Most RWA products can only be targeted at qualified investors or institutional investors because issuing compliant offerings to retail investors would incur high costs.

By DigiFT Ryan Chen et al.

Dilemma: Why Can Only Qualified Investors Be Targeted?

Apart from a few projects that have implemented RWA issuance schemes for retail investors within certain restrictions by complying with specific local laws, issuing special prospectuses, and specific securities registrations (specific schemes can be found in the RWA Innovation Module), most RWA in the market can only be targeted at qualified investors. Depending on the regulations in different regions, investors are required to demonstrate a certain amount of financial assets to be considered qualified investors, such as Singapore's requirement of 1 million SGD (approximately 730,000 USD) in personal financial assets.

The reason why most RWA products, including products related to US Treasury bonds, can only be targeted at qualified investors or institutional investors is that issuing compliant offerings to retail investors would incur high costs.

These costs stem from the lack of correlation between the underlying assets and the tokens issued in the end.

Relevant securities laws have strict requirements for issuing securities to retail investors, including the preparation and registration of prospectuses. In addition, the laws in most jurisdictions stipulate that ownership of assets such as stocks and bonds must be recorded in a specific manner (e.g., in a register maintained by the issuer). Currently, authoritative institutions do not accept tokens and blockchain directly as tools for ownership registration, which means that under these laws and regulations, token ownership cannot directly represent ownership of the underlying assets.

For RWA issued using an asset-backed model, such as RWA tokens backed by US Treasury bonds, there needs to be a "bridge" between the underlying assets and the expected RWA tokens. The RWA token is a new security, and this "bridge" can be established by treating the RWA token as its own independent security. However, this also means that the RWA token needs to independently comply with all relevant securities laws, i.e., the issuer needs to prepare and register a prospectus specifically for the RWA token as a security.

To understand this, we can look at the traditional model for issuing securities to retail users. Whether issuing stocks or bonds, it needs to go through:

The internal preparation stage of the company, determining the various characteristics of the company's securities, selecting and hiring investment banks (underwriters) and other financial professionals such as lawyers and accountants to assist in the IPO process.

Selecting underwriters. Underwriters will assist the company in preparing and executing the bond issuance.

Due diligence, auditing, and rating (for bonds), reviewing internal controls and governance structures to ensure compliance; for bonds, the rating will affect the credit quality of the bonds.

Prospectus, if targeting retail investors, the prospectus must be approved by regulatory authorities to ensure that investors have sufficient information.

Pricing, determining valuation and issuance price conditions in conjunction with underwriters.

Marketing, conducting roadshows, interacting with potential investors, explaining the company's business situation, etc.

Issuance and listing, needing to meet the listing requirements and standards of the exchange.

Post-transaction management, such as financial information disclosure, announcements, etc.

It can be seen that if securities assets are to be sold to retail investors, they need to go through a complex process. In these processes, there are two reasons why RWA is difficult to be directly targeted at retail investors:

High costs and insufficient returns. The entire process of issuing securities to retail investors would incur costs of several million US dollars and require regulatory approval. The overall size of the encrypted market is relatively small compared to traditional markets, which cannot meet the large-scale financing needs. Therefore, the high cost of compliant issuance and insufficient returns.

Inadequate infrastructure. Tokens do not have compliant securities exchanges to provide trading services, and securities registration agencies do not currently support tokens as a means of ownership registration, and so on.

If the issuer does not want to incur such high costs and trading friction, they can only issue products to qualified investors and institutional investors. The mainstream RWA assets in the current crypto market are all issued by SPVs established by start-up companies. If traditional capital market securities, such as US Treasury bonds, are used as underlying assets and issued using an asset-backed model, investors purchasing these issued bonds are essentially purchasing corporate bonds issued by the SPV with US Treasury bonds as underlying assets, resulting in very high counterparty risk. This turns the originally AA+ rated US Treasury bonds into BBB investment-grade corporate bonds through this structure. Other directly issued corporate bonds are mostly issued by smaller companies and have not gone through a complete issuance process targeted at retail investors, saving costs, resulting in the products only being targeted at qualified investors.

RWA Business Innovation Model: Combining RWA with DeFi

As most securities-type RWA assets can only be targeted at qualified investors, the market space is very limited. Many RWA protocols are exploring innovative business models from legal and business perspectives to introduce RWA into DeFi, allowing users to obtain returns on US Treasury bonds in a permissionless manner or to build infrastructure similar to an on-chain money market fund.

Lending Model: Ondo OUSG — Flux Finance Ondo Finance

Flux Finance has designed a lending protocol for its US Treasury bond token OUSG. Flux Finance replicates the code of the Compound V2 lending protocol and has made a series of modifications to support assets with whitelist restrictions as collateral, and has modified its interest rate curve and collateralization ratio to adapt to the characteristics of OUSG. Currently, the only collateral on Flux Finance is OUSG, with a collateralization ratio of 92%.

On the other end of the lending protocol is a permissionless system that any DeFi user can participate in. Users can deposit stablecoins into Flux Finance's lending pool to earn lending interest. Currently, Flux Finance supports four stablecoins: Frax, USDC, USDT, and Dai, with a utilization cap of 90%. OUSG holders can collateralize OUSG to borrow stablecoins from Flux Finance and obtain liquidity. Flux Finance keeps the borrowing interest rate below the yield of OUSG, and through the lending model, it transfers the yield of holding OUSG to USDC holders in a permissionless manner, while the liquidity pool maintains 10% liquidity that can be withdrawn by users at any time.

Token Wrapping and Lending Model: MatrixDock — TProtocol

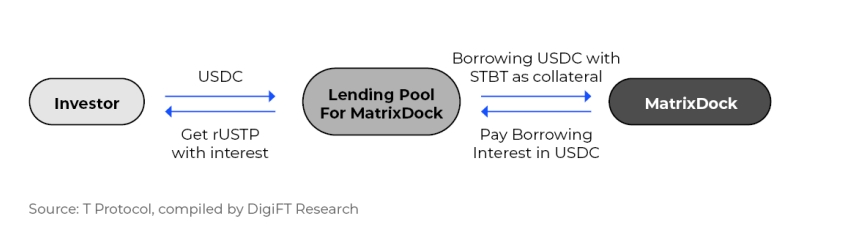

Recently, T Protocol announced a collaboration with MatrixDock to provide a lending pool for MatrixDock in T Protocol V2's lending protocol and help MatrixDock transmit the returns of its US Treasury bond token STBT to DeFi applications.

TProtocol v1

In the previous TProtocol V1, it achieved permissionless sales of its US Treasury bond token by wrapping MatrixDock's STBT for the second time; TProtocol uses the purchased STBT as collateral to issue the corresponding token wTBT, which changes in quantity along with the amount of STBT held, but without whitelist restrictions, allowing better integration with various DeFi applications and interaction across different blockchains through cross-chain bridges. The corresponding token wTBT currently has a circulation of 3.7 million.

T Protocol V1 wTBT token, Source: Etherscan, data as of November 27, 2023

TProtocol v2

T Protocol V2 Product Flowchart

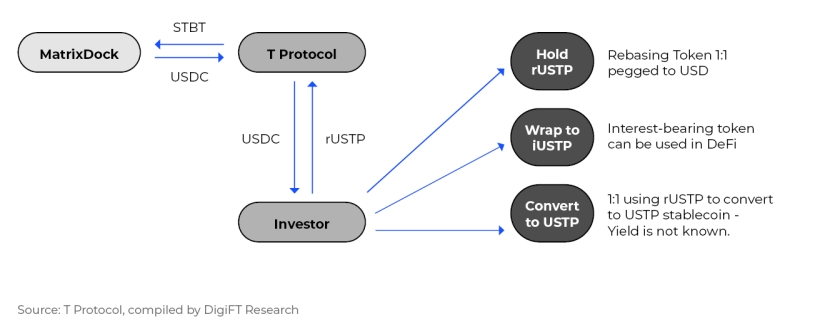

In September 2023, TProtocol and MatrixDock reached a collaboration to provide a lending pool for MatrixDock's STBT. MatrixDock STBT is a token with a dynamic rebasing model, with each STBT pegged to 1 USD. The underlying assets of STBT consist of a basket of short-term US Treasury bonds and money market funds, providing returns to holders, with the returns reflected in a dynamic rebasing mode, updating the token quantity daily based on the underlying asset prices.

In the future, TProtocol will open the lending pool for relevant collaborating institutions, currently supporting only MatrixDock STBT. Users can deposit USDC into the lending pool to receive a corresponding amount of rUSTP tokens. Holders of MatrixDock STBT can use STBT as collateral to borrow USDC at a 99% loan-to-value ratio (LTV).

The lending pool offers a floating yield to USDC users, which will not exceed the yield of STBT itself. The protocol is designed to pass on as much yield as possible to USDC users. The rUSTP tokens received by depositing USDC are rebasing tokens, with each rUSTP pegged to 1 USD. The yield is reflected in an increase in quantity daily; theoretically, based on the design of the lending rate, the yield of rUSTP will follow the yield provided by STBT.

MatrixDock currently holds a certain amount of USDC in the lending pool. If users need to redeem their USDC, they will first be redeemed through these USDC. If the amount is insufficient, they will be directly sold on Curve. For larger redemption volumes, redemption will be implemented through STBT on MatrixDock, requiring T+3 days for redemption based on the current design.

rUSTP can be converted into USTP, a stablecoin without yield. The remaining yield income does not indicate where it will go (possibly to TProtocol itself). Users can also exchange it for iUSTP based on the internal exchange rate, which is an accumulating yield token whose quantity does not change, and its value accumulates over time, integrating better with various DeFi protocols.

The overall process is as follows:

T Protocol V2 Product Flowchart

TProtocol V2 adopts a lending form to avoid the potential compliance issues of directly introducing tokenized securities, similar to Ondo Finance and Flux Finance. According to TProtocol documentation, in the future, users will be able to deposit USDC into a pool managed by different institutions to receive returns from RWA assets, backed by a stablecoin supported by RWA tokens.

RWA-Based Stablecoin: MatrixDock — USDV

The stablecoin project USDV (Verified USD) is issued based on RWA assets, with STBT as the underlying asset. Compared to centralized stablecoin issuers like Circle and Tether, RWA-based stablecoins have more transparency in their underlying assets, as they are based on on-chain assets, providing a more stable credit foundation for the stablecoin.

Typically, stablecoin issuers receive USD and mint the corresponding amount of stablecoins, then use the USD to purchase US Treasury bonds or high-rated bank bonds as one of their sources of income. Some stablecoin issuers, such as Circle, distribute a certain percentage of the income to ecosystem partners. USDV follows a similar approach, directly sharing the income from the underlying assets through smart contracts with ecosystem participants, such as minters, market makers, and liquidity providers, to drive the stablecoin ecosystem's development.

Holders of STBT who have undergone KYC verification can become minters of USDV by depositing STBT into the contract to mint new USDV. USDV, through a special coloring design similar to Bitcoin's UTXO mechanism, can identify the minters of this portion of stablecoins on-chain. The income generated from the dynamic adjustment of the corresponding quantity of underlying assets STBT will be retained in the contract, with 50% of the income distributed to the minters of these stablecoins, and the remaining 50% distributed to market operators and liquidity providers. These market participants of USDV can earn income based on these distributions, further incentivizing the development of the ecosystem.

Bearer Instruments: Backed Finance

The above solutions involve packaging and lending to transfer income through another related party to DeFi protocols in a permissionless manner, while retaining the original entity's compliance requirements. The model of Backed Finance and the subsequent Ondo Finance USDY is more of a breakthrough in terms of legal and regulatory aspects.

Before understanding the implementation of Backed Finance, it's important to understand registered instruments and bearer instruments:

Registered instruments: Generally, the negotiable instruments circulating in the market, especially securities, are registered instruments, where the issuer or an authorized registrar needs to register the holder of the instrument for each transaction and transfer.

Bearer instruments: The issuer or registrar only needs to know the identity of the holder of the instrument when needed, such as during subscription/redemption/trading, and does not need to record the holder's information in real-time during circulation.

Backed Finance issues "tracker certificates," a derivative to track the prices of underlying real-world assets. Each token represents a "tracker certificate," and token holders have related rights to the value of the underlying assets in the contract.

Backed Finance registered the "base prospectus" of the "tracker certificate" with the financial market supervisory authority in Liechtenstein. As Backed Finance is a company registered in Switzerland, under Swiss law, it can only promote to qualified investors. "Authorized participants," such as licensed banks, securities firms, and non-Swiss regulated financial institutions, can purchase products from Backed Finance and sell them to retail clients after the purchase. On the Backed Finance platform, token purchases can only be targeted at qualified professional investors, but retail investors who purchase Backed Finance-related products from elsewhere can also redeem them after undergoing KYC with Backed Finance.

In the prospectus, the tokens issued by Backed Finance are designed as bearer instruments, with a blacklist mechanism in the token contract design. Therefore, after issuance, transfers can be made without permission, or directly interact with various DeFi protocols. Only identity authentication is required during the subscription and redemption processes with Backed Finance.

Transaction records of Backed Finance tokens on Ethereum, showing liquidity on Uniswap, Source: Etherscan, data as of November 27, 2023

From the perspective of subscription and redemption, the short-term government bond ETF token bIB01 of Backed Finance has only two subscription addresses, 0x43 and 0x5f, and no redemptions. After subscription, the tokens are transferred to other investors, indicating that the two addresses may be authorized dealers transferring Backed's tokens to DeFi protocols or users. Tokens sold through dealers may only require KYC, bypassing the restrictions that end-users may encounter as qualified or institutional investors.

Interest-Bearing Stablecoin: Ondo USDY — Mantle Ondo Finance

The newly launched USDY is now available on the Layer 2 network Mantle as the interest-bearing stablecoin of the Mantle network. Users of the Mantle network will be able to directly purchase USDY on DEX. While Backed Finance embeds RWA into DeFi through special European laws, Ondo Finance has chosen a different approach.

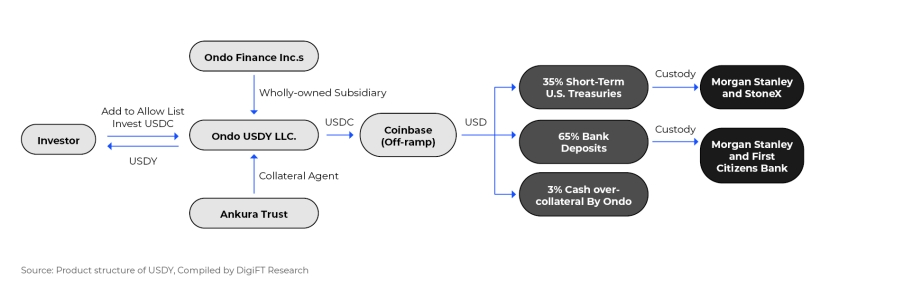

USDY Product Structure Diagram

USDY is issued by Ondo Finance Inc.'s wholly-owned subsidiary, Ondo USDY LLC, as a bankruptcy-isolated SPV. USDY is a token with short-term US government bonds and bank current deposits as underlying assets, registered under US Reg S, and can be sold to non-US retail users under certain restrictions. Currently, there is a restriction on USDY, with a 40 to 50-day lock-up period after sale, meaning users have to wait for the lock-up period to end after subscription to receive the on-chain tokens and cannot sell to US investors within one year.

The USDY token contract on Ethereum has a whitelist and blacklist design. Unlike other RWA token designs, the whitelist design of USDY is unique, allowing anyone to add their address to the whitelist by calling the contract, providing a user experience similar to an authorized transaction. The USDY website directly provides the function to send this transaction, and after detecting the IP address, users can agree to the terms and add their address to the whitelist without requiring KYC. Additionally, the USDY token contract is associated with a legal document stored on IPFS, indicating that users, by adding their address to the whitelist, are agreeing to the legal terms.

Currently, USDY is an accumulating yield token, accumulating returns over time. Subsequently, Ondo Finance released USDY and mUSD on Mantle, removing the whitelist and retaining only the blacklist function. mUSD is a stablecoin with a dynamic rebasing mechanism, anchored to the dollar, and balances are adjusted periodically based on returns. mUSD can be directly exchanged for USDY at the current ratio on the Ondo Finance platform.

The above five models address the compliance requirement of qualified investors for RWA assets from different perspectives such as technology, business, and law, bringing RWA assets into DeFi to reach a broader audience. For RWA project parties, this can increase their platform's sales volume. For DeFi, it adds more asset classes, providing stable foundational returns and enabling more diversified financial products through asset combinations.

However, regardless of the model used, there are several challenges:

AML restrictions: DeFi protocols cannot prevent non-compliant assets, such as stablecoins from risky addresses, from entering their protocols. RWA protocols typically require a review of the source of funds, with strict KYC and AML requirements. This mismatch may affect some DeFi protocols' efforts to strengthen the scrutiny of fund sources. If more RWA assets enter the DeFi space, the compliance of DeFi fund sources will also be strengthened.

Time mismatch: Traditional financial asset markets are open for only five working days a week, with only a few hours of operation each day, and they are closed on holidays. Asset trading requires settlement through banking and brokerage systems, often taking T+1 or even longer settlement times. DeFi protocols operate 24/7. If there is a need for liquidity, such as market fluctuations during holidays, DeFi protocols will need to liquidate assets, and RWA assets will require a longer processing time. Protocols that allocate RWA assets need to consider liquidity carefully.

Sales restrictions: Many of the above RWA projects require investors not to be residents of certain countries and regions, possibly due to tax (such as the complex US tax system), AML (sanctioned areas), or the complex financial systems of certain countries and regions. Through DeFi protocols, it is highly likely that assets will be sold to residents of areas or countries where they should not be sold. Since most RWA assets are defined as securities, they are subject to strict legal restrictions in those areas or countries, leading to sanctions against the RWA project by the laws of those areas or countries.

Asset ownership: It is difficult to confirm how RWA protocols complete KYC, custody assets after obtaining them, and the legal ownership of RWA assets purchased through stablecoins deposited by users. Generally, DeFi protocols open accounts through foundations or establish SPVs to purchase relevant assets for RWA projects using assets deposited by users. From a legal perspective off-chain, the ownership of the RWA assets belongs to the foundation or the SPV, with the ultimate beneficiaries being the shareholders behind the foundation or SPV, rather than the users of the DeFi protocol. However, DeFi users are generally anonymous or use DAO forms, and they only have a claim right implemented by code, without a legal claim right. Safeguarding user asset rights remains a challenge.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。