Preface

"A year later, facing the SEC, the Treasury Department, and the CFTC, Changpeng Zhao CZ will recall the not-so-distant November afternoon when SBF took him to see the tropical scenery of the Bahamas."

4B Difficult to Land, Both People and Money Return to Zhao

All the gifts of fate have already been secretly priced.

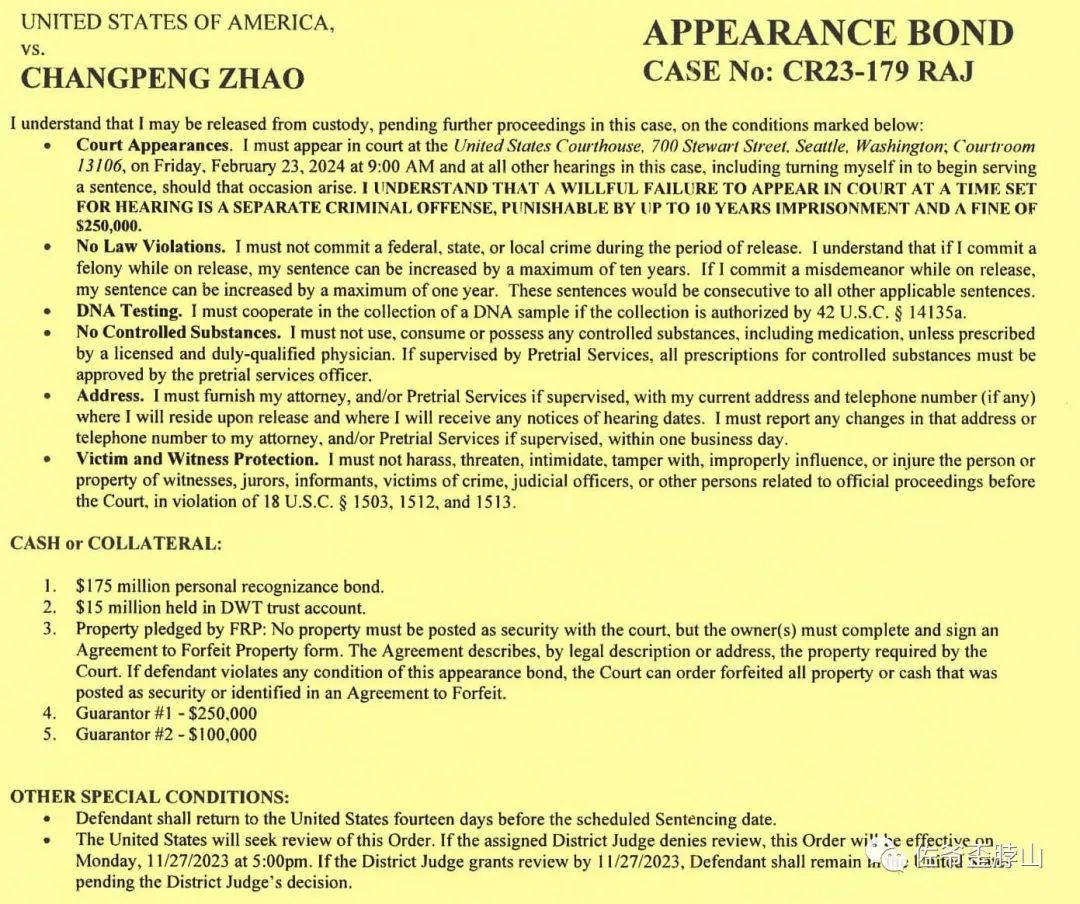

Personal fine of 500 million US dollars, bail of 175 million US dollars, and a total fine of 4.3 billion US dollars for Binance.

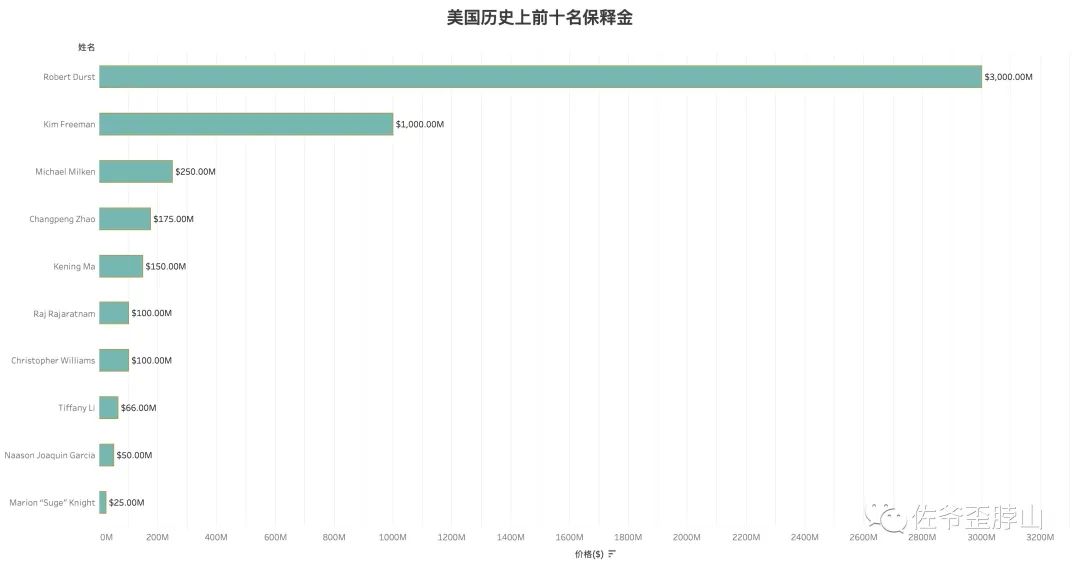

If you don't have a concept of the amounts, just remember that this is the highest bail ranking in the history of the United States, ranking fourth, far exceeding CZ's 49th place on the Bloomberg Billionaires Index.

Image description: Source of historical top ten bail amounts in the United States: https://www.bailagentnetwork.com/blog/portfolio/11-highest-bail-amounts-in-u-s-history/ Screenshot-2023-12-09-at-06 Image description: Bloomberg Billionaires Index image source: https://www.bloomberg.com/billionaires/

Screenshot-2023-12-09-at-06 Image description: Bloomberg Billionaires Index image source: https://www.bloomberg.com/billionaires/

This is the price for the world's largest exchange Binance and its founder CZ to finally "land." On November 22, 2023, when CZ appeared at the door of the Seattle court in the United States, the era of CZ disappeared completely, and from then on, there was only the era of Binance, and the golden legend was gone from the world.

From the results, CZ can retain the majority of Binance's equity, only needing to pay "a small amount of money," and hand over the operational rights to Singaporean Richard Teng to better face the suspicions of Western regulators and the public.

But the matter is far from over. Unlike Mt. Gox or FTX, Binance, as the world's largest exchange, is capitulating to regulatory pressure for the first time. The former two were due to internal operational or security issues, while Binance is the first to change its business plan due to external pressure. Don't forget, there is also a 5-year observation period in the settlement terms, during which the U.S. government can monitor Binance's every move.

Image description: Photo of CZ and SBF source: Sam Bankman-Fried (@SBF_FTX) on X.com

If we go back to November a year ago, it's unknown whether CZ would regret taking action against SBF, his former little fan. At that time, the wind on the Caribbean island of the Bahamas was still warm, and it just so happened that SBF also had an incident in November and lost his freedom of movement in December.

Zhao's Son Pays for the Whole Show

Current Situation of Binance, Pushing to FTX, Self-Destruction Continues

According to CZ's account, Binance started with a team of 6 people, gradually expanded to serve 166 million people globally, and became the king of both spot and derivative cryptocurrencies under multiple attacks and market competition, achieving unprecedented and temporarily unmatched performance. It truly demonstrated the essence of an East Asian problem solver to the extreme.

Image description: CZ court documents Image source: U.S. court

Looking back at the past half month's [CZ's confession, Binance settlement], it seems like a dream. It's not difficult to see that the core demands of the regulators have been met: personal imprisonment, company fines, comprehensive compliance, and ongoing scrutiny.

But CZ's demand to return to the UAE continues to be ignored. According to reports, CZ seems to have obtained UAE citizenship, in addition to Canadian citizenship, but he still hasn't obtained freedom of movement. It seems that Americans are still quite overbearing.

Image description: CZ event development chart Information source: Compiled from multiple media reports

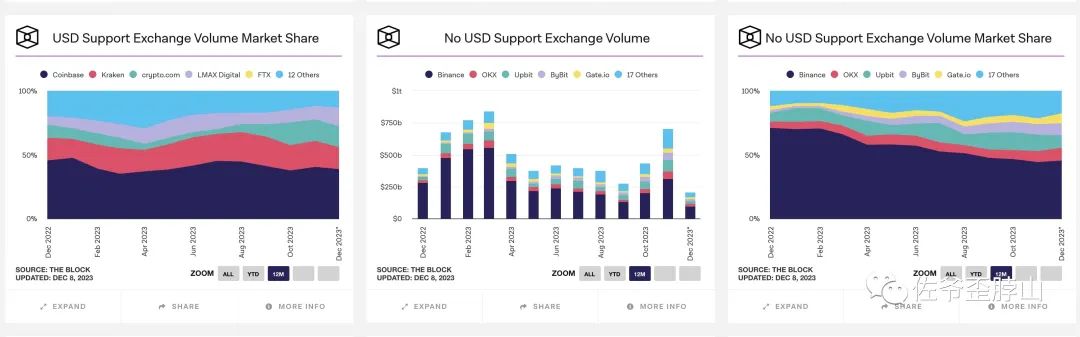

Unlike the confidence and openness about user growth, Binance has been very cautious about market data for a long time, but third-party traces still leave a lot of room for interpretation.

In terms of market share, Binance is the only one in the No USD market. After "gently pushing" FTX down in December last year, Binance's market share reached over 70%, truly achieving dominance, with Binance occupying the second position.

Image description: Market share of cryptocurrency exchanges in USD and non-USD markets Image source: https://www.theblock.co/data/crypto-markets/spot

But it doesn't matter. The U.S. Treasury Department and the SEC will take action. They do not allow such powerful people to exist, so they began a long investigation, litigation, and public pressure, and the USD market became the most critical entry point, with Binance.US ultimately becoming the first breakthrough.

Coinbase's U.S. identity now seems extremely precious, and even FTX is in the process of rebirth.

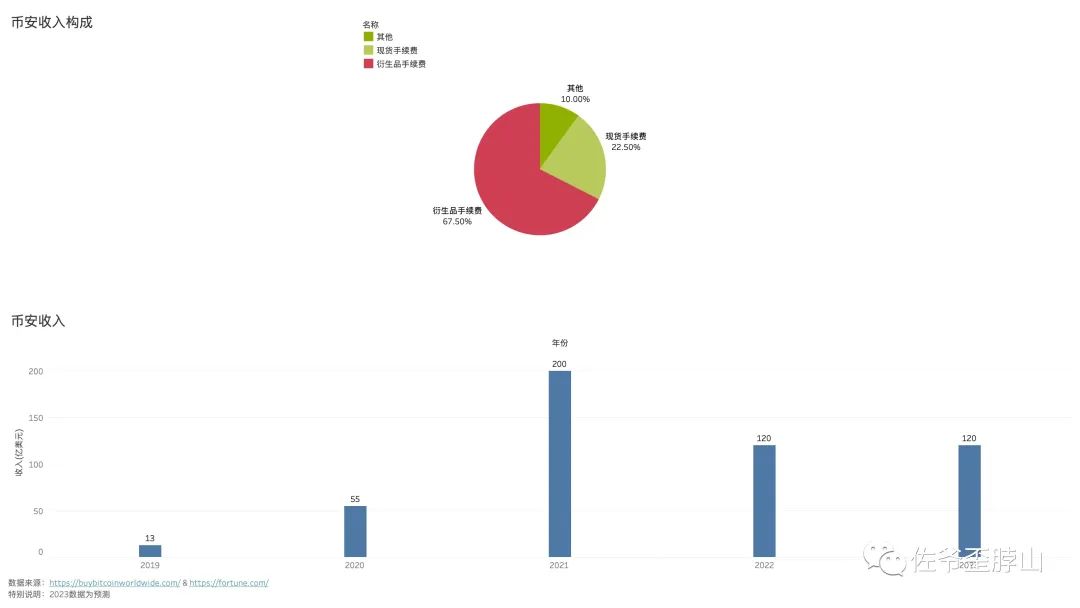

Although it has not gone public like Coinbase, or perhaps cannot go public, Binance itself is not short of money. According to CZ and Binance's account, the vast majority of Binance's income comes from transaction fees, accounting for over 90%, with spot accounting for 22.5% and derivatives for 67.5%. If you want to support Binance, the best way is to trade futures.

Image description: Binance's income and composition

Image description: Binance's income and composition

Image source: Compiled from multiple media reports

Thanks to the soaring market share, Binance's income is also very considerable. It reached $20 billion in 2021, and even during the bear market period in 2022, Binance still had $12 billion in income.

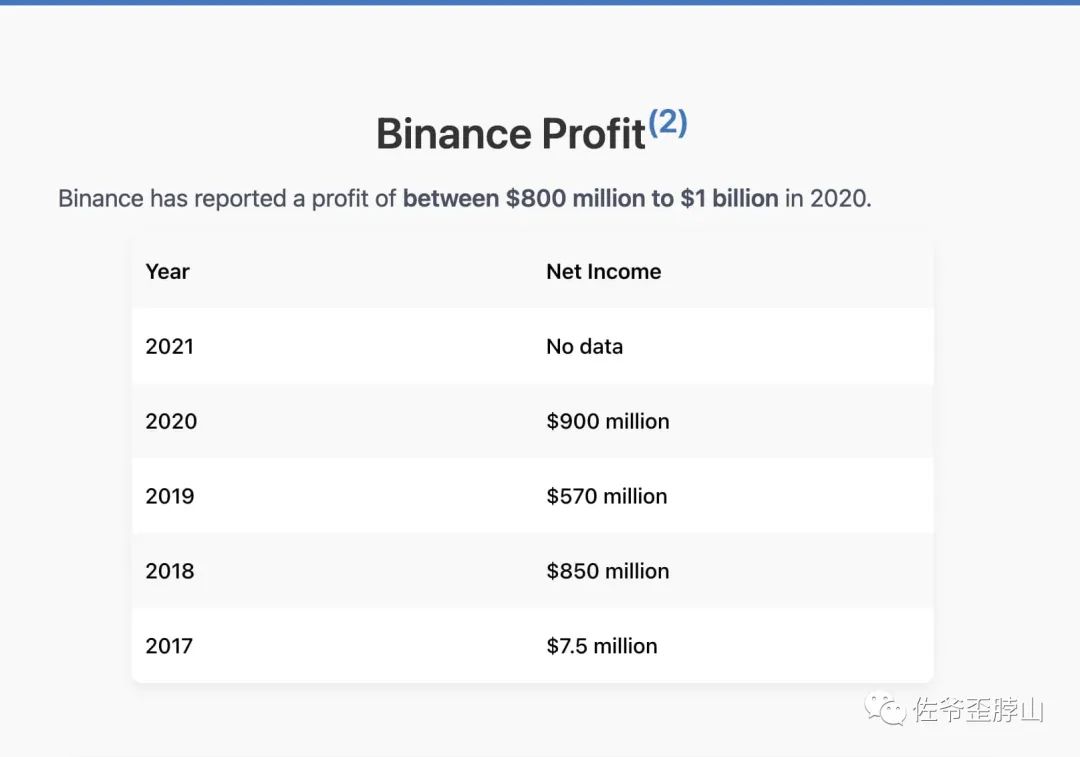

But to pay the fine, it cannot be paid with income, otherwise it would be like misappropriating customer assets, so we can only look at Binance's profits, which seems very mysterious. According to Fortube and Binance information, the estimate for 2020 is around $1 billion.

Image description: Binance's profits

Image source: https://buybitcoinworldwide.com/binance-statistics/#article-sources

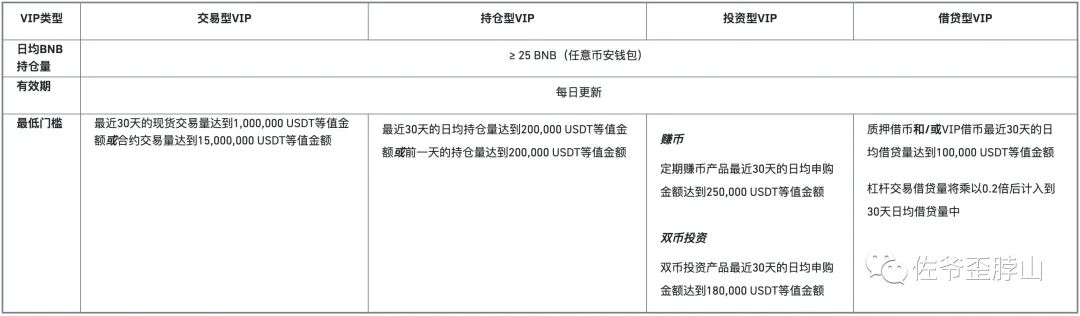

It's worth noting that Binance's spot transaction fees are only 10 basis points, and derivative trading fees are 1 to 5 basis points. Binance platform coin BNB holders can also receive different discounts, so it seems that Binance is indeed a money-making machine.

Image description: Binance VIP level classification

Image source: https://www.binance.com/zh-CN/support/faq/%E5%A6%82%E4%BD%95%E6%88%90%E4%B8%BA%E5%B8%81%E5%AE%89vip-473a8456403c438e902d7b3048e49eb6

In a sense, the highest level VIPs of Binance are actually stakeholders in Binance's interests. They use real money to support the price of BNB, so it's no wonder that CZ needs to take care of their feelings. As for the retail investors in spot trading, they only contribute to the denominator value of 166 million.

According to CZ's slogan, he only holds BNB and BTC. This amount of money should be enough for personal bail, so Binance's fine may not have to come from the boss's account. With the current rise in BTC, Binance should still be able to afford it. Don't spread fear, uncertainty, and doubt (FUD).

Image description: CZ's personal profile on Twitter

Image source: https://x.com/cz_binance

Escaping from Non-National Actors Under U.S. Sanctions

If you don't know what the cost is, then you are the cost

Facing Binance's escape from death, Alstom, Huawei, and ZTE should each have their own feelings. There is no way out without kneeling, and not kneeling requires others to provide a way out. Faced with U.S. sanctions and regulations, paying fines is the best outcome.

Fortunately, Binance's market still exists. Perhaps after full compliance, it can still enter the U.S. market, or maybe not. But it can still retain the markets in other regions around the world. However, all of this is temporarily irrelevant to CZ, because he said he wants to do science.

Eighteen months later, we will be able to see scientist CZ.

References:

- U.S. prosecutors argue CZ may face up to 10 years and should be detained in the U.S.

- In the next ten years, there will be no second Binance in Crypto

- https://foresightnews.pro

- Binance CEO CZ Steps Down As Part Of $4 Billion Settlement With US

- 47+ Binance Users & Revenue Statistics (2023)

- How Binance really operates: The world’s largest crypto exchange boasts vast profits, hefty influencer payouts, and a ticking time bomb on its balance sheet

- Binance Founder Pleads Guilty to Violating Money Laundering Rules

- 11 Highest Bail Amounts in US History

- CZ released from custody on $175 million bond after capitulation to DoJ charges, faces 18 months jail term

- Bloomberg Billionaires Index

- https://www.cftc.gov/PressRoom/PressReleases/8825-23

- Sunshine Act Notice

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。