chain state is still updated, ensuring data consistency.

Note: Zero-knowledge proof (ZKP) is a cryptographic concept that allows a prover to prove the truth of a statement to a verifier without revealing any other information about the statement. In short, zero-knowledge proofs allow a person to prove possession of certain information without revealing the information itself.

2.3 Comparison Analysis of ZK and OP

ZK and OP each have their own characteristics. I have analyzed them from the following 5 different perspectives for your reference:

Verification Method:

- OP verifies transactions through fraud proofs, assuming transactions are valid by default unless someone submits evidence proving a transaction is invalid. This requires continuous monitoring by off-chain users and nodes to ensure that the Rollup Operator is not malicious.

- ZK verifies transactions through zero-knowledge proofs (such as zk-SNARKs or zk-STARKs), generating a concise proof to ensure the validity of the batch of transactions without the need to individually check each transaction.

Security:

- OP defaults to assuming transactions are valid, which may pose certain security risks, requiring active monitoring of transactions by off-chain users and nodes to ensure security.

- ZK's verification method based on zero-knowledge proofs provides higher security because it requires generating a proof to ensure transaction validity.

Throughput and Performance:

- OP has a faster off-chain transaction processing speed, but on-chain verification may take longer due to the challenge period for fraud proofs.

- ZK's generation of zero-knowledge proofs requires certain computational resources, but on-chain verification is faster. Once the proof is generated, the main chain can quickly verify it.

Generality:

- OP is fully compatible with EVM, allowing numerous DApps to migrate directly, with low computational complexity, suitable for general smart contract execution and complex calculations.

- ZK technology is still in development, and its current applications in general smart contracts and complex calculations are somewhat limited.

Cost:

- OP has lower off-chain transaction costs.

- ZK's generation of zero-knowledge proofs requires certain computational resources, which may result in higher off-chain transaction costs.

Overall, Optimistic Rollups and zk-Rollups each have their own advantages and disadvantages. Optimistic Rollups are more suitable for handling complex smart contract scenarios and have good Ethereum compatibility, while zk-Rollups have advantages in security and privacy protection. Although there is a trend for Ethereum to develop scaling around ZK technology due to the inherent drawbacks of OP technology, technological iterations do not happen overnight. Layer2 based on OP technology is also researching OP+ZK hybrid proof technology, and it is still uncertain who will dominate the future, OP or ZK.

3. Layer2 Track Data Analysis

ZK or OP has always been the focus of discussion or debate, but ultimately, it depends on the market's choice. Below, we will look at the detailed status of the Layer2 track from the dimensions of transaction volume, TVL, TPS, and other data.

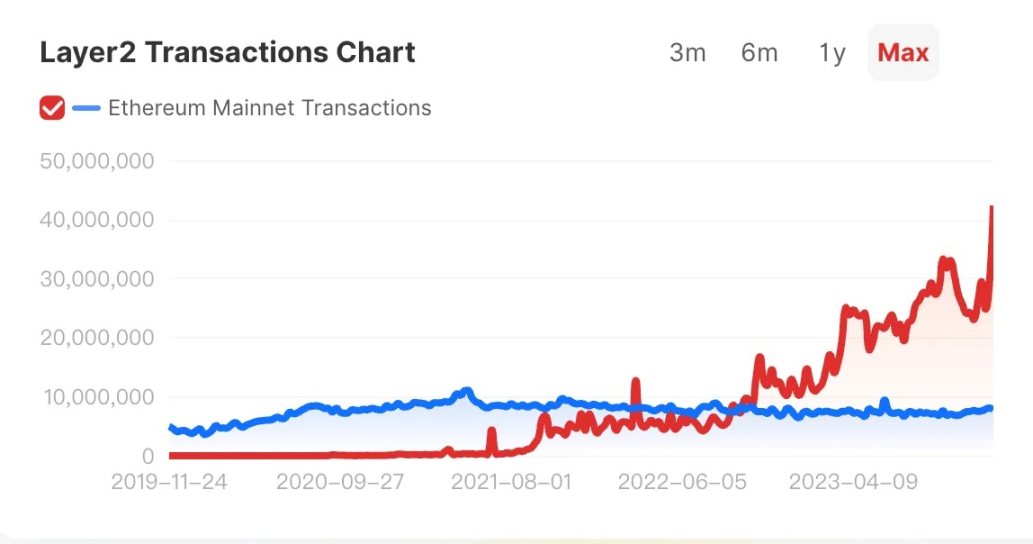

3.1 Layer2 On-chain Transaction Volume Far Exceeds Mainnet

The total daily transaction volume of Layer2 has far exceeded the Ethereum mainnet, and it is expected that this trend will continue with the continuous development of Layer2, especially after the Dencun upgrade. In the future, Ethereum transactions will be divided into traditional transaction calldata storage and Rollup transaction blob storage, with EIP-4844 expected to increase Rollup's overall scalability by 3-5 times. The author predicts that as the Dencun upgrade approaches, the ETH/BTC exchange rate will also rise, making it worth paying attention to the changes in Layer2 on-chain data.

3.2 TVL and Market Share

In terms of TVL, Arbitrum steadily occupies about 50% of the market share, and at its peak, it can occupy around 65% of the market share. The second and third places are OP and Base, both of which are OP technology Rollups.

Although Arbitrum's TVL reached a historical high of $8.48 billion on December 9, 2023, its market share has been declining, mainly due to the strong rise of OP and the dilution from the launch of multiple Layer2 mainnets. OP's circulating market value of $2 billion also exceeds Arbitrum's circulating market value of $1.3 billion, and in terms of total market value, OP is only about $1 billion less than ARB. The market's optimism about OP's future is higher than Arbitrum's, leading to slightly higher pricing.

Base's TVL has recently increased, mainly due to the Seamless Protocol of the Base chain, with Coinbase announcing the listing of the Base ecosystem lending protocol governance token SEAM. SEAM will be the first and currently the only native project token in the Base ecosystem traded on Coinbase. As a result, a large number of users have shown interest in the Base chain's project interaction airdrop.

3.3 Profit and Trend Analysis of Layer2

In the past three months, compared to other projects, Linea has generated more Gas, mainly because Linea's technology is still in the iterative process, and the overall Gas Fee is not ideal. Looking at the peak, zkSync Era contributed more Gas, mainly from the expected interaction airdrop.

The overall profit model of Layer2 is not clear at the moment, as it is difficult to charge users for additional fees as a public infrastructure. Therefore, Layer2 mainly relies on financing and token issuance for development and operation.

Comparing the issued tokens and Ethereum prices: OP appears stronger compared to Ethereum and other Layer2 projects. The author believes this is mainly due to its more complete narrative (OP+ZK and OP Stack) and more capital support, leading to higher market expectations and a broader estimated upside potential. As the Dencun upgrade enters the countdown, both OP and the leading native token projects are receiving high market attention.

2.4 Latest TPS Data Comparison

Due to the hot market for on-chain transactions, the real-time TPS of various Layer2 projects has repeatedly reached new highs. The maximum TPS of zkSync Era has risen to 62, with Arbitrum ranking second at 58. However, Base and OP did not benefit from this on-chain market, and their TPS did not have new data. However, the current magnitude of TPS is still unable to handle the simultaneous interaction of tens of millions of users in the future, and Layer3 may be a solution that must be faced in the future.

2.5 Comparison and Analysis of Top Projects

From Active Addresses:

In the past three months, the total number of active addresses in zksync Era has remained relatively stable, with an average of around 200,000 active addresses per day. Arbitrum and OP, on the other hand, have maintained around 150,000 and 60,000 active addresses per day, respectively. We can see that Arbitrum's ecosystem stickiness is significantly higher than OP's, but the market's pricing of ARB is lower than OP's, mainly because:

- OP Stack has a large amount of capital and developer support.

- As an Ethereum officially supported Layer2, OP will transition to OP+ZK hybrid proof in the future.

From Transaction Volume and TVL:

Arbitrum is far ahead in terms of data, with zkSync ranking second. Additionally, StarkNet has seen a significant increase in new users this month due to the official confirmation of the airdrop snapshot. The author speculates that ZK-based zkSync and StarkNet may announce airdrop details at the end of this year or in Q1 of next year. Based on historical experience, Rollups during the airdrop period will see a short-term significant increase in TVL for projects within the ecosystem that have already issued tokens, with a high probability of a price increase.

- Layer2 Track Ecological Research

In the Top 10 market share, Op Rollups' Optimism and Arbitrum occupy over 80% of the share, while Zk Rollups are slightly lacking. However, as an important component of the Layer2 ecosystem and a highly anticipated potential solution, Zk Rollups and Op Rollups are developing and learning from each other in the competition. Below, we will choose Arbitrum, Optimism, Base, zkSync, StarkNet, and Linea for detailed analysis.

4.1 Arbitrum Ecosystem

As a Layer 2 scaling solution, Arbitrum uses Optimistic Rollups to increase throughput and reduce Gas Fees. It achieves this by bundling multiple transactions into a batch and then submitting them to the Ethereum mainnet. Arbitrum is compatible with Ethereum smart contracts, which means it can be used with existing dApps and DeFi protocols.

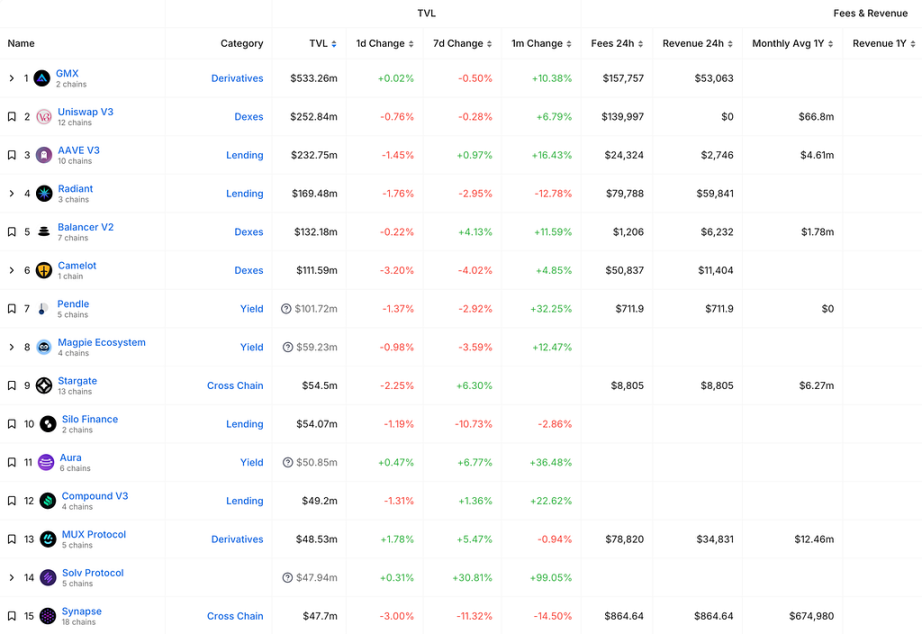

Currently, Arbitrum's ecosystem quality is higher than other Layer2 solutions, with a more extensive native ecosystem. Due to Arbitrum's leadership and experience in the hot Layer2 market, native projects within the Arbitrum ecosystem are more well-known (such as Radiant Capital, GMX, Camelot, Treasure DAO). In terms of daily active users, Arbitrum has the highest user stickiness among Layer2 solutions, excluding airdrop expectations. Next, we will explore the development status of the native ecosystems of various Layer2 solutions, especially those that have not issued tokens.

GMX

In the DEFI category of the Arbitrum ecosystem, it includes GMX, Radiant Capital, and Camelot. However, Arbitrum's DeFi ecosystem is more unique, with many DeFi projects built on the GMX liquidity pool.

Recently, GMX's overall transaction volume has rebounded with the overall market increase, and its token price has shown a positive correlation. With the integration of GMX by the OKX wallet to enable 50x leverage trading, it is expected that if the market continues to rise, it may lead to an increase in on-chain transaction volume for GMX and subsequently promote organic growth in GMX token value.

Treasure Dao

Treasure Dao is a non-DeFi project within the Arbitrum ecosystem, focusing on lightweight casual games with creativity and playability.

Due to the high capital requirements for industrial production capacity in 3A games, the author believes that lightweight creative games are likely to be the key to breaking through in competition with traditional Web2 games. They can quickly iterate to find the best economic model and provide users with immediate fun, rather than heavy upgrades and gold farming, which are often unsustainable.

4.2 Optimism Ecosystem

Optimism also uses optimistic Rollups technology to increase throughput and reduce Gas Fees as a Layer2 scaling solution. It is the first to provide Ethereum security guarantees to a large number of users bridging funds from L1 without paying high gas fees. It aims to be compatible with Ethereum smart contracts and supports the Ethereum Virtual Machine (EVM). Optimism also provides a feature called "fraud proof," allowing users to challenge invalid transactions.

Due to the weak innovation capability of the native ecosystem within OP, compared to Arbitrum, the OP ecosystem is slightly weaker, and the market has not seen a large number of native projects within the OP ecosystem. However, it has made significant progress in infrastructure development, such as modular codebase OP Stack and OP+ZK hybrid proof, with strong support and promotion from capital. Currently, the native projects with issued tokens within OP are mainly Velodrome, while others are non-native projects with average ecosystem development.

4.3 Base Ecosystem

Base is a Layer2 network created by the $200 billion crypto giant Coinbase, primarily using Optimistic Rollup developed on the Ethereum network using OP Stack technology. Its network node providers include Blockdaemon, QuickNode, Blast, Safe Wallet, block explorers Etherscan and Blockscout, as well as data indexers The Graph and Covalent. Base has a large number of native projects, including Aerodrome developed by Velodrome, Seamless Protocol, friend.tech, which have become leading projects within Base.

Seamless

Currently, Seamless has issued tokens, and users can stake tokens such as Aerodrome and Friend.tech for expected returns. Seamless does not have unique innovative features, but its token listing on Coinbase has attracted attention to native projects within the ecosystem.

Friend.tech

Frien.tech provides the opportunity to directly communicate with KOLs by buying and selling KOL tokens, but this mechanism has proven to be unsustainable.

Fren Pet

Fren Pet is a pixel-level game based on nurturing, operating on various token economics. As a Web3 game, Fren Pet also focuses more on token economics and overlooks the enjoyment of the game itself.

4.4 zkSync Ecosystem

zkSync is a Layer2 scaling solution that uses zero-knowledge proofs to increase throughput and reduce Gas Fees. It is designed to be compatible with Ethereum smart contracts and supports the Ethereum Virtual Machine (EVM). zkSync also provides a feature called "zkPorter," allowing users to aggregate transactions and further reduce Gas Fees.

Unlike other ecosystems where DEX forms a strong Matthew effect, the competition on zkSync's DEX is particularly fierce. Currently, there is no prominent presence of lending businesses, so many developers and VCs are betting on the zkSync ecosystem.

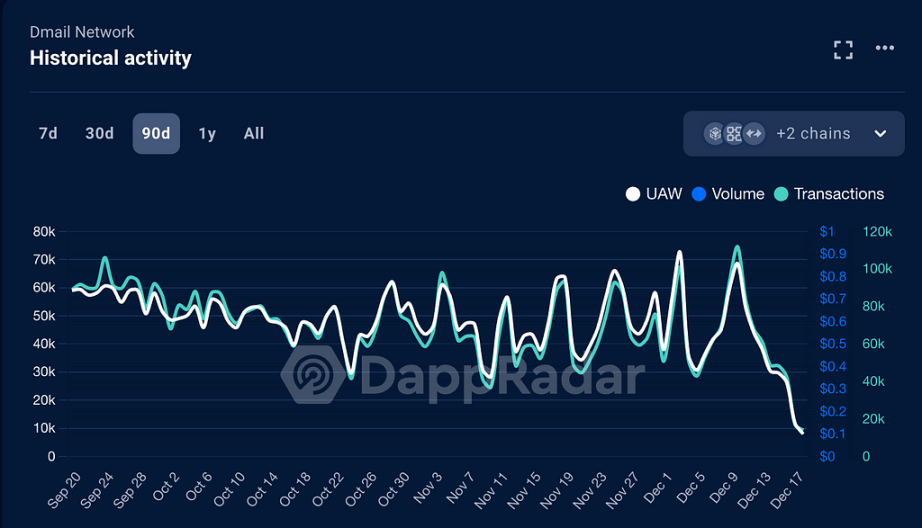

Dmail Network

Dmail Network is an email-related application on zkSync, which once won the first prize at an ETH hackathon. Currently, the main user activity (UAW) of Dmail Network is driven by the interaction brought by airdrop expectations.

Tevaera

Tevaera is a game platform similar to Treasure Dao on Arbitrum, but its game quality is poor, and it is still in the development stage and requires continuous attention.

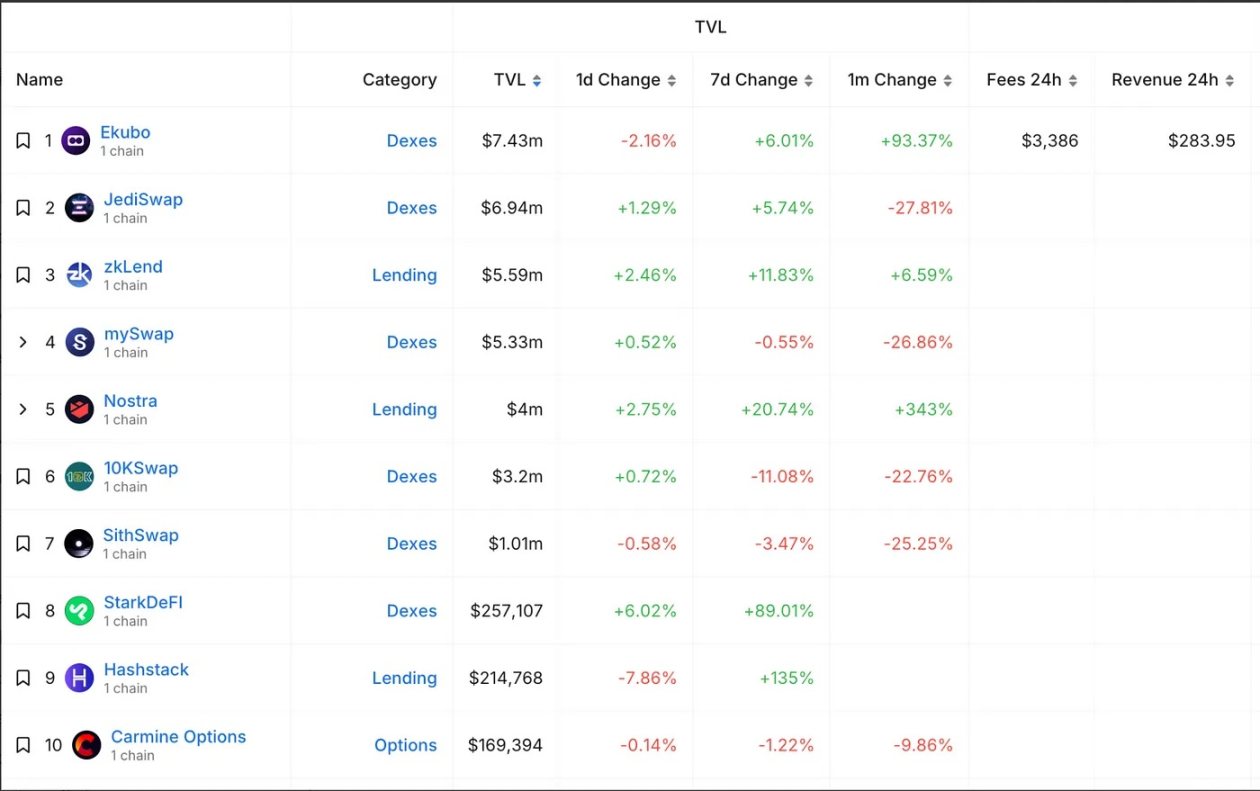

4.5 StarkNet Ecosystem

StarkNet is a Layer2 scaling solution that uses zk-rollups to increase throughput and reduce gas fees. It is designed to be compatible with Ethereum smart contracts and supports the Ethereum Virtual Machine (EVM). StarkNet also provides a feature called "validium," allowing users to execute more complex computations off-chain.

Due to technical limitations, StarkNet's TPS is restricted, and gas fees are relatively high, leading to lagging ecosystem development. However, benefiting from the development environment within StarkNet, many innovative projects are being incubated:

- StarkWare, the first to propose vertically scaling the Ethereum mainnet using recursive technology, and introduced Layer3;

- Decentralized sorter Madara;

- Dynamically upgradable NFT standard StarkSheet;

- Ekubo, the first to propose a landing solution for Uniswap V4 hooks (currently helping Uniswap improve the V4 version);

- Full-chain games and a full-chain game engine.

The lack of user interaction experience significantly increases the barrier to entry for speculative users, making it a key opportunity ecosystem for industry builders to explore early in the wilderness.

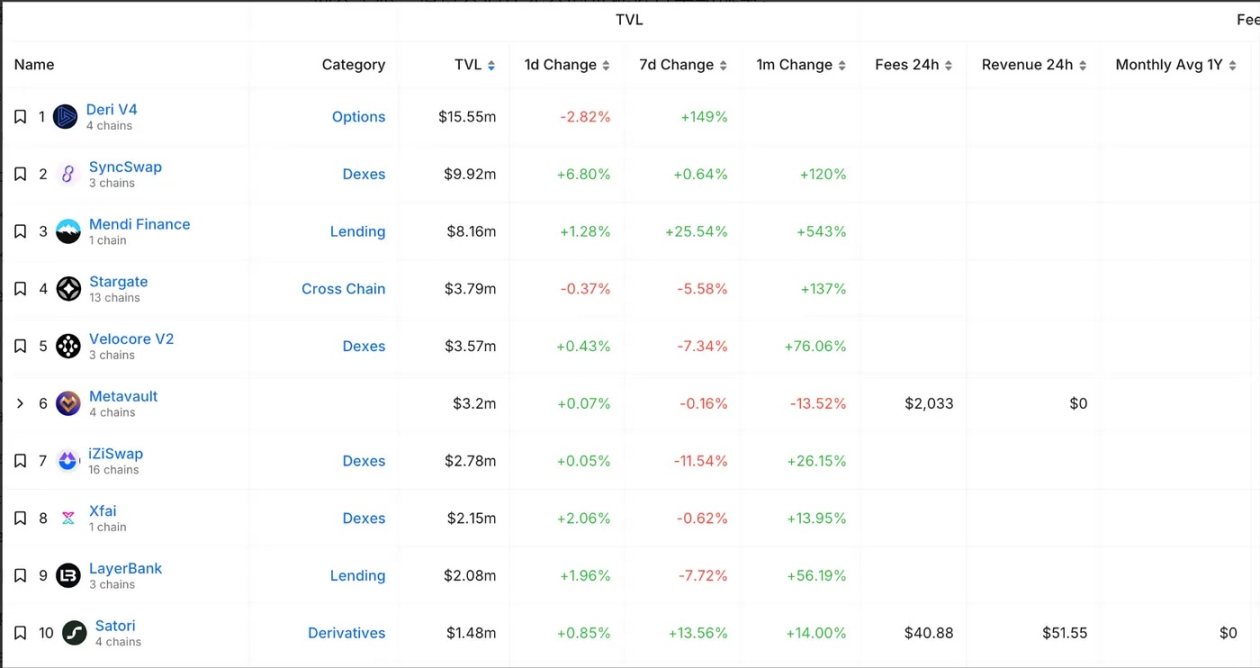

4.6 Linea Ecosystem

Linea is a Layer2 scaling solution that uses zk-rollups to increase throughput and reduce gas fees. It does not use a transpiler or custom compiler to generate ZK proofs for Solidity smart contracts but uses compiled Solidity bytecode. This not only reduces the surface risk of vulnerabilities and hacker attacks but also ensures faster transaction speeds and lower gas costs through their innovative prover design.

Linea, belonging to Consensys along with Metamask, has a massive traffic entry point. However, due to its use of ZK technology, the user experience is currently lagging behind Base, which was launched around the same time (Base chose OP).

The overall innovation capability of the Linea ecosystem is lacking, with the only native project being the lending protocol Mendi Finance, and non-DeFi projects lagging behind many other Layer2 developments.

5. Summary

The Layer2 war is still ongoing, and all Rollups are exploring many decentralized and scaling solutions, including decentralized sorter networks, modular solutions like ZK Stack and OP Stack, Layer3, OP+ZK hybrid proof technology, account abstraction, and more.

Currently, it seems that the scaling solutions for the EVM ecosystem will eventually move from the mainnet to Layer2, OP to ZK, and Layer2 to Layer3, but the Layer2 track is still in its very early stages. Each Rollup has its own way of surviving in a competitive market: Arbitrum with its rich and unique DeFi ecosystem, StarkNet with its strong innovation and innovative projects, Optimism with its capital support, zkSync with its strategic vision, and Base with its strong innovation and resources.

As the Dencun upgrade approaches, the EVM-centric era of Layer2 is about to begin, presenting potential market opportunities for investors and excellent opportunities to onboard the next billion users for developers.

Reference:

First-class cabin "Ulvetanna Research Report"

First-class cabin "zkSync Era Research Report" ```

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。