Editor's Note——

If we count from the official release of chatGPT, in less than a year, this AI model storm sweeping the globe is overturning everything, including Chinese enterprises at the moment.

In less than a year, Chinese enterprises have rushed to release hundreds of industry-scale models. In various evaluation rankings and articles, "the most powerful" seems to have become the official unified term. Although many analytical articles have already established some consensus, such as the current domestic large model craze has tended to calm down, and the competition pattern of basic large models has been determined, and the struggle at the application layer has begun.

But if we leave the context of geeks' excitement and return to a company, an industry itself, we may have a more practical perspective to solve some more practical and direct problems:

What is the AI strategy of an enterprise? How will it affect the future of this enterprise? Is it riding the wave or creating the wave?

"Silicon Research Lab" attempts to launch the "Prospective AI" plan from the perspective of corporate research, selecting "key companies" from different industries and tracks, hoping to clarify the future direction by dissecting their AI strategies and traversing the fog.

Source: Silicon Research Lab

Author: Bai Jiajia

Art Editor: Yu Fu

Image Source: Generated by Wujie AI

Zhou Hongyi and his 360 (601360.SH) may be the most obvious radicals in this wave of large model frenzy.

On December 10, Zhou Hongyi asked four consecutive "Do you believe…" questions at the 21st China Enterprise Leaders Annual Meeting, emphasizing to the entrepreneurs present the need to establish "AI faith," otherwise they will be eliminated by peers using AI.

Zhou Hongyi's speech continued his consistent style of going all in on AI with 360. Starting from the AI heat generated by ChatGPT, Zhou Hongyi frequently appeared in various forums and interviews, emphasizing tirelessly that large models will become the new engine driving productivity change and outputting many forward-looking views. In less than three months, 360 has iterated its large model from 1.0 to 4.0.

However, Zhou Hongyi's profound understanding of AI and 360's radical actions did not help the company seize the AI dividend. According to data from East Money, in the first three quarters of this year, 360's total revenue decreased by 2.83% year-on-year, and the cumulative net profit was a loss of 378 million yuan. Although the loss has been significantly narrowed, the reality of six consecutive quarters of losses still makes people sweat for the company's operating conditions.

What kind of AI era is 360 planning for? And why has it fallen into a deadlock? In the unpredictable market, Zhou Hongyi, who is all in on AI, and the indecisive 360, present a stark contrast.

Dual Main Lines Empowering AI

360's AI strategy has two main lines—security and Agent, but when initially observing its AI landscape, one is often confused by its "large and comprehensive" appearance.

From March 29, when AI was implemented in 360 Search, to June 13, when 360 Brain was integrated into full-terminal applications. In just 76 days, 360 established a "large and comprehensive" AI ecosystem, including various applications such as the NewBing benchmarked 360 Search, the Wenshengtu large model "360 Hongtu," 360 Digital Human, and the image community "LoRA360"…

Obviously, Zhou Hongyi expected 360 to naturally form a business model as it expanded its business map in the past. But unfortunately, it is doubtful whether the large model of 360 can bring more downloads to its software suite.

"Silicon Research Lab" checked the comments on related applications on the App Store. As of December 17, there were only 242 comments for 360 Brain, while Baidu's Wenxin Yiyuan had 23,000 comments and iFlytek's Xunfei Xinghuo had 26,000 comments.

In terms of user scale, Wenxin Yiyuan announced a user base of 70 million in November, and Xunfei Xinghuo announced a user base of 12 million in October, while 360 Brain has not disclosed its user data.

In the past, 360 was able to expand its user base by continuously releasing new products because it captured a justifiable need—users were concerned about asset security, while software developers generally lacked network security awareness.

However, at least at this stage, as the development of large models is still in its early stages, several securities firms have pointed out in their reports that next year will be the year of the outbreak of large model applications. Compared with the large model products launched by Baidu, Alibaba, and other companies, 360 Brain does not have a real core difference. Therefore, in the fierce competition, it has fallen into a "battle for users" with the big players.

In the fierce competition with the big players, 360 has taken a bumpy Agent route. It is worth mentioning that this route was not planned from the beginning, but was gradually refined in the process of integrating various capabilities.

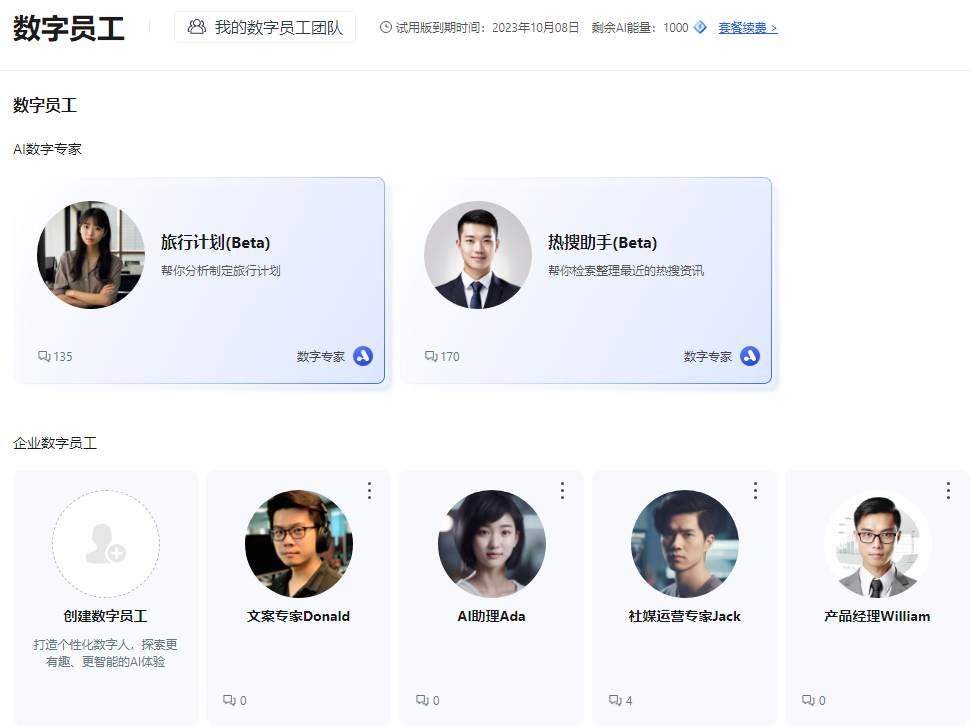

After the complete deployment of the large model ecosystem, Zhou Hongyi quickly shifted the focus of promotion to "digital employees" and demonstrated their capabilities at the World Internet Conference in June this year—employees only need to make demands as project managers, and digital employees can generate a live streaming video of the Nishan Shengjing Scenic Area tickets in 3 seconds and produce a detailed investment promotion plan in 5 seconds.

From a product perspective, the more intuitively named "digital employee" integrates various capabilities of large models, such as Wenshengtu and Wenshengwen, in June when most people had not yet established a cognition of large models, effectively reducing understanding and communication costs.

This thinking has been implemented in 360's entire large model strategy, integrating various capabilities of large models for different application scenarios to create personal or corporate exclusive assistants.

Later, the concept of Agent gained popularity in the market. Because its connotation is compatible with 360's strategy, it gradually became one of 360's common expressions of its AI strategy. Zhou Hongyi recently stated in an interview on Black Horse Live that "a large model without an Agent architecture is just a decoration."

Compared with the bumpy birth of Agent, the other main line "security" is much clearer.

In August of this year, at the Internet Security Conference, 360 Security Large Model was officially released. This model, known as the first deliverable large model in the domestic security industry, is not an independent product, but a supporting service for 360 Security Cloud.

Security has always been the core of 360's brand image, so the launch of the security large model was a natural step. The reason it was set as a plug-in is actually due to Zhou Hongyi's understanding of the large model landing mode.

Different from Li Yanhong's emphasis on native AI applications, Zhou Hongyi pursues a "small incision, great depth" landing mode for large models. He believes that the landing of large models should not disrupt existing business systems and should start with modularization and loose coupling, gradually moving towards deep integration with the enterprise's intelligent transformation in future iterations.

Why Did 360 Choose to Be "Large and Comprehensive"?

Looking at 360's large and comprehensive product matrix and the two main lines of security and Agent, it is not difficult to find that its business basically covers all categories of B, b, C, and G.

For most AI companies, covering the business surface too broadly is not a wise choice. First, there are many personalized needs that require cross-industry know-how.

360 Vice President and Head of 360 Large Model Application, Liang Zhihui, once admitted that small and medium-sized enterprises mainly focus on cost reduction and efficiency improvement, and ready-to-use AI tools or applications are more in line with their needs. Large enterprises focus on technical performance, while government departments are more concerned about whether the model has security issues and whether ethical security is guaranteed.

Secondly, the cost of computing power is high. According to internal statistics from 360, the cost of using large models is roughly more than 10 times that of search. Although the large model assisting search was reduced from 130B to 10B, Liang Zhihui still emphasized that "the cost of each call is a serious issue."

In that case, why did 360 still lay out a "large and comprehensive" plate for AI?

The reasons behind this are, first, the path dependence followed in 360's development history. Second, 360's understanding of large models is to "B-to-C-ize" things.

In the internet era, 360, as the first free antivirus software, disrupted the entire industry's profit model of "selling CDs" and switched to selling advertising and marketing services. Zhou Hongyi once introduced the origin of "360 Toolbox" in his book "My Internet Methodology":

"…After 2008, games became very popular, and there were frequent incidents of game account and equipment theft, so we created 360 Safebox; we launched 360 Software Manager so that users could download clean software instead of messy ad plugins; because many browsers had security vulnerabilities, and most viruses actually occurred in the browser, we launched 360 Browser."

Relying on the free model, 360 gained a large user base and an effective traffic entry, gradually forming the basic business of 360's advertising. In a recent interview, he mentioned, "If everyone enjoys free security services, they have to accept the internet advertising model."

It is not difficult to see that 360's "large and comprehensive" approach is not only the result of the company's development, but also a reflection of the majority of internet companies at the time relying on advertising to increase revenue.

Advertising is the main source of revenue for 360, but it has been shrinking in recent years. In the first half of 2023, the revenue from internet advertising and services was 2.168 billion yuan, accounting for 48.17% of total revenue. In the same period in 2021, this number was 3.059 billion yuan, a decrease of nearly one-third in two years.

In other words, for 360, AI may be able to bring incremental growth to its struggling advertising business.

In addition to considerations in the advertising business, 360's understanding of products and large models also prompted it to expand its plate. Liang Zhihui believes that "being able to B-to-C-ize things, like SaaS, ready-to-use out of the box, is the best experience." Therefore, 360 often promotes in the C-end market first and iterates the product based on user feedback.

In fact, because 360's "large model refining" phase ended very early, Zhou Hongyi has a deep understanding of the difficulties in landing large models in industrial scenarios.

In his speeches, you can see a more and more practical trend. From emphasizing that AI will bring industrial change, to advocating enterprise-level vertical large models, to promoting micro-innovations in remaking old businesses, and to proposing that the granularity of landing needs to be very fine, only by breaking down the scenarios into dozens or hundreds of targets can large models change the industry.

To some extent, you can also think that it is because Zhou Hongyi wanted to do something with his 360 in the AI era that he kept subdividing the business, presenting an astonishingly large AI product matrix.

"Red-Clothed Leader" Deeply Mired in Growth Dilemma

From "Red-Clothed Cannon" to "Red-Clothed Leader," Zhou Hongyi has been the subject of constant debate. The question of whether "360's free antivirus software is ultimately a good thing or a bad thing for the Chinese software industry" is still frequently discussed by industry practitioners today.

Zhou Hongyi has already completed a logically consistent analysis of these issues. He believes that early antivirus companies only served less than 10% of paying users, with total revenue not exceeding 1 billion yuan, while 360 expanded the market size of antivirus software to billions. With the support of traffic, antivirus software has a more commercially valuable model.

But just as he once advocated "all tools are worth redoing with AI," all difficulties also need to be experienced again. And this time, he is no longer the agile dark horse without business burdens.

After parting ways with Qihoo 360, 360 has been in a weak position in the B-end and G-end markets, and due to the high customer stickiness in the security industry, and with a relatively fixed customer base, it is very difficult for 360 to achieve leapfrog growth.

Can AI stir up the security industry? Objectively speaking, GPT technology has certain application value in the security field, but it will still take time to completely overturn the security industry.

The AI stories of various major companies have certain differences in detail, but the direction of their efforts is consistent, mainly divided into three stages: reducing the threshold for interpersonal interaction, automatically calling existing security products and systems to perform security tasks, and automatically producing security products according to demand.

Currently, the large security models on the market are basically in the 1.5 stage. For example, 360's security cloud, as a large security model, mainly plays the roles of "security Q&A expert" and "security operations expert," in simple terms, allowing operators to call the security products and systems behind them as easily as speaking in daily life. Anheng Information's Anheng Hengnao and Qihoo 360's Q-GPT are similar.

To highlight differentiation, Zhou Hongyi once again played the familiar "free card."

At the 11th Internet Security Conference, Zhou Hongyi released 360 Security Cloud with the concept of "security as a service." The so-called "security as a service" means free software and hardware, with service charges. The reason for this decision is that, on the one hand, software and hardware are already a red ocean market with very low profit margins, and on the other hand, the traditional security model based on selling goods, due to the lack of systematic operations, is no longer able to protect enterprise security.

Although at the conference, Zhou Hongyi once again denied the impact of "price wars" brought about by free services, at least from the data in 2022, the profitability of the security industry has become very difficult.

According to statistics from 21st Century Business Herald, among the 27 companies in the A-share network security sector in 2022, 21 companies saw a year-on-year decline in net profit, with 60% in a loss-making state, and 10 companies experienced losses for the first time.

In fact, the dilemma is also reflected in 360's financial reports. In the first quarter of this year, revenue from 360's security business decreased by 12.5% year-on-year. Although there was a significant year-on-year increase of 98% in the second quarter, the total revenue from the security business in the first half of the year (908 million yuan) was still in a declining trend compared to 2021 (912 million yuan).

In addition, it is also difficult to revitalize the growth curve with large models in the advertising business.

In the PC era, although the various pop-ups of 360 Toolbox caused dissatisfaction among many people, it was not unbearable under the temptation of free services. However, in the mobile internet era, 360's advertising business began to encounter resistance, as users became more averse to pop-ups and the experience urgently needed improvement.

Therefore, in 360's financial reports, the commercialized business still mainly relies on PC applications represented by 360 Search, 360 Browser, and 360 Security Guard.

For the performance decline in the past two years, 360's explanation is that regulatory oversight has become stricter, and industries such as education and real estate have lower business activity, leading to a decrease in advertising willingness.

However, the reality is different. In the same advertising business, Baidu (9888.HK) reported a 5% year-on-year growth in online marketing revenue in Q3, reaching 19.7 billion yuan. Tencent (0700.HK) had a network advertising revenue of 25.7 billion yuan, a year-on-year increase of 20%. Both companies mentioned the driving effect of mobile products such as apps and video accounts on their advertising business.

Although the advertising placement products under the Agent framework of 360 are indeed becoming more user-friendly, firstly, competitors such as BAT also have similar products, and secondly, the carrier is the key factor determining customer willingness to place ads. Therefore, 360's hopes of boosting its advertising business with large models are likely to fall through.

To some extent, the dilemma 360 faces this year is similar to that of antivirus software vendors in the past.

Antivirus software vendors may not have failed to foresee the internet era, but the companies had already formed a marketing, distribution, and dealer system around software fees, and that system was almost the highest executive department of the company. It's difficult for most people to change their fate.

And 360's habit of being "large and comprehensive" has already shown signs of fatigue in the mobile internet era, and its role in driving performance is becoming weaker and weaker. It does not show superiority in competition with peers, and has even become a burden.

The management of 360 may not be unaware of the need to make some trade-offs, but making changes is not an easy task.

Fortunately, as the soul of 360, Zhou Hongyi is still in charge of the company. He has the prestige and ability to drive any reform, and from his increasingly pragmatic remarks, it can also be seen that large models are not the panacea for 360.

But what the outside world is more looking forward to is when 360 will reach a turning point. Because at present, it seems that Zhou Hongyi and his 360 are still losing money while making noise.

Reference:

"My Internet Methodology" by Zhou Hongyi

"Security large models emerge in endlessly, and the cybersecurity industry can't help but feel it, AI Technology Review"

"Dialogue with Liang Zhihui, 360 Group: How does 360 build large models? Jiazi Light Year"

"Nearly 60% in losses! Cybersecurity companies had a tough time last year, where is the industry's road to recovery? 21st Century Business Herald"

"360 Group Financial Reports 2021-2023"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。