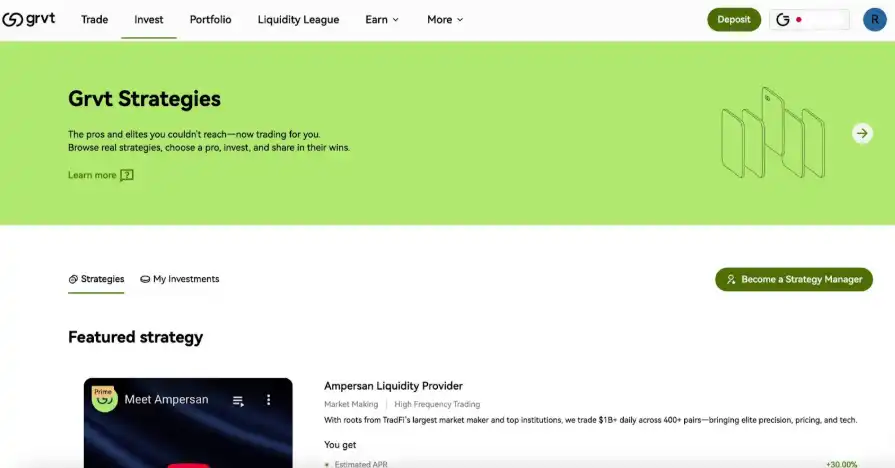

On July 16, 2025, Grvt, the world's first licensed on-chain derivatives trading platform, officially launched "Grvt Strategies," the world's first compliant on-chain peer-to-peer (P2P) investment strategy marketplace.

Through this platform, retail investors can directly participate in investment strategies ("Strategies") managed by institutional funds, market makers, and renowned traders for the first time, breaking the limitations of traditional finance and DeFi that make it difficult to access top strategy managers.

The current investment environment is increasingly challenging for ordinary users. According to data from the World Economic Forum, a large population globally still cannot participate in capital markets, mainly due to a lack of access channels, insufficient financial education, and a lack of trust in the market. Meanwhile, the rapidly growing private equity market has long been open only to institutional investors and high-net-worth individuals, making it difficult for ordinary users to get involved.

Hong Yea, co-founder and CEO of Grvt, stated: "We believe that the process of wealth growth should be as simple and natural as sending a message or hailing a ride. Grvt Strategies is a bold step we are taking to build an investment future that everyone can participate in, truly opening opportunities that were once reserved for institutions and elites to the public."

Blockchain-driven universal investment, with smart contracts ensuring transparent governance

Although the peer-to-peer model has reshaped the lending and payment sectors, investment remains a highly closed market. Ordinary users find it difficult to access mature and complex investment strategies and are hindered by information opacity, high barriers to entry, and complicated regulatory restrictions.

To break the traditional pattern, Grvt has built Strategies entirely on the blockchain, utilizing smart contracts to create and automate the management of investment strategies. This means that every step from user deposits to profit distribution operates transparently through programmable rules, without the need for manual intervention or reliance on intermediary institutions, truly achieving a decentralized and trustworthy investment experience.

Strategy managers can deploy their investment strategies more efficiently, while investors can clearly understand the flow of their funds. By eliminating many barriers in traditional investments, such as opaque management processes and high operational costs, Grvt Strategies has achieved a truly open and trustworthy professional-level investment method for everyone.

All strategies operate on-chain and adopt a non-custodial model, allowing investors to interact directly with strategy managers without intermediaries. Information such as historical performance, operational methods, and fund allocation of the strategies is also transparent and traceable, all recorded on-chain.

Additionally, there are no entry barriers for investment; retail investors can allocate any amount of funds directly to a range of selected strategies—these strategies were previously only available to institutions or high-net-worth individuals, covering everything from AI-driven trading vaults to professionally managed thematic portfolios, all created and operated by verified strategy managers.

First batch of industry-leading teams

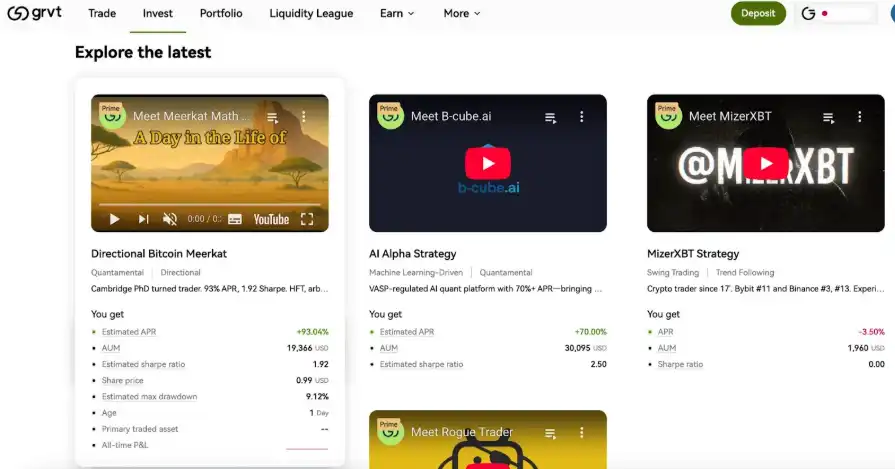

Grvt's strategy managers bring together solid traditional finance (TradFi) experience and native participation backgrounds in crypto and decentralized finance (DeFi). The first batch of the team includes six strategy managers, among them:

·Ampersan: A leading digital asset liquidity provider founded by former members of Optiver (one of the largest market makers in the world), supporting over $400 billion in trading volume since its inception;

·AllDeFi: A DeFi alpha strategy provider, with team members coming from outstanding hedge fund senior quantitative traders, possessing a successful track record of consistently generating returns in the market, bringing institutional-level expertise into the decentralized finance space;

·b-cube.ai: An AI-driven crypto quantitative trading platform regulated by VASP, dedicated to popularizing complex algorithmic trading strategies traditionally available only to hedge funds, with a team that has years of experience in finance, portfolio management, and quantitative trading;

·Rogue Traders: A team of professional traders with years of experience in proprietary trading and hedge fund strategies, currently mentoring and training the next generation of traders through Rogue Trader Academy.

By the end of 2025, a total of 25 strategy managers are expected to be launched on the Grvt Strategies platform, with total locked value (TVL) projected to grow to at least $100 million.

"This is not just another trading platform, but an open market for modern wealth creation," Hong Yea added. "We aim to eliminate complexity and create an environment where everyone has a fair opportunity to achieve wealth growth, and the launch of Grvt Strategies is the beginning of realizing this vision. We are very excited to welcome many industry leaders, whose recognition and participation are crucial to the success of this new concept."

Early experience and incentive measures

To celebrate the launch, early participating investors will enjoy a 20% annualized yield bonus, as well as additional EcoPoints rewards that can be redeemed for Grvt's upcoming airdrop tokens, valid until July 29.

Grvt Strategies is now available through the Grvt official website and web application; a mobile version is planned for release in the fourth quarter of 2025.

Daniel Ku, CEO of Ampersan, commented: "Since the launch of the Grvt mainnet, we have been collaborating with them to create a liquid and efficient trading platform. The launch of Grvt Strategies marks a new chapter in quality investments for the public and is an important step for Ampersan's deep involvement in the mature ecosystem of digital assets. We will work together to build a platform that balances liquidity and transparency, promoting healthy ecological development."

Guruprasad Venkatesha, co-founder and CEO of b-cube.ai, stated: "The mission of b-cube.ai is to popularize complex algorithmic trading strategies traditionally limited to hedge funds. The launch of Grvt Strategies is the opportunity we have long awaited. We are excited to bring our strategy library and unique AI-human collaboration model directly to ordinary investors and look forward to the continued growth of this project."

Shane Oglow, co-founder of Rogue Traders, said: "At Rogue Traders, our motto is simple: break the rules, create wealth. We have a deep understanding of the market and are committed to sharing our years of experience and expertise with a broader audience, especially novice investors. Grvt Strategies provides an ideal model for everyone. We are very excited to be early participants and supporters of this highly promising project."

About Grvt:

Grvt (pronounced "Gravity") is the world's first licensed on-chain trading platform, integrating traditional finance with decentralized innovation to build a compliant, trustless on-chain financial market. The Grvt hybrid trading platform is built on the ZK Stack; Grvt Strategies extends this ecosystem into the wealth management field, providing a new way to access diversified investment strategies without intermediaries.

This article is contributed and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。