来源:BANKLESS

原文标题:《Ethereum's Store of Value Era》

编译及整理:BitpushNews

昨日,The DeFi Report 发布了以太坊第二季度数据分析报告,揭示出一个正在转型的网络。

尽管由于 Pectra 升级和Layer 2使用率上升,协议收入和链上交易费用有所下降,但报告指出更深层次的趋势正在发生:以太坊正显现出从「实用型代币」向「价值存储资产」转变的清晰迹象。

以下是该报告的五大核心要点,为以太坊作为一种「货币资产」转型提供了清晰框架:

1. 机构正在大举买入 ETH

过去一个季度,ETH进入机构资产负债表的速度前所未有,主要通过两条路径实现:ETF 与公司金库。

ETH ETF:管理资产规模环比增长 20%,达到 410 万枚 ETH,占总供应量的 3.4%。这是自开始追踪以来的最大季度增幅,富达的 FETH 领跑资金流入。

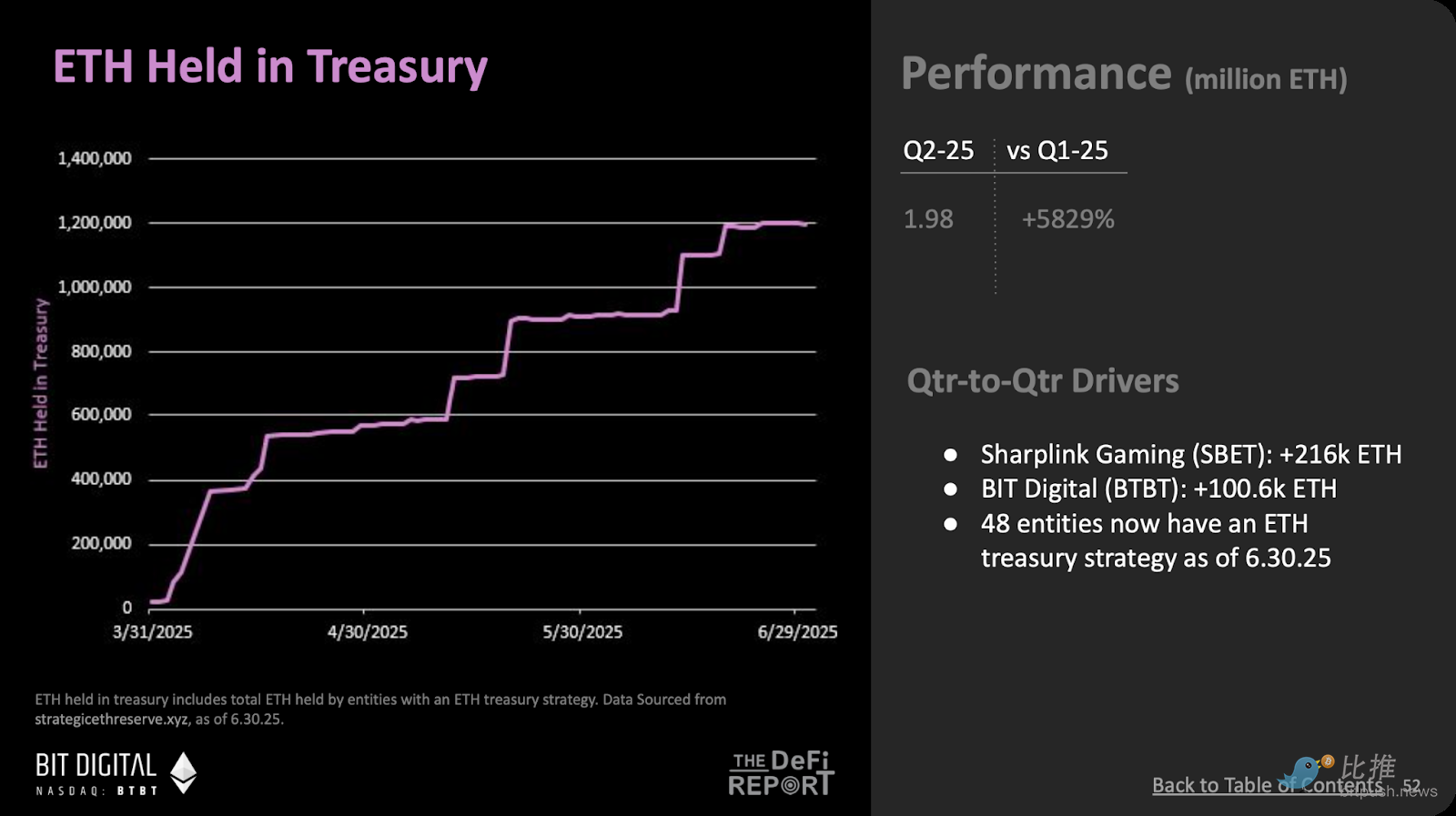

公司金库:ETH 持仓增长 5,829%,达 198 万枚。SharpLink Gaming 增持 21.6 万枚 ETH,包括从以太坊基金会直接购入;Bit Digital 增持超 10 万枚 ETH。共有 48 家机构将 ETH 纳入金库。

Bitminer 董事长 Tom Lee 表示,他们将 ETH 视作一种「稳定币筹码」,未来企业或将通过持有并质押 ETH 来运营自身稳定币网络,这也将加剧机构层面的 ETH 需求。

DeFi Report 认为,这种趋势正重现比特币早期的机构采用路径:ETF 与金库成为主要买方,而非用于交易或支付 Gas,ETH 被重新定义为长期储值资产,流通量也因此收缩。

2. 资金正从交易所流出,转向长期持有

过去一个季度,ETH 稳步退出流动性较高的交易市场,转向被锁仓或战略性持有的形式,这正是价值存储资产的典型行为。

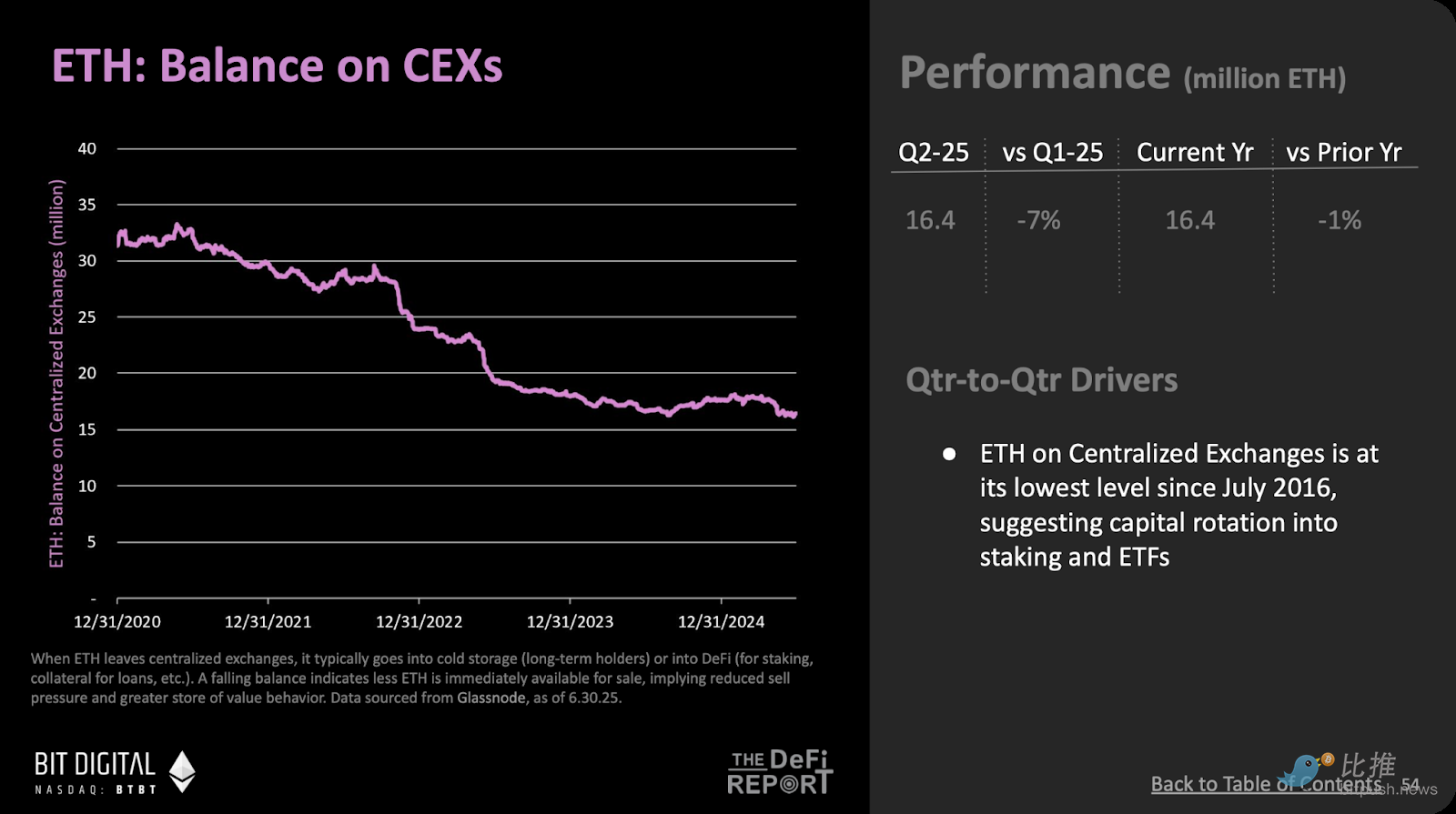

撤出交易所:中心化交易所中的 ETH 持仓减少 7%,可能已转入冷钱包、质押合约或机构托管账户,这一变化与质押比例上升趋势一致。

DeFi 使用减少:智能合约中的 ETH 占总供应比例下降 4%,至 43%。但这并不表示抛售,而是用户可能选择重新质押或配置至 ETF。

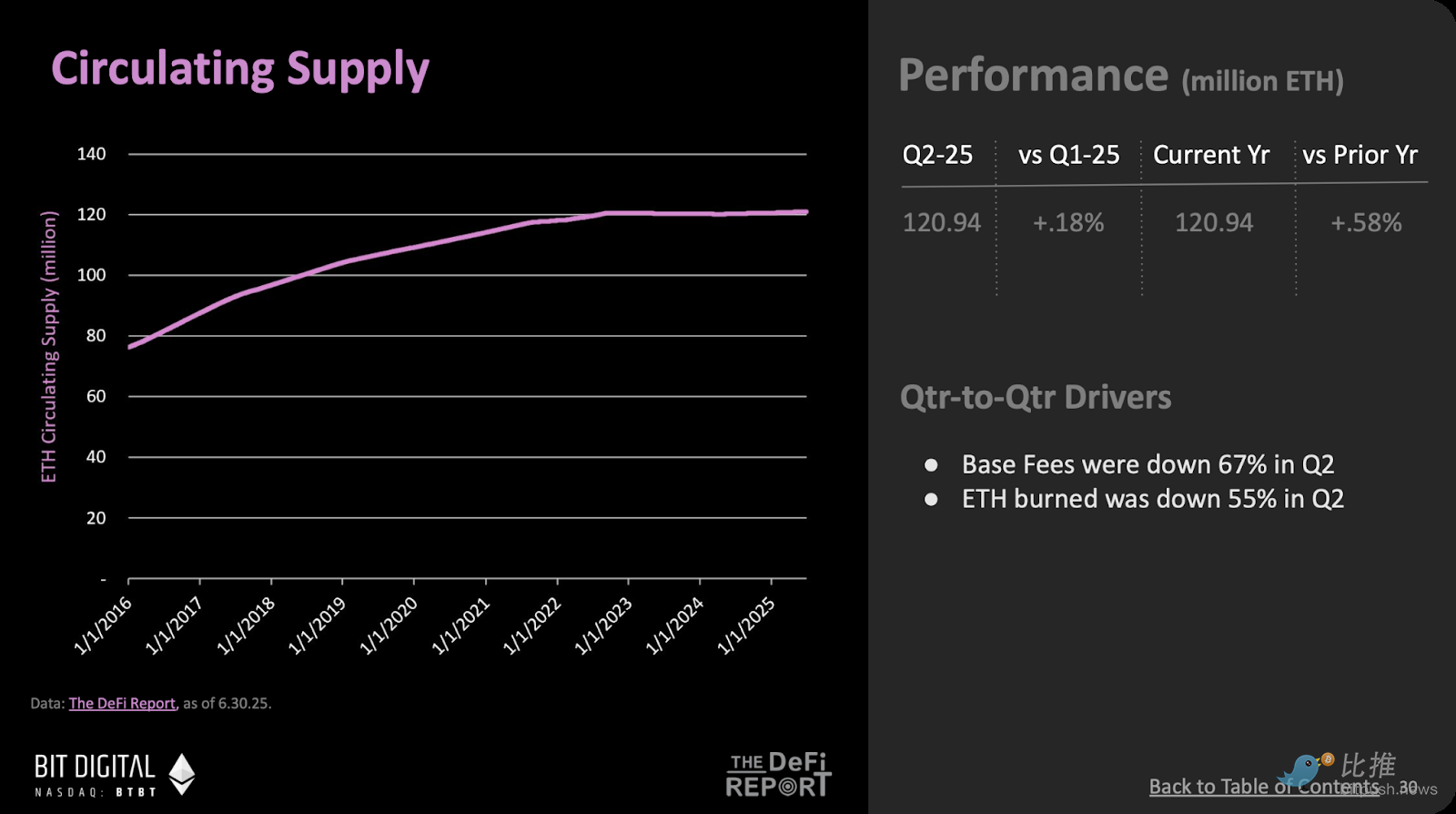

本季度 ETH 流通供应仅增长 0.18%,表明即便网络出现轻微通胀,市场依然可以有效吸收新增发行。

DeFi Report 指出,这种行为类似于经济不确定时期的「美元囤积」现象——用户选择以 ETH 储值,而非用于频繁交易或投机。

3. 质押成为 ETH 被动收益的重要载体

ETH 质押机制正将其塑造成一种可生息的储值资产,其持续增长反映出市场对该资产的长期信心。

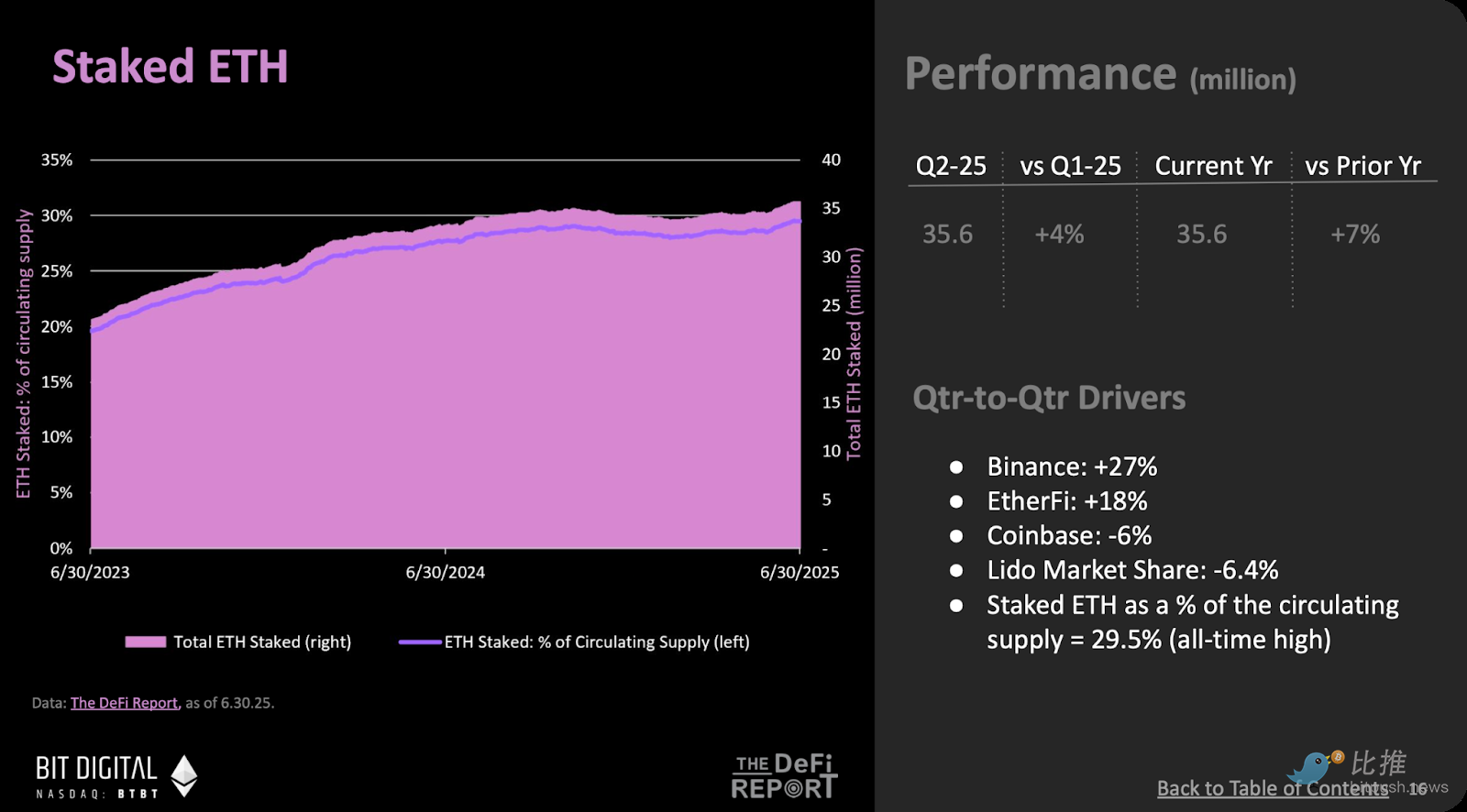

质押 ETH 总量:增长 4%,达 3,560 万枚,占供应量的 29.5%,创下历史新高。尽管 Pectra 升级后交易手续费减少,但质押仍能带来可观回报,发行奖励平均每日 2,685 枚,年化收益率为 3.22%。

奖励结构:88% 的验证者奖励来自 ETH 新发行,而非链上手续费。这也意味着 ETH 本身正在成为一种「可生产收益的资产」。

这使得 ETH 更接近一种「收益型国债」,而非单纯的投机品。质押机制正在将以太坊从「交易链」转型为「货币网络」。

4. 通胀回归,但 ETH 更成熟了

虽然 ETH 的净通胀看似是利空信号,但 DeFi Report 认为这标志着 ETH 的结构性成熟。

ETH 发行上升:本季度 ETH 总发行量增加 2%,销毁量下降 55%,年化净通胀率为 0.73%,创一年新高。

链上效率下降:单位链上收益的生产成本上升 58%,实际链上收益下降 28%。

尽管通胀回归,但市场并未抛售,反而是质押池与 ETF 继续吸收 ETH。DeFi Report 创始人 Michael Debault 指出,这种现象类似比特币早期周期——用户接受一定通胀换取网络长期安全与可持续性。

如今,ETH 更像是一个有「计划性通胀」和「内嵌收益」的货币系统,不同于传统的公链资产。更重要的是,即使经济数据疲软,持币者依然不减信心,这种「穿越通胀也不卖」的行为,正是价值存储资产的核心特质。

5. 以太坊主网正成为「结算层」

以太坊 Layer 1 正逐渐放弃其「交易引擎」的角色,转型为资本承载与最终结算的基础层——这正是货币型网络的特征。

L2 活跃度激增:Layer 2 每日交易量是主网的 12.7 倍,活跃地址数量是主网的 5 倍;L2 上拥有高交互频率的智能合约数量是主网的 5.7 倍;DeFi 交易速度也领先主网 7.5 倍。

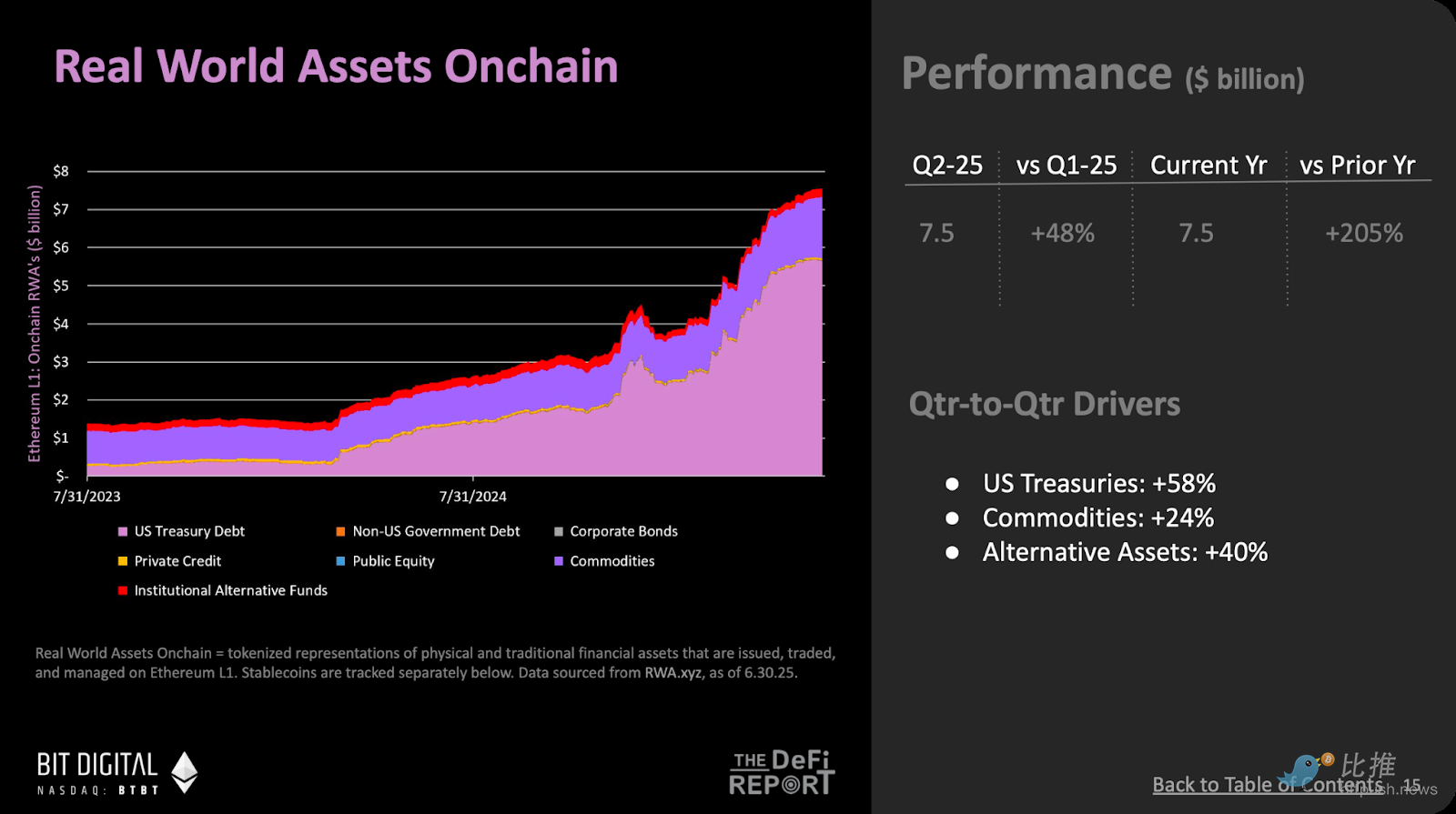

主网仍是资产锚点:尽管交易活动向 L2 迁移,主网的 TVL(总锁仓量)仍上涨 33%。现实世界资产(RWA)规模季度增长 48%,达到 75 亿美元,其中以代币化国债和大宗商品为主。

DeFi Report 认为,这一格局类似传统金融体系:次级平台负责交易和操作,而主层则负责最终结算。以太坊主网即是「防弹区块空间」,ETH 是其核心储备资产。

总结:ETH 正成为「货币主权资产」

Q2 报告清晰描绘出 ETH 正从「实用代币」向「主权债券」过渡的轨迹。

无论是 ETF、金库还是质押合约,ETH 正逐步退出高频交易环境,转向长期持有。Layer 2 承接了执行层功能,而以太坊主网则巩固为资本平台与现实资产锚点。质押奖励主要来自发行而非交易费,结构越来越像早期的货币系统。

换句话说:ETH 不再只是燃料,而是变成了网络自身不可分割的价值载体。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。