Title: "How Modularity and Rollups Impact ETH Value"

Author: Christine Kim

Translated by: Luccy, BlockBeats

Editor's Note: Christine Kim, Vice President of Research at Galaxy, combined the impact of restaking and account abstraction with the Cancun/Deneb upgrade to delve into the short-term and long-term prospects of L2's value accumulation on Ethereum. The report reveals the potential negative impact of L2 on Ethereum's value in the short term, but also points out that with the maturity of Rollup technology and improvements in DA functionality on Ethereum, the value of Ethereum is expected to perform well in the long term. The following is the translation of the original article by BlockBeats:

Abstract

The upcoming Ethereum Cancun/Deneb upgrade is expected to reduce the block space fees paid by rollup operators, which may pose a short-term resistance to Ethereum's fee-based protocol revenue. As rollups built on Ethereum become increasingly interoperable with other more performant and relatively cheaper settlement and DA chains, Ethereum may underperform as a result. In the long term, if the argument for blockchain modularity holds, the primary network fee driver for L1 blockchains (such as Ethereum and Celestia) will be the L2 rollup service providers rather than end users. Additionally, with the increasing adoption of account abstraction on L2, it can be expected that the primary entities holding Ethereum for block space payment purposes will be rollup operators rather than end users.

Introduction

In the crypto industry, an age-old problem has been how to maximize (or at least maintain) the network's decentralization and security properties while scaling the blockchain. The launch of Celestia marks the maturity of a new solution to the scalability trilemma of blockchains. Celestia is the first public blockchain highly optimized to provide DA (DA) for rollups. As a DA layer, Celestia does not have the capability to execute transactions natively. Instead, Celestia provides block space for rollups to temporarily publish batched user transaction data. As a DA layer, Celestia employs strategies such as DA sampling (DAS) to specifically reduce the cost of block space for use by the execution layer (such as smart contract rollups representing user data published on-chain).

Ethereum is also working to reduce the block space cost for DA, but this comes at the expense of higher node requirements. Proto-danksharding is a major code change set to take place in the next network upgrade for Ethereum. This upgrade, known as the Cancun/Deneb upgrade, is expected to increase the temporary data storage space for Ethereum nodes by 768kB. The additional block space for rollup transactions is expected to reduce the cost of DA on Ethereum by at least 10%.

At the core of the modularity argument related to blockchain scaling is the viewpoint that rather than having a single network perform all core functions of general blockchain computation (i.e., monolithic or integrated blockchain arguments), it is better to outsource responsibilities (such as execution or DA) to specialized infrastructure providers to achieve enhanced functionality and performance. Read this Galaxy Research report for more information on Celestia and "modularity."

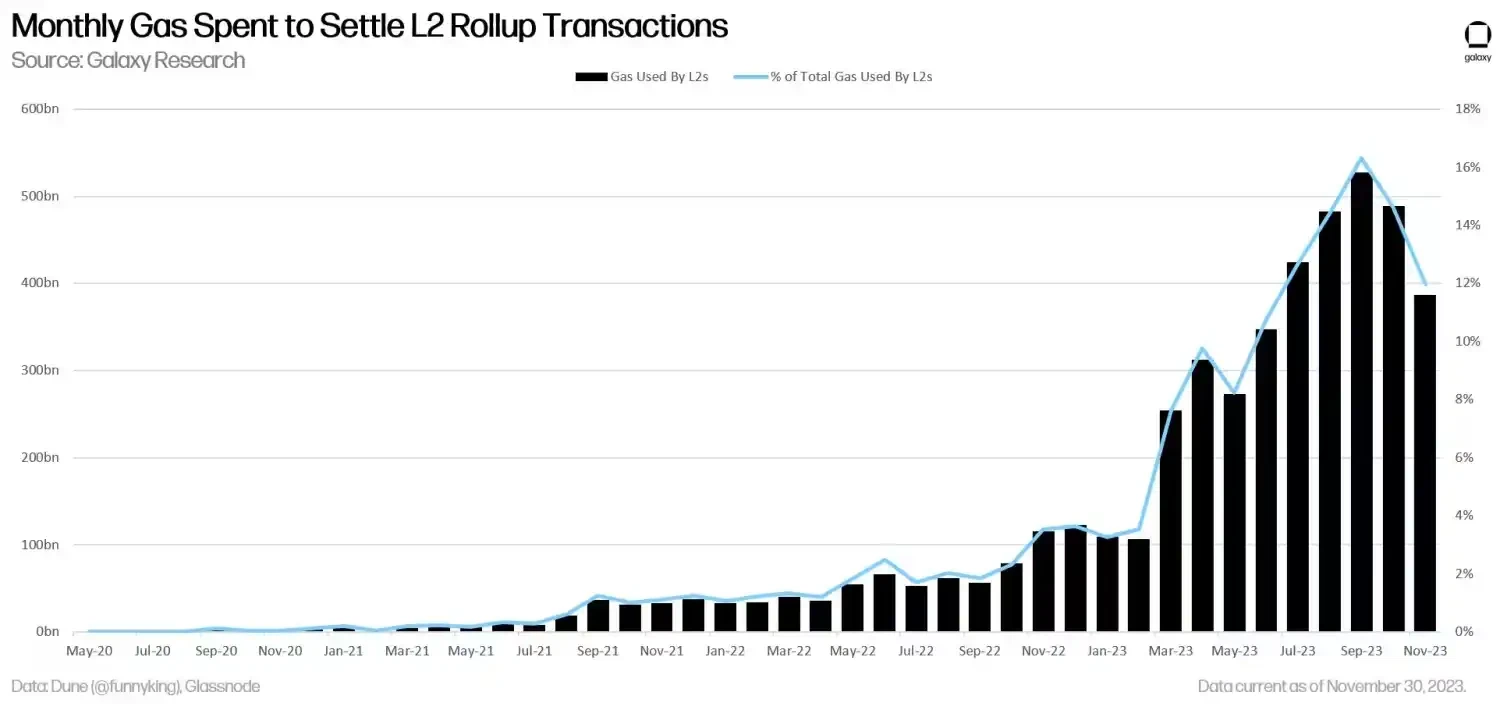

With Ethereum implementing network upgrades to better support L2 rollups, the share of protocol revenue from rollup sequencers may surpass that directly from L1 end users. Rollup sequencers are entities that publish user data to the DA layer. Currently, rollup payments account for approximately 12% of all gas paid, an increase from 3% at the beginning of the year.

This report will consider the impact of restaking and account abstraction, delving into the short-term and long-term prospects of value addition from L2 to L1 blockchains. Recent upgrades such as the Cancun/Deneb upgrade and the increasing flexibility of L2 may lead to a short-term negative impact on Ethereum's value as users may choose to migrate from Ethereum to other blockchains serving as settlement and DA layers, although in the long term, with the maturity of Rollup technology and improvements in DA functionality on Ethereum, the value of Ethereum is expected to perform well.

This report is an extension of our previous report on the modularity argument for blockchain, "Understanding Blockchain Modularity," which introduces many terms and concepts related to the modularity argument and provides additional insights into the cost generation and revenue drivers of layered blockchains.

Adoption of L2 on Ethereum in 2023

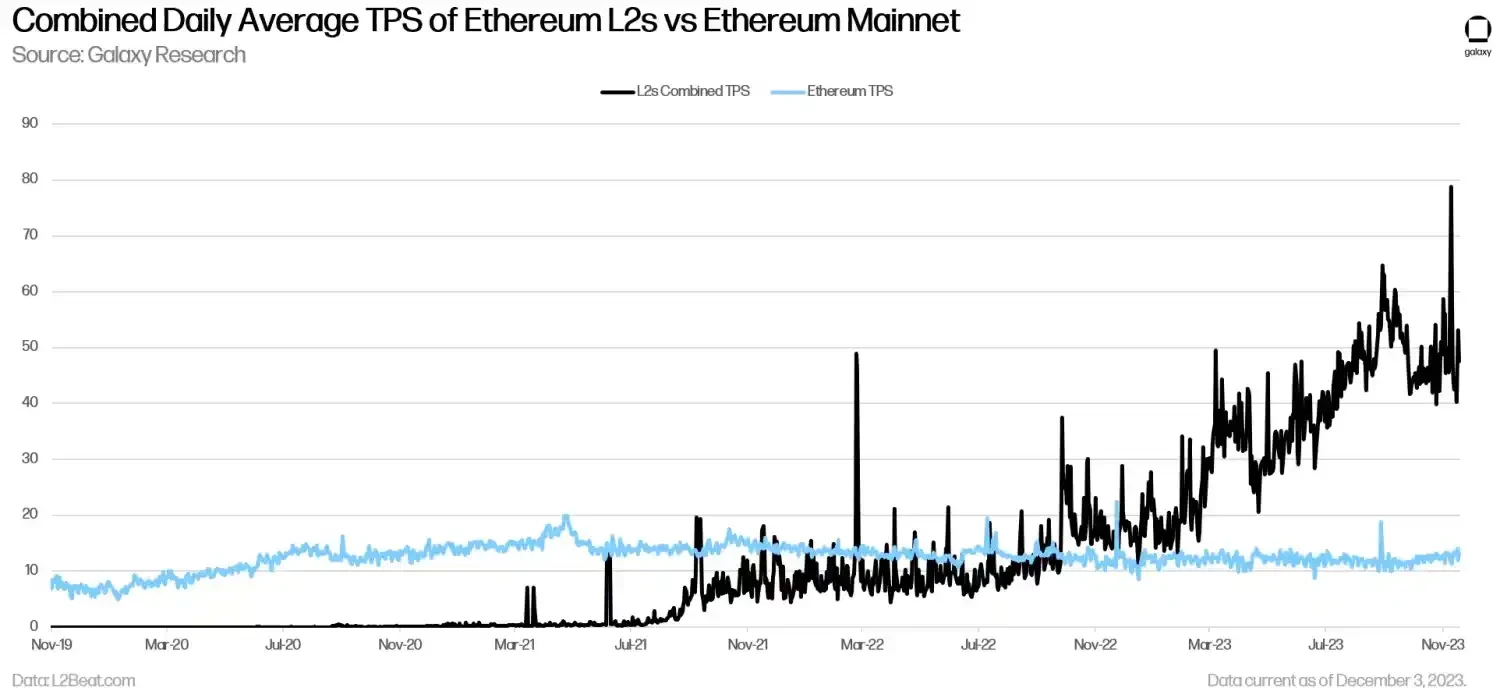

Since January, transaction activity on Ethereum's L2 has more than tripled. In 2023, the total daily transaction volume on L2 has seen the largest nominal and percentage growth.

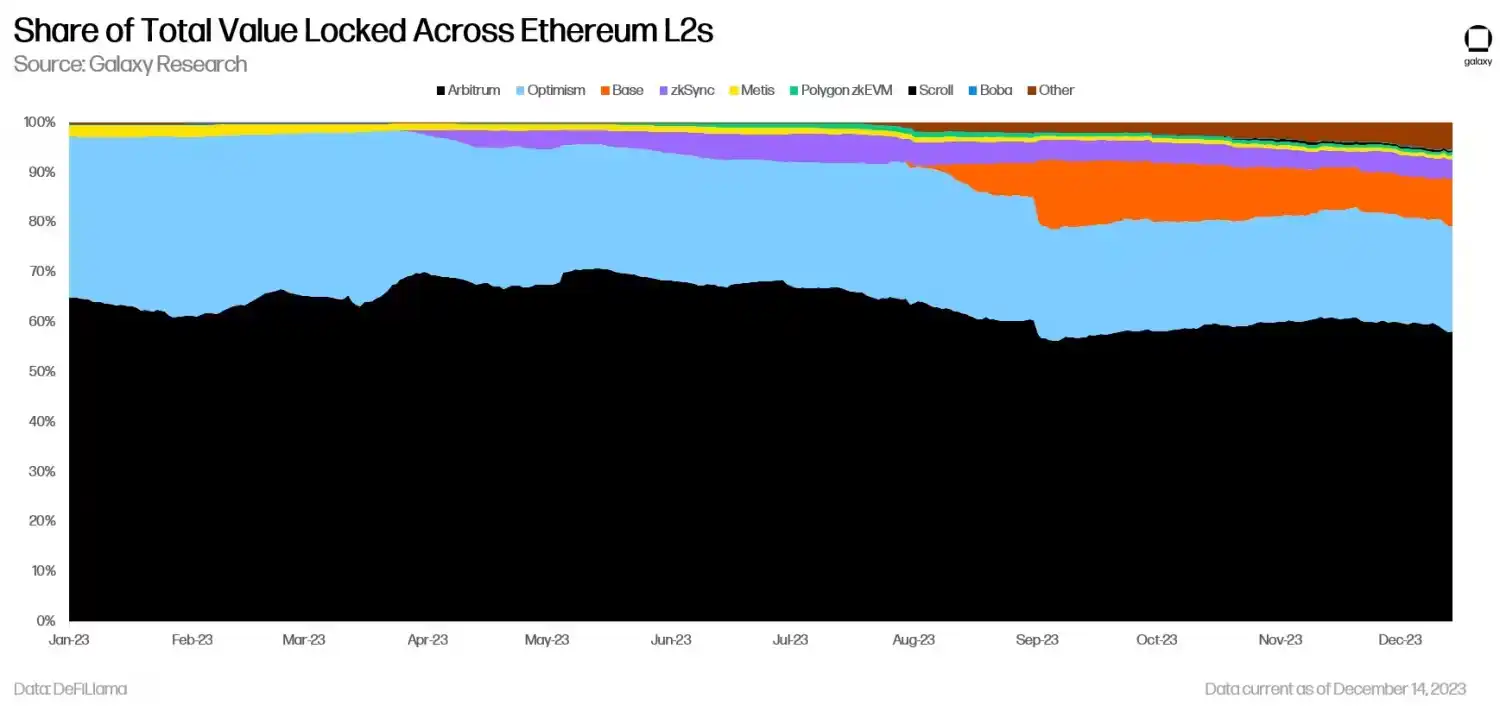

In L2, Optimism and Arbitrum experienced significant decreases in TVL in 2023, dropping by 11% and 7% respectively. Meanwhile, Base and zkSyncEra saw substantial growth in TVL on L2, increasing by 9% and 4% respectively. Note: TVL, a metric based on the dollar value of tokens, does not necessarily represent changes in the nominal quantity of tokens deposited into the protocol.

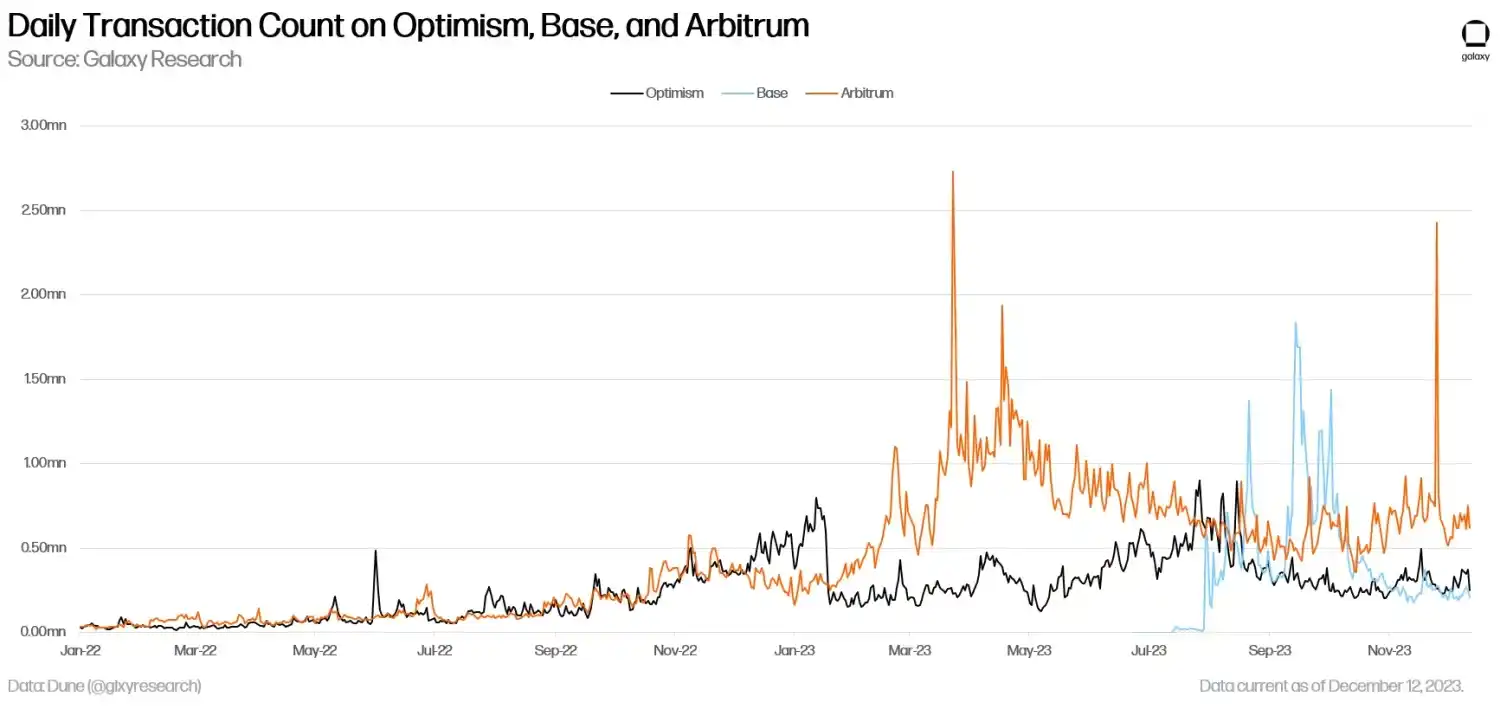

It is worth noting that Base, a rollup project launched by the cryptocurrency exchange Coinbase this year, has rapidly gained adoption and popularity among L2 users. As of December 12th, Base has accumulated the third-highest TVL in L2. In terms of transaction activity, Base's daily transaction volume has at times exceeded that of Arbitrum and Optimism, the two largest L2s on Ethereum.

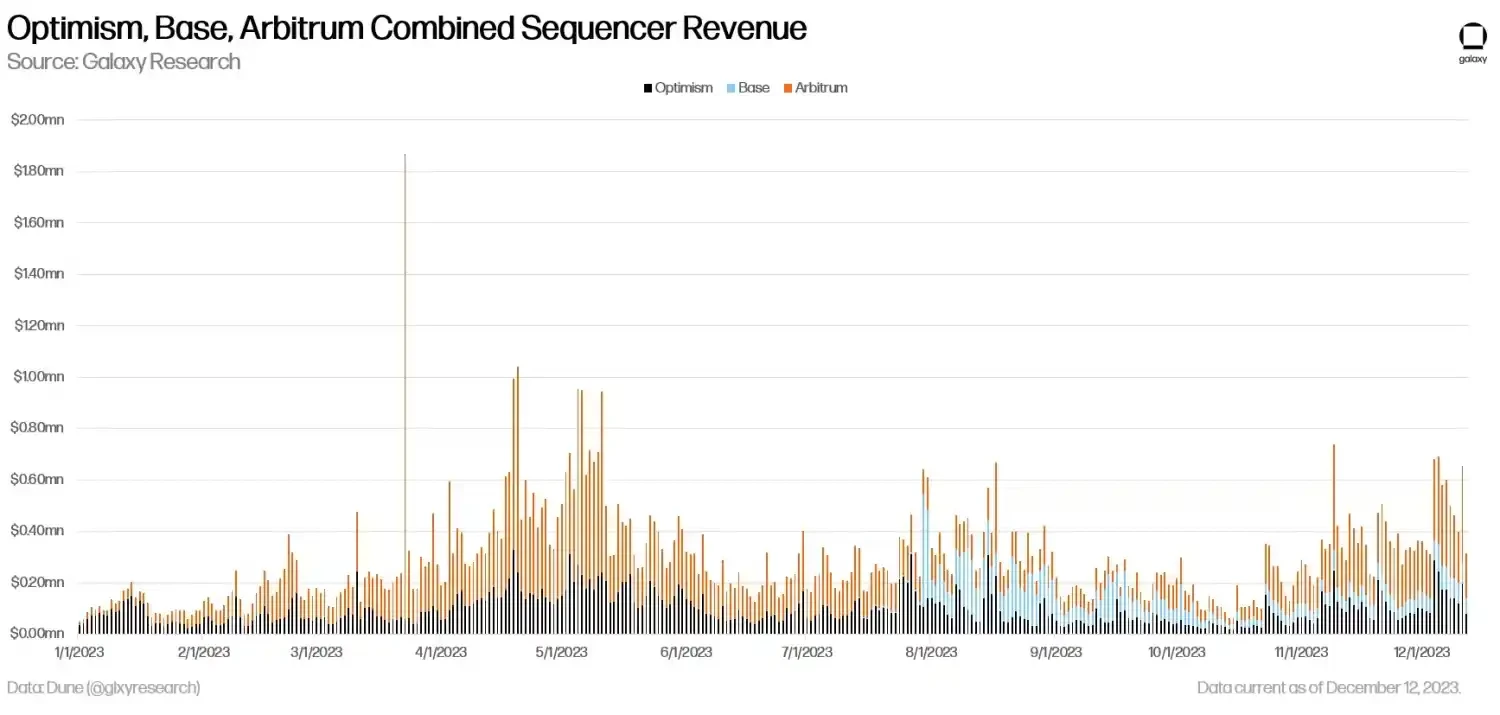

Among the top three L2s on Ethereum by TVL, Base's sequencer has roughly generated 20% of the total revenue, derived from sorting user transactions and batching them into blocks. To date, the sequencers of Optimism, Base, and Arbitrum have generated $140 million USD in revenue from user fees.

Looking ahead to 2024, with the launch of the Cancun/Deneb upgrade, the cost of batching user transactions and finalizing them on Ethereum will significantly decrease, increasing the profitability of rollup sequencers while reducing fee revenue on Ethereum.

Cancun/Deneb Upgrade

The main code change in the Cancun/Deneb upgrade is Ethereum Improvement Proposal (EIP) 4844, also known as proto-danksharding. Proto-danksharding creates dedicated block space "blobs" for rollup transactions, which are priced in a separate fee market from regular user transactions and temporarily store transaction data for approximately three weeks. By activating EIP 4844, each block will create an additional 768kB of data space for rollups.

The Cancun/Deneb upgrade may reduce Ethereum's fee revenue in the short term, as EIP 4844 reduces the cost of rollup to Ethereum block space by over 10 times. Additionally, due to technical challenges associated with rollups, including their lack of scalability, decentralization, and interoperability, most of Ethereum's fee revenue may still primarily come from end users directly executing their transactions on Ethereum rather than on L2. Until rollup technology matures, Ethereum's revenue may not significantly benefit from EIP 4844.

Short-Term Technical Challenges

The following is an in-depth exploration of three key areas of development that rollup operators will prioritize in 2023 and continue to drive in 2024:

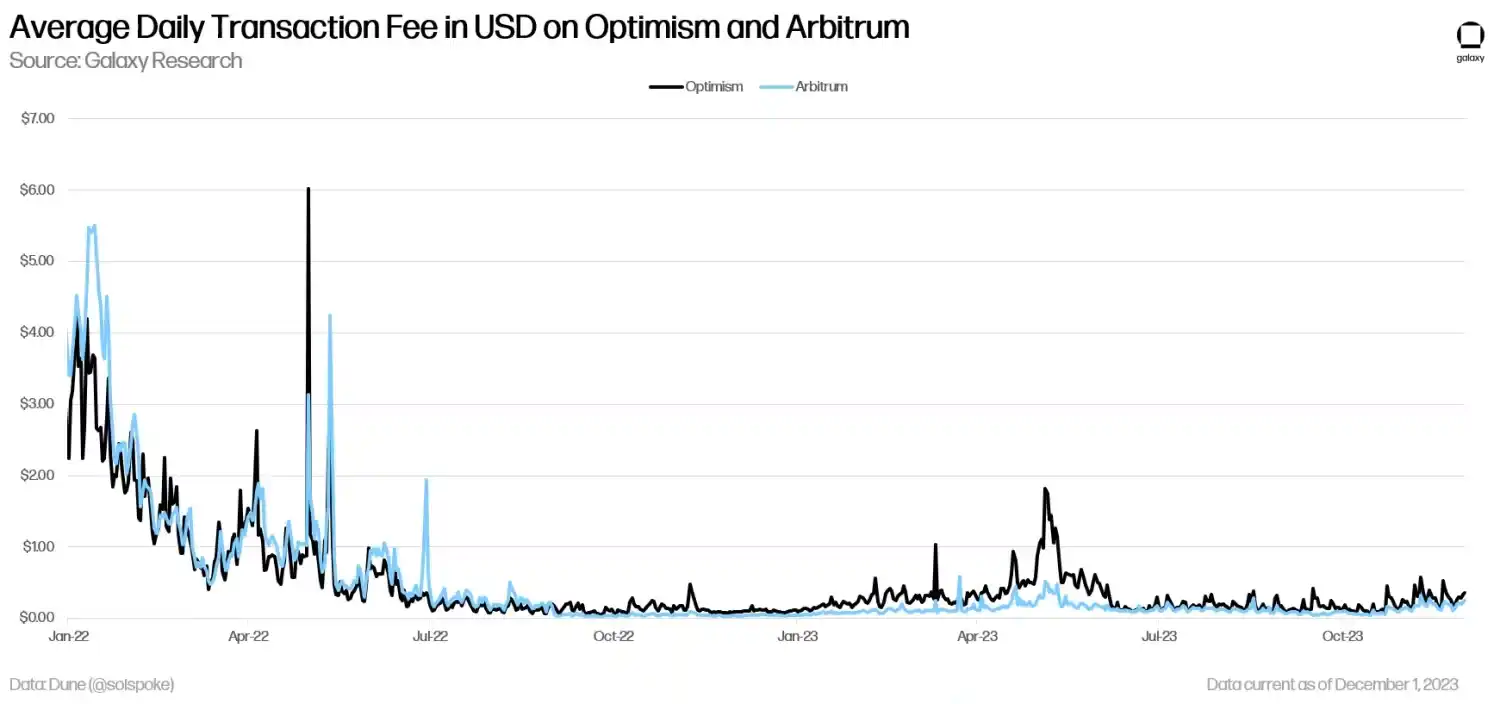

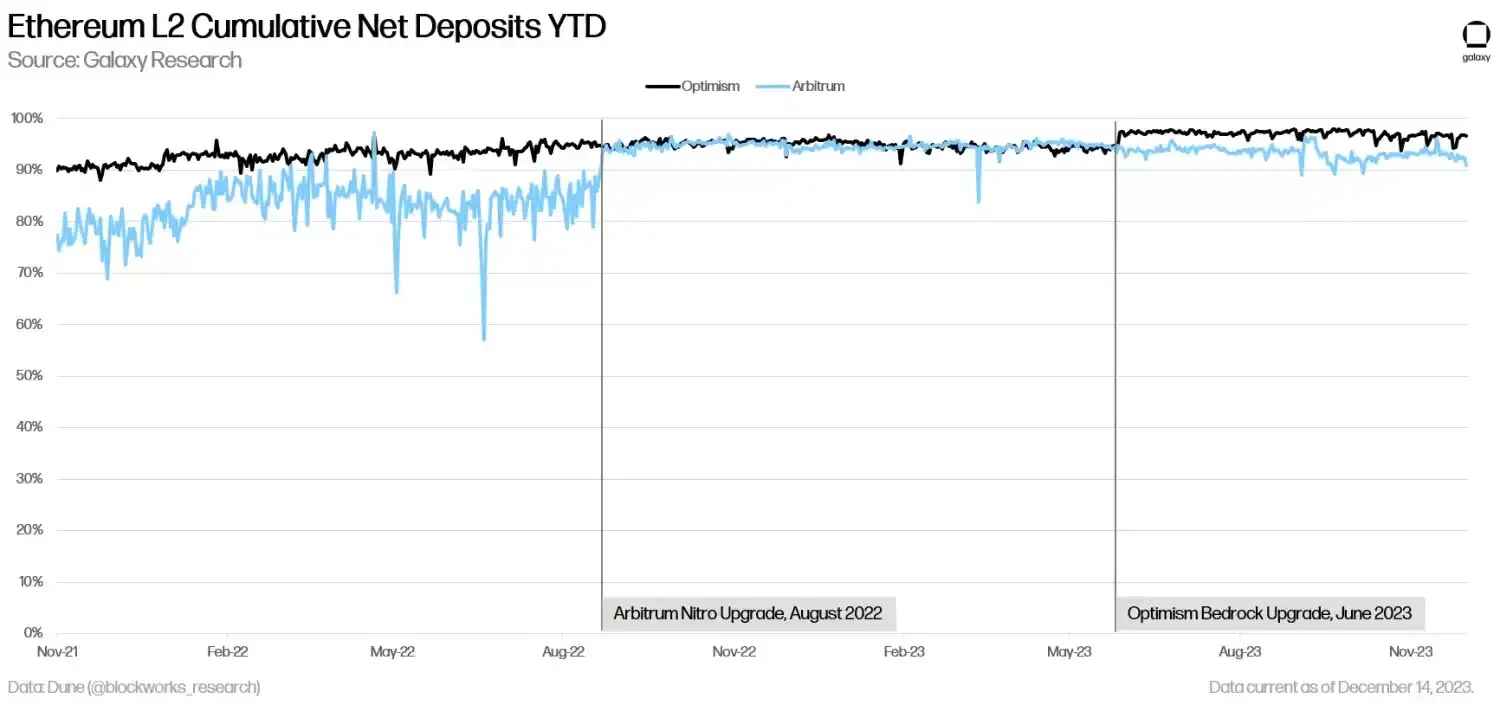

Scalability: Rollups are not immune to fee fluctuations. As emphasized in our previous report on blockchain modularity, the transaction fees on Ethereum's primary rollup, Arbitrum, briefly exceeded Ethereum in June 2022, when Project Galxe's Arbitrum Odyssey marketing campaign sparked a surge in on-chain activity. Subsequently, with the release of Nitro in August 2022, fees on Arbitrum significantly decreased. Optimism's Bedrock upgrade, completed in June 2023, also aimed to improve network scalability and reduce gas fees. Scalability of rollups is an active area of development that developers are focusing on improving.

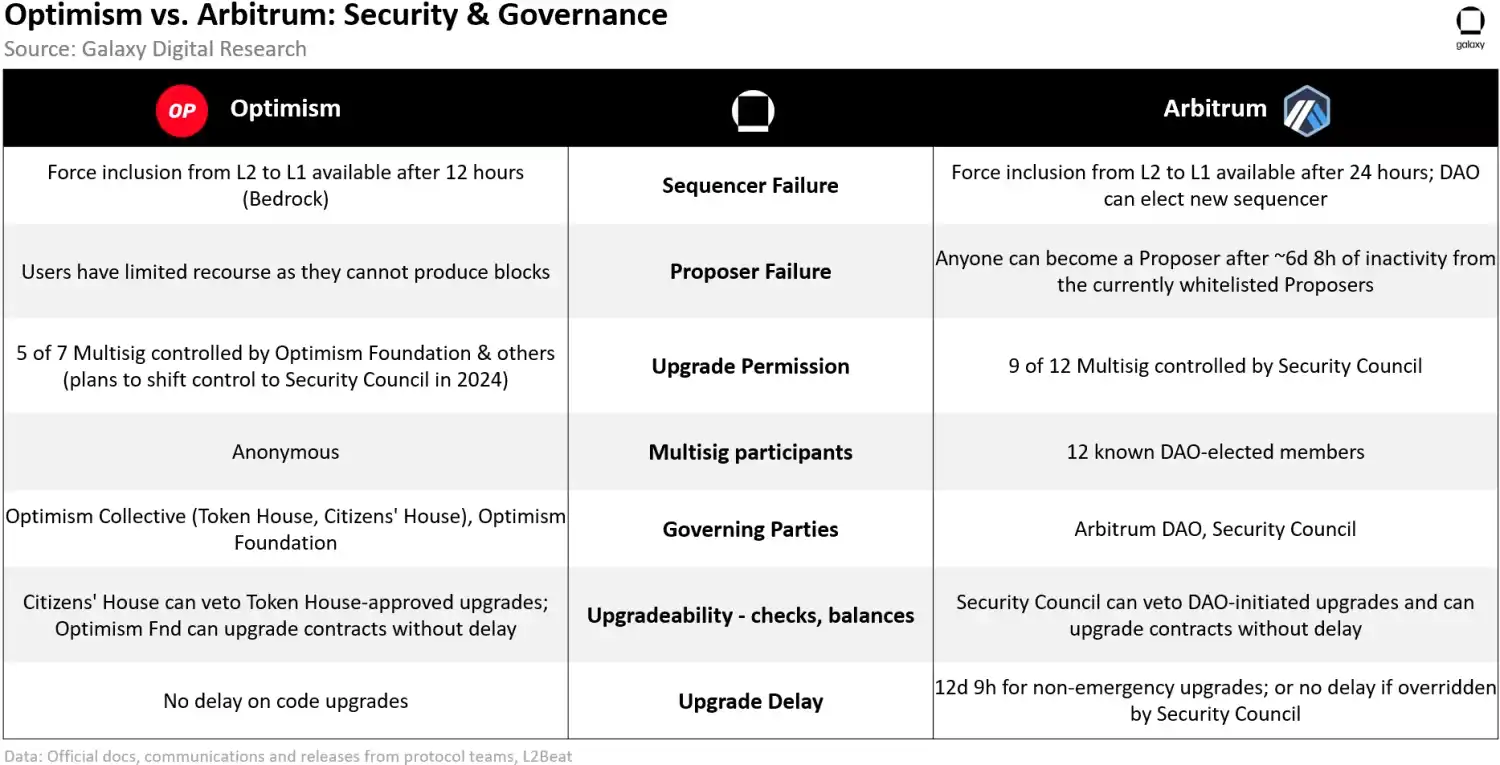

Decentralization and Security: Another area of development that rollup developers are focusing on is decentralization. All rollups on Ethereum are susceptible to centralized attack vectors as they rely on individual node operators to sort transactions and produce blocks. Three core areas of focus for improving decentralization and security in rollups include: (i) implementing validity/fraud proofs, (ii) expanding the set of operators for verification and sorting, and (iii) decentralizing control of rollups through governance and removing administrator privileges.

Interoperability: One of the main reasons Ethereum dominates the general blockchain market share is its strong network effects. As more users join Ethereum and the liquidity of assets interacting on Ethereum increases, the network's value also increases in a positive feedback loop, and this liquidity dispersion is a barrier to rollup adoption. The DeFi ecosystem benefits from liquidity concentration and composability of dapps with a protocol. Therefore, seamless migration of assets from L1 to L2 and within the L2 ecosystem is an important area of development that will help drive end users from Ethereum to L2.

Advantages of Alternative DA Solutions

In the short term, Ethereum's revenue will primarily still be generated by end users directly initiating transactions on L1. With the cost savings from scalability upgrades on L2 and improved decentralization and interoperability of rollups, adoption of L2 by users will increase. Additionally, using cost-effective rollups like Celestia as an alternative DA layer may achieve higher profit margins by passing only a portion of the cost savings to rollup users. In addition to Ethereum and Celestia, other L1 blockchains, such as NEAR, have announced plans to pivot to better serve rollups as a DA layer.

On L2, transaction fees paid by users can be over 90% less than on Ethereum, as shown in the following chart:

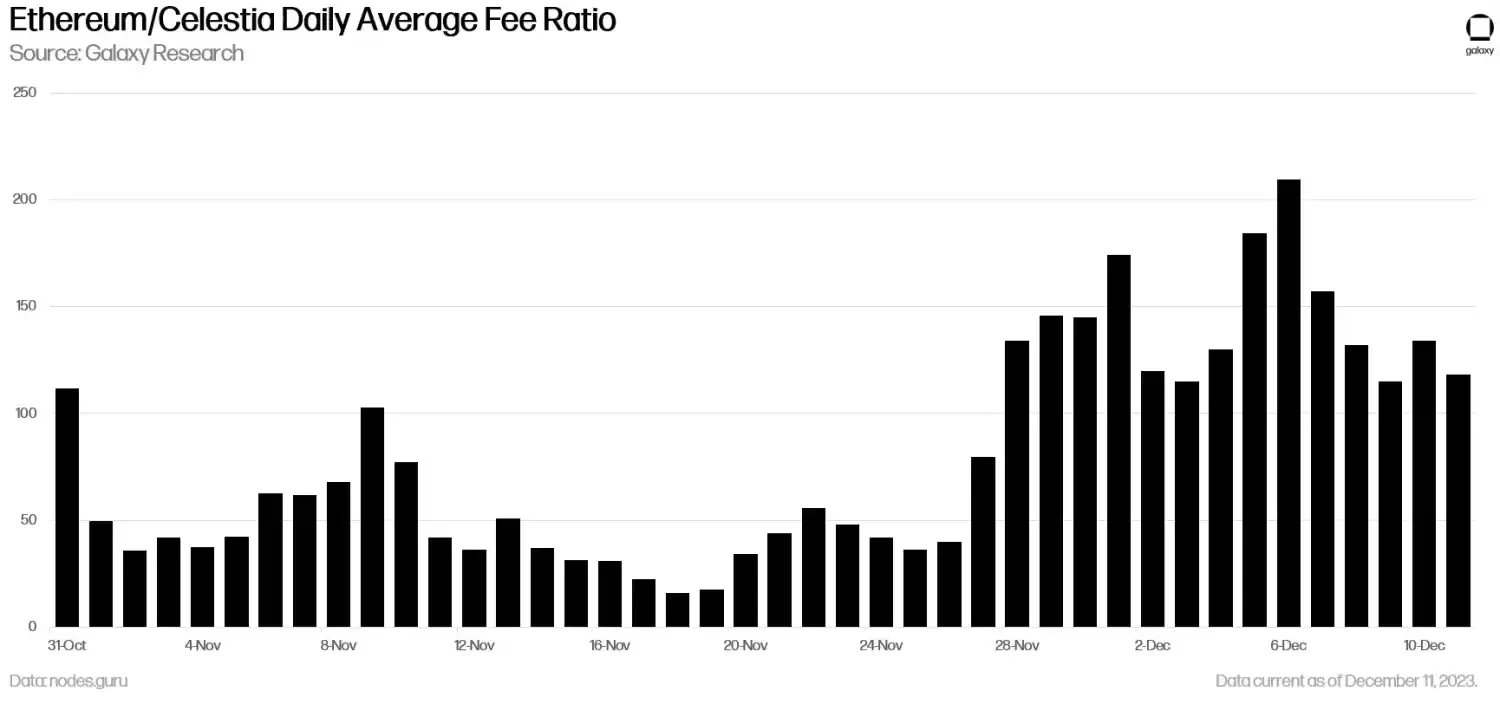

Rollup operators are expected to achieve higher profit margins due to lower transaction fees on Celestia. On average, fees on Celestia are often several times lower than on Ethereum, although this is largely due to Celestia being a new chain that only launched on the mainnet on October 31, 2023. The following chart shows the fee ratio between Celestia and Ethereum based on the average daily transaction fees per protocol in USD, with daily transaction fees on Celestia averaging 80 times cheaper than on Ethereum. (Note: The data below depicts the average transaction fees for all types of user transactions on Celestia and Ethereum, not just those paid by rollup sequencers.)

As a very new blockchain that has been live for less than two months, Celestia has not yet been widely used for DA on L2 like Ethereum. The majority of transaction activity on Celestia is related to pledging and delegating assets to Celestia's native assets. As transaction activity related to "blobs" increases on Celestia, transaction fees may fluctuate and trend upwards. However, due to the current lack of optimization for DA on Celestia compared to Ethereum, rollup fees on Celestia are unlikely to trend upwards compared to Ethereum unless all else is equal.

In conclusion, we expect that with the launch of the Cancun/Deneb upgrade in 2024, Ethereum's network revenue will decrease as the block space cost for rollups on Ethereum decreases with the activation of the Cancun/Deneb upgrade, or at least will be lower than without the Cancun/Deneb upgrade. Additionally, due to ongoing challenges related to the scalability, decentralization, and interoperability of rollups, it is expected that the majority of Ethereum's network revenue will still come from end users rather than L2. Finally, if sequencers do not pass on all the cost savings of DA to rollup users paying fees and migrate to using alternative DA solutions like Celestia, it is expected that profit margins for rollups will increase in the short term.

In the long term, five years or more, as the mass adoption of blockchain-based applications and services, and the usage of rollups for transaction execution, surpasses Ethereum by over 10 times, Ethereum's revenue may increase. Cheaper fees on L2 can unlock new use cases in multiple industries including gaming, social media, entertainment, sports, and more. The emergence of new use cases driving wider adoption of DApps is expected to increase the overall demand for block space on Ethereum, thereby increasing total revenue. In this scenario, Ethereum's primary source of revenue will come from providing settlement and DA layer for rollups. Additionally, with intensified competition for end-user activity, profit margins for rollup sequencers will become more strained.

In the coming years, the existence of multiple highly optimized DA layers may accelerate the migration of Ethereum L2 from exclusively publishing data to Ethereum to other DA layers that offer cheaper block space. These new DA layers may ultimately directly challenge Ethereum, potentially eroding its current position as the foundational layer most widely used for rollup activities. However, as discussed in the previous section, network effects are crucial, and rollup developers are working to improve interoperability and composability of DApps launched on different rollup protocols. Projects like Caldera, Hyperlane, and Polymer are building tools to ensure smooth operation of rollups across multiple DA layers without affecting user experience, allowing for seamless migration of assets and DApps between rollups. Depending on the extent to which shared settlement and DA layers (such as Ethereum) provide user experience advantages when users migrate their assets between rollups and run DApps across these rollups, Ethereum may continue to maintain its position as the most valuable DA layer.

Competitive Advantages of Ethereum

While Ethereum has dominated the market in 2023 as a settlement and DA blockchain, reaching the highest levels of security, value, decentralization, and network effects, there will be increasing competition from chains like Celestia, designed from the outset to specifically support rollup activities. Although still fewer in number and in the early stages of development compared to Ethereum, the dominant position of Ethereum as the DA blockchain for rollups may weaken over time, although this possibility remains small. To address this, Ethereum core developers are working to launch upgrades like the Cancun/Deneb upgrade and others to enhance Ethereum's DA capabilities. However, when discussing the long-term impact of L2 rollups on Ethereum's revenue, it must be considered whether rollups can successfully provide the same level of decentralization, security, and interoperability as the base layer.

Despite the advantage of cheaper fees, the dispersion of liquidity in the application layer through L2 rollups may anchor most user transaction activity on Ethereum in the short and long term. In this scenario, even if Celestia performs superiorly as a DA layer compared to Ethereum, Ethereum's competitive advantage as the world's most decentralized and universal single blockchain may continue to prevail and attract new users. Therefore, Ethereum's revenue will continue to be highly volatile and dependent on the number of users interacting directly with its base layer. Some users may choose to execute their transactions on Ethereum compared to cheaper L2 and alternative L1, taking full advantage of the unmatched decentralization and security of the network as a universal blockchain.

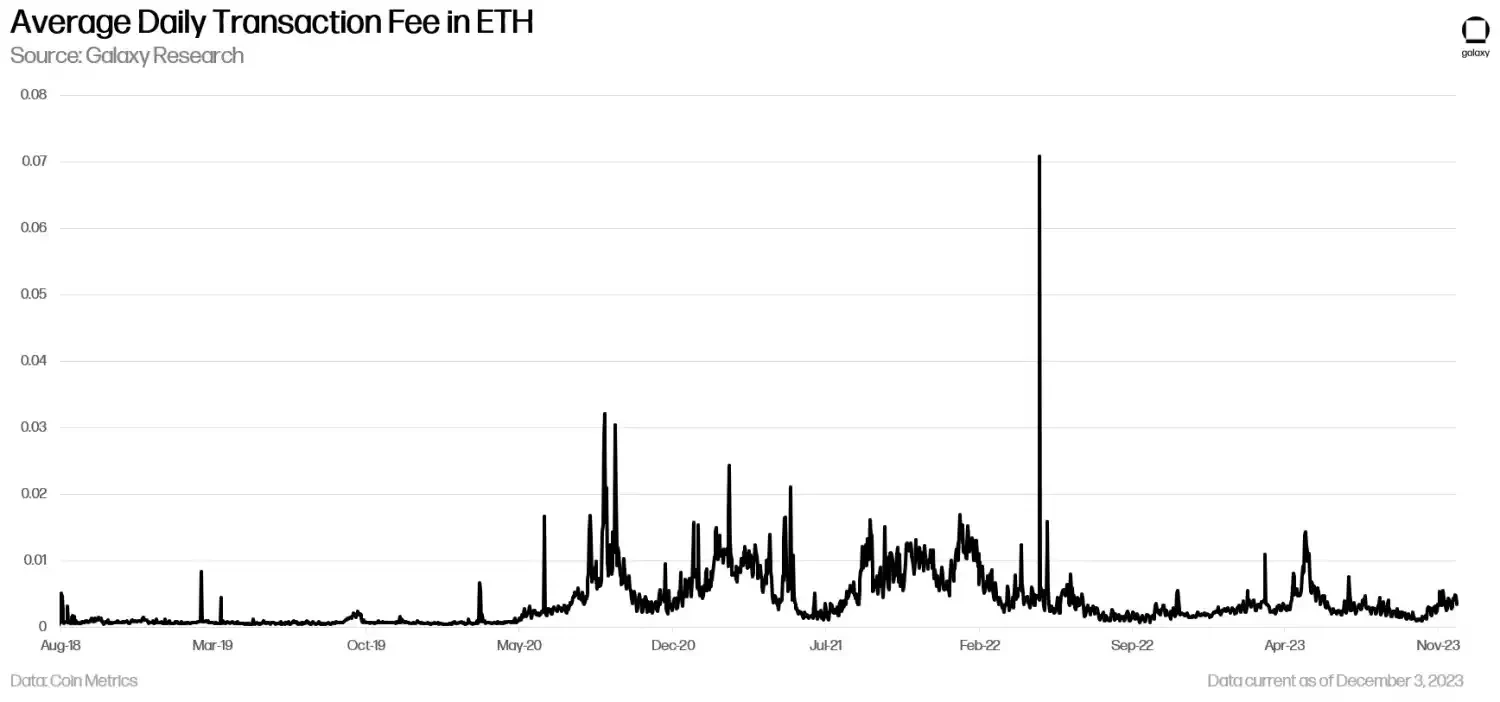

In the short term, as previously mentioned, the majority of end-user activity remains on Ethereum rather than migrating to L2, leading to a temporary surge in fees and network revenue. However, without scalability, Ethereum's revenue will be limited by the constrained transaction throughput and the unpredictability of maintaining sufficient block space to meet growing demand. The temporary increase in user fees, ultimately hampered by the network's inability to support a higher degree of user activity, will have a negative impact on Ethereum's value as a universal blockchain in the long run.

The following chart shows the volatility of daily average transaction fees in Ethereum units on Ethereum:

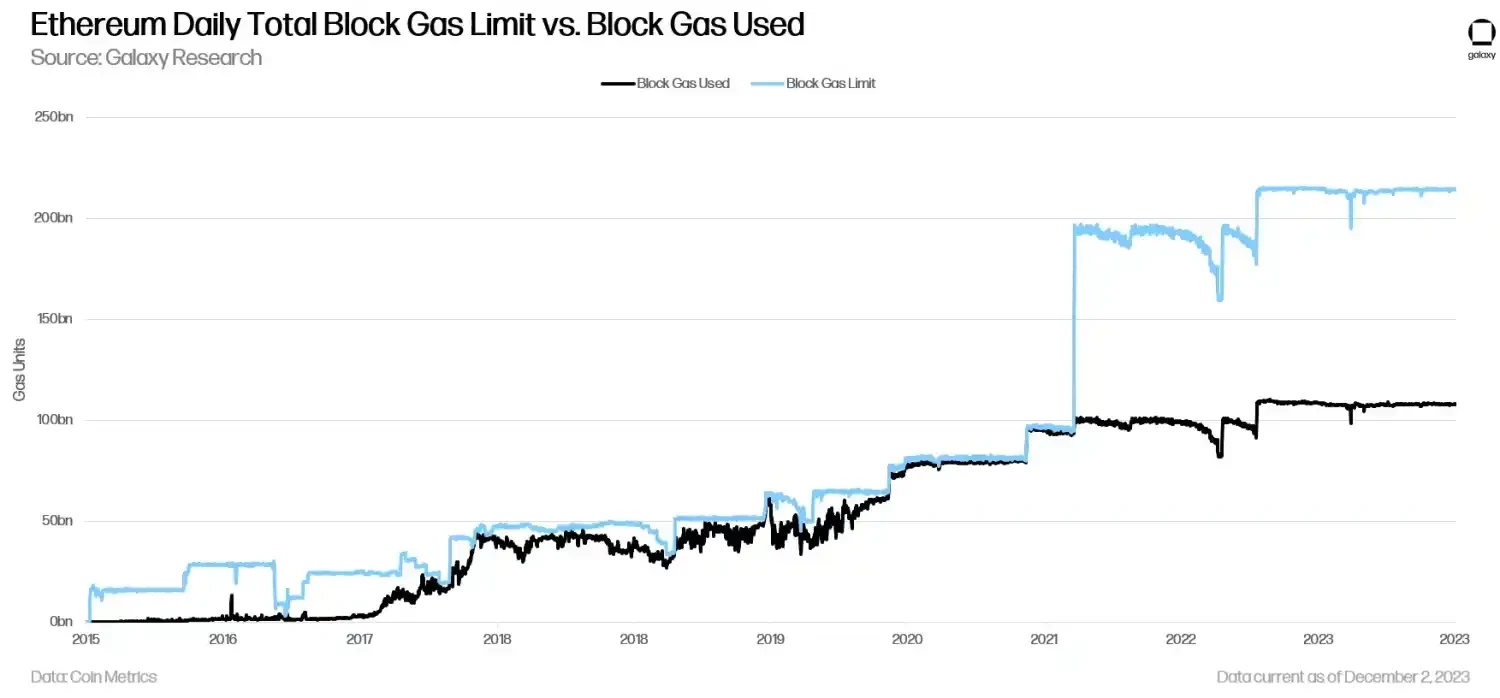

In the first six years of Ethereum's genesis block, miners, the block generators of Ethereum, collectively voted to increase the gas limit of blocks, effectively increasing the number of transactions a single block can accommodate by at least 12 times. In August 2021, Ethereum core developers executed a hard fork (a backward incompatible network-wide upgrade), increasing the maximum block gas limit from 15 million to 30 million and redesigning the fee market to reduce fee volatility.

The following chart illustrates the increase in Ethereum block gas limit due to user demand for block space:

Despite the changes in Ethereum's block gas limit over the years, fee volatility and limited network scalability remain persistent issues, and a long-term solution will be needed if rollups prove to be ineffective in inheriting the majority of end-user activity.

Other Considerations

When discussing the long-term value accrual from L2 to L1, two additional considerations worth discussing are the trend of native account abstraction on L2 and the re-staking solutions on Ethereum.

Account Abstraction

If L2 rollup sequencers eventually become intermediaries providing services for end users to interact with blockchain-based applications, rather than directly dealing with Ethereum, in this future, users may stop directly holding Ethereum and be able to pay transaction fees using stablecoins or even fiat currency, depending on the design of the sequencer and rollup, which would convert these payments to Ethereum to cover Ethereum's transaction costs.

The increased flexibility and programmability of paying fees on L2 depend primarily on a technology called "account abstraction," which has not been implemented on Ethereum and may not be implemented in the near future. While account abstraction offers many benefits for user experience, there is insufficient coordination among Ethereum core developers to prioritize its implementation ahead of other more urgent code changes, including increasing the maximum effective balance of validators, Verkle trees, Ethereum Virtual Machine object format, and the proposed separation of established builders.

Although there are proposals to implement account abstraction without changing the core Ethereum protocol (ERC 4337), widespread adoption of this proposal is unlikely as it depends on dapp developers updating their smart contracts and end users choosing to use alternative memory pools. On the other hand, as an emerging technology, rollup itself is a perfect testing ground for implementing native account abstraction at the protocol level. In fact, rollups like zkSync and Starkware have already implemented this, meaning accounts created by end users on these protocols automatically have enhanced programmability and usability.

Native account abstraction on rollups will be a game-changer for user interaction with DApps, as it unlocks multiple new functionalities for user transactions, including but not limited to:

Improving User Experience for Repeated or Frequent Transactions: For certain on-chain games and DeFi applications, users need to submit multiple transactions. Account contracts (ACs) can be programmed to automatically allow interactions with certain dapps, so users don't have to repeatedly authorize interactions with the same smart contract using their private keys.

Ability to Pause Asset Movement in the Event of a Hack: Users' accounts may be built with logic to stop the flow of funds when certain withdrawal limits are exceeded.

Support for Social Recovery of Private Keys: Users' accounts may also be designed to rely on the user's private key and other social recovery devices to transfer funds. If a user loses their private key, an account can be programmed to generate a new key using either 3 out of 5 or 2 out of 3 of the social recovery devices.

Re-Staking

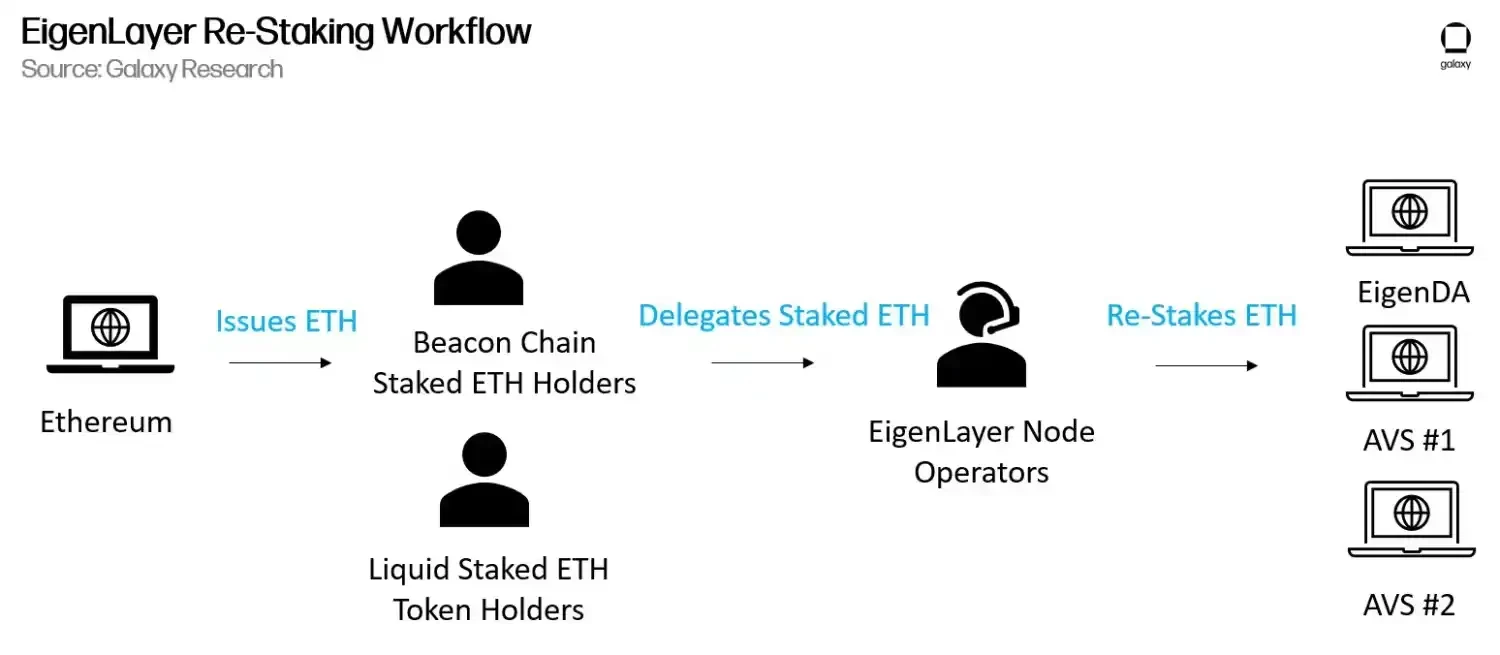

Another consideration related to the value accrual from rollup to Ethereum in the next five years is the maturity of re-staking protocols like EigenLayer. As explained in an article on re-staking in "Galaxy Perspectives," EigenLayer will enable end users to re-utilize their staked Ethereum to provide security for other protocols and DApps, yielding higher returns. As of December 2023, EigenLayer developers are testing the re-staking workflow for EigenDA, another DA layer secured by staked Ethereum, where rollup will be able to publish data to this layer instead of directly to Ethereum. Validator operators choosing to re-stake through EigenLayer will face additional slashing conditions for their transaction validation on both Ethereum and EigenDA, but in return, they will earn higher returns from staking in two protocols instead of one. The EigenLayer team expects to launch EigenDA on the mainnet in the first half of 2024. Subsequently, EigenLayer will introduce new protocols that validator operators can re-stake to outside of EigenDA.

The widespread adoption of re-staking protocols like EigenLayer on Ethereum may take several years. The initial active validator services (AVS) on EigenLayer will undergo careful planning and real-world testing for node operators to support re-staking. The EigenLayer developers intentionally limit the amount of staked Ethereum and liquid staking tokens that can be deposited into the protocol. Currently, the initial staked Ethereum deposit limit for EigenDA AVS has been set at 117,000 Ethereum. This limit will increase to approximately 200,000 Ethereum on December 18, 2023. Additionally, on December 18, 2023, EigenLayer will start accepting deposits from six new liquid staking tokens (osETH, swETH, oETH, ETHX, WEBETH, and AnkrETH).

As of December 14, 2023, the total staked Ethereum deposits from liquid staking tokens (including rETH, stETH, and cbETH) and native Ethereum tokens represent less than 1% of the total staked Ethereum on Ethereum. The EigenLayer team will gradually increase the staked Ethereum deposit capacity for EigenDA and other AVS to ensure the economic security of Ethereum and related AVS before the protocol undergoes full real-world testing. The complete development roadmap for EigenLayer may take several years and involve some unexpected errors, especially in the case of AVS pool growth.

In the event that re-staking becomes reliable and scalable, similar to the widespread adoption of liquid staking activities through the Lido protocol, rollup is expected to gain additional security by re-staking Ethereum for operational purposes (e.g., sequencing). Additionally, while the issuance of Ethereum is expected to decrease over time due to the reduction of additional validator operators, staking rewards on Ethereum are expected to increase, potentially causing demand for Ethereum to exceed rollup sequencers for DeFi applications and foundations. Re-staking activities create potential opportunities for lucrative returns, even as the utility of Ethereum for transaction execution on Ethereum declines and rollup adoption increases, which may encourage individuals and entities (outside of rollup operators) to purchase and stake Ethereum.

Conclusion

Ethereum's revenue will benefit from maintaining larger-scale transaction activity through L2, although in the short term, the network may face reduced revenue due to insufficient adoption of rollup and the implementation of upgrades to subsidize rollup costs. As upcoming upgrades should reduce, rather than increase, fee payments, Ethereum may perform poorly in the short term, at least when investors measure Ethereum's value based on its fee-based protocol revenue. Rollup is an emerging technology facing some technical challenges and adoption barriers in the short term. Over time, as the scalability, decentralization, security, and interoperability of rollup improve, most end-user activity may migrate from Ethereum to L2. As this process unfolds, competition between L2 for user adoption will intensify, and profit margins for rollup operators may decrease. In the long term, technologies like native account abstraction on L2 will further reduce the need for end users to directly hold Ethereum. More likely, with the existence of re-staking solutions like EigenLayer and the maturity of re-staking solutions, end users and DeFi protocols will hold Ethereum tokens representing their accumulated returns. The primary holders of native Ethereum are likely to be rollup operators, who use the token to purchase block space on Ethereum.

Further research areas related to the value accrual from L2 to L1 include the impact of maximal extractable value on the modular blockchain ecosystem and the evolution of zero-knowledge proofs in rollup, its bridges, and economic design.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。